Stay Ahead in Fast-Growing Economies.

Browse Reports NowSurgical Staplers Market- Global Size, Share & Industry Trends 2025-2032

Surgical staplers are medical instruments used in surgery to close wounds or cuts. They function similarly to traditional sutures but have several advantages, including faster closure times and less tissue trauma. Surgical staplers are commonly used in procedures that require multiple staples, such as gastrointestinal, lung, and skin surgeries.

IMR Group

Description

Surgical Staplers Market Synopsis

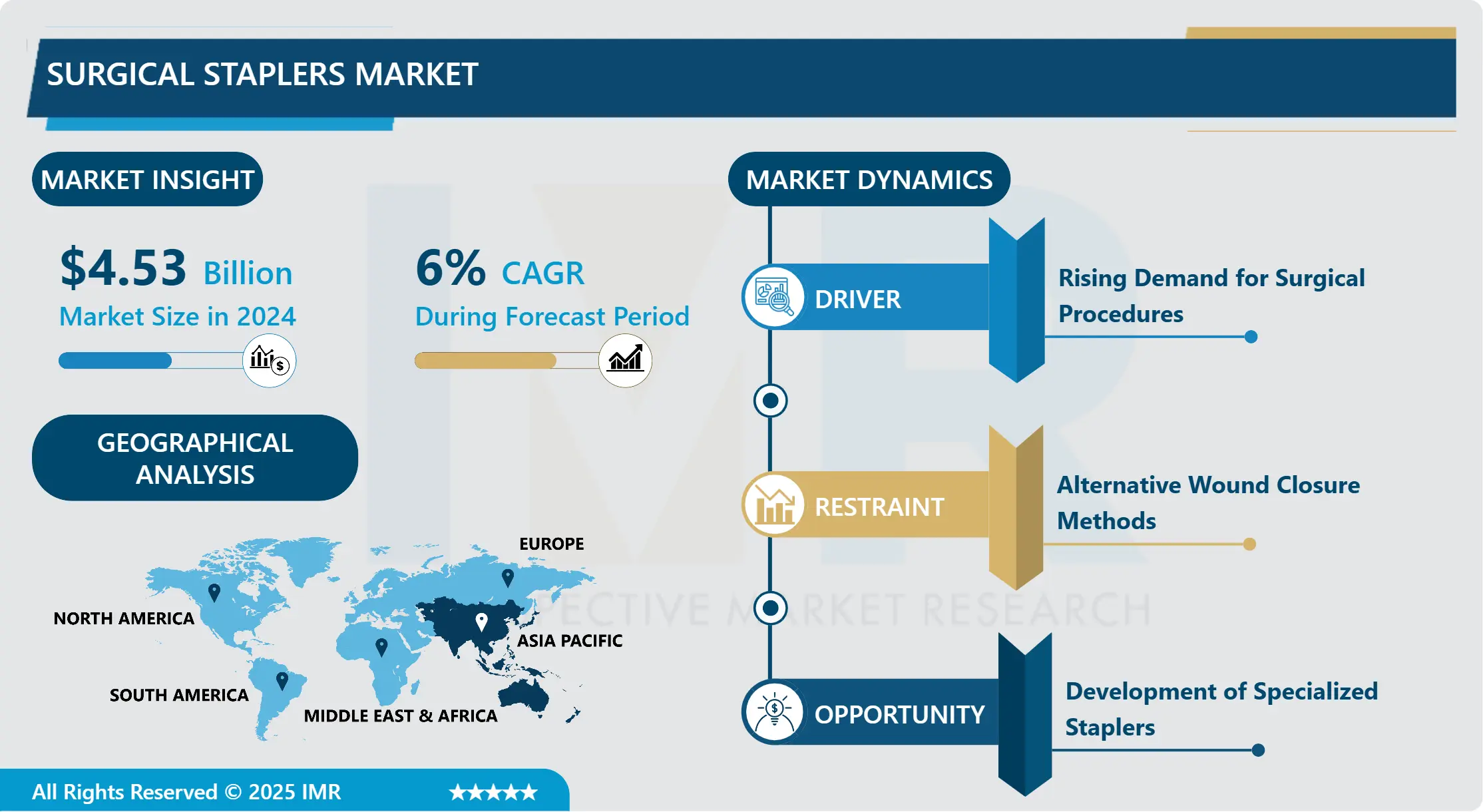

Surgical Staplers Market Size Was Valued at USD 4.53 Billion in 2024 and is Projected to Reach USD 7.22 Billion by 2032, Growing at a CAGR of 6% From 2025-2032.

