Stay Ahead in Fast-Growing Economies.

Browse Reports NowWine Packaging Market: Global Outlook & Market Dynamics

Wine packaging refers to the materials and containers used to package and present wine products which ensures the preservation, safety, and visual appeal of the wine during transportation, storage, and display. It involves the selection of appropriate packaging materials, designs, and formats.

IMR Group

Description

Wine Packaging Market Synopsis

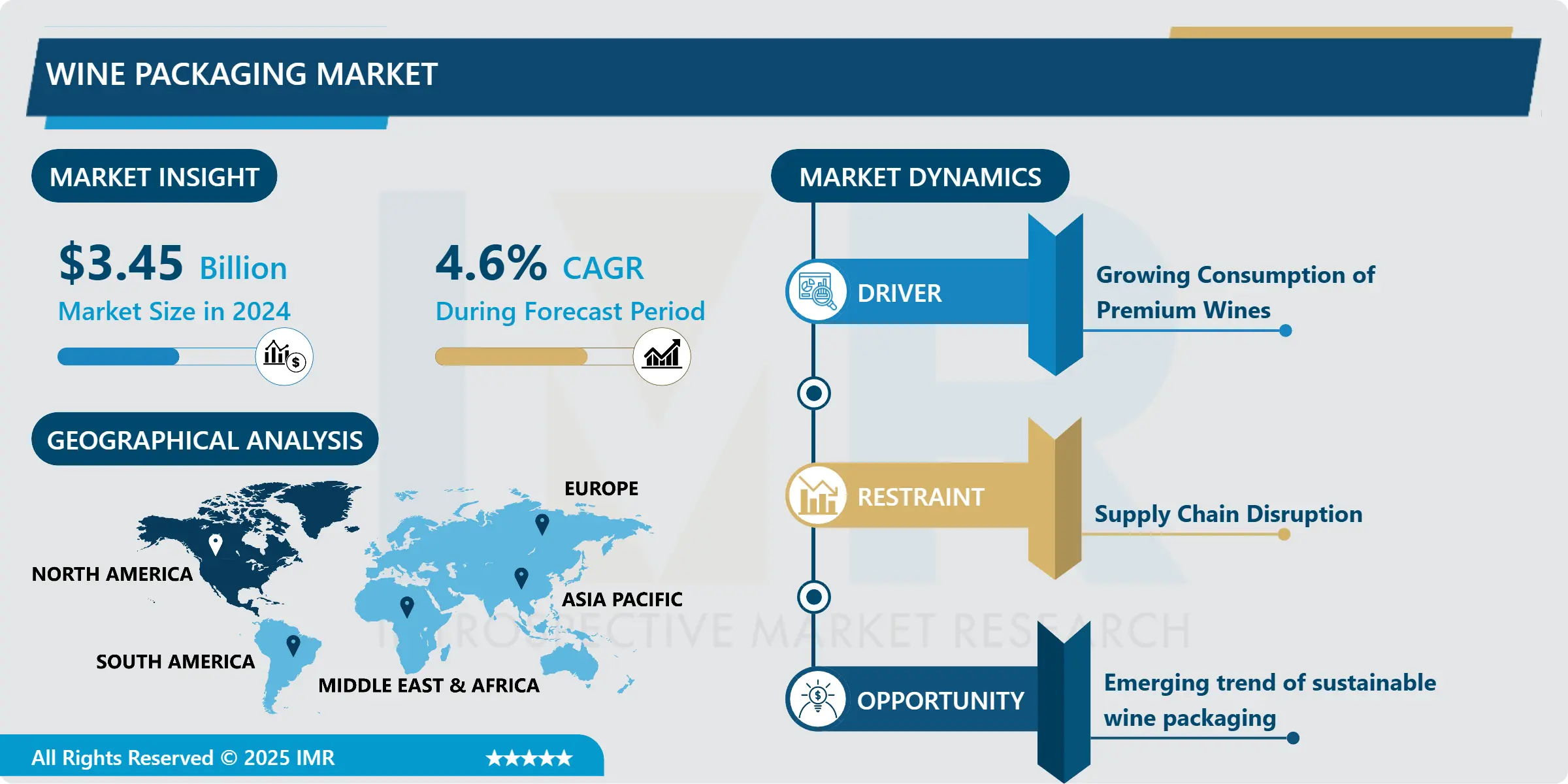

Wine Packaging Market Size Was Valued at USD 3.3 Billion in 2023 and is Projected to Reach USD 4.85 Billion by 2032, Growing at a CAGR of 4.6% From 2024-2032.

