Stay Ahead in Fast-Growing Economies.

Browse Reports NowPressure Reducing Valve Market – Analysis & Recent Trends

The Pressure Reducing Valve (PRV) Market has been rapidly growing in the recent past, Swolen this due to the enhanced need for fluid management equipment in a variety of sectors, such as in the oil and gas industry, water treatment, power generation industries and manufacturing industries. PRVs are essential devices employed to control the pressure of fluids to a level suitable for other connected systems downstream. Because many processes in industries are getting complicated and the exact pressure of the fluids needed is very important, therefore pressure reducing valves are now in high demand.

IMR Group

Description

Pressure Reducing Valve Market Synopsis

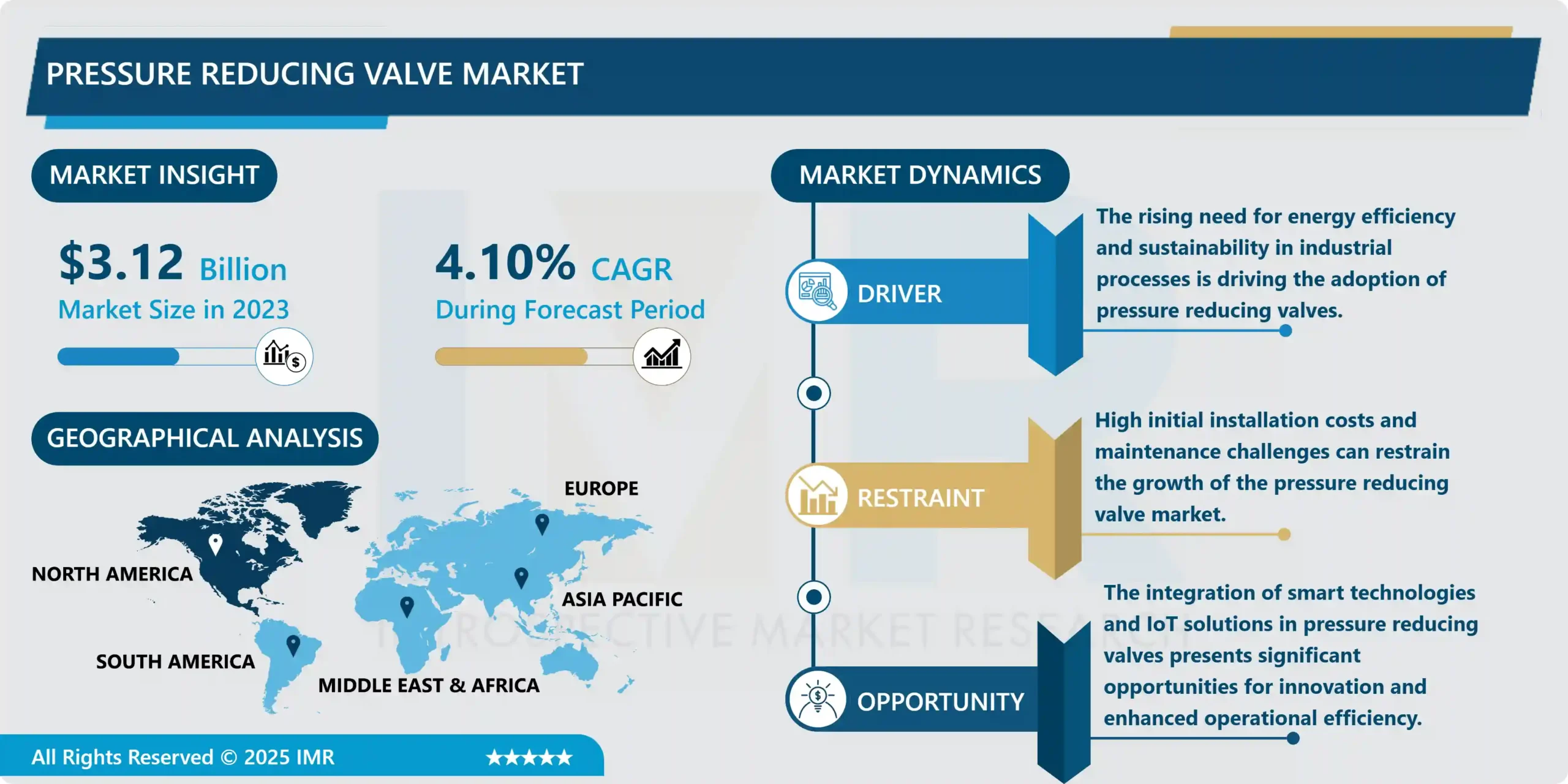

Pressure Reducing Valve Market Size is Valued at USD 3.12 Billion in 2023, and is Projected to Reach USD 4.30 Billion by 2032, Growing at a CAGR of 4.10% From 2024-2032.

The Pressure Reducing Valve (PRV) Market has been rapidly growing in the recent past, Swolen this due to the enhanced need for fluid management equipment in a variety of sectors, such as in the oil and gas industry, water treatment, power generation industries and manufacturing industries. PRVs are essential devices employed to control the pressure of fluids to a level suitable for other connected systems downstream. Because many processes in industries are getting complicated and the exact pressure of the fluids needed is very important, therefore pressure reducing valves are now in high demand. Also, there is increased concern towards energy management and saving has canned enhance the usage of the PRVs as they reduce energy wastage and give optimal performance.

Due to increasing investments in the infrastructural sector and industrial development particularly in the developing countries the global PRV market is expected to boom rapidly. There has been substantial population growth and expansion of companies in Asia-Pacific and Latin America that has forced development of efficient water and energy delivery networks. This trend is accompanied by rigid legislations and codes that serve to improve safety and performance in operations. This is one of the ways the manufacturers are coming up with new products that meet these regulations while at the same time enhancing the competency, sturdiness and resilience of the products.

Furthermore, the Pressure Reducing Valve Market is also exhibiting growth in technology where transformed Pressure Reducing Valves or smart valves are includes IoT features. These smart PRVs provide values such as monitoring and controlling so as the operators of the systems to perform well at minimal maintenance costs. Since industries are incorporating digitalization and automation mechanisms in the continuous operations, the adoption of smart technologies in pressure reducing valves is expected to rise. In sum, the analysis of the PRV market reveals significant potential for development, which is to be attributed to individual Industrial growth, new Technologies, and increasing demand for the effective fluid management.

