Stay Ahead in Fast-Growing Economies.

Browse Reports NowWarehouse Management Software (WMS) Market – Insights & Analysis

Warehouse Management Software (WMS) is a specialized platform that optimizes warehouse operations by managing inventory, order processing, and logistics. It allows real-time inventory tracking, automates order fulfillment, and minimizes errors. WMS is crucial for businesses dealing with large inventories, improving accuracy, reducing costs, and meeting customer demands in fast-paced supply chain environments.

IMR Group

Description

Warehouse Management Software (WMS) Market Synopsis

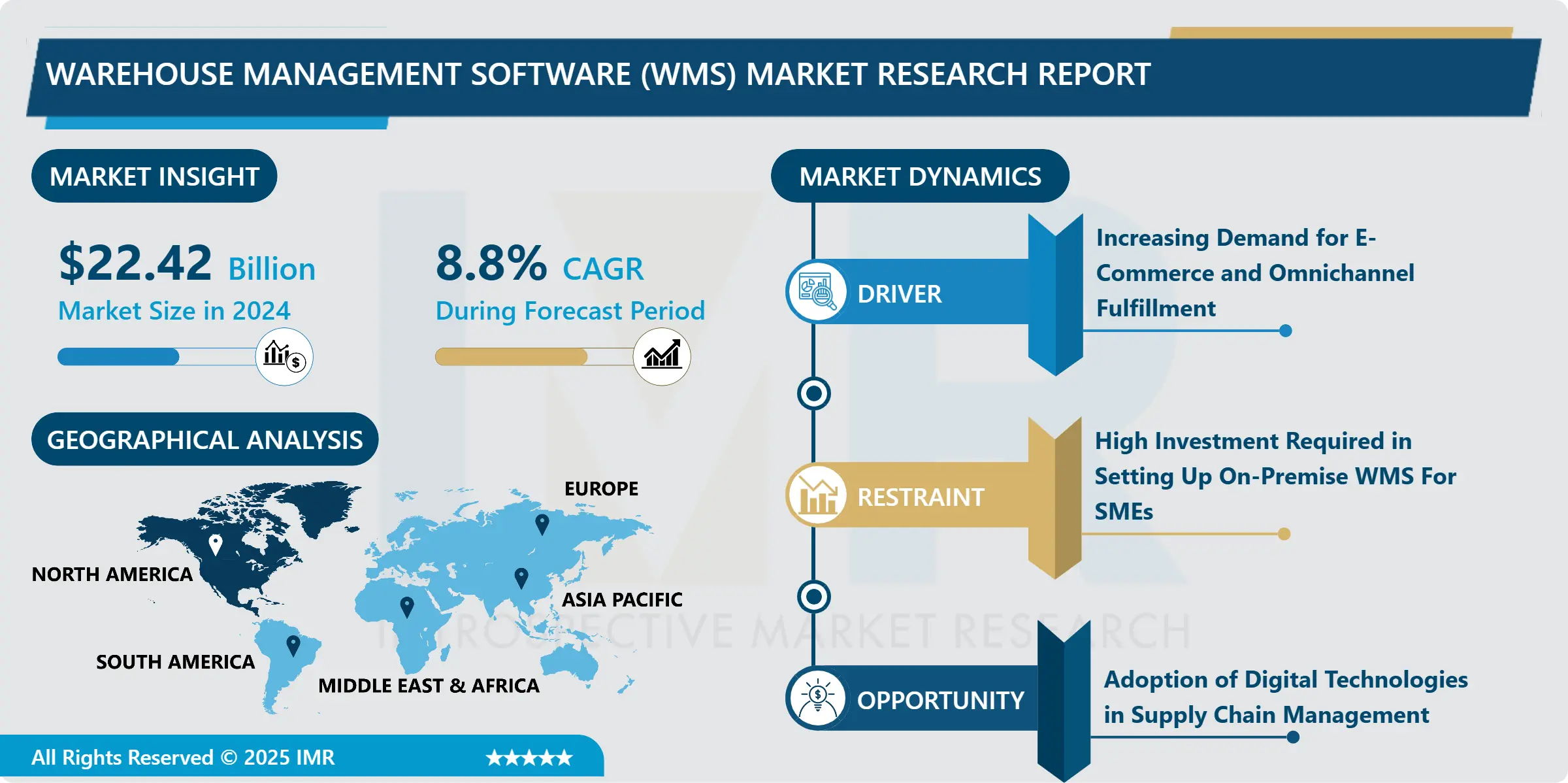

Warehouse Management Software (WMS) Market Size Was Valued at USD 22.42 Billion in 2024 and is Projected to Reach USD 44.02 Billion by 2032, Growing at a CAGR of 8.8 % From 2025-2032.

