Stay Ahead in Fast-Growing Economies.

Browse Reports NowSatellite Ground Station Market Size, Share, Growth & Forecast (2024-2032)

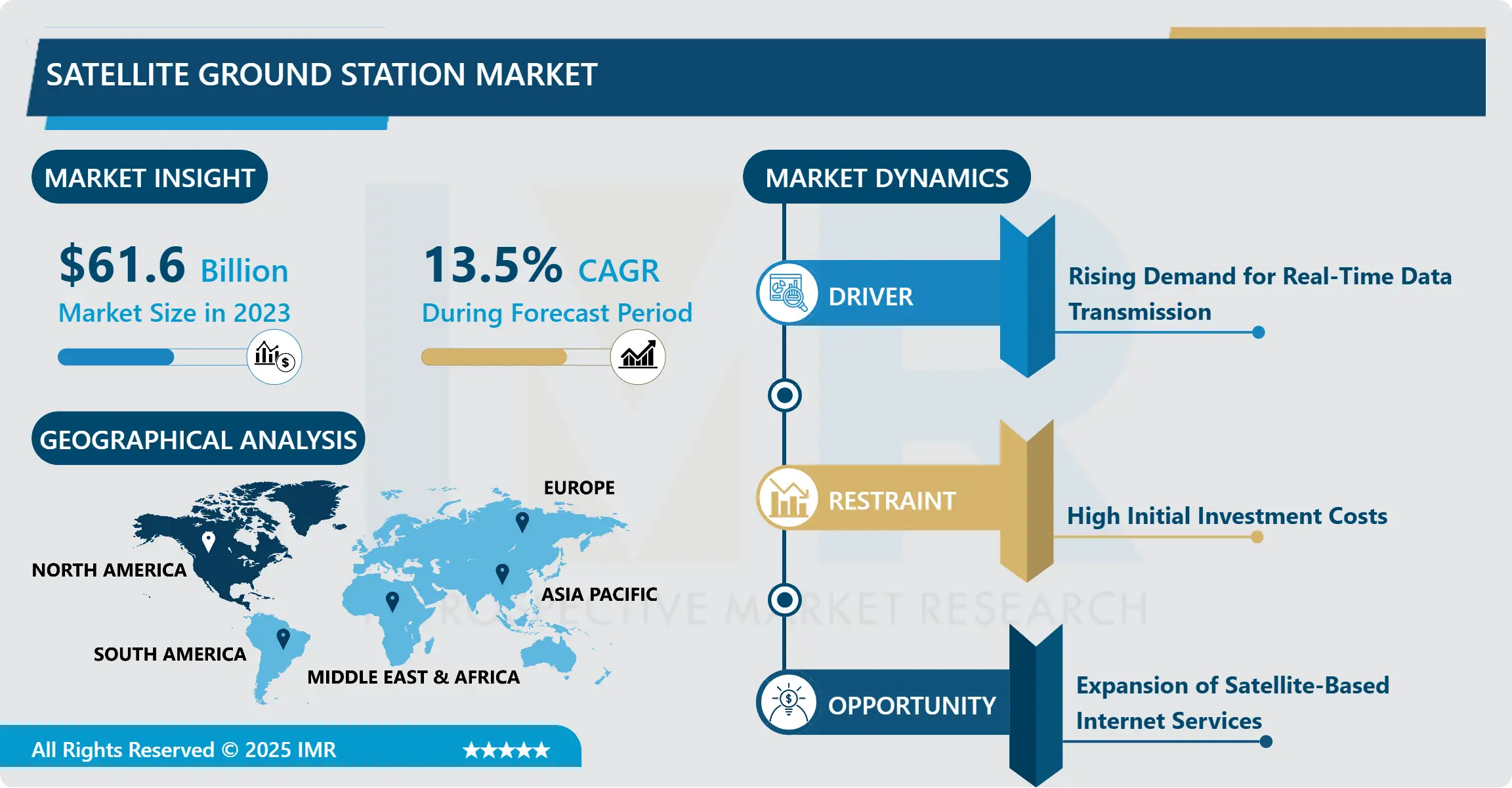

Satellite Ground Station Market Size Was Valued at USD 61.6 Billion in 2023, and is Projected to Reach USD 192.55 Billion by 2032, Growing at a CAGR of 13.5 % From 2024-2032.