Pressure Reducing Valve Market Trend Analysis

Adoption of Smart Pressure Reducing Valves

There is a clear shift towards smart pressure reducing valves (PRVs as the demand for automation and IoT (Internet of Things) wherein the core of a plant is pushed higher. It requires that PRVs should be smart and be fitted with one or several sensors as well as communication interfaces that relay relevant information about PRVs’ state and may alter the system functionality depending on pre-programmed or real-time scenarios requiring adjustments. It is not only an improvement in functional functionality but also helpful in predictive maintenance which will cut on operational time and costs of maintenance. With increasing drive towards higher efficiency and lower operational risks, smart PRVs are expected to gain a huge market, making them a part of today’s complex fluid management systems.

Furthermore, the use of smart technologies in the Pressure Reducing Valves is in harmony with the increasing digitization processes within different industries. The industries like water treatment, the oil and gas sector and manufacturing industries have taken advantage of data analytics and automation to enhance their operations and safety. With smart PRVs installed these industries will be able to monitor pressure variations, flow rates and system performance hence being in a better position to make right decisions. As corporations insistently focus on the exponential increase in productivity and the use of advanced algorithms, application of the smart pressure reducing valves becomes essential for subsequent progress of fluid control technologies.

Increasing Focus on Energy Efficiency

The other major trend evident in the Pressure Reducing Valve Market is the focus on energy management to realize efficiency and sustainability. This paper therefore seeks to establish the extent to which environmental consciousness affects energy use and carbon emissions by the various industries in the world. Pressure reducing valves contribute to the attainment of these objectives by controlling the amount of pressure in fluids to reduce energy losses in systems. This is a strategic shift amongst manufacturers to design PRVs that are energy efficient and which operate at optimum levels and within acceptable safety levels. This shift towards energy-efficient solutions is pushing change within the market thus developing enhanced valve designs that can satisfy the present needs of the environmentally conscious customers as well as the emerging trends in the various markets.

