Stay Ahead in Fast-Growing Economies.

Browse Reports NowVacuum Interrupters Market Size, Share, Growth & Forecast (2024-2032)

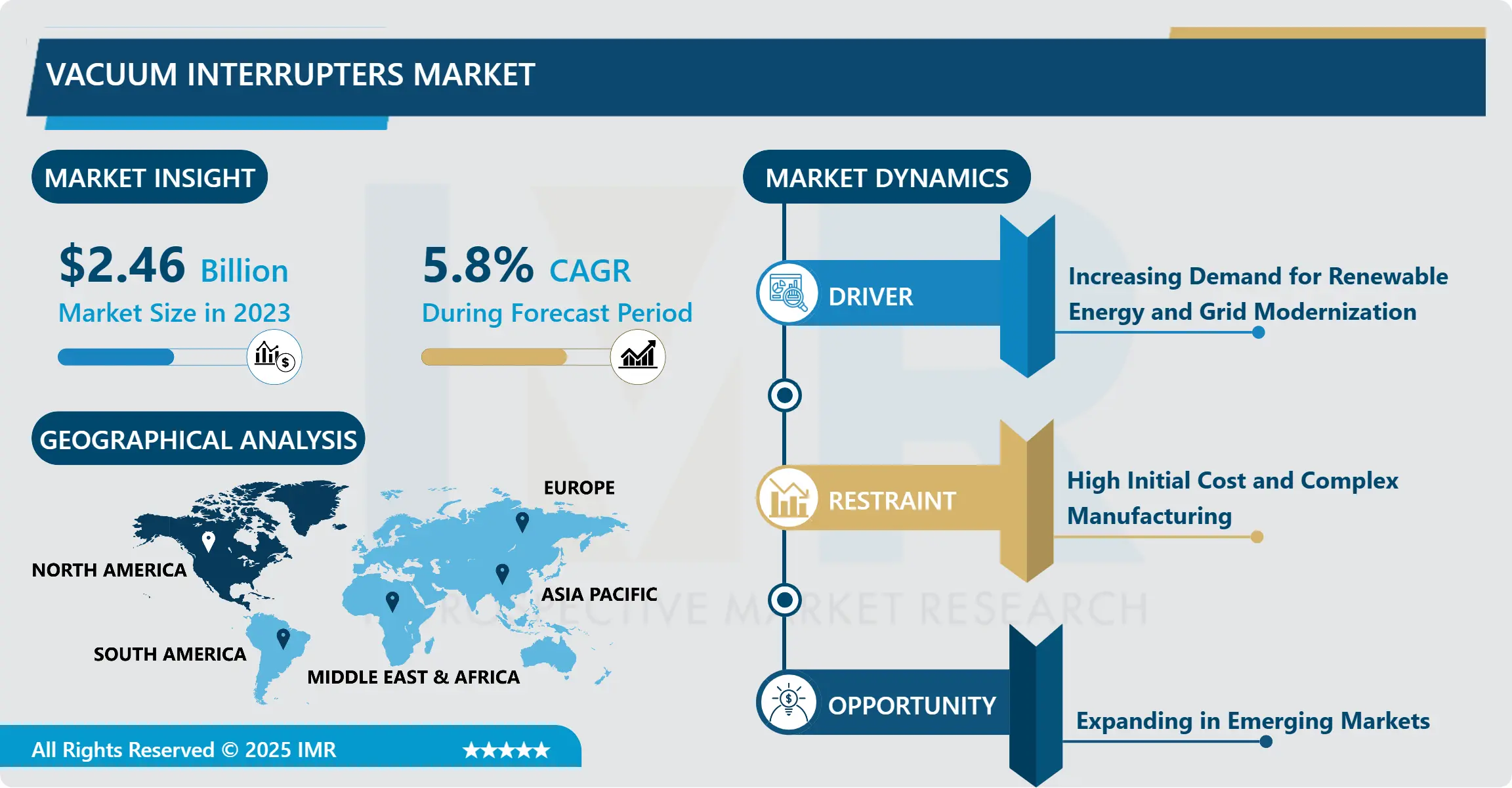

Vacuum Interrupters Market Size Was Valued at USD 2.46 Billion in 2023, and is Projected to Reach USD 4.09 Billion by 2032, Growing at a CAGR of 5.8% From 2024-2032.

