Stay Ahead in Fast-Growing Economies.

Browse Reports NowYogurt Market Opportunities, Challenges & Strategic Forecast (2024-2032)

The Yogurt industry includes the production, marketing and consumption of yogurt a dairy product which is made by simmering milk through the use of bacterial cultures. Yogurt contains probiotics, calcium, and other minerals that give it a leading place for consumers looking for healthy convenient foods.

IMR Group

Description

Yogurt Market Synopsis:

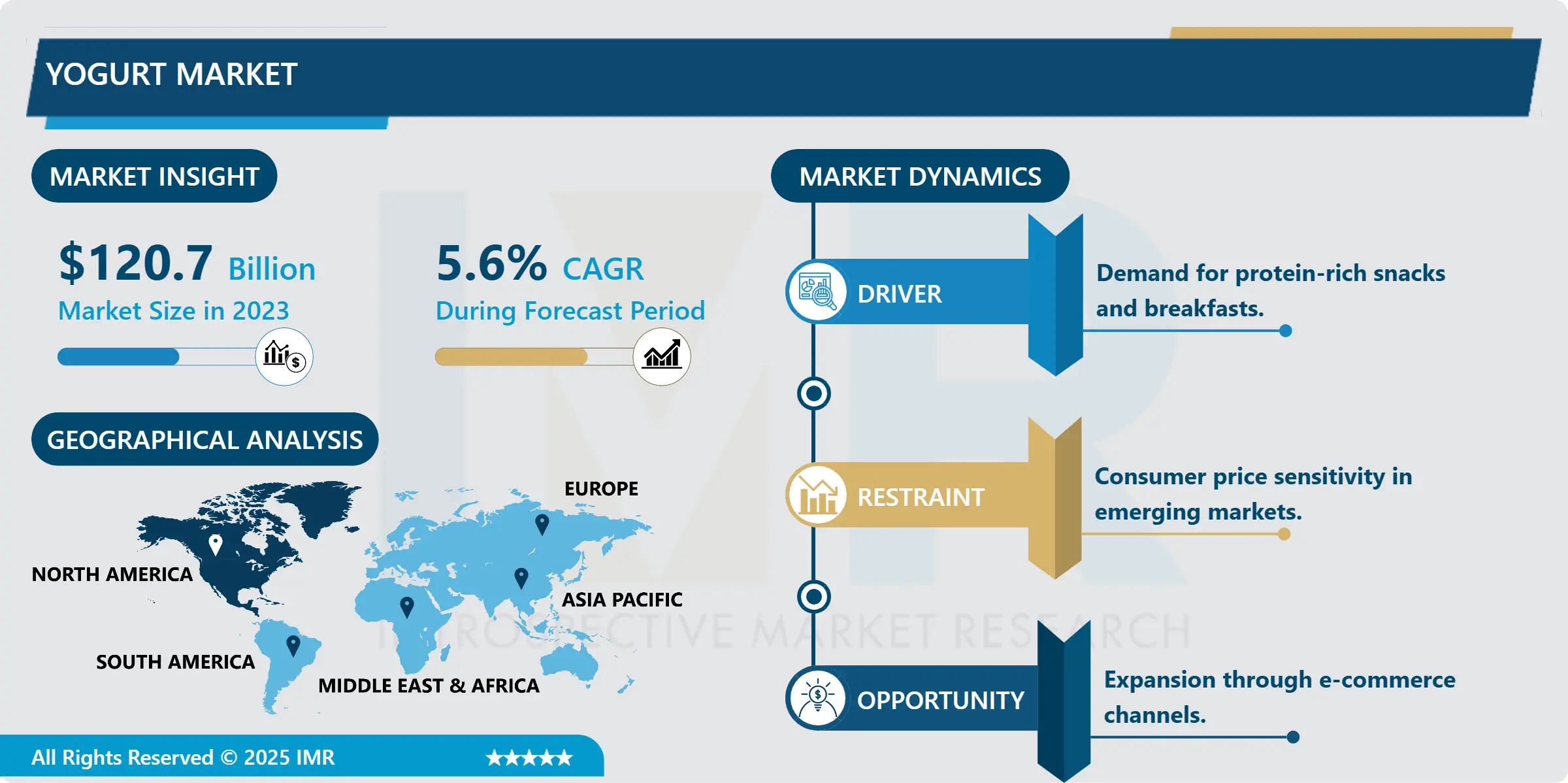

Yogurt Market Size Was Valued at USD 120.7 Billion in 2023, and is Projected to Reach USD 199.7 Billion by 2032, Growing at a CAGR of 5.6% From 2024-2032.

