Stay Ahead in Fast-Growing Economies.

Browse Reports NowSafety Needles Market – Size & Emerging Trends (2024–2032)

The Safety needles market is defined as the manufacturing and distribution industry of specialty medical needles intended for reducing the likelihood of needle-stick injuries, potentially fatal communicable diseases causal agents. The safety needles contain utilization reinforcements for example, retractories of the needle, bulletins that shield the needle and security limits which guarantee that the needle is safe after utilization. Growing awareness of the developing perils of healthcare occupations accompanied by more integral and constant measures to maintain both the patient and health-care employees protected from risks at work are fueling the safety needles market.

IMR Group

Description

Safety Needles Market Synopsis:

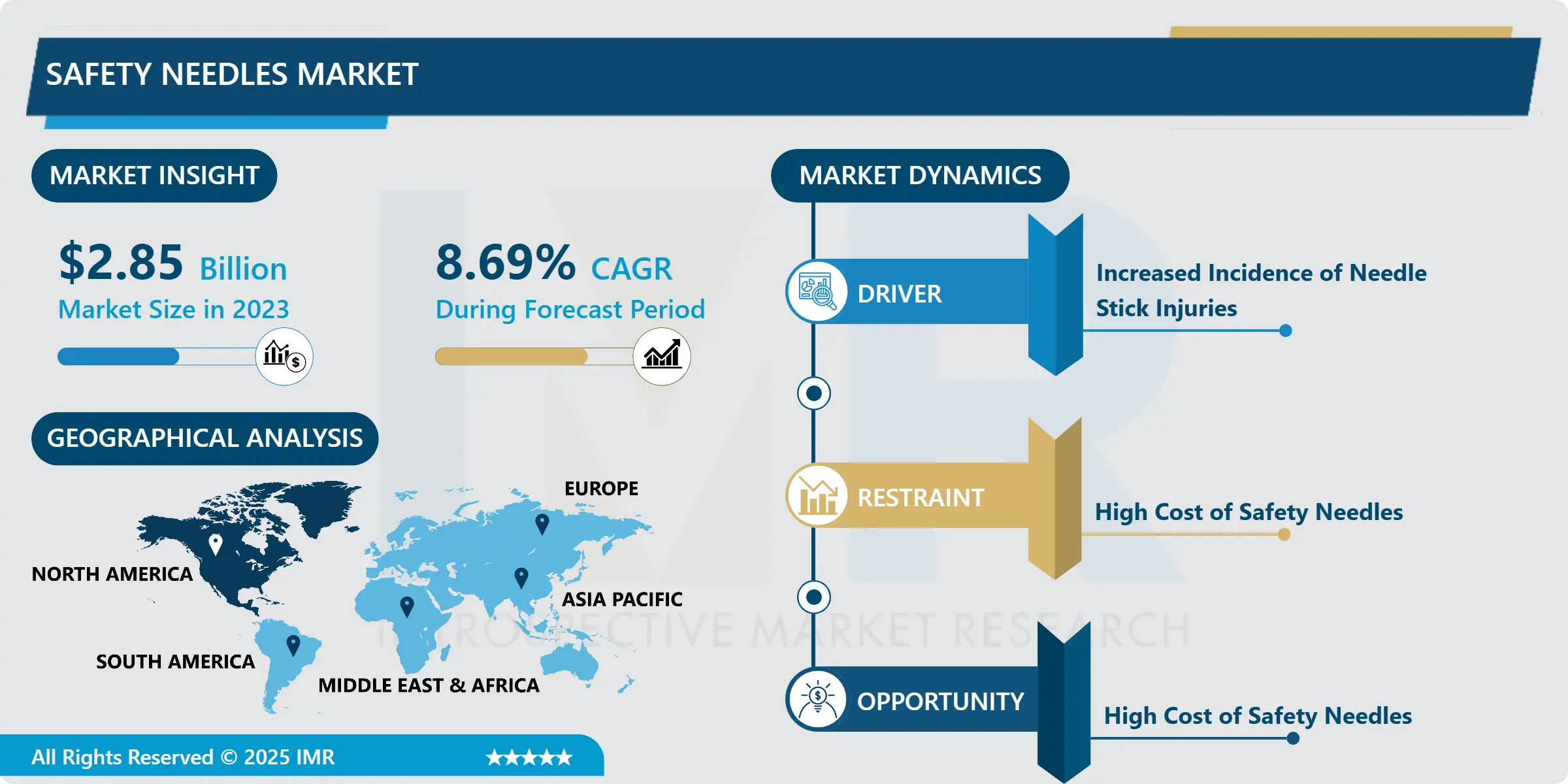

Safety Needles Market Size Was Valued at USD 2.85 Billion in 2023, and is Projected to Reach USD 6.03 Billion by 2032, Growing at a CAGR of 8.69% From 2024-2032

