Stay Ahead in Fast-Growing Economies.

Browse Reports NowReady-to-Eat Food Packaging Market -Comprehensive Study Report & Recent Trends 2025-2032

Ready-to-eat food packaging refers to the materials and processes used to encase and seal pre-cooked or prepared food items for direct consumption without further cooking or heating. This type of packaging ensures the preservation of freshness, flavor, and quality while providing convenience for consumers who seek quick and effortless meal solutions.

IMR Group

Description

Ready-to-Eat Food Packaging Market Synopsis

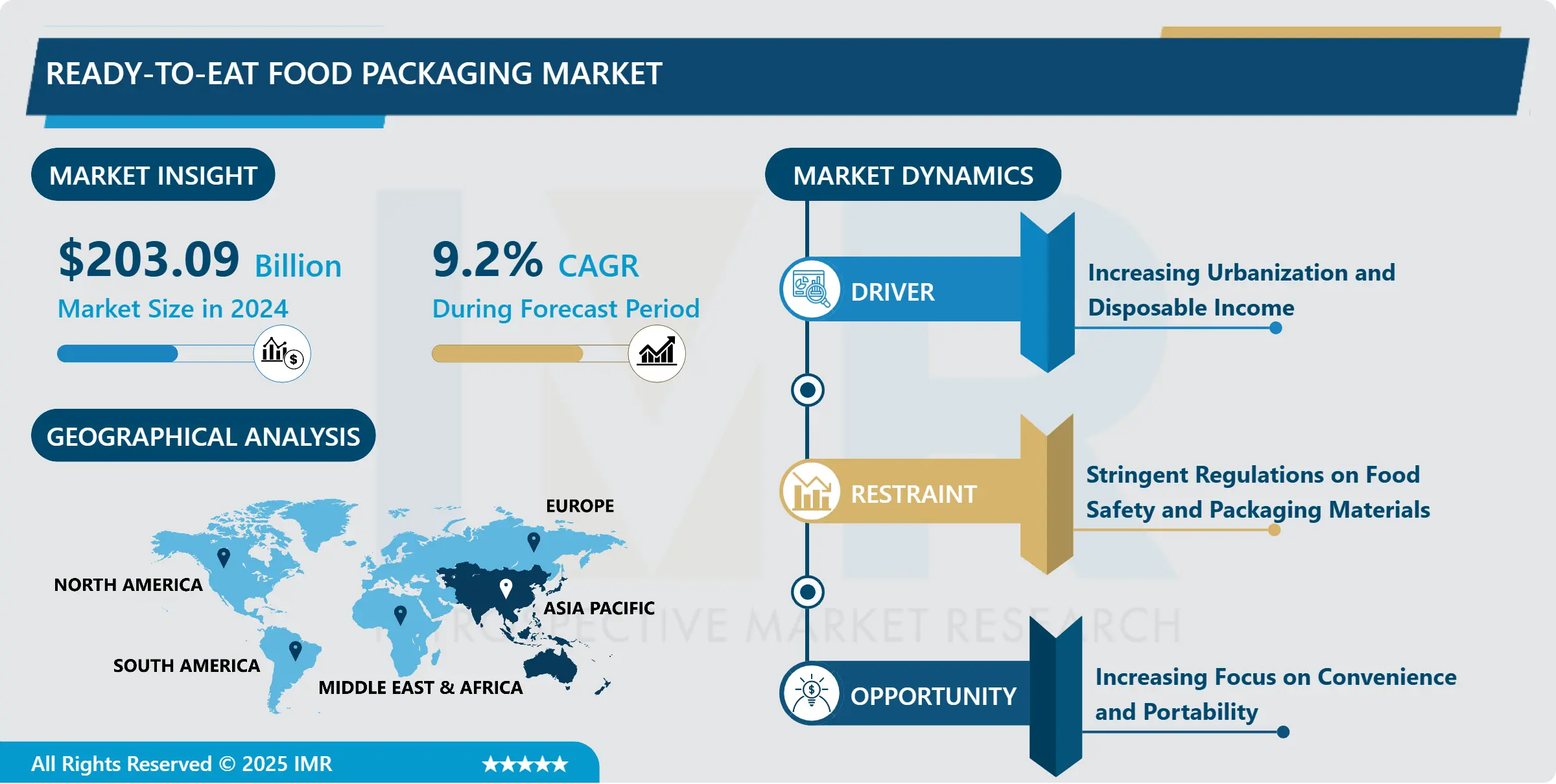

Ready-To-Eat Food Market Size Was Valued at USD 203.09 Billion in 2024 and is Projected to Reach USD 410.65 Billion by 2032, Growing at a CAGR of 9.2% From 2025-2032.

