Stay Ahead in Fast-Growing Economies.

Browse Reports NowWound Care Biologics Market – Global Analysis and Forecast (2024-2032)

The Wound Care Biologics Market has been expanding at a constant pace because of growth in the number of chronic wounds like diabetic ulcers, venous leg ulcers, pressure ulcers along with ageing populace and other health compromised population. Skin substitutes, growth factors, and cellular therapies known as biologics has gained importance in wound care because they help to promote physiological healing. All these products are designed to assist the wound to heal and close while at the same time avoiding contracting an infection.

IMR Group

Description

Wound Care Biologics Market Synopsis:

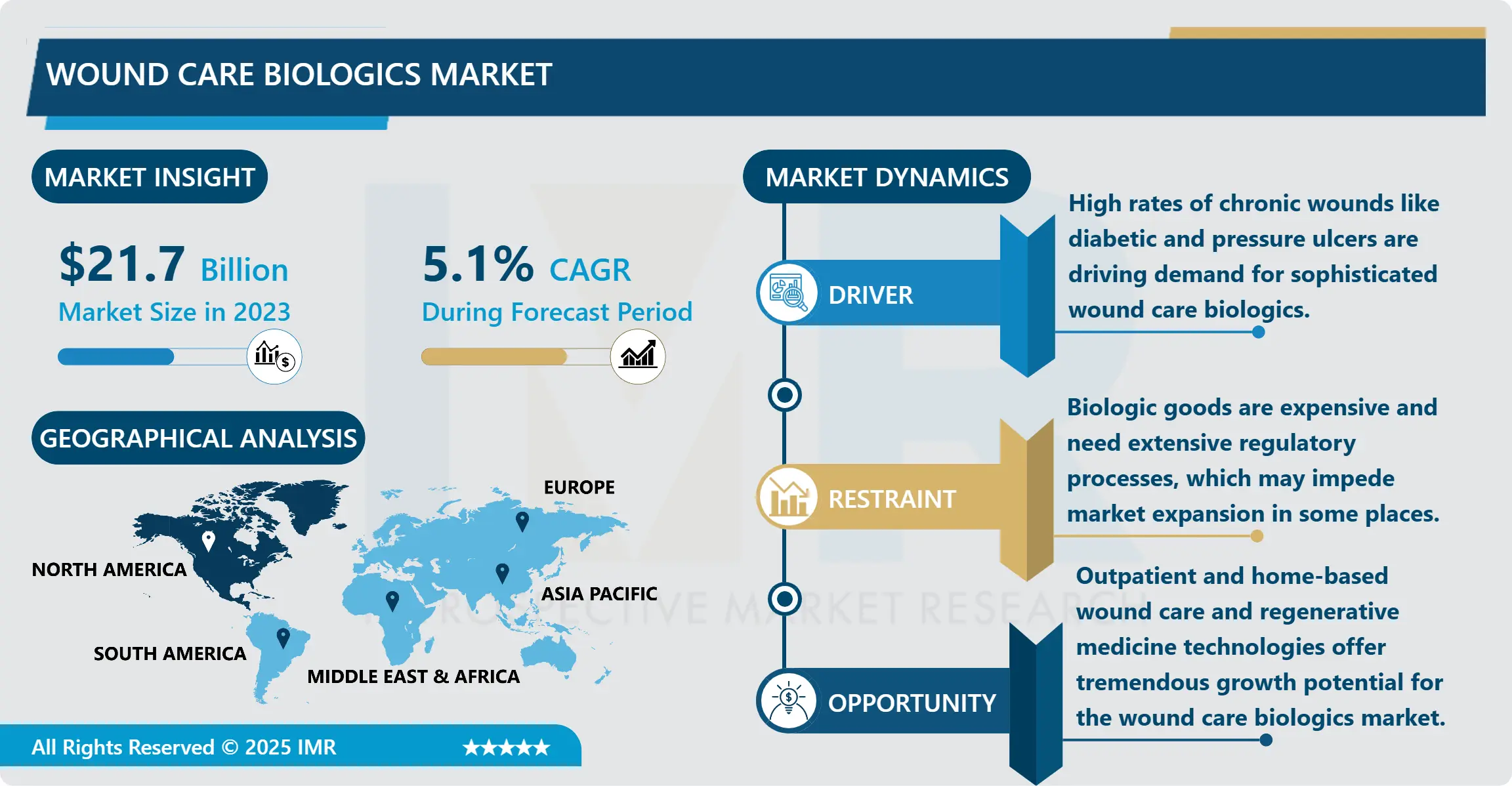

Wound Care Biologics Market Size Was Valued at USD 21.7 Billion in 2023, and is Projected to Reach USD 34.0 Billion by 2032, Growing at a CAGR of 5.10% From 2024-2032.

