Stay Ahead in Fast-Growing Economies.

Browse Reports NowPharmaceutical Packaging Equipment Market Segment Analysis, Share, and Forecast Report (2024-2032)

Pharmaceutical packaging equipment may be defined as the tools used in packaging of medicaments, vaccines, and supplements, among other commodities. This equipment includes bottle- r sorting and labelling system, blister packaging, and secondary packaging that guaranties safety and extended storage for the pharmaceutical products before they are sold in the market. In addition to safeguarding the drugs it also ensures compliance to regulatory requirements besides passing information to the consumer hence plays a vital role in the supply chain.

IMR Group

Description

Pharmaceutical Packaging Equipment Market Synopsis:

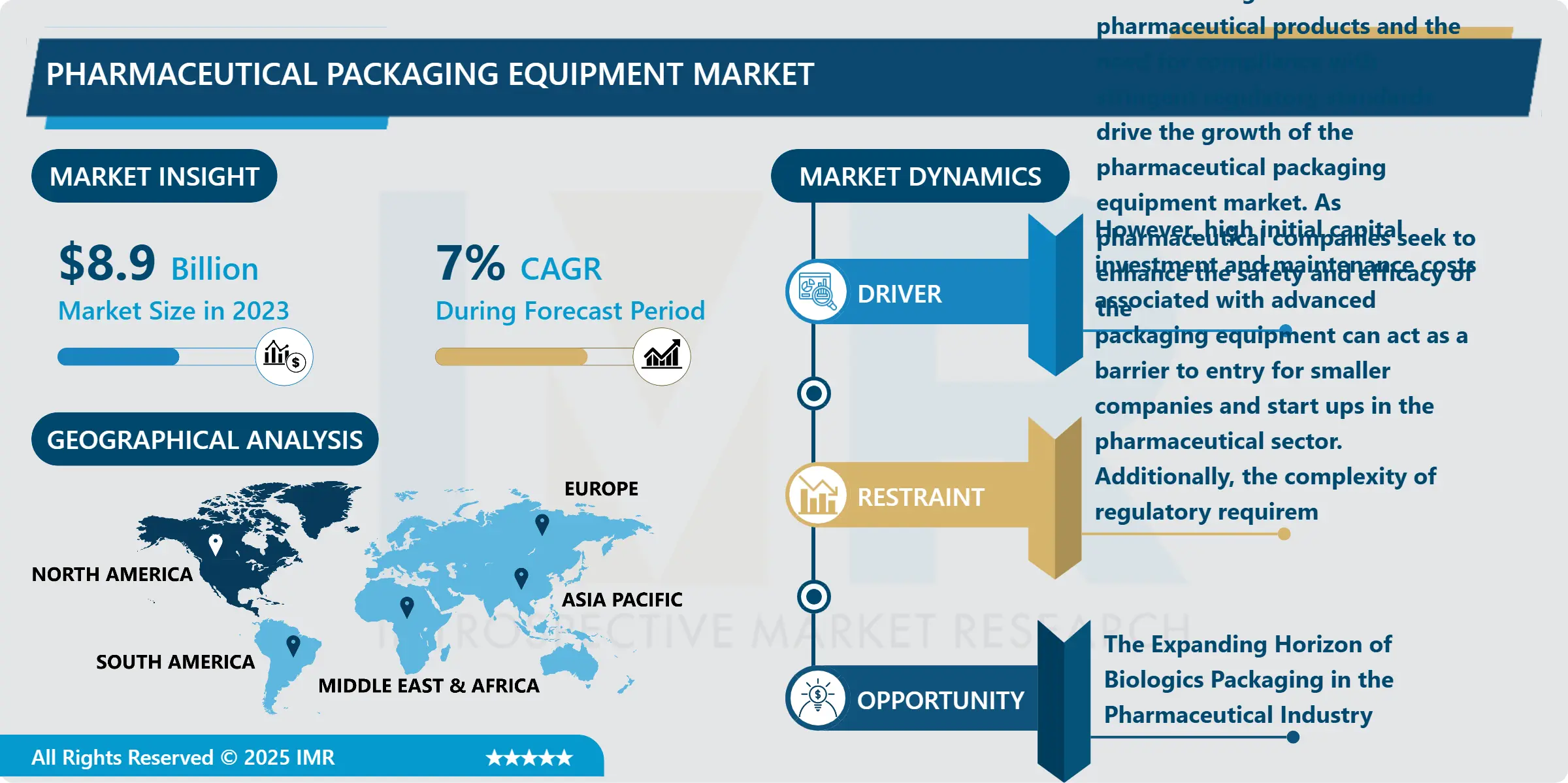

Pharmaceutical Packaging Equipment Market Size Was Valued at USD 8.9 Billion in 2023, and is Projected to Reach USD 16.36 Billion by 2032, Growing at a CAGR of 7% From 2024-2032.

Pharmaceutical packaging equipment may be defined as the tools used in packaging of medicaments, vaccines, and supplements, among other commodities. This equipment includes bottle- r sorting and labelling system, blister packaging, and secondary packaging that guaranties safety and extended storage for the pharmaceutical products before they are sold in the market. In addition to safeguarding the drugs it also ensures compliance to regulatory requirements besides passing information to the consumer hence plays a vital role in the supply chain.

The pharmaceutical packaging equipment market has been on an upward trend for quite sometime time due to the growing need for pharmaceutical products all over the world. Other causes for the increased production of pharmaceutical products include the following : Increased prevalence of chronic diseases, increased population of the ageing group people and the discovery of better drugs. Modern pharma packaging solutions are used by pharmaceutical organizations as a way to integrate the newest approaches that could increase the safety and effectiveness of their production by providing the necessary protection, increase the shelf-life of the drugs, and guarantee that the patient will administer the medicine properly. Furthermore, an increase in potent biologics and personalized medicines in the pipeline has increased the need for new or innovative and diverse packaging.

Also, there is a trend towards higher regulation requirements for packaging of pharmaceuticals. The FDA and EMA require drug producers to provide highly effective packaging methods as a guarantee to the safety of the produced medications and this has prompted producers to invest more on packaging equipment. There is also a rising trend in automation as well as smart packaging options due to the efficiency and little probability for mistakes in the packing line. Therefore, it has been observed that manufacturers are integrating their existing equipment with newly emerging technologies like robotics, artificial intelligence, and Internet of Things (IoT), for better and more efficient operations as well as better traceability.

