Stay Ahead in Fast-Growing Economies.

Browse Reports NowRestaurant POS Software Market-Latest Advancement And Industry Analysis

The Restaurant POS (Point of Sale) Software market has been driven by the increasing adoption of digital solutions by restaurants worldwide. This market offers software systems designed specifically for managing various operations within a restaurant, including order processing, payment processing, inventory management, and customer relationship management.

IMR Group

Description

Restaurant POS Software Market Synopsis

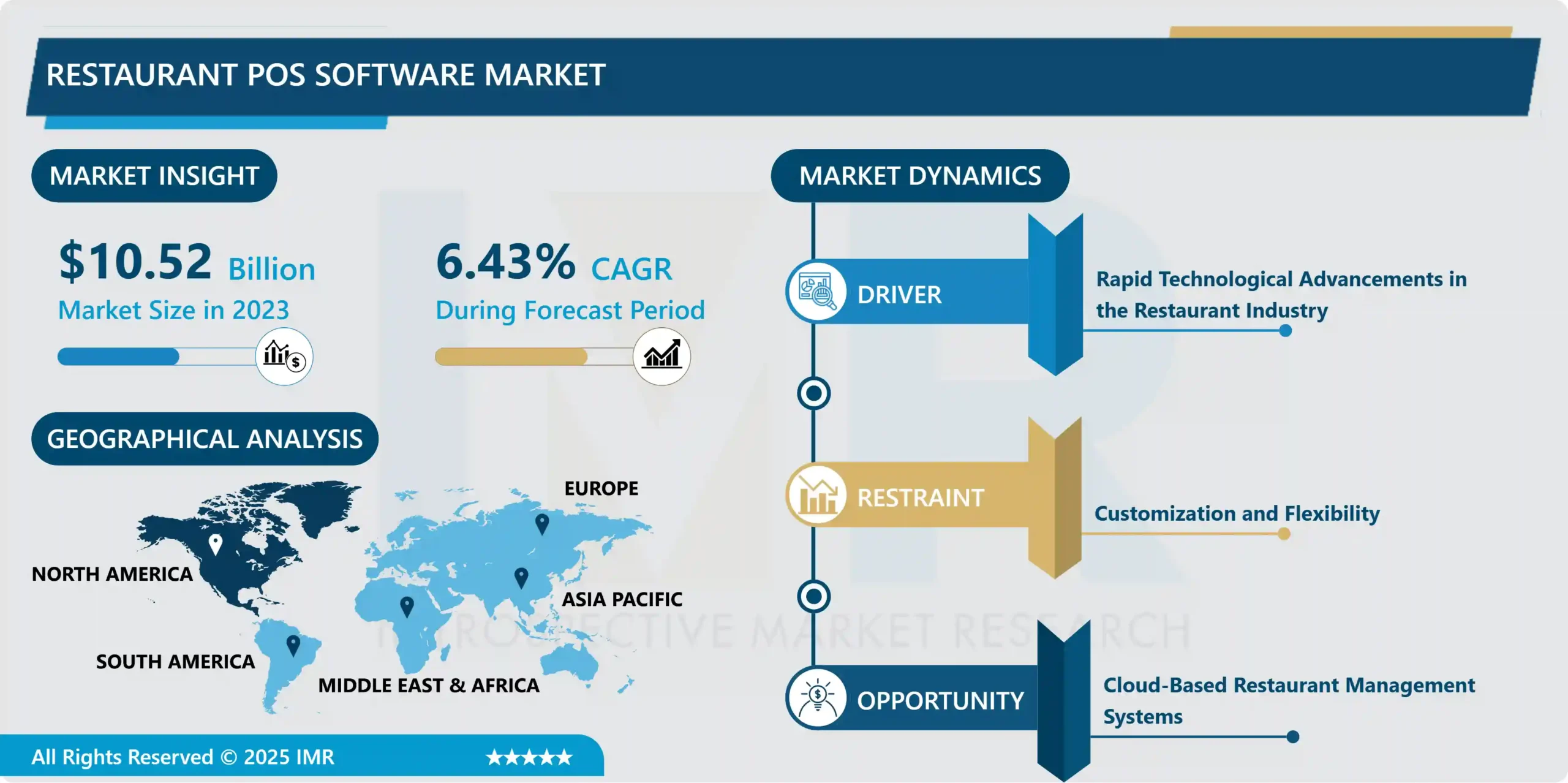

The Restaurant POS Software Market was valued at USD 10.52 billion in 2023 and is projected to reach USD 18.43 billion by 2032, registering a CAGR of 6.43 % from 2024 to 2032.