The Safety needles market is defined as the manufacturing and distribution industry of specialty medical needles intended for reducing the likelihood of needle-stick injuries, potentially fatal communicable diseases causal agents. The safety needles contain utilization reinforcements for example, retractories of the needle, bulletins that shield the needle and security limits which guarantee that the needle is safe after utilization. Growing awareness of the developing perils of healthcare occupations accompanied by more integral and constant measures to maintain both the patient and health-care employees protected from risks at work are fueling the safety needles market. It includes applications such as vaccinations, blood collection, insulin delivery and is constantly developing enhanced safety and ease of use features of the needles.

The Sterilization safety needles market has evolved over the years due to the enhanced focus on methods to avoid risk factors attached to needles that are used in hospitals to treat patients as well as administering necessary vaccinations to patients. These are injuries that can infect the persons with diseases such as HIV, hepatitis B and hepatitis C thus the need for new safety equipment. These risks are addressed in safety needles whose techniques include retractable needles and shields that help instantly hide the needle after use, so as to reduce on the dangers resulting from the usage of needles in certain medical procedures. The global healthcare organizations are focusing more on safety of its employees and patients and this has lead to higher adoption of safety needles due to growing regulatory norms and effective communication on safe injection.

By location, North America holds the largest share in the safety needles market due to improved healthcare system, increasing frequency of chronic diseases which require injections, and authorities’ concerns regarding needle-stick related accidents.. The Europe market also has strong growth from the same factors, such as the need of using safety devices in the healthcare facilities and approving rules. On the other hand, the Asia-Pacific region is rapidly growing as more people spend money on healthcare, medical facilities, and increasingly investing in safety standards. There are specific factors that industry players are adopting in a bid to increase their market footprint and broaden their product offerings. In addition, the increasing incidence of conditions that require injections, combined with market demands for self-injection systems, will doubtless advance market growth.

Nonetheless, there is also risks like high costs of safety needles, besides the possible resistance from the health professionals for reinvention of the otherwise traditional needles. To overcome these challenges, manufacturers are establishing innovations in the attempts to develop cheap and easy to use or safe safety needle products. Increasing at a compound annual growth rate, safety needles market is expected to grow in the future due to technology advancement and the rise in healthcare expenditure as well as the need to enhance safety in the medical procedures. Thus, focused on safety and high performance, the stakeholders involved in the healthcare section are progressive to advance and adopt the safety needles market in various healthcare sectors.

Safety Needles Market Trend Analysis:

Growing Demand for Safety Needles in Healthcare Settings

The use of safety needles is growing tremendously since both doctors and patients as well as overarching regulatory authorities have realized the need to embrace safety in operations.. This trend is especially most apparent in health facilities such as hospitals, clinics or any other setting that exposes a worker to bloodborne pathogens. Due to the growing concern in relation to the dangers of needle stick injuries there has been a positive change towards improved methods of injection. Therefore, providers are searching for safety needles containing these particular features and which have the capability to reduce the risks of HAI and provide better safety to health consumers and personnel.

New innovations like retractable and sheath covering needles play major role in this market development. These added safety features are not only safeguarding users from possible risks themselves, but they are also the response to the increasing worries about infection prevention and needle-stick hazards. The incorporation of these safety features to the needle designs caters for the prevailing call for safer health care services all over the world thus enhancing safety. In this way, the further advancement of safety needles will be instrumental in responding to the increasing need for better safety medical devices and to prevent needle-stick injuries that improve the quality of health care.

Focus on Infection Control and Prevention

The most compelling factor that defines the future development of the safety needles market can be referred to growth of the worldwide interest in infection control and prevention. Because health care workers continue to experience needle-stick injuries, which can expose them to pathogens like HIV and hepatitis, there is a renewed call for safety-engineered devices. The existing laws and recommendations are growing stricter for managing risks, to force healthcare facilities adapt safer strategies and supplies. This trend is well illustrated in the hospitals, Clinics and laboratories where the dangers of infection exposures are higher as a result of high usage of needles. The safety concern associated with the use of safety needles is considered a paramount factor that plays a role in protection of the professionals who use the products, as well as the patients creating an opportunity for market growth.

