Stay Ahead in Fast-Growing Economies.

Browse Reports NowPower Generation Equipment Market: Size & Industry Outlook

Power generation equipment encompasses machinery used to produce electrical energy from various sources such as fossil fuels, nuclear power, or renewable energy. This includes generators, turbines, transformers, boilers, and control systems, designed to convert mechanical, thermal, or chemical energy into electricity for industrial, commercial, and residential use. These systems are essential for ensuring reliable and efficient power supply.

IMR Group

Description

Power Generation Equipment Market Synopsis

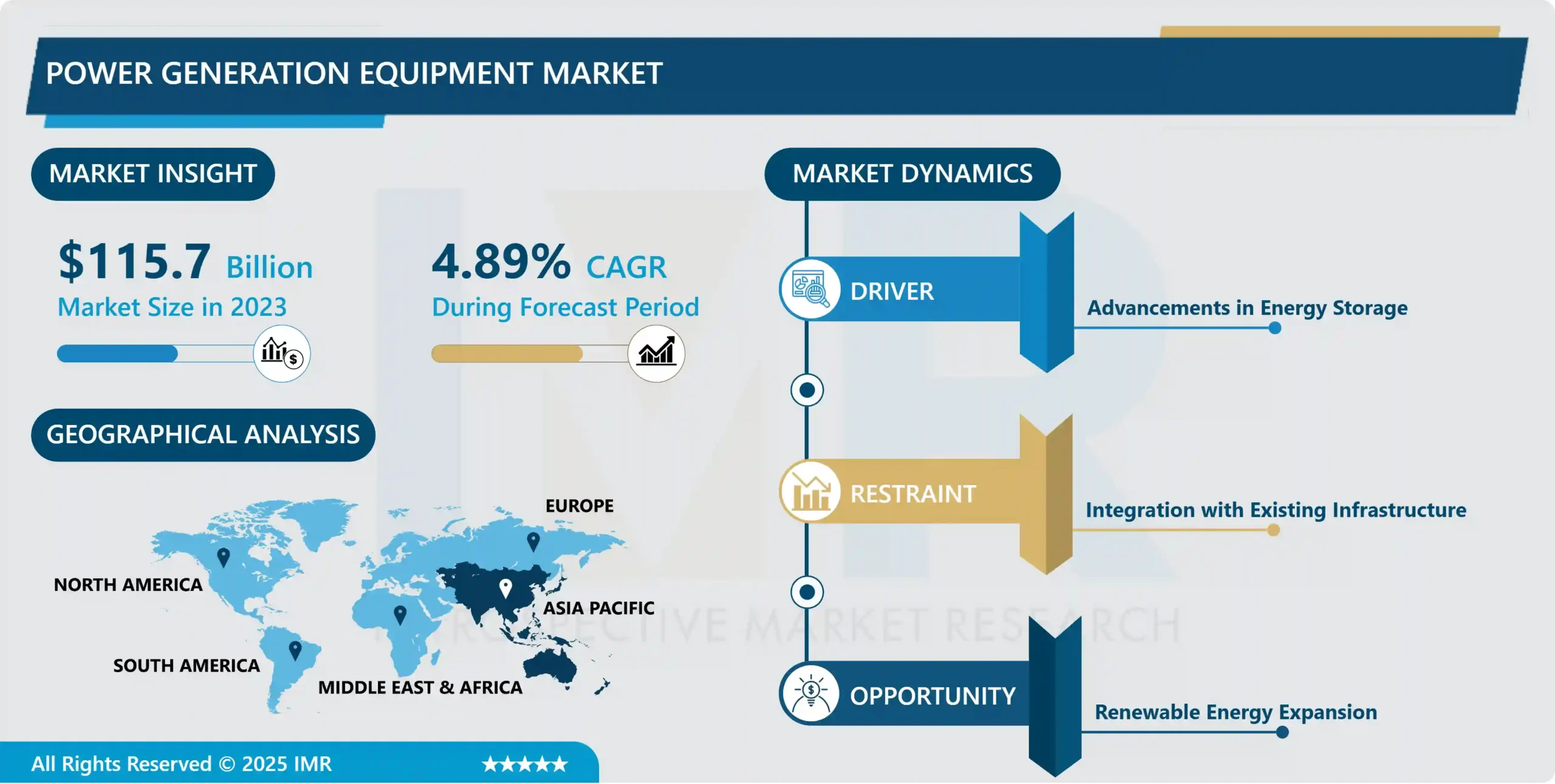

Power Generation Equipment Market Size Was Valued at USD 115.70 Billion in 2023, and is Projected to Reach USD 177.80 Billion by 2032, Growing at a CAGR of 4.89% From 2024-2032.

