Stay Ahead in Fast-Growing Economies.

Browse Reports NowSurgical Blade Market 2024- Overview and Outlook by Potential Growth By 2032

The surgical Blade is also known as a scalpel, for the surgical knife. A surgical Blade is a small, extremely sharp-bladed tool an essential dermatological tool used during surgical procedures for cutting skin and tissue. Scalpels may be single-use or reusable disposable. The Reusable scalpels are permanently attached blades that can be sharpened while single-use blades are used once. The surgical blades come in different sizes, which are identified by a blade number, and each serves a different purpose.

IMR Group

Description

Surgical Blade Market Synopsis

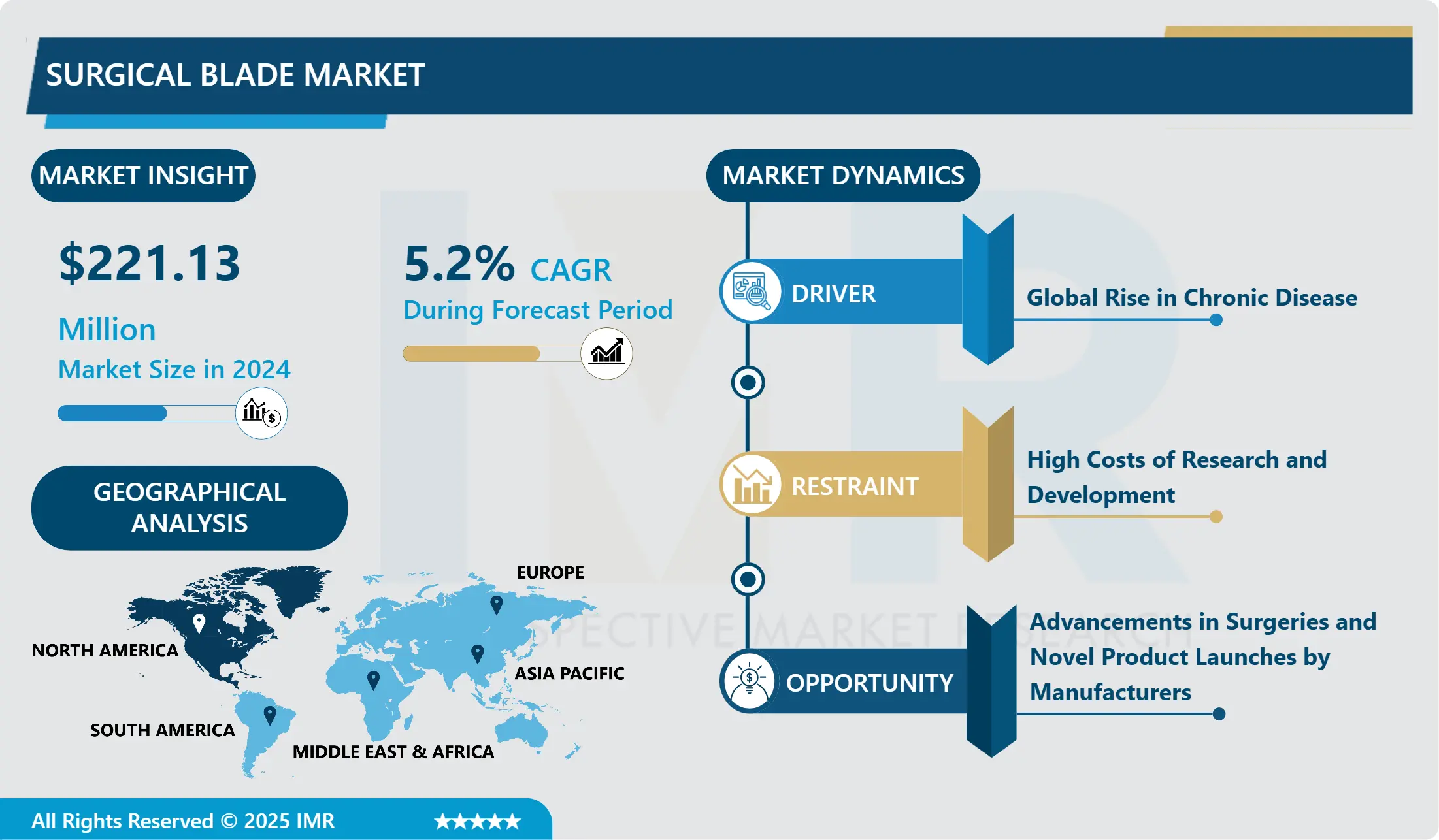

Surgical Blade Market Size Was Valued at USD 221.13 Million in 2024, and is Projected to Reach USD 331.72 Million by 2032, Growing at a CAGR of 5.2% From 2025-2032.

