Stay Ahead in Fast-Growing Economies.

Browse Reports NowTreatment Resistant Depression Market – Overview and Outlook by Growth By 2032

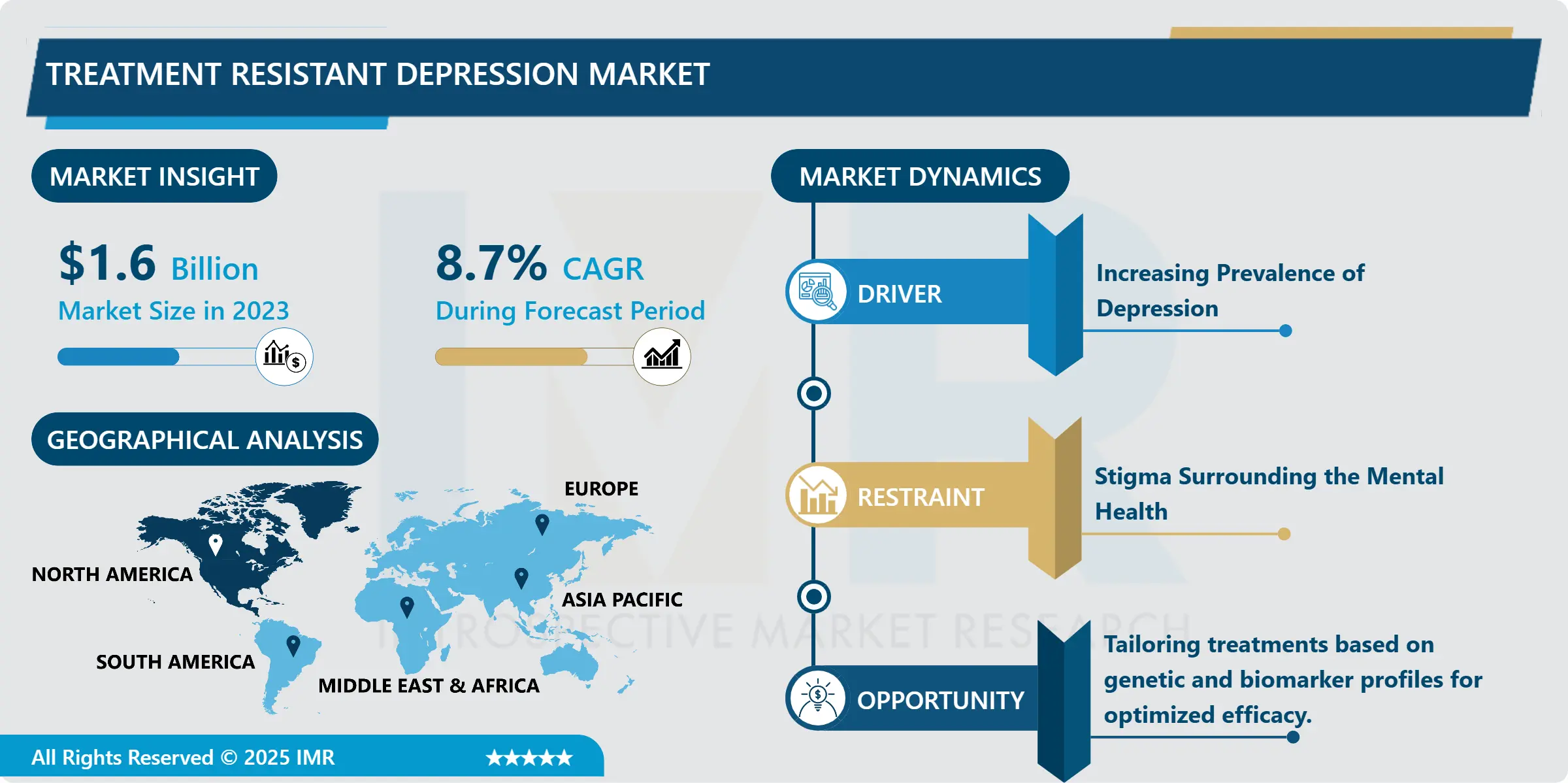

Treatment Resistant Depression Market Size Was Valued at USD 1.60 Billion in 2023, and is Projected to Reach USD 3.80 Billion by 2032, Growing at a CAGR of 8.7% from 2024-2032.

IMR Group

Description

Treatment Resistant Depression Market Synopsis:

Treatment Resistant Depression Market Size Was Valued at USD 1.60 Billion in 2023, and is Projected to Reach USD 3.80 Billion by 2032, Growing at a CAGR of 8.7% from 2024-2032.

