Stay Ahead in Fast-Growing Economies.

Browse Reports NowVegetable Paste Market – Trend, Growth, Forecast 2025-2032

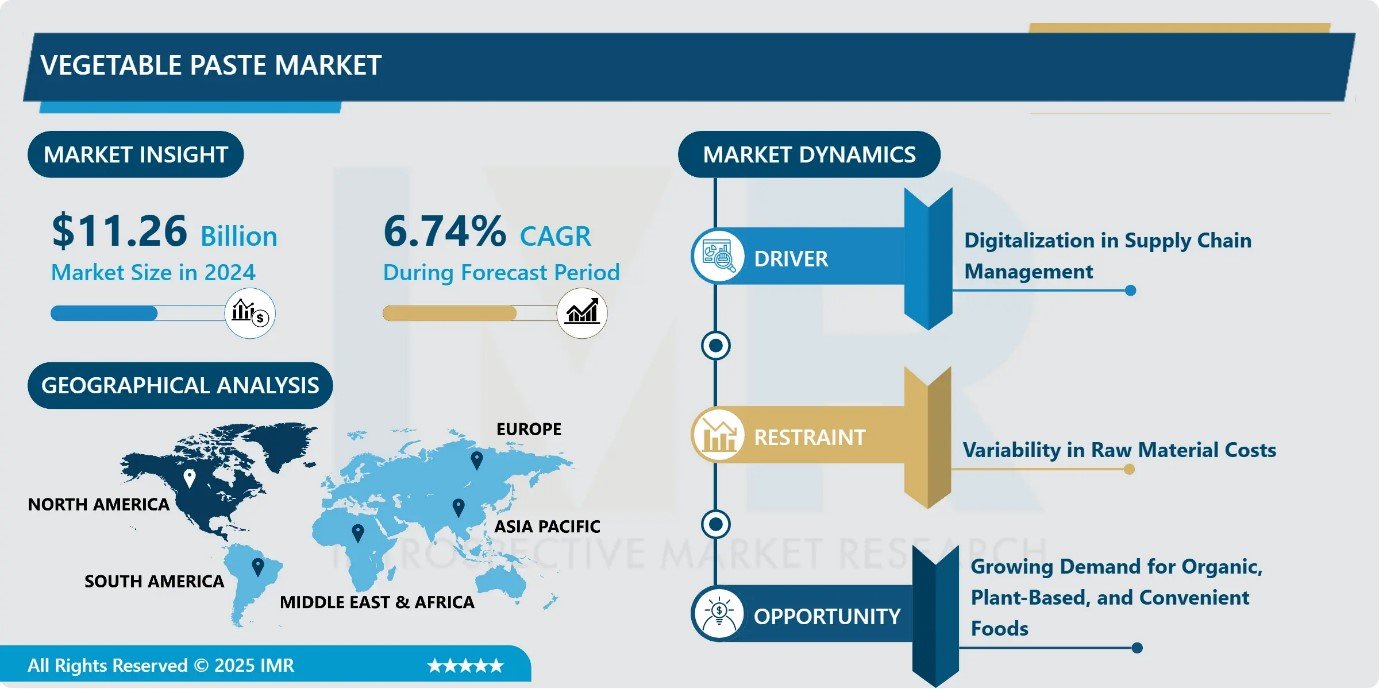

Vegetable Paste Market Size Was Valued at USD 11.26 Billion in 2024, and is Projected to Reach USD 18.97 Billion by 2032, Growing at a CAGR of 6.74% From 2024-2032.

IMR Group

Description

Vegetable Paste Market Synopsis:

Vegetable Paste Market Size Was Valued at USD 11.26 Billion in 2024, and is Projected to Reach USD 18.97 Billion by 2032, Growing at a CAGR of 6.74% From 2025-2032.

A paste (or mash) is cooked food, usually vegetables, fruits, or legumes, that has been ground, pressed, blended, or sieved to the consistency of a creamy paste or liquid. Paste of specific foods are often known by specific names, e.g., apple sauce or hummus. It can be made in a blender, with special implements such as a potato masher, by forcing the food through a strainer, or simply by crushing the food in a pot. It generally must be cooked, either before or after grinding, to improve flavor and texture, remove toxic substances, and/or reduce their water content.

The versatility of Paste makes it an ideal fruit substitute during seasons after harvest due to it retains fresh fruit qualities in both color and taste. The stability of Paste helps create uniform quality in dishes and cakes and is trusted by many large restaurant chains and bakeries. Paste serves multiple functions as a suitable ingredient for different food preparations. Drinks benefit from Paste since it enables smoothie and cocktail preparation as well as mocktail and fruit tea and numerous other beverage production.

