Stay Ahead in Fast-Growing Economies.

Browse Reports NowRadiation Dose Management Service Market Size, Share, Report

The Radiation Dose Management Service Market refers to the sector that provides tools, technologies, and services aimed at monitoring, recording, and managing the exposure to ionizing radiation within healthcare settings. This market encompasses software solutions for dose tracking, regulatory compliance, and optimization of radiation used in medical imaging and therapy, as well as consulting and training services to ensure the safe and effective use of radiological procedures. The primary goal of these services is to enhance patient safety, improve clinical outcomes, and ensure adherence to stringent regulatory standards by minimizing unnecessary radiation exposure and optimizing necessary doses.

IMR Group

Description

Radiation Dose Management Service Market Synopsis

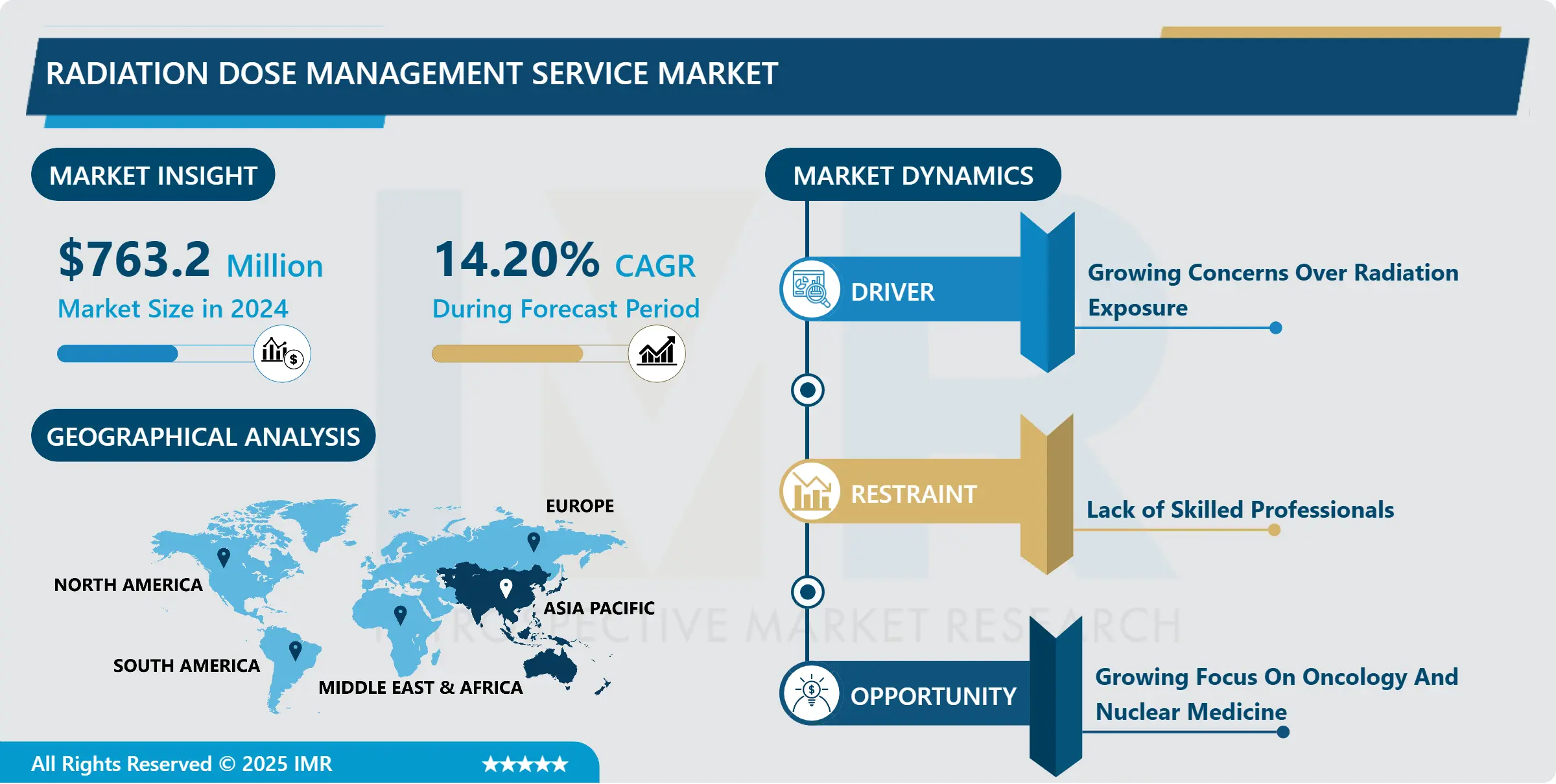

Radiation Dose Management Service Market Size Was Valued at USD 763.2 Million in 2024, and is Projected to Reach USD 2207.84 Million by 2032, Growing at a CAGR of 14.20% From 2025-2032.

The Radiation Dose Management Service Market refers to the sector that provides tools, technologies, and services aimed at monitoring, recording, and managing the exposure to ionizing radiation within healthcare settings. This market encompasses software solutions for dose tracking, regulatory compliance, and optimization of radiation used in medical imaging and therapy, as well as consulting and training services to ensure the safe and effective use of radiological procedures. The primary goal of these services is to enhance patient safety, improve clinical outcomes, and ensure adherence to stringent regulatory standards by minimizing unnecessary radiation exposure and optimizing necessary doses.

The Radiation Dose Management Service Market is a rapidly expanding market because there is more adoption and emphasis given to the fact that there can be serious complications by being exposed to radiation in hospitals and other related medical facilities. This market is of strategic importance for Radiant due to the growing demand for enhancing patient safety and meeting regulatory demands in diagnostic imaging practices. Radiation dose management solutions are having steady growth in utilization in the sector to help assess and address patients’ radiation doses in diagnosis and therapeutic procedures. These apply assistance in averting radiation-related diseases hence offering better patients’ care without boosting radiation impact.

Technological developments are among the significant determinants that contribute to the growth of the radiation dose management service market. The combination of utilizing enhanced software applications as well as medical imaging devices allows for the monitoring and analysis of cumulative radiation doses in real-time. It can also help control radiation exposure by providing better information to help in selecting and optimizing procedures that produce the best diagnostic results. Furthermore, the adoption of eHealth in the format of electronic health records empowers dose management systems to be integrated into the current systems thus improving accurate and proper data sharing among the medical professionals.

