Stay Ahead in Fast-Growing Economies.

Browse Reports NowPharmaceutical Lab Equipment Market Size, Growth Dynamics & Forecast (2024-2032)

The pharmaceutical lab equipment market is defined in this research as band comprises all those instruments and devices that are used during the various stages of pharmaceutical research development and manufacturing.

IMR Group

Description

Pharmaceutical Lab Equipment Market Synopsis:

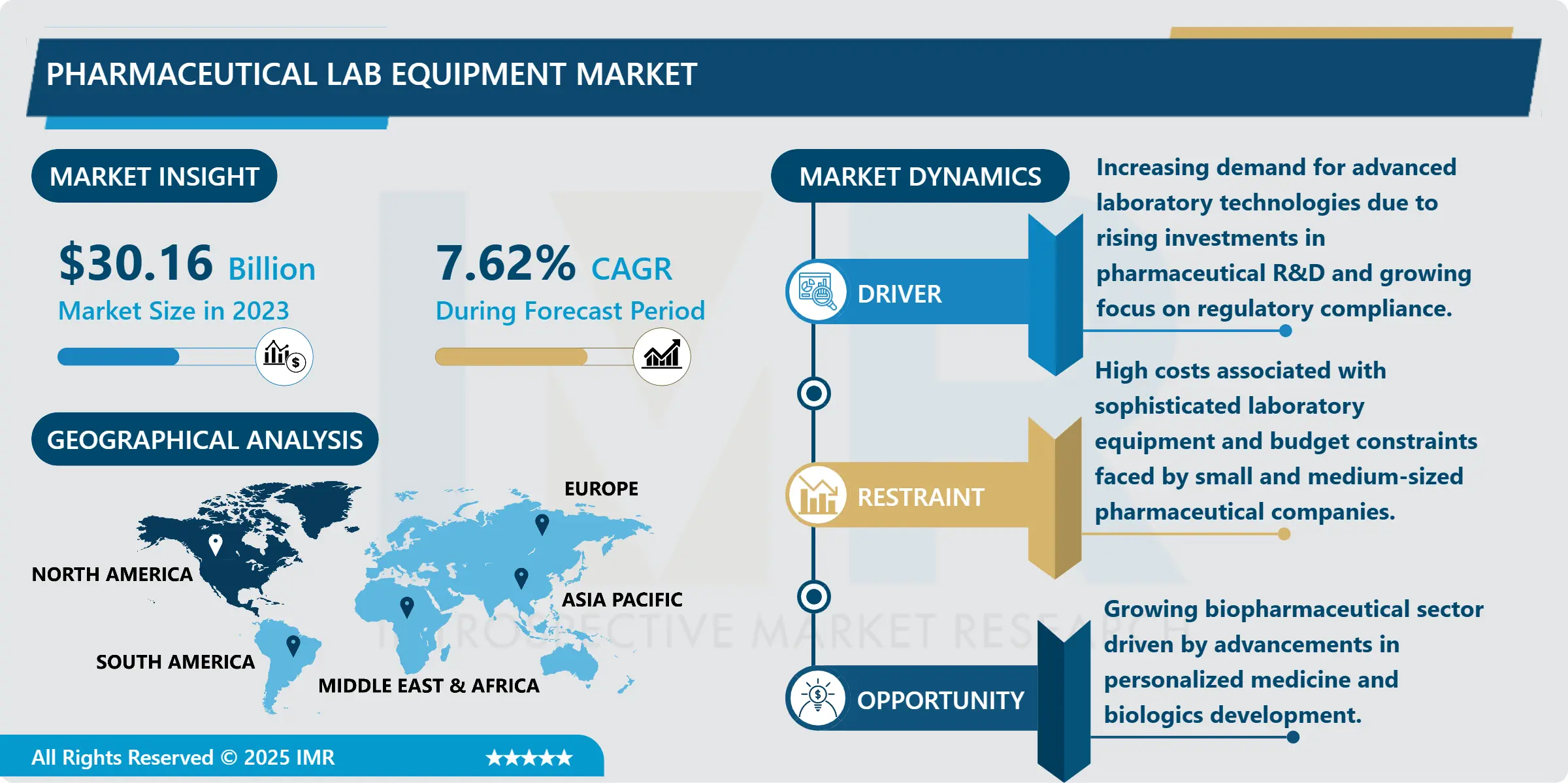

Pharmaceutical Lab Equipment Market Size Was Valued at USD 30.16 Billion in 2023, and is Projected to Reach USD 58.41 Billion by 2032, Growing at a CAGR of 7.62% From 2024-2032.

