Stay Ahead in Fast-Growing Economies.

Browse Reports NowSugar-free Hard Candies Market – Share, Size & Industry Analysis

Sugar free hard candies are sweets which look and taste like normal hard candies but do not contain regular sugar. Well, these candies rely on the following sweetening agents; sugar alcohols, artificial sweeteners and natural sweeteners.

IMR Group

Description

Sugar-free Hard Candies Market Synopsis

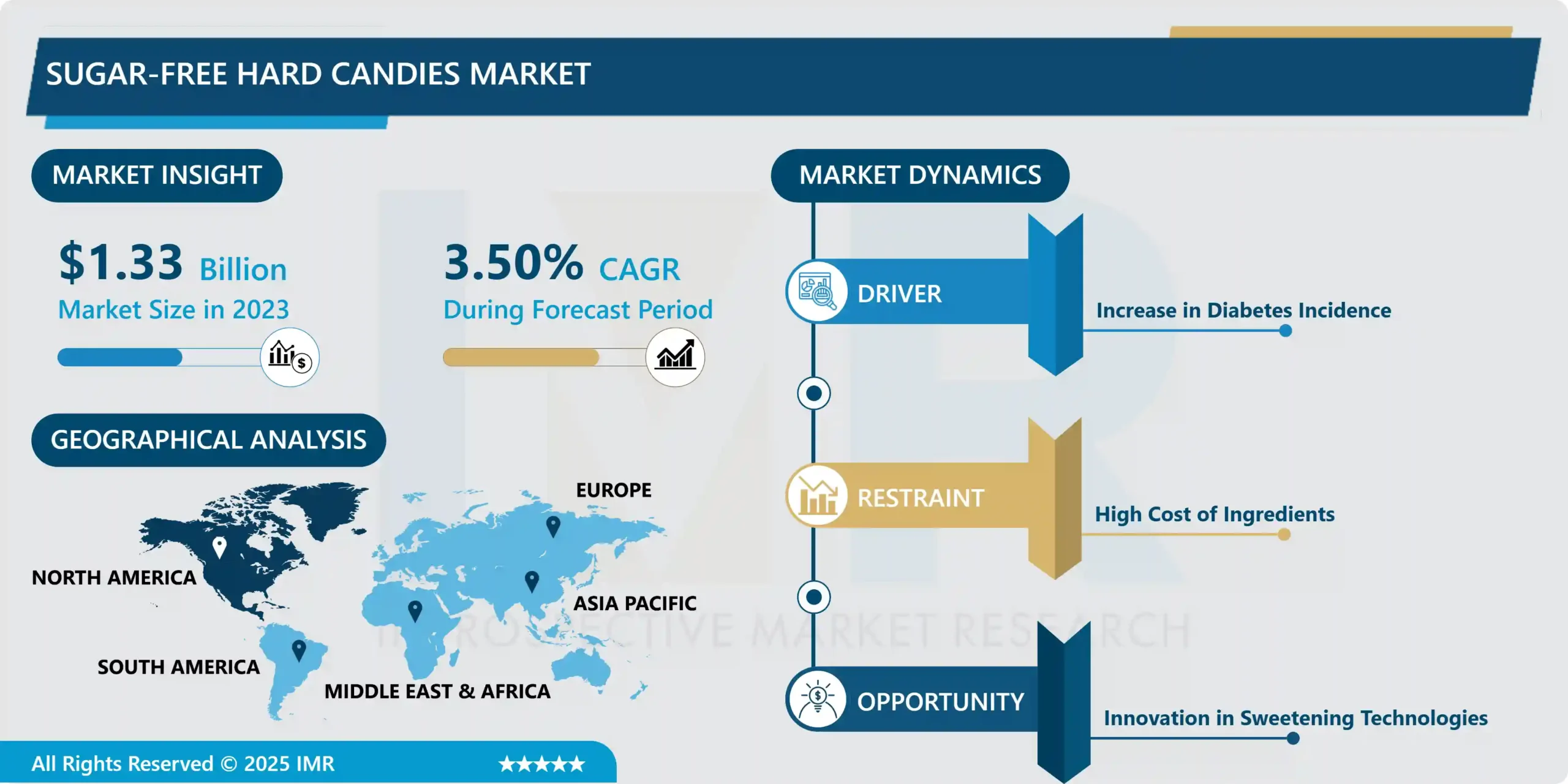

Sugar-free Hard Candies Market Size Was Valued at USD 1.33 Billion in 2023, and is Projected to Reach USD 1.81 Billion by 2032, Growing at a CAGR of 3.50% From 2024-2032.

