Stay Ahead in Fast-Growing Economies.

Browse Reports NowProtein Supplements Market Size, Share, Growth & Forecast (2024-2032)

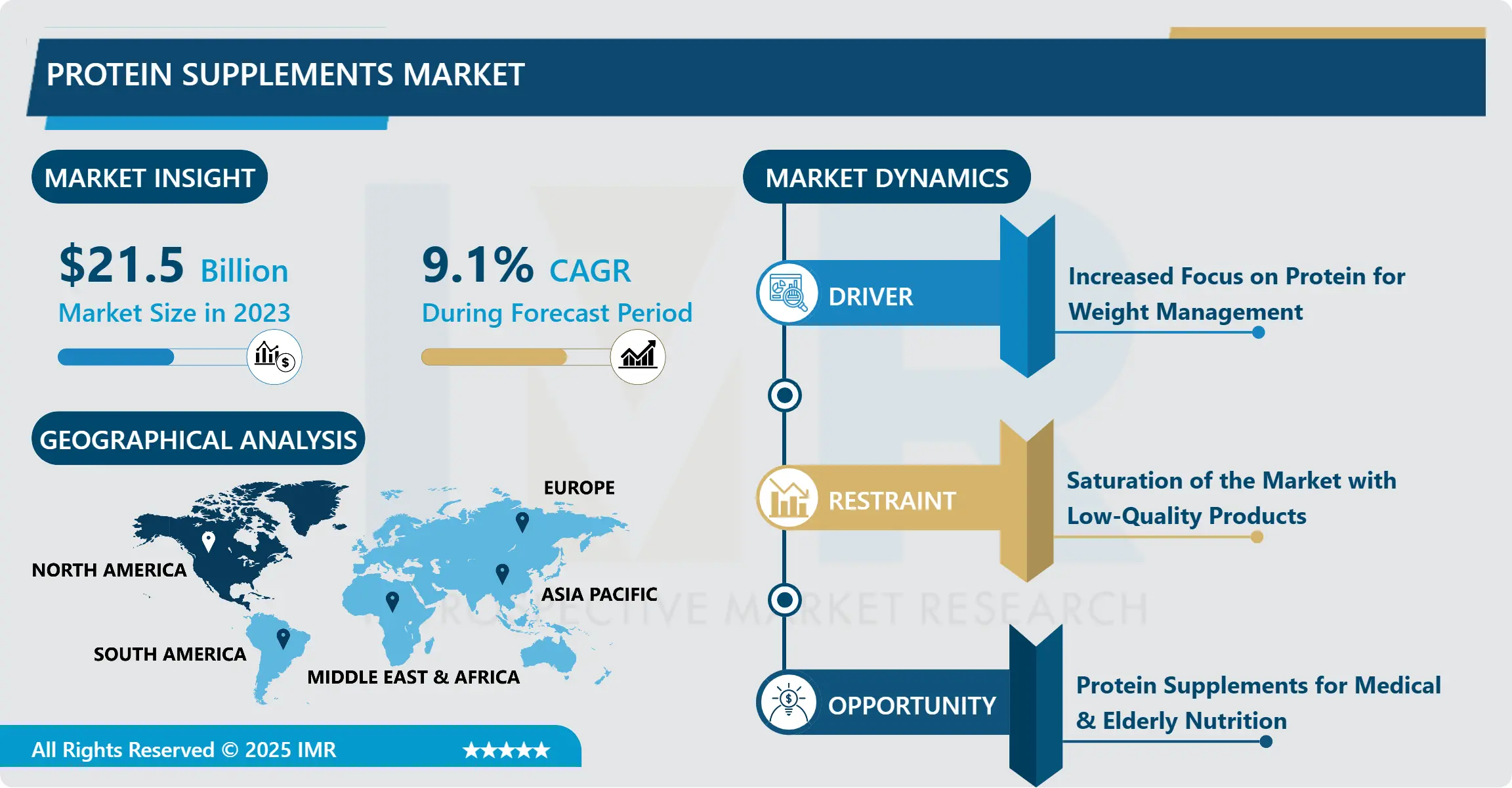

Protein Supplements Market Size Was Valued at USD 21.50 Billion in 2023, and is Projected to Reach USD 47.08 Billion by 2032, Growing at a CAGR of 9.10% From 2024-2032.