Warehouse Management Software (WMS) is a specialized platform that optimizes warehouse operations by managing inventory, order processing, and logistics. It allows real-time inventory tracking, automates order fulfillment, and minimizes errors. WMS is crucial for businesses dealing with large inventories, improving accuracy, reducing costs, and meeting customer demands in fast-paced supply chain environments.

Warehouse Management Software (WMS) is a pivotal solution offering numerous advantages in response to prevailing market trends and heightened demand. Primarily, WMS optimizes operational efficiency by automating critical warehouse functions like inventory management, order fulfillment, and picking, leading to increased accuracy and faster order processing. This aligns seamlessly with the market’s requirement for streamlined logistics and efficient operations.

Market trends indicate a growing inclination towards cloud-based WMS solutions, providing scalability, flexibility, and accessibility. The adoption of cloud deployment enables businesses to swiftly adapt to changing demands and efficiently scale operations. Additionally, the escalating demand for WMS is driven by the expanding prominence of e-commerce, necessitating seamless and rapid order fulfillment, showcasing the dynamic nature of the market.

Furthermore, WMS contributes significantly to cost savings by optimizing inventory levels, reducing carrying costs, and minimizing the need for excess safety stock. This resonates with the market’s pursuit of cost-effective and operationally efficient warehouse management solutions.

The surge in demand for WMS is further propelled by the integration of cutting-edge technologies like RFID, IoT, and AI, enhancing visibility, enabling real-time tracking, and supporting data-driven decision-making. This addresses the market’s appetite for innovative and technologically advanced warehouse management solutions.

Warehouse Management Software (WMS) Market Trend Analysis:

Increasing Demand for E-Commerce and Omnichannel Fulfillment

Surging demand for e-commerce and the embrace of omnichannel fulfillment strategies stand as pivotal drivers fueling the adoption of Warehouse Management Software (WMS). As online retail continues to experience unprecedented growth, businesses grapple with the intricate challenge of efficiently managing orders from diverse channels. WMS emerges as a solution by optimizing inventory processes, order fulfillment, and overall operations, ensuring the seamless and accurate execution of orders across various sales channels.

Integration of omnichannel strategies, combining both online and offline sales channels, underscores the need for sophisticated WMS to synchronize inventory levels, track orders in real-time, and optimize warehouse workflows. The software’s capacity to enhance visibility, automate tasks, and minimize errors becomes crucial in meeting the expectations of modern consumers who seek a smooth shopping experience across multiple platforms.

In a landscape where consumers increasingly favor online shopping and demand swift, error-free deliveries, the significance of robust WMS solutions grows. WMS not only facilitates operational efficiency but also empowers businesses to navigate the dynamic terrain of contemporary retail, establishing itself as an indispensable tool in the e-commerce and omnichannel fulfillment landscape.

Adoption of Digital Technologies in Supply Chain Management

The emergence of digital technologies in supply chain management presents a notable opportunity for Warehouse Management Software (WMS). In the era of digital transformation, WMS stands to benefit from the integration of technologies like IoT, AI, and advanced analytics, reshaping conventional warehouse operations. By aligning with these digital tools, WMS can offer real-time monitoring, predictive analytics, and data-driven decision-making capabilities within the warehouse environment.

WMS has the potential to leverage IoT devices for enhanced tracking of inventory and assets, while AI-driven algorithms can optimize picking routes, automate routine tasks, and furnish valuable insights for strategic decision-making. The incorporation of advanced analytics in WMS enables the analysis of historical data to predict demand patterns, facilitating proactive inventory management.

Moreover, the interconnected nature facilitated by digital technologies promotes seamless collaboration throughout the supply chain, fostering enhanced visibility and transparency. This interconnectedness not only streamlines warehouse processes but also contributes to the broader efficiency and resilience of the entire supply chain ecosystem, positioning WMS as a pivotal component in the digitalized landscape of modern supply chain management.

