Stay Ahead in Fast-Growing Economies.

Browse Reports NowSatellite AIS (Automatic Identification System) Market Size

Report of Satellite AIS (Automatic Identification System) Market is currently supplying a comprehensive analysis of many things which are liable for economy growth and factors which could play an important part in the increase of the marketplace in the prediction period. The record of Satellite AIS (Automatic Identification System) Industry is providing the thorough study on the grounds of market revenue discuss production and price happened. The report also provides the overview of the segmen

IMR Group

Description

Satellite AIS (Automatic Identification System) Market Synopsis

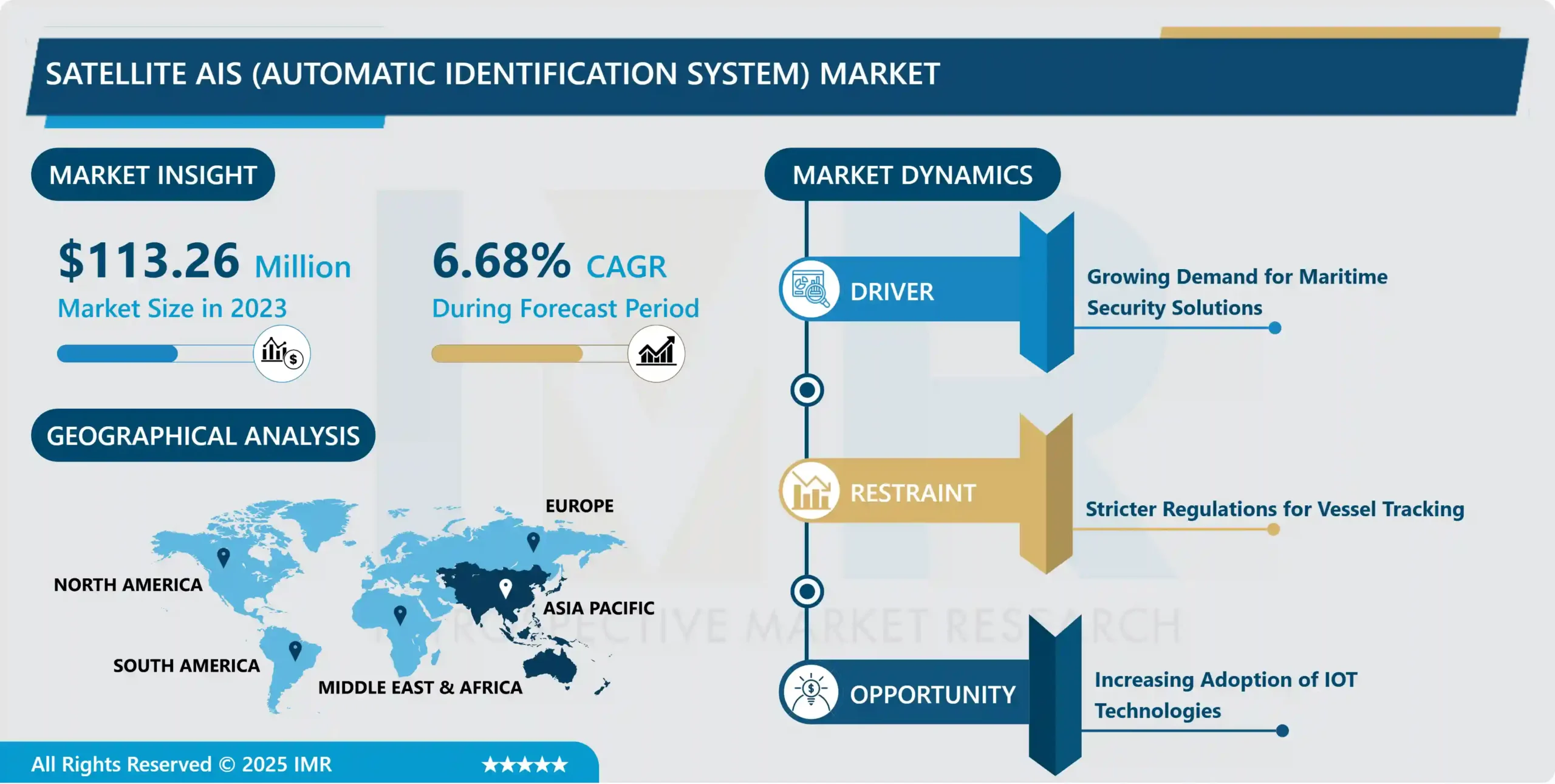

Satellite AIS (Automatic Identification System) Market Size Was Valued at USD 113.26 Million in 2023, and is Projected to Reach USD 202.69 Million by 2032, Growing at a CAGR of 6.68% From 2024-2032.