In addition, the advanced knowledge of occupational health hazards for healthcare employees has contributed to the active approach in the promotion of safety.. Employers PCB main putting emphasis on safety needles to make workplace safe not only for the employees but also improving patient care. The concern with technical safety requirements and procedures stimulates a favorable context and promotes the emergence of new and efficient Safety Needle Technologies. With global healthcare facilities remaining extra cautious in issues to do with infection control and personnel’s wellbeing, there is bound to be a demand for safety needles which is a good growth factor for the market.

Safety Needles Market Segment Analysis:

Safety Needles Market is Segmented on the basis of Product, Application, Distribution Channel, and Region.

By Product, Fine Aspiring Needles segment is expected to dominate the market during the forecast period

Fine Aspiring Needles are category of precise medical tools that are primarily used in fine needle aspiration (FNA) biopsies which is a non-invasive procedure that helps doctors to collect tissue samples of particular lumps or masses in the human body.. These needles are extremely slim –gauge, an essential element since sampling produces discomfort among the patients. Thus, with the help of fine aspiring needle, physicians can make an accurate intervention, select certain zones without harming healthy tissues and cells. This quality is particularly advantageous, especially when working on certain areas of the human body; with the big needles the patient is likely to be uncomfortable or develops complication.

It is also important to note that fine aspiring needles offer the adequacy of specimen size for satisfactory histopathology. These fine needles can use vacuum or suction ways to obtain specimens of the cells for efficient analysis and diagnosis of possible diseases including tumor or infection etc. Their use is most important when it comes to early detection plans which are important when it comes to intervening and treating the patient where need be. Therefore, fine aspiring needles have become indispensable in contemporary diagnose diagnostics, being easy to use while also producing accurate results which enhance patient’s health.

By Distribution Channel, Hospitals Pharmacies segment expected to held the largest share

Hospital pharmacy is a central part of the hospital services to guaranty availability of basic medical stock such as the medical needles in performance of in patients’ operations and surgeries. These are fixed pharmacy mainly located within hospitals to give easy access of all types of needles that are essential in differing uses including; enucleation, drug administration, blood sampling and biopsy among others. Large inventories allow hospital pharmacies to supply the variety and immediacy of orders that can be expected in a large hospital organization, such as surgery, emergency, and oncology departments. This capability is crucial in helping to ensure interrupted continuity in the delivery of care as the right needles in a timely manner influences the patient outcome in the equation.

In addition, hospital pharmacy is in charge of procurement, inventory control, and regulation compliance on medical needles products from manufacturers. Pharmacists and pharmacy technicians interact with other healthcare providers to discuss possible needs for the certain procedures, which is why size and types of needles are always prepared. It also increases patient safety and helps to achieve the goal of improving the hospital activity by reducing time losses for patients, as well as maintaining the high quality of the provided services. In general, hospital pharmacies are essential components of the healthcare delivery network and contribute significantly to the proper utilization of medical needles on the health scene.

Safety Needles Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America regional market for safety needles is rather influenced by the strict rules and requirements of the use of safer injection practices to prevent needle-stick injuries.. Such regulations have forced healthcare facilities to employ new and safe needle technologies necessary to dent safety and improve patient safeguard. The most significant donor in this market segment is the United States owing to high health spending and sound health care system. healthcare facilities across the country use safety-engineered devices to protect patients and healthcare workers, and the use of such devices has become widespread in hospitals and clinic.

Emerging compliance norms pertaining to patient safety and infection control have especially boosted the market for safety needles in North America. Hospital care givers have begun appreciating the value of adopting practices that control infections that are related to conventional needling. Consequently, the use of safety needles that are jammed with features such as retracting mechanisms and safety shields has recorded a sharp rise. This increased attention to safety is not only to meet compliances but also to promote health and safety ethos to improve the overall market prospects in the health care facilities in the region. Regulatory support from the governments, innovations from main manufacturers and focus towards patient safety make North America a favorable region for safety needles market.

Active Key Players in the Safety Needles Market:

Medtronic Public Limited Company

Boston Scientific Corp

Becton Dickinson and Company

Smith Medical, Argon Medical Devices, Inc.