The Restaurant POS (Point of Sale) Software market has been driven by the increasing adoption of digital solutions by restaurants worldwide. This market offers software systems designed specifically for managing various operations within a restaurant, including order processing, payment processing, inventory management, and customer relationship management.

One of the key drivers of growth in this market is the rising demand for efficient and streamlined operations in the restaurant industry. With the increasing competition and evolving consumer preferences, restaurant owners are increasingly turning to POS software to enhance their operational efficiency, reduce errors, and improve customer satisfaction.

Moreover, the COVID-19 pandemic has further accelerated the adoption of POS software, as restaurants seek contactless and online ordering solutions to comply with social distancing measures and cater to changing consumer behaviors. This has led to a surge in demand for features such as online ordering, delivery management, and curbside pickup integration within POS systems.

The emergence of cloud-based POS solutions has revolutionized the market, offering scalability, flexibility, and accessibility to restaurant owners. Cloud-based POS systems allow restaurants to manage their operations from anywhere with an internet connection, making them particularly attractive for small and medium-sized businesses.

Advancements in technology, such as the integration of artificial intelligence and data analytics capabilities, are driving innovation in the Restaurant POS Software market. These technologies enable restaurants to gain valuable insights into customer behavior, optimize menu offerings, and personalize the dining experience.

Restaurant POS Software Market Trend Analysis

Rapid Technological Advancements in the Restaurant Industry

Technology in the restaurant industry continues to develop rapidly and there is increasing demand for software designed specifically for restaurants-inventory control, table management systems, invoicing software or POS (point of sale) devices. All this bodes well for development of the market itself.

One recent development in order processing procedures has been that restaurant owners can simplify the taking of orders. The accompaniments Of course, this system also checks meal delivery dates and records the inventory.

Whenever there is less than two weeks’ worth of stock for a product, it automatically alerts users that are interested in placing an order to let them know how quickly needs may arise. This correlation is directly related to the restaurant’s point-of-sale system. And it ensures that communication is done effectively and the kitchen can be operated in a sustainable manner.

Cloud-Based Restaurant Management Systems Creates an Opportunity for the Global Restaurant POS Software Market

The increasing awareness of the cloud-based restaurant management systems, particularly in developing economies is stimulating the growth market. Also, onslaught of restaurant point-of sale software in the market is paving way for growth.

Also important market drivers are factors such as rising urbanization, industrialization and number of restaurants and eateries worldwide. Also, collaboratively the enormous presence of most technologically advanced vendors in this market who cater cutting edge technology for their customers and growing personal disposable income are expected to raise CAGRs across developed economies.

Restaurant POS Software Market Segment Analysis:

Restaurant POS Software Market Segmented because of Component, Type, Operating System, Application, Enterprise Size, Deployment Mode and Restaurant Type.

By Deployment Type, the On-premises segment is expected to dominate the market during the forecast period.

On-premises deployments offer a high level of control and customization, allowing businesses to tailor the software to their specific operational needs and integrate it seamlessly with existing infrastructure. This level of customization fosters efficiency and streamlines processes, enhancing overall productivity.

Concerns surrounding data security and compliance are effectively addressed through on-premises solutions, as sensitive customer and transaction data remain within the physical confines of the restaurant’s premises. This provides a sense of assurance to both businesses and their patrons, especially in an era marked by increasing cybersecurity threats and regulatory scrutiny.

For some restaurants, particularly those with limited or unreliable internet connectivity, on-premises solutions represent a more reliable option, ensuring uninterrupted service and transactions even in offline scenarios.

By Application, the Inventory Management segment held the largest share of 34.03% in 2022.

Inventory management is critical for restaurants to control costs, minimize waste, and ensure consistent supply of ingredients. POS software equipped with robust inventory management features enables restaurant owners to track stock levels, monitor ingredient usage in real-time, and automate reordering processes.

By efficiently managing inventory, restaurants can optimize stock levels, reduce overstocking or stockouts, and prevent food spoilage, leading to significant cost savings. Moreover, integrated inventory management streamlines operations by synchronizing inventory data with sales transactions, simplifying accounting processes and enhancing accuracy.

Furthermore, advanced inventory management functionalities offered by POS software allow for comprehensive analytics and reporting, enabling restaurant owners to make data-driven decisions to optimize their supply chain and menu offerings. This segment’s dominance underscores the importance of streamlined inventory operations in maximizing profitability and maintaining competitiveness in the restaurant industry.

Restaurant POS Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

North America is poised to dominate the restaurant POS (Point of Sale) software market for several compelling reasons. Firstly, the region boasts a robust and mature restaurant industry, comprising a diverse array of establishments ranging from quick-service eateries to fine dining restaurants. This diversity creates a substantial demand for POS solutions tailored to varying operational needs.