IMR Group

Description

Vacuum Interrupters Market Synopsis:

Vacuum Interrupters Market Size Was Valued at USD 2.46 Billion in 2023, and is Projected to Reach USD 4.09 Billion by 2032, Growing at a CAGR of 5.8% From 2024-2032.

Vacuum Interrupters are electrical devices employed in high voltage circuit breakers and switchgears to cut off circuit current. They work through making the contacts operated move apart where this gap helps in cutting off electric arc whilst serving on the power distribution networks correctly and safely.

The vacuum interrupters market is an important niche of the overall global electrical industry and is mainly stimulated by the consumers’ need for effective solutions for power distribution. Vacuum interrupters are employed in circuit breakers and other devices of switching gear in electrical energy management to effectively interrupt circuit in high voltage systems with safety. They possess the following features; Their operation under various hard condition is without involving risks of corrosion or other processes hence interrupter having vacuum within it helps in arc quenching without requiring external gases or liquids.

Renewable power generation along with development of power grid and utility infrastructure around the world has been a key trend influencing the demand for vacuum interrupters. The increasing demand for complex power infrastructure and the implementing of advance smart grid systems are also contributing towards the growth of this market, along with the increasing role of automation in power plants. Further, the demand for environmental friendly energy systems and the drive to cutting down on the number of routine maintenance is driving utilities and industries to embrace vacuum vacuum interrupters rather gas-insulated interrupters interrupters.

The market is divided into type, application, and region. Based on the type, the market segmentation is medium voltage and high voltage vacuum interrupters. Medium voltage vacuum interrupters are installed mainly in industries including manufacturing industries and middle voltage electrical networks while high voltage vacuum interrupters are used in electrical substations and large power networks. The vacuum interrupters find use in various switch gears, circuits breakers, transformers and other power equipment used in power transmission, distribution and for industrial uses.

In concludes that the future of the vacuum interrupters market is bright since technology is continually developing. Improvements like digital monitoring and condition-based maintenance of vacuum interrupters are expected to provide further improvements in their performance and reliability. Furthermore, the growing focus on lowering the carbon footprint and raising the safety requirements for electrical equipment will stimulate market development.

Vacuum Interrupters Market Trend Analysis:

Growing Demand for Smart Grid Systems

The growth of the vacuum interrupters market is shifting toward smart grid systems as an integration of digital technology in the energy sector. Smart grid is a better and upgraded electricity network that is responsive to local variations in usage through digital data communication technology, with reliability, efficiency and sustainable electricity. The short description of vacuum interrupters As noted earlier, vacuum interrupters are important in the security and functionality of these grids as they allow ordinary and safe interruption in faults. One of the dynamics that have been observed to be working within the market is the phenomenon of smart grid solutions in industries and homes around the world.

In the many utilities and power producers, there is emerging and continued adoption of smart grids powering several loads; hence the increase in use of vacuum interrupters in management equipment like circuit breakers and transformers. These smart grids include enhanced fault detection, a faster restoration of power and better load management, which all need high performance vacuum interrupters. Besides, as the smart grid technology is advanced with added features such as real-time data analytics and condition monitoring; the vacuum interrupters capable to run such systems will catalyze the growth of the market in the near future.

Expanding in Emerging Markets

For the growth of vacuum interrupters, business in the developing world especially in Asia Pacific, Latin America, Africa offers a good ground for business. Growth of infrastructure different regions around the globe depends on the growing demand of electrical products such as vacuum interrupters due to the growing rate of urbanization and the need for infrastructure in these areas. Since governments of these regions continue with infrastructure development in modernizing the power systems, enhancing energy access and extending electricity network, there is demand for high efficient, reliable and safe vacuum interrupters.

The opportunity lies in the fact that vacuum interrupter technologies are yet to be adopted and implemented in these regions could go along way in mitigaging the occurrences of outages as well as improving on the stability of the gird. This is particularly useful in nations with unstable grid infrastructure and rampant blackouts since vacuum interrupters may help the former. Also, as industries of manufacturing, mining and infrastructural constructions in emergent markets advance, demand for medium voltage vacuum interrupters will also rise, creating further opportunities to key players to expand and access new end user base.