The pharmaceutical lab equipment market is defined in this research as band comprises all those instruments and devices that are used during the various stages of pharmaceutical research development and manufacturing. This includes laboratory equipment for testing and analysis, quality assurance apparatus, equipment used in formulation of drugs, and clinical testing equipment, which defines the efficiency, safety and legal conformity of drugs manufactured. Some of the major equipment used in this sector are centrifuges, spectrophotometer, chromatograph and different types of bioreactor help in assessment of chemical as well as biological substances and drug intermediation. These products are needed as biopharmaceuticals research progresses, quality assurance becomes prioritized, and drug development becomes multifaceted.

The pharmaceutical lab equipment market is relatively growing fast due to increased need for advanced techniques in drug formulation and quality testing within the pharmaceutical sector. With more and more pharmaceutical companies utilizing sophisticated technology solutions in their quest for faster and heightened research acumen there is a growing requirement for superior quality laboratory equipment. However, the advance in such fields especially biotechnology and the shift towards more personalized medicine is also increasing the needs for more specialized laboratory instruments. Almost all regulatory bodies are estrict on the quality of both diagnosis and testing they approve, this has in one way led to extensive market for latest laboratory equipment.

Furthermore, the COVID-19 outbreak revealed the significance of optimizing the function of the laboratory in medicinal synthesis and testing, and state support for pharmaceutics development. COVID 19 was a wakeup call in the development of vaccines and others pharmaceuticals where pharmaceutical lab equipment was very important in responding to the current challenges. Therefore, many companies have enhanced their capacity to produce and diverse their range of products to encompass sophisticated laboratory innovations.

Pharmaceutical Lab Equipment Market Trend Analysis:

Automation and Digitization in Pharmaceutical Labs

One of the most emerging trends in the pharmaceutical lab equipment market is increased attention to the increasing automation degree and digitalization. Automation is becoming standard in laboratories as more ways are sought to increase lab productivity, minimize errors, and provide accurate results. Robotic systems and intelligent software, automation have been introduced to the laboratories to reduce the time required to handle large samples. Other than increasing efficiency, it also improves allocation of resources that enhance the affordability of operations. Automation also tends to make procedures more uniform, allowing the labs to work at levels of accuracy congruent with delivering highly precise information.

Data analysis and Cloud solution are revolutionizing the operation of the laboratories by offering actual-time monitoring and analysing of data. Such a change is beneficial to the research since labs can analyze data and come up with decisions without a breakdown. Another advantage of cloud technology that is useful in a business environment is enablement of remote working and content dissemination which increases generality. As the pharmaceutical industry adopts all these digital tools, the need for advanced automated laboratory equipment is likely to rise greatly.

Growth in Biopharmaceutical Research

The pharmaceutical lab equipment market is showing high signs of growth prospects, especially because of the growth of the biopharmaceutical industry. Worldwide there is an increased incidence of chronic diseases and an aging population; therefore there is a greater consumption of biologics and sophisticated biopharmaceuticals. Drug makers are adapting through investing more in research processes, that requires advanced manufacturing equipment for producing and testing the biologic drugs. With ongoing evolution in the industry, moving towards gene and cell-based treatments of diseases there is even higher demand in solutions that would be able to sustain biological processes in a lab environment. The opportunity to meet the demands of providers who require such complex tools to meet these advancing needs will be a strong selling point for firms competing in this fast-growing market.

Also, the partnerships of pharma companies with technological companies are building up the pace for new generation of lab devices. Such collaborations promote liberal relationships in development of laboratory instruments that address the present needs of biopharmaceutical research and forecasted future technologies. The specific kinds of partnerships that are needed are product development partnerships to build improved products, from automation driven tools to integrated platforms that enhance operations in the laboratory. To the firms within the lab equipment industry, this change holds promising prospects for the firms who provide pharma innovators tools to advance the next phase of therapeutic creation and accuracy in lab science.

Pharmaceutical Lab Equipment Market Segment Analysis:

Pharmaceutical Lab Equipment Market is Segmented on the basis of Product Type, Application, End User, and Region.

By Product Type, safety equipment segment is expected to dominate the market during the forecast period

This pharmaceutical lab equipment market is segmented by type, main comprising of analytical equipment which is critical in providing accuracy for multiple facets of pharmacy research and product control. This segment comprise of spectrophotometers, chromatography systems, and mass spectrometers used in determining the number and concentration of chemical compounds in drug formulations. Another very important segment is clinical diagnostic equipment, that includes PCR machine, Blood analyzers, Immunoassay systems which are used for diagnosing and monitoring diseases. These tools are highly valuable in the diagnostic laboratories and also amongst the pharmaceutical companies for developing the treatments and accurate results in every step of the way.

