Stay Ahead in Fast-Growing Economies.

Browse Reports NowVirtual Networking Market Size, Share, Growth Opportunities & Forecast Report (2024-2032)

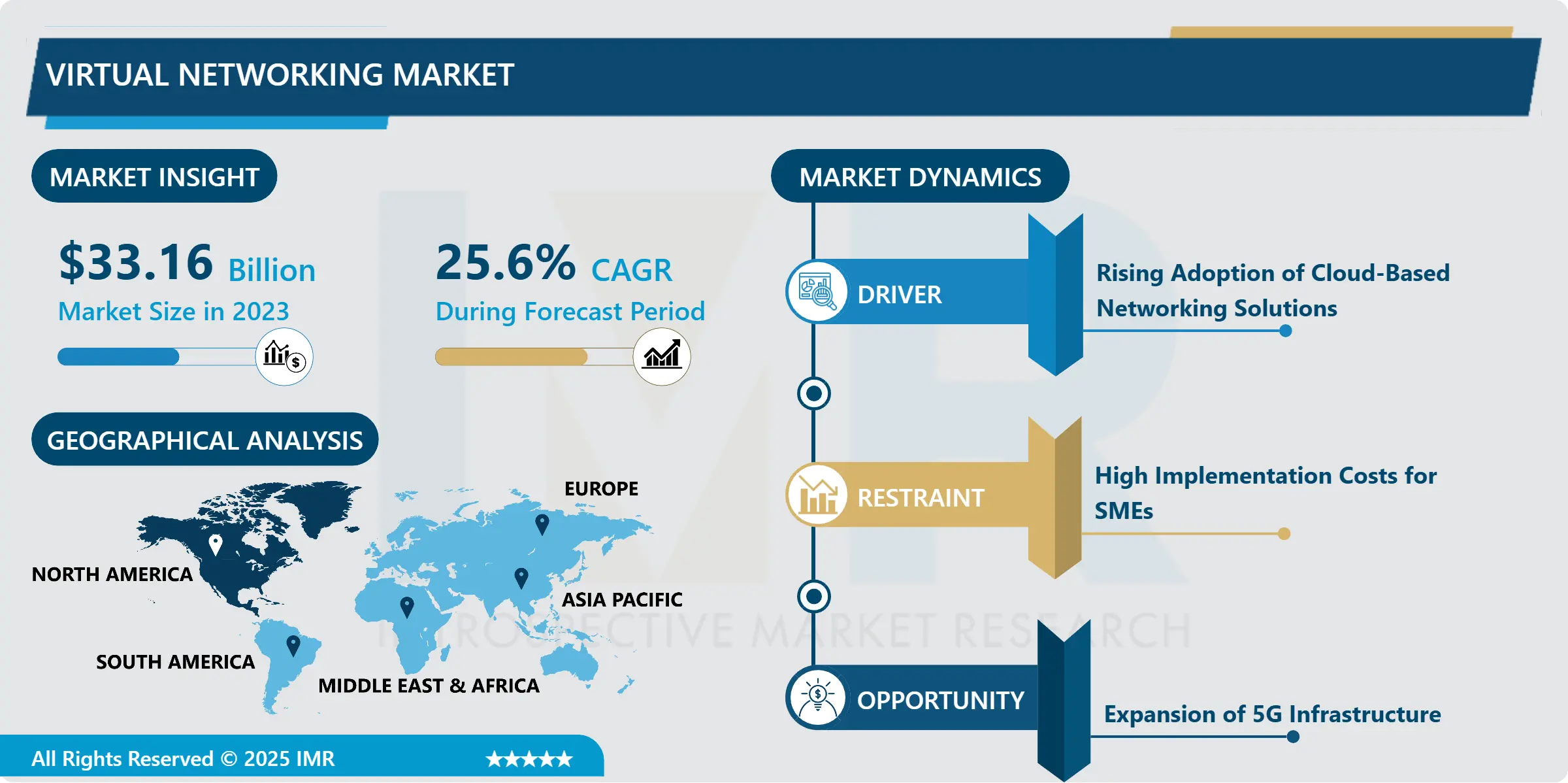

Virtual Networking Market Size Was Valued at USD 33.16 Billion in 2023 and is Projected to Reach USD 257.94 Billion by 2032, Growing at a CAGR of 25.6% From 2024-2032. The Virtual Networking Market refers to the industry focused on providing network services through virtualized infrastructure, allowing for scalable, flexible, and efficient connectivity.