Administrations in various parts of the world are upping the standards that medical practitioners are required to follow to utilize radiation appropriately. These regulations remain key contributors to the uptake of radiation dose management services due to compliance factors. The market is also achieving steady growth in spending on healthcare infrastructure and steady experience of entities related to chronic diseases that demand the implementation of regular imaging examinations. In addition, managing patient expectations regarding radiation risks is also demanding attention as patients are more informed and sensitive towards radiation exposure, thus exerting pressure on healthcare providers to implement dose management systems to sustain market competitiveness and consumer confidence.

They can be described as possessing several principal members who are involved in the global market of medical devices and hardware along with some dedicated software developers. These companies are keenly indulged in different strategies to increase their product portfolio and increase their market share some of them are merger-allied or acquisition-allied strategies. Ongoing advances in research and development ensure that newer, enhanced systems that can better facilitate effective dose management and easier use are developed, thus contributing to sustainable market growth. In summary, this LM seeks to conclude that the radiation dose management service market will grow strongly bolstered by technological advancement, certifications, and rising health consciousness among the global populace.

Radiation Dose Management Service Market Trend Analysis

Rising Usage of Diagnostic Imaging and the Necessity of Effective Radiation Dose Management

The increase in the number of diagnostic imaging procedures as per capita health expenditure including Computerized Tomography (CT) scans, X-rays, Nuclear Medicine, etc. is adding a lot of value to the global radiation dose management market. These imaging techniques are considered one of the most important tools of modern diagnostics and therapy, providing invaluable information about the human body and its functions necessary for correct diagnostics of the diseases and development of efficient treatment strategies. However, very few of them are applied with ionizing radiation that in the case of insufficient precautions can harm the health of the patient. The use of these techniques has therefore risen, and this has in turn led to the need to determine doses that are safe for patient radiation exposure. The process of radiation management assists in providing the exact amount of Radiation that is required to aid the diagnostic process while avoiding the negative consequences that are associated with radiation exposure.