Sugar free hard candies are sweets which look and taste like normal hard candies but do not contain regular sugar. Well, these candies rely on the following sweetening agents; sugar alcohols, artificial sweeteners and natural sweeteners.

The market for sugar-free hard candies has been growing steadily because of changing consumer habits prompted by health concerns, disease prevalence and demand for low-kilocalorie sugars. Many of these candies can be consumed by health enthusiasts, people with diabetes, and consumers concerned with low sugar intake, and yet still be enjoyable. Some of the primary opportunities that have been realized within the candy industry stem from consumers’ need for products they began regarding as healthier : products without sugar yet as tasty, diverse in flavors, and retaining their texture and sweetness.

Some key trends are concentration in product’s development and quality improvement of sugar-free hard candies with using natural sweeteners like stevia, erythritol and maltitol. Also, there is the intense market demand for clean label products which makes manufacturers shift their attention towards the purity and origin of the ingredients used. The distribution channels for these products has also been changing over the years, many of them has now shifted from the traditional retailing, to selling their products on the internet, which has made sugar-free hard candies easily available to the society.

Regionally, North America and Europe holds the largest share inconsumption of sugar-free hard candies as the consumer globally become more health-conscious. Nonetheless, there is expected growth in Asia-Pacific region especially because of increase in disposable income and sustaining lifestyles that advocate for healthier intake of commodities. Thus the market being rapidly growing offers a great chance to new market entrants as well as for the companies already in the market to capitalize on this market potential for sugar-free confections making the proper positioning possible in this competitive market.

Sugar-free Hard Candies Market Trend Analysis

Rising Demand for Sugar-Free Hard Candies

With an increasing health consciousness, more people are actually looking ways on how to cut down with sugar as there are risks of obesity, diabetes, and dental problems. This has resulted to change in consumer preference by seeking sugar free products through various consumptions these changes has favoured those who have diabetes and those who are in low carb diets. There are more and more people who seek for theweightless products, which can give them the pleasure of consumption of sweets without any possible harm to their health. Therefore, the sugar-free hard candies have gained a market in themselves to serve a society that is waiting for products that are healthy for consumption.

To meet this new emerging demand, product developers are working very hard to develop and diversify their assortment of sugar-free hard candies. Subsequently, they are aiming at creating products that resemble hard candies in taste and texture, so that consumers can effectively be subjected to the same level of satisfaction. This innovation sometimes use natural sweeteners such as stevia and Erythritol thus it is a low calorie sweetener. Further, due to abundant health awareness, manufacturers involve the Advertising for showcasing the sugar-free products as being healthy to consume for wider consumers. The following trend has shown that, as the general trend progresses, more soft sugar-free hard candies will be available to consumers because the product is currently tertiated based on health concerns.

Innovations and Marketing Strategies in the Sugar-Free Hard Candies Market

New hard candy products are being developed by manufacturers as the trend for healthier candy products or reduced sugar content gains a stronger foothold in the market. These companies are focused in mimicking the favourite hard candies and ensure that customers do not have to compromise on the taste buds and resultant satisfaction. It allows consumers to get the products with necessary degree of sweetness, but without the calories contained in caked, biscuits or chocolates. This way helps to satisfy the demand of health conscious population while preserving the positive connotation of hard candies consumption.

To increase their market demand even more, marketing strategies are taken by manufacturers that emphasize on the health effects of sugar-free hard candies. These actions are intended to help consumers better understand the benefits of a low sugar diet, as well as the negative effects on health brought on by high sugar diets. This way companies can attract more people who have some sort of dietary restrictions or have a certain goal they wish to achieve. Considering the general tendency towards consuming snacks and sweets of healthy profiles, the global market of sugar-free hard candies is truly promising since the consumers will have more choices to select from as the market expands.

