Stay Ahead in Fast-Growing Economies.

Browse Reports NowPigments Market Comprehensive Analysis & Growth Outlook to 2032

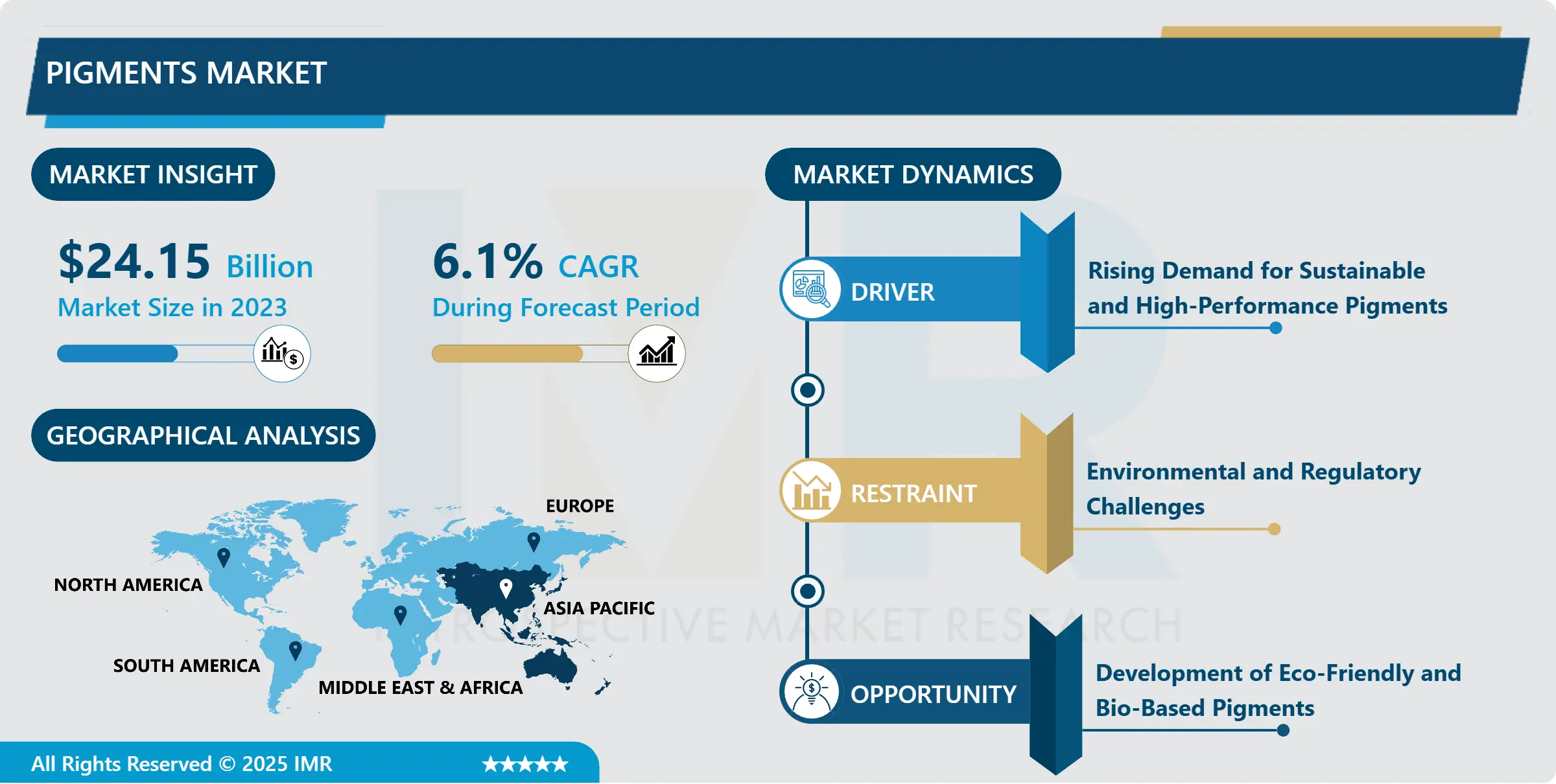

Pigments Market Size Was Valued at USD 24.15 Billion in 2023, and is Projected to Reach USD 41.14 Billion by 2032, Growing at a CAGR of 6.10 % From 2024-2032. The pigments market can be described as the manufacturing and sale of colored materials that are used to add color to various products for example; Paining, coating, platics, textiles and Cosmetics etc

IMR Group

Description

Pigments Market Synopsis:

Pigments Market Size Was Valued at USD 24.15 Billion in 2023, and is Projected to Reach USD 41.14 Billion by 2032, Growing at a CAGR of 6.10 % From 2024-2032.