Satellite AIS (Automatic Identification System) is a technology used for real-time tracking and monitoring of vessel movements at sea. By receiving signals transmitted by ships, satellites relay vessel positions, identity, course, and speed data to shore-based stations. They enable enhanced maritime domain awareness in vessel traffic management, maritime security, and environmental protection efforts.

The Satellite AIS (Automatic Identification System is increasing demand for real-time vessel tracking and maritime safety and security. Satellite AIS technology utilizes satellites to track the movements of vessels worldwide, providing valuable data for various applications such as maritime surveillance, vessel tracking, maritime domain awareness, and environmental monitoring.

Satellite AIS enables ship operators, maritime authorities, and other stakeholders to monitor vessel movements, optimize routes, and ensure compliance with regulations. Technology plays an important role in maritime security and prevents illegal activities such as smuggling, piracy, and unauthorized fishing.

There is growing adoption of Satellite AIS in the defense and intelligence sectors is contributing to market expansion. Defense agencies utilize AIS data for maritime reconnaissance, border security, and maritime situational awareness, driving the demand for advanced satellite-based AIS solutions.

Furthermore, the increasing importance of environmental protection and marine conservation is fueling the demand for Satellite AIS for monitoring vessel emissions, tracking oil spills, and studying marine ecosystems. Governments and environmental organizations are supporting AIS data to enforce environmental regulations and mitigate the impact of human activities on the oceans. The Advancements in satellite technology, such as small satellite deployment and new satellite constellations, are expected to drive market growth in the forecasting Period.

Satellite AIS (Automatic Identification System) Market Trend Analysis

Growing Demand for Maritime Security Solutions

The growing demand for maritime security solutions due to piracy, illegal fishing, smuggling, and environmental threats, has increased the need for effective monitoring and surveillance systems. Satellite AIS technology provides real-time vessel tracking and identification, enhancing maritime domain awareness and enabling timely response to security threats.

Governments, maritime agencies, and commercial organizations worldwide are increasingly investing in Satellite AIS solutions to safeguard their maritime assets, protect coastal borders, and ensure compliance with international regulations. Furthermore, the integration of AIS data with other maritime surveillance technologies, such as radar and satellite imagery, enhances situational awareness and operational effectiveness.

As the maritime industry continues to grow and global trade expands, the demand for Satellite AIS solutions is expected to rise further. Satellite AIS technology is increasingly being recognized for its significant role in maritime security issues and promoting a safer maritime environment.

Increasing Adoption of IoT Technologies

IoT devices become more prevalent across various industries, and the demand for real-time tracking and monitoring of assets, vessels, and maritime activities is growing. Satellite AIS controls satellite technology to provide global coverage and real-time data on vessel movements, enhancing maritime safety, security, and efficiency.

IoT integration in Satellite AIS can offer enhanced capabilities, such as seamless integration with other IoT devices and platforms, advanced analytics for predictive maintenance and operational optimization, and improved communication and coordination between vessels and onshore operations.

The IoT ecosystem can enable the development of innovative applications and services that leverage Satellite AIS data and can open up new revenue streams and business opportunities in the maritime industry.

The collaboration between IoT technologies and Satellite AIS expands the market potential by addressing diverse industry needs, driving innovation, and development among industry players to capitalize on the vast opportunities presented by the growing IoT landscape.

Satellite AIS (Automatic Identification System) Market Segment Analysis:

Satellite AIS (Automatic Identification System) Market Segmented based on Product Type, and Application.

By Product Type, Class A Transponders segment is expected to dominate the market during the forecast period

The Class A Transponders segment is primarily utilized in maritime vessels for transmitting and receiving identification and position data. Renowned for their high accuracy and reliability, Class A Transponders play a critical role in ensuring maritime safety, navigation, and efficient vessel management.