Furthermore, pressure reducing valves are being incorporated into numerous energy management systems used in various industries to improve performance in the system. By fine tuning the pressure of the fluids in the system, less energy is expended and energy costs less, equipment also has a longer span. Due to the rising incorporation of sustainable activities by companies for environmental concerns, energy-saving pressure reducing valves market will continue to grow to create a sustainable industrial economy. This trend will not only start the process of making global economies far healthier but will also serve to advance general environmental objective, and thus, set the stage for the more successful and responsible use of natural resources in terms of fluid management.

Pressure Reducing Valve Market Segment Analysis:

Pressure Reducing Valve Market Segmented on the basis of By Product Type, By Body Material, By Application, By Pressure, By Temperature and End User Industry

By Product Type, Direct Acting segment is expected to dominate the market during the forecast period

The Pressure Reducing Valve (PRV) Market can be segmented by product type into two main categories: The two basic types of indirect acting control valves are: the direct acting and pilot operated valves. Direct acting pressure reducing valves are very simple and compact in design intended for basic pressure control through the use of a diaphragm which is directly affected by the downstream pressure. These valves allow some variation of pressure and as such can be incorporated in various residential water supply systems and HVAC systems and many other industrial processes. Increasing requirements of miniaturized and inexpensive products in various applications including plumbing and irrigation systems are fueling the sales of direct acting valves, which are still expanding the market.

Whereas the pilot operated pressure reducing valves are capable of controlling higher flow rates and offers more stable pressure control. Some of these valves use a pilot valve which controls the flow of the fluid to the diaphragm to produce more precision in pressure regulation. Different industries including oil and gas, power generation, and chemical processing have a need for better pressure control and the need for pilot operated PRVs is therefore emanating from such sectors. Many applications require valves that can accommodate fluctuating pressure conditions and large flow rates – and these valves are uniquely suited to such demands. All in all, both product types are valuable in serving various operation requirements and contribute to diversifying and enlarging the PRV market.

By End-Use Industry, Chemical Industry segment held the largest share in 2024

The Pressure Reducing Valve (PRV) Market is a key enabler of numerous industries, all of which have varying needs and purposes. In the chemical industry, PRVs remain of significant importance in controlling pressures of differing fluids and gases, primarily in manufacturing procedures, with protective objectives of personnel alongside equipment in mind. In the same manner, in power generation, the valves are extremely critical for the control of steam and water pressure in thermal and electric power plants for efficiency in power generation and improved reliability of the system. It is used as pressure control devices in manufacturing industries including the pharmaceuticals besides the food and beverage industries during processing since this is very important in meeting set standards especially regarding pressure.

Also it is used in upstream operation for exploration of crude oil and natural gas and downstream processing of these fluids also the oil and gas industry is among the largest consumer of this type of valves. Another usage of PRVs within the industry is in the plumbing systems using the PRVs in regulation of water pressure needed by the guest. In control of flow within the pulp and paper manufacturing processes, the PRVs ensure the management of steam and water pressure for improved performance. Thus, having identified general industry trends, it becomes clear that as these industries grow and develop the need for better and more reliable pressure reducing valves in sectors identified will also expand due to the need for the safer, more efficient and compliant solution. In summary, the uses of PRV in various end user industries prove the importance of PRVs for constant pressure regulation in fluids systems.

Pressure Reducing Valve Market Regional Insights:

North America is expected to dominate the market

Currently, North America is expected to hold the largest growth of the Pressure Reducing Valve (PRV) market because of well-developed industrial network and large capital expenditures in various fields like oil & gas, water treatment, manufacturing, etc. The area is populated by a significant number of important stakeholders as well as sophisticated production sites behind the creation and delivery of premium pressure reducing valves. Further, the regulatory and increased safety standards in North America and the desire of organizations to have efficient managing system force the PMR of appealing and dependable PRVs. Such emphasis of safety and performance has contributed to the enhanced demand for the latest valve technologies that have strengthened its position in North America.

