Stay Ahead in Fast-Growing Economies.

Browse Reports NowRheumatoid Arthritis Diagnostic Test Market – Size & Emerging Trends (2024–2032)

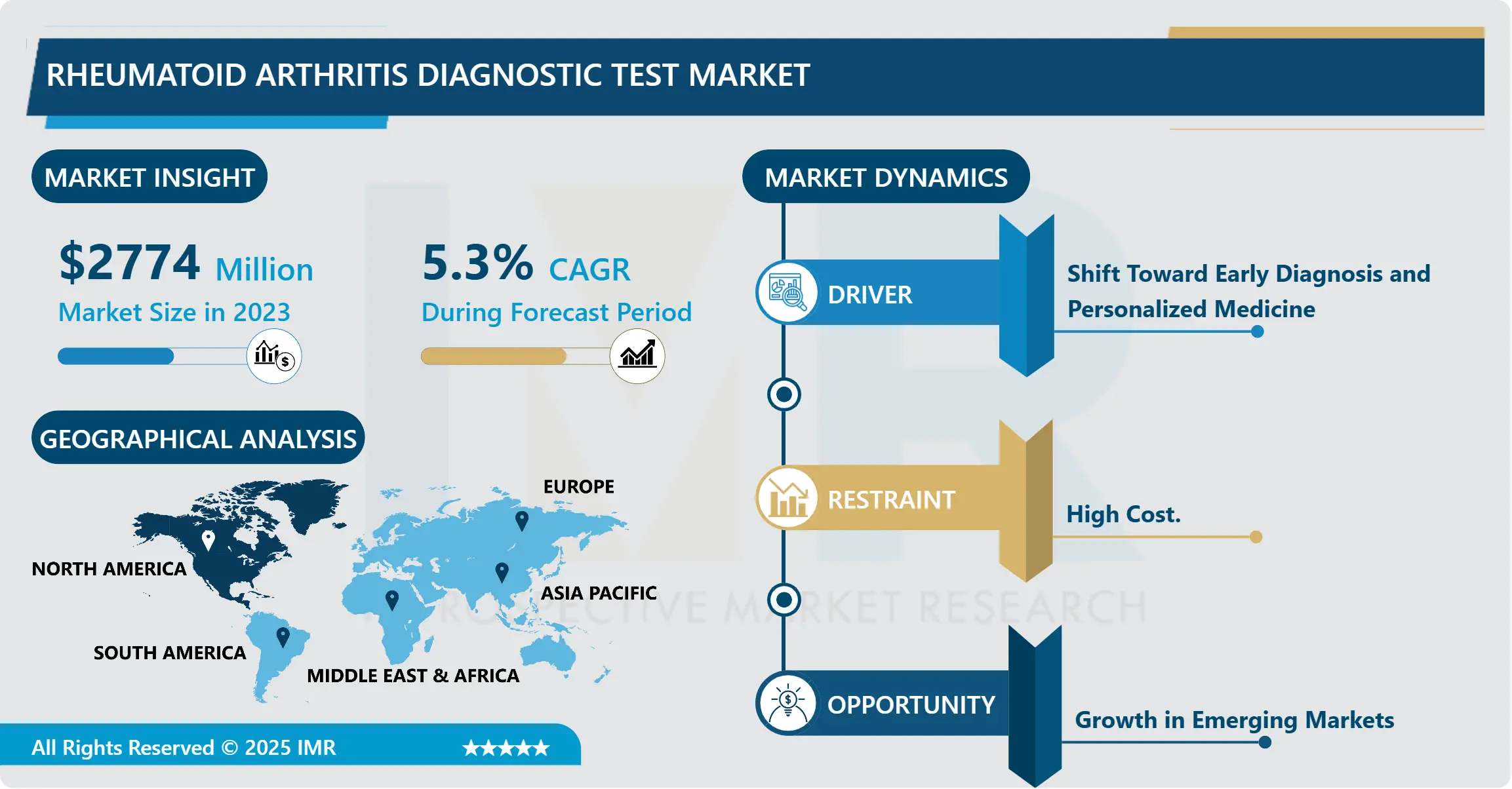

Rheumatoid Arthritis Diagnostic Test Market Size Was Valued at USD 2,774.0 Million in 2023, and is Projected to Reach USD 3982.035 Million by 2032, Growing at a CAGR of 5.3% From 2024-2032

IMR Group

Description

Rheumatoid Arthritis Diagnostic Test Market Synopsis:

Rheumatoid Arthritis Diagnostic Test Market Size Was Valued at USD 2,774.0 Million in 2023, and is Projected to Reach USD 3982.035 Million by 2032, Growing at a CAGR of 5.3% From 2024-2032.