Also, there is an increasing trend of using these imaging modalities and this led to concerns from regulatory authorities hence policies on radiation protection standards were developed. Many countries like the United States which has the Food and Drug Administration (FDA) European Commission and many others have set standards and Slegislation that dictate how much radiation people are exposed to. The entropy of these regulations makes it necessary for healthcare facilities to employ new technology in the management of radiation doses. These systems are not only invaluable in the area of patient safety by minimizing patients’ risk of exposure but also assist healthcare facilities in evading fines and improving their general quality of service. Inevitably, radiation dose management solutions have emerged as essential tools in the clinical pathways reflected in the functional models of hospitals and diagnostic centers as a means to promote patient protection and ensure compliance with regulatory requirements.

Patient Safety and Regulatory Compliance

Radiation safety has become an increasingly significant concern within medical imaging, and to combat the risks, appropriate measures have been put in place to regulate these hazards. It is therefore cumbersome to name a single regulation but an example of the existing legislation includes the European Directive 2013/59/Euratom which regulates radiation exposure to protect patients in the member countries of the European Union. This directive has led to the adoption of radiation dose management solutions from across Europe to ensure that patients’ exposure meets or is even lower than these set standards. These solutions will allow healthcare facilities to manage and control radiation doses to patients to achieve the minimum necessary dose for diagnosis. This regulatory framework has not just only benefitted the patient by increasing his or her safety, but also has improved the overall culture of learning and being answerable and responsible in institutions of healthcare.

In a similar manner, positive and sound regulatory scenarios along with increasing awareness of potential hazards of radiation exposure influence the market of radiation dose management in the United States. The approvals themselves, particularly by the U. S. Food and Drug Administration (FDA), elaborate strategies that denote careful dose prescription and patient protection. These regulations call for the use of dose control systems to meet federal and state recommendations. Growing tendencies of the population to endeavor health risks associated with high levels of ionizing radiation exposure, including the emergence of cancer, has also contributed to the increased public expectations regarding patients’ radiation doses as well as greater attention to the question of dose optimization in medical practice. As a result, healthcare providers, particularly hospitals and diagnostic centers, are applying stringent standards about dose management technology solutions in a bid to meet the laid down standards and regulations, ensure ultimate patient safety, and generally upgrade healthcare standards.

Radiation Dose Management Service Market Segment Analysis:

The radiation Dose Management Service Market is Segmented based on Product & Services, Modality, Mode of Deployment, Revenue Model, Application, End-User, and Region.

By Modality, Computed Tomography segment is expected to dominate the market during the forecast period

Computed Tomography (CT) stands as the cornerstone of modern medical imaging, holding a dominant position among imaging modalities due to its versatility and diagnostic efficacy. CT scans are extensively utilized across a spectrum of medical disciplines, ranging from routine diagnostic evaluations to complex surgical planning. The ability of CT imaging to provide detailed cross-sectional images of internal structures with exceptional clarity makes it indispensable in diagnosing a myriad of conditions, including traumatic injuries, cancers, and vascular diseases. As a result, healthcare providers rely heavily on CT scans for accurate disease detection, treatment monitoring, and intervention guidance, cementing its status as the dominant imaging modality in contemporary medical practice.

The widespread adoption of CT imaging brings forth the imperative need for effective dose management strategies to mitigate the potential risks associated with ionizing radiation exposure. Given the relatively higher radiation doses delivered during CT scans compared to other imaging modalities, ensuring patient safety while maintaining diagnostic efficacy is paramount. Consequently, dose optimization techniques, radiation dose monitoring systems, and adherence to established protocols for the justification and optimization of CT scans have become integral components of clinical practice. The prominence of CT scans across diverse medical specialties underscores the critical importance of robust dose management practices in safeguarding patient health and optimizing healthcare delivery.

By Revenue Model, the Capital/Annual Purchase Model segment held the largest share in 2024

The capital/annual purchase model stands as the prevailing revenue model in the realm of radiation dose management solutions, primarily due to its inherent advantages and widespread appeal to healthcare institutions. This model offers a straightforward approach, allowing facilities to make a one-time capital investment or opt for annual payments to acquire dose management solutions outright. Such a structure provides institutions with a sense of financial predictability, enabling them to allocate resources efficiently and plan budgets over an extended period. By securing ownership of the dose management system, healthcare providers gain autonomy and control over its implementation and customization, tailoring it to suit their specific needs and workflows. This ownership aspect fosters a sense of accountability and a long-term commitment to the effective utilization of dose management technologies.

