Stay Ahead in Fast-Growing Economies.

Browse Reports NowPropTech Market Size, Share, Growth Opportunities & Forecast Report (2024-2032)

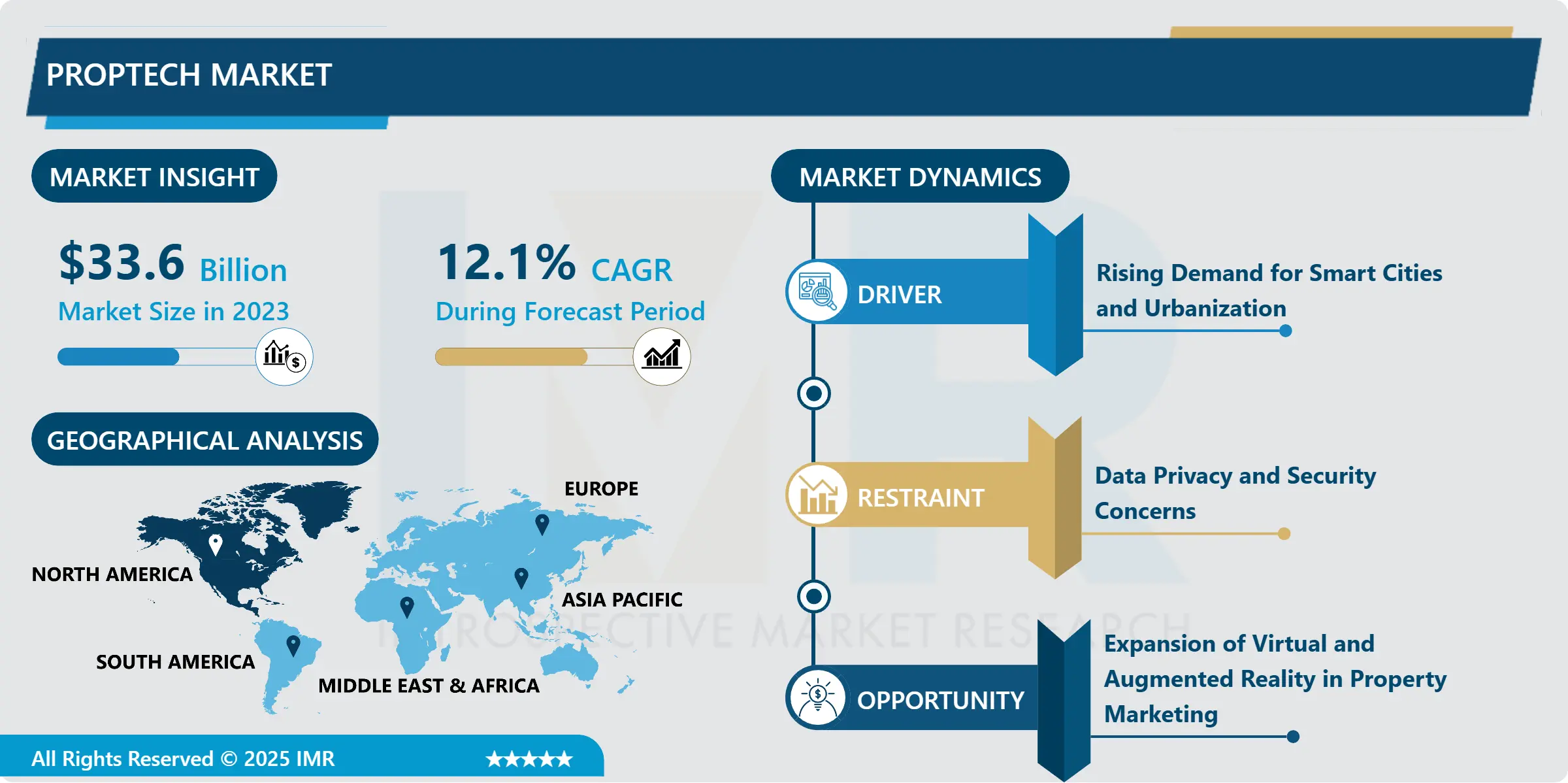

PropTech Market Size Was Valued at USD 33.60 Billion in 2023, and is Projected to Reach USD 93.26 Billion by 2032, Growing at a CAGR of 12.10% From 2024-2032. The PropTech (Property Technology) market encompasses application of technology and innovation in the property sector.