IMR Group

Description

Satellite Ground Station Market Synopsis:

Satellite Ground Station Market Size Was Valued at USD 61.6 Billion in 2023, and is Projected to Reach USD 192.55 Billion by 2032, Growing at a CAGR of 13.5 % From 2024-2032.

Satellite Ground Station Market involves equipments and facility, which has mostly the responsibilities of receiving and transmitting the signals from satellite, processing as well as analyzing the signals gathered from satellite. These ground stations are well maintained to provide interfaces between satellites and the customers or public for communication, navigation, broadcasting, and data transfer uses in defense, agriculture, energy, and telecom areas. The equipments of this market encompass several of them as the antennas, NOCs, power units and VSAT terminals to allow the communication with other satellites that are already present in orbit.

Some forces that are driving the Satellite Ground Station Market consists of an increasing utilization of satellite navigation, communication, earth observation and remote sensing. The enhanced use of satellite technology for near real-time data and information, communication in the off-shaking areas and in calamities and other disasters, contributes a healthy demand for ground station equipment globally. Furthermore, the introduction of LEO satellites which have very high dependency on many ground stations has put the pressure of having sophisticated system in terms of frequency and data handling infrastructure.

It will also be affected by technology uptake particularly concerning data processing using AI and ML on efficiency in the stock market. There has been a increase in the number of satellites either owned by governments and private firms hence ground stations are gradually transforming in way that will be able to cope with traffic to prevent disruption to satellite communication. The fact that such a market environment is dynamic emphasizes its role in the world connectivity as well as the basic sectors such as defense and agriculture.

Satellite Ground Station Market Trend Analysis:

Integration of AI in Satellite Ground Station Operations

One can notice that the application of artificial intelligence (AI) in satellite ground station control is an example of the emerging trend. AI techs are enhancing data handling since ground stations are gaining enhanced means to control and handle the SatComs. Machine learning is capable of predicting signal interferences for them to occur, manage or allocate bandwidth and also make decisions on the spot. These improvements are required because Broad League Satellite networks become more populated with new systems grounded in Low earth orbit constellations. Besides, the use of AI auto-controlled communicational modality reduces the cost of functionality and the input of human error in managing large traffic of data transfer. It is this shift that will most assuredly repristinate satellite ground stations as smaller, faster and nimbler and better prepared for what is to come in the ecosystems they undergird.

Expanding Demand for Remote Connectivity Solutions

One such market driver influencing the progression of the Satellite Ground Station Market is the rather rapidly expanding need for every business and person for some type of remote access solution. Some of the application which require satellite include; rual broadband, remote healthcare and emergency communication, hence satellite has become critical in the act of connecting the digital divide. It is a noteworthy revelation that the ground stations that have incorporated compatible integrities like 5G network, cloud structures, and IoT connectors provide communication possibilities in the geographically unserved regions. Furthermore, customer demand of government activities to improve communication networks in the rural and disaster-prone areas has lead to development of energy related ground station. The above conditions facilitate good market development meaning that there are good opportunities for both traditional players and new entrant.

Satellite Ground Station Market Segment Analysis:

Satellite Ground Station Market is Segmented on the basis of Equipment, Application, End User, and Region.

By Equipment, Consumer Equipment segment is expected to dominate the market during the forecast period

Consumer Equipment is expected to remain the largest satelliite ground station market through the forecast period due to integrating light weighted and portable satellite communication equipment. For this segment some of the products consist in Antennas, VSAT & Mobile Satellite Terminals, Personal Satellite Communication Instruments. Maritime, aviation and personal communication equipment used by customers ensure improvised connection and portability of such instruments. The use has also been made easier and cheaper by the advancement in satellite technology; the consumer grade satellite equipment is good for use in various applications. The popular usage of affordable satellite Internet services and GPS has also helped the entrenchment of this segment.