Pharmaceutical Packaging Equipment Market Trend Analysis:

Automation in Pharmaceutical Packaging

The use of automation technologies remains one of the defining features of the growth of the pharmaceutical packaging equipment market. Pharmaceutical products are in high demand and as more manufacture the greater the pressure to improve the production and efficiency. Depending on the type of packaging, automation also greatly proves essential in shortening the amount of time taken to complete operations as well as all but removing the potential for errors. Because packaging lines come in different types and packaging methods range from simple to complex; the packaging line should have features of being automated to complete different functions including filling, sealing, labelling and inspection at great speed in order to meet the industry demands. Such a change not only enhances quality and standardization, but also helps manufacturers to change their operations and meets the needs of the market or production line more promptly.

Furthermore, use of robotics and smart technologies in packaging lines in the industry has reached new heights in packaging pharmaceutical products. These sophisticated systems enable a closer watch to be placed on the structure of production with the aim of raising operational efficiency and reducing costs. For instance, smart packaging solutions with sensors could present actual-time information related to certain parameters of production, so adjustments could be made before breakdowns happen. This research anticipates that the trend will gather pace as more companies come to appreciate the value of automated solutions, with more manufacturers turning to the most advanced packaging technologies. As a result of this continuous change towards full automation the pharmaceutical companies will be able to effectively manage their packaging needs in a manner that means they will be able to effectively and successfully cater for this market need in the face of changing market environment.

Growth in Biologics Packaging

The entry and growth of complex biologics and biosimilars offer a strong prospect to the pharmaceutical packaging equipment market. Due to their characteristics, biologics are therapeutically sensitive products which, in turn translate into specific requirements of packaging, to ensure the functionality of the product all along the distribution channel. Based on the developing need for such valuable therapies through the application of various personalized and targeted therapy types, packaging manufacturers are now left in a position to ensure that a packaging solution that fulfils such specific needs is indeed developed. This involves developing acceptable manufacturing and storage vehicles to ensure that biologic products are safe from the vagaries of environmental conditions such as temperature and contaminants.