IMR Group

Description

PropTech Market Synopsis:

PropTech Market Size Was Valued at USD 33.60 Billion in 2023, and is Projected to Reach USD 93.26 Billion by 2032, Growing at a CAGR of 12.10% From 2024-2032.

The PropTech (Property Technology) market encompasses application of technology and innovation in the property sector. This also entails adoption of technology tools and software and other innovation in property management, purchasing, sales, leasing, construction and property appraisal. PropTech addresses how property transactions are carried out and also presents the possibilities for organizing and improving the process for the purchase of residential, commercial and industrial real estate.

The main trends that affect the PropTech market include the aggressive rate of urbanization and the demand for smarter cities. Quite logically, it becomes crucial to find suitable solutions offering great scalability to address real estate and property management needs arising with urbanization of cities. AI, IoT and Big data enable provision of real time property management, prudent management of assets, increased tenant satisfaction leading to increased demand for such solutions.

Through COVID-19 the adoption of digital technologies in the real estate market increased significantly. Current conditions influence remote activities concerned with properties, including leasing, property tours, and management. Over time, more and more people and companies are becoming aware and dependent on online property services, thus the need for new and improved solutions in the PropTech market.

PropTech Market Trend Analysis:

Growing adoption of AI and big data analytics

The upswing in the use of artificial intelligence and big data analysis in property valuation, smart maintenance, and tenant management is a social trend in the PropTech market. AI is applied to predict the price of properties ad hoc more effectively to invest based on market trends, location, etc; big data for property managers to make the right management decisions.

Another trend is the use of IoT within buildings making smart home, energy and security solutions better. Solutions based on IoT offer real-time data acquisition and control in houses and offices, increased usage efficiency, and user satisfaction– that is why IoT solutions’ applications are becoming more popular in the context of PropTech.

Development of sustainable and energy-efficient solutions for buildings

The first chance that has been identified in the PropTech market is the integration of sustainable and energy efficient solutions of buildings. As awareness over global climate change and sustenance of environment rises there is need for technologies that cut down accumulation of Carbon dioxide especially in buildings and using energy efficiently. Optimising systems of heating, cooling and lighting that single out properties as energy-smart are becoming even more important, which opens new opportunities for PropTech companies.

One should not forget that came up new opportunities in property marketing and sales due to the implementation of such technologies as VR and AR. Instead of physical property tours, the property designs based on augmented reality, as well as digital staging, issues that improve the experience of the customer. Consequently, the conditions that have emerged through this digital transition in property viewings have opened new prospects in the market for PropTech.

PropTech Market Segment Analysis:

PropTech Market is Segmented on the basis of Component, Technology, Application, End User, and Region.

By Component, Software segment is expected to dominate the market during the forecast period

The PropTech market is segmented into three primary components: Software based applications, physical products such as circuits, and facilities of service software. Applications in this segment are property management systems, leasing applications and solutions for data analysis and automation.

Hardware refers to Internet of Things (IOT) gadgets, sensors and other smart gadgets that relates to property management and monitoring. Services in this context pertain to consulting, support and maintenance services by companies to help organisations optimally deploy and adopt PropTech solutions.

By Application, Residential segment expected to held the largest share

PropTech market is also discussed on the basis of the application areas such as residential buildings, commercial building’s industrial buildings, and mixed-used buildings. Meanwhile, residential PropTech include applications for home automation and management, as well as for property transaction.