Wine packaging refers to the materials and containers used to package and present wine products which ensures the preservation, safety, and visual appeal of the wine during transportation, storage, and display. It involves the selection of appropriate packaging materials, designs, and formats.

Wine is a delicate product that can easily be affected by external factors so it requires proper packaging. It ensures the safe and secure transportation of wine bottles from wineries to consumers. Wine packaging helps in minimizing the risk of spoilage due to temperature fluctuations, humidity, or light exposure. It can impact the overall usability and convenience of wine consumption. The features like easy-to-open closures, pour spouts, ergonomic bottle shapes, and portable and lightweight packaging contribute to a user-friendly experience and can differentiate wine from competitors.

Wine packaging is designed to enhance the visual appeal of wine bottles and attract consumers with eye-catching labels, unique bottle shapes, and premium packaging materials. Luxurious, well-presented packages of wine make it an ideal choice for special occasions, celebrations, and corporate gifts. Sustainable packaging such as recycled paper, biodegradable plastics, or lightweight glass, can reduce waste, lower carbon footprint, and enhance brand reputation among environmentally-conscious consumers.

Wine Packaging Market Trend Analysis

Wine Packaging Market Driving Factors- Growing Consumption of Premium Wines

Premium wines are often associated with higher quality, good taste, and enhanced drinking experiences. As more consumers become aware of the premium taste of wine, there is a rise in the demand for wine packaging also. Wine packaging not only protects the integrity of the product but also reflects its sophistication and premium nature. Wine packaging is important in attracting consumers and enhancing the overall drinking experience. Premium wines are often packaged in glass bottles, which allow for an elegant and luxurious presentation with wine taste and quality protection. These bottles are carefully designed and may feature unique labelling, shape, and bottle colour.

The rising popularity of wine as a cultural symbol has further contributed to the increased consumption of premium wines. Younger consumers are increasingly seeking out higher quality, more unique wines, and premium packaging reflects the sophistication and exclusivity of the product. Consumer preferences have shifted towards premium wines due to factors such as increased exposure to wine culture, high interest in health and wellness, and a desire for more unique drinking experiences.

Wine Packaging Market Opportunity- Emerging trend of sustainable wine packaging

In the current situation, sustainability has become a major trend, with consumers increasingly seeking out products that are environmentally friendly and socially responsible. As a result, wine brands are also trying to adopt sustainable practices across their entire production process, including packaging. This helps to minimize waste at every stage of the supply chain. Sustainable packaging options include recycled materials, biodegradable or compostable materials like paper board and lightweight designs.

Biodegradable and compostable packaging materials are designed to break down naturally over time. Biodegradable packaging options include plant-based plastics, derived from corn, sugarcane. Compostable packaging can decompose and contribute to nutrient-rich compost. Sustainable packaging can be lightweight than traditional packaging which can help to reduce the amount of material used and decreases transportation emissions. This wine packaging market can address the unique needs and preferences of different brands and products.

Wine Packaging Market Segment Analysis:

The wine packaging Market is Segmented on the basis of material, packaging type, and distribution channels.

By Material, Glass Segment Is Expected to Dominate the Market During the Forecast Period

By material, there are five segments such as glass, plastic, metal, paper board, other such as compostable, and biodegradable. Among these segments, the glass segment is expected to dominate the market during the forecast period.

Glass is most preferred for wine packaging due to its ability to preserve the quality and taste of the wine. Glass can provide an excellent barrier against oxygen and moisture, which can have an impact on the wine’s flavour and longevity. The bottles also protect the wine from exposure to light, which can degrade its composition. The inert nature of glass ensures that the wine remains unaffected by any chemical reactions and preserves its natural characteristics.

Glass packaging often defines the high quality, luxury, and elegance of the wine. The transparency of glass allows consumers to appreciate the colour and clarity of the wine and enhances the overall experience. Glass is a highly recyclable material that can be recycled without losing its purity. Glass material’s unique properties, premium image, recyclability, branding opportunities, and long-established tradition make it the preferred material for preserving and presenting wine.

By Packaging Type, the Bottle Segment Held the Largest Share in 2024

By packaging type, there are five segments such as bottles, bag-in-box, barrels & kegs, cans, and cartons. Among these, the bottle segment held the largest share in 2023.