Novo Nordisk A/S

Terumo Corporation

NIPRO Medical Corporation

B. Braun Melsungen AG.

Abbott Laboratories

Eli Lilly and Company

Retractable Technologies

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Industry Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Strategic Pestle Overview

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Mapping

3.6 Regulatory Framework

3.7 Princing Trend Analysis

3.8 Patent Analysis

3.9 Technology Evolution

3.10 Investment Pockets

3.11 Import-Export Analysis

Chapter 4: Safety Needles Market by Product

4.1 Safety Needles Market Snapshot and Growth Engine

4.2 Safety Needles Market Overview

4.3 Fine Aspiring Needles

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Fine Aspiring Needles: Geographic Segmentation Analysis

4.4 Biopsy Needles

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Biopsy Needles: Geographic Segmentation Analysis

4.5 Hypodermic Needles

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Hypodermic Needles: Geographic Segmentation Analysis

4.6 Pen Needles

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Pen Needles: Geographic Segmentation Analysis

4.7 Suture Needles

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Suture Needles: Geographic Segmentation Analysis

4.8 IV Catheter Needles

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 IV Catheter Needles: Geographic Segmentation Analysis

4.9 Blood Collection Needles

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Blood Collection Needles: Geographic Segmentation Analysis

4.10 Spinal Anesthesia and Epidural Needles

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Spinal Anesthesia and Epidural Needles: Geographic Segmentation Analysis

4.11 Prefilled Needles

4.11.1 Introduction and Market Overview

4.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.11.3 Prefilled Needles: Geographic Segmentation Analysis

4.12 A.V. Fistula

4.12.1 Introduction and Market Overview

4.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.12.3 A.V. Fistula: Geographic Segmentation Analysis

4.13 Cannula Needles and Huber Needles

4.13.1 Introduction and Market Overview

4.13.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.13.3 Cannula Needles and Huber Needles: Geographic Segmentation Analysis

Chapter 5: Safety Needles Market by Application

5.1 Safety Needles Market Snapshot and Growth Engine

5.2 Safety Needles Market Overview

5.3 Sample Collection and Drug Delivery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Sample Collection and Drug Delivery: Geographic Segmentation Analysis

Chapter 6: Safety Needles Market by Distribution Channel

6.1 Safety Needles Market Snapshot and Growth Engine

6.2 Safety Needles Market Overview

6.3 Hospitals Pharmacies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Hospitals Pharmacies: Geographic Segmentation Analysis

6.4 Private Clinics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Private Clinics: Geographic Segmentation Analysis

6.5 Retail Pharmacies & Drug Stores and E-commerce

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Retail Pharmacies & Drug Stores and E-commerce: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Safety Needles Market Share by Manufacturer (2023)

7.1.3 Concentration Ratio(CR5)

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MEDTRONIC PUBLIC LIMITED COMPANY

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.3 BOSTON SCIENTIFIC CORP

7.4 BECTON DICKINSON AND COMPANY

7.5 SMITH MEDICAL

7.6 ARGON MEDICAL DEVICES INC.

7.7 NOVO NORDISK A/S

7.8 TERUMO CORPORATION

7.9 NIPRO MEDICAL CORPORATION

7.10 B. BRAUN MELSUNGEN AG.

7.11 ABBOTT LABORATORIES

7.12 ELI LILLY AND COMPANY

7.13 RETRACTABLE TECHNOLOGIES

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Safety Needles Market By Region