IMR Group

Description

Virtual Networking Market Synopsis:

Virtual Networking Market Size Was Valued at USD 33.16 Billion in 2023 and is Projected to Reach USD 257.94 Billion by 2032, Growing at a CAGR of 25.6% From 2024-2032.

The Virtual Networking Market refers to the industry focused on providing network services through virtualized infrastructure, allowing for scalable, flexible, and efficient connectivity. It includes technologies like software-defined networking (SDN), network function virtualization (NFV), and cloud networking, serving sectors like telecommunications, enterprise IT, and cloud services.

The Virtual Networking Market is expanding exponentially around the world essentially due to the increasing demand for networking solutions which can fulfill the requirements of an organization and which can expand as per its needs. Through the cloud computing concept, 5G and IoT devices have provided so many opportunities to organizations and make virtualized networking as good solution to deal with complicated networks and provide connectivity.

The growth of the number of digital transformation projects in all fields adds an even greater impulse to the use of virtual networking techniques. They also enhance the network productivity, reliability, and analytical predictability in VN by integrating AI and ML into VN for the primary concern of anticipation and efficient problem-solving in virtual networking platforms. This has led to the implementation of virtual networking solutions in organizations as they adopt the culture of sustainability in an endeavor aimed at reducing the usage of energy to reduce their carbon footprint.

Virtual Networking Market Trend Analysis:

Edge Computing and Virtual Networking Integration

The virtual networking market is expanding as enterprises adopt decentralized IT infrastructures to enhance application performance and data accessibility. With the rapid rollout of 5G, IoT, and cloud-native platforms, virtual networking provides flexible, software-based connectivity across distributed environments. Organizations are prioritizing solutions that enable seamless communication between edge devices, core systems, and cloud applications. Vendors offering scalable and programmable network services are seeing increased demand, particularly those supporting real-time data exchange and low-latency configurations.

Edge computing is transforming how data is processed, and virtual networking plays a central role in supporting this architecture. By enabling dynamic routing and virtual overlays, businesses can optimize network efficiency across multiple locations. This integration supports new use cases in manufacturing, energy, retail, and logistics where localized processing is essential. As use cases diversify, virtual networking technologies are evolving to support automation, network slicing, and multi-cloud interoperability across enterprise environments.

Growth Potential in Developing Economies

The virtual networking market is expanding steadily across developing economies as organizations adopt cloud-based infrastructure and digital communication tools to increase efficiency. With the rise in remote work, e-learning, and digital service delivery, businesses in regions such as Southeast Asia, Africa, and Latin America are investing in scalable, low-cost virtual networking solutions. These markets are seeing rapid internet penetration and mobile connectivity, creating new demands for virtual private networks, software-defined networking, and secure cloud platforms. As enterprises upgrade legacy systems, the adoption of virtual networking technologies presents long-term value creation opportunities for solution providers.

In these developing regions, government initiatives promoting digital transformation and infrastructure modernization are accelerating the use of virtual networking tools across sectors such as healthcare, education, and retail. Vendors entering these markets are aligning product offerings with localized needs, including language support, data compliance, and cost-effective deployment models. As digital ecosystems mature, virtual networking is becoming integral to regional growth strategies and enterprise resilience planning.