Furthermore, the capital/annual purchase model offers tangible ownership benefits, affording healthcare institutions the flexibility to customize and scale dose management solutions according to evolving requirements and technological advancements. Unlike subscription-based models that entail ongoing payments without ownership rights, the capital/annual purchase model allows facilities to amortize costs over time, potentially resulting in cost savings in the long run. Additionally, owning the dose management system facilitates seamless integration with existing infrastructure and enables in-house maintenance and upgrades, thereby reducing reliance on external vendors and enhancing operational efficiency. Overall, the attractiveness of the capital/annual purchase model lies in its ability to provide financial stability, ownership advantages, and flexibility for healthcare institutions seeking to invest in robust and sustainable dose management solutions.

Radiation Dose Management Service Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

In the Asia Pacific region, the radiation dose management service market holds a dominant share, largely propelled by several key factors driving its growth trajectory. One significant driver is the substantial investments in healthcare infrastructure witnessed across countries like China, Japan, and India. These investments are aimed at addressing the burgeoning healthcare needs of rapidly growing populations, particularly in urban areas where demand for medical services, including diagnostic imaging procedures, is surging. As these nations continue to modernize their healthcare systems, there’s a parallel increase in the adoption of advanced medical imaging technologies, creating a conducive environment for the uptake of radiation dose management solutions.

Moreover, the rising incidence of chronic diseases in the Asia Pacific region further amplifies the demand for medical imaging services, thereby contributing to the expansion of the radiation dose management market. Chronic conditions such as cardiovascular diseases, cancer, and respiratory illnesses necessitate frequent diagnostic imaging procedures, driving the need for efficient radiation dose monitoring and management solutions. Countries like India and China, with their large patient populations, are particularly significant contributors to this trend.

Government initiatives aimed at promoting radiation safety also play a pivotal role in propelling market growth in the Asia Pacific region. Regulatory bodies in countries like Japan and South Korea have implemented stringent guidelines and standards to ensure the safe use of radiation in medical imaging practices. These initiatives not only foster a culture of radiation safety but also drive the adoption of radiation dose management solutions by healthcare providers seeking to comply with regulatory requirements.

Despite these favorable conditions, challenges such as limited awareness about radiation safety practices and the high cost of advanced radiation dose management solutions pose potential impediments to market expansion. Efforts to address these challenges through educational campaigns, collaborations between healthcare stakeholders, and technological advancements aimed at cost reduction are crucial for sustaining the momentum of growth in the Asia Pacific radiation dose management service market.

Active Key Players in the Radiation Dose Management Service Market

Bayer AG

GE Healthcare

Philips Healthcare

Siemens Healthcare

FUJIFILM Holdings Corporation

Canon Inc.

PACSHealth, LLC

Sectra AB

Bracco Imaging S.P.A.

Qaelum N.V.

Agfa Healthcare

Novarad Corporation

Medic Vision

Guerbet

Medsquare

INFINITT Healthcare Co. Ltd.

Volpara Helath Limited.

Medic Vision

Imalogix

Dedalus S.P.A

Nanjing Perlove Medical Equipment CO., LTD.

Mirion Technologies, Inc.

Landauer

Polimaster

Fortive

Other Active Players

Key Industry Developments in the Radiation Dose Management Service Market:

May 2023 – Carestream Health announced the introduction of its novel DRX-LC Detector, designed to improve image quality, patient comfort, and diagnostic confidence, as well as productivity for capturing long-length images in orthopedics.