Vacuum Interrupters Market Segment Analysis:

Vacuum Interrupters Market is Segmented on the basis of Type, Application, End User Industry, and Region.

By Type, Medium Voltage Vacuum Interrupters segment is expected to dominate the market during the forecast period

Applications of medium voltage vacuum interrupters are in voltage ratings from 1 kV to 72.5 kV. They are used broadly in factories, factories, power stations, and also in networks of utilities industries. Their primary strength is the ability to afford very reliable arc quenching within the medium voltage range and without extensive use of gases or oils. Medium voltage interrupters are employed extensively for switchgear applications due to safety they afford, the long service times that the product has and little or no maintenance that is required.

On the other hand, high voltage vacuum interrupters are employed in uses that relate to voltages that exceed 72.5 kV. These are normally applied in power substations and high voltage transmission circuits. As it is noticed they cost bit higher than customary pipes because of their complicated design and production, however, their application in high voltage installation where arcing and equipment deterioration is more tough makes it crucial components for grid security and stability.

By Application, Switchgear segment expected to held the largest share

One of the major customer products where vacuum interrupters are put to use is switchgear. Switchgear can be defined as equipment for controlling, protecting and isolating electrical equipment in power distribution networks. Switching applications require vacuum interrupters because they allow for the interruption of circuits under load rapidly and safely. Due to their ability to interrupt high current faults and prevent arc damage they are suited widely for use in medium and high voltage switchgear. The use of vacuum interrupters increases in this application due to such factors as rising importance of efficient power transmission and trends of grid upgrades and advanced automation.

The conversion to compact and modular switchgear systems in residential as well as commercial applications has further boosted the usage of vacuum interrupters. These two types of switchgear are suitable for small size, easy to maintain, and safe for use especially in urban areas where space and reliability of the switchgear is a big concern. Thus, with the development of the switchgear, incorporating more digital & automated switchgear, the Vacuum Interrupters are also going to play the vital role in operation & protection of the power networks.

Vacuum Interrupters Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The regional report includes North America dominating the vacuum interrupters market, mainly due to the developed infrastructure and increased need for extremely efficient and secure power distribution systems. At the same time, the United States and Canada are marked as the top spenders on the grid modernization program with a strong focus on RE and smart grids. These initiatives are resulting in higher usage of vacuum interrupters in devices like circuit breakers and switchgears. In addition to this, the increasing concern towards reduction of carbon emissions and rise in energy efficiency awareness particularly in area of North America has been in tun with features offered by vacuum interrupters thus contributing to market growth.

Furthermore, because of enormous investments in technologies and the power sector generally, North America continues to be one of the most important consumers of vacuum interrupters. Due to large usage from utility companies, grid operators and other industry participants, along with relatively high regulatory standards, vacuum interrupters have a suitable market in this area. Global demand for renewable energy sources and energy storage systems is expected to persist to boost the regional dominance in the market.

Active Key Players in the Vacuum Interrupters Market

ABB Ltd. (Switzerland)

Chint Group (China)

Eaton Corporation (Ireland)

GE Grid Solutions (USA)

Hitachi Energy (Switzerland)

Hyundai Electric & Energy Systems Co., Ltd. (South Korea)

LS Electric Co., Ltd. (South Korea)

Mitsubishi Electric Corporation (Japan)

S&C Electric Company (USA)

Schneider Electric (France)

Siemens AG (Germany)

Toshiba Corporation (Japan)

Other Active Players.

Key Industry Developments in the Vacuum Interrupters Market:

In February 2023, ABB introduced the ConVac Hoover Contractor at ELECRAMA 2023, showcasing innovations from its Electrification and Motion businesses. ABB’s Electrification business offers a wide range of equipment, digital solutions, and services, from substations to sockets, to ensure safe, intelligent, and sustainable electrification.

In February 2023, Green World Renewable Energy LLC, a Solar Permit Designing & PE Stamping service provider across the USA, announced the launch of a new and innovative solar panel and combiner box system at the ISNA Exhibition, Long Beach, CA. These solar energy products provide a reliable and efficient solution for harnessing the sun’s power. It is designed to meet the increasing demand for energy from renewable sources while providing an efficient, economical, and sustainable alternative to conventional sources of energy.