The Wound Care Biologics Market has been expanding at a constant pace because of growth in the number of chronic wounds like diabetic ulcers, venous leg ulcers, pressure ulcers along with ageing populace and other health compromised population. Skin substitutes, growth factors, and cellular therapies known as biologics has gained importance in wound care because they help to promote physiological healing. All these products are designed to assist the wound to heal and close while at the same time avoiding contracting an infection. Tissue engineering as well as, regenerative medicine advances have led to the emergence of the higher echelon of biologics that necessitates targeted healing, putting this particular sector as an imperative fragment of the larger wound care market.

Another reason is increasing healthcare costs along with innovation within the field of biotechnology leads to the demand for the wound care biologics market.. The emphasis that has been placed on outpatient care, and more specifically home care, with regard to wound management has increased the use of biologic products that Heal emphasizes has quicker healing times and less of a demand for additional hospitalization. In addition, advancement in approvals of the biologic agent in advanced wound care has put these products at a more accessible position in the market. North America and Europe are expected to have the largest share at the present time due to high healthcare expenditure and appropriate healthcare infrastructure.

Despite the promising growth, the market faces challenges such as high costs of biologic wound care products and regulatory complexities surrounding product approvals. These observed costs may bar access of the technology in some regions which have a strained health care finance. Further, understanding the permits and other regulations and getting a reimbursement approval in a particular country also take time before new products can arrive at markets. But, rising research investments along with signification improvement in regulations in developed countries are predicted to overcome some of these challenges. Therefore it can postulated that the wound care biologics market is poised to reach new heights in the coming years as more investor pour in there technology driven efforts into modern wound care solutions.

Wound Care Biologics Market Trend Analysis:

Rise of Advanced Skin Substitutes for Chronic Wound Management

Two major drivers that have been identified in the Wound Care Biologics Market are the growing preference for skin substitutes as well as the mounting prevalence of chronic injuries such as diabetic foot ulcers and pressure ulcers. These substitutes are designed to have a structural similarity to skin in order to offer appropriate niche for wound healing.

The advancements in material science engineers are developing skin substitutes that involve cellular structures and growth factors for improved regenerative results. Anticipated factors include the population demographics coupled with older patients with chronic wounds, new and innovative products with improved healing time and with least adverse effects. These specialized skin substitutes are slowly assuming basic importance in medical practice because of their efficiency and importance in enhancing patient’s well-being.

Shift Toward Outpatient and Home-Based Wound Care Solutions

Another is the development of the trend towards outpatient and home management of wound care, made possible by biologics that can easily be applied as well as inherited wound healing in other environments. This has been occasioned by the increasing costs of inpatient care and by the convenience and effective and safer outcomes associated with home-based care.

According to the perceived trends, given that both the healthcare practitioners and the patients are ever looking for affordable ways of treatment, there is an increasing trend in biologic products that can be used at home, including easy to apply dressings that contain growth factors or antimicrobial activity. This is backed up by telemedicine and remote patient monitoring; this means that doctors can oversee patients’ wound healing progress from a distance, all the while making certain that the patients are receiving quality wound care from the comforts of their homes.

Wound Care Biologics Market Segment Analysis:

Wound Care Biologics Market Segmented on the basis of Product, End user, and Region.

By Product, Biological Skin Substitutes segment is expected to dominate the market during the forecast period

The Wound Care Biologics Market is broadly categorized based on products into Biological Skin Substitutes and Topical Agents. In the biological skin substitutes, the products such as the allografts, xenografts, and biosynthetic skin replacements mimic skin properties in order to create a perfect environment for the presentation of the tissue formation in major or chronic wounds.

These are useful in handling many complicated wound situations, drawing a structure that facilitates quicker cellular action, and therefore, healing. Topical agents are substances that have a local effect on tissues, where the biologically active substances are growth factors and collagen-based formulations used directly at the site of the injury. These agents enhance tissue regeneration activities, fight infection, and maintain an appropriate moist wound condition. Both product categories are experiencing increased demand owing to the increasing cases of chronic and complex wounds, innovations in biotechnology, and increased knowledge of wound care by clinicians.