Natural sweetness and flavor appear through the Paste substance. Paste functions as an essential ingredient in baking when used for making distinct-flavored cakes or when employed as stuffing or ornamental garnishes. Vegetable paste shares comparable versatility since food manufacturers use it as a foundation for sauces and soups and to create bases for different savory ingredients.

Vegetable Paste Market Growth and Trend Analysis:

Digitalization in Supply Chain Management

Digitalization stands as a central trend which transforms both the supply chain operation and value chain structure. Supply chain operations in their traditional form depend mostly on human workers using minimal digital platforms. Processed vegetable supply chains require increased digitalization for their operation. Organization plans require trouble-free processes that start with the initial purchase of raw materials to minimize waste and decrease operational losses. Manufacturers make significant investments to integrate digital control as well as design and synchronization techniques to supervise the entire production flow.

For instance, in August 2024, DENVER & DUBLIN, announced they have partnered to accelerate digital transformation, AI adoption, and operational decision-making across the Co-op. This partnership will bring QSCC towards a fully integrated Supply Chain Network with opportunities for AI-driven, automated workflows as well as a future Wendy’s connected ecosystem of suppliers, distributors, and manufacturers. In conclusion, innovations will drive growth in the vegetable Paste market by improving operational efficiencies, enabling faster decision-making, and increasing responsiveness to market demands, all of which are crucial for global expansion and meeting consumer needs.

Variability in Raw Material Costs

The vegetable Paste market worldwide deals with various problems originating from disrupted supply chains due to climate change effects together with delivery constraints and seasonal product availability patterns. Fresh vegetables display a short shelf life which leads to quality concerns so advanced packaging and preservatives become essential for retaining nutritional value and taste during storage. Rising material costs and fuel rates as well as market price movements act as elements that intensify market instability. Organic and clean-label products alongside customer taste shifts generate competition between packaged vegetables and fresh items as well as ready-to-eat foods.

Growing Demand for Organic, Plant-Based, and Convenient Foods

The worldwide vegetable Paste industry exhibits rapid expansion due to consumers seeking beneficial food items that combine natural elements with convenient usage methods. The market presents an opening for businesses to launch high-end organic vegetable Pastes due to growing consumer choices for GMO-free and organic ingredients. The market expansion in both the food and beverage sectors brings substantial growth because vegetable Pastes serve as essential ingredients in creating soups, sauces, smoothies, and ready-to-eat meals. The rising interest in vegan diets together with plant-based eating patterns has elevated the market need for vegetable-derived alternatives thus creating new spaces for development and innovation within this domain.

High Competition From Local Producers

Vegetable pastes often require flavor customization for different markets, increasing production complexity and operational costs. High competition from local producers, who often offer lower-priced alternatives, limits the market penetration of premium or international brands. Furthermore, regulatory differences in food safety, additives, and labeling standards across countries create hurdles for global market expansion. Lastly, limited consumer awareness and accessibility in rural or developing regions restrict the overall market potential,

Vegetable Paste Market Segment Analysis:

Vegetable Paste Market is segmented based on type, application, nature, and region

By Type, the Tomato segment is expected to dominate the market during the forecast period

The global export market of tomato paste achieved its highest point ever during July 2023-June 2024 when it reached 3.91 million metric tonnes representing a 7% growth compared to the previous period. Global tomato paste exports grew significantly because China and Greece together with Italy the USA and Iran produced almost 300,000 metric tonnes of the total rise. A single group of the ten leading exporting nations led by China Italy and Spain together with the USA Portugal Chile Turkey Greece Iran and Egypt control 94.5% of worldwide tomato paste trades. The same countries have maintained their export dominance for the past five years since they exported 4% more goods in the most recent year compared to the previous year.

The primary drivers of this growth are the performance of China, Greece, Italy, the USA, and Iran, whose export activities have significantly impacted the overall increase in global trade. The seasonal patterns and monthly export trends demonstrate how tomato paste continues to dominate the vegetable paste sector while its market shows expected sustained expansion into the future. The tomato paste segment of the vegetable paste market will maintain its leading position as the market expands due to its consistent dominance in international trade.

By Application, the Ready-to-eat segment held the largest share of in projected period

The increasing demand for ready-to-eat food products is primarily driven by evolving social and economic patterns, coupled with changing consumer lifestyles and meal preferences. According to consumer research in the United States, approximately 76% of consumers choose ready-to-eat meals primarily for convenience and quick preparation, while 46% select these products based on taste and flavor preferences. This trend is particularly prominent among working professionals, university students, and urban households who seek nutritious yet easily preparable meal options. The integration of healthier ingredients and improved nutritional profiles in ready-to-eat foods has further accelerated market growth, as consumers increasingly prioritize wellness while maintaining convenience.