February 2023 – Carestream Health partnered with Robarts Research Institute to increase and demonstrate the clinical value of digital X-ray, digital tomosynthesis, and dual-energy technologies. It would improve the outcomes of patients with cardiothoracic and pulmonary diseases.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Radiation Dose Management Service Market by Product & Services (2018-2032)

4.1 Radiation Dose Management Service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Radiation Dose Management Solutions

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Standalone Solutions

4.5 Integrated Solutions

4.6 Radiation Dose Management Services

4.7 Support & Maintenance Services

4.8 Implementation & Integration Services

4.9 Consulting Services

4.10 Education & Training Services

4.11 Radiation Dose Management

Chapter 5: Radiation Dose Management Service Market by Modality (2018-2032)

5.1 Radiation Dose Management Service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Computed Tomography

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Fluoroscopy & Interventional Imaging

5.5 Radiography

5.6 Mammography

5.7 Nuclear Medicine

Chapter 6: Radiation Dose Management Service Market by Mode of Deployment (2018-2032)

6.1 Radiation Dose Management Service Market Snapshot and Growth Engine

6.2 Market Overview

6.3 On-Premises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Cloud-Based

6.5 Web-Based

Chapter 7: Radiation Dose Management Service Market by Revenue Model (2018-2032)

7.1 Radiation Dose Management Service Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Capital/Annual Purchase Model

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Pay-Per Procedure Model

Chapter 8: Radiation Dose Management Service Market by Application (2018-2032)

8.1 Radiation Dose Management Service Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Oncology

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Cardiology

8.5 Dental

8.6 Orthopaedic Application

8.7 Other Applications (Neuroimaging

8.8 Genitourinary Imaging

8.9 etc)

Chapter 9: Radiation Dose Management Service Market by End-User (2018-2032)

9.1 Radiation Dose Management Service Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Hospitals and Healthcare Systems

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Ambulatory Surgery Centers

9.5 Diagnostic and Imaging Centers

9.6 Other End-users (Academic Research Institutes

9.7 Public and Private Research Laboratories)

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Radiation Dose Management Service Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 FLIR SYSTEMS INC. (U.S.)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 FLUKE CORPORATION (U.S.)

10.4 LEONARDO DRS (U.S.)

10.5 TESTO INC. (U.S.)

10.6 UNITED TECHNOLOGIES (U.S.)

10.7 TELEDYNE FLIR LLC (U.S.)

10.8 L3HARRIS TECHNOLOGIES INC (U.S.)

10.9 SEEK THERMAL INC. (U.S.)

10.10 TRIJICON INC. (U.S.)

10.11 RAYTHEON CO. (U.S.)

10.12 BULLARD GMBH (GERMANY)

10.13 XENICS (BELGIUM)

10.14 AXIS COMMUNICATIONS AB (SWEDEN)

10.15 BAE SYSTEMS PLC (UK)

10.16 THERMOTEKNIX SYSTEMS (UK)

10.17 HT ITALIA S.R.L. (ITALY)

10.18 LEONARDO (ITALY)

10.19 DALI TECHNOLOGY COLTD. (CHINA)

10.20 ZHEJIANG DALI TECHNOLOGY COLTD. (CHINA)

10.21 OPGAL OPTRONIC INDUSTRIES LTD (ISRAEL)

10.22

Chapter 11: Global Radiation Dose Management Service Market By Region

11.1 Overview

11.2. North America Radiation Dose Management Service Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Product & Services

11.2.4.1 Radiation Dose Management Solutions

11.2.4.2 Standalone Solutions

11.2.4.3 Integrated Solutions

11.2.4.4 Radiation Dose Management Services

11.2.4.5 Support & Maintenance Services

11.2.4.6 Implementation & Integration Services

11.2.4.7 Consulting Services

11.2.4.8 Education & Training Services

11.2.4.9 Radiation Dose Management

11.2.5 Historic and Forecasted Market Size by Modality

11.2.5.1 Computed Tomography

11.2.5.2 Fluoroscopy & Interventional Imaging

11.2.5.3 Radiography

11.2.5.4 Mammography

11.2.5.5 Nuclear Medicine

11.2.6 Historic and Forecasted Market Size by Mode of Deployment

11.2.6.1 On-Premises

11.2.6.2 Cloud-Based

11.2.6.3 Web-Based

11.2.7 Historic and Forecasted Market Size by Revenue Model

11.2.7.1 Capital/Annual Purchase Model

11.2.7.2 Pay-Per Procedure Model

11.2.8 Historic and Forecasted Market Size by Application

11.2.8.1 Oncology

11.2.8.2 Cardiology

11.2.8.3 Dental

11.2.8.4 Orthopaedic Application

11.2.8.5 Other Applications (Neuroimaging

11.2.8.6 Genitourinary Imaging

11.2.8.7 etc)