In January 2023, KCC Corp. announced that it would mass-produce ceramic products for eco-friendly vacuum interrupters that do not emit sulfur hexafluoride (SF6) gas. Ceramics for KCC’s vacuum circuit breakers are expected to be mainly applied to vacuum circuit breakers for power transmission and distribution equipment due to their excellent bonding and vacuum sealing properties.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Vacuum Interrupters Market by Type

4.1 Vacuum Interrupters Market Snapshot and Growth Engine

4.2 Vacuum Interrupters Market Overview

4.3 AC Drives

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 AC Drives: Geographic Segmentation Analysis

4.4 DC Drives

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 DC Drives: Geographic Segmentation Analysis

4.5 Servo Drives

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Servo Drives: Geographic Segmentation Analysis

Chapter 5: Vacuum Interrupters Market by Power Range

5.1 Vacuum Interrupters Market Snapshot and Growth Engine

5.2 Vacuum Interrupters Market Overview

5.3 Micro Power Drive

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Micro Power Drive: Geographic Segmentation Analysis

5.4 Low Power Drive

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Low Power Drive: Geographic Segmentation Analysis

5.5 Medium Power Drive

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Medium Power Drive: Geographic Segmentation Analysis

5.6 High Power Drive

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 High Power Drive: Geographic Segmentation Analysis

Chapter 6: Vacuum Interrupters Market by Application

6.1 Vacuum Interrupters Market Snapshot and Growth Engine

6.2 Vacuum Interrupters Market Overview

6.3 Pumps

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Pumps: Geographic Segmentation Analysis

6.4 Fans

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Fans: Geographic Segmentation Analysis

6.5 Compressors

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Compressors: Geographic Segmentation Analysis

6.6 Conveyors

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Conveyors: Geographic Segmentation Analysis

6.7 Extruders

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Extruders: Geographic Segmentation Analysis

6.8 Others

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Others: Geographic Segmentation Analysis

Chapter 7: Vacuum Interrupters Market by Voltage Range

7.1 Vacuum Interrupters Market Snapshot and Growth Engine

7.2 Vacuum Interrupters Market Overview

7.3 Low Voltage

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Low Voltage: Geographic Segmentation Analysis

7.4 Medium Voltage

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Medium Voltage: Geographic Segmentation Analysis

7.5 High Voltage

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 High Voltage: Geographic Segmentation Analysis

Chapter 8: Vacuum Interrupters Market by End-User Industry

8.1 Vacuum Interrupters Market Snapshot and Growth Engine

8.2 Vacuum Interrupters Market Overview

8.3 Industrial

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Industrial: Geographic Segmentation Analysis

8.4 Infrastructure

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Infrastructure: Geographic Segmentation Analysis

8.5 Oil & Gas

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Oil & Gas: Geographic Segmentation Analysis

8.6 Power Generation

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Power Generation: Geographic Segmentation Analysis

8.7 HVAC

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 HVAC: Geographic Segmentation Analysis

8.8 Automotive

8.8.1 Introduction and Market Overview

8.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.8.3 Key Market Trends, Growth Factors and Opportunities

8.8.4 Automotive: Geographic Segmentation Analysis

8.9 Food & Beverage

8.9.1 Introduction and Market Overview

8.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.9.3 Key Market Trends, Growth Factors and Opportunities

8.9.4 Food & Beverage: Geographic Segmentation Analysis

8.10 Others

8.10.1 Introduction and Market Overview

8.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.10.3 Key Market Trends, Growth Factors and Opportunities

8.10.4 Others: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Vacuum Interrupters Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 SCHNEIDER ELECTRIC (FRANCE)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 EATON CORPORATION (IRELAND)