Power generation equipment encompasses machinery used to produce electrical energy from various sources such as fossil fuels, nuclear power, or renewable energy. This includes generators, turbines, transformers, boilers, and control systems, designed to convert mechanical, thermal, or chemical energy into electricity for industrial, commercial, and residential use. These systems are essential for ensuring reliable and efficient power supply. The increasing need for energy as a result of population growth and industrialization, particularly in developing nations, is causing the usage of more advanced power generation technologies to produce energy that is both more dependable and economical. As renewable energy grows, so does the emphasis on energy storage solutions like battery systems. Power grids are being modernized to handle diverse sources, featuring smart grid technologies for improved management of decentralized generation and ensuring stable power supply.

There is a growing use of renewable energy sources like wind, solar, and hydroelectric power, resulting in more investment in specific equipment. Regions are improving energy infrastructure to boost efficiency, reliability, and environmental sustainability. Gas-fired power generation is evolving alongside renewables, highlighting natural gas as a temporary option because it produces less carbon emissions compared to coal. Advancements in technology increase productivity and lower pollution levels. Government strategies and encouragements for renewable energy spur investments in innovative power generation technology, as growing ecological consciousness propels the sector toward sustainable options. Economic development often leads to increased energy needs and investments in power generation infrastructure, contributing to market growth. Enhancements in technology such as upgraded gas turbines and digital transformation are increasing the efficiency of power plants. Decentralization is increasing as smaller power systems such as microgrids and DERs are gaining popularity, boosting local power and grid resilience.

Power Generation Equipment Market Trend Analysis

Advancements in Energy Storage

Integrating renewable energy requires using energy storage systems such as batteries to balance supply and demand by managing the intermittency. This also aids in preserving grid stability by reducing variations in power generation. Progress in energy storage technology, especially lithium-ion batteries, has resulted in lower costs, making them accessible for a range of uses. Continual technological advancement, like solid-state batteries, is enhancing performance, safety, and energy density in comparison to conventional lithium-ion batteries. Numerous governments offer incentives and subsidies for energy storage to encourage the use of renewable energy sources and decrease emissions. Developing rules and benchmarks are backing energy storage, and promoting investment and implementation.

Energy storage is essential for improving grid flexibility and resilience by participating in demand response programs and supplying backup power during outages. It further backs decentralized energy systems by maximizing distributed generation resources such as rooftop solar panels and facilitating the functioning of microgrids. These systems boost self-reliance and energy independence by combining different energy sources to improve reliability. Significant investment and innovation are being driven by the increasing need for energy storage solutions in the shift towards sustainable energy systems. Investors are showing a growing interest in energy storage technologies due to their potential for high profits and importance in upcoming energy systems.

Energy storage systems offer advantages like peak shaving, operational efficiency, and assistance for electric vehicles and charging infrastructure, bringing economic benefits. Storing energy during low-demand periods can lower costs and enhance load management. Energy waste can be reduced by enhancing the efficiency of energy generation and distribution. Furthermore, energy storage also contributes to the expansion of electric vehicles by supplying charging infrastructure and solutions for integrating vehicles with the grid, improving grid stability during peak charging periods.

Renewable Energy Expansion

The rising awareness of climate change and environmental degradation is spurring the need for clean energy sources to lower greenhouse gas emissions. Governments are enforcing more rigorous rules and carbon reduction goals, driving the shift towards renewable energy. Advancements in technology have lowered expenses and increased the effectiveness of renewable energy options such as solar panels and wind turbines, making them more competitive with conventional sources.

Governments offer financial assistance, tax breaks, and funding to support the development of renewable energy technology. Renewable portfolio standards and feed-in tariffs encourage utilities to incorporate a specific quantity of renewable energy, thus boosting the need for renewable equipment. Renewable sources reduce dependence on non-domestic fossil fuels and enhance energy security by diversifying sources. Wind and solar power obtained from nearby sources lessen the need for long-distance energy transportation, improving energy self-sufficiency.

Increased market presence in developing countries is fueling growth potential for renewable energy. The growth needs to be supported by infrastructure development, such as energy storage systems and smart grids. Numerous corporations are establishing sustainability objectives and allocating resources to renewable energy as components of their corporate social responsibility plans, driven by the public’s desire for eco-friendly energy choices.

Power Generation Equipment Market Segment Analysis:

Power Generation Equipment Market Segmented based on Type, Power Generation Source, Application, End-User, And Region.