The Rheumatoid Arthritis (RA) diagnostics test market includes all certifiable diagnostics methods and equipment employed to identify and track rheumatoid arthritis (RA) diseases in clients. Inflammation of joints and sometimes the surrounding tissues, often resulting in pain, swelling and even potential damage to the joints, rheumatoid arthritis is a chronic autoimmune disorder. These diagnostic tests fulfill the purpose of early detection of the disease, to estimate its severity and progression. For example there are the simpler blood test conducted in laboratories, the imaging tests such as x-rays and MRI, and the biomarkers and genetic tests that assist in diagnosis.

The market for Rheumatoid Arthritis diagnostics test has marked growth in the recent past as more awareness regarding Rheumatoid Arthritis, availability of advanced diagnostic methods, and the high tendency of the elderly population towards autoimmune diseases. Diagnoses of rheumatoid arthritis involves a combination of clinical examination, laboratory investigations (RF, ACAs), and imaging examination with some diagnostic tests being used for early rheumatoid arthritis diagnosis. Global healthcare is evolving due to advanced healthcare facilities, availability of sophisticated diagnostic devices and growing number of auto immunes diseases. Morissey et al., opine that diagnosis and management of RA requires early diagnosis and therefore the need for efficient diagnostic tools.

It is also noted that the market is gradually moving away from the conventional diagnostic techniques and towards modern, faster and less invasive ones, including point of care and automated lab systems. The shift towards early diagnosis allows clinicians easily diagnose RA at an early stage and ensures proper treatment reduces the future complications of the disease. In addition, there is an emphasis on targeted medicine marked by new technologies for early-time prognosis of the disease, evaluation of treatment outcomes, and evaluation of patient’s response to certain treatments. By these trends, it may be concluded that the further growth of the RA diagnostics market is possible due to the constant discovery of new biomarkers and technologies.

Rheumatoid Arthritis Diagnostic Test Market Trend Analysis:

Shift Toward Early Diagnosis and Personalized Medicine

One trend of the market for Rheumatoid Arthritis diagnostics is the focus on the early detection and implementation of the personalized medicine concept. Modern medicine attributes RA detection efforts to detecting the conditions at their nascent stages before complications arise and even before any physical signs manifest. Diagnostic tools like biomarker based tests like Anti-Citrullinated Protein Antibody (ACPA) Rheumatoid Factor (RF) has eased early identification and can halt or even prevent joint destruction stages of RA.

Further, the management of rheumatic diseases, especially the RA, has been challenged to encompass the principles of P4 medicine that is the developing and applying of the treatment regimens based on the individual patient information. Diagnostic tests are today being written not only to diagnose RA but also to learn the gene profile of the patient to determine what therapies will respond to. This trend is going to persist as investment in genomics as well as biomarkers increases enabling treatment to be personalised. This shift is also helped by such technologies as Artificial Intelligence which comes in handy in handling test results to help patients improve their results.

Growth in Emerging Markets

The market for the Rheumatoid Arthritis diagnostics test has more potential in the emerging market than many of the existing markets. Increasing healthcare facilities and growing access to diagnosis in areas geographically located in Asia Pacific, Latin America, and Middle East there is a growing demand of tests related to number of chronic diseases including rheumatoid arthritis. Increased knowledge of autoimmune diseases and increased health care expenditure in these regions have made it suitable to introduce and implement progressive RA diagnostic technologies. Additionally, governments’ efforts in enhancing healthcare coverage and tangible backing of new-age health care solutions are a strong pointer to the factors that will boost the markets in these areas.

The increasing mavement to emerging economies is expected to be force by diagnostics mavaments between the global diagnostics mavaments and local healthcare mavaments providers. For instance, multinational corporations interested in increasing their operations in these regions are penetrating the market through distribution agreements or joint ventures and collaborations that include making the advanced diagnostic tests more available. For the reason that, owing to the changes in the lifestyles, and the increasing population of the aged persons in these markets, the occurrences of RA are also rising and thus making the demand for efficient diagnostic products for this stage highly responsive, making the growth opportunities for the market players enormous.

Rheumatoid Arthritis Diagnostic Test Market Segment Analysis:

Rheumatoid Arthritis Diagnostic Test Market is Segmented on the basis of Type, End User, and Region.