Drug discovery reagents also make up a large portion of the market, as these are used in the identification of new compounds with which potential drugs may be developed, through the use of high throughput screening and cell culture equipment. Sterilization products such as sterilizers and autoclaves are used in laboratories to ensure that equipment and accessories used in the laboratory are free from contamination essential for laboratory purposes. Chemical hoods and safety clothing are useful for safeguarding lab employees as well as maintaining complete compliance with security requirements. Last, we have the “others” category which comprises of other instruments that support the functionality of the laboratory, and all help the pharmaceutical industry provide compliance and operation levels to meet regulatory requirements.

By Application, quality control segment expected to held the largest share

This market can be divided by application which include research and development since most of the pharmaceutical companies spend so much money on research and development of new product. R&D applications involve the use of equipment to carry out often detailed chemical and biochemical reactions, analyze specimen, and evaluate the effectiveness and toxicity of various drugs. Quality control is also another important segment as it checks products against great corporate regulatory standards. This area includes applying of various analytical and diagnostic tools, which allow to check the purity, stability and homogeneity of the necessary pharmaceuticals before their release on the market, excluding potential dangers for patients.

Military logistics and healthcare are two major fields that employ testing equipment, although clinical diagnostics – Application is relatively new and involves using lab equipment to test an analyte or sample for specific biomarkers that will enhance disease diagnosis and treatment. Production in the biopharmaceutical industry relies on various specialized equipment especially in the production of biologics, including cell and gene therapies, which involve handling of materials with such complexities. Sometimes drug screening plays an essential role in defining the efficacy of potential drugs compounds and it is one of the initial stages of drug development while toxicology studies use various types of lab instruments to determine possible toxic effects for determined substances for people. All together these applications clearly depict the varied and important function of laboratory equipment in the enhancement of pharmaceutical knowledge and continual production of safe and effective treatments.

Pharmaceutical Lab Equipment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America dominates the market. This comprehensive dominance can be investigated with key pharmaceutical organizations, developed healthcare stock, and substantial health sector investment in research and development sector established in the region. Case in point, the United States is an influential country in both drug discovery and manufacturing thanks to a quite efficient regulatory system and a major emphasis on biopharmaceutical development. These include precision medicine and personalised therapeutic technology used to enhance lab equipment in the Asia Pacific region. Furthermore, the sustained strategic partnership between the pharmaceutical industries and the technology vendors to advance the innovation and application of sophisticated laboratory solutions strengthen the region’s domain over the North American pharmaceutical lab equipment market.

Also, continuous outsourcing of laboratory services by various companies to contract research organizations (CROs) is a major factor driving the North American market. These CROs currently need good quality lab equipment to conduct different services such as clinical trial, drug analysis, and compliance. With outsourcing being on a regular rise in future, it will help the market for pharmaceutical lab equipment to grow further in North America. This commitment make this region a strong contender in the pharmaceutical lab equipment market, and a huge investment on healthcare technologies will result to continuous growth and development in the coming years.

Active Key Players in the Pharmaceutical Lab Equipment Market

Agilent Technologies (USA)

Beckman Coulter (USA)

Bio-Rad Laboratories (USA)

Eppendorf AG (Germany)

GE Healthcare (USA)

Horiba (Japan)

Merck Group (Germany)

PerkinElmer (USA)

Sartorius AG (Germany)

Shimadzu Corporation (Japan)

Thermo Fisher Scientific (USA)

Waters Corporation (USA)

Zinsser Analytic (Germany)

Sciex (USA)

VWR International (USA), and Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pharmaceutical Lab Equipment Market by Product Type

4.1 Pharmaceutical Lab Equipment Market Snapshot and Growth Engine

4.2 Pharmaceutical Lab Equipment Market Overview

4.3 Analytical Equipment

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Analytical Equipment: Geographic Segmentation Analysis

4.4 Clinical Diagnostic Equipment

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Clinical Diagnostic Equipment: Geographic Segmentation Analysis

4.5 Drug Discovery Equipment

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Drug Discovery Equipment: Geographic Segmentation Analysis

4.6 Laboratory Sterilization Equipment

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Laboratory Sterilization Equipment: Geographic Segmentation Analysis

4.7 Safety Equipment

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Safety Equipment: Geographic Segmentation Analysis

4.8 Others

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Others: Geographic Segmentation Analysis

