Stay Ahead in Fast-Growing Economies.

Browse Reports NowPicture Archiving and Communication System (PACS) Market Size, Share, Growth & Forecast (2024-2032)

The Picture Archiving and Communication System, or PACS, consists of technology for storing, retrieving, managing, distributing, and presenting medical images. PACS allows healthcare professionals electronic access to images and related information; in effect, it eliminates film and enables remote access to imaging studies, reducing workflow and thereby enhancing care for the patient.

IMR Group

Description

Picture Archiving and Communication System (PACS) Market Synopsis:

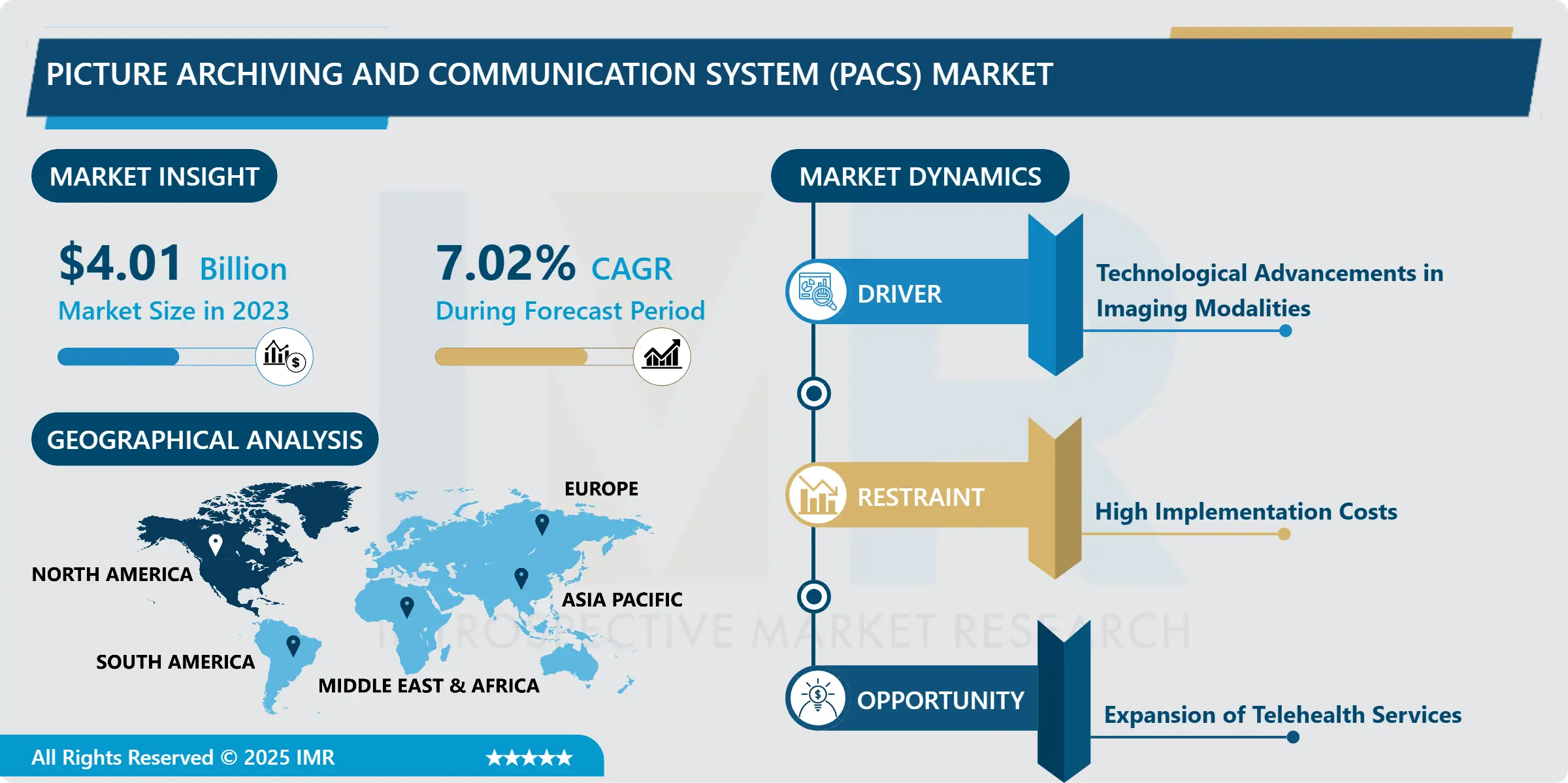

Picture Archiving and Communication System (PACS) Market Size Was Valued at USD 4.01 Billion in 2023, and is Projected to Reach USD 7.38 Billion by 2032, Growing at a CAGR of 7.02% From 2024-2032.