A surgical blade is a sharp tool that is used in surgery to cut tissues particularly when opening the body. Constructed from stainless steel or carbon steel, these blades are characterized by their sharpness, enhanced strength, and can be sterilized. These devices are developed in various sizes and forms depending on their specific application in surgical procedures. Given their uses in procedures, which require precision and less trauma during surgery, surgical blades have become vital tools in most surgeries today.

The rising number of surgical procedures and the expansion of the global geriatric population are also presented as key factors for the growth of the market. Furthermore, advancements and an increase in the global incidences of chronic diseases like diabetes, cancer, & cardiovascular diseases will also contribute to growth over the forecast period.

Surgical products are regarded as low risk tools that are used during operations, and that their production and utilization does not necessarily require a highly rigorous regulatory process. In addition, the rise in chronic diseases has thus encouraged more hospital construction and clinic facilities, ambulatory surgical center, etc. , hence more employment opportunities for surgeons. These factors are boosting the surgical blade market to reach new heights.

Surgical knives made of stainless steel are popular among surgeons since they are less prone to corrosion than knives constructed from carbon steel, which is preferable for procedures that require the utilization of a significant amount of saline solution. These blades are usually applied in surgeries that are in areas that get subjected to moist conditions for longer time by involving several incisions.

In addition to this, the number of blades available in sets of different sizes and shapes for a particular procedure is likely to fuel growth. Surgical blades come in different sizes and design to allow the doctors or the support staff in picking the most appropriate blade to apply in the surgical procedures. Technologically, physicians all over the world are using stainless steel blades in surgeries. Technological advancements in the design of scalpel include other features like the acute sharp cutting edges that enable clean cuts & high-quality cutting, and the numbered scalpel handles are increasingly being used by surgeons.

Surgical Blade Market Trend Analysis

Rising prevalence of surgery across the globe along with a surge in chronic diseases

The number of surgical treatments defines the market’s primary drivers base. Additionally, the rising prevalence of surgery across the globe along with a surge in chronic diseases like cardiovascular disorders, diabetes, and cancer will also help to drive the growth of the overall surgical blades market towards 2024 to 2032.

Rising incidence of illnesses and infections, addition of new technologies, and the progression of healthcare across the world also puts a positive light on surgical blade market in the future period. For instance, based on World Health Organization (WHO), the geriatric population of the world will be increased from 12% to 22% in 2050 from 2015 accordingly. Hence, in turns the market demand should increase.

Increase in the number of surgeries and a rising global geriatric population

There has been a massive rise in the demand for surgical blade as the number of operations is on the rise and the geriatric population is growing day by day globally. This increasing elderly population comes with more longevity diseases and chronic illnesses that require surgery as patients age. Furthermore, with improved technology in the medical field and the development of better healthcare system there has been increase in surgeries globally. These factors, as a sum, increase the requirement for top-notch surgical blades since they are crucial instruments utilized in many surgeries. Thus, factors like technology, variety, and strictness in blade design have become critical to manufacturers as they strive to fulfill the rising demands of healthcare facilities and expand the market even further.

Surgical Blade Market Segment Analysis:

Surgical Blade Market Segmented based on Product, Material, and End-User.

By Product, Stainless steel segment is expected to dominate the market during the forecast period

Based on the product type, market has been classified stainless steel blades and high-grade carbon steel blades. These blades are also made of the finest quality materials and offers great satisfaction to the surgeons during operations. They are usually of lighter construction, such as being plastic, which can be very useful in various surgeries.

Automotive & Industrial applications segment is expected to dominate the market during the forecast period due to the rise in automotive sector & widespread industrial uses. Apart from being applied in medical operations, stainless steel blades are also known to be used for piercing or modifying or transplanting the body. These blades are stronger and longer lasting than high-grade carbon steel grades, therefore making them ideal for our use. These features in addition to numerous applications including their non-corrosive nature to form rust on stainless steel are contributing to the market growth of stainless-steel blades.