Bottles have long been associated with wine and are considered the traditional packaging type. Additionally, it has an elegant and premium image that aligns with the high-end consumer target audience and brand identity of many vineyards. Bottles provide ample surface area for labelling, allowing wineries to customize each bottle’s design, shape, and colour. Wine packaged in bottles carries a higher perceived value than wine packaged in other formats. This makes it more appealing to consumers who are willing to invest in a premium wine experience.

Wine bottles are majorly made of glass, which makes them recyclable and sustainable without compromising their quality or purity. The aesthetic appeal of wine bottles can play a crucial role in brand recognition and shelf appeal. The wine bottles make them a preferred packaging option for both businesses and customers due to their familiarity and ease of handling. The cultural attachment to wine bottles such as the ritual of uncorking a bottle, presenting and sharing it during meals contributes to their continued dominance in the market.

Wine Packaging Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

There has been a significant increase in wine consumption in North America due to changing consumer preferences, expanding wine tourism, and a growing interest in wine culture. The United States and Canada have witnessed a surge in domestic wine production which has led to an increased need for wine packaging solutions to cater to the expanding market. Wineries are investing in packaging to preserve their wine quality, and to enhance their brand image and appeal

North America has witnessed a trend toward premiumization in the wine market where consumers are willing to spend more on high-quality, premium wines, creating a demand for packaging that reflects exclusivity and luxury. The well-established distribution channels for wine, including retail stores, e-commerce platforms, and restaurants contribute to the wine and wine packaging market. North American wineries often adopt new advanced packaging techniques such as innovation in packaging materials, design, and manufacturing processes to attract a wider base of consumers.

Wine Packaging Market Active Players

Berlin Packaging

All American Containers

Brick Packaging LLC.

Avery Dennison Corporation

Sambucks Co. Ltd.

Scholle IPN

Dongguan Huacheng Can Co. Ltd.

Amcor Ltd.

Golden State Box Factory

Guala Closures Group

Ardagh Group

Ball Corporation

Encore Glass

G3 Enterprises

Owens-Illinois Group

Liqui-Box Corp

Vidrala S.A.

DS Smith

WestRock Company

International Paper Company

Trivium Packaging

Frugalpac Limited

TricorBraun Inc.

Smurfit Kappa Group and Other Active Players

Key Industry Developments in the Wine Packaging Market:

In March 2024, Aldi, the UK’s first supermarket-owned wine brand launched their wine with 94% recycled paper board packaging which is manufactured by sustainable packaging firm Frugalpac. The cardboard is fully recyclable and five times lighter than standard glass bottles.

In 2024, Diageo Global Travel is launching Baileys in an aluminium bottle, bringing international travellers the product in a lightweight bottle. Baileys has certified B Corp status and this new format is the latest in its sustainable journey, a bottle made from aluminium rather than glass, making the bottle five times lighter than traditional 70cl Baileys bottles.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Wine Packaging Market by Type (2018-2032)

4.1 Wine Packaging Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Glass

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Plastic

4.5 Metal

4.6 Paper Board

4.7 Others (Compostable

4.8 Biodegradable)

Chapter 5: Wine Packaging Market by Packaging Type (2018-2032)

5.1 Wine Packaging Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Bottles

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Bag-in-Box

5.5 Barrels & kegs

5.6 Cans

5.7 Cartons

Chapter 6: Wine Packaging Market by Distribution Channel (2018-2032)

6.1 Wine Packaging Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Offline

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Wine Packaging Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BERLIN PACKAGING

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALL AMERICAN CONTAINERS

7.4 BRICK PACKAGING LLC.

7.5 AVERY DENNISON CORPORATION

7.6 SAMBUCKS CO. LTDSCHOLLE IPN

7.7 DONGGUAN HUACHENG CAN CO. LTDAMCOR LTDGOLDEN STATE BOX FACTORY

7.8 GUALA CLOSURES GROUP

7.9 ARDAGH GROUP

7.10 BALL CORPORATION

7.11 ENCORE GLASS

7.12 G3 ENTERPRISES

7.13 OWENS-ILLINOIS GROUP

7.14 LIQUI-BOX CORP

7.15 VIDRALA S.ADS SMITH

7.16 WESTROCK COMPANY

7.17 INTERNATIONAL PAPER COMPANY

7.18 TRIVIUM PACKAGING

7.19 FRUGALPAC LIMITED

7.20 TRICORBRAUN INCSMURFIT KAPPA GROUP AND

Chapter 8: Global Wine Packaging Market By Region

8.1 Overview

8.2. North America Wine Packaging Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Glass

8.2.4.2 Plastic

8.2.4.3 Metal

8.2.4.4 Paper Board

8.2.4.5 Others (Compostable

8.2.4.6 Biodegradable)

8.2.5 Historic and Forecasted Market Size by Packaging Type

8.2.5.1 Bottles

8.2.5.2 Bag-in-Box

8.2.5.3 Barrels & kegs

8.2.5.4 Cans

8.2.5.5 Cartons

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Online

8.2.6.2 Offline

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Wine Packaging Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Glass

