Stay Ahead in Fast-Growing Economies.

Browse Reports NowSharps Containers Market – Current Analysis by Market Share

Sharps containers are specially designed receptacles used in healthcare settings to safely dispose of needles, syringes, and other sharp objects that may pose a risk of injury or infection if not properly contained.

IMR Group

Description

Sharps Containers Market Synopsis

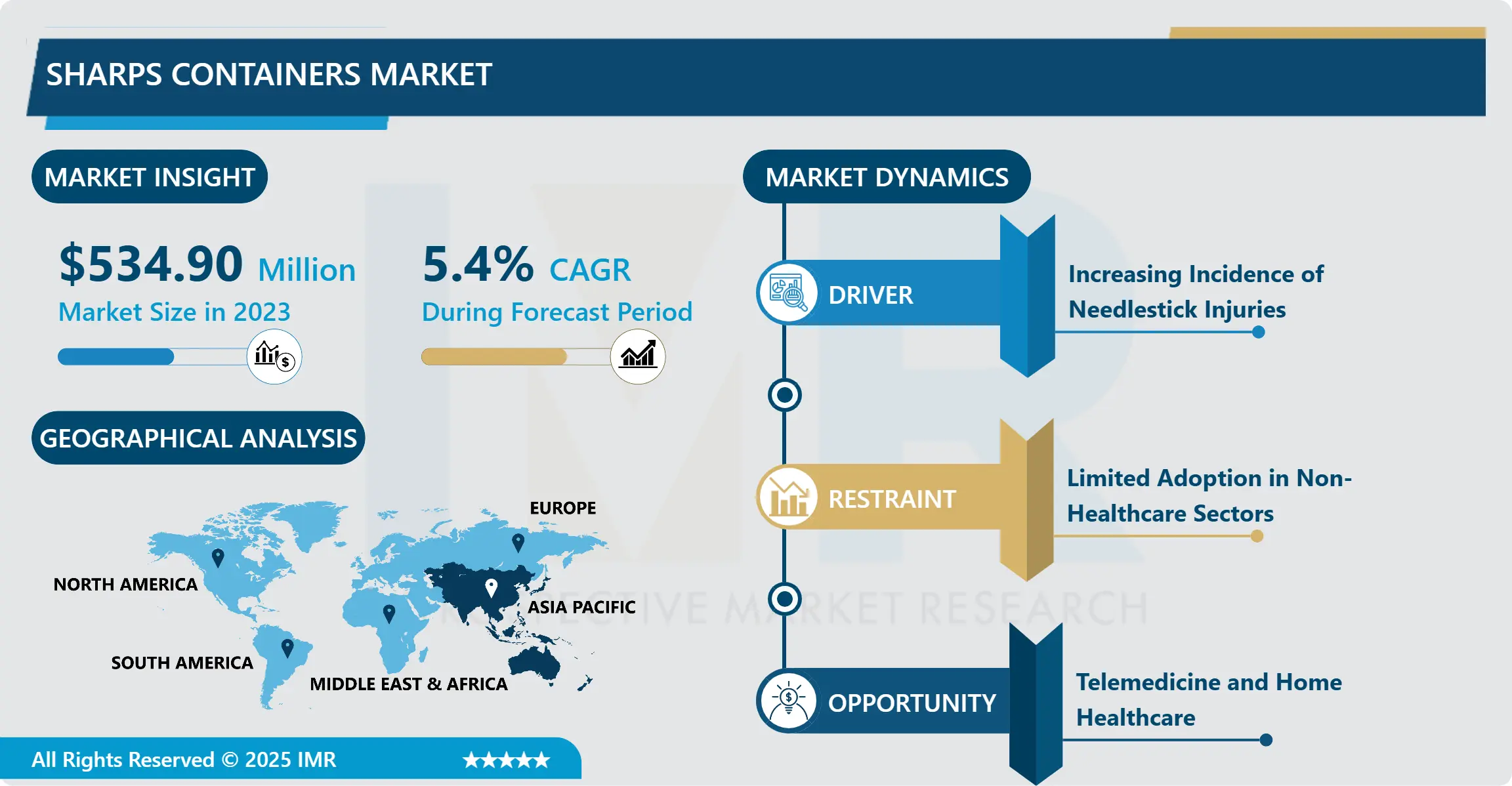

Sharps containers Market Size Was Valued at USD 534.90 Million in 2023, and is Projected to Reach USD 858.69 Million by 2032, Growing at a CAGR of 5.4% From 2024-2032.