By Type, Serology Test segment is expected to dominate the market during the forecast period

the market is segmented into Serology Test (Erythrocyte Sedimentation Rate (ESR), Rheumatoid Factor (RF), Anti-cyclic Citrullinated Peptide (anti-CCP), Antinuclear Antibody (ANA), Uric Acid, Other Tests), Monitoring RA Treatment Efficiency Tests (Salicylate Level Count, Muscle Enzyme Tests (CPK, Aldolase), Creatinine Test) out of which, the into Serology Test (Erythrocyte Sedimentation Rate (ESR), Rheumatoid Factor (RF), Anti-cyclic Citrullinated Peptide (anti-CCP), Antinuclear Antibody (ANA), Uric Acid, Other Tests) is expected to hold a dominant position in the global rheumatoid arthritis diagnostic tests market during the forecast period and this is attributed to awareness of rhumetoid arthritis.

By End User ,Diagnostic segment expected to held the largest share

The market for diagnostic laboratories, private laboratories, public laboratories, ambulatory surgical centers has been segmented among which the possession of diagnostic laboratories is expected to capture large market share over the forecast period The reason being, initial diagnosis plays a crucial role in controlling or eliminating the disease and hence early diagnosis plays a vital role in the recovery process.

In this context, the end users who are expected to hold greater market share over the forecast period are correctly identifying rheumatoid arthritis as rheumatoid arthritis diagnostic tests market over the forecast period.

Rheumatoid Arthritis Diagnostic Test Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The global Rheumatoid Arthritis diagnostics test market continues to be dominated by North America in 2023. This may be as a result of well endowed health facilities, increased health care awareness regarding rheumatoid arthritis, and increased health care expenditure. The United States especially occupies the largest market share for the industry with the global market share of approximately 40% as it has an advanced healthcare sector, the growing rate of autoimmune diseases, and robust health care expenditure. The market for diagnostic tests in North America is also preceded by the leading diagnostic test suppliers and growing research study volume in superior diagnostic solutions.

In addition, regulatory bodies in the North American countries have well – established guidelines and policies on the medical devices and diagnostic tests used in RA diagnostic tools. The region is also home to a large number of healthcare, hospital, and research institutiShon aiming at autoimmune diseases, thus making it a convinient market for diagnostic test firms. Furthermore, the high prevalence of rheumatoid arthritis, especially in the emerging nations of North America, the demand for new products owing to early diagnosis, and increasing patient awareness of personalization of medicine are prime factors that are poised to help North America maintain its market leadership position in the next years.

Active Key Players in the Rheumatoid Arthritis Diagnostic Test Market:

Abbott Laboratories (USA)

AbbVie Inc. (USA)

Becton Dickinson and Company (USA)

Bio-Rad Laboratories (USA)

DiaSorin (Italy)

F. Hoffmann-La Roche Ltd (Switzerland)

GE Healthcare (USA)

Hoffmann-La Roche AG (Switzerland)

Medtronic (USA)

Ortho Clinical Diagnostics (USA)

Other key Players

Quidel Corporation (USA)

Roche Diagnostics (Switzerland)

Siemens Healthineers (Germany)

Thermo Fisher Scientific (USA)

Thermo Fisher Scientific Inc. (USA)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Rheumatoid Arthritis Diagnostic Test Market by Type

4.1 Rheumatoid Arthritis Diagnostic Test Market Snapshot and Growth Engine

4.2 Rheumatoid Arthritis Diagnostic Test Market Overview

4.3 Serology Test (Erythrocyte Sedimentation Rate (ESR)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Serology Test (Erythrocyte Sedimentation Rate (ESR) : Geographic Segmentation Analysis

4.4 Rheumatoid Factor (RF)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Rheumatoid Factor (RF) : Geographic Segmentation Analysis

4.5 Anti-cyclic Citrullinated Peptide (anti-CCP)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Anti-cyclic Citrullinated Peptide (anti-CCP) : Geographic Segmentation Analysis

4.6 Antinuclear Antibody (ANA)

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Antinuclear Antibody (ANA): Geographic Segmentation Analysis

4.7 Uric Acid

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Uric Acid : Geographic Segmentation Analysis

4.8 Other Tests) Monitoring RA Treatment Efficiency Tests (Salicylate Level Count

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Other Tests) Monitoring RA Treatment Efficiency Tests (Salicylate Level Count : Geographic Segmentation Analysis

4.9 Muscle Enzyme Tests (CPK

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Muscle Enzyme Tests (CPK: Geographic Segmentation Analysis

4.10 Aldolase)

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Aldolase): Geographic Segmentation Analysis

4.11 Creatinine Test)

4.11.1 Introduction and Market Overview

4.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.11.3 Key Market Trends, Growth Factors and Opportunities