In addition, North American energy and sustainability needs have been majorly driving the demand for pressure reducing valves throughout several applications. Because industries are seeking methods of managing and minimizing energy and operational costs managing fluid and pressure using PRVs is very beneficial. The adoption of other smart technologies and incorporation of IoT is also slowly picking up in the region especially in valve systems for real-time monitoring and control. Such factors causing growth, North America is expected to dominate the Pressure Reducing Valve Market and mark its future possibilities for introducing new innovations and development in the valve.

Active Key Players in the Pressure Reducing Valve Market

Spirax Sarco Limited (U.K.)

Forbes Marshall (India)

Nutech Controls (India)

Armstrong International Inc. (U.S.)

CONTRO VALVE EQUIPMENT INC. (Canada)

Richards Industrials (U.S.)

Honeywell International Inc. (U.S.)

Watts Water Technologies EMEA (U.S.)

Eaton (Ireland)

KSB SE & Co. KGaA (Germany)

PARKER HANNIFIN CORP (U.S.)

RWC (Australia)

Mueller Water Products, Inc. (U.S.)

TALIS Beteiligungs GmbH (Germany)

Aalberts N.V. (Netherlands)

CIRCOR International, Inc. (U.S.)

ITAP (Italy)

Caleffi S.p.a. (Italy)

HAWE Hydraulik SE (Germany) others

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pressure Reducing Valve Market by Product Type (2018-2032)

4.1 Pressure Reducing Valve Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Direct Acting

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Pilot Operating

Chapter 5: Pressure Reducing Valve Market by Body Material (2018-2032)

5.1 Pressure Reducing Valve Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cast Iron

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cast steel

5.5 Ductile Iron

5.6 Stainless steel

5.7 Bronze

5.8 Carbon steel

Chapter 6: Pressure Reducing Valve Market by Application (2018-2032)

6.1 Pressure Reducing Valve Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Steam

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Gas

6.5 Liquid

Chapter 7: Pressure Reducing Valve Market by Pressure (2018-2032)

7.1 Pressure Reducing Valve Market Snapshot and Growth Engine

7.2 Market Overview

7.3 50-200 psig

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 201-500 psig

7.5 501-800 psig

7.6 Above 800 psig

Chapter 8: Pressure Reducing Valve Market by Temperature (2018-2032)

8.1 Pressure Reducing Valve Market Snapshot and Growth Engine

8.2 Market Overview

8.3 10 – 100 F

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 101-250 F

8.5 251-400 F

8.6 401-550 F

8.7 551-700 F

8.8 Above 700 F

Chapter 9: Pressure Reducing Valve Market by End User Industry (2018-2032)

9.1 Pressure Reducing Valve Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Chemical Industry

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Power Generation Industry

9.5 Hospitality Industry

9.6 Pharmaceuticals Industry

9.7 Food and Beverage Industry

9.8 Pulp and Paper industry

9.9 Oil and Gas Industry

9.10 Others

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Pressure Reducing Valve Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 SPIRAX SARCO LIMITED (U.K.)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 FORBES MARSHALL (INDIA)