Ready-to-eat food packaging refers to the materials and processes used to encase and seal pre-cooked or prepared food items for direct consumption without further cooking or heating. This type of packaging ensures the preservation of freshness, flavor, and quality while providing convenience for consumers who seek quick and effortless meal solutions.

Ready-to-eat food packaging is utilized across diverse segments of the food industry, facilitating the storage, transit, and consumption of precooked or prepared food items. It caters to a broad spectrum of products, including salads, sandwiches, ready meals, snacks, and desserts. This packaging plays a pivotal role in ensuring food safety and quality while accommodating the demands of busy lifestyles, rendering it indispensable for on-the-go consumption, catering services, and retail establishments.

It heightens convenience for consumers by obviating the need for meal preparation or cooking, thus saving time and effort prolonging the shelf life of food items, curbing food wastage, and enabling retailers to furnish a wider array of fresh, ready-to-eat choices. Furthermore, ready-to-eat packaging facilitates portion control and packaging, assisting consumers in managing their dietary intake and fostering healthier eating habits.

The future demand for ready-to-eat food packaging is poised for substantial expansion. With urbanization and hectic lifestyles gaining traction globally, there is a growing reliance on convenient food solutions. Additionally, burgeoning trends such as online food delivery services and grab-and-go food options are propelling the demand for ready-to-eat packaging. Moreover, anticipated advancements in packaging technology, encompassing sustainable and eco-friendly materials, intelligent packaging solutions, and fortified barrier properties, are expected to fuel market growth, meeting the evolving needs of consumers and food enterprises alike.

Ready-to-Eat Food Packaging Market Trend Analysis

Increasing Urbanization and Disposable Income

The growth of the Ready-to-Eat Food Packaging Market is propelled by the increasing pace of urbanization and the upward trend in disposable income levels. As individuals flock to urban centers in search of improved job prospects and lifestyle amenities, there emerges a heightened demand for convenient food options that seamlessly fit into bustling urban routines. Ready-to-eat food packaging addresses this need by providing quick and effortless meal choices that necessitate minimal preparation or cooking, perfectly suiting the time constraints and preferences of city dwellers.

Furthermore, the rise in disposable income levels among urban residents amplifies the adoption of ready-to-eat food packaging. With enhanced purchasing power, consumers are inclined towards convenient food selections that offer a blend of convenience, diversity, and quality. Ready-to-eat food packaging empowers consumers to enjoy a broad spectrum of freshly prepared meals, snacks, and desserts without compromising on taste or nutritional value.

Moreover, as urbanization continues to surge worldwide, particularly in emerging economies, the demand for ready-to-eat food packaging is anticipated to witness sustained expansion. The convenience and adaptability inherent in ready-to-eat meals appeal not only to urban professionals but also to busy families and individuals in search of convenient meal solutions. Manufacturers and retailers are channeling investments into pioneering packaging solutions to meet this burgeoning market demand, fostering further proliferation and advancement of the Ready-to-Eat Food Packaging Market.

Increasing Focus on Convenience and Portability

The Ready-to-Eat Food Packaging Market is poised for significant expansion due to the increasing focus on convenience and portability. With lifestyles becoming busier, consumers are in search of food options that offer ease of consumption on the go. Ready-to-eat food packaging capitalizes on this trend by providing pre-prepared meals and snacks that require minimal effort and are conveniently portable, allowing consumers to enjoy them anywhere, at any time.

Moreover, the demand for convenience extends beyond traditional meal times, with consumers seeking quick and hassle-free options for snacking and light meals throughout the day. Ready-to-eat food packaging addresses this need by offering a diverse range of portable and portion-controlled snacks and meals that seamlessly integrate into busy schedules. Whether it’s a quick bite during a commute or a ready-made meal for a lunch break, the convenience and portability of these packaged foods make them highly appealing to consumers.

Furthermore, the focus on convenience and portability is driving innovation in ready-to-eat food packaging, with manufacturers continuously developing new packaging solutions to enhance freshness, convenience, and user-friendliness. These innovations range from resealable packaging for snacks to microwaveable containers for ready meals, catering to the evolving preferences of modern consumers. As consumer demand for convenience-driven food choices continues to grow.