North America has a high adoption rate of technology in the restaurant sector, driven by a combination of factors such as efficiency demands, customer preferences, and regulatory compliance. This inclination towards technological solutions extends to POS software, which enables restaurants to streamline operations, enhance customer experiences, and gather valuable data for business insights.

Additionally, the region’s advanced infrastructure, including widespread internet connectivity and digital payment systems, further facilitates the adoption and utilization of POS software solutions.

Restaurant POS Software Market Top Key Players:

Oracle (U.S.)

Infor. (U.S.)

Toshiba Tec Corporation (Japan)

SpotOn Transact, LLC (U.S.)

Clover Network, Inc. (U.S.)

Epos Now (U.K.)

eZee BurrP! (India)

Future POS. (U.S.)

Global Retail Technology Limited. (U.K.)

Guest Innovations, Inc. (U.S.)

Kitchen CUT Limited (U.K.)

LimeTray. (India)

Loyverse (U.S.)

Mad Mobile. (U.S.)

PAR Tech (U.S.)

POSitouch (U.S.)

Other Active players

Key Industry Developments in the Restaurant POS Software Market :

In August 2023, Toast the all-in-one technology platform built for restaurants, announced the launch of Toast Catering & Events, a new product fully integrated with the Toast point-of-sale (POS) to help restaurants seamlessly manage large catering orders and event planning. Toast Catering & Events supports customizable banquet event orders (BEO), fulfillment tools, and lead management functionality.

In June 2023, Oracle announced the MICROS Workstation 8 Series, a new restaurant POS workstation that offers modern, powerful hardware that can be configured to meet each restaurant’s unique vibe and space requirements. The slim profile with a 14-inch touchscreen display and platinum finish provides quality and durability in a sleek, ergonomic package, ensuring that restaurants can create a unique dining experience for their customers.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Restaurant POS Software Market by Component (2018-2032)

4.1 Restaurant POS Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hardware

4.5 Services

Chapter 5: Restaurant POS Software Market by Type (2018-2032)

5.1 Restaurant POS Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Terminal POS System

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Tablet POS System

5.5 Mobile POS System

5.6 Online POS System

5.7 Self-Service Kiosk POS System

Chapter 6: Restaurant POS Software Market by Operating System (2018-2032)

6.1 Restaurant POS Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Android

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 MAC

6.5 Dos System

6.6 Windows System

6.7 Linux System

Chapter 7: Restaurant POS Software Market by Application (2018-2032)

7.1 Restaurant POS Software Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Inventory Management

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Employee Clocking

7.5 Tablet Compatibility

7.6 Receipt Printing

7.7 Menu Building

7.8 Accounting Integration

7.9 Credit/Debit Card Processing

Chapter 8: Restaurant POS Software Market by Enterprise Size (2018-2032)

8.1 Restaurant POS Software Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Large Enterprises

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 SME’s

Chapter 9: Restaurant POS Software Market by Deployment Mode (2018-2032)

9.1 Restaurant POS Software Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Cloud

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 On-Premise

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Restaurant POS Software Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 ORACLE (U.S.)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 INFOR. (U.S.)