11.2.9 Historic and Forecasted Market Size by End-User

11.2.9.1 Hospitals and Healthcare Systems

11.2.9.2 Ambulatory Surgery Centers

11.2.9.3 Diagnostic and Imaging Centers

11.2.9.4 Other End-users (Academic Research Institutes

11.2.9.5 Public and Private Research Laboratories)

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Radiation Dose Management Service Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Product & Services

11.3.4.1 Radiation Dose Management Solutions

11.3.4.2 Standalone Solutions

11.3.4.3 Integrated Solutions

11.3.4.4 Radiation Dose Management Services

11.3.4.5 Support & Maintenance Services

11.3.4.6 Implementation & Integration Services

11.3.4.7 Consulting Services

11.3.4.8 Education & Training Services

11.3.4.9 Radiation Dose Management

11.3.5 Historic and Forecasted Market Size by Modality

11.3.5.1 Computed Tomography

11.3.5.2 Fluoroscopy & Interventional Imaging

11.3.5.3 Radiography

11.3.5.4 Mammography

11.3.5.5 Nuclear Medicine

11.3.6 Historic and Forecasted Market Size by Mode of Deployment

11.3.6.1 On-Premises

11.3.6.2 Cloud-Based

11.3.6.3 Web-Based

11.3.7 Historic and Forecasted Market Size by Revenue Model

11.3.7.1 Capital/Annual Purchase Model

11.3.7.2 Pay-Per Procedure Model

11.3.8 Historic and Forecasted Market Size by Application

11.3.8.1 Oncology

11.3.8.2 Cardiology

11.3.8.3 Dental

11.3.8.4 Orthopaedic Application

11.3.8.5 Other Applications (Neuroimaging

11.3.8.6 Genitourinary Imaging

11.3.8.7 etc)

11.3.9 Historic and Forecasted Market Size by End-User

11.3.9.1 Hospitals and Healthcare Systems

11.3.9.2 Ambulatory Surgery Centers

11.3.9.3 Diagnostic and Imaging Centers

11.3.9.4 Other End-users (Academic Research Institutes

11.3.9.5 Public and Private Research Laboratories)

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Radiation Dose Management Service Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Product & Services

11.4.4.1 Radiation Dose Management Solutions

11.4.4.2 Standalone Solutions

11.4.4.3 Integrated Solutions

11.4.4.4 Radiation Dose Management Services

11.4.4.5 Support & Maintenance Services

11.4.4.6 Implementation & Integration Services

11.4.4.7 Consulting Services

11.4.4.8 Education & Training Services

11.4.4.9 Radiation Dose Management

11.4.5 Historic and Forecasted Market Size by Modality

11.4.5.1 Computed Tomography

11.4.5.2 Fluoroscopy & Interventional Imaging

11.4.5.3 Radiography

11.4.5.4 Mammography

11.4.5.5 Nuclear Medicine

11.4.6 Historic and Forecasted Market Size by Mode of Deployment

11.4.6.1 On-Premises

11.4.6.2 Cloud-Based

11.4.6.3 Web-Based

11.4.7 Historic and Forecasted Market Size by Revenue Model

11.4.7.1 Capital/Annual Purchase Model

11.4.7.2 Pay-Per Procedure Model

11.4.8 Historic and Forecasted Market Size by Application

11.4.8.1 Oncology

11.4.8.2 Cardiology

11.4.8.3 Dental

11.4.8.4 Orthopaedic Application

11.4.8.5 Other Applications (Neuroimaging

11.4.8.6 Genitourinary Imaging

11.4.8.7 etc)

11.4.9 Historic and Forecasted Market Size by End-User

11.4.9.1 Hospitals and Healthcare Systems

11.4.9.2 Ambulatory Surgery Centers

11.4.9.3 Diagnostic and Imaging Centers

11.4.9.4 Other End-users (Academic Research Institutes

11.4.9.5 Public and Private Research Laboratories)

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Radiation Dose Management Service Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Product & Services