Ready-to-Eat Food Packaging Market Segment Analysis:

Ready-to-Eat Food Packaging Market Segmented on the basis of Type, Packaging Type, Packaging Material and Region.

By Type, Vegetable-based segment is expected to dominate the market during the forecast period

The dominance of the Ready-to-Eat Food Packaging Market by the Vegetable-based segment is expected, driven by the increasing consumer inclination towards healthier and plant-based food choices. As awareness about the health benefits linked with vegetable consumption grows, there’s a rising demand for conveniently packaged, ready-to-eat vegetable-based meals and snacks. This segment encompasses a diverse range of options, including salads, vegetable bowls, and plant-based snacks, appealing to health-conscious individuals seeking nutritious on-the-go options.

Furthermore, the surge in sustainability awareness and environmental consciousness further propels the growth of the Vegetable-based segment. Packaging materials derived from vegetables, such as biodegradable plastics and plant-based packaging, are gaining popularity as consumers prioritize eco-friendly alternatives. With escalating concerns surrounding plastic waste and environmental harm, vegetable-based packaging aligns perfectly with the increasing demand for sustainable packaging solutions.

By Packaging Type, Retort Pouches segment held the largest share in 2024

The Retort Pouches segment emerges as the primary driver of growth in the Ready-to-Eat Food Packaging Market. This segment’s dominance stems from the versatile and convenient packaging solutions it provides for a wide array of ready-to-eat food products. Retort pouches are engineered to endure high temperatures during sterilization, ensuring the safety and prolonged shelf life of packaged foods while preserving taste and quality.

Furthermore, the lightweight and portable nature of retort pouches make them highly favored, enabling hassle-free consumption on-the-go and effortless storage. These pouches serve as a convenient packaging option for an extensive range of ready-to-eat meals, spanning soups, curries, meats, and seafood, effectively catering to the diverse preferences of consumers. With their unparalleled ability to uphold the freshness and flavor of packaged foods, retort pouches are poised to retain their supremacy in the Ready-to-Eat Food Packaging Market, effectively addressing the evolving demands of contemporary consumers.

Ready-to-Eat Food Packaging Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

Asia Pacific is poised to lead the expansion of the Ready-to-Eat Food Packaging market. This forecast is supported by various factors, including the region’s expanding population, rapid urbanization, and evolving consumer preferences toward convenient food options. As urban areas grow and lifestyles become busier, there is a rising demand for easily accessible ready-to-eat meals. Ready-to-eat food packaging meets this demand by providing a wide range of conveniently packaged meals and snacks that require minimal preparation.

Furthermore, the rising disposable incomes in emerging economies throughout the Asia Pacific region amplify the demand for ready-to-eat food products and their associated packaging. With increased purchasing power, consumers gravitate towards convenient food choices, propelling the growth of the Ready-to-Eat Food Packaging market. Additionally, the presence of prominent market players, combined with ongoing investments in food processing infrastructure and advancements in packaging technology, is anticipated to reinforce Asia Pacific’s dominance in the Ready-to-Eat Food Packaging market.

Ready-to-Eat Food Packaging Market Top Key Players:

General Mills, Inc (U.S.)

ConAgra Foods Inc. (U.S.)

The Kraft Heinz Company (U.S.)

Mars, Incorporated (U.S.)

Tyson Foods, Inc. (U.S.)

Kellogg Company (U.S.)

Campbell Soup Company (U.S.)

McCain Foods (Canada)

Bakkavor Foods Ltd (UK)

Nomad Foods Ltd. (UK)

JBS S.A. (Brazil)

Premier Foods Group Ltd. (UK)

Greencore Group Plc. (Ireland)

Unilever (Netherlands)

Orkla ASA (Norway)

ITC Limited (India)

Other Active Players

Key Industry Developments in the Ready-to-Eat Food Packaging Market:

In February 2024, Antalis agreed to acquire the packaging company Pakella + Aper and an industrial packaging company. Antalis signed a binding agreement to acquire fellow packaging business Pakella. Pakella was reportedly one of the leading distributors and manufacturers of made-to-measure industrial and food packaging in the Baltic region, with a turnover of €15m ($16.20m).