The Treatment-Resistant Depression (TRD) industry is defined as the niche within the healthcare sector that targets major depressive disorder (MDD) patients who did not respond to standard antidepressant treatments. TRD is defined as failure to demonstrate adequate improvement after administering at least two distinct antidepressant therapies with suitable doses and in a sufficient timeframe TRD is fraught with considerable difficulties for patients and care providers. This market involves distinct treatments including, new chemical entities, psychotherapy like CBT, neurostimulation therapies like TMS and ECT. New players were drawn into the TRD market due to the increasing rate of depression and a growing consciousness of mental health disorders, and new actors engaged in the pharmaceutical sector, healthcare providers, research institutions, and mental health organizations to enhance the quality of life of depressed patients with chronic and severe depressive disorders.

The Treatment-Resistant Depression (TRD) business is a relatively novel area of the health care industry for patients with major depressive disorder (MDD) who experience limited or no improvements from traditional antidepressant therapies. As it was described as an absence of suitable outcome following two or more distinct treatments, TRD is a very common phenomenon, which has a rather negative impact on the quality of life and impairs subject’s autonomy to a great extent. Since the mental health problems are emerging as important societal concerns, there is a need for efficient treatments to address the problem and spur development of new cures and treatments. The market is estimated to include any and all new methods of treating a variety of illnesses and diseases, from medication to talk therapy to newer stimulation therapies not covered by traditional healthcare options for a patient who has failed to get healing for their condition.

Several variables define the market for TRD, including: the growing incidence of depression, the process of constant introduction of new therapeutic approaches, and the focus on individualized treatment. Industry participants including, drug manufactures, medical facilities, and research organizations continue to work on new treatment solutions and delivery models for patients, while digital healthcare solutions are reaching more patients to receive care. Nevertheless, barriers still exist today such as; expensive costs of treatment, inequitable nature of insurance policies and homework variability in healthcare services. In general, the TRD market occupies a great but potentially promising place in approaches to providing mental health services and can considerably facilitate the effective treatment of patients with severe and persistent depression. It is commensurate with further advancements in research and development of newer therapies that the market will continue to expand, holding out the possibility of improved outcome in this multifaceted disorder.

Treatment Resistant Depression Market Trend Analysis:

The Emergence of Novel Therapeutics

The Treatment-Resistant Depression (TRD) market has been experiencing expansion in its growth due to the following main factors. The use of new medications, especially the new modes of action like ketamine and esketamine in treatment of depression has created interest due to the speed of relief offered in the process. The push for a shift to more patient-centric model of care is improving overall drug efficacy through methods based on genetic profiles and biomarkers. Digital adoption of expending therapeutic services through telehealth solutions and mobile applications is improving the reach and follow- through of services. At the same time, the new kinds of evidence-based psychotherapeutic approaches are being integrated with pharmacological interventions.

Technological developments of neuromodulation approaches, including TMS and VNS are making conventional treatment for cases nonresponsive to normal therapy more achievable. Pharmaceuticals firms’ partnering with research institutions is engendering innovation in the type of TRD therapies, further, the enhancement of mental health consciousnesses through more extensive campaigns dilutes the prejudice that come with seeking psychiatric treatment. Regulation reforms and novel accelerated approval procedures the place new market entry for potential innovative treatment solutions faster to cater increasingly encouraging the management of TRD.

Urgent Need for Effective Therapies for Patients

The Treatment-Resistant Depression (TRD) market presents numerous opportunities for growth and innovation, driven by the urgent need for effective therapies for patients who do not respond to standard treatments. As awareness of mental health issues increases, there is a rising demand for novel therapeutics and integrated care solutions, providing a fertile ground for pharmaceutical companies and healthcare providers to develop and deliver advanced treatment options. The expansion of digital health technologies, including teletherapy and mobile applications, offers a unique opportunity to enhance patient engagement and accessibility, particularly in underserved populations.

The push towards personalized medicine, leveraging genetic and biomarker data, can lead to more targeted and effective treatment strategies, increasing patient satisfaction and outcomes. Collaborations between research institutions and industry players can accelerate innovation, paving the way for new therapies and approaches that address the complexities of TRD. Overall, the growing recognition of the need for comprehensive mental health care creates a dynamic environment for investment and development in the TRD market.

Treatment Resistant Depression Market Segment Analysis:

Treatment Resistant Depression Market is Segmented on the basis of Type, Application, End User and Region.

By Drug Type, NMDA antagonists’ segment is expected to dominate the market during the forecast period

Among the NMDA antagonists’ segment, in Treatment-Resistant Depression (TRD) market, it holds major revenue share during the forecast period due to fast acting agents such as ketamine and esketamine. These treatments have received much attention because such approaches yield positive results within hours of the treatments; an essential feature for patients who have not benefit from other normal anti-depressant therapies. This mechanism of action, which employs antagonists to NMDA receptors in the glutamatergic system, is thus a welcome different approach that may help to improve the treatment of TRD.