Surgical staplers are medical instruments used in surgery to close wounds or cuts. They function similarly to traditional sutures but have several advantages, including faster closure times and less tissue trauma. Surgical staplers are commonly used in procedures that require multiple staples, such as gastrointestinal, lung, and skin surgeries.

The rising prevalence of chronic diseases, as well as the growing elderly population, are driving up demand for surgical procedures and increasing the need for surgical staplers. shift towards minimally invasive surgeries (MIS), which provide several benefits such as faster recovery times, less pain, and smaller incisions. Surgical staplers play an important role in these procedures, which drives market growth.

Stapler design advancements like enhanced tissue compatibility, automated features, and improved ergonomics make these tools more effective and user-friendly for surgeons. Surgical staplers are becoming increasingly popular because they provide quicker closure times than traditional sutures, possibly less blood loss, and a possibly decreased risk of infection.

Ongoing research and development efforts aimed at improving the safety and efficacy of surgical staplers further propel market growth, increasing investments in healthcare infrastructure, growing awareness of the benefits of surgical staplers among healthcare professionals, and rising healthcare expenditure worldwide are expected to sustain market growth in the foreseeable future.

Surgical Staplers Market Trend Analysis

Rising Demand for Surgical Procedures

Surgery becomes even more necessary as chronic diseases become more common as a result of unhealthy lifestyle choices such as smoking, poor eating, and lack of exercise. As the global population ages, chronic diseases such as diabetes, heart disease, and cancer become more prevalent. The need for surgeries to treat or manage these conditions frequently increases the demand for surgical procedures.

Furthermore, as healthcare systems strive to improve patient outcomes while lowering costs, there is an increasing emphasis on minimally invasive surgical procedures. Minimally invasive techniques, aided by surgical staplers, provide advantages such as shorter hospital stays, faster recovery times, and fewer post-operative complications than traditional open surgeries. As a result, surgeons and healthcare facilities are increasingly implementing minimally invasive approaches in a variety of surgical specialties, driving up demand for surgical staplers.

The expanding scope of surgical procedures beyond traditional surgeries, such as robotic-assisted surgeries and single-incision laparoscopic procedures, is boosting the surgical stapler’s market. These innovative surgical techniques necessitate the use of specialized staplers designed to meet the specific needs of advanced procedures, which fuels the demand for advanced surgical stapling devices. The surgical staplers market is experiencing significant growth due to rising demand for surgical procedures, as well as growing adoption of minimally invasive techniques and innovative surgical approaches.

Development of Specialized Staplers

The surgical stapler market is seeing an increase in the development of specialized staplers designed to meet specific surgical needs. This trend is being driven by the growing popularity of minimally invasive surgeries and the demand for better surgical outcomes. These specialized staplers have a smaller size for easier maneuverability in laparoscopic procedures, specific jaw designs for delicate tissues in cardiac surgeries, and even integration with technology for real-time feedback and accuracy.

These staplers lower the possibility of problems like leaks and strictures by making it easier to create accurate and consistent anastomoses. In the field of thoracic surgery, which involves frequent lung resections and bronchial surgeries, sophisticated linear staplers featuring articulating jaws and sophisticated cutting mechanisms have been developed to facilitate accurate tissue dissection and staple formation in constricted areas.

The development of specialized staplers is expected to remain a major growth driver in the surgical stapler market. Advances in technology, materials science, and increased demand for minimally invasive and targeted surgical procedures will pave the way for more innovation in this field. Manufacturers that can effectively address the challenges associated with the development and gain surgeon acceptance through robust clinical data and training programs are likely to succeed in this changing market landscape.

Surgical Staplers Market Segment Analysis:

Surgical Staplers Market Segmented based on Product Type, Mechanism, Usability, and Application.