In February 2024, Mother’s Recipe unveiled a modern packaging for its Ready to Cook range. The new design embodied a modern look, setting a fresh and vibrant tone for the range while aligning with the brand’s values and commitments to authenticity, innovation, and consumer well-being. The revised packaging featured bright background colors in a matte finish, with green for all vegetarian variants, pink for all non-vegetarian variants, yellow for regional variants, and purple for seafood variants.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ready-to-Eat Food Packaging Market by Type (2018-2032)

4.1 Ready-to-Eat Food Packaging Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Vegetable-based

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cereal-based

4.5 Meat/Poultry

Chapter 5: Ready-to-Eat Food Packaging Market by Application (2018-2032)

5.1 Ready-to-Eat Food Packaging Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Retort Pouches

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Chilled or Frozen

5.5 Canned

5.6 Thermoformed Trays

Chapter 6: Ready-to-Eat Food Packaging Market by Packaging Material (2018-2032)

6.1 Ready-to-Eat Food Packaging Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Plastics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Paper & Paperboard

6.5 Metal

6.6 Glass

Chapter 7: Ready-to-Eat Food Packaging Market by Distribution Channel (2018-2032)

7.1 Ready-to-Eat Food Packaging Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Specialty Store

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Departmental/Convenience Store

7.5 Hypermarket/Supermarket

7.6 Online Retail

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Ready-to-Eat Food Packaging Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 HITACHI VANTARA (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 IBM CORPORATION (U.S.)

8.4 MICROSOFT (U.S.)

8.5 DELL TECHNOLOGIES (U.S.)

8.6 ZADARA STORAGE (U.S.)

8.7 BACKBLAZE (U.S.)

8.8 CLOUDIAN (U.S.)

8.9 VERITAS TECHNOLOGIES LLC (U.S.)

8.10 QUANTUM CORPORATION (U.S.)

8.11 AWS (U.S.)

8.12 NETAPP (U.S.)

8.13 HPE (U.S.)

8.14 AT&T (U.S.)

8.15 TECHTARGET (U.S.)

8.16 PURE STORAGE (U.S.)

8.17 DELL TECHNOLOGIES (U.S.)

8.18 RACKSPACE INC. (U.S.)

8.19

Chapter 9: Global Ready-to-Eat Food Packaging Market By Region

9.1 Overview

9.2. North America Ready-to-Eat Food Packaging Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Vegetable-based

9.2.4.2 Cereal-based

9.2.4.3 Meat/Poultry

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Retort Pouches

9.2.5.2 Chilled or Frozen

9.2.5.3 Canned

9.2.5.4 Thermoformed Trays

9.2.6 Historic and Forecasted Market Size by Packaging Material

9.2.6.1 Plastics

9.2.6.2 Paper & Paperboard

9.2.6.3 Metal

9.2.6.4 Glass

9.2.7 Historic and Forecasted Market Size by Distribution Channel

9.2.7.1 Specialty Store

9.2.7.2 Departmental/Convenience Store

9.2.7.3 Hypermarket/Supermarket

9.2.7.4 Online Retail

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Ready-to-Eat Food Packaging Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Vegetable-based

9.3.4.2 Cereal-based

9.3.4.3 Meat/Poultry

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Retort Pouches

9.3.5.2 Chilled or Frozen

9.3.5.3 Canned

9.3.5.4 Thermoformed Trays

9.3.6 Historic and Forecasted Market Size by Packaging Material

9.3.6.1 Plastics

9.3.6.2 Paper & Paperboard

9.3.6.3 Metal

9.3.6.4 Glass

9.3.7 Historic and Forecasted Market Size by Distribution Channel

9.3.7.1 Specialty Store

9.3.7.2 Departmental/Convenience Store

9.3.7.3 Hypermarket/Supermarket

9.3.7.4 Online Retail

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Ready-to-Eat Food Packaging Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Vegetable-based

9.4.4.2 Cereal-based

9.4.4.3 Meat/Poultry

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Retort Pouches

9.4.5.2 Chilled or Frozen

9.4.5.3 Canned

9.4.5.4 Thermoformed Trays

9.4.6 Historic and Forecasted Market Size by Packaging Material

9.4.6.1 Plastics

9.4.6.2 Paper & Paperboard

9.4.6.3 Metal

9.4.6.4 Glass

9.4.7 Historic and Forecasted Market Size by Distribution Channel

9.4.7.1 Specialty Store

9.4.7.2 Departmental/Convenience Store

9.4.7.3 Hypermarket/Supermarket

9.4.7.4 Online Retail

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Ready-to-Eat Food Packaging Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Vegetable-based

