Stay Ahead in Fast-Growing Economies.

Browse Reports NowPet Insurance Market -Global Size & Upcoming Industry Trends

Pet insurance is an insurance policy bought by the pet owner to pay partly or in total for the veterinary treatment of the insured pet’s illness or injury. Some policy also covers the pet death, or in case it the lost or stolen. Moreover, the growing medical expenses in veterinary medicine and employing of expensive medical techniques and drugs is boosting the demand of pet insurance market. Growing and increased demand for pet insurance market policies and rise in need for financial safety in case of surge in uncertainties boost the growth of the global pet insurance market.

IMR Group

Description

Global Pet Insurance Market Synopsis

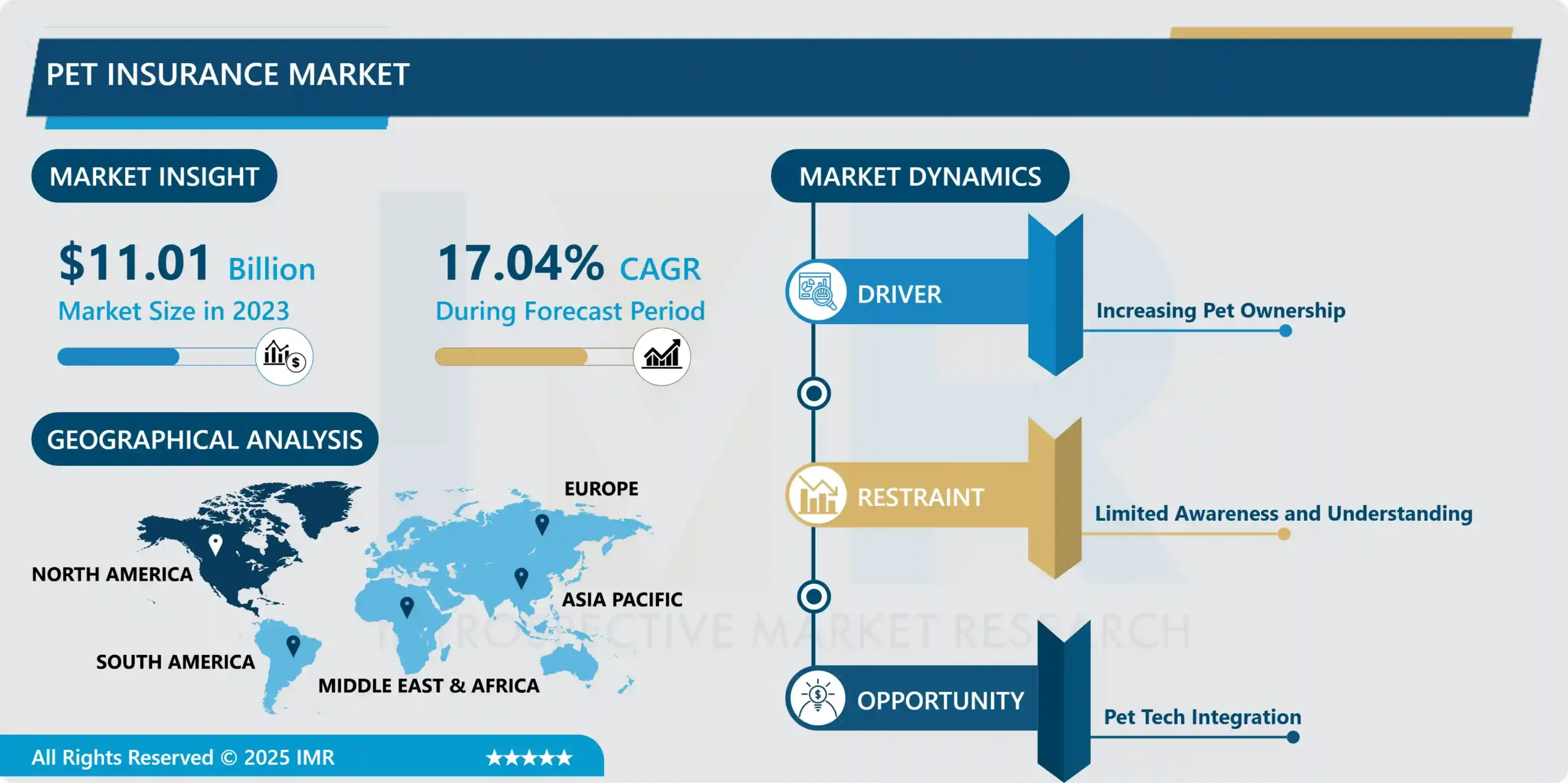

Global Pet Insurance Market size was valued at USD 11.01 Billion in 2023 and is projected to reach USD 45.37 Billion by 2032, growing at a CAGR of 17.04% from 2024 to 2032.

Pet insurance is an insurance policy bought by the pet owner to pay partly or in total for the veterinary treatment of the insured pet’s illness or injury. Some policy also covers the pet death, or in case it the lost or stolen.