Sharps containers are specially designed receptacles used in healthcare settings to safely dispose of needles, syringes, and other sharp objects that may pose a risk of injury or infection if not properly contained. These containers are constructed with puncture-resistant materials to prevent accidental needle sticks and leakage of potentially hazardous materials. They play a critical role in infection control and occupational safety by providing a secure and convenient method for healthcare professionals to discard used sharps, thereby reducing the risk of transmission of bloodborne pathogens such as HIV, hepatitis B, and hepatitis C. The global sharps containers market encompasses a variety of sizes, designs, and disposal mechanisms to accommodate the diverse needs of healthcare facilities and ensure compliance with regulatory standards for safe sharps management.

The market for sharps containers is expanding rapidly worldwide due to strict laws governing healthcare waste management and growing awareness of the need to dispose of medical waste safely. Sharps containers are becoming more and more popular in healthcare facilities all around the world. They are made expressly to dispose of needles, syringes, and other sharp medical devices safely.

The requirement for appropriate disposal solutions is critical to preventing unintentional needlestick injuries and the spread of infections given the rising prevalence of chronic conditions like diabetes and cancer that require frequent injections.

In addition, the development of needlestick prevention initiatives and the enlargement of healthcare infrastructure in developing nations also support market expansion. To improve safety and sustainability, major competitors in the sharps container market are concentrating on product developments such reusable choices and tamper-proof containers.

Furthermore, firms are increasingly forming strategic alliances and collaborations to bolster their market share and diversify their product lines. Sharps containers will continue to be in high demand in the upcoming years as long as healthcare facilities prioritize the safety of their patients and employees.

Sharps Containers Market Trend Analysis

The Growing Demand for Safety-Engineered Sharps Devices (SESDs) and Compatible Sharps Containers

The increasing use of safety-engineered sharps devices, or SESDs, is a significant change in healthcare procedures, demonstrating a determined attempt to put healthcare workers’ safety and wellbeing first. These cutting-edge tools, which range from needleless systems to retractable needles, are designed to lower the possibility of bloodborne pathogen exposure and needlestick injuries. The need for SESDs has skyrocketed as healthcare facilities realize how critical it is to protect their employees from workplace dangers.

The increasing use of SESDs has led to a commensurate demand for sharps containers made especially to hold these cutting-edge safety devices. The newest generation of sharps containers has characteristics designed specifically to meet the needs of SESDs, in contrast to conventional containers, which might not be able to enable the safe disposal of these devices. These containers provide healthcare establishments with a comprehensive solution for the safe containment and disposal of medical sharps. Features include enhanced durability and specific holes that handle various types of SESDs.

Furthermore, the benefits of using SESDs in conjunction with appropriate sharps containers go beyond simple practicality; they also support a safety-conscious culture in healthcare environments. Healthcare facilities show their dedication to putting employee well-being first and reducing the chances of injuries from sharp objects by making investments in both cutting-edge safety equipment and specially designed containers. This comprehensive strategy positions SESDs and compatible sharps containers as essential parts of contemporary healthcare procedures, improving workplace safety while also promoting overall operational efficiency and regulatory compliance.

Expanding Healthcare Infrastructure and Rising Demand

The growth of the healthcare industry in emerging economies is representative of a larger movement toward increased infrastructure development and better access to healthcare services. To satisfy the expanding healthcare demands of their populations, these economies are seeing a boom in the construction of hospitals, clinics, and diagnostic facilities in tandem with demographic changes, urbanization, and rising wages. Sharps container demand is fueled by the need for a strong framework for handling medical waste, which includes the safe disposal of sharps, as a result of the expanding healthcare infrastructure.

Furthermore, the significance of safe medical waste management techniques is highlighted by the rising incidence of chronic diseases and the increased focus on preventative healthcare measures. As early diagnosis, routine immunizations, and medical interventions become more important, healthcare institutions are producing more garbage that contains sharp objects. Therefore, in order to guarantee the safe containment and disposal of medical sharps, thereby reducing the danger of injuries and the spread of infectious illnesses, there is an urgent need for trustworthy and effective sharps containers.