By End user, Hospitals/Clinics segment expected to held the largest share

End users of products such as hospitals, clinics, ambulatory surgical centres (ASCs), and others of Wound Care Biologics also play the decision-making roles for the use of these products. Hospitals and clinics remain the primary customers since they treat complicated and chronic wounds that require state biologic interventions like skin grafts and cellular therapies that are well served by the controlled environment and expertise available in the facilities.

ASCs are also upgrading their consumption of wound care biologics as they serve patients who need same day surgical procedures and intricate wound management after the surgery. There is also demand for use in home-based care services and LTC settings because of the increasing range of biologics for outpatient and home care encouraged by transitory, individual-career and cost-reduction treatment models. These various end user groups are contributing to the development of the market by increasing the availability of sophisticated wound care systems in various healthcare settings.

Wound Care Biologics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is anticipated to be the largest market for Wound Care Biologics during the period under consideration due to high healthcare spending, favourable healthcare infrastructure, and large patient pool of people suffering from chronic wounds. There are many patients with diabetes and obesity associated conditions in this region and as a result, the number of people developing chronic wounds such as diabetic foot ulcers is equally on the rise.

Moreover, the R&D infrastructure in North America and the presence of key market players also led to a relatively high rate of innovations as well as the minimum time required to gain approval for novel biologic wound care products. Expansion of government grants as well as encouraging policies for development of the advanced wound care solutions helps to enhance the market growth where North America is miles ahead in the adoption and development of the innovative wound care biologics.

Active Key Players in the Wound Care Biologics Market:

3M Company (US)

Acelity L.P. Inc. (KCI) (US)

ACell, Inc. (US)

Anika Therapeutics, Inc. (US)

Baxter International Inc. (US)

Coloplast Group (Denmark)

ConvaTec Group Plc (United Kingdom)

Ethicon, Inc. (a subsidiary of Johnson & Johnson) (US)

Integra LifeSciences Corporation (US)

Johnson & Johnson (US)

Kerecis (Iceland)

Medline Industries, Inc. (US)

MiMedx Group, Inc. (US)

Mölnlycke Health Care AB (Sweden)

Organogenesis Inc. (US)

Osiris Therapeutics, Inc. (US)

Smith & Nephew plc (UK)

Solsys Medical (US)

Stryker Corporation (US)

Vericel Corporation (US)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Wound Care Biologics Market by Product

4.1 Wound Care Biologics Market Snapshot and Growth Engine

4.2 Wound Care Biologics Market Overview

4.3 Biological Skin Substitutes and Topical Agents)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Biological Skin Substitutes and Topical Agents): Geographic Segmentation Analysis

4.4

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 : Geographic Segmentation Analysis

Chapter 5: Wound Care Biologics Market by End User

5.1 Wound Care Biologics Market Snapshot and Growth Engine

5.2 Wound Care Biologics Market Overview

5.3 Hospitals/Clinics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hospitals/Clinics: Geographic Segmentation Analysis

5.4 Ambulatory Surgical Centers

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Ambulatory Surgical Centers: Geographic Segmentation Analysis

5.5 and Other End Users)

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 and Other End Users) : Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Wound Care Biologics Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ACELITY L.P. INC. (KCI) (US)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 SMITH & NEPHEW PLC (UK)

6.4 MÖLNLYCKE HEALTH CARE AB (SWEDEN)

6.5 INTEGRA LIFESCIENCES CORPORATION (US)

6.6 ORGANOGENESIS INC. (US)

6.7 STRYKER CORPORATION (US)

6.8 OSIRIS THERAPEUTICS INC. (US)

6.9 ACELL INC. (US)

6.10 VERICEL CORPORATION (US)

6.11 COLOPLAST GROUP (DENMARK)

6.12 MEDLINE INDUSTRIES INC. (US)

6.13 CONVATEC GROUP PLC (UNITED KINGDOM)

6.14 ETHICON INC. (A SUBSIDIARY OF JOHNSON & JOHNSON) (US)

6.15 ANIKA THERAPEUTICS INC. (US)

6.16 KERECIS (ICELAND)

6.17 3M COMPANY (US)