Warehouse Management Software (WMS) Market Segment Analysis:

Warehouse Management Software (WMS) Market Segmented on the basis of type, application, and end-users.

By Component, Software segment is expected to dominate the market during the forecast period

Projected dominance of the Software segment in the Warehouse Management Software (WMS) market throughout the forecast period is grounded in the fundamental role that software plays in optimizing and automating warehouse operations. Serving as the core component of WMS, software is instrumental in enhancing efficiency, accuracy, and responsiveness within modern logistics settings.

Critical functionalities offered by WMS software, including real-time inventory tracking, automated order fulfillment, and analytical capabilities for strategic decision-making, underscore the essential nature of the software component in warehouse management. With businesses increasingly prioritizing digital transformation in their supply chain processes, the software segment becomes a linchpin for orchestrating intelligent and seamlessly integrated warehouse operations.

Furthermore, the adaptability of WMS software to emerging technologies like AI, IoT, and cloud computing reinforces its anticipated dominance. This adaptability empowers businesses to tailor and expand their WMS solutions to meet specific requirements, ensuring a competitive edge in the dynamic landscape of contemporary logistics. In summary, the expected dominance of the Software segment highlights the pivotal role of advanced software solutions in driving the efficiency and success of Warehouse Management Systems.

By Technology, Barcode Scanning segment is expected to dominate the market during the forecast period

Expected dominance of the Barcode Scanning segment in the Warehouse Management Software (WMS) market over the forecast period is rooted in the widespread acceptance and proven effectiveness of this technology in refining warehouse operations. Barcode scanning plays a pivotal role in elevating the precision, speed, and overall efficiency of tasks related to inventory management and order processing within warehouses.

Technology simplifies data entry, reduces errors, and expedites the identification and tracking of items. Its user-friendly characteristics and cost-effectiveness contribute to its popularity, particularly among businesses seeking practical and dependable solutions for their warehouse management needs. As the demand for real-time visibility and accurate inventory tracking continues to grow, Barcode Scanning emerges as a foundational technology within the realm of WMS.

Furthermore, the ease of integration and compatibility of Barcode Scanning with existing systems make it a preferred choice for numerous organizations. Its capacity to improve data accuracy and streamline processes aligns seamlessly with the evolving requirements of contemporary supply chain management, solidifying its dominance in the WMS market. Essentially, the projected dominance of the Barcode Scanning segment underscores its pivotal role in enhancing warehouse processes and overall operational efficiency.

Warehouse Management Software (WMS) Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

Projected dominance of North America in the Warehouse Management Software (WMS) market throughout the forecast period is underpinned by several key elements. North America, encompassing the United States and Canada, boasts a robust and technologically advanced business landscape, positioning it as a primary adopter of innovative logistics solutions. The region’s well-established e-commerce sector, coupled with a strong emphasis on optimizing supply chains, propels the demand for advanced WMS.

Moreover, the prevalence of extensive distribution networks, the ongoing evolution of omnichannel retail practices, and the increasing need for real-time visibility in supply chain operations contribute to the prominence of WMS solutions. Businesses in North America are actively investing in cutting-edge technologies to elevate warehouse efficiency, and the strategic integration of WMS aligns with the region’s commitment to precision, efficiency, and meeting evolving customer expectations.

Expected leadership of North America in the WMS market reflects its technologically adept business environment, thriving e-commerce ecosystem, and continuous pursuit of state-of-the-art logistics solutions to address the dynamic demands of the market.

Warehouse Management Software (WMS) Market Top Key Players:

Manhattan Associates Inc. (US)

Blue Yonder Group Inc. (US)

HighJump (Körber) (US)

Oracle Corporation (US)

Juniper Networks Inc. (US)

Versa Networks Inc. (US)

Cisco Systems Inc. (US)

Microsoft Corporation (US)

Infor Inc. (US)

Fishbowl Inventory (US)

3PL Central LLC (US)

EPICOR (US)

Made4net (US)

Softeon (US)

VMWare Inc. (US)

Hewlett Packard Enterprise Development LP (US)

Telco Systems (US)

Tecsys Inc. (Canada)

SAP (Germany)

Korber AG (Germany)

PSI Logistics (Germany)

Ericsson Inc (Sweden)

Reply (Italy)

Unicommerce eSolutions Pvt. Ltd. (India)

NEC Corporation (Japan), and Other Active Players.