The Yogurt industry includes the production, marketing and consumption of yogurt a dairy product which is made by simmering milk through the use of bacterial cultures. Yogurt contains probiotics, calcium, and other minerals that give it a leading place for consumers looking for healthy convenient foods. It claimed that the market consists of various yogurt types that are traditional, Greek, flavoured yogurt and plant-based yogurt. The growth of the yogurt market is driven by a rising trend of consumption of functional foods with added proteins and new knowledge of the positive effect of probiotics.

The overall global yogurt market has been growing constantly over the last few years mainly because of the resized demand for functional food products. An increase in health concerns is forcing customers to get into this food product because yogurt is considered a healthy food product, mainly because it has probiotics which are helpful when it comes to digestion. Also, yogurt is a source of protein and calcium as well as other nutrients which are important in the diet plans for most individuals. The market evolution is our main focus; specifically, we focus on modern trends such as the popularity of Greek yogurt that has a firmer structure and contains more protein than traditional yogurt. People also prefer plant and lactose-free yogurt owing to increased cases of lactose intolerance and increasing vegan population.

There exist subcategories of yogurt based on its type and these include a dairy-based yogurt and non-dairy yogurt. Traditional yogurt made from cow’s milk still has its market advantage, but novel cultured products from plant sources are rapidly growing due to heightened interest in vegan diets. Their offer includes fruit yogurts and their numerous variations, sweetened and flavored, for example, fruit, vanilla, and chocolate yogurts, which contributed to the overall market growth. Other factors relating to packaging also enhance the market advancement for instance the carry-on cups and acceptable environmentally friendly cup’s material. Most trendy yogurt is consumed in North America and Europe because people in these areas have a high craving for yogurt and different yogurt products like the Americans, Germans, and the French. Furthermore, asian countries of APAC especially India and China show a growing inclination towards yogurts due to growing consumer disposable income and shift in their eating habits.

Yogurt Market Trend Analysis:

Increasing preference for Greek yogurt

Another shift in the market of yogurt is the preference of the Greek yogurt because its protein content coupled with its texture is thicker than the regular yogurt. Consumers seeking a dietary source of protein, for example, take Greek yogurt and all brands are returning to the market with new Flavors and options. Furthermore, there is a growing trend toward consuming probiotics in foods, and this particularly applies to yogurt since consumers are becoming much more educated about the value of gut health and digestion. The growth is further observed in functional yogurts, containing ingredients improving the immune and fat burning systems, containing vitamins, minerals, and fibre.

Another trend is the development of plant-based yogurt products as well. While the general fold shift towards veganism and plant-based diets, there has been a growing preference for non-dairy yogurt prepared from the likes of almond, coconut, and oat milk. This is has also contributed by the increasing consumer base of people with lactose intolerance or even people with allergies to dairy products. There are other similar brand substitutes of yogurt from plant sources, which do not affect the flavour or the consistency. The situation implies on brands paying adequate attention to enhancing taste sensations of such products and guarantee that the nutritional value is not far from normal yogurt, such as protein, probiotics etc. Further growth in the new plant-based yogurt formats and innovative products & formulations has been anticipated to have tremendous influence on the market in the coming years.

Emerging markets like Asia-Pacific

The global yogurt market has considerable room for expansion and development: Unfavourable yet reformative tendencies of the yogurt market also stemmed from the Asia Pacific region that is experiencing transformations associated with urbanization and higher levels of disposable income and changing customer preferences. With these markets grow there is the possibility to offer new products in the region like yoghurt with local flavor or addition of local products. Also, the need for healthy products showing the possibility of creating and launching functional and nutritional yogurts for certain health concerns such as immunity booster, digestive, and weight watchers’ yogurt.

Yogurt Market Segment Analysis:

Yogurt Market is Segmented on the basis of Type, Application, End User, and Region.

By Type, Set Yogurt segment is expected to dominate the market during the forecast period

For the yogurt market during the forecast period, the Set Yogurt segment is anticipated to gain significant popularity primarily due to its use of a non-typical process of production. Set yogurt is prepared by allowing milk to ferment in the same container to which it is packaged giving it a thicker texture and uniform taste, which is easily appreciated by customers who go for natural products with minimal interference. Consumer’s awareness towards consuming probiotics and the actual increase in the consumption of natural yogurts including the set yogurt are likely to add to the set yogurt market. Also, set yogurt is considered to be more genuine by consumers, primarily those in the European and Asian markets which include the traditional yogurt types. Set yogurt has a thick texture and healthy, which according to market analysts will remain a favorite of the health-conscious market throughout the forecast year.

