Stay Ahead in Fast-Growing Economies.

Browse Reports NowPharmaceutical Intermediates Market Size, Share & Forecast (2024-2032)

The pharmaceutical intermediates market includes Multitude of chemical compounds, which are used as precursors in preparation of active pharmaceutical ingredients and the finished products.

IMR Group

Description

Pharmaceutical Intermediates Market Synopsis:

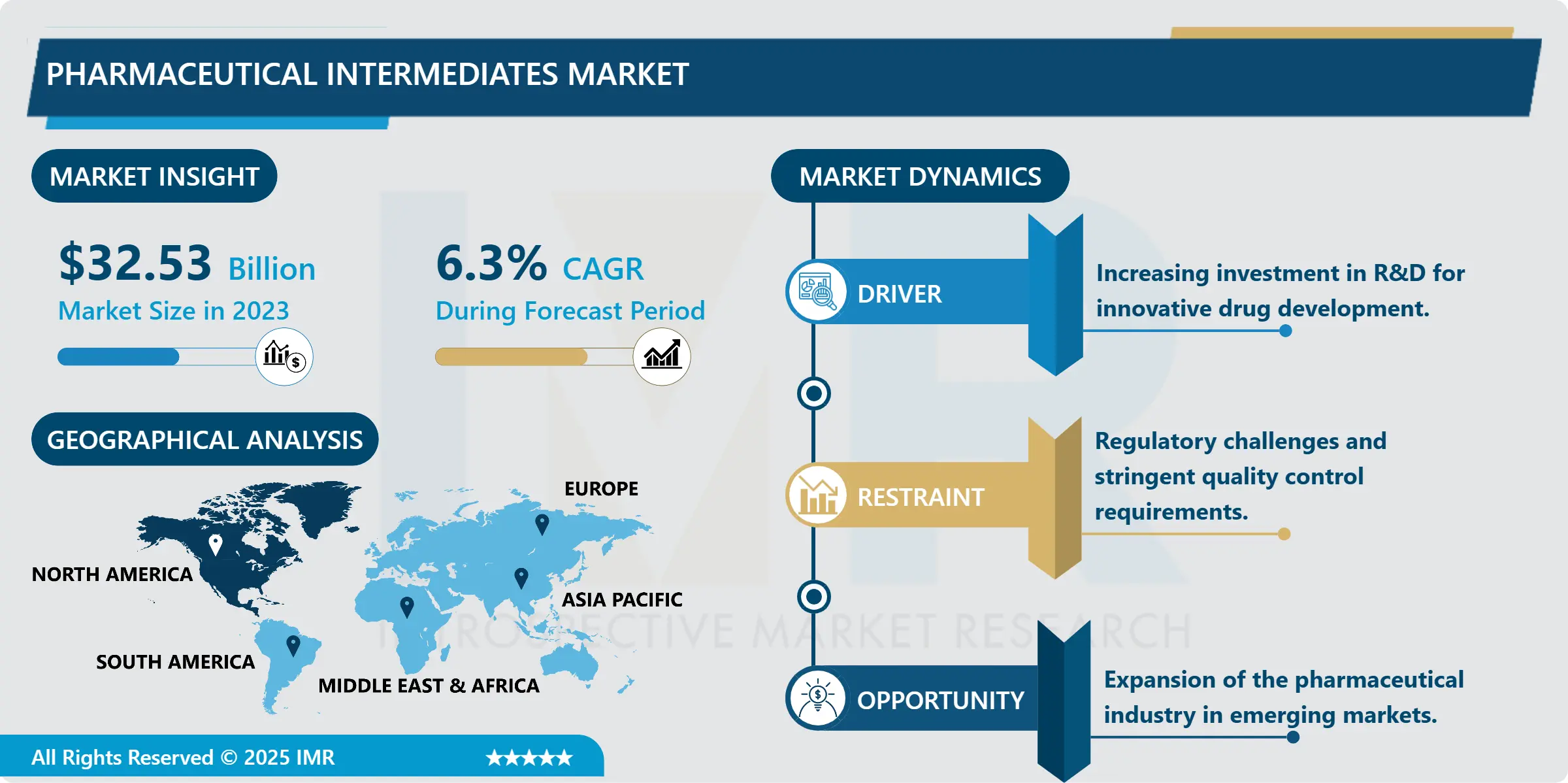

Pharmaceutical Intermediates Market Size Was Valued at USD 32.53 Billion in 2023, and is Projected to Reach USD 56.37 Billion by 2032, Growing at a CAGR of 6.3% From 2024-2032.