The Picture Archiving and Communication System, or PACS, consists of technology for storing, retrieving, managing, distributing, and presenting medical images. PACS allows healthcare professionals electronic access to images and related information; in effect, it eliminates film and enables remote access to imaging studies, reducing workflow and thereby enhancing care for the patient.

Advancements in imaging technology, increased demand for digital solutions in the healthcare sector, and a shift from traditional film-based systems to digital formats have played a major role in stimulating the PACS market. Integration of PACS in clinical workflows is fundamental currently as health care systems around the world adopt EHRs and practice telemedicine. These systems enable medical images to be shared directly through healthcare providers, and consequently result in better collaboration and decision-making during patient care. Furthermore, the chronic diseases and aging population have increased the need for such advanced imaging solutions because there is a desire on the part of healthcare facilities about the ways through which they can manage and analyze the patient data in an efficient manner.

The offerings in the PACS market vary from 2D and 3D and web-based PACS solutions designed specifically for healthcare providers to cater to their diverse needs. For example, 2D is primarily used for routine images, whereas 3D PACS solutions for advanced visualization techniques are used to benefit many in cardiology and oncology. The use of web-based PACS solutions provides flexibility and convenience, where images can be accessed directly from remote locations by healthcare professionals who are thereby enabled to view and analyze images in environments that are increasingly becoming an integral part of an interconnected healthcare landscape. In the highly competitive landscape of the PACS market, several significant key players play a driving role in constant innovation and upgrade to improve system capabilities, furthering the continued evolution of medical imaging technologies.

Picture Archiving and Communication System (PACS) Market Trend Analysis:

Integration of Artificial Intelligence (AI)

Among the trends dominating the PACS market is the incorporation of AI technologies to enhance image analysis and interpretation. For instance, AI algorithms will help radiologists and other health care providers identify abnormalities and anomalies within medical images while reducing human errors, thus improving diagnosis. This will enable the analysis of extremely large imaging data sets for actionable insights and cases prioritization towards higher urgency, thus streamlining workflow within radiology departments and boosting productivity. PACS is an application of AI supporting a radiologist where it is in alignment with the increased spotlight laid on precision medicine, thus developing treatment plans strictly from patient data.

In PACS, the employment of AI will probably enhance relationships between health practitioners to a higher extent. Teams in healthcare will be able to concentrate on more complicated cases and improve teamwork by automating routine operations and speeding image analysis. Health facilities will continue seeking innovative solutions to enhance positive outcomes about patients, and so, AI integration into PACS is likely to take off to include smart systems in imaging that will change the way medical professionals interpret and use imaging data.

Expansion of Telehealth Services

Telehealth service is an opportunity in the PACS market. The pandemic has significantly accelerated this segment as global healthcare systems shift towards new care delivery models. As a result, the demand for remote consultations and tele-radiology services skyrocketed. This has created an excellent opportunity for the development of PACS solutions that allow medical images to be accessed from remote locations and provide health professionals with the opportunity to consult with patients or peers located elsewhere. Ensuring connectivity and access to healthcare increases patient care and satisfaction through telehealth services, especially in terms of those who are in rurally isolated or underserved areas and cannot access a specialist conveniently.

Telehealth is also increasing to such a degree that health care organizations are compelled to invest in robust and secure PACS solutions that allow easy collaboration and sharing of imaging data across multiple platforms. The growing demands of healthcare providers are now offering room for vendors to innovate and design an integrated solution for interoperability between PACS, EHR systems, and telehealth platforms. The PACS providers can take advantage of the trend of telehealth and improve their market position and, as a result, generally improve delivery systems of health.

Picture Archiving and Communication System (PACS) Market Segment Analysis:

Picture Archiving and Communication System (PACS) Market is Segmented on the basis of type, Component, Deployment Type, application and end user.

By Type, 2D PACS segment is expected to dominate the market during the forecast period

The market has been segmented into different types, which include 2D PACS, 3D PACS, and web-based PACS. 2D PACS is the most conventional type that has been used in routine imaging, providing simple functionalities of capturing, storing, and sharing images. It is mostly found in a radiology department where it is used in common procedures like X-rays and ultrasounds. Increasing usage of the 3D PACS has become inevitable as technology advances in imaging. 3D PACS solutions are also helping the practitioners produce three-dimensional reconstructions from images that allow more effective visualization and analysis, especially in complex cases like oncology and cardiology.