By Application, Strawberry Blend segment expected to held the largest share

During the forecast period the market for yogurt is expected to be dominated by the Strawberry Blend segment since it has remained a favourite among consumers. The strawberry-favored yogurt blends are popular with all groups of people starting from children and working their way up to the more conscious and health-conscious adults. The natural appearance of strawberries together with their bright red hue and sweet berry flavour improves consumer value. With demand for flavoured yogurts extending, strawberry is one of the leading favoured yogurts because of its compatibility with both normal and Greek yogurt products. The market regarding healthier and indulgent snacks is also rising, which is the reason for buying strawberry-blend yogurts because of the benefit of healthy yet tasty consumption. It is believed that this segment will continue to dominate the future with an unceasing conception of product and excellent marketing strategies.

Yogurt Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America and Europe stay leading in the yogurt market, where North American consume a large share of yogurt in general owing to the preferences for Greek yogurt and rising trends connected with the use of high-protein products. Europe’s demand for yogurt was also high particularly Germany, France and United Kingdom and the traditional and organic yogurt was highly demanded. The largest a share of global yogurt market and the largest consumer of yogurt was the United States that composed 35%. The total market share represented by European countries in 1996 stood at 30%, Greece and France being major consumers based on traditional yogurt consumption.

Active Key Players in the Yogurt Market

Almarai (Saudi Arabia)

Arla Foods (Denmark)

Bright Dairy & Food Co. (China)

Chobani (USA)

Cowhead Dairy (Japan)

Danone (France)

Emmi Group (Switzerland)

FAGE (Greece)

General Mills (USA)

Lactalis Group (France)

Müller Group (Germany)

Nestlé (Switzerland)

Yoplait (France)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Yogurt Market by Type

4.1 Yogurt Market Snapshot and Growth Engine

4.2 Yogurt Market Overview

4.3 Set Yogurt

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Set Yogurt: Geographic Segmentation Analysis

4.4 Greek Yogurt

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Greek Yogurt: Geographic Segmentation Analysis

4.5 Yogurt Drinks

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Yogurt Drinks: Geographic Segmentation Analysis

4.6 Frozen Yogurt

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Frozen Yogurt: Geographic Segmentation Analysis

4.7 and Others)

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 and Others): Geographic Segmentation Analysis

4.8

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 : Geographic Segmentation Analysis

Chapter 5: Yogurt Market by Application

5.1 Yogurt Market Snapshot and Growth Engine

5.2 Yogurt Market Overview

5.3 Strawberry Blend

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Strawberry Blend: Geographic Segmentation Analysis

5.4 Vanilla

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Vanilla: Geographic Segmentation Analysis

5.5 Plain

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Plain: Geographic Segmentation Analysis

5.6 Strawberry

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Strawberry: Geographic Segmentation Analysis

5.7 Peach

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Peach: Geographic Segmentation Analysis

5.8 and Others)

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 and Others): Geographic Segmentation Analysis

5.9

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 : Geographic Segmentation Analysis

Chapter 6: Yogurt Market by End User

6.1 Yogurt Market Snapshot and Growth Engine

6.2 Yogurt Market Overview

6.3 Supermarkets and Hypermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Supermarkets and Hypermarkets: Geographic Segmentation Analysis

6.4 Convenience Stores

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Convenience Stores: Geographic Segmentation Analysis

6.5 Specialty Stores

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Specialty Stores: Geographic Segmentation Analysis

6.6 Online Stores

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Online Stores: Geographic Segmentation Analysis

6.7 and Others)

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 and Others) : Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Yogurt Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DANONE (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 NESTLÉ (SWITZERLAND)

7.4 YOPLAIT (FRANCE)

7.5 CHOBANI (USA)

7.6 FAGE (GREECE)

7.7 OTHER ACTIVE PLAYERS

Chapter 8: Global Yogurt Market By Region

8.1 Overview

8.2. North America Yogurt Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Set Yogurt

8.2.4.2 Greek Yogurt

8.2.4.3 Yogurt Drinks

8.2.4.4 Frozen Yogurt

8.2.4.5 and Others)

8.2.4.6

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Strawberry Blend

8.2.5.2 Vanilla

8.2.5.3 Plain

8.2.5.4 Strawberry

8.2.5.5 Peach

8.2.5.6 and Others)

8.2.5.7

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Supermarkets and Hypermarkets

8.2.6.2 Convenience Stores

8.2.6.3 Specialty Stores

8.2.6.4 Online Stores

8.2.6.5 and Others)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Yogurt Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Set Yogurt