11.5.4.1 Radiation Dose Management Solutions

11.5.4.2 Standalone Solutions

11.5.4.3 Integrated Solutions

11.5.4.4 Radiation Dose Management Services

11.5.4.5 Support & Maintenance Services

11.5.4.6 Implementation & Integration Services

11.5.4.7 Consulting Services

11.5.4.8 Education & Training Services

11.5.4.9 Radiation Dose Management

11.5.5 Historic and Forecasted Market Size by Modality

11.5.5.1 Computed Tomography

11.5.5.2 Fluoroscopy & Interventional Imaging

11.5.5.3 Radiography

11.5.5.4 Mammography

11.5.5.5 Nuclear Medicine

11.5.6 Historic and Forecasted Market Size by Mode of Deployment

11.5.6.1 On-Premises

11.5.6.2 Cloud-Based

11.5.6.3 Web-Based

11.5.7 Historic and Forecasted Market Size by Revenue Model

11.5.7.1 Capital/Annual Purchase Model

11.5.7.2 Pay-Per Procedure Model

11.5.8 Historic and Forecasted Market Size by Application

11.5.8.1 Oncology

11.5.8.2 Cardiology

11.5.8.3 Dental

11.5.8.4 Orthopaedic Application

11.5.8.5 Other Applications (Neuroimaging

11.5.8.6 Genitourinary Imaging

11.5.8.7 etc)

11.5.9 Historic and Forecasted Market Size by End-User

11.5.9.1 Hospitals and Healthcare Systems

11.5.9.2 Ambulatory Surgery Centers

11.5.9.3 Diagnostic and Imaging Centers

11.5.9.4 Other End-users (Academic Research Institutes

11.5.9.5 Public and Private Research Laboratories)

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Radiation Dose Management Service Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Product & Services

11.6.4.1 Radiation Dose Management Solutions

11.6.4.2 Standalone Solutions

11.6.4.3 Integrated Solutions

11.6.4.4 Radiation Dose Management Services

11.6.4.5 Support & Maintenance Services

11.6.4.6 Implementation & Integration Services

11.6.4.7 Consulting Services

11.6.4.8 Education & Training Services

11.6.4.9 Radiation Dose Management

11.6.5 Historic and Forecasted Market Size by Modality

11.6.5.1 Computed Tomography

11.6.5.2 Fluoroscopy & Interventional Imaging

11.6.5.3 Radiography

11.6.5.4 Mammography

11.6.5.5 Nuclear Medicine

11.6.6 Historic and Forecasted Market Size by Mode of Deployment

11.6.6.1 On-Premises

11.6.6.2 Cloud-Based

11.6.6.3 Web-Based

11.6.7 Historic and Forecasted Market Size by Revenue Model

11.6.7.1 Capital/Annual Purchase Model

11.6.7.2 Pay-Per Procedure Model

11.6.8 Historic and Forecasted Market Size by Application

11.6.8.1 Oncology

11.6.8.2 Cardiology

11.6.8.3 Dental

11.6.8.4 Orthopaedic Application

11.6.8.5 Other Applications (Neuroimaging

11.6.8.6 Genitourinary Imaging

11.6.8.7 etc)

11.6.9 Historic and Forecasted Market Size by End-User

11.6.9.1 Hospitals and Healthcare Systems

11.6.9.2 Ambulatory Surgery Centers

11.6.9.3 Diagnostic and Imaging Centers

11.6.9.4 Other End-users (Academic Research Institutes

11.6.9.5 Public and Private Research Laboratories)

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Radiation Dose Management Service Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Product & Services

11.7.4.1 Radiation Dose Management Solutions

11.7.4.2 Standalone Solutions

11.7.4.3 Integrated Solutions

11.7.4.4 Radiation Dose Management Services

11.7.4.5 Support & Maintenance Services

11.7.4.6 Implementation & Integration Services

11.7.4.7 Consulting Services

11.7.4.8 Education & Training Services

11.7.4.9 Radiation Dose Management

11.7.5 Historic and Forecasted Market Size by Modality

11.7.5.1 Computed Tomography

11.7.5.2 Fluoroscopy & Interventional Imaging

11.7.5.3 Radiography

11.7.5.4 Mammography

11.7.5.5 Nuclear Medicine

11.7.6 Historic and Forecasted Market Size by Mode of Deployment

11.7.6.1 On-Premises

11.7.6.2 Cloud-Based

11.7.6.3 Web-Based

11.7.7 Historic and Forecasted Market Size by Revenue Model

11.7.7.1 Capital/Annual Purchase Model

11.7.7.2 Pay-Per Procedure Model

11.7.8 Historic and Forecasted Market Size by Application

11.7.8.1 Oncology

11.7.8.2 Cardiology

11.7.8.3 Dental

11.7.8.4 Orthopaedic Application

11.7.8.5 Other Applications (Neuroimaging

11.7.8.6 Genitourinary Imaging

11.7.8.7 etc)