Sugar-free Hard Candies Market Segment Analysis:

Sugar-free Hard Candies Market Segmented based on By Type, By Sweetening Agent, By Functionality, By Distribution Channel and By Flavors

By Type, Hard Candy segment is expected to dominate the market during the forecast period

Hard candy is one of the most favored edibles that have proved beyond doubt to be enjoyable thanks to their very long shelf life and strained flavor. This candy is produced mainly from sugar and corn syrup Where by through a heating process, the product looses most of its moisture and becomes hard solidified mass. Among the benefits of this lower moisture content extends its shelf life but also retains its pungent flavor for a longer time. The choices range from the usual forms of hard candy such as mint and butterscotch to fruity forms which makes it possible to meet a variety of compromises that individually consumers may have.

Another feature that makes hard candy easily preferred by consumers is Portability. The solidity of the product is more portable since it can be carried in your pocket and bags, or even in lunch boxes. In the same way, the enjoyable crackling and slow disintegration of the hard candy offer another experience which, most consumers would not mind, enjoying about it. Lollipops, candy canes, gummies and toffees are distinguished by these properties; this kind of candies is typically linked to personal nostalgic memories, sharing a lollipop or getting a candy cane during the holidays. In general, hard candy continues to be popular due to its combined features of the attractive taste, well-defined texture and easy to handle characteristic.

By Flavors,Butterscotch segment held the largest share in 2023

Butterscotch are traditional candy flavors that create an appetite and the recall of childhood or at least childhood-like experiences; On this note, butterscotch seems to be a favorite of most candy lovers. Butterscotch is a sweet and rich resembling that of butter with a hint of nutty which causes every one and many to think of home made goodies and family functions. It possesses a glossy texture with dense and creamy taste developed from the cooking of brown sugar and butter it literally dissolves in the mouth and offers warmly feeling. Due to such an association, butterscotch is well-loved in many types of candies and is used in hard candies, chocolates, condiments, and baked products.

While toffee is more well-known for its smooth and buttery texture, and sweet taste caramel is known for its buttery, smooth taste with a perfectly cooked sugar that turns amber when heated. Caramel can assume several uses where it can be enjoyed, as a soft chewy candy, a topping for other sweets, or a centre for chocolates. The density of the caramel frequently gives an individual a feeling of overindulgence which is why it is popular in elegant candies and sweets. If combined, butterscotch and caramel make people happy and let them feel the increase of the quality of their life and the return to childhood, getting the top taste addition.

Sugar-free Hard Candies Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

Specially in North America and particularly the United States the demand for sugar free hard candies has risen tremendously because of changing trends in consumer preferences towards healthier products. This change is mainly occasioned by calamity on the vice impacts of excessive sugar intake which include among others obesity and diabetes. The infrastructure that underlines the small stores deeply determines Dubai’s population opinion about a rather vast spectrum of sugar-free products as such products are easily accessible in the region. Further, health education through marketing campaigns supporting the use of the products which are sugar-free has been instrumental in supporting these products to the market. Consequently, more consumers are now consuming sugar-free hard candies to curb this vice; hence there is a higher market demand.

Thus, leading companies in the current sugar-free hard candy market are making pertinent steps to meet this demand by developing new tastes and extraordinary components that should capture the attention of the conscious calorie consumer. This include addition of natural sourced sweetener such as stevia or erythritol to enable people to enjoy the delicious product without the undesired effects of sugars. Manufacturers are also venturing into various formulation techniques just to address the change in taste and texture of food products. also, the competition is intensifying, but brands continue to introduce novelties, as well as extend the range of products containing no added sugar. It is through this broad and deliberate focus that it also fulfills the consumer needs while spearheading market development in North America, which is fast becoming a hub for the sugar-free confectionery market.

Active Key Players in the Sugar-free Hard Candies Market

THE HERSHEY COMPANY (U.S.)

Asher’s Chocolate Co. (U.S.)

Hyet Sweet B.V. (Netherlands)

Dr. John’s Healthy Sweets LLC (U.S.)

LILY’S SWEETS (U.S.)

ROY Chocolatier (France)

Russell Stover Chocolates, LLC (U.S.)

Koochikoo Lollipops (U.S.)

Sugarless Confectionery (U.S.)

Barnett (U.S.)