PACS over the internet is also gaining popularity as it is very user-friendly. This system allows health professionals to view images from anywhere with the help of a connection via the internet and, thus, allows efficient communication between the different medical teams and better patient care. This transition towards web-based solutions proves especially useful for telehealth services, which can easily harmonize with electronic health records and other health applications. With the evolution of the PACS market, the adoption of 3D and web-based systems is expected to be highly correlated with increases in market size and innovation.

By Application, Cardiology segment expected to held the largest share

The applications of the PACS market include radiology, cardiology, orthopedics, oncology, and many others. Radiology holds the largest application for PACS because the systems essentially were meant to deal with medical image data produced from X-rays, CT scans, MRIs, and ultrasounds. The ability to store, retrieve, and analyze these radiological images effectively serves as a crucial foundation for the diagnosis and monitoring of a very wide range of medical disorders. The demand for PACS in radiology increases in the future because it will continue to be driven by advanced imaging technologies and the volume of imaging studies.

PACS is also highly applied in more cardiology and oncology applications. In cardiology, a higher efficiency may be derived from managing cardiac imaging studies, including echocardiogram and angiogram which are very essential in diagnosing cardiovascular diseases. In oncology, 3D imaging capabilities provided by PACS support the evaluation of the tumor and planning of treatment. Cross-application of PACS across a wide array of medical specialties further supports the critical function of PACS in modern healthcare, stimulates market growth, and facilitates a better outcome for the patient.

Picture Archiving and Communication System (PACS) Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America currently holds the highest share in the PACS market, mainly due to the developed healthcare infrastructure and high adoption rates of digital health technologies in the United States and Canada. The modern network of hospitals and healthcare facilities is equipped with high-end imaging technologies. The demand for effective PACS solutions is driven by this factor. Also, the ongoing activities in electronic health record implementation and improvement of interoperability among the health care systems support the growth of PACS in this region.

Furthermore, North America, significantly investment by public and private sectors in healthcare IT, so the region dominates the market for the PACS. As the organization strives to reduce costs and make overall operations more efficient, recent attention on patient care has increased, making PACS solutions a good fit for healthcare organizations. Telehealth and remote consultations, fueled by COVID-19, will continue to reinforce North America’s leadership position in the market and encourage innovation and brings quality healthcare services within reach for people.

Active Key Players in the Picture Archiving and Communication System (PACS) Market:

Siemens Healthineers (Germany)

Philips Healthcare (Netherlands)

GE Healthcare (USA)

Agfa HealthCare (Belgium)

Fujifilm Holdings Corporation (Japan)

Canon Medical Systems Corporation (Japan)

Cerner Corporation (USA)

McKesson Corporation (USA)

Allscripts Healthcare Solutions (USA)

Visage Imaging (Germany)

IBM Watson Health (USA)

Intelerad Medical Systems (Canada), and Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Picture Archiving and Communication System (PACS) Market by Type

4.1 Picture Archiving and Communication System (PACS) Market Snapshot and Growth Engine

4.2 Picture Archiving and Communication System (PACS) Market Overview

4.3 2D PACS

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 2D PACS: Geographic Segmentation Analysis

4.4 3D PACS

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 3D PACS: Geographic Segmentation Analysis

4.5 Web-based PACS

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Web-based PACS: Geographic Segmentation Analysis

Chapter 5: Picture Archiving and Communication System (PACS) Market by Component

5.1 Picture Archiving and Communication System (PACS) Market Snapshot and Growth Engine

5.2 Picture Archiving and Communication System (PACS) Market Overview

5.3 Hardware

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hardware: Geographic Segmentation Analysis

5.4 Software

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Software: Geographic Segmentation Analysis

5.5 Services

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Services: Geographic Segmentation Analysis

Chapter 6: Picture Archiving and Communication System (PACS) Market by Deployment Type

6.1 Picture Archiving and Communication System (PACS) Market Snapshot and Growth Engine

6.2 Picture Archiving and Communication System (PACS) Market Overview

6.3 On-premises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 On-premises: Geographic Segmentation Analysis

6.4 Cloud-based

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Cloud-based: Geographic Segmentation Analysis

Chapter 7: Picture Archiving and Communication System (PACS) Market by End User

7.1 Picture Archiving and Communication System (PACS) Market Snapshot and Growth Engine

7.2 Picture Archiving and Communication System (PACS) Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitals: Geographic Segmentation Analysis