Today’s consumer market demonstrates consistent demand for nutritious products that allow customization while using natural ingredients and must help people keep up their active lifestyles. The convenience food market uses vegetable mash as a fundamental ingredient to prepare ready-to-eat and ready-to-cook products. The growing consumer interest in healthful infant nutrition drives manufacturers of infant foods to add vegetable mash to their product lines.

Vegetable Paste Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The North American region maintained its position as the leading market for vegetable paste globally due to its extensive vegetable cultivation advanced processing technology and substantial import activities. United States functioned as a prominent center where Mexico stood as the primary exporter of fresh vegetables which delivered 14.84 billion pounds to the U.S. market. The two main vegetables used for paste manufacturing which included tomatoes (4.29 billion pounds) and peppers (1.85 billion pounds) ranked as leading imported products.

Canada exported 3.89 billion pounds of vegetables to the United States where potatoes at 1.39 billion pounds and cucumbers as well as tomatoes and peppers led the export list. The fresh produce export from Peru in 2023 amounted to 2.05 billion pounds of which vegetables comprised 22.6 percent. Fresh produce exports from the U.S. during 2023 amounted to 9.97 billion pounds where Canada bought 4.99 billion pounds while Mexico purchased 2.08 billion pounds. Canadian and Mexican import markets received lettuce (561 million pounds) potatoes (460 million pounds) and onions (418 million pounds) as their major vegetable imports from the United States before potatoes (415 million pounds) and onions/shallots (169 million pounds) took the lead. These trends reinforce North America’s dominance in the global vegetable paste market, as the region continues to drive supply through a combination of domestic production, imports, and exports to key global markets.

Vegetable Paste Market Active Players:

Austevoll Seafood ASA (Norway)

Bonduelle Group (France)

Coca-Cola Company (USA)

ConAgra Brands, Inc. (USA)

Dole Food Company, Inc. (USA)

Fertilab Co., Ltd. (China)

General Mills, Inc. (USA)

H.J. Heinz Company (USA)

Ingredion Incorporated (USA)

Kraft Heinz Company (USA)

Lifeway Foods, Inc. (USA)

McCain Foods Limited (Canada)

Nestlé S.A. (Switzerland)

Nikita Global Foods (India)

Olam Group (Singapore)

Sanfeng Foodstuffs Co., Ltd. (China)

Sevibio Agrochem Pvt Ltd. (India)

Suntory Beverage & Food Limited (Japan)

TOMRA Systems ASA (Norway)

Vitamins and Supplements Ltd. (UK)

Other Active Players

Key Industry Developments in the Vegetable Paste Market:

In January 2025, Adani Wilmar Limited, one of India’s largest FMCG food companies, has officially launched operations at its integrated food processing plant in Gohana, District Sonepat, Haryana. The commencement of operations was marked by the first dispatch of 100 metric tonnes of rice, signifying a key milestone in the company’s expansion.

In May 2024, 2,548 food processing units opened in Kerala Kerala has secured the third position in the ranking of micro-food processing units in the country. The first and second positions were secured by Tamil Nadu and Telangana.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Vegetable Paste Market by Type

4.1 Vegetable Paste Market Snapshot and Growth Engine

4.2 Vegetable Paste Market Overview

4.3 Carrot

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Carrot: Geographic Segmentation Analysis

4.4 Spinach

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Spinach: Geographic Segmentation Analysis

4.5 Tomato

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Tomato: Geographic Segmentation Analysis

4.6 Pumpkin

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Pumpkin: Geographic Segmentation Analysis

4.7 and Others

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 and Others: Geographic Segmentation Analysis

Chapter 5: Vegetable Paste Market by By Application

5.1 Vegetable Paste Market Snapshot and Growth Engine

5.2 Vegetable Paste Market Overview

5.3 Ready-to-eat/Cook Products

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Ready-to-eat/Cook Products: Geographic Segmentation Analysis

5.4 Infant Nutrition

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Infant Nutrition: Geographic Segmentation Analysis

5.5 Beverages

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Beverages: Geographic Segmentation Analysis

5.6 and Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 and Others: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Vegetable Paste Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AUSTEVOLL SEAFOOD ASA (NORWAY)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BONDUELLE GROUP (FRANCE)