9.4 SIEMENS AG (GERMANY)

9.5 ABB LTD. (SWITZERLAND)

9.6 MITSUBISHI ELECTRIC CORPORATION (JAPAN)

9.7 HITACHI ENERGY (SWITZERLAND)

9.8 GE GRID SOLUTIONS (USA)

9.9 HYUNDAI ELECTRIC & ENERGY SYSTEMS CO. LTD. (SOUTH KOREA)

9.10 TOSHIBA CORPORATION (JAPAN)

9.11 LS ELECTRIC CO. LTD. (SOUTH KOREA)

9.12 S&C ELECTRIC COMPANY (USA)

9.13 CHINT GROUP (CHINA)

9.14 OTHER ACTIVE PLAYERS

Chapter 10: Global Vacuum Interrupters Market By Region

10.1 Overview

10.2. North America Vacuum Interrupters Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Type

10.2.4.1 AC Drives

10.2.4.2 DC Drives

10.2.4.3 Servo Drives

10.2.5 Historic and Forecasted Market Size By Power Range

10.2.5.1 Micro Power Drive

10.2.5.2 Low Power Drive

10.2.5.3 Medium Power Drive

10.2.5.4 High Power Drive

10.2.6 Historic and Forecasted Market Size By Application

10.2.6.1 Pumps

10.2.6.2 Fans

10.2.6.3 Compressors

10.2.6.4 Conveyors

10.2.6.5 Extruders

10.2.6.6 Others

10.2.7 Historic and Forecasted Market Size By Voltage Range

10.2.7.1 Low Voltage

10.2.7.2 Medium Voltage

10.2.7.3 High Voltage

10.2.8 Historic and Forecasted Market Size By End-User Industry

10.2.8.1 Industrial

10.2.8.2 Infrastructure

10.2.8.3 Oil & Gas

10.2.8.4 Power Generation

10.2.8.5 HVAC

10.2.8.6 Automotive

10.2.8.7 Food & Beverage

10.2.8.8 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Vacuum Interrupters Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Type

10.3.4.1 AC Drives

10.3.4.2 DC Drives

10.3.4.3 Servo Drives

10.3.5 Historic and Forecasted Market Size By Power Range

10.3.5.1 Micro Power Drive

10.3.5.2 Low Power Drive

10.3.5.3 Medium Power Drive

10.3.5.4 High Power Drive

10.3.6 Historic and Forecasted Market Size By Application

10.3.6.1 Pumps

10.3.6.2 Fans

10.3.6.3 Compressors

10.3.6.4 Conveyors

10.3.6.5 Extruders

10.3.6.6 Others

10.3.7 Historic and Forecasted Market Size By Voltage Range

10.3.7.1 Low Voltage

10.3.7.2 Medium Voltage

10.3.7.3 High Voltage

10.3.8 Historic and Forecasted Market Size By End-User Industry

10.3.8.1 Industrial

10.3.8.2 Infrastructure

10.3.8.3 Oil & Gas

10.3.8.4 Power Generation

10.3.8.5 HVAC

10.3.8.6 Automotive

10.3.8.7 Food & Beverage

10.3.8.8 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Vacuum Interrupters Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Type

10.4.4.1 AC Drives

10.4.4.2 DC Drives

10.4.4.3 Servo Drives

10.4.5 Historic and Forecasted Market Size By Power Range

10.4.5.1 Micro Power Drive

10.4.5.2 Low Power Drive

10.4.5.3 Medium Power Drive

10.4.5.4 High Power Drive

10.4.6 Historic and Forecasted Market Size By Application

10.4.6.1 Pumps

10.4.6.2 Fans

10.4.6.3 Compressors

10.4.6.4 Conveyors

10.4.6.5 Extruders

10.4.6.6 Others

10.4.7 Historic and Forecasted Market Size By Voltage Range

10.4.7.1 Low Voltage

10.4.7.2 Medium Voltage

10.4.7.3 High Voltage

10.4.8 Historic and Forecasted Market Size By End-User Industry

10.4.8.1 Industrial

10.4.8.2 Infrastructure

10.4.8.3 Oil & Gas

10.4.8.4 Power Generation

10.4.8.5 HVAC

10.4.8.6 Automotive

10.4.8.7 Food & Beverage

10.4.8.8 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Vacuum Interrupters Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Type

10.5.4.1 AC Drives

10.5.4.2 DC Drives

10.5.4.3 Servo Drives

10.5.5 Historic and Forecasted Market Size By Power Range

10.5.5.1 Micro Power Drive

10.5.5.2 Low Power Drive

10.5.5.3 Medium Power Drive

10.5.5.4 High Power Drive

10.5.6 Historic and Forecasted Market Size By Application

10.5.6.1 Pumps

10.5.6.2 Fans

10.5.6.3 Compressors

10.5.6.4 Conveyors

10.5.6.5 Extruders

10.5.6.6 Others

10.5.7 Historic and Forecasted Market Size By Voltage Range

10.5.7.1 Low Voltage

10.5.7.2 Medium Voltage

10.5.7.3 High Voltage

10.5.8 Historic and Forecasted Market Size By End-User Industry

10.5.8.1 Industrial

10.5.8.2 Infrastructure

10.5.8.3 Oil & Gas

10.5.8.4 Power Generation

10.5.8.5 HVAC

10.5.8.6 Automotive

10.5.8.7 Food & Beverage

10.5.8.8 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Vacuum Interrupters Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Type