By Material, Sterile segment held the largest share in 2024

Sterile blades category is expected to exhibit high compound value growth over the next few years due to properties like sharper edge and neat cuts. In surgery, sterile blades give the requirement sharp edge and augment effectiveness for a surgery. In addition, the use of disposable products and gloves is safer and more hygienic as it provides protection to medical staff from various infections and diseases that are becoming crucial to the end-users in the medical field.

In comparison to the cultured non-sterile blades segment, the industry is expected to grow at a CAGR of 3%. A CAGR of 1% over the forecast period could be attributed to the rise in demand for the equipment among surgeons and the product’s availability in various grades and sizes to match the function that varies with the surgery.

Surgical Blade Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to maintain its position as the global market leader in the forcast period. The United States is by far the leading marker in the North American area for surgical device due to better regulation of the device for surgeries and increasing awareness to undertake operations in cases of injuries or chronic diseases.

The region is expected to grow at a faster pace due to the growing incidence of surgical procedures using advanced tools and devices and growing cases of cardiovascular diseases and obesity. Additionally, considering a report in the CDC’s 2022, it was stated that 18 years and above are most likely to be affected by obesity. Two million adults had coronary artery disease, which suggested that about 70 per cent of such patients required operation. Many individuals find themselves being admitted into hospitals as every year, about 35 million persons in the United States receive such treatment. Consequently, the growth in the market for surgical blades in a particular region would be fueled by the rising rate of hospitalization and number of surgeries. Continuing the list of possible consequences associated with the growing statistics of road accidents in the United States the demand for surgical blades has escalated due to the need for more surgeries for individuals who sustained injuries on the roads.

Active Key Players in the Surgical Blade Market

Swann-Morton Limited

PL Medical Co.

Hill-Rom, LLC

Beaver-Visitec International

VOGT Medical

Hu-Friedy Mfg. Co., LLC

B. Braun Melsungen AG

Mölnlycke Health Care AB (Sweden)

Smith & Nephew plc (UK)

Medline Industries, Inc. (USA)

Johnson & Johnson (USA)

Nipro Corporation (Japan)

Cardinal Health, Inc. (USA)

Zimmer Biomet Holdings, Inc. (USA)

Aesculap Inc. (Germany)

Microline Surgical (USA)

Stryker Corporation (USA)

Surgical Specialties Corporation

Other Active Players

Key Industry Developments in the Surgical Blade Market:

In May 2024, Medline announced that it had reached a definitive agreement to acquire Ecolab’s surgical solutions business for over $950 million. The transaction, which was subject to standard closing conditions and regulatory approvals, was expected to be finalized in the second half of 2024. This acquisition provided Medline with sterile drape solutions for surgeons and Ecolab’s fluid temperature management system, enhancing its offerings in the surgical solutions sector.

In May 2024, SouthMedic, a prominent manufacturer of surgical blades, scalpels, and innovative medical devices, announced its partnership with Nano Surgical as the exclusive master distributor of Lumohs MD no. 3 Lighted Scalpel Handles in Canada. The Lumohs MD no. 3 Lighted Scalpel Handles were cutting-edge solutions designed to enhance surgical instruments by providing shadowless, unobstructed illumination just millimeters from the operating site. This advancement guaranteed improved precision and visibility during scalpel-based procedures, promoting a safer environment for surgeons, their teams, and patients.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Surgical Blade Market by Product (2018-2032)

4.1 Surgical Blade Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Stainless Steel

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 High-Grade Carbon Steel

Chapter 5: Surgical Blade Market by Material (2018-2032)

5.1 Surgical Blade Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Sterile

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Non-Sterile

Chapter 6: Surgical Blade Market by End-user (2018-2032)

6.1 Surgical Blade Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospital

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Clinics

6.5 Ambulatory Surgical Centers

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Surgical Blade Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BRAUN MELSUNGEN AG (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SMITH & NEPHEW PLC (UK)

7.4 ZIMMER BIOMET (US)

7.5 ALCON LABORATORIES INC. (SWITZERLAND)

7.6 ASPEN SURGICAL (US)

7.7 MEDTRONIC (US)

7.8 DICKINSON AND COMPANY (US)

7.9 ETHICON (US)

7.10 COOPERSURGICAL INC. (US)

7.11 SURGICAL INNOVATIONS (UK)

7.12 OTHER KEY PLAYERS

7.13

Chapter 8: Global Surgical Blade Market By Region

8.1 Overview

8.2. North America Surgical Blade Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product

8.2.4.1 Stainless Steel

8.2.4.2 High-Grade Carbon Steel

8.2.5 Historic and Forecasted Market Size by Material

8.2.5.1 Sterile

8.2.5.2 Non-Sterile

8.2.6 Historic and Forecasted Market Size by End-user

8.2.6.1 Hospital

8.2.6.2 Clinics

8.2.6.3 Ambulatory Surgical Centers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Surgical Blade Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product