By Type, Turbines and Engine Segment Is Expected to Dominate the Market During the Forecast Period.

Gas, steam, and wind turbines are very effective at converting energy and are well-suited for generating electricity during both base-load and peak-load periods. Gas turbines provide the ability to start up quickly, whereas steam turbines are commonly utilized for generating electricity on a large scale. Diesel and gas engines are both dependable sources of power generation, with diesel engines valued for their longevity and capacity for remote operation, while gas engines are recognized for their efficiency and reduced emissions. Turbines and engines are adaptable, with turbines utilized in different power generation environments and engines used in backup power systems, emergency power, and distributed generation, operating on a variety of fuels and supplying power as needed.

The growing popularity of renewable energy is increasing the need for both wind turbines and gas turbines. Countries are focusing on increasing their use of clean energy by improving the technology and decreasing the cost of wind turbines. Gas turbines are being utilized in conjunction with renewable sources to ensure consistent power production. Advancements in turbines, such as CCGT and updated design, improve performance and efficiency levels. Advancements in engines concentrate on efficiency, controlling emissions, and fuel versatility, resulting in improved performance, reduced emissions, and enhanced fuel efficiency, thus gaining popularity in the power generation market.

Continued growth of infrastructure in developing countries necessitates substantial funding for power generation machinery such as turbines and engines. These parts are crucial for developing a dependable power system, aiding in industrial growth, and fulfilling increasing energy needs. Engines play a crucial role in providing essential backup power to guarantee energy security across different industries. Gas turbines and advanced steam turbines are preferred for their enhanced environmental efficiency, backed by regulations advocating for cleaner technologies.

By End-User, Industrial Segment Held the Largest Share In 2023

Increased global industrial production has resulted in a greater need for power generation equipment to meet manufacturing and operational requirements. Industrial plants are enhancing their technology to increase productivity, frequently incorporating the newest innovations in power generation machinery. The increasing energy requirements of growing industries necessitate dependable and adaptable power generation solutions.

Businesses are concentrating on reducing costs by purchasing efficient power generation systems, leading to decreased operational expenses. More stringent environmental rules are motivating industries to embrace cleaner technologies that lower emissions and enhance performance. Industries are improving energy security and reliability by investing in strong power generation solutions, like on-site power generation systems, to decrease reliance on external grid supplies and guarantee continuous operations.

Continuous infrastructure growth and updates in developing countries increase the need for new power generation machinery. Important factors driving this expansion are the industrial fields related to building and extracting resources. The need for advanced systems is driven by the globalization of supply chains, requiring reliable power generation in various regions. Tailored power generation solutions designed for specific industrial needs stimulate market expansion by meeting distinct operational requirements and performance criteria.

Power Generation Equipment Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

China and India are experiencing fast economic development, leading to an increased need for more power production capacity. The growth of cities and the building of infrastructure in Asia Pacific countries demand more energy for homes, businesses, and industries. Increasing energy needs are fueled by a rising population and higher living standards, underscoring the significance of power generation machinery.

Governments across the Asia Pacific region are dedicating resources to energy infrastructure development, with an emphasis on renewable sources to ensure sustainable growth and energy security. China has made considerable financial contributions to decrease carbon emissions. The growth of industry in developing countries creates a demand for additional electricity production infrastructure. The area is a centre for technological advancements in generating power, with quick acceptance of renewable energy, energy storage, and smart grids.

The power sector in the Asia Pacific region attracts significant Foreign Direct Investment (FDI), which encourages the utilization of modern power generation technologies. Nations are focusing on ensuring energy security through the expansion of energy sources and improvements to power infrastructure. The area is seen as crucial for the expansion of worldwide energy markets, enticing higher investments in power generation machinery.

Power Generation Equipment Market Active Players

General Electric (USA)

Siemens Energy (Germany)

Schneider Electric (France)

Mitsubishi Power (Mitsubishi Heavy Industries) (Japan)

Siemens Gamesa Renewable Energy (Spain)

ABB Ltd. (Switzerland)

Honeywell International Inc. (USA)

Eaton Corporation (Ireland)

Duke Energy (USA)

Emerson Electric Co. (USA)

Vestas Wind Systems A/S (Denmark)

Enel Green Power (Italy)

Ørsted (Denmark)

Nordex SE (Germany)

First Solar, Inc., (USA)

GE Renewable Energy (France)

Alstom Power (France)

China National Nuclear Corporation (CNNC) (China)

China General Nuclear Power Group (CGN) (China)

Westinghouse Electric Company (USA)

Suzlon Energy (India)