10.6.4.1 AC Drives

10.6.4.2 DC Drives

10.6.4.3 Servo Drives

10.6.5 Historic and Forecasted Market Size By Power Range

10.6.5.1 Micro Power Drive

10.6.5.2 Low Power Drive

10.6.5.3 Medium Power Drive

10.6.5.4 High Power Drive

10.6.6 Historic and Forecasted Market Size By Application

10.6.6.1 Pumps

10.6.6.2 Fans

10.6.6.3 Compressors

10.6.6.4 Conveyors

10.6.6.5 Extruders

10.6.6.6 Others

10.6.7 Historic and Forecasted Market Size By Voltage Range

10.6.7.1 Low Voltage

10.6.7.2 Medium Voltage

10.6.7.3 High Voltage

10.6.8 Historic and Forecasted Market Size By End-User Industry

10.6.8.1 Industrial

10.6.8.2 Infrastructure

10.6.8.3 Oil & Gas

10.6.8.4 Power Generation

10.6.8.5 HVAC

10.6.8.6 Automotive

10.6.8.7 Food & Beverage

10.6.8.8 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Vacuum Interrupters Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Type

10.7.4.1 AC Drives

10.7.4.2 DC Drives

10.7.4.3 Servo Drives

10.7.5 Historic and Forecasted Market Size By Power Range

10.7.5.1 Micro Power Drive

10.7.5.2 Low Power Drive

10.7.5.3 Medium Power Drive

10.7.5.4 High Power Drive

10.7.6 Historic and Forecasted Market Size By Application

10.7.6.1 Pumps

10.7.6.2 Fans

10.7.6.3 Compressors

10.7.6.4 Conveyors

10.7.6.5 Extruders

10.7.6.6 Others

10.7.7 Historic and Forecasted Market Size By Voltage Range

10.7.7.1 Low Voltage

10.7.7.2 Medium Voltage

10.7.7.3 High Voltage

10.7.8 Historic and Forecasted Market Size By End-User Industry

10.7.8.1 Industrial

10.7.8.2 Infrastructure

10.7.8.3 Oil & Gas

10.7.8.4 Power Generation

10.7.8.5 HVAC

10.7.8.6 Automotive

10.7.8.7 Food & Beverage

10.7.8.8 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Vacuum Interrupters Market research report?

A1: The forecast period in the Vacuum Interrupters Market research report is 2024-2032.

Q2: Who are the key players in the Vacuum Interrupters Market?

A2: Schneider Electric (France), Eaton Corporation (Ireland), Siemens AG (Germany), ABB Ltd. (Switzerland), Mitsubishi Electric Corporation (Japan), Hitachi Energy (Switzerland), GE Grid Solutions (USA), and Other Active Players.

Q3: What are the segments of the Vacuum Interrupters Market?

A3: The Vacuum Interrupters Market is segmented into Type, Application, End User Industry and region. By Type, the market is categorized into Medium Voltage Vacuum Interrupters, High Voltage Vacuum Interrupters. By Application, the market is categorized into Switchgear, Circuit Breakers, Transformers, Other. By End-User Industry, the market is categorized into Power Generation, Transmission & Distribution, Industrial, Commercial, Residential. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Vacuum Interrupters Market?

A4: Vacuum Interrupters are electrical devices employed in high voltage circuit breakers and switchgears to cut off circuit current. They work through making the contacts operated move apart where this gap helps in cutting off electric arc whilst serving on the power distribution networks correctly and safely.

Q5: How big is the Vacuum Interrupters Market?

A5: Vacuum Interrupters Market Size Was Valued at USD 2.46 Billion in 2023, and is Projected to Reach USD 4.09 Billion by 2032, Growing at a CAGR of 5.8% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!