Other Key Players

Key Industry Developments in the Sugar-free Hard Candies Market:

In April 2024, Candy Pros, building on the success of their versatile Melt and Pour gummy base, unveiled their latest innovation: the Naked Gold Sugar-Free Hard Candy Mix. This pioneering formula is tailored for creating both THC-infused hard candies and CBD-edibles, providing confectioners with a novel solution to cater to the increasing demand for healthier and customizable cannabis products

In January 2024, Zolli Candy introduced its market-first Zero-Sugar Gum Pop. The Zolli Gum PopZ features a zero-sugar gum core encased in a zero-sugar hard candy shell

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sugar-free Hard Candies Market by Type (2018-2032)

4.1 Sugar-free Hard Candies Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hard Candy

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Chewy Candy

4.5 Gummies

4.6 Lollipops

4.7 Chewing Gums

Chapter 5: Sugar-free Hard Candies Market by Sweetening Agent (2018-2032)

5.1 Sugar-free Hard Candies Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Stevia

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Isomalt

5.5 Sorbitol

5.6 Maltitol

5.7 Xylitol

5.8 Polydextrose

5.9 Others

Chapter 6: Sugar-free Hard Candies Market by Functionality (2018-2032)

6.1 Sugar-free Hard Candies Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Texture

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Stability

6.5 Moisture Retention

Chapter 7: Sugar-free Hard Candies Market by Distribution Channel (2018-2032)

7.1 Sugar-free Hard Candies Market Snapshot and Growth Engine

7.2 Market Overview

7.3 B2B

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 B2C

7.5 Hypermarket/Supermarket

7.6 Specialty Store

7.7 Convenience Store

7.8 Retailers

7.9 Online Store

7.10 Others

Chapter 8: Sugar-free Hard Candies Market by Flavors (2018-2032)

8.1 Sugar-free Hard Candies Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Butterscotch

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Caramel

8.5 Blueberry

8.6 Strawberry

8.7 Banana

8.8 Coffee

8.9 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Sugar-free Hard Candies Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 THE HERSHEY COMPANY (U.S.)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 ASHER’S CHOCOLATE CO. (U.S.)

9.4 HYET SWEET B.V. (NETHERLANDS)

9.5 DR. JOHN’S HEALTHY SWEETS LLC (U.S.)

9.6 LILY’S SWEETS (U.S.)

9.7 ROY CHOCOLATIER (FRANCE)

9.8 RUSSELL STOVER CHOCOLATES

9.9 LLC (U.S.)

9.10 KOOCHIKOO LOLLIPOPS (U.S.)

9.11 SUGARLESS CONFECTIONERY (U.S.)

9.12 BARNETT (U.S.)

9.13 OTHER KEY PLAYERS

Chapter 10: Global Sugar-free Hard Candies Market By Region

10.1 Overview

10.2. North America Sugar-free Hard Candies Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Hard Candy

10.2.4.2 Chewy Candy

10.2.4.3 Gummies

10.2.4.4 Lollipops

10.2.4.5 Chewing Gums

10.2.5 Historic and Forecasted Market Size by Sweetening Agent

10.2.5.1 Stevia

10.2.5.2 Isomalt

10.2.5.3 Sorbitol

10.2.5.4 Maltitol

10.2.5.5 Xylitol

10.2.5.6 Polydextrose

10.2.5.7 Others

10.2.6 Historic and Forecasted Market Size by Functionality

10.2.6.1 Texture

10.2.6.2 Stability

10.2.6.3 Moisture Retention

10.2.7 Historic and Forecasted Market Size by Distribution Channel

10.2.7.1 B2B

10.2.7.2 B2C

10.2.7.3 Hypermarket/Supermarket

10.2.7.4 Specialty Store

10.2.7.5 Convenience Store

10.2.7.6 Retailers

10.2.7.7 Online Store

10.2.7.8 Others

10.2.8 Historic and Forecasted Market Size by Flavors

10.2.8.1 Butterscotch

10.2.8.2 Caramel

10.2.8.3 Blueberry

10.2.8.4 Strawberry

10.2.8.5 Banana

10.2.8.6 Coffee

10.2.8.7 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Sugar-free Hard Candies Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Hard Candy