The pharmaceutical intermediates market includes Multitude of chemical compounds, which are used as precursors in preparation of active pharmaceutical ingredients and the finished products. The use of these intermediates is important in drug synthesis so that drug manufacturing firms can develop formulations that cater for the therapeutic requirements of the society. Included compounds span a wide variety of therapeutic markets, thus marking the value of the market when it comes to creating drugs. Thus, the need for quality intermediates has steadily risen with advances in pharmacy and pharmaceutical formulations, and an emphasis on individualized medicine and treatment.

The present global market for pharmaceutical intermediates has been developing rapidly in recent years due to the growth of the pharmaceutical and biotechnology industries.. With the fact that age increases, and the frequency of chronic diseases that affects the global population, the need for improved medications has also soared. Intermediates are used in the manufacture of new drugs with pharmaceutical firms dedicating large resources in product development hence the increasing demand for intermediates. This sector not only helps in the manufacturing of existing molecules for drugs but also plays a role in the advancement of new molecular entity and formulation of new drugs such as Biologics and biosimilars thus expanding it’s utility.

Outsourcing activity regarding intermediates production is also growing, and the majority of the market players prefer outsourcing to specialized contract manufacturers.. This shift enables the pharmaceutical organizations expand its scopes of operational focus and strategy while at the same time outsourcing for their professional technical abilities and organization structures to these contract organizations. Global location that forms the outsourcing map include Asia-Pacific due to cheap labor and strong supply chain. In addition to the level of competition, regulatory demands affect the quality control and hence influence the selection of desired intermediates and manufacturers.

Pharmaceutical Intermediates Market Trend Analysis:

Growing Demand for Green Chemistry

The move towards green chemistry is now revolutionizing the market of pharmaceutical intermediates. There is always growing concern over the environment and this has triggered the need for sustainable chemistry in the synthesis of chemicals. Drug makers are also practicing ecological manufacturing in their effort to decrease waste. It also proactively responds the requirements from regulatory authorities increase environmental requirements for chemicals processes. So, organisations are looking at advanced technologies to create likely intermediates that would require lesser energy input and minimum production of dangerous by-products.

Moreover, application of biocatalysis, and nonconventional solvents in the synthesis of pharmaceutical intermediates is gradually picking up. These methods do not only increase the efficiency and selectivity of the synthesis processes but also increase safety of the chemicals. In other words, green chemistry makes reputational value greater, drives environmental consumers to brands, and accommodates strict environmental legal standards. Based on this trend, more advancement in the near future is predicted to impact market forces and foster development of the sector.

Expansion in Emerging Markets

Growth in the pharmaceutical intermediates market is yet another opportunity associated with emerging markets. India, China and Brazil among other nations are rapidly industrializing thus exposing their population to the need for heath cares solutions. Such areas are even enhancing their capacities in health systems and boosting their production in the manufacturing of drugs, therefore leading to the need for quality intermediates. This is so because there is increasing population, income per capita and a rising concern in health consumers and their costs.

In addition, the governments of these countries are Fashioning friendly policies that encourage the manufacture and development of pharmaceuticals. Measures designed at enhancing the local content and mitigating on importation create a good bed for the development of the sector on pharmaceutical intermediates. The companies that center themselves intra-industry and in the correct temporal location to be ready to pounce on these new markets will be the ones on the receiving end when their market shares expand as their revenues receive a boost. Thus, the development of these regions presents large opportunities for both strong pharmaceutical intermediates market players and newcomers.

Pharmaceutical Intermediates Market Segment Analysis:

Pharmaceutical Intermediates Market is Segmented on the basis of Type, Application, and End User.

By Type, Chemical Intermediate segment is expected to dominate the market during the forecast period

It is projected that the chemical intermediate segment will remain the largest during the forecast period owing to its essential application in the synthesis of active pharmaceutical ingredients and different forms of drugs. These intermediates are strategic products as this finding demonstrates how they play a crucial role in manufacturing numerous drugs within various therapeutic classes. As the need for new drugs rises and the desire to develop drugs intensifies, chemical intermediates have become a critical input for pharmaceutical firms to optimize for production. Moreover, a constantly evolving chemical synthesis technologies and the growing tendency of outsourcing production to specialized manufacturers will also continue to create solid base for this segment and maintain its leading position in the global market.

By Application, Analgesics segment expected to held the largest share

The analgesics segment is expected to represent the largest growth of the global pharmaceutical intermediates market during the period upcoming due to the high occurrences of related ailments and the increasing demand for efficient pain relief products. Since more and more people experience chronic pain, arthritis, and postoperative pain, there is added pressure to create strong analgesic drugs. Players in the pharma sector are aware of the need to explore and develop better products in this category of drugs, and thus they allocate a lot of efforts and capital to R&D, which automatically translates into increased demand for specific intermediates that are used to produce analgesics. Further, the growth in pain management treatment and the shifting focus to individualized medicine will continue the strong growth in this segment which makes a significant part in the PI market.