Moreover, the growing medical expenses in veterinary medicine and employing of expensive medical techniques and drugs is boosting the demand of pet insurance market. Growing and increased demand for pet insurance market policies and rise in need for financial safety in case of surge in uncertainties boost the growth of the global pet insurance market.

In addition, surge in number of veterinary centers positively impacts the growth of the market. However, lack of awareness regarding pet insurance policy and high premium cost hampers the market growth. On the contrary implementation of technologies in existing products and service lines, and government initiatives regarding pet insurance policies are expected to offer remunerative opportunities for expansion of the market during the forecast period.

Global Pet Insurance Market Trend Analysis

Increasing Pet Ownership

Pet ownership is on the rise globally. Dogs, cats, and various other pets have become integral members of households. The increasing number of pets creates a larger customer base for pet insurance providers.

Many people consider their pets as family members, and they are willing to invest in their pets’ well-being. The emotional bond between pet owners and their animals drives the desire to ensure that pets receive the best possible healthcare, including access to insurance coverage.

As pet owners become more informed about their pets’ healthcare needs, they recognize the potential financial burden associated with veterinary expenses. Routine check-ups, vaccinations, surgeries, and emergency care can be expensive. Pet insurance provides peace of mind by covering these costs.

Advances in veterinary medicine and pet nutrition have contributed to longer lifespans for pets. As pets age, they may develop chronic conditions or require specialized care. Pet insurance helps pet owners afford ongoing medical treatment throughout their pets’ lives.

Urbanization and changing lifestyles have made pets more popular among city dwellers. In urban areas, people often have limited space and time, leading them to choose smaller pets like cats or small dog breeds. These pets tend to have longer lifespans and may require more healthcare services, further driving the demand for insurance

Pet Tech Integration

Integrating with pet wearables, such as fitness trackers and health monitors, allows insurers to access real-time health data. This data can be used to assess the pet’s overall health, detect early signs of illness, and encourage preventive care.

Insurance providers can develop or partner with pet health apps that allow policyholders to track their pets’ health and receive personalized recommendations. These apps can include reminders for vaccinations, medication, and wellness check-ups.

Pet insurers can leverage data analytics to assess pet health risks more accurately. This enables insurers to offer customized policies with appropriate coverage levels and pricing based on individual pet characteristics, behaviour, and health history.

Advanced predictive modeling can help identify potential health issues in pets and provide insights to pet owners on preventive measures. This proactive approach can reduce claims and improve pet health outcomes.

Integration with Telemedicine Platforms: Insurance providers can integrate with telemedicine platforms, allowing policyholders to access virtual veterinary consultations. This offers convenience, especially for non-emergency medical concerns, and may reduce claims costs.

Global Pet Insurance Market Segment Analysis:

Global Pet Insurance Market Segmented on the basis of type, application, and end-users.

By Coverage Type, Accident & Illness segment is expected to dominate the market during the forecast period

This insurance category offers pet owners financial protection against unexpected incidents, including injuries from accidents or the onset of various illnesses. It’s a comprehensive package that encompasses a wide array of medical conditions and accidents that could afflict beloved pets. Pet owners seek reassurance that their furry companions will receive the best care possible, especially in emergencies. Accident & Illness insurance steps in to cover expenses related to sudden injuries from mishaps like car accidents, broken bones, or unforeseen illnesses like cancer or infections. This breadth of coverage alleviates concerns about potential costly treatments, enabling owners to focus on their pet’s well-being rather than financial burdens.

The rising cost of veterinary care has fueled the demand for robust insurance coverage. Advanced medical treatments, diagnostic procedures, surgeries, and medications for pets can strain an owner’s finances. Accident & Illness plans offer a solution by shouldering a significant portion of these expenses, making high-quality care more accessible and affordable for pet owners.

By Animal Type, dogs segment held the largest share of 59% in 2022

Dogs undoubtedly take the lead in dominating the global pet insurance market. This prevalence stems from various factors, with dogs being the most commonly insured pets due to their sheer numbers in households worldwide. As a result, insurance companies have tailored their policies to cater extensively to the needs of dog owners, fueling the prominence of this segment.

One pivotal reason for dogs’ dominance in the pet insurance realm is their susceptibility to various health issues. Unlike some other pets, dogs often encounter a wide range of medical conditions throughout their lifetimes, from genetic predispositions to common ailments like hip dysplasia, allergies, and even breed-specific concerns. This predisposition to health issues prompts owners to seek comprehensive insurance coverage to handle potential high veterinary expenses.

Global Pet Insurance Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

In the North American region, the United States accounted for the largest market share. High pet ownership, awareness, increasing pet insurance, and technological advancements in the diagnostics field are the major driving factors in the US region. The country’s socio-economic conditions are good enough to give economic support to the market on the production and at the end-user level.

According to the 2021-2022 National Pet Owners Survey conducted by American Pet Products Association (APPA), pet ownership increased from 67 % to 70% of households in the United States. Millennials were also discovered to be the greatest cohort of pet owners, accounting for 32%, followed by Boomers (27%) and Gen X (24%).