In commercial facilities technology is used to enhance the functioning of facility, design the space and control the utility usage. Target customers in industrial applications are first of all, involved in the management of warehouses, logistics centers, manufacturing plants, turning to PropTech for maintenance, automation. While single purpose properties bring many specific usages, multi-functional properties imply multiple applications that must be managed, rented, and controlled with the help of facilities that are more sophisticated in their technologies.

PropTech Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is the largest market for PropTech due to its advanced technological support, the need for housing stock, and first impacts of new technologies. Several of the biggest PropTech firms are located in the United States and Canada where there is huge capital investment especially in areas such as the New York city, San Francisco, and Toronto. There is an appreciable number of real estate companies that are excited to embrace the use of technology in their businesses, and good regulatory climates are also found in North America that is why the region leads globally in the PropTech market.

The rise of smart city and urban development across the North American region, continues to contribute largely to the maintenance of that position. The market continues to adopt new technologies that can enhance the performance of buildings, enhance management of urban environment, and enhance the experience in real estate business making, which all enhance the growth of the region’s market.

Active Key Players in the PropTech Market:

Katerra (USA)

Matterport (USA)

Opendoor (USA)

Procore Technologies (USA)

PropertyNest (UK)

RealPage (USA)

Redfin (USA)

Tianfu Property (China)

WeWork (USA)

Zillow (USA), and Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: PropTech Market by Product

4.1 PropTech Market Snapshot and Growth Engine

4.2 PropTech Market Overview

4.3 Instruments

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Instruments: Geographic Segmentation Analysis

4.4 Reagents

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Reagents: Geographic Segmentation Analysis

4.5 Kits

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Kits: Geographic Segmentation Analysis

Chapter 5: PropTech Market by Technology

5.1 PropTech Market Snapshot and Growth Engine

5.2 PropTech Market Overview

5.3 Chromatography

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Chromatography: Geographic Segmentation Analysis

5.4 Electrophoresis

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Electrophoresis: Geographic Segmentation Analysis

5.5 Filtration

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Filtration: Geographic Segmentation Analysis

5.6 Precipitation

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Precipitation: Geographic Segmentation Analysis

Chapter 6: PropTech Market by Application

6.1 PropTech Market Snapshot and Growth Engine

6.2 PropTech Market Overview

6.3 Drug Development

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Drug Development: Geographic Segmentation Analysis

6.4 Diagnostics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Diagnostics: Geographic Segmentation Analysis

6.5 Research & Development

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Research & Development: Geographic Segmentation Analysis

6.6 Clinical & Industrial Applications

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Clinical & Industrial Applications: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 PropTech Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ZILLOW (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 REDFIN (USA)

7.4 OPENDOOR (USA)

7.5 REALPAGE (USA)

7.6 WEWORK (USA)

7.7 PROCORE TECHNOLOGIES (USA)

7.8 KATERRA (USA)

7.9 MATTERPORT (USA)

7.10 PROPERTYNEST (UK)

7.11 TIANFU PROPERTY (CHINA)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global PropTech Market By Region

8.1 Overview

8.2. North America PropTech Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product

8.2.4.1 Instruments

8.2.4.2 Reagents

8.2.4.3 Kits

8.2.5 Historic and Forecasted Market Size By Technology

8.2.5.1 Chromatography

8.2.5.2 Electrophoresis

8.2.5.3 Filtration

8.2.5.4 Precipitation

8.2.6 Historic and Forecasted Market Size By Application

8.2.6.1 Drug Development

8.2.6.2 Diagnostics

8.2.6.3 Research & Development

8.2.6.4 Clinical & Industrial Applications

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe PropTech Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product