Pharmaceutical Intermediates Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

He added that in 2023 Asia-Pacific region controls most of of pharma intermediates market in terms of demand. These factors may explain why Europe remains dominant in this area due to a strong manufacturing industry, cheap production capacity and a rising pharma market in emerging markets like China and India. The area has plenty of fairly skilled human resource and governmental polices that support production of new drugs and medicines. Due to cost-cutting strategies directed to outsourcing manufacturing activities with a view to achieving higher levels of productivity by multinationals, Asia-Pacific region has emerged as the most sought-after market in sourcing of pharmaceutical intermediates.

Active Key Players in the Pharmaceutical Intermediates Market

Aarti Industries Ltd. (India)

Alkaloid AD Skopje (North Macedonia)

BASF SE (Germany)

Boehringer Ingelheim GmbH (Germany)

Divi’s Laboratories Ltd. (India)

Fujifilm Diosynth Biotechnologies (Japan)

Hikma Pharmaceuticals PLC (UK)

Hubei Zhenguo Pharmaceutical Co., Ltd. (China)

Jubilant Life Sciences Ltd. (India)

Lonza Group AG (Switzerland)

Piramal Pharma Solutions (India)

Sun Pharmaceutical Industries Ltd. (India)

Syngene International Ltd. (India)

Teva Pharmaceutical Industries Ltd. (Israel)

Wuxi AppTec (China), and Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pharmaceutical Intermediates Market by Type

4.1 Pharmaceutical Intermediates Market Snapshot and Growth Engine

4.2 Pharmaceutical Intermediates Market Overview

4.3 Chemical Intermediate

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Chemical Intermediate: Geographic Segmentation Analysis

4.4 Bulk Drug Intermediate

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Bulk Drug Intermediate: Geographic Segmentation Analysis

4.5 and Others

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 and Others: Geographic Segmentation Analysis

Chapter 5: Pharmaceutical Intermediates Market by Application

5.1 Pharmaceutical Intermediates Market Snapshot and Growth Engine

5.2 Pharmaceutical Intermediates Market Overview

5.3 Analgesics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Analgesics: Geographic Segmentation Analysis

5.4 Anti-Infective Drugs

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Anti-Infective Drugs: Geographic Segmentation Analysis

5.5 Cardiovascular Drugs

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Cardiovascular Drugs: Geographic Segmentation Analysis

5.6 Oral Antidiabetic Drugs

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Oral Antidiabetic Drugs: Geographic Segmentation Analysis

5.7 Antimicrobial Drugs

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Antimicrobial Drugs: Geographic Segmentation Analysis

5.8 and Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 and Others: Geographic Segmentation Analysis

Chapter 6: Pharmaceutical Intermediates Market by End User

6.1 Pharmaceutical Intermediates Market Snapshot and Growth Engine

6.2 Pharmaceutical Intermediates Market Overview

6.3 Biotech and Pharma Companies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Biotech and Pharma Companies: Geographic Segmentation Analysis

6.4 Research Institutions

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Research Institutions: Geographic Segmentation Analysis

6.5 and Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pharmaceutical Intermediates Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AARTI INDUSTRIES LTD. (INDIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALKALOID AD SKOPJE (NORTH MACEDONIA)

7.4 BASF SE (GERMANY)

7.5 BOEHRINGER INGELHEIM GMBH (GERMANY)

7.6 DIVI’S LABORATORIES LTD. (INDIA)

7.7 FUJIFILM DIOSYNTH BIOTECHNOLOGIES (JAPAN)

7.8 HIKMA PHARMACEUTICALS PLC (UK)

7.9 HUBEI ZHENGUO PHARMACEUTICAL CO. LTD. (CHINA)

7.10 JUBILANT LIFE SCIENCES LTD. (INDIA)

7.11 LONZA GROUP AG (SWITZERLAND)

7.12 PIRAMAL PHARMA SOLUTIONS (INDIA)

7.13 SUN PHARMACEUTICAL INDUSTRIES LTD. (INDIA)

7.14 SYNGENE INTERNATIONAL LTD. (INDIA)

7.15 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

7.16 WUXI APPTEC (CHINA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Pharmaceutical Intermediates Market By Region

8.1 Overview

8.2. North America Pharmaceutical Intermediates Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Chemical Intermediate

8.2.4.2 Bulk Drug Intermediate

8.2.4.3 and Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Analgesics

8.2.5.2 Anti-Infective Drugs

8.2.5.3 Cardiovascular Drugs

8.2.5.4 Oral Antidiabetic Drugs

8.2.5.5 Antimicrobial Drugs

8.2.5.6 and Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Biotech and Pharma Companies