9.5.4.2 Cereal-based

9.5.4.3 Meat/Poultry

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Retort Pouches

9.5.5.2 Chilled or Frozen

9.5.5.3 Canned

9.5.5.4 Thermoformed Trays

9.5.6 Historic and Forecasted Market Size by Packaging Material

9.5.6.1 Plastics

9.5.6.2 Paper & Paperboard

9.5.6.3 Metal

9.5.6.4 Glass

9.5.7 Historic and Forecasted Market Size by Distribution Channel

9.5.7.1 Specialty Store

9.5.7.2 Departmental/Convenience Store

9.5.7.3 Hypermarket/Supermarket

9.5.7.4 Online Retail

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Ready-to-Eat Food Packaging Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Vegetable-based

9.6.4.2 Cereal-based

9.6.4.3 Meat/Poultry

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Retort Pouches

9.6.5.2 Chilled or Frozen

9.6.5.3 Canned

9.6.5.4 Thermoformed Trays

9.6.6 Historic and Forecasted Market Size by Packaging Material

9.6.6.1 Plastics

9.6.6.2 Paper & Paperboard

9.6.6.3 Metal

9.6.6.4 Glass

9.6.7 Historic and Forecasted Market Size by Distribution Channel

9.6.7.1 Specialty Store

9.6.7.2 Departmental/Convenience Store

9.6.7.3 Hypermarket/Supermarket

9.6.7.4 Online Retail

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Ready-to-Eat Food Packaging Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Vegetable-based

9.7.4.2 Cereal-based

9.7.4.3 Meat/Poultry

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Retort Pouches

9.7.5.2 Chilled or Frozen

9.7.5.3 Canned

9.7.5.4 Thermoformed Trays

9.7.6 Historic and Forecasted Market Size by Packaging Material

9.7.6.1 Plastics

9.7.6.2 Paper & Paperboard

9.7.6.3 Metal

9.7.6.4 Glass

9.7.7 Historic and Forecasted Market Size by Distribution Channel

9.7.7.1 Specialty Store

9.7.7.2 Departmental/Convenience Store

9.7.7.3 Hypermarket/Supermarket

9.7.7.4 Online Retail

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Ready-to-Eat Food Packaging Market research report?

A1: The forecast period in the Ready-to-Eat Food Packaging Market research report is 2025-2032.

Q2: Who are the key players in the Ready-to-Eat Food Packaging Market?

A2: General Mills, Inc. (U.S.), ConAgra Foods Inc. (U.S.), The Kraft Heinz Company (U.S.), Mars, Incorporated (U.S.), Tyson Foods, Inc. (U.S.), Kellogg Company (U.S.), Campbell Soup Company (U.S.), McCain Foods (Canada), Bakkavor Foods Ltd (UK), Nomad Foods Ltd. (UK), JBS S.A. (Brazil), Premier Foods Group Ltd. (UK), Greencore Group Plc. (Ireland),Unilever (Netherlands), Orkla ASA (Norway), ITC Limited (India), and Other Active Players.

Q3: What are the segments of the Ready-to-Eat Food Packaging Market?

A3: The Ready-to-Eat Food Packaging Market is segmented into Type, Packaging Type, Packaging Material, Distribution Channel, and Region. By Type, the market is categorized into Vegetable-based, Cereal-based, and Meat/Poultry. By Packaging Type, the market is categorized into XXX. By Packaging Material, the market is categorized into Plastics, Paper & Paperboard, Metal, and Glass. By Distribution Channel, the market is categorized into Specialty Store, Departmental/Convenience Store, Hypermarket/Supermarket, and Online Retail. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; ; Spain; Rest of Western Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil; Argentina, etc.).

Q4: What is the Ready-to-Eat Food Packaging Market?

A4: Ready-to-eat food packaging refers to the materials and processes used to encase and seal pre-cooked or prepared food items for direct consumption without further cooking or heating. This type of packaging ensures the preservation of freshness, flavor, and quality while providing convenience for consumers who seek quick and effortless meal solutions.

Q5: How big is the Ready-to-Eat Food Packaging Market?

A5: Ready-To-Eat Food Market Size Was Valued at USD 203.09 Billion in 2024 and is Projected to Reach USD 410.65 Billion by 2032, Growing at a CAGR of 9.2% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!