Key Industry Developments in the Warehouse Management Software (WMS) Market:

In March 2023, Stockone, an Indian warehouse management system provider, introduced a SaaS-based system designed to facilitate seamless warehouse operations management for users.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Warehouse Management Software (WMS) Market by Deployment Type (2018-2032)

4.1 Warehouse Management Software (WMS) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 On-Premises

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cloud-Based

Chapter 5: Warehouse Management Software (WMS) Market by Component (2018-2032)

5.1 Warehouse Management Software (WMS) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Software

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Services

Chapter 6: Warehouse Management Software (WMS) Market by Technology (2018-2032)

6.1 Warehouse Management Software (WMS) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 RFID (Radio-Frequency Identification)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Barcode Scanning

6.5 Voice Recognition

6.6 IoT (Internet of Things)

Chapter 7: Warehouse Management Software (WMS) Market by End-User (2018-2032)

7.1 Warehouse Management Software (WMS) Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Retail

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Manufacturing

7.5 Healthcare

7.6 Automotive

7.7 E-commerce

7.8 Food and Beverage

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Warehouse Management Software (WMS) Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 EQUINIX

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 DIGITAL REALTY

8.4 CHINA TELECOM

8.5 NTT COMMUNICATIONS

8.6 TELEHOUSE/KDDI

8.7 CORESITE

8.8 VERIZON

8.9 CYXTERA TECHNOLOGIES

8.10 CHINA UNICOM

8.11 IBM CLOUD (USA)

8.12 MICROSOFT AZURE (USA)

8.13 GOOGLE CLOUD (USA)

8.14 ALIBABA CLOUD (CHINA)

8.15 DIGITALOCEAN (USA)

8.16 AMAZON WEB SERVICES

8.17 AND OTHER KEY PLAYERS

Chapter 9: Global Warehouse Management Software (WMS) Market By Region

9.1 Overview

9.2. North America Warehouse Management Software (WMS) Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Deployment Type

9.2.4.1 On-Premises

9.2.4.2 Cloud-Based

9.2.5 Historic and Forecasted Market Size by Component

9.2.5.1 Software

9.2.5.2 Services

9.2.6 Historic and Forecasted Market Size by Technology

9.2.6.1 RFID (Radio-Frequency Identification)

9.2.6.2 Barcode Scanning

9.2.6.3 Voice Recognition

9.2.6.4 IoT (Internet of Things)

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Retail

9.2.7.2 Manufacturing

9.2.7.3 Healthcare

9.2.7.4 Automotive

9.2.7.5 E-commerce

9.2.7.6 Food and Beverage

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Warehouse Management Software (WMS) Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Deployment Type

9.3.4.1 On-Premises

9.3.4.2 Cloud-Based

9.3.5 Historic and Forecasted Market Size by Component

9.3.5.1 Software

9.3.5.2 Services

9.3.6 Historic and Forecasted Market Size by Technology

9.3.6.1 RFID (Radio-Frequency Identification)

9.3.6.2 Barcode Scanning

9.3.6.3 Voice Recognition

9.3.6.4 IoT (Internet of Things)

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Retail

9.3.7.2 Manufacturing

9.3.7.3 Healthcare

9.3.7.4 Automotive

9.3.7.5 E-commerce

9.3.7.6 Food and Beverage

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Warehouse Management Software (WMS) Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Deployment Type

9.4.4.1 On-Premises

9.4.4.2 Cloud-Based

9.4.5 Historic and Forecasted Market Size by Component

9.4.5.1 Software

9.4.5.2 Services

9.4.6 Historic and Forecasted Market Size by Technology

9.4.6.1 RFID (Radio-Frequency Identification)

9.4.6.2 Barcode Scanning

9.4.6.3 Voice Recognition

9.4.6.4 IoT (Internet of Things)

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Retail

9.4.7.2 Manufacturing

9.4.7.3 Healthcare

9.4.7.4 Automotive

9.4.7.5 E-commerce

9.4.7.6 Food and Beverage

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Warehouse Management Software (WMS) Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Deployment Type