Further, the advances made in the category are seeing a rise in the complexities that come with the biologic, particularly in relation to its tracking and traceability through the supply chain. This demand extends the need for sophisticated packaging solutions which not only protect the products but also help address the legal requirements. Those companies that engaged in research and development department to produce and deign the suitable packaging for biologics specialized will gain the largest market share. However it is noteworthy that by using innovation in packaging format and design, these manufacturers can tap into this growing opportunity to guarantee the safety and efficacy of biologics before they reach the patient population and to meet the changing dynamics of the pharma sector.

Pharmaceutical Packaging Equipment Market Segment Analysis:

Pharmaceutical Packaging Equipment Market is Segmented on the basis of Product Type, Packaging, End User, and Region.

By Product Type, Labelling Equipment segment is expected to dominate the market during the forecast period

The segmentation of pharmaceutical packaging equipment market is based on product type which have some popular types such as filling and sealing equipment, labeling equipment, blister packaging equipment, inspection equipment and cartoning equipment. Casting and sealing machinery is used widely for sealing a variety of goods, especially liquids, powders and granules into containers and ensuring that they are effectively sealed to enhance and preserve their quality. The labeling of the equipment is very crucial since ideals information to customers and the authority on the dosage and usage of the product besides helping in the regulation of the use of the product. Blister packaging equipment is more crucial in unit dose packaging due to increased convenience and accurate dosing for patients and inspection equipment is necessary to maintain a quality in packaging since it is used for identification of defects in packaging.

Apart from these two major classification, Cartoning equipment is used to pack single items in to carton form for ease in handling and storage in order to create further layers of security. The Others subsegment contains specific equipment designed for specific packaging needs to capture the heterogeneity of the pharmacy. This is because as companies intensify efforts to maintain the functionality and effectiveness of packaging as well as contain any adverse impacts on the environment, there is always increased need for new and efficient packaging equipment through all the product types. This segmentation underscores the need to hit the right packaging choice in order to cater for safety and compliance as well as competition in the market segment of pharmaceutical products.

By Packaging Type, Primary Packaging segment expected to held the largest share

The pharmaceutical packaging equipment market is categorized by packaging type, which includes primary, secondary, and tertiary packaging. Primary packaging refers to the packaging that directly contains the pharmaceutical product, such as vials, ampoules, blister packs, and prefilled syringes. This type of packaging is crucial for protecting the product from contamination, ensuring its stability, and maintaining its efficacy. The design and materials used in primary packaging must comply with stringent regulatory standards, as they directly affect the safety and quality of the pharmaceutical products. As the demand for innovative drug delivery systems and personalized medicines grows, manufacturers are increasingly investing in advanced primary packaging solutions to meet these evolving needs.

Secondary packaging serves to group primary packages together for distribution, providing additional protection and information to consumers. This includes cartons, boxes, and shrink wraps that contain multiple primary packages and often feature labeling that complies with regulatory requirements. Secondary packaging enhances product identification and branding while also facilitating easier handling and storage. Tertiary packaging refers to the outermost layer of packaging used for bulk handling, storage, and transportation, such as pallets and shipping containers. While often less visible to the consumer, tertiary packaging plays a critical role in supply chain logistics, ensuring that products are delivered safely and efficiently from manufacturers to end users. Together, these packaging types form a comprehensive framework that supports the pharmaceutical supply chain, ensuring product integrity and compliance at every stage.

Pharmaceutical Packaging Equipment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America emerged as the largest region for the growth of the pharmaceutical packaging equipment market in 2023. This leadership emanates from the existing cst structure centered on many large pharma firms, a favourable healthcare infrastructure, and a sound legal framework that acknowledges efficient packaging solutions. The US alone has several of the world’s largest drug producers that require sophisticated packaging equipment to meet stringent regulatory requirements and the increasing need for creative packaging and delivery formats. This allows everyday maintenance of the region as a powerhouse of pharmaceutical activeness in both packaging advancement and deploymenting crucial health care products.