Chapter 5: Pharmaceutical Lab Equipment Market by Application

5.1 Pharmaceutical Lab Equipment Market Snapshot and Growth Engine

5.2 Pharmaceutical Lab Equipment Market Overview

5.3 Research and Development

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Research and Development: Geographic Segmentation Analysis

5.4 Quality Control

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Quality Control: Geographic Segmentation Analysis

5.5 Clinical Diagnostics

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Clinical Diagnostics: Geographic Segmentation Analysis

5.6 Biopharmaceutical Production

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Biopharmaceutical Production: Geographic Segmentation Analysis

5.7 Drug Screening

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Drug Screening: Geographic Segmentation Analysis

5.8 Toxicology

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Toxicology: Geographic Segmentation Analysis

Chapter 6: Pharmaceutical Lab Equipment Market by End User

6.1 Pharmaceutical Lab Equipment Market Snapshot and Growth Engine

6.2 Pharmaceutical Lab Equipment Market Overview

6.3 Pharmaceutical Companies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Pharmaceutical Companies: Geographic Segmentation Analysis

6.4 Biopharmaceutical Companies

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Biopharmaceutical Companies: Geographic Segmentation Analysis

6.5 Contract Research Organizations (CROs)

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Contract Research Organizations (CROs): Geographic Segmentation Analysis

6.6 Academic and Research Institutes

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Academic and Research Institutes: Geographic Segmentation Analysis

6.7 Diagnostic Laboratories

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Diagnostic Laboratories: Geographic Segmentation Analysis

6.8 Others

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pharmaceutical Lab Equipment Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AGILENT TECHNOLOGIES (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BECKMAN COULTER (USA)

7.4 BIO-RAD LABORATORIES (USA)

7.5 EPPENDORF AG (GERMANY)

7.6 GE HEALTHCARE (USA)

7.7 HORIBA (JAPAN)

7.8 MERCK GROUP (GERMANY)

7.9 PERKINELMER (USA)

7.10 SARTORIUS AG (GERMANY)

7.11 SHIMADZU CORPORATION (JAPAN)

7.12 THERMO FISHER SCIENTIFIC (USA)

7.13 WATERS CORPORATION (USA)

7.14 ZINSSER ANALYTIC (GERMANY)

7.15 SCIEX (USA)

7.16 VWR INTERNATIONAL (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Pharmaceutical Lab Equipment Market By Region

8.1 Overview

8.2. North America Pharmaceutical Lab Equipment Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Analytical Equipment

8.2.4.2 Clinical Diagnostic Equipment

8.2.4.3 Drug Discovery Equipment

8.2.4.4 Laboratory Sterilization Equipment

8.2.4.5 Safety Equipment

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Research and Development

8.2.5.2 Quality Control

8.2.5.3 Clinical Diagnostics

8.2.5.4 Biopharmaceutical Production

8.2.5.5 Drug Screening

8.2.5.6 Toxicology

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Pharmaceutical Companies

8.2.6.2 Biopharmaceutical Companies

8.2.6.3 Contract Research Organizations (CROs)

8.2.6.4 Academic and Research Institutes

8.2.6.5 Diagnostic Laboratories

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pharmaceutical Lab Equipment Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Analytical Equipment

8.3.4.2 Clinical Diagnostic Equipment

8.3.4.3 Drug Discovery Equipment

8.3.4.4 Laboratory Sterilization Equipment

8.3.4.5 Safety Equipment

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Research and Development

8.3.5.2 Quality Control

8.3.5.3 Clinical Diagnostics

8.3.5.4 Biopharmaceutical Production

8.3.5.5 Drug Screening

8.3.5.6 Toxicology

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Pharmaceutical Companies

8.3.6.2 Biopharmaceutical Companies

8.3.6.3 Contract Research Organizations (CROs)

8.3.6.4 Academic and Research Institutes

8.3.6.5 Diagnostic Laboratories

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Pharmaceutical Lab Equipment Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Analytical Equipment

8.4.4.2 Clinical Diagnostic Equipment

8.4.4.3 Drug Discovery Equipment

8.4.4.4 Laboratory Sterilization Equipment

8.4.4.5 Safety Equipment

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Research and Development

8.4.5.2 Quality Control

8.4.5.3 Clinical Diagnostics

8.4.5.4 Biopharmaceutical Production

8.4.5.5 Drug Screening

8.4.5.6 Toxicology

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Pharmaceutical Companies

8.4.6.2 Biopharmaceutical Companies

8.4.6.3 Contract Research Organizations (CROs)

8.4.6.4 Academic and Research Institutes

8.4.6.5 Diagnostic Laboratories

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Pharmaceutical Lab Equipment Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Analytical Equipment