Virtual Networking Market Segment Analysis:

Virtual Networking Market is Segmented on the basis of Component, Application, Deployment, and Region

By Component, Software segment is expected to dominate the market during the forecast period

The virtual networking market continues to evolve as enterprises prioritize scalable and efficient IT infrastructure. The software segment is expected to lead during the forecast period due to increasing adoption of cloud-native platforms and virtualization tools. Businesses are aligning their network architecture with software-defined models to optimize bandwidth, manage network traffic, and support dynamic workloads. This shift allows organizations to streamline operations, reduce dependency on physical infrastructure, and improve overall performance across hybrid and multi-cloud environments.

Growth in the virtual networking space is being influenced by the rising need for centralized network management and real-time visibility. Software solutions offer greater agility in configuration and security enforcement, making them essential for enterprises managing remote workforces and distributed data centers. As network complexity increases, the reliance on virtual software tools for automation, orchestration, and policy control is expanding.

By Application, IT And Telecommunication segment expected to hold the largest share

The IT and Telecommunication segment is expected to account for the largest share of the virtual networking market due to the increasing adoption of digital infrastructure, cloud-based services, and software-defined networking across global enterprises. As telecom operators modernize their core networks to support growing data demands and next-generation technologies like 5G, virtual networking plays a central role in enhancing scalability, operational efficiency, and network automation. The segment continues to expand as service providers invest in virtual network functions (VNFs) and network function virtualization (NFV) to improve service delivery and reduce infrastructure costs.

The virtual networking market is evolving in response to rising enterprise needs for secure, flexible, and cost-efficient connectivity solutions. Businesses across sectors are embracing remote work, edge computing, and multi-cloud strategies, which rely heavily on virtualized networking to manage complex, distributed environments. The trend toward software-defined everything is accelerating transformation, with telecom and IT players positioned as key adopters and solution providers in this growing landscape.

Virtual Networking Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is poised to maintain a leading position in the virtual networking market through the forecast period. This growth is supported by the strong presence of established cloud service providers, robust digital infrastructure, and high adoption of advanced network virtualization technologies across key industries. Enterprises in the region are actively integrating virtual networking to support scalable, secure, and agile network operations as they expand remote work environments and cloud-first strategies.

The region’s competitive technology landscape and early investment in SDN (Software-Defined Networking) and NFV (Network Functions Virtualization) platforms continue to shape market developments. Organizations are optimizing network performance and reducing operational complexity through virtual network solutions, responding to increasing data traffic and cloud-native application deployment. These trends are reinforcing North America’s position as a central hub for innovation and implementation in the global virtual networking space.

Active Key Players in the Virtual Networking Market

Arista Networks (USA)

Broadcom Inc. (USA)

Ciena Corporation (USA)

Cisco Systems, Inc. (USA)

Citrix Systems, Inc. (USA)

Dell Technologies Inc. (USA)

Extreme Networks (USA)

F5, Inc. (USA)

Huawei Technologies Co., Ltd. (China)

Juniper Networks, Inc. (USA)

Microsoft Corporation (USA)

Nokia Corporation (Finland)

Oracle Corporation (USA)

VMware, Inc. (USA)

ZTE Corporation (China)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Virtual Networking Market by Component

4.1 Virtual Networking Market Snapshot and Growth Engine

4.2 Virtual Networking Market Overview

4.3 Hardware Software Services

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Hardware Software Services: Geographic Segmentation Analysis

Chapter 5: Virtual Networking Market by Type

5.1 Virtual Networking Market Snapshot and Growth Engine

5.2 Virtual Networking Market Overview

5.3 Pre-production Production Post-product

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Pre-production Production Post-product: Geographic Segmentation Analysis

Chapter 6: Virtual Networking Market by End User

6.1 Virtual Networking Market Snapshot and Growth Engine

6.2 Virtual Networking Market Overview

6.3 Movies TV Series Commercial Ads Online Videos Others

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Movies TV Series Commercial Ads Online Videos Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Virtual Networking Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ARISTA NETWORKS (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BROADCOM INC. (USA)