However, the number of geriatric patients, chronic disease patients, and people affected with some or other health issues have been on the rise in North America; this increases the demand for pharmaceutical products, consequently increasing the need for efficient packaging machinery. With growth within the market being observed, firms operating within the region are seeking to incorporate such elements as automation and smart packaging to increase performance and strengthen the quality of the supplied products. Even if it consolidates support to the packaging of other more products such as biologics and specialty pharmaceuticals, it also enhance North America to dominate the pharmaceutical packaging equipment market. Under these circumstances, the North America remains optimistic to dominate the market for several more years with continued response to the changes that may occur in the global market.

Active Key Players in the Pharmaceutical Packaging Equipment Market

ACG Worldwide (India)

Bosch Packaging Technology (Germany)

CPK Packaging (Italy)

ELAU (Germany)

IMA Group (Italy)

KHS GmbH (Germany)

Marchesini Group (Italy)

Multivac (Germany)

Romaco Group (Germany)

Schott AG (Germany)

Syntegon Technology (Germany), and Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pharmaceutical Packaging Equipment Market by Product Type

4.1 Pharmaceutical Packaging Equipment Market Snapshot and Growth Engine

4.2 Pharmaceutical Packaging Equipment Market Overview

4.3 Filling and Sealing Equipment

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Filling and Sealing Equipment: Geographic Segmentation Analysis

4.4 Labelling Equipment

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Labelling Equipment: Geographic Segmentation Analysis

4.5 Blister Packaging Equipment

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Blister Packaging Equipment: Geographic Segmentation Analysis

4.6 Inspection Equipment

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Inspection Equipment: Geographic Segmentation Analysis

4.7 Cartoning Equipment

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Cartoning Equipment: Geographic Segmentation Analysis

4.8 Others

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Others: Geographic Segmentation Analysis

Chapter 5: Pharmaceutical Packaging Equipment Market by Packaging

5.1 Pharmaceutical Packaging Equipment Market Snapshot and Growth Engine

5.2 Pharmaceutical Packaging Equipment Market Overview

5.3 Primary Packaging

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Primary Packaging: Geographic Segmentation Analysis

5.4 Secondary Packaging

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Secondary Packaging: Geographic Segmentation Analysis

5.5 Tertiary Packaging

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Tertiary Packaging: Geographic Segmentation Analysis

Chapter 6: Pharmaceutical Packaging Equipment Market by End User

6.1 Pharmaceutical Packaging Equipment Market Snapshot and Growth Engine

6.2 Pharmaceutical Packaging Equipment Market Overview

6.3 Pharmaceutical Companies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Pharmaceutical Companies: Geographic Segmentation Analysis

6.4 Contract Packaging Organizations (CPOs)

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Contract Packaging Organizations (CPOs): Geographic Segmentation Analysis

6.5 Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pharmaceutical Packaging Equipment Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACG WORLDWIDE (INDIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BOSCH PACKAGING TECHNOLOGY (GERMANY)

7.4 CPK PACKAGING (ITALY)

7.5 ELAU (GERMANY)

7.6 IMA GROUP (ITALY)

7.7 KHS GMBH (GERMANY)

7.8 MARCHESINI GROUP (ITALY)

7.9 MULTIVAC (GERMANY)

7.10 ROMACO GROUP (GERMANY)

7.11 SCHOTT AG (GERMANY)

7.12 SYNTEGON TECHNOLOGY (GERMANY)

7.13 OTHER ACTIVE PLAYERS

Chapter 8: Global Pharmaceutical Packaging Equipment Market By Region

8.1 Overview

8.2. North America Pharmaceutical Packaging Equipment Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Filling and Sealing Equipment

8.2.4.2 Labelling Equipment

8.2.4.3 Blister Packaging Equipment

8.2.4.4 Inspection Equipment

8.2.4.5 Cartoning Equipment

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size By Packaging

8.2.5.1 Primary Packaging

8.2.5.2 Secondary Packaging

8.2.5.3 Tertiary Packaging

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Pharmaceutical Companies

8.2.6.2 Contract Packaging Organizations (CPOs)

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pharmaceutical Packaging Equipment Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Filling and Sealing Equipment