8.5.4.2 Clinical Diagnostic Equipment

8.5.4.3 Drug Discovery Equipment

8.5.4.4 Laboratory Sterilization Equipment

8.5.4.5 Safety Equipment

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Research and Development

8.5.5.2 Quality Control

8.5.5.3 Clinical Diagnostics

8.5.5.4 Biopharmaceutical Production

8.5.5.5 Drug Screening

8.5.5.6 Toxicology

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Pharmaceutical Companies

8.5.6.2 Biopharmaceutical Companies

8.5.6.3 Contract Research Organizations (CROs)

8.5.6.4 Academic and Research Institutes

8.5.6.5 Diagnostic Laboratories

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pharmaceutical Lab Equipment Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Analytical Equipment

8.6.4.2 Clinical Diagnostic Equipment

8.6.4.3 Drug Discovery Equipment

8.6.4.4 Laboratory Sterilization Equipment

8.6.4.5 Safety Equipment

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Research and Development

8.6.5.2 Quality Control

8.6.5.3 Clinical Diagnostics

8.6.5.4 Biopharmaceutical Production

8.6.5.5 Drug Screening

8.6.5.6 Toxicology

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Pharmaceutical Companies

8.6.6.2 Biopharmaceutical Companies

8.6.6.3 Contract Research Organizations (CROs)

8.6.6.4 Academic and Research Institutes

8.6.6.5 Diagnostic Laboratories

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pharmaceutical Lab Equipment Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Analytical Equipment

8.7.4.2 Clinical Diagnostic Equipment

8.7.4.3 Drug Discovery Equipment

8.7.4.4 Laboratory Sterilization Equipment

8.7.4.5 Safety Equipment

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Research and Development

8.7.5.2 Quality Control

8.7.5.3 Clinical Diagnostics

8.7.5.4 Biopharmaceutical Production

8.7.5.5 Drug Screening

8.7.5.6 Toxicology

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Pharmaceutical Companies

8.7.6.2 Biopharmaceutical Companies

8.7.6.3 Contract Research Organizations (CROs)

8.7.6.4 Academic and Research Institutes

8.7.6.5 Diagnostic Laboratories

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Pharmaceutical Lab Equipment Market research report?

A1: The forecast period in the Pharmaceutical Lab Equipment Market research report is 2024-2032.

Q2: Who are the key players in the Pharmaceutical Lab Equipment Market?

A2: Agilent Technologies (USA), Beckman Coulter (USA), Bio-Rad Laboratories (USA), Eppendorf AG (Germany), GE Healthcare (USA), Horiba (Japan), Merck Group (Germany), PerkinElmer (USA), Sartorius AG (Germany), Shimadzu Corporation (Japan), Thermo Fisher Scientific (USA), Waters Corporation (USA), Zinsser Analytic (Germany), Sciex (USA), VWR International (USA), and Other Active Players.

Q3: What are the segments of the Pharmaceutical Lab Equipment Market?

A3: The Pharmaceutical Lab Equipment Market is segmented into Product Type, Application, End User, and Region. By Product Type, the market is categorized into Analytical Equipment, Clinical Diagnostic Equipment, Drug Discovery Equipment, Laboratory Sterilization Equipment, Safety Equipment, and Others. By End User, the market is categorized into Pharmaceutical Companies, Biopharmaceutical Companies, Contract Research Organizations (CROs), Academic and Research Institutes, Diagnostic Laboratories, and Others. By Application, the market is categorized into Pharmaceutical Companies, Biopharmaceutical Companies, Contract Research Organizations (CROs), Academic and Research Institutes, Diagnostic Laboratories, and Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Pharmaceutical Lab Equipment Market?

A4: The pharmaceutical lab equipment market is defined in this research as band comprises all those instruments and devices that are used during the various stages of pharmaceutical research development and manufacturing. This includes laboratory equipment for testing and analysis, quality assurance apparatus, equipment used in formulation of drugs, and clinical testing equipment, which defines the efficiency, safety and legal conformity of drugs manufactured. Some of the major equipment used in this sector are centrifuges, spectrophotometer, chromatograph and different types of bioreactor help in assessment of chemical as well as biological substances and drug intermediation. These products are needed as biopharmaceuticals research progresses, quality assurance becomes prioritized, and drug development becomes multifaceted.

Q5: How big is the Pharmaceutical Lab Equipment Market?

A5: Pharmaceutical Lab Equipment Market Size Was Valued at USD 30.16 Billion in 2023, and is Projected to Reach USD 58.41 Billion by 2032, Growing at a CAGR of 7.62% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!