8.2.6.2 Research Institutions

8.2.6.3 and Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pharmaceutical Intermediates Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Chemical Intermediate

8.3.4.2 Bulk Drug Intermediate

8.3.4.3 and Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Analgesics

8.3.5.2 Anti-Infective Drugs

8.3.5.3 Cardiovascular Drugs

8.3.5.4 Oral Antidiabetic Drugs

8.3.5.5 Antimicrobial Drugs

8.3.5.6 and Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Biotech and Pharma Companies

8.3.6.2 Research Institutions

8.3.6.3 and Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Pharmaceutical Intermediates Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Chemical Intermediate

8.4.4.2 Bulk Drug Intermediate

8.4.4.3 and Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Analgesics

8.4.5.2 Anti-Infective Drugs

8.4.5.3 Cardiovascular Drugs

8.4.5.4 Oral Antidiabetic Drugs

8.4.5.5 Antimicrobial Drugs

8.4.5.6 and Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Biotech and Pharma Companies

8.4.6.2 Research Institutions

8.4.6.3 and Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Pharmaceutical Intermediates Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Chemical Intermediate

8.5.4.2 Bulk Drug Intermediate

8.5.4.3 and Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Analgesics

8.5.5.2 Anti-Infective Drugs

8.5.5.3 Cardiovascular Drugs

8.5.5.4 Oral Antidiabetic Drugs

8.5.5.5 Antimicrobial Drugs

8.5.5.6 and Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Biotech and Pharma Companies

8.5.6.2 Research Institutions

8.5.6.3 and Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pharmaceutical Intermediates Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Chemical Intermediate

8.6.4.2 Bulk Drug Intermediate

8.6.4.3 and Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Analgesics

8.6.5.2 Anti-Infective Drugs

8.6.5.3 Cardiovascular Drugs

8.6.5.4 Oral Antidiabetic Drugs

8.6.5.5 Antimicrobial Drugs

8.6.5.6 and Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Biotech and Pharma Companies

8.6.6.2 Research Institutions

8.6.6.3 and Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pharmaceutical Intermediates Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Chemical Intermediate

8.7.4.2 Bulk Drug Intermediate

8.7.4.3 and Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Analgesics

8.7.5.2 Anti-Infective Drugs

8.7.5.3 Cardiovascular Drugs

8.7.5.4 Oral Antidiabetic Drugs

8.7.5.5 Antimicrobial Drugs

8.7.5.6 and Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Biotech and Pharma Companies

8.7.6.2 Research Institutions

8.7.6.3 and Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Pharmaceutical Intermediates Market research report?

A1: The forecast period in the Pharmaceutical Intermediates Market research report is 2024-2032.

Q2: Who are the key players in the Pharmaceutical Intermediates Market?

A2: Aarti Industries Ltd. (India), Alkaloid AD Skopje (North Macedonia), BASF SE (Germany), Boehringer Ingelheim GmbH (Germany), Divi's Laboratories Ltd. (India), Fujifilm Diosynth Biotechnologies (Japan), Hikma Pharmaceuticals PLC (UK), Hubei Zhenguo Pharmaceutical Co., Ltd. (China), Jubilant Life Sciences Ltd. (India), Lonza Group AG (Switzerland), Piramal Pharma Solutions (India), Sun Pharmaceutical Industries Ltd. (India), Syngene International Ltd. (India), Teva Pharmaceutical Industries Ltd. (Israel), Wuxi AppTec (China), and Other Active Players.

Q3: What are the segments of the Pharmaceutical Intermediates Market?

A3: The Pharmaceutical Intermediates Market is segmented into Type, Application, End User, and region. By Type, the market is categorized into Chemical Intermediate, Bulk Drug Intermediate, and Others. By Application, the market is categorized into Analgesics, Anti-Infective Drugs, Cardiovascular Drugs, Oral Antidiabetic Drugs, Antimicrobial Drugs, and Others. By End User, the market is categorized into Biotech and Pharma Companies, Research Institutions, and Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Pharmaceutical Intermediates Market?

A4: The pharmaceutical intermediates market comprises various chemical compounds that serve as building blocks in the production of active pharmaceutical ingredients (APIs) and finished pharmaceutical products. These intermediates are essential for the synthesis of drugs, enabling pharmaceutical companies to create formulations that meet therapeutic needs. The market includes a diverse range of compounds utilized across different therapeutic areas, highlighting its significance in the drug development process. The demand for high-quality intermediates is driven by the growing pharmaceutical industry, advancements in drug formulations, and an increasing focus on personalized medicine.

Q5: How big is the Pharmaceutical Intermediates Market?

A5: Pharmaceutical Intermediates Market Size Was Valued at USD 32.53 Billion in 2023, and is Projected to Reach USD 56.37 Billion by 2032, Growing at a CAGR of 6.3% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!