By Product Type, Linear Staplers segment is expected to dominate the market during the forecast period

The growing use of minimally invasive surgical techniques has contributed to increased demand for linear staplers. Linear staplers are commonly used in laparoscopic and robotic-assisted surgeries, which provide advantages such as shorter hospital stays, faster recovery times, and fewer postoperative complications. Manufacturers are constantly innovating to create advanced linear staplers with better features like ergonomic designs, improved stapling mechanisms, and integrated cutting capabilities.

These technological advancements improve the performance and efficiency of linear staplers, making them more appealing to surgeons and medical professionals. Linear staplers are versatile tools used in surgical specialties other than gastrointestinal surgery, such as thoracic, gynecological, and urological procedures. Linear staplers are increasingly used in a variety of surgical disciplines due to their versatility and ability to effectively seal and divide tissues in a straight line.

The growth of healthcare infrastructure, particularly in emerging economies, is driving the use of advanced surgical techniques and tools, such as linear staplers. As healthcare facilities improve their surgical capabilities and invest in modern equipment, demand for linear staplers is expected to rise. The linear stapler segment in the surgical stapler market is growing due to technological advancements, expanding applications, and a shift towards minimally invasive surgical approaches.

By Application, General Surgery segment is expected to dominate the market during the forecast period

General surgery refers to a wide range of procedures involving different organs and structures in the abdominal cavity. Many of these procedures require precise tissue approximation and secure closure, which surgical staplers excel at. Gastrointestinal surgeries such as bowel resections, gastric bypass surgery, and appendectomies frequently require multiple staple lines for resection, anastomosis, and tissue layer closure. Surgical staplers allow surgeons to perform these procedures efficiently and with consistent outcomes.

The growing popularity of minimally invasive surgical techniques in general surgery has boosted the use of surgical staplers. In laparoscopic and robotic-assisted procedures, where access to the surgical site is limited, surgical staplers allow for precise tissue manipulation and closure via small incisions. Surgical staplers are essential tools in minimally invasive general surgery, allowing surgeons to carry out complex procedures with greater precision and safety.

Surgical staplers come in a variety of sizes and configurations to suit different tissue thicknesses and surgical needs. Surgical staplers are indispensable in general surgery due to their efficiency, precision, and safety. Their widespread use in a variety of procedures emphasizes their significance in modern surgical practice, where improving patient outcomes and streamlining surgical workflows are essential.

Surgical Staplers Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

North America’s geriatric population is growing, increasing demand for surgeries such as joint replacements and cardiac procedures, both of which rely heavily on surgical staplers. The prevalence of chronic diseases such as cancer and obesity is increasing, necessitating more surgeries for treatment and management, which drives up demand for staplers. Minimally invasive surgeries (MIS) are gaining popularity due to advantages such as shorter recovery times and smaller incisions.

North America is home to several leading surgical stapler manufacturers, including Ethicon, Medtronic, and Intuitive Surgical. These companies invest heavily in R&D, resulting in continuous innovation and the introduction of advanced stapler technologies. Surgeons and hospitals in North America are generally more open to implementing new and advanced medical technologies, such as innovative surgical staples.

North American countries, particularly the United States, allocate a higher percentage of GDP to healthcare than many other regions. This leads to increased investment in medical equipment, such as surgical staplers. Insurance companies and government healthcare programs in North America frequently reimburse for surgeries that use surgical staplers, making them more accessible to patients and encouraging their use.

Surgical Staplers Market Top Key Players:

Ethicon (US)

Intuitive Surgical (US)

Teleflex Incorporated (US)

Zimmer Biomet (US)

CONMED Corporation (US)

Applied Medical (US)

Intuitive Surgical (US)

Becton, Dickinson (US)

Zimmer Biomet (US)

Stryker (US)

DJO Surgical (US)

Lexington Medical (US)

Dextera Surgical Inc. (US)

B. Braun (Germany)

Smith+Nephew (UK)

Purple Surgical (UK)

Welfare Medical Ltd. (UK)

Grena Ltd. (UK)

Medtronic (Ireland)

Meril life (India)

Frankenman International Limited (Hong Kong)

Touchstone International Medical Science Co. Ltd. (China)

Reach Surgical Inc. (China), and other active players

Key Industry Developments in the Surgical Staplers Market:

In August 2023, Teleflex acquired Standard Bariatrics for $300m. US-based Standard Bariatrics developed the Titan SGS stapler, which is designed to assist in achieving more consistent and symmetrical sleeve pouch anatomy. It offers the longest continuous 23cm staple cutline and was developed to address unmet needs in sleeve gastrectomy.