10.3.4.2 Chewy Candy

10.3.4.3 Gummies

10.3.4.4 Lollipops

10.3.4.5 Chewing Gums

10.3.5 Historic and Forecasted Market Size by Sweetening Agent

10.3.5.1 Stevia

10.3.5.2 Isomalt

10.3.5.3 Sorbitol

10.3.5.4 Maltitol

10.3.5.5 Xylitol

10.3.5.6 Polydextrose

10.3.5.7 Others

10.3.6 Historic and Forecasted Market Size by Functionality

10.3.6.1 Texture

10.3.6.2 Stability

10.3.6.3 Moisture Retention

10.3.7 Historic and Forecasted Market Size by Distribution Channel

10.3.7.1 B2B

10.3.7.2 B2C

10.3.7.3 Hypermarket/Supermarket

10.3.7.4 Specialty Store

10.3.7.5 Convenience Store

10.3.7.6 Retailers

10.3.7.7 Online Store

10.3.7.8 Others

10.3.8 Historic and Forecasted Market Size by Flavors

10.3.8.1 Butterscotch

10.3.8.2 Caramel

10.3.8.3 Blueberry

10.3.8.4 Strawberry

10.3.8.5 Banana

10.3.8.6 Coffee

10.3.8.7 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Sugar-free Hard Candies Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Hard Candy

10.4.4.2 Chewy Candy

10.4.4.3 Gummies

10.4.4.4 Lollipops

10.4.4.5 Chewing Gums

10.4.5 Historic and Forecasted Market Size by Sweetening Agent

10.4.5.1 Stevia

10.4.5.2 Isomalt

10.4.5.3 Sorbitol

10.4.5.4 Maltitol

10.4.5.5 Xylitol

10.4.5.6 Polydextrose

10.4.5.7 Others

10.4.6 Historic and Forecasted Market Size by Functionality

10.4.6.1 Texture

10.4.6.2 Stability

10.4.6.3 Moisture Retention

10.4.7 Historic and Forecasted Market Size by Distribution Channel

10.4.7.1 B2B

10.4.7.2 B2C

10.4.7.3 Hypermarket/Supermarket

10.4.7.4 Specialty Store

10.4.7.5 Convenience Store

10.4.7.6 Retailers

10.4.7.7 Online Store

10.4.7.8 Others

10.4.8 Historic and Forecasted Market Size by Flavors

10.4.8.1 Butterscotch

10.4.8.2 Caramel

10.4.8.3 Blueberry

10.4.8.4 Strawberry

10.4.8.5 Banana

10.4.8.6 Coffee

10.4.8.7 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Sugar-free Hard Candies Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Hard Candy

10.5.4.2 Chewy Candy

10.5.4.3 Gummies

10.5.4.4 Lollipops

10.5.4.5 Chewing Gums

10.5.5 Historic and Forecasted Market Size by Sweetening Agent

10.5.5.1 Stevia

10.5.5.2 Isomalt

10.5.5.3 Sorbitol

10.5.5.4 Maltitol

10.5.5.5 Xylitol

10.5.5.6 Polydextrose

10.5.5.7 Others

10.5.6 Historic and Forecasted Market Size by Functionality

10.5.6.1 Texture

10.5.6.2 Stability

10.5.6.3 Moisture Retention

10.5.7 Historic and Forecasted Market Size by Distribution Channel

10.5.7.1 B2B

10.5.7.2 B2C

10.5.7.3 Hypermarket/Supermarket

10.5.7.4 Specialty Store

10.5.7.5 Convenience Store

10.5.7.6 Retailers

10.5.7.7 Online Store

10.5.7.8 Others

10.5.8 Historic and Forecasted Market Size by Flavors

10.5.8.1 Butterscotch

10.5.8.2 Caramel

10.5.8.3 Blueberry

10.5.8.4 Strawberry

10.5.8.5 Banana

10.5.8.6 Coffee

10.5.8.7 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Sugar-free Hard Candies Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Hard Candy

10.6.4.2 Chewy Candy

10.6.4.3 Gummies

10.6.4.4 Lollipops

10.6.4.5 Chewing Gums

10.6.5 Historic and Forecasted Market Size by Sweetening Agent

10.6.5.1 Stevia

10.6.5.2 Isomalt

10.6.5.3 Sorbitol

10.6.5.4 Maltitol

10.6.5.5 Xylitol

10.6.5.6 Polydextrose

10.6.5.7 Others

10.6.6 Historic and Forecasted Market Size by Functionality

10.6.6.1 Texture

10.6.6.2 Stability

10.6.6.3 Moisture Retention

10.6.7 Historic and Forecasted Market Size by Distribution Channel

10.6.7.1 B2B

10.6.7.2 B2C

10.6.7.3 Hypermarket/Supermarket

10.6.7.4 Specialty Store

10.6.7.5 Convenience Store

10.6.7.6 Retailers

10.6.7.7 Online Store

10.6.7.8 Others

10.6.8 Historic and Forecasted Market Size by Flavors

10.6.8.1 Butterscotch

10.6.8.2 Caramel

10.6.8.3 Blueberry

10.6.8.4 Strawberry

10.6.8.5 Banana

10.6.8.6 Coffee

10.6.8.7 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Sugar-free Hard Candies Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Hard Candy