Furthermore, the demand for healthcare services at all societal levels is rising as a result of the shift towards universal healthcare coverage in many emerging nations. The goal of this inclusive approach to healthcare is to give underprivileged communities access to basic medical treatment, which will encourage the construction of additional healthcare facilities in areas that were previously underserved. As a result, the market for sharps containers is expected to rise steadily in emerging nations due to the expansion of healthcare facilities and legislative requirements that emphasize the safe disposal of medical waste.

Sharps Containers Market Segment Analysis:

Sharps Containers Market Segmented based on into By Product Type, By Waste Generators, By Usage, By Waste Type and By Size.

By Waste Generators, Hospitals segment is expected to dominate the market during the forecast period

When it comes to multipurpose containers for medical waste management, hospitals are unquestionably the market leader and the cornerstone of this industry. They are the main consumers and adopters of these adaptable waste management solutions due to a variety of variables that contribute to their importance.

First and foremost, hospitals produce a significant amount of medical waste every day due to their size and range of healthcare services. Every department in a hospital adds to this waste stream, from the operating room to the patient ward, hence a strong and flexible waste management infrastructure is required. As a result of this need, multifunctional containers become essential equipment that can handle a wide range of waste materials, such as medications, sharps, and infectious materials. These containers’ adaptability fits in perfectly with the various requirements of healthcare environments, where various departments could generate various waste kinds that need for particular care.

Furthermore, the dynamic nature of hospital settings—which are marked by fast turnover rates and round-the-clock patient care—highlights the significance of effective waste disposal systems. A subset of multifunctional containers known as patient room containers is essential to satisfying these needs since it makes waste disposal in patient care settings quick and sanitary. The fact that these containers are so commonplace in emergency rooms, intensive care units, and outpatient clinics underscores how important it is to keep them clean, manage infections, and ensure patient safety.

Hospitals prioritize regulatory compliance and strict adherence to safety standards above all other operational concerns. Hospitals give top priority to the selection of waste management systems that not only exceed regulatory standards but also improve worker safety, given the inherent risks involved with medical waste, ranging from biohazard contamination to injuries related to sharps. With features like secure closure mechanisms and materials resistant to punctures, multipurpose containers offer hospitals the certainty of compliance while reducing the risk of medical waste being disposed of illegally.

Moreover, the prevalence of hospitals in the domain of multifunctional containers signifies a wider dedication to ecological responsibility and sustainability. Hospitals, being important players in the healthcare industry, understand how important it is to reduce their environmental impact and implement eco-friendly measures whenever possible. The disposal of medical waste has inherent environmental issues. However, the proactive use of multipurpose containers, especially those intended for reuse uses, can help reduce waste generation and promote resource efficiency.

Essentially, hospitals’ market dominance in multipurpose containers for medical waste management is evidence of their critical roles as public health stewards and suppliers of healthcare. Hospitals set the bar for best practices in the handling and disposal of medical waste by their unwavering pursuit of efficiency, safety, and compliance. This drives demand for these crucial waste management solutions.

By Usage, Reusable Containers segment held the largest share in 2023

Single-use containers dominate the market when it comes to their application in medical waste management, accounting for the majority of sales. Their dominance can be ascribed to a number of variables that make them the go-to option for many healthcare facilities across the globe.

The ease of single-use containers is by far their greatest benefit. Single-use containers are particularly useful in healthcare settings with high patient turnover rates and strict hygiene regulations because they simplify waste disposal procedures, save downtime, and maximize workflow efficiency. Without the need for drawn-out cleaning or sterilizing processes, healthcare providers may quickly dispose of medical waste, guaranteeing smooth operations and upholding the highest standards of hygiene throughout their facilities.

Additionally, single-use containers provide built-in advantages for infection control that are highly valued by facility managers and medical experts alike. These waste containment containers assist reduce the risk of cross-contamination and infectious disease transmission in healthcare environments by offering a closed, tamper-evident waste containment system. Since preventing infections proactively is in line with the main objective of protecting the health of patients and staff, single-use containers are an essential part of complete infection control plans.