10.4 TOSHIBA TEC CORPORATION (JAPAN)

10.5 SPOTON TRANSACT

10.6 LLC (U.S.)

10.7 CLOVER NETWORK INC. (U.S.)

10.8 EPOS NOW (U.K.)

10.9 EZEE BURRP! (INDIA)

10.10 FUTURE POS. (U.S.)

10.11 GLOBAL RETAIL TECHNOLOGY LIMITED. (U.K.)

10.12 GUEST INNOVATIONS INC. (U.S.)

10.13 KITCHEN CUT LIMITED (U.K.)

10.14 LIMETRAY. (INDIA)

10.15 LOYVERSE (U.S.)

10.16 MAD MOBILE. (U.S.)

10.17 PAR TECH (U.S.)

10.18 POSITOUCH (U.S.)

10.19

Chapter 11: Global Restaurant POS Software Market By Region

11.1 Overview

11.2. North America Restaurant POS Software Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Component

11.2.4.1 Software

11.2.4.2 Hardware

11.2.4.3 Services

11.2.5 Historic and Forecasted Market Size by Type

11.2.5.1 Terminal POS System

11.2.5.2 Tablet POS System

11.2.5.3 Mobile POS System

11.2.5.4 Online POS System

11.2.5.5 Self-Service Kiosk POS System

11.2.6 Historic and Forecasted Market Size by Operating System

11.2.6.1 Android

11.2.6.2 MAC

11.2.6.3 Dos System

11.2.6.4 Windows System

11.2.6.5 Linux System

11.2.7 Historic and Forecasted Market Size by Application

11.2.7.1 Inventory Management

11.2.7.2 Employee Clocking

11.2.7.3 Tablet Compatibility

11.2.7.4 Receipt Printing

11.2.7.5 Menu Building

11.2.7.6 Accounting Integration

11.2.7.7 Credit/Debit Card Processing

11.2.8 Historic and Forecasted Market Size by Enterprise Size

11.2.8.1 Large Enterprises

11.2.8.2 SME’s

11.2.9 Historic and Forecasted Market Size by Deployment Mode

11.2.9.1 Cloud

11.2.9.2 On-Premise

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Restaurant POS Software Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Component

11.3.4.1 Software

11.3.4.2 Hardware

11.3.4.3 Services

11.3.5 Historic and Forecasted Market Size by Type

11.3.5.1 Terminal POS System

11.3.5.2 Tablet POS System

11.3.5.3 Mobile POS System

11.3.5.4 Online POS System

11.3.5.5 Self-Service Kiosk POS System

11.3.6 Historic and Forecasted Market Size by Operating System

11.3.6.1 Android

11.3.6.2 MAC

11.3.6.3 Dos System

11.3.6.4 Windows System

11.3.6.5 Linux System

11.3.7 Historic and Forecasted Market Size by Application

11.3.7.1 Inventory Management

11.3.7.2 Employee Clocking

11.3.7.3 Tablet Compatibility

11.3.7.4 Receipt Printing

11.3.7.5 Menu Building

11.3.7.6 Accounting Integration

11.3.7.7 Credit/Debit Card Processing

11.3.8 Historic and Forecasted Market Size by Enterprise Size

11.3.8.1 Large Enterprises

11.3.8.2 SME’s

11.3.9 Historic and Forecasted Market Size by Deployment Mode

11.3.9.1 Cloud

11.3.9.2 On-Premise

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Restaurant POS Software Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Component

11.4.4.1 Software

11.4.4.2 Hardware

11.4.4.3 Services

11.4.5 Historic and Forecasted Market Size by Type

11.4.5.1 Terminal POS System

11.4.5.2 Tablet POS System

11.4.5.3 Mobile POS System

11.4.5.4 Online POS System

11.4.5.5 Self-Service Kiosk POS System

11.4.6 Historic and Forecasted Market Size by Operating System

11.4.6.1 Android

11.4.6.2 MAC

11.4.6.3 Dos System

11.4.6.4 Windows System

11.4.6.5 Linux System

11.4.7 Historic and Forecasted Market Size by Application

11.4.7.1 Inventory Management

11.4.7.2 Employee Clocking

11.4.7.3 Tablet Compatibility

11.4.7.4 Receipt Printing

11.4.7.5 Menu Building

11.4.7.6 Accounting Integration

11.4.7.7 Credit/Debit Card Processing

11.4.8 Historic and Forecasted Market Size by Enterprise Size

11.4.8.1 Large Enterprises

11.4.8.2 SME’s

11.4.9 Historic and Forecasted Market Size by Deployment Mode

11.4.9.1 Cloud

11.4.9.2 On-Premise

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Restaurant POS Software Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Component

11.5.4.1 Software

11.5.4.2 Hardware

11.5.4.3 Services

11.5.5 Historic and Forecasted Market Size by Type

11.5.5.1 Terminal POS System

11.5.5.2 Tablet POS System

11.5.5.3 Mobile POS System

11.5.5.4 Online POS System

11.5.5.5 Self-Service Kiosk POS System

11.5.6 Historic and Forecasted Market Size by Operating System

11.5.6.1 Android

11.5.6.2 MAC

11.5.6.3 Dos System

11.5.6.4 Windows System

11.5.6.5 Linux System

11.5.7 Historic and Forecasted Market Size by Application

11.5.7.1 Inventory Management

11.5.7.2 Employee Clocking

11.5.7.3 Tablet Compatibility

11.5.7.4 Receipt Printing

11.5.7.5 Menu Building

11.5.7.6 Accounting Integration

11.5.7.7 Credit/Debit Card Processing

11.5.8 Historic and Forecasted Market Size by Enterprise Size

11.5.8.1 Large Enterprises

11.5.8.2 SME’s

11.5.9 Historic and Forecasted Market Size by Deployment Mode

11.5.9.1 Cloud

11.5.9.2 On-Premise

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Restaurant POS Software Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Component