6.4 COCA-COLA COMPANY (USA)

6.5 CONAGRA BRANDS INC. (USA)

6.6 DOLE FOOD COMPANY INC. (USA)

6.7 FERTILAB CO. LTD. (CHINA)

6.8 GENERAL MILLS INC. (USA)

6.9 H.J. HEINZ COMPANY (USA)

6.10 INGREDION INCORPORATED (USA)

6.11 KRAFT HEINZ COMPANY (USA)

6.12 LIFEWAY FOODS INC. (USA)

6.13 MCCAIN FOODS LIMITED (CANADA)

6.14 NESTLÉ S.A. (SWITZERLAND)

6.15 NIKITA GLOBAL FOODS (INDIA)

6.16 OLAM GROUP (SINGAPORE)

6.17 SANFENG FOODSTUFFS CO. LTD. (CHINA)

6.18 SEVIBIO AGROCHEM PVT LTD. (INDIA)

6.19 SUNTORY BEVERAGE & FOOD LIMITED (JAPAN)

6.20 TOMRA SYSTEMS ASA (NORWAY)

6.21 VITAMINS AND SUPPLEMENTS LTD. (UK)

6.22 OTHER ACTIVE PLAYERS.

Chapter 7: Global Vegetable Paste Market By Region

7.1 Overview

7.2. North America Vegetable Paste Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Type

7.2.4.1 Carrot

7.2.4.2 Spinach

7.2.4.3 Tomato

7.2.4.4 Pumpkin

7.2.4.5 and Others

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 Ready-to-eat/Cook Products

7.2.5.2 Infant Nutrition

7.2.5.3 Beverages

7.2.5.4 and Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Vegetable Paste Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Type

7.3.4.1 Carrot

7.3.4.2 Spinach

7.3.4.3 Tomato

7.3.4.4 Pumpkin

7.3.4.5 and Others

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 Ready-to-eat/Cook Products

7.3.5.2 Infant Nutrition

7.3.5.3 Beverages

7.3.5.4 and Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Vegetable Paste Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Type

7.4.4.1 Carrot

7.4.4.2 Spinach

7.4.4.3 Tomato

7.4.4.4 Pumpkin

7.4.4.5 and Others

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 Ready-to-eat/Cook Products

7.4.5.2 Infant Nutrition

7.4.5.3 Beverages

7.4.5.4 and Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Vegetable Paste Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Type

7.5.4.1 Carrot

7.5.4.2 Spinach

7.5.4.3 Tomato

7.5.4.4 Pumpkin

7.5.4.5 and Others

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 Ready-to-eat/Cook Products

7.5.5.2 Infant Nutrition

7.5.5.3 Beverages

7.5.5.4 and Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Vegetable Paste Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Type

7.6.4.1 Carrot

7.6.4.2 Spinach

7.6.4.3 Tomato

7.6.4.4 Pumpkin

7.6.4.5 and Others

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 Ready-to-eat/Cook Products

7.6.5.2 Infant Nutrition

7.6.5.3 Beverages

7.6.5.4 and Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Vegetable Paste Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Type

7.7.4.1 Carrot

7.7.4.2 Spinach

7.7.4.3 Tomato

7.7.4.4 Pumpkin

7.7.4.5 and Others

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 Ready-to-eat/Cook Products

7.7.5.2 Infant Nutrition

7.7.5.3 Beverages

7.7.5.4 and Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the Vegetable Paste Market research report?

A1: The forecast period in the Vegetable Paste Market research report is 2024-2032.

Q2: Who are the key players in the Vegetable Paste Market?

A2: Austevoll Seafood ASA (Norway), Bonduelle Group (France), Coca-Cola Company (USA), ConAgra Brands, Inc. (USA), Dole Food Company, Inc. (USA), Fertilab Co., Ltd. (China), General Mills, Inc. (USA), H.J. Heinz Company (USA), Ingredion Incorporated (USA), Kraft Heinz Company (USA), Lifeway Foods, Inc. (USA), McCain Foods Limited (Canada), Nestlé S.A. (Switzerland), Nikita Global Foods (India), Olam Group (Singapore), Sanfeng Foodstuffs Co., Ltd. (China), Sevibio Agrochem Pvt Ltd. (India), Suntory Beverage & Food Limited (Japan), TOMRA Systems ASA (Norway), Vitamins and Supplements Ltd. (UK), and Other Active Players.

Q3: What are the segments of the Vegetable Paste Market?

A3: The Vegetable Paste Market is segmented into Type, Nature, Application, and Region. Type, it is categorized into Carrot, Spinach, Tomato, Pumpkin, and Others. By Application, it is categorized into Ready-to-eat/Cook Products, Infant Nutrition, Beverages, and Others. By Nature, it is categorized into Organic and Conventional. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Vegetable Paste Market?

A4: A paste (or mash) is cooked food, usually vegetables, fruits, or legumes, that has been ground, pressed, blended, or sieved to the consistency of a creamy paste or liquid. Paste of specific foods are often known by specific names, e.g., apple sauce or hummus. It can be made in a blender, with special implements such as a potato masher, by forcing the food through a strainer, or simply by crushing the food in a pot. It generally must be cooked, either before or after grinding, to improve flavor and texture, remove toxic substances, and/or reduce their water content.

Q5: How big is the Vegetable Paste Market?

A5: Vegetable Paste Market Size Was Valued at USD 11.26 Billion in 2024, and is Projected to Reach USD 18.97 Billion by 2032, Growing at a CAGR of 6.74% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!