7.4 Diagnostic Centers

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Diagnostic Centers: Geographic Segmentation Analysis

7.5 Research Institutions

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Research Institutions: Geographic Segmentation Analysis

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Geographic Segmentation Analysis

Chapter 8: Picture Archiving and Communication System (PACS) Market by Application

8.1 Picture Archiving and Communication System (PACS) Market Snapshot and Growth Engine

8.2 Picture Archiving and Communication System (PACS) Market Overview

8.3 Radiology

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Radiology: Geographic Segmentation Analysis

8.4 Cardiology

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Cardiology: Geographic Segmentation Analysis

8.5 Orthopedics

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Orthopedics: Geographic Segmentation Analysis

8.6 Oncology

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Oncology: Geographic Segmentation Analysis

8.7 Others

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Others: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Picture Archiving and Communication System (PACS) Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 SIEMENS HEALTHINEERS (GERMANY)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 PHILIPS HEALTHCARE (NETHERLANDS)

9.4 GE HEALTHCARE (USA)

9.5 AGFA HEALTHCARE (BELGIUM)

9.6 FUJIFILM HOLDINGS CORPORATION (JAPAN)

9.7 CANON MEDICAL SYSTEMS CORPORATION (JAPAN)

9.8 CERNER CORPORATION (USA)

9.9 MCKESSON CORPORATION (USA)

9.10 ALLSCRIPTS HEALTHCARE SOLUTIONS (USA)

9.11 VISAGE IMAGING (GERMANY)

9.12 IBM WATSON HEALTH (USA)

9.13 INTELERAD MEDICAL SYSTEMS (CANADA)

9.14 OTHER ACTIVE PLAYERS

Chapter 10: Global Picture Archiving and Communication System (PACS) Market By Region

10.1 Overview

10.2. North America Picture Archiving and Communication System (PACS) Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Type

10.2.4.1 2D PACS

10.2.4.2 3D PACS

10.2.4.3 Web-based PACS

10.2.5 Historic and Forecasted Market Size By Component

10.2.5.1 Hardware

10.2.5.2 Software

10.2.5.3 Services

10.2.6 Historic and Forecasted Market Size By Deployment Type

10.2.6.1 On-premises

10.2.6.2 Cloud-based

10.2.7 Historic and Forecasted Market Size By End User

10.2.7.1 Hospitals

10.2.7.2 Diagnostic Centers

10.2.7.3 Research Institutions

10.2.7.4 Others

10.2.8 Historic and Forecasted Market Size By Application

10.2.8.1 Radiology

10.2.8.2 Cardiology

10.2.8.3 Orthopedics

10.2.8.4 Oncology

10.2.8.5 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Picture Archiving and Communication System (PACS) Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Type

10.3.4.1 2D PACS

10.3.4.2 3D PACS

10.3.4.3 Web-based PACS

10.3.5 Historic and Forecasted Market Size By Component

10.3.5.1 Hardware

10.3.5.2 Software

10.3.5.3 Services

10.3.6 Historic and Forecasted Market Size By Deployment Type

10.3.6.1 On-premises

10.3.6.2 Cloud-based

10.3.7 Historic and Forecasted Market Size By End User

10.3.7.1 Hospitals

10.3.7.2 Diagnostic Centers

10.3.7.3 Research Institutions

10.3.7.4 Others

10.3.8 Historic and Forecasted Market Size By Application

10.3.8.1 Radiology

10.3.8.2 Cardiology

10.3.8.3 Orthopedics

10.3.8.4 Oncology

10.3.8.5 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Picture Archiving and Communication System (PACS) Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Type

10.4.4.1 2D PACS

10.4.4.2 3D PACS

10.4.4.3 Web-based PACS

10.4.5 Historic and Forecasted Market Size By Component

10.4.5.1 Hardware

10.4.5.2 Software

10.4.5.3 Services

10.4.6 Historic and Forecasted Market Size By Deployment Type

10.4.6.1 On-premises

10.4.6.2 Cloud-based

10.4.7 Historic and Forecasted Market Size By End User

10.4.7.1 Hospitals

10.4.7.2 Diagnostic Centers

10.4.7.3 Research Institutions

10.4.7.4 Others

10.4.8 Historic and Forecasted Market Size By Application

10.4.8.1 Radiology

10.4.8.2 Cardiology

10.4.8.3 Orthopedics

10.4.8.4 Oncology

10.4.8.5 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Picture Archiving and Communication System (PACS) Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Type