The pigments market can be described as the manufacturing and sale of colored materials that are used to add color to various products for example; Paining, coating, platics, textiles and Cosmetics etc. These pigments are utilized in many industries because they give color, opacity and mechanical strength for the component. Organic pigments are those pigments which are produced from carbon containing compounds while inorganic pigments are generally those that are produced from minerals. Pigment demand arises due to new application in automotive segment, construction, and consumer products segments.

The use of bright, heavy, and naturally resistant pigments has become a key factor in the development of market demand. Automotive, construction, packaging etc needs pigments that offer better performance CRS and resistance to color change. It is noted that this change in trends towards higher performance and bio-sustainability is forcing the pigments industry to develop new products with an emphasis on safe products.

The second is by expediting industrialization and urbanisation in the emerging globe notably within the Asia Pacific region. Sterile consumer disposables being digested by growing disposable per capital incomes the demand for a variety of consumer products that range from textiles to coatings, among others has been on the rise coinciding with the expansion of infrastructure projects. This has the effect of creating the need for pigments that will be capable of fulfilling the new needs of these growing markets. It enhances the need for specialized pigments since consumer concern towards differentiated products and appearance intensifies.

Pigments Market Trend Analysis:

Increasing customer demand regarding the environmental profile of pigments

The major market trend that are observed at the moment are the increasing customer demand regarding the environmental profile of pigments. Consumers and manufacturers are paying more attentions towards low VOC pigments and water-base products. This shift is being motivated by the increased stringency of environmental standards and called-for products which are environmentally friendly. This is because many companies are now focusing on the use of sustainable pigments that have the following characteristics although they are also looking for pigments with better performance.

Continuously increasing demand for high performance pigments (HPPs) in a range of applications. Such pigments have enhanced organoleptic properties, outstanding light fastness, opacity than the other classes of pigments and tremendous resistance to chemicals making them ideal for use in high end technical applications such as automotive coatings and industries. As the consumers’ perception of the functional and aesthetic properties of textiles continues to advance – demanding brighter and better colors that last longer- manufacturers are shifting to HPPs.

Growing need and advance new niche solutions

This is an appealing trend for the producers of pigments, as they can find ways to meet this growing need and advance new niche solutions. As such, manufacturers in this field stand to benefit from a greater focus on natural and organic compounds or exploring for other eco-friendly ways of synthesizing inorganic pigments. launch of bio-pigment and pigment with low energy impact is likely to emerge as key strategic battleground over the forecast period.

Chance in young industries which are now developing in Asia Pacific and Latin America. With growing industrial growth and expansion in city size, needs for these types of pigments are experiencing a rise in these counties particularly in automobile production, construction and packaging sectors. Hence, the companies that will be able to source these rapidly developing markets with products specifically suited to the needs of those markets will be well placed to achieve growth within the global pigments market.

Pigments Market Segment Analysis:

Pigments Market is Segmented on the basis of Type, Application, End-User, and Region.

By Type, Organic Pigments segment is expected to dominate the market during the forecast period

The Organic Pigments segment is projected to dominate the pigments market during the forecast period due to a combination of performance benefits and increasing demand from key end-use industries. Organic pigments, derived from carbon-based molecules, are known for their vibrant color range, superior brightness, and excellent tinting strength, making them highly preferred in applications such as coatings, plastics, and printing inks.

Growing environmental concerns and the push for sustainable alternatives have spurred innovation in bio-based organic pigments, which are less toxic and more environmentally friendly compared to their inorganic counterparts. Industries are increasingly shifting toward organic pigments for use in automotive coatings, packaging materials, and decorative paints. The rising trend of eco-friendly and aesthetically appealing consumer goods further supports the growth of this segment, positioning it as a leading contributor in the global pigments market.