Further advancement of studies aiming to discover more about the versatility and advantages of these agents has increase the chances of their use in the future and has placed these agents strategically as one of the most preferred in the therapeutic market. This is a trend of a general shift towards the improvement of approaches to managing depression, which is a multilayered issue, and thus, providing an increased satisfaction for patients.

By Application, Pharmacological treatment segment expected to held the largest share

The pharmacological treatment segment is estimated to dominate the Treatment-Resistant Depression (TRD) market share size in the forecast period as there is increased investment in the research and development of new pharmacological products in this space. As a part of this segment we have rapid-acting agents including NMDA antagonist’s ketamine and esketamine, atypical antidepressant, and other new chemicals that have shown good efficacy in patients who do not respond to other agents.

Medications definitely play significant roles in the treatment of TRD, are lifesaving in modeling severe depressive episodes, and are usually the first line of treatment that patients receive. Yet, since psychotherapy and neurostimulation techniques implement critical steps in comprehensive treatment planning, the growing availability and efficacy of novel pharmacological agents establish this segment as the primary target for both clinicians and consumers when depicting the need for rational approaches to the management of treatment-resistant depression.

Treatment Resistant Depression Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North American market will remain the most prominent market in the global TRD market over the forecast period, due to the high prevalence rates of major depressive disorder, a well-developed healthcare system and increasing focus on mental health research. The United States and Canada have led the way in formulating new treatment approaches, such as new-fangled immediate acting agents such as ketamine and esketamine which is currently being used in clinical practice. Thus, the growing prevalence of mental disorders due to increased awareness and campaigns, and also due to advocacy for such problems has created demand for effective forms of TRD hence encouraging growth in the market in the region. The abundance of the pharmaceutical companies and industry research institutes focused on developing new psychiatric therapies makes this industry perfect for advancement and invention.

The North American environment for new drugs is steadily shifting toward less restrictive, as new fast-track review processes allow new effective drugs to reach patients faster. The application of modern digital technologies in terms of the various telemedicine services also improves the availability of treatment for the TRD population and enables more people to seek and ultimately receive treatment. There is also a favourable reimbursement landscape in North America where early indications show that clients are typically able to obtain full reimbursement for these techniques and technologies, enforcing the use of such novel solutions by the healthcare provider. Awareness level, research & development activities along with regulatory support for the market is consistently high in North America therefore with high growth expected in the coming years making North America to be a significant player in TRD market.

Active Key Players in the Treatment Resistant Depression Market

AstraZeneca (United Kingdom)

Brainstorm Cell Therapeutics (United States)

H. Lundbeck A/S (Denmark)

Johnson & Johnson (United States)

Lilly (Eli Lilly and Company) (United States)

Novartis AG (Switzerland)

Otsuka Pharmaceutical Co., Ltd. (Japan)

Pfizer Inc. (United States)

Sunovion Pharmaceuticals (United States)

Takeda Pharmaceutical Company Limited (Japan)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Treatment Resistant Depression Market by Drug Type

4.1 Treatment Resistant Depression Market Snapshot and Growth Engine

4.2 Treatment Resistant Depression Market Overview

4.3 NMDA

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 NMDA: Geographic Segmentation Analysis

4.4 Antidepressants

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Antidepressants: Geographic Segmentation Analysis

4.5 Antipsychotics)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Antipsychotics): Geographic Segmentation Analysis

4.6

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 : Geographic Segmentation Analysis

Chapter 5: Treatment Resistant Depression Market by Application

5.1 Treatment Resistant Depression Market Snapshot and Growth Engine

5.2 Treatment Resistant Depression Market Overview

5.3 Pharmacological Treatment

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Pharmacological Treatment: Geographic Segmentation Analysis

5.4 Psychotherapy

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Psychotherapy: Geographic Segmentation Analysis

5.5 Neurostimulation Techniques)

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Neurostimulation Techniques): Geographic Segmentation Analysis

5.6

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 : Geographic Segmentation Analysis

Chapter 6: Treatment Resistant Depression Market by End User

6.1 Treatment Resistant Depression Market Snapshot and Growth Engine

6.2 Treatment Resistant Depression Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Clinics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Clinics: Geographic Segmentation Analysis

6.5 Pharmaceutical Companies

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Pharmaceutical Companies: Geographic Segmentation Analysis

6.6 Telehealth Providers

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Telehealth Providers: Geographic Segmentation Analysis

6.7 Research Institutions)

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Research Institutions) : Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Treatment Resistant Depression Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 JOHNSON & JOHNSON (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 LILLY (ELI LILLY AND COMPANY) (UNITED STATES)