8.3.4.2 Greek Yogurt

8.3.4.3 Yogurt Drinks

8.3.4.4 Frozen Yogurt

8.3.4.5 and Others)

8.3.4.6

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Strawberry Blend

8.3.5.2 Vanilla

8.3.5.3 Plain

8.3.5.4 Strawberry

8.3.5.5 Peach

8.3.5.6 and Others)

8.3.5.7

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Supermarkets and Hypermarkets

8.3.6.2 Convenience Stores

8.3.6.3 Specialty Stores

8.3.6.4 Online Stores

8.3.6.5 and Others)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Yogurt Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Set Yogurt

8.4.4.2 Greek Yogurt

8.4.4.3 Yogurt Drinks

8.4.4.4 Frozen Yogurt

8.4.4.5 and Others)

8.4.4.6

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Strawberry Blend

8.4.5.2 Vanilla

8.4.5.3 Plain

8.4.5.4 Strawberry

8.4.5.5 Peach

8.4.5.6 and Others)

8.4.5.7

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Supermarkets and Hypermarkets

8.4.6.2 Convenience Stores

8.4.6.3 Specialty Stores

8.4.6.4 Online Stores

8.4.6.5 and Others)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Yogurt Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Set Yogurt

8.5.4.2 Greek Yogurt

8.5.4.3 Yogurt Drinks

8.5.4.4 Frozen Yogurt

8.5.4.5 and Others)

8.5.4.6

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Strawberry Blend

8.5.5.2 Vanilla

8.5.5.3 Plain

8.5.5.4 Strawberry

8.5.5.5 Peach

8.5.5.6 and Others)

8.5.5.7

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Supermarkets and Hypermarkets

8.5.6.2 Convenience Stores

8.5.6.3 Specialty Stores

8.5.6.4 Online Stores

8.5.6.5 and Others)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Yogurt Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Set Yogurt

8.6.4.2 Greek Yogurt

8.6.4.3 Yogurt Drinks

8.6.4.4 Frozen Yogurt

8.6.4.5 and Others)

8.6.4.6

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Strawberry Blend

8.6.5.2 Vanilla

8.6.5.3 Plain

8.6.5.4 Strawberry

8.6.5.5 Peach

8.6.5.6 and Others)

8.6.5.7

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Supermarkets and Hypermarkets

8.6.6.2 Convenience Stores

8.6.6.3 Specialty Stores

8.6.6.4 Online Stores

8.6.6.5 and Others)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Yogurt Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Set Yogurt

8.7.4.2 Greek Yogurt

8.7.4.3 Yogurt Drinks

8.7.4.4 Frozen Yogurt

8.7.4.5 and Others)

8.7.4.6

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Strawberry Blend

8.7.5.2 Vanilla

8.7.5.3 Plain

8.7.5.4 Strawberry

8.7.5.5 Peach

8.7.5.6 and Others)

8.7.5.7

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Supermarkets and Hypermarkets

8.7.6.2 Convenience Stores

8.7.6.3 Specialty Stores

8.7.6.4 Online Stores

8.7.6.5 and Others)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Yogurt Market research report?

A1: The forecast period in the Yogurt Market research report is 2024-2032.

Q2: Who are the key players in the Yogurt Market?

A2: Danone (France), Nestlé (Switzerland), Yoplait (France), Chobani (USA), FAGE (Greece) and Other Major Players.

Q3: What are the segments of the Yogurt Market?

A3: The Yogurt Market is segmented into Type, Application, End User and region. By Type, the market is categorized into Set Yogurt, Greek Yogurt, Yogurt Drinks, Frozen Yogurt, and Others. By Application, the market is categorized into Strawberry Blend, Vanilla, Plain, Strawberry, Peach, and Others. By End User, the market is categorized into Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, and Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Yogurt Market?

A4: The Yogurt industry includes the production, marketing, and consumption of yogurt a dairy product which is made by simmering milk through the use of bacterial cultures. Yogurt contains probiotics, calcium, and other minerals that give it a leading place for consumers looking for healthy convenient foods. It claimed that the market consists of various yogurt types that are traditional, Greek, flavored yogurt and plant-based yogurt. The growth of the yogurt market is driven by a rising trend of consumption of functional foods with added proteins and new knowledge of the positive effect of probiotics.

Q5: How big is the Yogurt Market?

A5: Yogurt Market Size Was Valued at USD 120.7 Billion in 2023, and is Projected to Reach USD 199.7 Billion by 2032, Growing at a CAGR of 5.6% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!