11.7.9 Historic and Forecasted Market Size by End-User

11.7.9.1 Hospitals and Healthcare Systems

11.7.9.2 Ambulatory Surgery Centers

11.7.9.3 Diagnostic and Imaging Centers

11.7.9.4 Other End-users (Academic Research Institutes

11.7.9.5 Public and Private Research Laboratories)

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

Q1: What would be the forecast period in the Radiation Dose Management Service Market research report?

A1: The forecast period in the Radiation Dose Management Service Market research report is 2025-2032.

Q2: Who are the key players in the Radiation Dose Management Service Market?

A2: Bayer AG (Germany), GE Healthcare (US), Philips Healthcare (Netherlands), Siemens Healthcare (Germany), FUJIFILM Holdings Corporation (Japan), Canon Inc. (Japan), PACSHealth, LLC (US), Sectra AB (Sweden), Bracco Imaging S.P.A. (Italy), Qaelum N.V. (Belgium), Agfa Healthcare (Belgium), Novarad Corporation (US), Medic Vision (US), Guerbet (France), Medsquare (France), INFINITT Healthcare Co. Ltd. (South Korea), Volpara Health Limited. (New Zealand), Medic Vision (Israel), Imalogix (US)., Dedalus S.P.A (Italy), Nanjing Perlove Medical Equipment CO., LTD. (China), Mirion Technologies, Inc. (US), Landauer (US), Polimaster (Austria), and Fortive (US). and Other Active Players.

Q3: What are the segments of the Radiation Dose Management Service Market?

A3: The Radiation Dose Management Service Market is segmented into By Products & Services, By Modality, By Mode of Deployment, By Revenue Model, By Application, By End-User, and region. By Product & Services, the market is categorized into Radiation Dose Management Solutions (Standalone Solutions, Integrated Solutions) and Radiation Dose Management Services(Support & Maintenance Services, Implementation & Integration Services, Consulting Services, Education & Training Services, Radiation Dose Management). By Modality, the market is categorized into Computed Tomography, Fluoroscopy & Interventional Imaging, Radiography, Mammography and Nuclear Medicine. By Mode of Deployment, the market is categorized into On-Premises, Cloud-Based and Web-Based. By Revenue Model, the market is categorized into the Capital/Annual Purchase Model and Pay-Per Procedure Model. By Application, the market is categorized into Oncology, Cardiology, Dental, Orthopaedic Application, and Other Applications (Neuroimaging, Genitourinary Imaging, etc). By End-User, the market is categorized into Hospitals and Healthcare Systems, Ambulatory Surgery Centers, Diagnostic and Imaging Centers, and Other End-users (Academic Research Institutes, Public and Private Research Laboratories). By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; ; Spain; Rest of Western Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil; Argentina, etc.).

Q4: What is the Radiation Dose Management Service Market?

A4: The Radiation Dose Management Service Market refers to the sector that provides tools, technologies, and services aimed at monitoring, recording, and managing the exposure to ionizing radiation within healthcare settings. This market encompasses software solutions for dose tracking, regulatory compliance, and optimization of radiation used in medical imaging and therapy, as well as consulting and training services to ensure the safe and effective use of radiological procedures. The primary goal of these services is to enhance patient safety, improve clinical outcomes, and ensure adherence to stringent regulatory standards by minimizing unnecessary radiation exposure and optimizing necessary doses.

Q5: How big is the Radiation Dose Management Service Market?

A5: Radiation Dose Management Service Market Size Was Valued at USD 763.2 Million in 2024, and is Projected to Reach USD 2207.84 Million by 2032, Growing at a CAGR of 14.20% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!