By Application, Navigation segment expected to held the largest share

Navigation segment is recognized to have the largest market share in the Satellite Ground Station Market due to the significance of the satellite navigation systems in a range of arenas such as transport, farming, and defence. Some systems like the Global Position System (GPS) employs ground stations in issues of accuracy, reliability and current informational feedback. The rational employed on the increasing adoption of self-driving cars for self-transportation and drones and Internet of Things for smart farming and efficient transport also contributed on the utilization of navigation techniques. Since satellite navigation has become indispensable to efficiency and management of risks it plays in various industries, this segment is expected to grow.

Satellite Ground Station Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The global Satellite Ground Station Market has been marked as experiencing the maximum maturity in the North America region throughout the period under consideration. This has favored the leadership of the region with the vital satellite, relevant market participants and most importantly, the robust government involvement in the satellite. The US especially leads this regime owning to number of satellite programs it possesses in defence, communication and space research. NASA, as a governmental organization, in collaboration with other federal bodies, and SpaceX, as a private company, has laid down the foundation for the development of new satellite for the region.

And something like satellites in the vehicle was already present in the segments like agricultural transportation and response in North America which is fueling this growth for the global market. The region continues to support enhanced access in unserved premises and consistently emphasizes the need for using newer technologies like AI and 5G. The high detection for satellite communication and facility ground station services in North America make it the leading distribution of Satellite Ground Station Market.

Active Key Players in the Satellite Ground Station Market

Airbus (France)

Comtech Telecommunications Corp. (United States)

EchoStar Corporation (United States)

Gilat Satellite Networks (Israel)

Hughes Network Systems (United States)

Inmarsat (United Kingdom)

Intelsat (United States)

Kratos Defense & Security Solutions (United States)

SES S.A. (Luxembourg)

SpaceX (United States)

Telesat (Canada)

Thales Group (France)

Viasat, Inc. (United States)

Work Microwave (Germany)

Zodiac Aerospace (France)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Satellite Ground Station Market by Frequency Band

4.1 Satellite Ground Station Market Snapshot and Growth Engine

4.2 Satellite Ground Station Market Overview

4.3 L-band C-band K-band X-band

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 L-band C-band K-band X-band: Geographic Segmentation Analysis

Chapter 5: Satellite Ground Station Market by Internet Industry

5.1 Satellite Ground Station Market Snapshot and Growth Engine

5.2 Satellite Ground Station Market Overview

5.3 Energy & Utility Government and Public Sector Transport & CargoMaritimeMilitaryCorporates/Enterprises Media & Broadcasting Others

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Energy & Utility Government and Public Sector Transport & CargoMaritimeMilitaryCorporates/Enterprises Media & Broadcasting Others: Geographic Segmentation Analysis

Chapter 6: Satellite Ground Station Market by End User

6.1 Satellite Ground Station Market Snapshot and Growth Engine

6.2 Satellite Ground Station Market Overview

6.3 Commercial/Enterprise Users Banking

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Commercial/Enterprise Users Banking: Geographic Segmentation Analysis

6.4 Government

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Government: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Satellite Ground Station Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AIRBUS (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 COMTECH TELECOMMUNICATIONS CORP. (UNITED STATES)

7.4 ECHOSTAR CORPORATION (UNITED STATES)

7.5 GILAT SATELLITE NETWORKS (ISRAEL)

7.6 HUGHES NETWORK SYSTEMS (UNITED STATES)

7.7 INMARSAT (UNITED KINGDOM)

7.8 INTELSAT (UNITED STATES)

7.9 KRATOS DEFENSE & SECURITY SOLUTIONS (UNITED STATES)

7.10 SES S.A. (LUXEMBOURG)

7.11 SPACEX (UNITED STATES)

7.12 THALES GROUP (FRANCE)

7.13 TELESAT (CANADA).

7.14 VIASAT INC. (UNITED STATES)

7.15 WORK MICROWAVE (GERMANY)

7.16 ZODIAC AEROSPACE (FRANCE)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Satellite Ground Station Market By Region

8.1 Overview

8.2. North America Satellite Ground Station Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Frequency Band

8.2.4.1 L-band C-band K-band X-band

8.2.5 Historic and Forecasted Market Size By Internet Industry

8.2.5.1 Energy & Utility Government and Public Sector Transport & CargoMaritimeMilitaryCorporates/Enterprises Media & Broadcasting Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Commercial/Enterprise Users Banking