4.11.4 Creatinine Test): Geographic Segmentation Analysis

4.12

4.12.1 Introduction and Market Overview

4.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.12.3 Key Market Trends, Growth Factors and Opportunities

4.12.4 : Geographic Segmentation Analysis

Chapter 5: Rheumatoid Arthritis Diagnostic Test Market by End User

5.1 Rheumatoid Arthritis Diagnostic Test Market Snapshot and Growth Engine

5.2 Rheumatoid Arthritis Diagnostic Test Market Overview

5.3 Diagnostic Laboratories Private Laboratories

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Diagnostic Laboratories Private Laboratories : Geographic Segmentation Analysis

5.4 Public Laboratories

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Public Laboratories : Geographic Segmentation Analysis

5.5 Ambulatory Surgical Centers)

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Ambulatory Surgical Centers) : Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Rheumatoid Arthritis Diagnostic Test Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABBOTT LABORATORIES

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ROCHE DIAGNOSTICS

6.4 SIEMENS HEALTHINEERS

6.5 THERMO FISHER SCIENTIFIC

6.6 BIO-RAD LABORATORIES

6.7 OTHER ACTIVE PLAYERS

Chapter 7: Global Rheumatoid Arthritis Diagnostic Test Market By Region

7.1 Overview

7.2. North America Rheumatoid Arthritis Diagnostic Test Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Type

7.2.4.1 Serology Test (Erythrocyte Sedimentation Rate (ESR)

7.2.4.2 Rheumatoid Factor (RF)

7.2.4.3 Anti-cyclic Citrullinated Peptide (anti-CCP)

7.2.4.4 Antinuclear Antibody (ANA)

7.2.4.5 Uric Acid

7.2.4.6 Other Tests) Monitoring RA Treatment Efficiency Tests (Salicylate Level Count

7.2.4.7 Muscle Enzyme Tests (CPK

7.2.4.8 Aldolase)

7.2.4.9 Creatinine Test)

7.2.4.10

7.2.5 Historic and Forecasted Market Size By End User

7.2.5.1 Diagnostic Laboratories Private Laboratories

7.2.5.2 Public Laboratories

7.2.5.3 Ambulatory Surgical Centers)

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Rheumatoid Arthritis Diagnostic Test Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Type

7.3.4.1 Serology Test (Erythrocyte Sedimentation Rate (ESR)

7.3.4.2 Rheumatoid Factor (RF)

7.3.4.3 Anti-cyclic Citrullinated Peptide (anti-CCP)

7.3.4.4 Antinuclear Antibody (ANA)

7.3.4.5 Uric Acid

7.3.4.6 Other Tests) Monitoring RA Treatment Efficiency Tests (Salicylate Level Count

7.3.4.7 Muscle Enzyme Tests (CPK

7.3.4.8 Aldolase)

7.3.4.9 Creatinine Test)

7.3.4.10

7.3.5 Historic and Forecasted Market Size By End User

7.3.5.1 Diagnostic Laboratories Private Laboratories

7.3.5.2 Public Laboratories

7.3.5.3 Ambulatory Surgical Centers)

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Rheumatoid Arthritis Diagnostic Test Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Type

7.4.4.1 Serology Test (Erythrocyte Sedimentation Rate (ESR)

7.4.4.2 Rheumatoid Factor (RF)

7.4.4.3 Anti-cyclic Citrullinated Peptide (anti-CCP)

7.4.4.4 Antinuclear Antibody (ANA)

7.4.4.5 Uric Acid

7.4.4.6 Other Tests) Monitoring RA Treatment Efficiency Tests (Salicylate Level Count

7.4.4.7 Muscle Enzyme Tests (CPK

7.4.4.8 Aldolase)

7.4.4.9 Creatinine Test)

7.4.4.10

7.4.5 Historic and Forecasted Market Size By End User

7.4.5.1 Diagnostic Laboratories Private Laboratories

7.4.5.2 Public Laboratories

7.4.5.3 Ambulatory Surgical Centers)

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Rheumatoid Arthritis Diagnostic Test Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Type

7.5.4.1 Serology Test (Erythrocyte Sedimentation Rate (ESR)

7.5.4.2 Rheumatoid Factor (RF)

7.5.4.3 Anti-cyclic Citrullinated Peptide (anti-CCP)

7.5.4.4 Antinuclear Antibody (ANA)

7.5.4.5 Uric Acid

7.5.4.6 Other Tests) Monitoring RA Treatment Efficiency Tests (Salicylate Level Count

7.5.4.7 Muscle Enzyme Tests (CPK

7.5.4.8 Aldolase)

7.5.4.9 Creatinine Test)

7.5.4.10

7.5.5 Historic and Forecasted Market Size By End User

7.5.5.1 Diagnostic Laboratories Private Laboratories

7.5.5.2 Public Laboratories

7.5.5.3 Ambulatory Surgical Centers)

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Rheumatoid Arthritis Diagnostic Test Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Type