IMR Group

Description

Protein Supplements Market Synopsis:

Protein Supplements Market Size Was Valued at USD 21.50 Billion in 2023, and is Projected to Reach USD 47.08 Billion by 2032, Growing at a CAGR of 9.10% From 2024-2032.

Protein supplements are known as the dietary products meant to serve as extra sources of protein to consumers. These supplements are popular with sportspersons, gym goers and people who are would like to shed some weight or gain some muscle mass or those who wish to lead a healthy lifestyle. Protein supplements come in forms of powders, bars, and liquid ready to drink products through which one can get their daily protein dose, most of which are gotten from specific protein source like whey, casein, soy, pea, hemp and egg.

The increasing consciousness of the global population with reference to health and fitness is a primary factor to the growth of the protein supplements market. With an increasing awareness of people towards the necessity of good health, there has been a tendency towards increase in prevalence of protean items. Also, increased awareness regarding the problem of obesity and growth in the number of diseases caused directly by changes in eating habits have sparked consumer interest in protein-based supplements.

Another factor is also growth of the active population with a healthy lifestyle; millennials and generation Z are more inclined to take dietary supplements. The fitness industry has grown, and it comprises gyms, health clubs, and even the many online programs that promote an active lifestyle, and this has increased the call for protein products because they contribute to muscle building, ability to recover as well as being healthy products that the body needs.

Protein Supplements Market Trend Analysis:

Shift toward plant-based protein products

Another emerging trend that is visible in the protein supplements market today is the conversion of plant protein products. With the increasing focus on healthy living and a sustainable environment, there is an increasing trend of plant sourced protein ingredients such as soy, pea and hemp. The same feelings can be traced with the growth of vegan, vegetarian, and flexitarian audience that tend to choose plant-based proteins rather than animal-based ones.

Second emerging trend is the demand for clean-label products. Customers are becoming more conscious of what they take and would prefer protein supplements which are naturally preserved. Therefore, brands are awaking to ensure that they develop products with clearer labels displaying natural resources used in their production and making provisions for brands without allergens, which are requested in the market to be healthier.

Interested in health and fitness products

The emerging economies, especially Asia-Pacific and Latin America regions offer a great future market opportunity to the protein supplements business. As disposable income and the general standard of living increases in these regions consumers are increasingly adopting a more active interest in healthy living and, thus, fitness products. To benefit, from this emerging trend brands must find region adequate flavors, packaging and advertising appeals, which are cultural, to some extent.

Medical nutrition is another promising market niche since people, especially elderly and those who suffered from some illnesses, tend to look for protein supplements. Due to the aging population of the world there is a growing requirement for products that help build muscles and support the general health of the population. Specific protein supplements for medical applications can meet this need and extend farther than conventional athletics nourishment.

Protein Supplements Market Segment Analysis:

Protein Supplements Market is Segmented on the basis of Type, Form, Application, End User, and Region.

By Type, Whey Protein segment is expected to dominate the market during the forecast period

The Protein Supplements market is divided by the type of protein used with whey protein on the top, although, it is easily digestible and contains high amino acid value. This type of protein is particularly favourite among meals that provide a slow and constant extend of amino acids as it is a considered slow digesting type of protein.

Soy, pea, rice, and hemp protein ingredients are especially popular today, as they are vegan, and free from allergens. They include egg protein – an excellent source of protein with all the essential amino acids; and use other proteins in certain groups of formulae according to the intend consumer.

By Application, Sports Nutrition segment expected to held the largest share

Protein supplements are used for various purposes whereas the major category is in the sports nutrition market. Protein products are used by athletes and those that involve themselves in regular physical activities for muscle repair and building. Another increasing weight losing segment is also the protein supplements since they aid in hunger control apart from supporting the fat reduction process.

Technological application of medical nutrition is gradually gaining importance especially in peoples’ health scenarios which include elderly and people with certain health complication. By the same token, the general wellness applications are rising higher since consumers take their protein supplements to evoke general health and immunity.

Protein Supplements Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The protein supplements market is lead by the North American region owing to the increased market awareness, advanced fitness consciousness and higher population of the fitness conscious population. The three countries are especially important, but the United States is the largest market for the protein supplements as they are popular among all people regardless their ages, occupation or profession, first of all, athletes and bodybuilders as well as the people who want to accomplish a healthy lifestyle.