10.5.4.1 2D PACS

10.5.4.2 3D PACS

10.5.4.3 Web-based PACS

10.5.5 Historic and Forecasted Market Size By Component

10.5.5.1 Hardware

10.5.5.2 Software

10.5.5.3 Services

10.5.6 Historic and Forecasted Market Size By Deployment Type

10.5.6.1 On-premises

10.5.6.2 Cloud-based

10.5.7 Historic and Forecasted Market Size By End User

10.5.7.1 Hospitals

10.5.7.2 Diagnostic Centers

10.5.7.3 Research Institutions

10.5.7.4 Others

10.5.8 Historic and Forecasted Market Size By Application

10.5.8.1 Radiology

10.5.8.2 Cardiology

10.5.8.3 Orthopedics

10.5.8.4 Oncology

10.5.8.5 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Picture Archiving and Communication System (PACS) Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Type

10.6.4.1 2D PACS

10.6.4.2 3D PACS

10.6.4.3 Web-based PACS

10.6.5 Historic and Forecasted Market Size By Component

10.6.5.1 Hardware

10.6.5.2 Software

10.6.5.3 Services

10.6.6 Historic and Forecasted Market Size By Deployment Type

10.6.6.1 On-premises

10.6.6.2 Cloud-based

10.6.7 Historic and Forecasted Market Size By End User

10.6.7.1 Hospitals

10.6.7.2 Diagnostic Centers

10.6.7.3 Research Institutions

10.6.7.4 Others

10.6.8 Historic and Forecasted Market Size By Application

10.6.8.1 Radiology

10.6.8.2 Cardiology

10.6.8.3 Orthopedics

10.6.8.4 Oncology

10.6.8.5 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Picture Archiving and Communication System (PACS) Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Type

10.7.4.1 2D PACS

10.7.4.2 3D PACS

10.7.4.3 Web-based PACS

10.7.5 Historic and Forecasted Market Size By Component

10.7.5.1 Hardware

10.7.5.2 Software

10.7.5.3 Services

10.7.6 Historic and Forecasted Market Size By Deployment Type

10.7.6.1 On-premises

10.7.6.2 Cloud-based

10.7.7 Historic and Forecasted Market Size By End User

10.7.7.1 Hospitals

10.7.7.2 Diagnostic Centers

10.7.7.3 Research Institutions

10.7.7.4 Others

10.7.8 Historic and Forecasted Market Size By Application

10.7.8.1 Radiology

10.7.8.2 Cardiology

10.7.8.3 Orthopedics

10.7.8.4 Oncology

10.7.8.5 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Picture Archiving and Communication System (PACS) Market research report?

A1: The forecast period in the Picture Archiving and Communication System (PACS) Market research report is 2024-2032.

Q2: Who are the key players in the Picture Archiving and Communication System (PACS) Market?

A2: Siemens Healthineers (Germany), Philips Healthcare (Netherlands), GE Healthcare (USA), Agfa HealthCare (Belgium), Fujifilm Holdings Corporation (Japan), Canon Medical Systems Corporation (Japan), Cerner Corporation (USA), McKesson Corporation (USA), Allscripts Healthcare Solutions (USA), Visage Imaging (Germany), IBM Watson Health (USA), Intelerad Medical Systems (Canada), and Other Active Players.

Q3: What are the segments of the Picture Archiving and Communication System (PACS) Market?

A3: The Picture Archiving and Communication System (PACS) Market is segmented into Type, Component, Deployment Type, Application, End User and region. By Component, the market is categorized into Hardware, Software, Services. By Type, the market is categorized into, 2D PACS, 3D PACS, Web-based PACS. By Deployment Type, the market is categorized into On-premises, Cloud-based. By End User, the market is categorized into Hospitals, Diagnostic Centers, Research Institutions, Others. By Application, the market is categorized into Radiology, Cardiology, Orthopedics, Oncology, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Picture Archiving and Communication System (PACS) Market?

A4: The Picture Archiving and Communication System, or PACS, consists of technology for storing, retrieving, managing, distributing, and presenting medical images. PACS allows healthcare professionals electronic access to images and related information; in effect, it eliminates film and enables remote access to imaging studies, reducing workflow and thereby enhancing care for the patient.

Q5: How big is the Picture Archiving and Communication System (PACS) Market?

A5: Picture Archiving and Communication System (PACS) Market Size Was Valued at USD 4.01 Billion in 2023, and is Projected to Reach USD 7.38 Billion by 2032, Growing at a CAGR of 7.02% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!