8.1 Overview

8.2. North America Safety Needles Market

8.2.1 Historic and Forecasted Market Size by Segments

8.2.2 Historic and Forecasted Market Size By Product

8.2.2.1 Fine Aspiring Needles

8.2.2.2 Biopsy Needles

8.2.2.3 Hypodermic Needles

8.2.2.4 Pen Needles

8.2.2.5 Suture Needles

8.2.2.6 IV Catheter Needles

8.2.2.7 Blood Collection Needles

8.2.2.8 Spinal Anesthesia and Epidural Needles

8.2.2.9 Prefilled Needles

8.2.2.10 A.V. Fistula

8.2.2.11 Cannula Needles and Huber Needles

8.2.3 Historic and Forecasted Market Size By Application

8.2.3.1 Sample Collection and Drug Delivery

8.2.4 Historic and Forecasted Market Size By Distribution Channel

8.2.4.1 Hospitals Pharmacies

8.2.4.2 Private Clinics

8.2.4.3 Retail Pharmacies & Drug Stores and E-commerce

8.2.5 Historic and Forecast Market Size by Country

8.2.5.1 US

8.2.5.2 Canada

8.2.5.3 Mexico

8.3. Eastern Europe Safety Needles Market

8.3.1 Historic and Forecasted Market Size by Segments

8.3.2 Historic and Forecasted Market Size By Product

8.3.2.1 Fine Aspiring Needles

8.3.2.2 Biopsy Needles

8.3.2.3 Hypodermic Needles

8.3.2.4 Pen Needles

8.3.2.5 Suture Needles

8.3.2.6 IV Catheter Needles

8.3.2.7 Blood Collection Needles

8.3.2.8 Spinal Anesthesia and Epidural Needles

8.3.2.9 Prefilled Needles

8.3.2.10 A.V. Fistula

8.3.2.11 Cannula Needles and Huber Needles

8.3.3 Historic and Forecasted Market Size By Application

8.3.3.1 Sample Collection and Drug Delivery

8.3.4 Historic and Forecasted Market Size By Distribution Channel

8.3.4.1 Hospitals Pharmacies

8.3.4.2 Private Clinics

8.3.4.3 Retail Pharmacies & Drug Stores and E-commerce

8.3.5 Historic and Forecast Market Size by Country

8.3.5.1 Bulgaria

8.3.5.2 The Czech Republic

8.3.5.3 Hungary

8.3.5.4 Poland

8.3.5.5 Romania

8.3.5.6 Rest of Eastern Europe

8.4. Western Europe Safety Needles Market

8.4.1 Historic and Forecasted Market Size by Segments

8.4.2 Historic and Forecasted Market Size By Product

8.4.2.1 Fine Aspiring Needles

8.4.2.2 Biopsy Needles

8.4.2.3 Hypodermic Needles

8.4.2.4 Pen Needles

8.4.2.5 Suture Needles

8.4.2.6 IV Catheter Needles

8.4.2.7 Blood Collection Needles

8.4.2.8 Spinal Anesthesia and Epidural Needles

8.4.2.9 Prefilled Needles

8.4.2.10 A.V. Fistula

8.4.2.11 Cannula Needles and Huber Needles

8.4.3 Historic and Forecasted Market Size By Application

8.4.3.1 Sample Collection and Drug Delivery

8.4.4 Historic and Forecasted Market Size By Distribution Channel

8.4.4.1 Hospitals Pharmacies

8.4.4.2 Private Clinics

8.4.4.3 Retail Pharmacies & Drug Stores and E-commerce

8.4.5 Historic and Forecast Market Size by Country

8.4.5.1 Germany

8.4.5.2 UK

8.4.5.3 France

8.4.5.4 Netherlands

8.4.5.5 Italy

8.4.5.6 Russia

8.4.5.7 Spain

8.4.5.8 Rest of Western Europe

8.5. Asia Pacific Safety Needles Market

8.5.1 Historic and Forecasted Market Size by Segments

8.5.2 Historic and Forecasted Market Size By Product

8.5.2.1 Fine Aspiring Needles

8.5.2.2 Biopsy Needles

8.5.2.3 Hypodermic Needles

8.5.2.4 Pen Needles

8.5.2.5 Suture Needles

8.5.2.6 IV Catheter Needles

8.5.2.7 Blood Collection Needles

8.5.2.8 Spinal Anesthesia and Epidural Needles

8.5.2.9 Prefilled Needles

8.5.2.10 A.V. Fistula

8.5.2.11 Cannula Needles and Huber Needles

8.5.3 Historic and Forecasted Market Size By Application

8.5.3.1 Sample Collection and Drug Delivery

8.5.4 Historic and Forecasted Market Size By Distribution Channel

8.5.4.1 Hospitals Pharmacies

8.5.4.2 Private Clinics

8.5.4.3 Retail Pharmacies & Drug Stores and E-commerce

8.5.5 Historic and Forecast Market Size by Country

8.5.5.1 China

8.5.5.2 India

8.5.5.3 Japan

8.5.5.4 South Korea

8.5.5.5 Malaysia

8.5.5.6 Thailand

8.5.5.7 Vietnam

8.5.5.8 The Philippines

8.5.5.9 Australia

8.5.5.10 New Zealand

8.5.5.11 Rest of APAC

8.6. Middle East & Africa Safety Needles Market

8.6.1 Historic and Forecasted Market Size by Segments

8.6.2 Historic and Forecasted Market Size By Product

8.6.2.1 Fine Aspiring Needles

8.6.2.2 Biopsy Needles