8.3.4.1 Stainless Steel

8.3.4.2 High-Grade Carbon Steel

8.3.5 Historic and Forecasted Market Size by Material

8.3.5.1 Sterile

8.3.5.2 Non-Sterile

8.3.6 Historic and Forecasted Market Size by End-user

8.3.6.1 Hospital

8.3.6.2 Clinics

8.3.6.3 Ambulatory Surgical Centers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Surgical Blade Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product

8.4.4.1 Stainless Steel

8.4.4.2 High-Grade Carbon Steel

8.4.5 Historic and Forecasted Market Size by Material

8.4.5.1 Sterile

8.4.5.2 Non-Sterile

8.4.6 Historic and Forecasted Market Size by End-user

8.4.6.1 Hospital

8.4.6.2 Clinics

8.4.6.3 Ambulatory Surgical Centers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Surgical Blade Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product

8.5.4.1 Stainless Steel

8.5.4.2 High-Grade Carbon Steel

8.5.5 Historic and Forecasted Market Size by Material

8.5.5.1 Sterile

8.5.5.2 Non-Sterile

8.5.6 Historic and Forecasted Market Size by End-user

8.5.6.1 Hospital

8.5.6.2 Clinics

8.5.6.3 Ambulatory Surgical Centers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Surgical Blade Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product

8.6.4.1 Stainless Steel

8.6.4.2 High-Grade Carbon Steel

8.6.5 Historic and Forecasted Market Size by Material

8.6.5.1 Sterile

8.6.5.2 Non-Sterile

8.6.6 Historic and Forecasted Market Size by End-user

8.6.6.1 Hospital

8.6.6.2 Clinics

8.6.6.3 Ambulatory Surgical Centers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Surgical Blade Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product

8.7.4.1 Stainless Steel

8.7.4.2 High-Grade Carbon Steel

8.7.5 Historic and Forecasted Market Size by Material

8.7.5.1 Sterile

8.7.5.2 Non-Sterile

8.7.6 Historic and Forecasted Market Size by End-user

8.7.6.1 Hospital

8.7.6.2 Clinics

8.7.6.3 Ambulatory Surgical Centers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Surgical blade Market research report?

A1: The forecast period in the Surgical Blade Market research report is 2025-2032.

Q2: Who are the key players in the Surgical blade Market?

A2: Swann-Morton Limited,PL Medical Co.,Hill-Rom, LLC,Beaver-Visitec International,VOGT Medical,Hu-Friedy Mfg. Co., LLC,B. Braun Melsungen AG,Mölnlycke Health Care AB (Sweden),Smith & Nephew plc (UK),Medline Industries, Inc. (USA),Johnson & Johnson (USA),Nipro Corporation (Japan),Cardinal Health, Inc. (USA),Zimmer Biomet Holdings, Inc. (USA),Aesculap Inc. (Germany),Microline Surgical (USA),Stryker Corporation (USA),Surgical Specialties Corporation, and Other Active Players.

Q3: What are the segments of the Surgical blade Market?

A3: The Surgical Blade Market is segmented into product, material, end-user and region. By product, the market is categorized into stainless steel, high-grade carbon steel. By material, the market is categorized into sterile, non-sterile. By end-user, the market is categorized into hospitals, clinics, and ambulatory surgical centers. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; ; Spain; Rest of Western Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil; Argentina, Rest of SA.).

Q4: What is the Surgical blade Market?

A4: A surgical blade is a part of medical equipment that is used to excise parts of the body by cutting through the tissue. These blades are of stainless steel carbon steel, to allow for flexibility and vast accuracy in the utensil. They are flexible and are available in different sizes; each used in specific surgeries and specific task. Surgical blades are a very important component in the surgical process as they ensure the right cuts are made with little or no hurt to the tissues to allow for fast healing.

Q5: How big is the Surgical blade Market?

A5: Surgical Blade Market Size Was Valued at USD 221.13 Million in 2024, and is Projected to Reach USD 331.72 Million by 2032, Growing at a CAGR of 5.2% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!