In June 2023, ETHICON launched the Next Generation Echelon™ 3000 Staple, designed for superior access and control. ECHELON 3000 is designed with a 39% greater jaw aperture and a 27% greater articulation span, giving surgeons better access and control over each transection, even in tight spaces and on challenging tissue.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Surgical Staplers Market by Product Type (2018-2032)

4.1 Surgical Staplers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Linear Staplers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Circular Staplers

4.5 Skin Staplers

4.6 Endoscopic Staplers

4.7 Others

Chapter 5: Surgical Staplers Market by Mechanism (2018-2032)

5.1 Surgical Staplers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Manual

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Powered

Chapter 6: Surgical Staplers Market by Usability (2018-2032)

6.1 Surgical Staplers Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Disposable

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Reusable

Chapter 7: Surgical Staplers Market by Application (2018-2032)

7.1 Surgical Staplers Market Snapshot and Growth Engine

7.2 Market Overview

7.3 General Surgery

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Abdominal & Pelvic Surgery

7.5 Cardiac & Thoracic Surgery

7.6 Orthopedic Surgery

7.7 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Surgical Staplers Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 CARIBOU COFFEE COMPANY

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CARTE NOIRE

8.4 DALLMAYR PRODOMO GROUND COFFEE

8.5 BLUE BOTTLE

8.6 LEROUX

8.7 BULLETPROOF

8.8 COSTA COFFEE

8.9 JACQUES VABRE

8.10 EIGHT O’CLOCK COFFEE

8.11 DON FRANCISCO’S COFFEE

8.12 CAFFÈ NERO GROUP LTDJAB HOLDING COMPANY

8.13 LUIGI LAVAZZA S.P.ASTRAUSS GROUP LTD.

Chapter 9: Global Surgical Staplers Market By Region

9.1 Overview

9.2. North America Surgical Staplers Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 Linear Staplers

9.2.4.2 Circular Staplers

9.2.4.3 Skin Staplers

9.2.4.4 Endoscopic Staplers

9.2.4.5 Others

9.2.5 Historic and Forecasted Market Size by Mechanism

9.2.5.1 Manual

9.2.5.2 Powered

9.2.6 Historic and Forecasted Market Size by Usability

9.2.6.1 Disposable

9.2.6.2 Reusable

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 General Surgery

9.2.7.2 Abdominal & Pelvic Surgery

9.2.7.3 Cardiac & Thoracic Surgery

9.2.7.4 Orthopedic Surgery

9.2.7.5 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Surgical Staplers Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 Linear Staplers

9.3.4.2 Circular Staplers

9.3.4.3 Skin Staplers

9.3.4.4 Endoscopic Staplers

9.3.4.5 Others

9.3.5 Historic and Forecasted Market Size by Mechanism

9.3.5.1 Manual

9.3.5.2 Powered

9.3.6 Historic and Forecasted Market Size by Usability

9.3.6.1 Disposable

9.3.6.2 Reusable

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 General Surgery

9.3.7.2 Abdominal & Pelvic Surgery

9.3.7.3 Cardiac & Thoracic Surgery

9.3.7.4 Orthopedic Surgery

9.3.7.5 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Surgical Staplers Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 Linear Staplers

9.4.4.2 Circular Staplers

9.4.4.3 Skin Staplers

9.4.4.4 Endoscopic Staplers

9.4.4.5 Others

9.4.5 Historic and Forecasted Market Size by Mechanism

9.4.5.1 Manual

9.4.5.2 Powered

9.4.6 Historic and Forecasted Market Size by Usability

9.4.6.1 Disposable

9.4.6.2 Reusable

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 General Surgery

9.4.7.2 Abdominal & Pelvic Surgery

9.4.7.3 Cardiac & Thoracic Surgery

9.4.7.4 Orthopedic Surgery

9.4.7.5 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Surgical Staplers Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 Linear Staplers