Moreover, the extensive use of single-use containers is especially noticeable in healthcare settings like clinics, hospitals, and outpatient centers that have strict hygienic standards and significant patient turnover. The tremendous amount of medical waste produced in these environments on a daily basis calls for effective, disposable solutions that can keep up with the incessant demands of patient care. Single-use containers offer a workable solution to this problem by giving a quick and hygienic way to dispose of garbage that reduces the chance of contamination and guarantees adherence to legal requirements.

Reusable containers provide definite financial and environmental advantages over time, but practical issues—most notably the requirement for thorough cleaning and sterilizing procedures—may prevent their widespread use. The logistical challenges connected with reusable containers may prevent healthcare facilities from fully embracing them as viable alternatives to single-use counterparts in contexts where operational restrictions and time-sensitive needs take precedence.

Sharps Containers Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The Asia Pacific region is experiencing a remarkable surge in urbanization, accompanied by a corresponding increase in healthcare expenditure. This phenomenon is particularly pronounced in countries like China, Japan, and India, where burgeoning populations and economic development are driving substantial investments in healthcare infrastructure. As healthcare facilities expand to meet the growing demand for services, there’s a parallel emphasis on enhancing infection control measures to ensure the safety of patients and healthcare workers alike. One critical component of this effort is the widespread adoption of sharps containers, which play a pivotal role in safe disposal practices for medical sharps, such as needles and syringes.

In China, Japan, and India, the rapid urbanization and modernization processes are accompanied by a growing awareness of the importance of proper medical waste management. With healthcare systems evolving to address the needs of expanding populations, there’s a heightened focus on preventing the spread of infections and diseases. As a result, healthcare facilities are increasingly prioritizing the use of sharps containers to safely collect and dispose of medical sharps, reducing the risk of needlestick injuries and potential exposure to bloodborne pathogens. This trend is driving significant growth in the market for sharps containers across the Asia Pacific region, reflecting the region’s commitment to advancing healthcare standards and ensuring the well-being of both patients and healthcare professionals.

Active Key Players in the Sharps Containers Market

Sharps Compliance, Inc.

EnviroTain, LLC.

Bondtech Corporation

MAUSER Group

Daniels Healthcare Group

Henry Schein, Inc.

Thermo Fisher Scientific Inc.

Stericycle

GPC Medical

Other Key Players

Key Industry Developments in the Sharps Containers Market:

In August 2023, Stericycle, Inc. introduced its redesigned one-gallon SafeDrop Sharps Mail Back and one-gallon CsRx Controlled Substance Wastage containers. Stericycle’s SafeDrop Sharps Mail Back containers offer a convenient solution for healthcare providers to safely manage sharps waste. This product launch is expected to strengthen the company’s sharps containers product portfolio and drive increased business revenue.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sharps Containers Market by Product Type (2018-2032)

4.1 Sharps Containers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Multipurpose Containers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Patient Room Containers

4.5 Phlebotomy Containers

Chapter 5: Sharps Containers Market by Waste Generators (2018-2032)

5.1 Sharps Containers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Other Healthcare Providers

5.5 Pharmacies

5.6 Academic & Research Institutes

5.7 Pharmaceutical Companies

5.8 Others

Chapter 6: Sharps Containers Market by Usage (2018-2032)

6.1 Sharps Containers Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Reusable Containers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Single Use Containers

Chapter 7: Sharps Containers Market by Waste Type (2018-2032)

7.1 Sharps Containers Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Sharps Waste

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Infectious Waste

7.5 Non-infectious Waste

7.6 Pharmaceutical Waste

Chapter 8: Sharps Containers Market by Size (2018-2032)

8.1 Sharps Containers Market Snapshot and Growth Engine

8.2 Market Overview

8.3 1–2 Gallons

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 2–4 Gallons

8.5 4–8 Gallons

8.6 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Sharps Containers Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 SHARPS COMPLIANCE INC.