10.4 NUTECH CONTROLS (INDIA)

10.5 ARMSTRONG INTERNATIONAL INC. (U.S.)

10.6 CONTRO VALVE EQUIPMENT INC. (CANADA)

10.7 RICHARDS INDUSTRIALS (U.S.)

10.8 HONEYWELL INTERNATIONAL INC. (U.S.)

10.9 WATTS WATER TECHNOLOGIES EMEA (U.S.)

10.10 EATON (IRELAND)

10.11 KSB SE & CO. KGAA (GERMANY)

10.12 PARKER HANNIFIN CORP (U.S.)

10.13 RWC (AUSTRALIA)

10.14 MUELLER WATER PRODUCTS INC. (U.S.)

10.15 TALIS BETEILIGUNGS GMBH (GERMANY)

10.16 AALBERTS N.V. (NETHERLANDS)

10.17 CIRCOR INTERNATIONAL INC. (U.S.)

10.18 ITAP (ITALY)

10.19 CALEFFI S.P.A. (ITALY)

10.20 HAWE HYDRAULIK SE (GERMANY)

10.21 OTHERS

10.22

Chapter 11: Global Pressure Reducing Valve Market By Region

11.1 Overview

11.2. North America Pressure Reducing Valve Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Product Type

11.2.4.1 Direct Acting

11.2.4.2 Pilot Operating

11.2.5 Historic and Forecasted Market Size by Body Material

11.2.5.1 Cast Iron

11.2.5.2 Cast steel

11.2.5.3 Ductile Iron

11.2.5.4 Stainless steel

11.2.5.5 Bronze

11.2.5.6 Carbon steel

11.2.6 Historic and Forecasted Market Size by Application

11.2.6.1 Steam

11.2.6.2 Gas

11.2.6.3 Liquid

11.2.7 Historic and Forecasted Market Size by Pressure

11.2.7.1 50-200 psig

11.2.7.2 201-500 psig

11.2.7.3 501-800 psig

11.2.7.4 Above 800 psig

11.2.8 Historic and Forecasted Market Size by Temperature

11.2.8.1 10 – 100 F

11.2.8.2 101-250 F

11.2.8.3 251-400 F

11.2.8.4 401-550 F

11.2.8.5 551-700 F

11.2.8.6 Above 700 F

11.2.9 Historic and Forecasted Market Size by End User Industry

11.2.9.1 Chemical Industry

11.2.9.2 Power Generation Industry

11.2.9.3 Hospitality Industry

11.2.9.4 Pharmaceuticals Industry

11.2.9.5 Food and Beverage Industry

11.2.9.6 Pulp and Paper industry

11.2.9.7 Oil and Gas Industry

11.2.9.8 Others

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Pressure Reducing Valve Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Product Type

11.3.4.1 Direct Acting

11.3.4.2 Pilot Operating

11.3.5 Historic and Forecasted Market Size by Body Material

11.3.5.1 Cast Iron

11.3.5.2 Cast steel

11.3.5.3 Ductile Iron

11.3.5.4 Stainless steel

11.3.5.5 Bronze

11.3.5.6 Carbon steel

11.3.6 Historic and Forecasted Market Size by Application

11.3.6.1 Steam

11.3.6.2 Gas

11.3.6.3 Liquid

11.3.7 Historic and Forecasted Market Size by Pressure

11.3.7.1 50-200 psig

11.3.7.2 201-500 psig

11.3.7.3 501-800 psig

11.3.7.4 Above 800 psig

11.3.8 Historic and Forecasted Market Size by Temperature

11.3.8.1 10 – 100 F

11.3.8.2 101-250 F

11.3.8.3 251-400 F

11.3.8.4 401-550 F

11.3.8.5 551-700 F

11.3.8.6 Above 700 F

11.3.9 Historic and Forecasted Market Size by End User Industry

11.3.9.1 Chemical Industry

11.3.9.2 Power Generation Industry

11.3.9.3 Hospitality Industry

11.3.9.4 Pharmaceuticals Industry

11.3.9.5 Food and Beverage Industry

11.3.9.6 Pulp and Paper industry

11.3.9.7 Oil and Gas Industry

11.3.9.8 Others

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Pressure Reducing Valve Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Product Type