It also accounts for quite a large market since consumers continue to demand protein supplements in countries like Germany, the United Kingdom, and France and other European countries. In addition, obesity and an aging population, coupled with the growth in tailored protein supplement consumption, specifically plant-based protein supplements in the region, enrich the mark,

Active Key Players in the Protein Supplements Market:

Abbott Laboratories (USA)

Amway Corporation (USA)

Dymatize Nutrition (USA)

Glanbia PLC (Ireland)

GNC Holdings, LLC (USA)

Herbalife Nutrition Ltd. (USA)

Isagenix International LLC (USA)

MusclePharm Corporation (USA)

Nestlé S.A. (Switzerland)

PepsiCo, Inc. (USA), and Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Protein Supplements Market by Product Type

4.1 Protein Supplements Market Snapshot and Growth Engine

4.2 Protein Supplements Market Overview

4.3 Animal-based Proteins

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Animal-based Proteins: Geographic Segmentation Analysis

4.4 Plant-based Proteins

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Plant-based Proteins: Geographic Segmentation Analysis

4.5 Synthetic Proteins

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Synthetic Proteins: Geographic Segmentation Analysis

4.6 Insect-based Proteins

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Insect-based Proteins: Geographic Segmentation Analysis

Chapter 5: Protein Supplements Market by Technology

5.1 Protein Supplements Market Snapshot and Growth Engine

5.2 Protein Supplements Market Overview

5.3 Protein Extraction

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Protein Extraction: Geographic Segmentation Analysis

5.4 Protein Isolation

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Protein Isolation: Geographic Segmentation Analysis

5.5 Protein Hydrolysis

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Protein Hydrolysis: Geographic Segmentation Analysis

5.6 Recombinant Proteins

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Recombinant Proteins: Geographic Segmentation Analysis

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Geographic Segmentation Analysis

Chapter 6: Protein Supplements Market by Application

6.1 Protein Supplements Market Snapshot and Growth Engine

6.2 Protein Supplements Market Overview

6.3 Food & Beverages

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Food & Beverages: Geographic Segmentation Analysis

6.4 Animal Feed

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Animal Feed: Geographic Segmentation Analysis

6.5 Pharmaceuticals

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Pharmaceuticals: Geographic Segmentation Analysis

6.6 Cosmetics & Personal Care

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Cosmetics & Personal Care: Geographic Segmentation Analysis

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Protein Supplements Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 HERBALIFE NUTRITION LTD. (USA)

7.4 GLANBIA PLC (IRELAND)

7.5 PEPSICO INC. (USA)

7.6 NESTLÉ S.A. (SWITZERLAND)

7.7 AMWAY CORPORATION (USA)

7.8 MUSCLEPHARM CORPORATION (USA)

7.9 ISAGENIX INTERNATIONAL LLC (USA)

7.10 GNC HOLDINGS LLC (USA)

7.11 DYMATIZE NUTRITION (USA)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Protein Supplements Market By Region

8.1 Overview

8.2. North America Protein Supplements Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Animal-based Proteins

8.2.4.2 Plant-based Proteins

8.2.4.3 Synthetic Proteins

8.2.4.4 Insect-based Proteins

8.2.5 Historic and Forecasted Market Size By Technology

8.2.5.1 Protein Extraction

8.2.5.2 Protein Isolation

8.2.5.3 Protein Hydrolysis

8.2.5.4 Recombinant Proteins

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size By Application

8.2.6.1 Food & Beverages

8.2.6.2 Animal Feed

8.2.6.3 Pharmaceuticals

8.2.6.4 Cosmetics & Personal Care

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Protein Supplements Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Animal-based Proteins

8.3.4.2 Plant-based Proteins

8.3.4.3 Synthetic Proteins

8.3.4.4 Insect-based Proteins

8.3.5 Historic and Forecasted Market Size By Technology

8.3.5.1 Protein Extraction

8.3.5.2 Protein Isolation

8.3.5.3 Protein Hydrolysis

8.3.5.4 Recombinant Proteins

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size By Application

8.3.6.1 Food & Beverages

8.3.6.2 Animal Feed

8.3.6.3 Pharmaceuticals

8.3.6.4 Cosmetics & Personal Care

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Protein Supplements Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Animal-based Proteins