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 ENVIROTAIN

9.4 LLCBONDTECH CORPORATION

9.5 MAUSER GROUP

9.6 DANIELS HEALTHCARE GROUP

9.7 HENRY SCHEIN INCTHERMO FISHER SCIENTIFIC INCSTERICYCLE

9.8 GPC MEDICAL

9.9 OTHER KEY PLAYERS

Chapter 10: Global Sharps Containers Market By Region

10.1 Overview

10.2. North America Sharps Containers Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Product Type

10.2.4.1 Multipurpose Containers

10.2.4.2 Patient Room Containers

10.2.4.3 Phlebotomy Containers

10.2.5 Historic and Forecasted Market Size by Waste Generators

10.2.5.1 Hospitals

10.2.5.2 Other Healthcare Providers

10.2.5.3 Pharmacies

10.2.5.4 Academic & Research Institutes

10.2.5.5 Pharmaceutical Companies

10.2.5.6 Others

10.2.6 Historic and Forecasted Market Size by Usage

10.2.6.1 Reusable Containers

10.2.6.2 Single Use Containers

10.2.7 Historic and Forecasted Market Size by Waste Type

10.2.7.1 Sharps Waste

10.2.7.2 Infectious Waste

10.2.7.3 Non-infectious Waste

10.2.7.4 Pharmaceutical Waste

10.2.8 Historic and Forecasted Market Size by Size

10.2.8.1 1–2 Gallons

10.2.8.2 2–4 Gallons

10.2.8.3 4–8 Gallons

10.2.8.4 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Sharps Containers Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Product Type

10.3.4.1 Multipurpose Containers

10.3.4.2 Patient Room Containers

10.3.4.3 Phlebotomy Containers

10.3.5 Historic and Forecasted Market Size by Waste Generators

10.3.5.1 Hospitals

10.3.5.2 Other Healthcare Providers

10.3.5.3 Pharmacies

10.3.5.4 Academic & Research Institutes

10.3.5.5 Pharmaceutical Companies

10.3.5.6 Others

10.3.6 Historic and Forecasted Market Size by Usage

10.3.6.1 Reusable Containers

10.3.6.2 Single Use Containers

10.3.7 Historic and Forecasted Market Size by Waste Type

10.3.7.1 Sharps Waste

10.3.7.2 Infectious Waste

10.3.7.3 Non-infectious Waste

10.3.7.4 Pharmaceutical Waste

10.3.8 Historic and Forecasted Market Size by Size

10.3.8.1 1–2 Gallons

10.3.8.2 2–4 Gallons

10.3.8.3 4–8 Gallons

10.3.8.4 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Sharps Containers Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Product Type

10.4.4.1 Multipurpose Containers

10.4.4.2 Patient Room Containers

10.4.4.3 Phlebotomy Containers

10.4.5 Historic and Forecasted Market Size by Waste Generators

10.4.5.1 Hospitals

10.4.5.2 Other Healthcare Providers

10.4.5.3 Pharmacies

10.4.5.4 Academic & Research Institutes

10.4.5.5 Pharmaceutical Companies

10.4.5.6 Others

10.4.6 Historic and Forecasted Market Size by Usage

10.4.6.1 Reusable Containers

10.4.6.2 Single Use Containers

10.4.7 Historic and Forecasted Market Size by Waste Type

10.4.7.1 Sharps Waste

10.4.7.2 Infectious Waste

10.4.7.3 Non-infectious Waste

10.4.7.4 Pharmaceutical Waste

10.4.8 Historic and Forecasted Market Size by Size

10.4.8.1 1–2 Gallons

10.4.8.2 2–4 Gallons

10.4.8.3 4–8 Gallons

10.4.8.4 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Sharps Containers Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Product Type

10.5.4.1 Multipurpose Containers

10.5.4.2 Patient Room Containers

10.5.4.3 Phlebotomy Containers

10.5.5 Historic and Forecasted Market Size by Waste Generators

10.5.5.1 Hospitals

10.5.5.2 Other Healthcare Providers

10.5.5.3 Pharmacies

10.5.5.4 Academic & Research Institutes

10.5.5.5 Pharmaceutical Companies

10.5.5.6 Others

10.5.6 Historic and Forecasted Market Size by Usage

10.5.6.1 Reusable Containers

10.5.6.2 Single Use Containers

10.5.7 Historic and Forecasted Market Size by Waste Type

10.5.7.1 Sharps Waste

10.5.7.2 Infectious Waste

10.5.7.3 Non-infectious Waste

10.5.7.4 Pharmaceutical Waste

10.5.8 Historic and Forecasted Market Size by Size

10.5.8.1 1–2 Gallons

10.5.8.2 2–4 Gallons

10.5.8.3 4–8 Gallons

10.5.8.4 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Sharps Containers Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Product Type