7.4 CIENA CORPORATION (USA)

7.5 CISCO SYSTEMS INC. (USA)

7.6 CITRIX SYSTEMS INC. (USA)

7.7 DELL TECHNOLOGIES INC. (USA)

7.8 EXTREME NETWORKS (USA)

7.9 F5 INC. (USA)

7.10 HUAWEI TECHNOLOGIES CO. LTD. (CHINA)

7.11 JUNIPER NETWORKS INC. (USA)

7.12 MICROSOFT CORPORATION (USA)

7.13 NOKIA CORPORATION (FINLAND)

7.14 ORACLE CORPORATION (USA)

7.15 VMWARE INC. (USA)

7.16 ZTE CORPORATION (CHINA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Virtual Networking Market By Region

8.1 Overview

8.2. North America Virtual Networking Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Component

8.2.4.1 Hardware Software Services

8.2.5 Historic and Forecasted Market Size By Type

8.2.5.1 Pre-production Production Post-product

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Movies TV Series Commercial Ads Online Videos Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Virtual Networking Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Component

8.3.4.1 Hardware Software Services

8.3.5 Historic and Forecasted Market Size By Type

8.3.5.1 Pre-production Production Post-product

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Movies TV Series Commercial Ads Online Videos Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Virtual Networking Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Component

8.4.4.1 Hardware Software Services

8.4.5 Historic and Forecasted Market Size By Type

8.4.5.1 Pre-production Production Post-product

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Movies TV Series Commercial Ads Online Videos Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Virtual Networking Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Component

8.5.4.1 Hardware Software Services

8.5.5 Historic and Forecasted Market Size By Type

8.5.5.1 Pre-production Production Post-product

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Movies TV Series Commercial Ads Online Videos Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Virtual Networking Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Component

8.6.4.1 Hardware Software Services

8.6.5 Historic and Forecasted Market Size By Type

8.6.5.1 Pre-production Production Post-product

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Movies TV Series Commercial Ads Online Videos Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Virtual Networking Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Component

8.7.4.1 Hardware Software Services

8.7.5 Historic and Forecasted Market Size By Type

8.7.5.1 Pre-production Production Post-product

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Movies TV Series Commercial Ads Online Videos Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Virtual Networking Market research report?

A1: The forecast period in the Virtual Networking Market research report is 2024-2032.

Q2: Who are the key players in the Virtual Networking Market?

A2: Arista Networks (USA), Broadcom Inc. (USA), Ciena Corporation (USA), Cisco Systems, Inc. (USA), Citrix Systems, Inc. (USA), Dell Technologies Inc. (USA), Extreme Networks (USA), F5, Inc. (USA), Huawei Technologies Co., Ltd. (China), Juniper Networks, Inc. (USA), Microsoft Corporation (USA), Nokia Corporation (Finland), Oracle Corporation (USA), VMware, Inc. (USA), ZTE Corporation (China), and Other Active Players.

Q3: What are the segments of the Virtual Networking Market?

A3: The Virtual Networking Market is segmented into Components, Application, Deployment, and Region. By Component, the market is categorized into Hardware and Software Services. By Application, the market is categorized into BFSI, Public Sector, Manufacturing, Hospitality, IT and Telecommunication, Healthcare Others. By Deployment, the market is categorized into Cloud and On-Premise. By Region, it is analyzed across North America (U.S., Canada, Mexico),Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe),Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Virtual Networking Market?

A4: The Virtual Networking Market refers to the industry focused on providing network services through virtualized infrastructure, allowing for scalable, flexible, and efficient connectivity. It includes technologies like software-defined networking (SDN), network function virtualization (NFV), and cloud networking, serving sectors like telecommunications, enterprise IT, and cloud services.

Q5: How big is the Virtual Networking Market?

A5: Virtual Networking Market Size Was Valued at USD 33.16 Billion in 2023 and is Projected to Reach USD 257.94 Billion by 2032, Growing at a CAGR of 25.6% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!