11.4.4.1 Direct Acting

11.4.4.2 Pilot Operating

11.4.5 Historic and Forecasted Market Size by Body Material

11.4.5.1 Cast Iron

11.4.5.2 Cast steel

11.4.5.3 Ductile Iron

11.4.5.4 Stainless steel

11.4.5.5 Bronze

11.4.5.6 Carbon steel

11.4.6 Historic and Forecasted Market Size by Application

11.4.6.1 Steam

11.4.6.2 Gas

11.4.6.3 Liquid

11.4.7 Historic and Forecasted Market Size by Pressure

11.4.7.1 50-200 psig

11.4.7.2 201-500 psig

11.4.7.3 501-800 psig

11.4.7.4 Above 800 psig

11.4.8 Historic and Forecasted Market Size by Temperature

11.4.8.1 10 – 100 F

11.4.8.2 101-250 F

11.4.8.3 251-400 F

11.4.8.4 401-550 F

11.4.8.5 551-700 F

11.4.8.6 Above 700 F

11.4.9 Historic and Forecasted Market Size by End User Industry

11.4.9.1 Chemical Industry

11.4.9.2 Power Generation Industry

11.4.9.3 Hospitality Industry

11.4.9.4 Pharmaceuticals Industry

11.4.9.5 Food and Beverage Industry

11.4.9.6 Pulp and Paper industry

11.4.9.7 Oil and Gas Industry

11.4.9.8 Others

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Pressure Reducing Valve Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Product Type

11.5.4.1 Direct Acting

11.5.4.2 Pilot Operating

11.5.5 Historic and Forecasted Market Size by Body Material

11.5.5.1 Cast Iron

11.5.5.2 Cast steel

11.5.5.3 Ductile Iron

11.5.5.4 Stainless steel

11.5.5.5 Bronze

11.5.5.6 Carbon steel

11.5.6 Historic and Forecasted Market Size by Application

11.5.6.1 Steam

11.5.6.2 Gas

11.5.6.3 Liquid

11.5.7 Historic and Forecasted Market Size by Pressure

11.5.7.1 50-200 psig

11.5.7.2 201-500 psig

11.5.7.3 501-800 psig

11.5.7.4 Above 800 psig

11.5.8 Historic and Forecasted Market Size by Temperature

11.5.8.1 10 – 100 F

11.5.8.2 101-250 F

11.5.8.3 251-400 F

11.5.8.4 401-550 F

11.5.8.5 551-700 F

11.5.8.6 Above 700 F

11.5.9 Historic and Forecasted Market Size by End User Industry

11.5.9.1 Chemical Industry

11.5.9.2 Power Generation Industry

11.5.9.3 Hospitality Industry

11.5.9.4 Pharmaceuticals Industry

11.5.9.5 Food and Beverage Industry

11.5.9.6 Pulp and Paper industry

11.5.9.7 Oil and Gas Industry

11.5.9.8 Others

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Pressure Reducing Valve Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Product Type

11.6.4.1 Direct Acting

11.6.4.2 Pilot Operating

11.6.5 Historic and Forecasted Market Size by Body Material

11.6.5.1 Cast Iron

11.6.5.2 Cast steel

11.6.5.3 Ductile Iron

11.6.5.4 Stainless steel

11.6.5.5 Bronze

11.6.5.6 Carbon steel

11.6.6 Historic and Forecasted Market Size by Application

11.6.6.1 Steam

11.6.6.2 Gas

11.6.6.3 Liquid

11.6.7 Historic and Forecasted Market Size by Pressure

11.6.7.1 50-200 psig

11.6.7.2 201-500 psig

11.6.7.3 501-800 psig

11.6.7.4 Above 800 psig

11.6.8 Historic and Forecasted Market Size by Temperature

11.6.8.1 10 – 100 F

11.6.8.2 101-250 F

11.6.8.3 251-400 F

11.6.8.4 401-550 F

11.6.8.5 551-700 F

11.6.8.6 Above 700 F

11.6.9 Historic and Forecasted Market Size by End User Industry

11.6.9.1 Chemical Industry

11.6.9.2 Power Generation Industry

11.6.9.3 Hospitality Industry

11.6.9.4 Pharmaceuticals Industry

11.6.9.5 Food and Beverage Industry

11.6.9.6 Pulp and Paper industry

11.6.9.7 Oil and Gas Industry

11.6.9.8 Others

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Pressure Reducing Valve Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Product Type