9.5.4.2 Circular Staplers

9.5.4.3 Skin Staplers

9.5.4.4 Endoscopic Staplers

9.5.4.5 Others

9.5.5 Historic and Forecasted Market Size by Mechanism

9.5.5.1 Manual

9.5.5.2 Powered

9.5.6 Historic and Forecasted Market Size by Usability

9.5.6.1 Disposable

9.5.6.2 Reusable

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 General Surgery

9.5.7.2 Abdominal & Pelvic Surgery

9.5.7.3 Cardiac & Thoracic Surgery

9.5.7.4 Orthopedic Surgery

9.5.7.5 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Surgical Staplers Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 Linear Staplers

9.6.4.2 Circular Staplers

9.6.4.3 Skin Staplers

9.6.4.4 Endoscopic Staplers

9.6.4.5 Others

9.6.5 Historic and Forecasted Market Size by Mechanism

9.6.5.1 Manual

9.6.5.2 Powered

9.6.6 Historic and Forecasted Market Size by Usability

9.6.6.1 Disposable

9.6.6.2 Reusable

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 General Surgery

9.6.7.2 Abdominal & Pelvic Surgery

9.6.7.3 Cardiac & Thoracic Surgery

9.6.7.4 Orthopedic Surgery

9.6.7.5 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Surgical Staplers Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 Linear Staplers

9.7.4.2 Circular Staplers

9.7.4.3 Skin Staplers

9.7.4.4 Endoscopic Staplers

9.7.4.5 Others

9.7.5 Historic and Forecasted Market Size by Mechanism

9.7.5.1 Manual

9.7.5.2 Powered

9.7.6 Historic and Forecasted Market Size by Usability

9.7.6.1 Disposable

9.7.6.2 Reusable

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 General Surgery

9.7.7.2 Abdominal & Pelvic Surgery

9.7.7.3 Cardiac & Thoracic Surgery

9.7.7.4 Orthopedic Surgery

9.7.7.5 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Surgical Staplers Market research report?

A1: The forecast period in the Surgical Staplers Market research report is 2025-2032.

Q2: Who are the key players in the Surgical Staplers Market?

A2: Ethicon (US), Intuitive Surgical (US), Teleflex Incorporated (US), Zimmer Biomet (US), CONMED Corporation (US), Applied Medical (US), Intuitive Surgical (US), Becton, Dickinson (US), Zimmer Biomet (US), Stryker (US), DJO Surgical (US), Lexington Medical (US), Dextera Surgical Inc. (US), B. Braun (Germany), Smith+Nephew (UK), Purple Surgical (UK), Welfare Medical Ltd. (UK), Grena Ltd. (UK), Medtronic (Ireland), Meril life (India), Frankenman International Limited (Hong Kong), Touchstone International Medical Science Co. Ltd. (China), Reach Surgical Inc. (China) and Other Active Players.

Q3: What are the segments of the Surgical Staplers Market?

A3: The Surgical Staplers Market is segmented into Product Type, Mechanism, Usability, Application, and region. By Product Type, the market is categorized into Linear Staplers, Circular Staplers, Skin Staplers, Endoscopic Staplers, and Others. By Mechanism, the market is categorized into Manual, and Powered. By Usability, the market is categorized into Disposable and Reusable. By Application, the market is categorized into General Surgery, Abdominal & Pelvic Surgery, Cardiac & Thoracic Surgery, Orthopedic Surgery, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Surgical Staplers Market?

A4: Surgical staplers are medical instruments used in surgery to close wounds or cuts. They function similarly to traditional sutures but have several advantages, including faster closure times and less tissue trauma. Surgical staplers are commonly used in procedures that require multiple staples, such as gastrointestinal, lung, and skin surgeries

Q5: How big is the Surgical Staplers Market?

A5: Surgical Staplers Market Size Was Valued at USD 4.53 Billion in 2024 and is Projected to Reach USD 7.22 Billion by 2032, Growing at a CAGR of 6% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!