8.3.4.1 Instruments

8.3.4.2 Reagents

8.3.4.3 Kits

8.3.5 Historic and Forecasted Market Size By Technology

8.3.5.1 Chromatography

8.3.5.2 Electrophoresis

8.3.5.3 Filtration

8.3.5.4 Precipitation

8.3.6 Historic and Forecasted Market Size By Application

8.3.6.1 Drug Development

8.3.6.2 Diagnostics

8.3.6.3 Research & Development

8.3.6.4 Clinical & Industrial Applications

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe PropTech Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product

8.4.4.1 Instruments

8.4.4.2 Reagents

8.4.4.3 Kits

8.4.5 Historic and Forecasted Market Size By Technology

8.4.5.1 Chromatography

8.4.5.2 Electrophoresis

8.4.5.3 Filtration

8.4.5.4 Precipitation

8.4.6 Historic and Forecasted Market Size By Application

8.4.6.1 Drug Development

8.4.6.2 Diagnostics

8.4.6.3 Research & Development

8.4.6.4 Clinical & Industrial Applications

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific PropTech Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product

8.5.4.1 Instruments

8.5.4.2 Reagents

8.5.4.3 Kits

8.5.5 Historic and Forecasted Market Size By Technology

8.5.5.1 Chromatography

8.5.5.2 Electrophoresis

8.5.5.3 Filtration

8.5.5.4 Precipitation

8.5.6 Historic and Forecasted Market Size By Application

8.5.6.1 Drug Development

8.5.6.2 Diagnostics

8.5.6.3 Research & Development

8.5.6.4 Clinical & Industrial Applications

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa PropTech Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product

8.6.4.1 Instruments

8.6.4.2 Reagents

8.6.4.3 Kits

8.6.5 Historic and Forecasted Market Size By Technology

8.6.5.1 Chromatography

8.6.5.2 Electrophoresis

8.6.5.3 Filtration

8.6.5.4 Precipitation

8.6.6 Historic and Forecasted Market Size By Application

8.6.6.1 Drug Development

8.6.6.2 Diagnostics

8.6.6.3 Research & Development

8.6.6.4 Clinical & Industrial Applications

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America PropTech Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product

8.7.4.1 Instruments

8.7.4.2 Reagents

8.7.4.3 Kits

8.7.5 Historic and Forecasted Market Size By Technology

8.7.5.1 Chromatography

8.7.5.2 Electrophoresis

8.7.5.3 Filtration

8.7.5.4 Precipitation

8.7.6 Historic and Forecasted Market Size By Application

8.7.6.1 Drug Development

8.7.6.2 Diagnostics

8.7.6.3 Research & Development

8.7.6.4 Clinical & Industrial Applications

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the PropTech Market research report?

A1: The forecast period in the PropTech Market research report is 2024-2032.

Q2: Who are the key players in the PropTech Market?

A2: •Zillow (USA), Redfin (USA), Opendoor (USA), RealPage (USA), WeWork (USA), Procore Technologies (USA), Katerra (USA), Matterport (USA), PropertyNest (UK), Tianfu Property (China), and Other Active Players.

Q3: What are the segments of the PropTech Market?

A3: The PropTech Market is segmented into by Component (Software, Hardware, Services), Technology (Artificial Intelligence (AI), Internet of Things (IoT), Blockchain, Big Data & Analytics, Virtual Reality (VR) / Augmented Reality (AR)), Application (Residential, Commercial, Industrial, Mixed-use), End User (Real Estate Developers, Property Managers, Real Estate Agents, Facility Managers, Homeowners). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the PropTech Market?

A4: The PropTech (Property Technology) market encompasses application of technology and innovation in the property sector. This also entails adoption of technology tools and software and other innovation in property management, purchasing, sales, leasing, construction and property appraisal. PropTech addresses how property transactions are carried out and also presents the possibilities for organizing and improving the process for the purchase of residential, commercial and industrial real estate.

Q5: How big is the PropTech Market?

A5: PropTech Market Size Was Valued at USD 33.60 Billion in 2023, and is Projected to Reach USD 93.26 Billion by 2032, Growing at a CAGR of 12.10% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!