10.7.4.2 Chewy Candy

10.7.4.3 Gummies

10.7.4.4 Lollipops

10.7.4.5 Chewing Gums

10.7.5 Historic and Forecasted Market Size by Sweetening Agent

10.7.5.1 Stevia

10.7.5.2 Isomalt

10.7.5.3 Sorbitol

10.7.5.4 Maltitol

10.7.5.5 Xylitol

10.7.5.6 Polydextrose

10.7.5.7 Others

10.7.6 Historic and Forecasted Market Size by Functionality

10.7.6.1 Texture

10.7.6.2 Stability

10.7.6.3 Moisture Retention

10.7.7 Historic and Forecasted Market Size by Distribution Channel

10.7.7.1 B2B

10.7.7.2 B2C

10.7.7.3 Hypermarket/Supermarket

10.7.7.4 Specialty Store

10.7.7.5 Convenience Store

10.7.7.6 Retailers

10.7.7.7 Online Store

10.7.7.8 Others

10.7.8 Historic and Forecasted Market Size by Flavors

10.7.8.1 Butterscotch

10.7.8.2 Caramel

10.7.8.3 Blueberry

10.7.8.4 Strawberry

10.7.8.5 Banana

10.7.8.6 Coffee

10.7.8.7 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Sugar-free Hard Candies Market research report?

A1: The forecast period in the Market research report is 2024-2032.

Q2: Who are the key players in the Sugar-free Hard Candies Market?

A2: THE HERSHEY COMPANY (U.S.), Asher’s Chocolate Co. (U.S.), Hyet Sweet B.V. (Netherlands), Dr. John's Healthy Sweets LLC (U.S.), LILY'S SWEETS (U.S.), ROY Chocolatier (France), Russell Stover Chocolates, LLC (U.S.), Koochikoo Lollipops (U.S.), Sugarless Confectionery (U.S.), and Barnett (U.S.) and among others

Q3: What are the segmentThe Sugar-free Hard Candies Market is segmented into By Type, By Sweetening Agent, By Functionality, By Distribution Channel, By Flavors and region.By Type, the market is categorized into Hard Candy, Chewy Candy, Gummies, Lollipops, and Chewing Gums. By Sweetening Agent, the market is categorized into Stevia, Isomalt, Sorbitol, Maltitol, Xylitol, Polydextrose and Others. By Functionality, the market is categorized into Texture, Stability, and Moisture Retention. By Flavors, the market is categorized into Butterscotch, Caramel, Blueberry, Strawberry, Banana, Coffee, and Others. By Distribution Channel , the market is categorized into B2B and B2C.By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).s of the Sugar-free Hard Candies Market?

A3: The Sugar-free Hard Candies Market is segmented into By Type, By Sweetening Agent, By Functionality, By Distribution Channel, By Flavors and region.By Type, the market is categorized into Hard Candy, Chewy Candy, Gummies, Lollipops, and Chewing Gums. By Sweetening Agent, the market is categorized into Stevia, Isomalt, Sorbitol, Maltitol, Xylitol, Polydextrose and Others. By Functionality, the market is categorized into Texture, Stability, and Moisture Retention. By Flavors, the market is categorized into Butterscotch, Caramel, Blueberry, Strawberry, Banana, Coffee, and Others. By Distribution Channel , the market is categorized into B2B and B2C.By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Sugar-free Hard Candies Market?

A4: Sugar substituted hard candies are products similar to normal hard candies, intended to have the same taste and texture, but contain no sugar. But rather these candies contain non-caloric sweeteners like sugar alcohols, artificial sweeteners or for natural sweeteners.

Q5: How big is the Sugar-free Hard Candies Market?

A5: Sugar-free Hard Candies Market Size Was Valued at USD 1.33 Billion in 2023, and is Projected to Reach USD 1.81 Billion by 2032, Growing at a CAGR of 3.50% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!