By Application, Paints and Coatings segment expected to held the largest share

The paints and coatings segment is projected to hold the largest share in the global pigments market due to its extensive use across various end-use industries such as construction, automotive, and industrial manufacturing. Pigments play a vital role in enhancing the aesthetic appeal, surface durability, and corrosion resistance of paints and coatings. Rapid urbanization, infrastructure development, and the rise in automobile production, especially in emerging economies, have fueled demand for high-performance pigments.

Growing consumer preferences for eco-friendly and sustainable coatings have led to innovations in pigment formulations, further driving segment growth. The widespread application of pigments in architectural and decorative paints, industrial finishes, and protective coatings cements this segment’s dominance in the market. As industries increasingly prioritize durability and visual appeal, the demand for advanced pigment solutions in this category is expected to remain strong.

Pigments Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia Pacific leads the global pigments industry because of increase in industrialization and urbanization coupled with demand for consumer products. is served by a number of production centres, particularly within the Asia-Pacific, which is the largest consumer of pigments for automotive, construction and packaging applications. Moreover, expanding middle class population base and generation of higher per capital income in Asia Pacific is enhancing demand for better quality pigments in consumer products.

Besides the manufacturing influence, the region is gradually experiencing the independent players who are stretching their prices and products. The increasing awareness towards sustainability and environmentally friendly products is also affecting the growth and innovations in the pigments market making Asia Pacific at a larger position in the global market.

Active Key Players in the Pigments Market:

BASF (Germany)

Cabot Corporation (USA)

Clariant (Switzerland)

DIC Corporation (Japan)

Huntsman Corporation (USA)

Kronos Worldwide (USA)

Lanxess (Germany)

Sudarshan Chemical Industries (India)

The Chemours Company (USA)

Toyo Ink SC Holdings (Japan), and Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pigments Market by Type

4.1 Pigments Market Snapshot and Growth Engine

4.2 Pigments Market Overview

4.3 Hydraulic Piling Machines

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Hydraulic Piling Machines: Geographic Segmentation Analysis

4.4 Mechanical Piling Machines

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Mechanical Piling Machines: Geographic Segmentation Analysis

4.5 Diesel Piling Machines

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Diesel Piling Machines: Geographic Segmentation Analysis

Chapter 5: Pigments Market by Applications

5.1 Pigments Market Snapshot and Growth Engine

5.2 Pigments Market Overview

5.3 Residential Construction

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Residential Construction: Geographic Segmentation Analysis

5.4 Commercial Construction

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Commercial Construction: Geographic Segmentation Analysis

5.5 Infrastructure Development

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Infrastructure Development: Geographic Segmentation Analysis

5.6 Industrial Projects

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Industrial Projects: Geographic Segmentation Analysis

Chapter 6: Pigments Market by End-User Industry

6.1 Pigments Market Snapshot and Growth Engine

6.2 Pigments Market Overview

6.3 Construction

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Construction: Geographic Segmentation Analysis

6.4 Oil & Gas

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Oil & Gas: Geographic Segmentation Analysis

6.5 Mining

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Mining: Geographic Segmentation Analysis

6.6 Marine

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Marine: Geographic Segmentation Analysis

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pigments Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BASF (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CLARIANT (SWITZERLAND)

7.4 DIC CORPORATION (JAPAN)

7.5 HUNTSMAN CORPORATION (USA)

7.6 LANXESS (GERMANY)

7.7 KRONOS WORLDWIDE (USA)

7.8 CABOT CORPORATION (USA)

7.9 SUDARSHAN CHEMICAL INDUSTRIES (INDIA)

7.10 TOYO INK SC HOLDINGS (JAPAN)

7.11 THE CHEMOURS COMPANY (USA)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Pigments Market By Region

8.1 Overview

8.2. North America Pigments Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Hydraulic Piling Machines

8.2.4.2 Mechanical Piling Machines

8.2.4.3 Diesel Piling Machines

8.2.5 Historic and Forecasted Market Size By Applications

8.2.5.1 Residential Construction

8.2.5.2 Commercial Construction

8.2.5.3 Infrastructure Development

8.2.5.4 Industrial Projects

8.2.6 Historic and Forecasted Market Size By End-User Industry

8.2.6.1 Construction

8.2.6.2 Oil & Gas

8.2.6.3 Mining

8.2.6.4 Marine

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pigments Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Hydraulic Piling Machines