11.6.4.1 Software

11.6.4.2 Hardware

11.6.4.3 Services

11.6.5 Historic and Forecasted Market Size by Type

11.6.5.1 Terminal POS System

11.6.5.2 Tablet POS System

11.6.5.3 Mobile POS System

11.6.5.4 Online POS System

11.6.5.5 Self-Service Kiosk POS System

11.6.6 Historic and Forecasted Market Size by Operating System

11.6.6.1 Android

11.6.6.2 MAC

11.6.6.3 Dos System

11.6.6.4 Windows System

11.6.6.5 Linux System

11.6.7 Historic and Forecasted Market Size by Application

11.6.7.1 Inventory Management

11.6.7.2 Employee Clocking

11.6.7.3 Tablet Compatibility

11.6.7.4 Receipt Printing

11.6.7.5 Menu Building

11.6.7.6 Accounting Integration

11.6.7.7 Credit/Debit Card Processing

11.6.8 Historic and Forecasted Market Size by Enterprise Size

11.6.8.1 Large Enterprises

11.6.8.2 SME’s

11.6.9 Historic and Forecasted Market Size by Deployment Mode

11.6.9.1 Cloud

11.6.9.2 On-Premise

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Restaurant POS Software Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Component

11.7.4.1 Software

11.7.4.2 Hardware

11.7.4.3 Services

11.7.5 Historic and Forecasted Market Size by Type

11.7.5.1 Terminal POS System

11.7.5.2 Tablet POS System

11.7.5.3 Mobile POS System

11.7.5.4 Online POS System

11.7.5.5 Self-Service Kiosk POS System

11.7.6 Historic and Forecasted Market Size by Operating System

11.7.6.1 Android

11.7.6.2 MAC

11.7.6.3 Dos System

11.7.6.4 Windows System

11.7.6.5 Linux System

11.7.7 Historic and Forecasted Market Size by Application

11.7.7.1 Inventory Management

11.7.7.2 Employee Clocking

11.7.7.3 Tablet Compatibility

11.7.7.4 Receipt Printing

11.7.7.5 Menu Building

11.7.7.6 Accounting Integration

11.7.7.7 Credit/Debit Card Processing

11.7.8 Historic and Forecasted Market Size by Enterprise Size

11.7.8.1 Large Enterprises

11.7.8.2 SME’s

11.7.9 Historic and Forecasted Market Size by Deployment Mode

11.7.9.1 Cloud

11.7.9.2 On-Premise

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

Q1: What would be the forecast period in the Global Restaurant POS Software Market research report?

A1: The forecast period in the Global Restaurant POS Software Market research report is 2024-2032.

Q2: Who are the key players in the Global Restaurant POS Software Market?

A2: Oracle (U.S.), Infor (U.S.), Toshiba Tec Corporation (Japan), SpotOn Transact LLC (U.S.), Clover Network Inc. (U.S.), Epos Now (U.K.), eZee BurrP! (India), Future POS (U.S.), Global Retail Technology Limited (U.K.), Guest Innovations Inc. (U.S.), Kitchen CUT Limited (U.K.), LimeTray (India), Loyverse (U.S.), Mad Mobile (U.S.), PAR Tech (U.S.), POSitouch (U.S.) and Other Active Players.

Q3: What are the segments of the Global Restaurant POS Software Market?

A3: Global Restaurant POS Software Market Segmented because of Component, Type, Operating System, Application, Enterprise Size, Deployment Mode and Restaurant Type. By Component, the market is categorized into Software, Hardware, Services. By Type, the market is categorized into Terminal POS System, Tablet POS System, Mobile POS Systems, Online POS System, Self-Service Kiosk POS System. By, Operating System, the market is categorized into Android, MAC, DOS System, Windows System, Linux System. By Application, the market is categorized into Inventory Management, Employee Clocking, Tablet Compatibility, Receipt Printing, Menu Building, Accounting Integration, Credit/Debit Card Processing. By Enterprise Size, the market is categorized into Large Enterprises and SME’s. By Deployment Mode, the market is categorized into Cloud and On-Premise. By Restaurant Type, the market is categorized into Full Service Restaurants (FSR) and Quick Service Restaurants (QSR). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Global Restaurant POS Software Market?

A4: The Restaurant POS (Point of Sale) Software market has been driven by the increasing adoption of digital solutions by restaurants worldwide. This market offers software systems designed specifically for managing various operations within a restaurant, including order processing, payment processing, inventory management, and customer relationship management.

Q5: How big is the Global Restaurant POS Software Market?

A5: The Restaurant POS Software Market was valued at USD 10.52 billion in 2023 and is projected to reach USD 18.43 billion by 2032, registering a CAGR of 6.43 % from 2024 to 2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!