8.2.6.2 Government

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Satellite Ground Station Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Frequency Band

8.3.4.1 L-band C-band K-band X-band

8.3.5 Historic and Forecasted Market Size By Internet Industry

8.3.5.1 Energy & Utility Government and Public Sector Transport & CargoMaritimeMilitaryCorporates/Enterprises Media & Broadcasting Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Commercial/Enterprise Users Banking

8.3.6.2 Government

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Satellite Ground Station Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Frequency Band

8.4.4.1 L-band C-band K-band X-band

8.4.5 Historic and Forecasted Market Size By Internet Industry

8.4.5.1 Energy & Utility Government and Public Sector Transport & CargoMaritimeMilitaryCorporates/Enterprises Media & Broadcasting Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Commercial/Enterprise Users Banking

8.4.6.2 Government

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Satellite Ground Station Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Frequency Band

8.5.4.1 L-band C-band K-band X-band

8.5.5 Historic and Forecasted Market Size By Internet Industry

8.5.5.1 Energy & Utility Government and Public Sector Transport & CargoMaritimeMilitaryCorporates/Enterprises Media & Broadcasting Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Commercial/Enterprise Users Banking

8.5.6.2 Government

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Satellite Ground Station Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Frequency Band

8.6.4.1 L-band C-band K-band X-band

8.6.5 Historic and Forecasted Market Size By Internet Industry

8.6.5.1 Energy & Utility Government and Public Sector Transport & CargoMaritimeMilitaryCorporates/Enterprises Media & Broadcasting Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Commercial/Enterprise Users Banking

8.6.6.2 Government

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Satellite Ground Station Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Frequency Band

8.7.4.1 L-band C-band K-band X-band

8.7.5 Historic and Forecasted Market Size By Internet Industry

8.7.5.1 Energy & Utility Government and Public Sector Transport & CargoMaritimeMilitaryCorporates/Enterprises Media & Broadcasting Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Commercial/Enterprise Users Banking

8.7.6.2 Government

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Satellite Ground Station Market research report?

A1: The forecast period in the Satellite Ground Station Market research report is 2024-2032.

Q2: Who are the key players in the Satellite Ground Station Market?

A2: Airbus (France), Comtech Telecommunications Corp. (United States), EchoStar Corporation (United States), Gilat Satellite Networks (Israel), Hughes Network Systems (United States), Inmarsat (United Kingdom), Intelsat (United States), Kratos Defense & Security Solutions (United States), SES S.A. (Luxembourg), SpaceX (United States), Telesat (Canada), Thales Group (France), Viasat, Inc. (United States), Work Microwave (Germany), Zodiac Aerospace (France), Other Active Players.

Q3: What are the segments of the Satellite Ground Station Market?

A3: The Satellite Ground Station Market is segmented into Equipment, Application, End User and region. By Equipment, the market is categorized into Consumer Equipment Satellite Navigation Equipment Dish Antenna Satellite Radio Broadband Equipment Mobile Satellite Terminals Network Equipment Network Operation Centre (NOCs) Equipment VSAT Equipment Antennas Power Units Gateways Test and Monitoring Equipment. By Application, the market is categorized into Communication Earth Observation Navigation. By End User, the market is categorized into Consumer, Government and Military, Commercial, Enterprise. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Satellite Ground Station Market?

A4: Satellite Ground Station Market involves equipments and facility, which has mostly the responsibilities of receiving and transmitting the signals from satellite, processing as well as analyzing the signals gathered from satellite. These ground stations are well maintained to provide interfaces between satellites and the customers or public for communication, navigation, broadcasting, and data transfer uses in defense, agriculture, energy, and telecom areas. The equipments of this market encompass several of them as the antennas, NOCs, power units and VSAT terminals to allow the communication with other satellites that are already present in orbit.

Q5: How big is the Satellite Ground Station Market?

A5: Satellite Ground Station Market Size Was Valued at USD 61.6 Billion in 2023, and is Projected to Reach USD 192.55 Billion by 2032, Growing at a CAGR of 13.5 % From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!