8.3.4.2 Mechanical Piling Machines

8.3.4.3 Diesel Piling Machines

8.3.5 Historic and Forecasted Market Size By Applications

8.3.5.1 Residential Construction

8.3.5.2 Commercial Construction

8.3.5.3 Infrastructure Development

8.3.5.4 Industrial Projects

8.3.6 Historic and Forecasted Market Size By End-User Industry

8.3.6.1 Construction

8.3.6.2 Oil & Gas

8.3.6.3 Mining

8.3.6.4 Marine

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Pigments Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Hydraulic Piling Machines

8.4.4.2 Mechanical Piling Machines

8.4.4.3 Diesel Piling Machines

8.4.5 Historic and Forecasted Market Size By Applications

8.4.5.1 Residential Construction

8.4.5.2 Commercial Construction

8.4.5.3 Infrastructure Development

8.4.5.4 Industrial Projects

8.4.6 Historic and Forecasted Market Size By End-User Industry

8.4.6.1 Construction

8.4.6.2 Oil & Gas

8.4.6.3 Mining

8.4.6.4 Marine

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Pigments Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Hydraulic Piling Machines

8.5.4.2 Mechanical Piling Machines

8.5.4.3 Diesel Piling Machines

8.5.5 Historic and Forecasted Market Size By Applications

8.5.5.1 Residential Construction

8.5.5.2 Commercial Construction

8.5.5.3 Infrastructure Development

8.5.5.4 Industrial Projects

8.5.6 Historic and Forecasted Market Size By End-User Industry

8.5.6.1 Construction

8.5.6.2 Oil & Gas

8.5.6.3 Mining

8.5.6.4 Marine

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pigments Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Hydraulic Piling Machines

8.6.4.2 Mechanical Piling Machines

8.6.4.3 Diesel Piling Machines

8.6.5 Historic and Forecasted Market Size By Applications

8.6.5.1 Residential Construction

8.6.5.2 Commercial Construction

8.6.5.3 Infrastructure Development

8.6.5.4 Industrial Projects

8.6.6 Historic and Forecasted Market Size By End-User Industry

8.6.6.1 Construction

8.6.6.2 Oil & Gas

8.6.6.3 Mining

8.6.6.4 Marine

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pigments Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Hydraulic Piling Machines

8.7.4.2 Mechanical Piling Machines

8.7.4.3 Diesel Piling Machines

8.7.5 Historic and Forecasted Market Size By Applications

8.7.5.1 Residential Construction

8.7.5.2 Commercial Construction

8.7.5.3 Infrastructure Development

8.7.5.4 Industrial Projects

8.7.6 Historic and Forecasted Market Size By End-User Industry

8.7.6.1 Construction

8.7.6.2 Oil & Gas

8.7.6.3 Mining

8.7.6.4 Marine

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Pigments Market research report?

A1: The forecast period in the Pigments Market research report is 2024-2032.

Q2: Who are the key players in the Pigments Market?

A2: BASF (Germany), Clariant (Switzerland), DIC Corporation (Japan), Huntsman Corporation (USA), Lanxess (Germany), Kronos Worldwide (USA), Cabot Corporation (USA), Sudarshan Chemical Industries (India), Toyo Ink SC Holdings (Japan), The Chemours Company (USA), and Other Active Players.

Q3: What are the segments of the Pigments Market?

A3: The Pigments Market is segmented into By Type, By Application, By End-User and region. By Type, the market is categorized into Organic Pigments, Inorganic Pigments. By Application, the market is categorized into Paints and Coatings, Plastics, Printing Inks, Cosmetics, Textiles, Others. By End-User, the market is categorized into Automotive, Construction, Consumer Goods, Industrial Applications, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Pigments Market?

A4: The pigments market can be described as the manufacturing and sale of colored materials that are used to add color to various products for example; Paining, coating, platics, textiles and Cosmetics etc. These pigments are utilized in many industries because they give color, opacity and mechanical strength for the component. Organic pigments are those pigments which are produced from carbon containing compounds while inorganic pigments are generally those that are produced from minerals. Pigment demand arises due to new application in automotive segment, construction, and consumer products segments.

Q5: How big is the Pigments Market?

A5: Pigments Market Size Was Valued at USD 24.15 Billion in 2023, and is Projected to Reach USD 41.14 Billion by 2032, Growing at a CAGR of 6.10 % From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!