7.4 PFIZER INC. (UNITED STATES)

7.5 ASTRAZENECA (UNITED KINGDOM)

7.6 OTSUKA PHARMACEUTICAL CO. LTD. (JAPAN)

7.7 OTHER ACTIVE PLAYERS

Chapter 8: Global Treatment Resistant Depression Market By Region

8.1 Overview

8.2. North America Treatment Resistant Depression Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Drug Type

8.2.4.1 NMDA

8.2.4.2 Antidepressants

8.2.4.3 Antipsychotics)

8.2.4.4

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Pharmacological Treatment

8.2.5.2 Psychotherapy

8.2.5.3 Neurostimulation Techniques)

8.2.5.4

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Pharmaceutical Companies

8.2.6.4 Telehealth Providers

8.2.6.5 Research Institutions)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Treatment Resistant Depression Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Drug Type

8.3.4.1 NMDA

8.3.4.2 Antidepressants

8.3.4.3 Antipsychotics)

8.3.4.4

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Pharmacological Treatment

8.3.5.2 Psychotherapy

8.3.5.3 Neurostimulation Techniques)

8.3.5.4

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Pharmaceutical Companies

8.3.6.4 Telehealth Providers

8.3.6.5 Research Institutions)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Treatment Resistant Depression Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Drug Type

8.4.4.1 NMDA

8.4.4.2 Antidepressants

8.4.4.3 Antipsychotics)

8.4.4.4

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Pharmacological Treatment

8.4.5.2 Psychotherapy

8.4.5.3 Neurostimulation Techniques)

8.4.5.4

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Pharmaceutical Companies

8.4.6.4 Telehealth Providers

8.4.6.5 Research Institutions)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Treatment Resistant Depression Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Drug Type

8.5.4.1 NMDA

8.5.4.2 Antidepressants

8.5.4.3 Antipsychotics)

8.5.4.4

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Pharmacological Treatment

8.5.5.2 Psychotherapy

8.5.5.3 Neurostimulation Techniques)

8.5.5.4

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Pharmaceutical Companies

8.5.6.4 Telehealth Providers

8.5.6.5 Research Institutions)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Treatment Resistant Depression Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Drug Type

8.6.4.1 NMDA

8.6.4.2 Antidepressants

8.6.4.3 Antipsychotics)

8.6.4.4

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Pharmacological Treatment

8.6.5.2 Psychotherapy

8.6.5.3 Neurostimulation Techniques)

8.6.5.4

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Pharmaceutical Companies

8.6.6.4 Telehealth Providers

8.6.6.5 Research Institutions)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Treatment Resistant Depression Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Drug Type

8.7.4.1 NMDA

8.7.4.2 Antidepressants

8.7.4.3 Antipsychotics)

8.7.4.4

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Pharmacological Treatment

8.7.5.2 Psychotherapy

8.7.5.3 Neurostimulation Techniques)

8.7.5.4

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Pharmaceutical Companies

8.7.6.4 Telehealth Providers

8.7.6.5 Research Institutions)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Treatment Resistant Depression Market research report?

A1: The forecast period in the Treatment Resistant Depression Market research report is 2024-2032.

Q2: Who are the key players in the Treatment Resistant Depression Market?

A2: Johnson & Johnson (United States), Lilly (Eli Lilly and Company) (United States), Pfizer Inc. (United States), AstraZeneca (United Kingdom), Otsuka Pharmaceutical Co., Ltd. (Japan)and Other Active Players.

Q3: What are the segments of the Treatment Resistant Depression Market?

A3: The Treatment Resistant Depression Market is segmented into Type, Application, End User and region. By Type, the market is categorized into NMDA, Antidepressants, and Antipsychotics. By Application, the market is categorized into Pharmacological Treatment, Psychotherapy, Neurostimulation Techniques. By End User, the market is categorized into Hospitals, Clinics, Pharmaceutical Companies, Telehealth Providers, Research Institutions. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Treatment Resistant Depression Market?

A4: The Treatment-Resistant Depression (TRD) industry is defined as the niche within the healthcare sector that targets major depressive disorder (MDD) patients who did not respond to standard antidepressant treatments. TRD is defined as failure to demonstrate adequate improvement after administering at least two distinct antidepressant therapies with suitable doses and in a sufficient timeframe TRD is fraught with considerable difficulties for patients and care providers. This market involves distinct treatments including, new chemical entities, psychotherapy like CBT, neurostimulation therapies like TMS and ECT.

Q5: How big is the Treatment Resistant Depression Market?

A5: Treatment Resistant Depression Market Size Was Valued at USD 1.60 Billion in 2023, and is Projected to Reach USD 3.80 Billion by 2032, Growing at a CAGR of 8.7% from 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!