8.4.4.2 Plant-based Proteins

8.4.4.3 Synthetic Proteins

8.4.4.4 Insect-based Proteins

8.4.5 Historic and Forecasted Market Size By Technology

8.4.5.1 Protein Extraction

8.4.5.2 Protein Isolation

8.4.5.3 Protein Hydrolysis

8.4.5.4 Recombinant Proteins

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size By Application

8.4.6.1 Food & Beverages

8.4.6.2 Animal Feed

8.4.6.3 Pharmaceuticals

8.4.6.4 Cosmetics & Personal Care

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Protein Supplements Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Animal-based Proteins

8.5.4.2 Plant-based Proteins

8.5.4.3 Synthetic Proteins

8.5.4.4 Insect-based Proteins

8.5.5 Historic and Forecasted Market Size By Technology

8.5.5.1 Protein Extraction

8.5.5.2 Protein Isolation

8.5.5.3 Protein Hydrolysis

8.5.5.4 Recombinant Proteins

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size By Application

8.5.6.1 Food & Beverages

8.5.6.2 Animal Feed

8.5.6.3 Pharmaceuticals

8.5.6.4 Cosmetics & Personal Care

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Protein Supplements Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Animal-based Proteins

8.6.4.2 Plant-based Proteins

8.6.4.3 Synthetic Proteins

8.6.4.4 Insect-based Proteins

8.6.5 Historic and Forecasted Market Size By Technology

8.6.5.1 Protein Extraction

8.6.5.2 Protein Isolation

8.6.5.3 Protein Hydrolysis

8.6.5.4 Recombinant Proteins

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size By Application

8.6.6.1 Food & Beverages

8.6.6.2 Animal Feed

8.6.6.3 Pharmaceuticals

8.6.6.4 Cosmetics & Personal Care

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Protein Supplements Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Animal-based Proteins

8.7.4.2 Plant-based Proteins

8.7.4.3 Synthetic Proteins

8.7.4.4 Insect-based Proteins

8.7.5 Historic and Forecasted Market Size By Technology

8.7.5.1 Protein Extraction

8.7.5.2 Protein Isolation

8.7.5.3 Protein Hydrolysis

8.7.5.4 Recombinant Proteins

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size By Application

8.7.6.1 Food & Beverages

8.7.6.2 Animal Feed

8.7.6.3 Pharmaceuticals

8.7.6.4 Cosmetics & Personal Care

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Protein Supplements Market research report?

A1: The forecast period in the Protein Supplements Market research report is 2024-2032.

Q2: Who are the key players in the Protein Supplements Market?

A2: Abbott Laboratories (USA), Herbalife Nutrition Ltd. (USA), Glanbia PLC (Ireland), PepsiCo, Inc. (USA), Nestlé S.A. (Switzerland), Amway Corporation (USA), MusclePharm Corporation (USA), Isagenix International LLC (USA), GNC Holdings, LLC (USA), Dymatize Nutrition (USA), and Other Active Players.

Q3: What are the segments of the Protein Supplements Market?

A3: Protein Supplements Market is Segmented on the basis of Type, Form, Application, End User, and Region. By Type, the market is categorized into Whey Protein, Casein Protein, Soy Protein, Pea Protein, Rice Protein, Hemp Protein, Egg Protein, Others. By Form, the market is categorized into Powder, Ready-to-drink, Bars. By Application, the market is categorized into Sports Nutrition, Weight Management, Medical Nutrition, General Wellness. By End User, Athletes & Bodybuilders, Fitness Enthusiasts, Elderly, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Protein Supplements Market?

A4: Protein supplements are known as the dietary products meant to serve as extra sources of protein to consumers. These supplements are popular with sportspersons, gym goers and people who are would like to shed some weight or gain some muscle mass or those who wish to lead a healthy lifestyle. Protein supplements come in forms of powders, bars, and liquid ready to drink products through which one can get their daily protein dose, most of which are gotten from specific protein source like whey, casein, soy, pea, hemp and egg.

Q5: How big is the Protein Supplements Market?

A5: Protein Supplements Market Size Was Valued at USD 21.50 Billion in 2023, and is Projected to Reach USD 47.08 Billion by 2032, Growing at a CAGR of 9.10% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!