8.3.4.2 Plastic

8.3.4.3 Metal

8.3.4.4 Paper Board

8.3.4.5 Others (Compostable

8.3.4.6 Biodegradable)

8.3.5 Historic and Forecasted Market Size by Packaging Type

8.3.5.1 Bottles

8.3.5.2 Bag-in-Box

8.3.5.3 Barrels & kegs

8.3.5.4 Cans

8.3.5.5 Cartons

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Online

8.3.6.2 Offline

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Wine Packaging Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Glass

8.4.4.2 Plastic

8.4.4.3 Metal

8.4.4.4 Paper Board

8.4.4.5 Others (Compostable

8.4.4.6 Biodegradable)

8.4.5 Historic and Forecasted Market Size by Packaging Type

8.4.5.1 Bottles

8.4.5.2 Bag-in-Box

8.4.5.3 Barrels & kegs

8.4.5.4 Cans

8.4.5.5 Cartons

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Online

8.4.6.2 Offline

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Wine Packaging Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Glass

8.5.4.2 Plastic

8.5.4.3 Metal

8.5.4.4 Paper Board

8.5.4.5 Others (Compostable

8.5.4.6 Biodegradable)

8.5.5 Historic and Forecasted Market Size by Packaging Type

8.5.5.1 Bottles

8.5.5.2 Bag-in-Box

8.5.5.3 Barrels & kegs

8.5.5.4 Cans

8.5.5.5 Cartons

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Online

8.5.6.2 Offline

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Wine Packaging Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Glass

8.6.4.2 Plastic

8.6.4.3 Metal

8.6.4.4 Paper Board

8.6.4.5 Others (Compostable

8.6.4.6 Biodegradable)

8.6.5 Historic and Forecasted Market Size by Packaging Type

8.6.5.1 Bottles

8.6.5.2 Bag-in-Box

8.6.5.3 Barrels & kegs

8.6.5.4 Cans

8.6.5.5 Cartons

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Online

8.6.6.2 Offline

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Wine Packaging Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Glass

8.7.4.2 Plastic

8.7.4.3 Metal

8.7.4.4 Paper Board

8.7.4.5 Others (Compostable

8.7.4.6 Biodegradable)

8.7.5 Historic and Forecasted Market Size by Packaging Type

8.7.5.1 Bottles

8.7.5.2 Bag-in-Box

8.7.5.3 Barrels & kegs

8.7.5.4 Cans

8.7.5.5 Cartons

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Online

8.7.6.2 Offline

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Wine Packaging Market research report?

A1: The forecast period in the Wine Packaging Market research report is 2025-2032.

Q2: Who are the key players in the Wine Packaging Market?

A2: Berlin Packaging, All American Containers, Brick Packaging LLC., Avery Dennison Corporation, Sambucks Co. Ltd., and Other Active Players.

Q3: What are the segments of the Wine Packaging Market?

A3: The Wine Packaging Market is segmented into Type, Nature, Application, and region. By Material, the market is categorized into Glass, Plastic, Metal, Paper Board, and Others such as compostable, and biodegradable. By Packaging type, the market is categorized into Bottles, Bag-in-Box, Barrels & kegs, Cans, and Cartons. By Distribution Channel, the market is categorized into Online and offline. By region, it is analyzed across• North America (U.S., Canada, Mexico) • Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) • Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe) • Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC) • Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) • South America (Brazil, Argentina, Rest of SA)

Q4: What is the Wine Packaging Market?

A4: Wine packaging refers to the materials and containers used to package and present wine products which ensures the preservation, safety, and visual appeal of the wine during transportation, storage, and display. It involves the selection of appropriate packaging materials, designs, and formats.

Q5: How big is the Wine Packaging Market?

A5: Wine Packaging Market Size Was Valued at USD 3.3 Billion in 2023 and is Projected to Reach USD 4.85 Billion by 2032, Growing at a CAGR of 4.6% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!