6.18 BAXTER INTERNATIONAL INC. (US)

6.19 JOHNSON & JOHNSON (US)

6.20 MIMEDX GROUP INC. (US)

6.21 SOLSYS MEDICAL (US)

6.22 OTHER ACTIVE PLAYERS

Chapter 7: Global Wound Care Biologics Market By Region

7.1 Overview

7.2. North America Wound Care Biologics Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Product

7.2.4.1 Biological Skin Substitutes and Topical Agents)

7.2.4.2

7.2.5 Historic and Forecasted Market Size By End User

7.2.5.1 Hospitals/Clinics

7.2.5.2 Ambulatory Surgical Centers

7.2.5.3 and Other End Users)

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Wound Care Biologics Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Product

7.3.4.1 Biological Skin Substitutes and Topical Agents)

7.3.4.2

7.3.5 Historic and Forecasted Market Size By End User

7.3.5.1 Hospitals/Clinics

7.3.5.2 Ambulatory Surgical Centers

7.3.5.3 and Other End Users)

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Wound Care Biologics Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Product

7.4.4.1 Biological Skin Substitutes and Topical Agents)

7.4.4.2

7.4.5 Historic and Forecasted Market Size By End User

7.4.5.1 Hospitals/Clinics

7.4.5.2 Ambulatory Surgical Centers

7.4.5.3 and Other End Users)

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Wound Care Biologics Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Product

7.5.4.1 Biological Skin Substitutes and Topical Agents)

7.5.4.2

7.5.5 Historic and Forecasted Market Size By End User

7.5.5.1 Hospitals/Clinics

7.5.5.2 Ambulatory Surgical Centers

7.5.5.3 and Other End Users)

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Wound Care Biologics Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Product

7.6.4.1 Biological Skin Substitutes and Topical Agents)

7.6.4.2

7.6.5 Historic and Forecasted Market Size By End User

7.6.5.1 Hospitals/Clinics

7.6.5.2 Ambulatory Surgical Centers

7.6.5.3 and Other End Users)

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Wound Care Biologics Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Product

7.7.4.1 Biological Skin Substitutes and Topical Agents)

7.7.4.2

7.7.5 Historic and Forecasted Market Size By End User

7.7.5.1 Hospitals/Clinics

7.7.5.2 Ambulatory Surgical Centers

7.7.5.3 and Other End Users)

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the Wound Care Biologics Market research report?

A1: The forecast period in the Wound Care Biologics Market research report is 2024-2032.

Q2: Who are the key players in the Wound Care Biologics Market?

A2: Acelity L.P. Inc. (KCI) (US), Smith & Nephew plc (UK), Mölnlycke Health Care AB (Sweden), Integra LifeSciences Corporation (US), Organogenesis Inc. (US), Stryker Corporation (US), Osiris Therapeutics, Inc. (US), ACell, Inc. (US), Vericel Corporation (US), Coloplast Group (Denmark), Medline Industries, Inc. (US), ConvaTec Group Plc (United Kingdom), Ethicon, Inc. (a subsidiary of Johnson & Johnson) (US), Anika Therapeutics, Inc. (US), Kerecis (Iceland), 3M Company (US), Baxter International Inc. (US), Johnson & Johnson (US), MiMedx Group, Inc. (US), Solsys Medical (US), and Other Active Players.

Q3: What are the segments of the Wound Care Biologics Market?

A3: The Wound Care Biologics Market is segmented into By Product, End User and region. By Product(Biological Skin Substitutes and Topical Agents), By End user(Hospitals/Clinics, Ambulatory Surgical Centers, and Other End Users). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Wound Care Biologics Market?

A4: Wound care biologics are advanced therapeutic products derived from natural biological sources, designed to enhance the body’s ability to heal complex and chronic wounds. These biologics include a range of products, such as growth factors, skin substitutes, and cell-based therapies, which work by mimicking or augmenting natural tissue regeneration and repair processes. Skin substitutes can provide temporary or permanent coverage for wounds, while growth factors stimulate cellular activity and expedite healing. Cell-based therapies involve the application of living cells to promote tissue repair and regeneration. Together, these biologics represent a cutting-edge approach to wound care, offering effective alternatives to traditional treatments by targeting the underlying biological mechanisms of healing.

Q5: How big is the Wound Care Biologics Market?

A5: Wound Care Biologics Market Size Was Valued at USD 21.7 Billion in 2023, and is Projected to Reach USD 34.0 Billion by 2032, Growing at a CAGR of 5.10% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!