10.6.4.1 Multipurpose Containers

10.6.4.2 Patient Room Containers

10.6.4.3 Phlebotomy Containers

10.6.5 Historic and Forecasted Market Size by Waste Generators

10.6.5.1 Hospitals

10.6.5.2 Other Healthcare Providers

10.6.5.3 Pharmacies

10.6.5.4 Academic & Research Institutes

10.6.5.5 Pharmaceutical Companies

10.6.5.6 Others

10.6.6 Historic and Forecasted Market Size by Usage

10.6.6.1 Reusable Containers

10.6.6.2 Single Use Containers

10.6.7 Historic and Forecasted Market Size by Waste Type

10.6.7.1 Sharps Waste

10.6.7.2 Infectious Waste

10.6.7.3 Non-infectious Waste

10.6.7.4 Pharmaceutical Waste

10.6.8 Historic and Forecasted Market Size by Size

10.6.8.1 1–2 Gallons

10.6.8.2 2–4 Gallons

10.6.8.3 4–8 Gallons

10.6.8.4 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Sharps Containers Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Product Type

10.7.4.1 Multipurpose Containers

10.7.4.2 Patient Room Containers

10.7.4.3 Phlebotomy Containers

10.7.5 Historic and Forecasted Market Size by Waste Generators

10.7.5.1 Hospitals

10.7.5.2 Other Healthcare Providers

10.7.5.3 Pharmacies

10.7.5.4 Academic & Research Institutes

10.7.5.5 Pharmaceutical Companies

10.7.5.6 Others

10.7.6 Historic and Forecasted Market Size by Usage

10.7.6.1 Reusable Containers

10.7.6.2 Single Use Containers

10.7.7 Historic and Forecasted Market Size by Waste Type

10.7.7.1 Sharps Waste

10.7.7.2 Infectious Waste

10.7.7.3 Non-infectious Waste

10.7.7.4 Pharmaceutical Waste

10.7.8 Historic and Forecasted Market Size by Size

10.7.8.1 1–2 Gallons

10.7.8.2 2–4 Gallons

10.7.8.3 4–8 Gallons

10.7.8.4 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Sharps Containers Market research report?

A1: The forecast period in the Sharps Containers Market research report is 2024-2032.

Q2: Who are the key players in the Sharps Containers Market?

A2: Sharps Compliance, Inc., EnviroTain, LLC., Bondtech Corporation, MAUSER Group, Daniels Healthcare Group, Henry Schein, Inc., Thermo Fisher Scientific Inc., Stericycle, GPC Medical, and Other Major Players.

Q3: What are the segments of the Sharps Containers Market?

A3: When it comes to multipurpose containers for medical waste management, hospitals are unquestionably the market leader and the cornerstone of this industry. They are the main consumers and adopters of these adaptable waste management solutions due to a variety of variables that contribute to their importance. Single-use containers dominate the market when it comes to their application in medical waste management, accounting for the majority of sales. Their dominance can be ascribed to a number of variables that make them the go-to option for many healthcare facilities across the globe.

Q4: What is the Sharps Containers Market?

A4: Sharps containers are specially designed receptacles used in healthcare settings to safely dispose of needles, syringes, and other sharp objects that may pose a risk of injury or infection if not properly contained. These containers are constructed with puncture-resistant materials to prevent accidental needle sticks and leakage of potentially hazardous materials. They play a critical role in infection control and occupational safety by providing a secure and convenient method for healthcare professionals to discard used sharps, thereby reducing the risk of transmission of bloodborne pathogens such as HIV, hepatitis B, and hepatitis C. The global sharps containers market encompasses a variety of sizes, designs, and disposal mechanisms to accommodate the diverse needs of healthcare facilities and ensure compliance with regulatory standards for safe sharps management.

Q5: How big is the Sharps Containers Market?

A5: Sharps containers Market Size Was Valued at USD 534.90 Million in 2023, and is Projected to Reach USD 858.69 Million by 2032, Growing at a CAGR of 5.4% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!