8.3.4.2 Labelling Equipment

8.3.4.3 Blister Packaging Equipment

8.3.4.4 Inspection Equipment

8.3.4.5 Cartoning Equipment

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size By Packaging

8.3.5.1 Primary Packaging

8.3.5.2 Secondary Packaging

8.3.5.3 Tertiary Packaging

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Pharmaceutical Companies

8.3.6.2 Contract Packaging Organizations (CPOs)

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Pharmaceutical Packaging Equipment Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Filling and Sealing Equipment

8.4.4.2 Labelling Equipment

8.4.4.3 Blister Packaging Equipment

8.4.4.4 Inspection Equipment

8.4.4.5 Cartoning Equipment

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size By Packaging

8.4.5.1 Primary Packaging

8.4.5.2 Secondary Packaging

8.4.5.3 Tertiary Packaging

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Pharmaceutical Companies

8.4.6.2 Contract Packaging Organizations (CPOs)

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Pharmaceutical Packaging Equipment Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Filling and Sealing Equipment

8.5.4.2 Labelling Equipment

8.5.4.3 Blister Packaging Equipment

8.5.4.4 Inspection Equipment

8.5.4.5 Cartoning Equipment

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size By Packaging

8.5.5.1 Primary Packaging

8.5.5.2 Secondary Packaging

8.5.5.3 Tertiary Packaging

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Pharmaceutical Companies

8.5.6.2 Contract Packaging Organizations (CPOs)

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pharmaceutical Packaging Equipment Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Filling and Sealing Equipment

8.6.4.2 Labelling Equipment

8.6.4.3 Blister Packaging Equipment

8.6.4.4 Inspection Equipment

8.6.4.5 Cartoning Equipment

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size By Packaging

8.6.5.1 Primary Packaging

8.6.5.2 Secondary Packaging

8.6.5.3 Tertiary Packaging

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Pharmaceutical Companies

8.6.6.2 Contract Packaging Organizations (CPOs)

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pharmaceutical Packaging Equipment Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Filling and Sealing Equipment

8.7.4.2 Labelling Equipment

8.7.4.3 Blister Packaging Equipment

8.7.4.4 Inspection Equipment

8.7.4.5 Cartoning Equipment

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size By Packaging

8.7.5.1 Primary Packaging

8.7.5.2 Secondary Packaging

8.7.5.3 Tertiary Packaging

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Pharmaceutical Companies

8.7.6.2 Contract Packaging Organizations (CPOs)

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Pharmaceutical Packaging Equipment Market research report?

A1: The forecast period in the Pharmaceutical Packaging Equipment Market research report is 2024-2032.

Q2: Who are the key players in the Pharmaceutical Packaging Equipment Market?

A2: ACG Worldwide (India), Bosch Packaging Technology (Germany), CPK Packaging (Italy), ELAU (Germany), IMA Group (Italy), KHS GmbH (Germany), Marchesini Group (Italy), Multivac (Germany), Romaco Group (Germany), Schott AG (Germany), Syntegon Technology (Germany), and Other Active Players.

Q3: What are the segments of the Pharmaceutical Packaging Equipment Market?

A3: The Pharmaceutical Packaging Equipment Market is segmented into Product Type, Packaging, End User, and Region. By Product Type, the market is categorized into Filling and Sealing Equipment, Labelling Equipment, Blister Packaging Equipment, Inspection Equipment, Cartoning Equipment, and Others. By Packaging, the market is categorized into Primary Packaging, Secondary Packaging, and Tertiary Packaging. By End User, the market is categorized into (Pharmaceutical Companies, Contract Packaging Organizations (CPOs), Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Pharmaceutical Packaging Equipment Market?

A4: Pharmaceutical packaging equipment may be defined as the tools used in packaging of medicaments, vaccines, and supplements, among other commodities. This equipment includes bottle- r sorting and labelling system, blister packaging, and secondary packaging that guaranties safety and extended storage for the pharmaceutical products before they are sold in the market. In addition to safeguarding the drugs it also ensures compliance to regulatory requirements besides passing information to the consumer hence plays a vital role in the supply chain.

Q5: How big is the Pharmaceutical Packaging Equipment Market?

A5: Pharmaceutical Packaging Equipment Market Size Was Valued at USD 8.9 Billion in 2023, and is Projected to Reach USD 16.36 Billion by 2032, Growing at a CAGR of 7% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!