Toshiba Energy Systems & Solutions Corporation (Japan)

Nextera Energy (USA)

S&P Globa, (USA), and Other Active Players

Key Industry Developments in the Power Generation Equipment Market:

In July 2024, Siemens and Boson Energy enter an agreement to accelerate the green energy transition through?waste-to-hydrogen?(to-X) technology. Boson Energy and Siemens AG have signed a Memorandum of Understanding (MoU) to facilitate collaboration on technology that converts non-recyclable waste into clean energy. The collaboration aims to advance sustainable, local energy security, enabling hydrogen-powered electric vehicle charging infrastructure without compromising grid stability or impacting consumer prices.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Power Generation Equipment Market by Type (2018-2032)

4.1 Power Generation Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Generator

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Transformer

4.5 Turbine

4.6 Engine

4.7 Power Cable

Chapter 5: Power Generation Equipment Market by Power Generation Source (2018-2032)

5.1 Power Generation Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fossil Fuels

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Solar

5.5 Wind

5.6 Nuclear

5.7 Hydro

5.8 Power Generation Source

Chapter 6: Power Generation Equipment Market by Application (2018-2032)

6.1 Power Generation Equipment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Power Generation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Transmission

6.5 Distribution

Chapter 7: Power Generation Equipment Market by End-User (2018-2032)

7.1 Power Generation Equipment Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Industrial

7.5 Commercial

7.6 Utility

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Power Generation Equipment Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 GENERAL ELECTRIC (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SIEMENS ENERGY (GERMANY)

8.4 SCHNEIDER ELECTRIC (FRANCE)

8.5 MITSUBISHI POWER (MITSUBISHI HEAVY INDUSTRIES) (JAPAN)

8.6 SIEMENS GAMESA RENEWABLE ENERGY (SPAIN)

8.7 ABB LTD. (SWITZERLAND)

8.8 HONEYWELL INTERNATIONAL INC. (USA)

8.9 EATON CORPORATION (IRELAND)

8.10 DUKE ENERGY (USA)

8.11 EMERSON ELECTRIC CO. (USA)

8.12 VESTAS WIND SYSTEMS A/S (DENMARK)

8.13 ENEL GREEN POWER (ITALY)

8.14 ØRSTED (DENMARK)

8.15 NORDEX SE (GERMANY)

8.16 FIRST SOLAR INC(USA)

8.17 GE RENEWABLE ENERGY (FRANCE)

8.18 ALSTOM POWER (FRANCE)

8.19 CHINA NATIONAL NUCLEAR CORPORATION (CNNC) (CHINA)

8.20 CHINA GENERAL NUCLEAR POWER GROUP (CGN) (CHINA)

8.21 WESTINGHOUSE ELECTRIC COMPANY (USA)

8.22 SUZLON ENERGY (INDIA)

8.23 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION (JAPAN)

8.24 NEXTERA ENERGY (USA)

8.25 S&P GLOBA

8.26 (USA)

8.27 AND

Chapter 9: Global Power Generation Equipment Market By Region

9.1 Overview

9.2. North America Power Generation Equipment Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Generator

9.2.4.2 Transformer

9.2.4.3 Turbine

9.2.4.4 Engine

9.2.4.5 Power Cable

9.2.5 Historic and Forecasted Market Size by Power Generation Source

9.2.5.1 Fossil Fuels

9.2.5.2 Solar

9.2.5.3 Wind

9.2.5.4 Nuclear

9.2.5.5 Hydro

9.2.5.6 Power Generation Source

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Power Generation

9.2.6.2 Transmission

9.2.6.3 Distribution

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Residential

9.2.7.2 Industrial

9.2.7.3 Commercial

9.2.7.4 Utility

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Power Generation Equipment Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Generator

9.3.4.2 Transformer

9.3.4.3 Turbine

9.3.4.4 Engine

9.3.4.5 Power Cable

9.3.5 Historic and Forecasted Market Size by Power Generation Source

9.3.5.1 Fossil Fuels

9.3.5.2 Solar

9.3.5.3 Wind

9.3.5.4 Nuclear

9.3.5.5 Hydro

9.3.5.6 Power Generation Source

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Power Generation

9.3.6.2 Transmission

9.3.6.3 Distribution

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Residential

9.3.7.2 Industrial

9.3.7.3 Commercial

9.3.7.4 Utility

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Power Generation Equipment Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Generator