11.7.4.1 Direct Acting

11.7.4.2 Pilot Operating

11.7.5 Historic and Forecasted Market Size by Body Material

11.7.5.1 Cast Iron

11.7.5.2 Cast steel

11.7.5.3 Ductile Iron

11.7.5.4 Stainless steel

11.7.5.5 Bronze

11.7.5.6 Carbon steel

11.7.6 Historic and Forecasted Market Size by Application

11.7.6.1 Steam

11.7.6.2 Gas

11.7.6.3 Liquid

11.7.7 Historic and Forecasted Market Size by Pressure

11.7.7.1 50-200 psig

11.7.7.2 201-500 psig

11.7.7.3 501-800 psig

11.7.7.4 Above 800 psig

11.7.8 Historic and Forecasted Market Size by Temperature

11.7.8.1 10 – 100 F

11.7.8.2 101-250 F

11.7.8.3 251-400 F

11.7.8.4 401-550 F

11.7.8.5 551-700 F

11.7.8.6 Above 700 F

11.7.9 Historic and Forecasted Market Size by End User Industry

11.7.9.1 Chemical Industry

11.7.9.2 Power Generation Industry

11.7.9.3 Hospitality Industry

11.7.9.4 Pharmaceuticals Industry

11.7.9.5 Food and Beverage Industry

11.7.9.6 Pulp and Paper industry

11.7.9.7 Oil and Gas Industry

11.7.9.8 Others

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

Q1: What would be the forecast period in the Pressure Reducing Valve Market research report?

A1: The forecast period in the Pressure Reducing Valve Market research report is 2024-2032.

Q2: Who are the key players in the Pressure Reducing Valve Market?

A2: Spirax Sarco Limited (U.K.), Forbes Marshall (India), Nutech Controls (India), Armstrong International Inc. (U.S.), CONTRO VALVE EQUIPMENT INC. (Canada), Richards Industrials (U.S.), Honeywell International Inc. (U.S.), Watts Water Technologies EMEA (U.S.), Eaton (Ireland), KSB SE & Co. KGaA (Germany), PARKER HANNIFIN CORP (U.S.), RWC (Australia), Mueller Water Products, Inc. (U.S.), TALIS Beteiligungs GmbH (Germany), Aalberts N.V. (Netherlands), CIRCOR International, Inc. (U.S.), ITAP (Italy), Caleffi S.p.a. (Italy), HAWE Hydraulik SE (Germany), others.

Q3: What are the segments of the Pressure Reducing Valve Market?

A3: The Pressure Reducing Valve Market is segmented into By Product Type (Direct Acting and Pilot Operating), Body Material (Cast Iron, Cast steel, Ductile Iron, Stainless steel, Bronze, and Carbon steel), Application (Steam, Gas, and Liquid), Pressure (50-200 psig, 201-500 psig, 501-800 psig, and Above 800 psig), Temperature (10 – 100 F, 101-250 F, 251-400 F, 401-550 F, 551-700 F, and Above 700 F), End User Industry (Chemical Industry, Power Generation Industry, Hospitality Industry, Pharmaceuticals Industry, Food and Beverage Industry, Pulp and Paper industry, Oil and Gas Industry, and Others).By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Pressure Reducing Valve Market?

A4: A pressure reducing valve (PRV) is a type of valve designed to automatically maintain a predetermined outlet pressure, regardless of changes in upstream pressure or flow conditions. It functions by reducing the high pressure from a supply line to a lower, controlled pressure suitable for downstream applications, ensuring safe and efficient operation of fluid systems. Commonly used in various industries, including water treatment, oil and gas, and manufacturing, PRVs help protect sensitive equipment, maintain system integrity, and improve overall energy efficiency. These valves typically consist of a spring-loaded mechanism that adjusts the valve's opening in response to fluctuations in downstream pressure, allowing for precise pressure control and minimizing the risk of damage to pipes and machinery.

Q5: How big is the Pressure Reducing Valve Market?

A5: Pressure Reducing Valve Market Size is Valued at USD 3.12 Billion in 2023, and is Projected to Reach USD 4.30 Billion by 2032, Growing at a CAGR of 4.10% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!