9.5.4.1 On-Premises

9.5.4.2 Cloud-Based

9.5.5 Historic and Forecasted Market Size by Component

9.5.5.1 Software

9.5.5.2 Services

9.5.6 Historic and Forecasted Market Size by Technology

9.5.6.1 RFID (Radio-Frequency Identification)

9.5.6.2 Barcode Scanning

9.5.6.3 Voice Recognition

9.5.6.4 IoT (Internet of Things)

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Retail

9.5.7.2 Manufacturing

9.5.7.3 Healthcare

9.5.7.4 Automotive

9.5.7.5 E-commerce

9.5.7.6 Food and Beverage

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Warehouse Management Software (WMS) Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Deployment Type

9.6.4.1 On-Premises

9.6.4.2 Cloud-Based

9.6.5 Historic and Forecasted Market Size by Component

9.6.5.1 Software

9.6.5.2 Services

9.6.6 Historic and Forecasted Market Size by Technology

9.6.6.1 RFID (Radio-Frequency Identification)

9.6.6.2 Barcode Scanning

9.6.6.3 Voice Recognition

9.6.6.4 IoT (Internet of Things)

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Retail

9.6.7.2 Manufacturing

9.6.7.3 Healthcare

9.6.7.4 Automotive

9.6.7.5 E-commerce

9.6.7.6 Food and Beverage

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Warehouse Management Software (WMS) Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Deployment Type

9.7.4.1 On-Premises

9.7.4.2 Cloud-Based

9.7.5 Historic and Forecasted Market Size by Component

9.7.5.1 Software

9.7.5.2 Services

9.7.6 Historic and Forecasted Market Size by Technology

9.7.6.1 RFID (Radio-Frequency Identification)

9.7.6.2 Barcode Scanning

9.7.6.3 Voice Recognition

9.7.6.4 IoT (Internet of Things)

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Retail

9.7.7.2 Manufacturing

9.7.7.3 Healthcare

9.7.7.4 Automotive

9.7.7.5 E-commerce

9.7.7.6 Food and Beverage

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Warehouse Management Software (WMS) Market research report?

A1: The forecast period in the Warehouse Management Software (WMS) Market research report is 2024-2030.

Q2: Who are the key players in Warehouse Management Software (WMS) market?

A2: Manhattan Associates Inc. (US), Blue Yonder Group Inc. (US), HighJump (Körber) (US), Oracle Corporation (US), Juniper Networks Inc. (US), Versa Networks Inc. (US), Cisco Systems Inc. (US), Microsoft Corporation (US), Infor Inc. (US), Fishbowl Inventory (US), 3PL Central LLC (US), EPICOR (US), Made4net (US), Softeon (US), VMWare Inc. (US), Hewlett Packard Enterprise Development LP (US), Telco Systems (US), Tecsys Inc. (Canada), SAP (Germany), Korber AG (Germany), PSI Logistics (Germany), Ericsson Inc (Sweden), Reply (Italy), Unicommerce eSolutions Pvt. Ltd. (India), NEC Corporation (Japan), and Other Active Players.

Q3: What are the segments of the Warehouse Management Software (WMS) Market?

A3: The Warehouse Management Software (WMS) Market is segmented into Deployment Type, Component, Technology, End-User, and Region. By Deployment Type, the market is categorized into On-Premises and Cloud-Based. By Component, the market is categorized into Software and Services. By Technology, the market is categorized into RFID (Radio-Frequency Identification), Barcode Scanning, Voice Recognition, and IoT (Internet of Things). By End-User, the market is categorized into Retail, Manufacturing, Healthcare, Automotive, E-commerce, and Food and Beverage. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.)

Q4: What is the Warehouse Management Software (WMS) market?

A4: Warehouse Management Software (WMS) is a specialized platform that optimizes warehouse operations by managing inventory, order processing, and logistics. It allows real-time inventory tracking, automates order fulfillment, and minimizes errors. WMS is crucial for businesses dealing with large inventories, improving accuracy, reducing costs, and meeting customer demands in fast-paced supply chain environments.

Q5: How big is the Warehouse Management Software (WMS) Market?

A5: Warehouse Management Software (WMS) Market Size Was Valued at USD 22.42 Billion in 2024 and is Projected to Reach USD 44.02 Billion by 2032, Growing at a CAGR of 8.8 % From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!