Class A Transponders advanced features such as real-time tracking, long-range communication capabilities, and compatibility with terrestrial and satellite-based AIS networks. The Class A Transponders segment experiences steady growth driven by increasing maritime traffic, rising demand for maritime safety and security solutions, and regulatory mandates for vessel tracking and monitoring.

Furthermore, ongoing technological advancements, such as enhanced signal processing algorithms and integration with emerging satellite communication technologies, continue to augment the capabilities and market penetration of Class A Transponders in the Satellite AIS industry.

By Application, the Search & Rescue segment held the largest share of xx% in 2022

Search and rescue segment, operations can efficiently locate and assist vessels in distress, minimizing response times and potentially saving lives. Satellite AIS enables real-time tracking and monitoring of vessels, allowing search and rescue teams to quickly identify vessels in distress, determine their precise location, and coordinate rescue efforts effectively. This capability is particularly crucial in remote or high-risk maritime environments where traditional communication and tracking methods may be limited.

Furthermore, advancements in satellite AIS technology, such as improved coverage, higher accuracy, and enhanced data processing capabilities, further strengthen the effectiveness of search and rescue operations. These technological enhancements enable search and rescue teams to respond rapidly to emergencies, navigate challenging maritime conditions, and provide timely assistance to vessels in need.

Satellite AIS (Automatic Identification System) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

The Asia Pacific region boasts a significant maritime industry, with countries like China, Japan, South Korea, and Singapore leading in maritime trade and activities. The region has a vast network of ports and shipping routes. There is a growing demand for efficient vessel tracking and monitoring systems like Satellite AIS to enhance maritime safety and security.

The rapid technological advancements and increasing investments in satellite-based communication and navigation systems in countries across the Asia Pacific region are further pushing the adoption of Satellite AIS technology. Governments and maritime authorities are increasingly recognizing the importance of real-time vessel tracking for maritime surveillance, fisheries management, environmental monitoring, and search and rescue operations.

The region’s strategic geographical location, major shipping lanes, and busy waterways emphasize the significance of effective maritime domain awareness. There is a need for robust Satellite AIS solutions to monitor vessel movements and activities in these critical maritime areas in the region. The Asia Pacific region is expected to dominate the Satellite AIS market due to increasing maritime activities, technological advancements, and strategic requirements.

Satellite AIS (Automatic Identification System) Market Top Key Players:

L3Harris Technologies (United States)

ORBCOMM (United States)

exactEarth (Canada)

Kongsberg Gruppen (Norway)

Raymarine (United Kingdom)

MarineTraffic (Greece)

CLS Collection Localization Satellites (France)

Spacecom Satellite Communications Ltd (Israel)

JRC (Japan Radio Co., Ltd.) (Japan)

Furuno Electric Co., Ltd (Japan), and Other Major Players.

EXACTEARTH

KONGSBERG GRUPPEN

MARITEC

IRIDIUM COMMUNICATIONS INC

INMARSAT PLC

SPIRE GLOBAL

IHS MARKIT

KPLER

HONEYWELL INTERNATIONAL INC

CNS SYSTEMS AB

SAAB AB

COMNAV MARINE LTD

TRUE HEADING AB

Key Industry Developments in the Satellite AIS (Automatic Identification System) Market:

In June 2024, L3Harris Technologies received a contract worth up to $153 million to deliver an interoperable, critical communication network throughout Wisconsin, enabling public safety agencies to connect through a unified network during emergencies. Under the Wisconsin Interoperable Systems for Communications (WISCOM) contract, L3Harris provided next-generation technology to support the state’s public safety migration to Project 25-compliant operations. The L3Harris solution offered a high-reliability, IP-based network that incorporated the best, next-generation technologies from the company’s XL Series and Two47 portfolio.