8.6.2.3 Hypodermic Needles

8.6.2.4 Pen Needles

8.6.2.5 Suture Needles

8.6.2.6 IV Catheter Needles

8.6.2.7 Blood Collection Needles

8.6.2.8 Spinal Anesthesia and Epidural Needles

8.6.2.9 Prefilled Needles

8.6.2.10 A.V. Fistula

8.6.2.11 Cannula Needles and Huber Needles

8.6.3 Historic and Forecasted Market Size By Application

8.6.3.1 Sample Collection and Drug Delivery

8.6.4 Historic and Forecasted Market Size By Distribution Channel

8.6.4.1 Hospitals Pharmacies

8.6.4.2 Private Clinics

8.6.4.3 Retail Pharmacies & Drug Stores and E-commerce

8.6.5 Historic and Forecast Market Size by Country

8.6.5.1 Turkey

8.6.5.2 Bahrain

8.6.5.3 Kuwait

8.6.5.4 Saudi Arabia

8.6.5.5 Qatar

8.6.5.6 UAE

8.6.5.7 Israel

8.6.5.8 South Africa

8.7. South America Safety Needles Market

8.7.1 Historic and Forecasted Market Size by Segments

8.7.2 Historic and Forecasted Market Size By Product

8.7.2.1 Fine Aspiring Needles

8.7.2.2 Biopsy Needles

8.7.2.3 Hypodermic Needles

8.7.2.4 Pen Needles

8.7.2.5 Suture Needles

8.7.2.6 IV Catheter Needles

8.7.2.7 Blood Collection Needles

8.7.2.8 Spinal Anesthesia and Epidural Needles

8.7.2.9 Prefilled Needles

8.7.2.10 A.V. Fistula

8.7.2.11 Cannula Needles and Huber Needles

8.7.3 Historic and Forecasted Market Size By Application

8.7.3.1 Sample Collection and Drug Delivery

8.7.4 Historic and Forecasted Market Size By Distribution Channel

8.7.4.1 Hospitals Pharmacies

8.7.4.2 Private Clinics

8.7.4.3 Retail Pharmacies & Drug Stores and E-commerce

8.7.5 Historic and Forecast Market Size by Country

8.7.5.1 Brazil

8.7.5.2 Argentina

8.7.5.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Safety Needles Market research report?

A1: The forecast period in the Safety Needles Market research report is 2024-2032.

Q2: Who are the key players in the Safety Needles Market?

A2: Medtronic Public Limited Company, Boston Scientific Corp, Becton Dickinson and Company, Smith Medical, Argon Medical Devices, Inc., Novo Nordisk A/S, Terumo Corporation, NIPRO Medical Corporation, B. Braun Melsungen AG., Abbott Laboratories, Eli Lilly and Company, Retractable Technologies, and Other Active Players.

Q3: What are the segments of the Safety Needles Market?

A3: The Safety Needles Market is segmented into By Product, By Application, By Distribution Channel and region. By Product, the market is categorized into Fine Aspiring Needles, Biopsy Needles, Hypodermic Needles, Pen Needles, Suture Needles, IV Catheter Needles, Blood Collection Needles, Spinal Anesthesia and Epidural Needles, Prefilled Needles, A.V. Fistula, Cannula Needles and Huber Needles. By Application, the market is categorized into Sample Collection and Drug Delivery. By Distribution Channel, the market is categorized into Hospitals Pharmacies, Private Clinics, Retail Pharmacies & Drug Stores and E-commerce. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Safety Needles Market?

A4: This is the industry which deals with safety needles; these are arrows that incorporated into a medical system, to reduce cases of high risk from needle pricking because they are toxic and can cause illnesses. These safety needles also feature finger rings, needle guards, or flip protectors, that automatically retract, cover, or lock the needle upon use. Growing consciousness relating to workplace dangers in the healthcare sector, in combination with tough manufacturing standards and activities meant to strengthen patient and HCW protection, are the key factors boosting the safety needles market. It is a large market connecting to diverse applications such as vaccines, blood sampling, and insulin injections, and distinguished by frequent product development to enhance the safety and easiness of using a needle.

Q5: How big is the Safety Needles Market?

A5: Safety Needles Market Size Was Valued at USD 2.85 Billion in 2023, and is Projected to Reach USD 6.03 Billion by 2032, Growing at a CAGR of 8.69% From 2024-2032

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!