9.4.4.2 Transformer

9.4.4.3 Turbine

9.4.4.4 Engine

9.4.4.5 Power Cable

9.4.5 Historic and Forecasted Market Size by Power Generation Source

9.4.5.1 Fossil Fuels

9.4.5.2 Solar

9.4.5.3 Wind

9.4.5.4 Nuclear

9.4.5.5 Hydro

9.4.5.6 Power Generation Source

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Power Generation

9.4.6.2 Transmission

9.4.6.3 Distribution

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Residential

9.4.7.2 Industrial

9.4.7.3 Commercial

9.4.7.4 Utility

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Power Generation Equipment Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Generator

9.5.4.2 Transformer

9.5.4.3 Turbine

9.5.4.4 Engine

9.5.4.5 Power Cable

9.5.5 Historic and Forecasted Market Size by Power Generation Source

9.5.5.1 Fossil Fuels

9.5.5.2 Solar

9.5.5.3 Wind

9.5.5.4 Nuclear

9.5.5.5 Hydro

9.5.5.6 Power Generation Source

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Power Generation

9.5.6.2 Transmission

9.5.6.3 Distribution

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Residential

9.5.7.2 Industrial

9.5.7.3 Commercial

9.5.7.4 Utility

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Power Generation Equipment Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Generator

9.6.4.2 Transformer

9.6.4.3 Turbine

9.6.4.4 Engine

9.6.4.5 Power Cable

9.6.5 Historic and Forecasted Market Size by Power Generation Source

9.6.5.1 Fossil Fuels

9.6.5.2 Solar

9.6.5.3 Wind

9.6.5.4 Nuclear

9.6.5.5 Hydro

9.6.5.6 Power Generation Source

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Power Generation

9.6.6.2 Transmission

9.6.6.3 Distribution

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Residential

9.6.7.2 Industrial

9.6.7.3 Commercial

9.6.7.4 Utility

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Power Generation Equipment Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Generator

9.7.4.2 Transformer

9.7.4.3 Turbine

9.7.4.4 Engine

9.7.4.5 Power Cable

9.7.5 Historic and Forecasted Market Size by Power Generation Source

9.7.5.1 Fossil Fuels

9.7.5.2 Solar

9.7.5.3 Wind

9.7.5.4 Nuclear

9.7.5.5 Hydro

9.7.5.6 Power Generation Source

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Power Generation

9.7.6.2 Transmission

9.7.6.3 Distribution

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Residential

9.7.7.2 Industrial

9.7.7.3 Commercial

9.7.7.4 Utility

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Power Generation Equipment Market research report?

A1: The forecast period in the Power Generation Equipment Market research report is 2024-2032.

Q2: Who are the key players in the Power Generation Equipment Market?

A2: General Electric (USA), Siemens Energy (Germany), Schneider Electric (France), Mitsubishi Power (Mitsubishi Heavy Industries) (Japan), Siemens Gamesa Renewable Energy (Spain), ABB Ltd. (Switzerland), Honeywell International Inc. (USA), Eaton Corporation (Ireland), Duke Energy (USA), Emerson Electric Co. (USA), Vestas Wind Systems A/S (Denmark), Enel Green Power (Italy), Ørsted (Denmark), Nordex SE (Germany), First Solar, Inc. (USA), GE Renewable Energy (France), Alstom Power (France), China National Nuclear Corporation (CNNC) (China), China General Nuclear Power Group (CGN) (China), Westinghouse Electric Company (USA), Suzlon Energy (India), Toshiba Energy Systems & Solutions Corporation (Japan), Nextera Energy (USA), S&P Global (USA), and Other Active Players.

Q3: What are the segments of the Power Generation Equipment Market?

A3: The Power Generation Equipment Market is segmented into Type, Power Generation Source, Application, End-User, and region. By Type, the market is categorized into Generator, Transformer, Turbine, Engine, Power Cable. By Power Generation Source, the market is categorized into Fossil Fuels, Solar, Wind, Nuclear, Hydro. By Application, the market is categorized into Power Generation, Transmission, and Distribution. By End-User, the market is categorized into Residential, Industrial, Commercial, and Utility. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Power Generation Equipment Market?

A4: Power generation equipment encompasses machinery used to produce electrical energy from various sources such as fossil fuels, nuclear power, or renewable energy. This includes generators, turbines, transformers, boilers, and control systems, designed to convert mechanical, thermal, or chemical energy into electricity for industrial, commercial, and residential use. These systems are essential for ensuring reliable and efficient power supply.

Q5: How big is the Power Generation Equipment Market?

A5: Power Generation Equipment Market Size Was Valued at USD 115.70 Billion in 2023, and is Projected to Reach USD 177.80 Billion by 2032, Growing at a CAGR of 4.89% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!