In June 2024, ORBCOMM announced the launch of its next-generation satellite IoT service, OGx, featuring innovative network capabilities and flexible pricing. The release initiated the network’s rollout, showcasing patented technology designed to significantly reduce IoT solution power consumption. This development aimed to help IoT solutions either match traditional performance at lower costs or exceed it at the same cost.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Satellite AIS (Automatic Identification System) Market by Product Type (2018-2032)

4.1 Satellite AIS (Automatic Identification System) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Class A Transponder

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Class B Transponder

Chapter 5: Satellite AIS (Automatic Identification System) Market by Application (2018-2032)

5.1 Satellite AIS (Automatic Identification System) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Search & Rescue

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Defense

5.5 Intelligence & Security

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Satellite AIS (Automatic Identification System) Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 INSTRON (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AMETEK (UNITED STATES)

6.4 EPSILON TECH (UNITED STATES)

6.5 MTS SYSTEMS (UNITED STATES)

6.6 TINIUS OLSEN (UNITED STATES)

6.7 TESTRESOURCES (UNITED STATES)

6.8 POINT SEMANTICS CORPORATION (PSC) (UNITED STATES)

6.9 EPSILON TECHNOLOGY (UNITED STATES)

6.10 OPSENS SOLUTIONS (CANADA)

6.11 ALTHEN SENSORS (GERMANY)

6.12 SHIMADZU (JAPAN)

6.13 ANALIS (BELGIUM)

6.14

Chapter 7: Global Satellite AIS (Automatic Identification System) Market By Region

7.1 Overview

7.2. North America Satellite AIS (Automatic Identification System) Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product Type

7.2.4.1 Class A Transponder

7.2.4.2 Class B Transponder

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Search & Rescue

7.2.5.2 Defense

7.2.5.3 Intelligence & Security

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Satellite AIS (Automatic Identification System) Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product Type

7.3.4.1 Class A Transponder

7.3.4.2 Class B Transponder

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Search & Rescue

7.3.5.2 Defense

7.3.5.3 Intelligence & Security

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Satellite AIS (Automatic Identification System) Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product Type

7.4.4.1 Class A Transponder

7.4.4.2 Class B Transponder

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Search & Rescue

7.4.5.2 Defense

7.4.5.3 Intelligence & Security

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Satellite AIS (Automatic Identification System) Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product Type

7.5.4.1 Class A Transponder

7.5.4.2 Class B Transponder

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Search & Rescue

7.5.5.2 Defense

7.5.5.3 Intelligence & Security

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Satellite AIS (Automatic Identification System) Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product Type

7.6.4.1 Class A Transponder

7.6.4.2 Class B Transponder

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Search & Rescue

7.6.5.2 Defense

7.6.5.3 Intelligence & Security

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Satellite AIS (Automatic Identification System) Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product Type

7.7.4.1 Class A Transponder

7.7.4.2 Class B Transponder

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Search & Rescue

7.7.5.2 Defense

7.7.5.3 Intelligence & Security

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the Satellite AIS (Automatic Identification System) Market research report?

A1: The forecast period in the Satellite AIS (Automatic Identification System) Market research report is 2024-2032.

Q2: Who are the key players in the Satellite AIS (Automatic Identification System) Market?

A2: L3Harris Technologies (United States), ORBCOMM (United States), exactEarth (Canada), Kongsberg Gruppen (Norway), Raymarine (United Kingdom), MarineTraffic (Greece), CLS Collection Localization Satellites (France), Spacecom Satellite Communications Ltd (Israel), JRC (Japan Radio Co., Ltd.) (Japan), Furuno Electric Co., Ltd (Japan), and Other Major Players.

Q3: What are the segments of the Satellite AIS (Automatic Identification System) Market?

A3: The Satellite AIS (Automatic Identification System) Market is segmented into Product Type, Application, and region. By Product Type, the market is categorized into class A Transponder and Class B Transponder. By Application, the market is categorized into Search & Rescue, Defense, and Intelligence & Security. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Satellite AIS (Automatic Identification System) Market?

A4: Satellite AIS (Automatic Identification System) is a technology used for real-time tracking and monitoring of vessel movements at sea. By receiving signals transmitted by ships, satellites relay vessel positions, identity, course, and speed data to shore-based stations. They enable enhanced maritime domain awareness in vessel traffic management, maritime security, and environmental protection efforts.

Q5: How big is the Satellite AIS (Automatic Identification System) Market?

A5: Satellite AIS (Automatic Identification System) Market Size Was Valued at USD 113.26 Million in 2023, and is Projected to Reach USD 202.69 Million by 2032, Growing at a CAGR of 6.68% From 2024-2032

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!