7.6.4.1 Serology Test (Erythrocyte Sedimentation Rate (ESR)

7.6.4.2 Rheumatoid Factor (RF)

7.6.4.3 Anti-cyclic Citrullinated Peptide (anti-CCP)

7.6.4.4 Antinuclear Antibody (ANA)

7.6.4.5 Uric Acid

7.6.4.6 Other Tests) Monitoring RA Treatment Efficiency Tests (Salicylate Level Count

7.6.4.7 Muscle Enzyme Tests (CPK

7.6.4.8 Aldolase)

7.6.4.9 Creatinine Test)

7.6.4.10

7.6.5 Historic and Forecasted Market Size By End User

7.6.5.1 Diagnostic Laboratories Private Laboratories

7.6.5.2 Public Laboratories

7.6.5.3 Ambulatory Surgical Centers)

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Rheumatoid Arthritis Diagnostic Test Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Type

7.7.4.1 Serology Test (Erythrocyte Sedimentation Rate (ESR)

7.7.4.2 Rheumatoid Factor (RF)

7.7.4.3 Anti-cyclic Citrullinated Peptide (anti-CCP)

7.7.4.4 Antinuclear Antibody (ANA)

7.7.4.5 Uric Acid

7.7.4.6 Other Tests) Monitoring RA Treatment Efficiency Tests (Salicylate Level Count

7.7.4.7 Muscle Enzyme Tests (CPK

7.7.4.8 Aldolase)

7.7.4.9 Creatinine Test)

7.7.4.10

7.7.5 Historic and Forecasted Market Size By End User

7.7.5.1 Diagnostic Laboratories Private Laboratories

7.7.5.2 Public Laboratories

7.7.5.3 Ambulatory Surgical Centers)

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the Rheumatoid Arthritis Diagnostic Test Market research report?

A1: The forecast period in the Rheumatoid Arthritis Diagnostic Test Market research report is 2024-2032.

Q2: Who are the key players in the Rheumatoid Arthritis Diagnostic Test Market?

A2: Abbott Laboratories (USA), AbbVie Inc. (USA), Becton Dickinson and Company (USA), Bio-Rad Laboratories (USA), DiaSorin (Italy), F. Hoffmann-La Roche Ltd (Switzerland), GE Healthcare (USA), Hoffmann-La Roche AG (Switzerland), Medtronic (USA), Ortho Clinical Diagnostics (USA), Quidel Corporation (USA), Roche Diagnostics (Switzerland), Siemens Healthineers (Germany), Thermo Fisher Scientific (USA), Thermo Fisher Scientific Inc. (USA), Other key Players, Other Active Players.

Q3: What are the segments of the Rheumatoid Arthritis Diagnostic Test Market?

A3: The Rheumatoid Arthritis Diagnostic Test Market is segmented into Type, End User and region. By Type, the market is categorized into Serology Test( Erythrocyte Sedimentation Rate (ESR) Rheumatoid Factor (RF) Anti-cyclic Citrullinated Peptide (anti-CCP) Antinuclear Antibody (ANA) Uric Acid Other Tests) Monitoring RA Treatment Efficiency Tests( Salicylate Level Count Muscle Enzyme Tests (CPK, Aldolase) Creatinine Test) By End User, the market is categorized into Diagnostic Laboratories ,Private Laboratories ,Public Laboratories ,Ambulatory Surgical Centers, By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Rheumatoid Arthritis Diagnostic Test Market?

A4: The Rheumatoid Arthritis (RA) diagnostics test market encompasses various diagnostic techniques and tools used to detect and monitor the presence of rheumatoid arthritis (RA) in patients. Rheumatoid arthritis is a chronic autoimmune disease characterized by inflammation in the joints, leading to pain, swelling, and potential joint damage. These diagnostic tests help clinicians identify the disease early, assess its severity, and monitor its progression. The market includes laboratory-based blood tests, imaging techniques like X-rays and MRIs, as well as advanced biomarker and genetic tests that help in providing accurate and reliable diagnosis.

Q5: How big is the Rheumatoid Arthritis Diagnostic Test Market?

A5: Rheumatoid Arthritis Diagnostic Test Market Size Was Valued at USD 2,774.0 Million in 2023, and is Projected to Reach USD 3982.035 Million by 2032, Growing at a CAGR of 5.3% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!