Also, as per the report published by do something. organization 2020, every year, approximately 7.6 million companion animals enter animal shelters across the United States. There are approximately 3.9 million dogs and 3.4 million cats among them. Thus, the rise in the adoption of pet animals is expected to increase the spending on the healthcare needs of these animals, which, in turn, is expected to boost the growth of the market over the forecast period. According to the American Pet Products Association (APPA) 2021-2022, there is an increase in expenditure on the pet industry in the United States.

Global Pet Insurance Market Top Key Players:

Trupanion (US)

Nationwide (US)

Petplan (United Kingdom)

Healthy Paws(US)

Embrace Pet Insurance (US)

ASPCA Pet Health Insurance (US)

Crum & Forster Pet Insurance (US)

Healthy Paws Pet Insurance & Foundation (US)

Figo Pet Insurance (US)

PetFirst Pet Insurance (US)

Hartville Pet Insurance (US)

MetLife Pet Insurance (US)

VPI Pet Insurance (US)

Pets Best (US)

Agria Pet Insurance (Sweden)

Direct Line Group (UK)

RSA Insurance Group Plc (UK)

Petplan (UK)

Petsecure (Canada)

24PetWatch (Canada)

PetSure (Australia)

Anicom Holdings (Japan)

The Oriental Insurance Company Ltd. (India)

Oneplan Pet Insurance (South Africa)

Key Industry Developments in the Global Pet Insurance Market:

In May 2024, Unum Group, a leading provider of financial protection benefits in the U.S., launched Unum Pet Insurance in partnership with Nationwide. Unum Pet Insurance offered plans that provided coverage employees could count on to keep their pets healthy. With this offering, Unum Group rounded out its financial benefits portfolio, offering holistic protection for employees and their families, no matter what their family looked like.

In December 2023, Aflac Incorporated and Trupanion confirmed their commitment to a strategic alliance in North America on December 14, 2023. Together, they had launched a suite of high-quality pet medical insurance products available at U.S. worksites. Aflac Incorporated’s $200 million investment in Trupanion and their distribution alliance underscored their mutual commitment to unlocking the significant, long-term potential of this category and their belief in the products offered by Trupanion, the largest provider of pet medical insurance in North America.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pet Insurance Market by Coverage Type (2018-2032)

4.1 Pet Insurance Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Accident & Illness

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Accident Only

4.5 Embedded Wellness

Chapter 5: Pet Insurance Market by Animal Type (2018-2032)

5.1 Pet Insurance Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Dogs

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cats

5.5 Horses

5.6 Exotic Pets

5.7 Others

Chapter 6: Pet Insurance Market by Sales Channel (2018-2032)

6.1 Pet Insurance Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Agency

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Broker

6.5 Direct

6.6 Bancassurance

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pet Insurance Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 OCULUS (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CYBERGLOVE SYSTEMS INC. (US)

7.4 META PLATFORMS INC. (US)

7.5 MICROSOFT CORPORATION (US)

7.6 SENSICS INC. (US)

7.7 ALPHABET INC (US)

7.8 SIXENSE ENTERPRISES INC. (US)

7.9 GOOGLE (US)

7.10 ULTRALEAP LTD. (US)

7.11 NVIDIA CORPORATION (U.S.)

7.12 HAPTX INC. (US)

7.13 QUALCOMM INCORPORATED (US)

7.14 UNITY SOFTWARE INC. (US)

7.15 EON REALITY (US)

7.16 VUZIX (US)

7.17 LEAP MOTION (US)

7.18 SAMSUNG ELECTRONICS (SOUTH KOREA)

7.19 BARCO NV (BELGIUM)

7.20 SONY (JAPAN)

7.21 HTC CORPORATION (CHINA)

7.22

Chapter 8: Global Pet Insurance Market By Region

8.1 Overview

8.2. North America Pet Insurance Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Coverage Type

8.2.4.1 Accident & Illness

8.2.4.2 Accident Only

8.2.4.3 Embedded Wellness

8.2.5 Historic and Forecasted Market Size by Animal Type

8.2.5.1 Dogs

8.2.5.2 Cats

8.2.5.3 Horses

8.2.5.4 Exotic Pets

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by Sales Channel

8.2.6.1 Agency

8.2.6.2 Broker

8.2.6.3 Direct

8.2.6.4 Bancassurance

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pet Insurance Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Coverage Type

8.3.4.1 Accident & Illness

8.3.4.2 Accident Only

8.3.4.3 Embedded Wellness

8.3.5 Historic and Forecasted Market Size by Animal Type

8.3.5.1 Dogs

8.3.5.2 Cats

8.3.5.3 Horses

8.3.5.4 Exotic Pets

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by Sales Channel

8.3.6.1 Agency

8.3.6.2 Broker

8.3.6.3 Direct

8.3.6.4 Bancassurance

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Pet Insurance Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Coverage Type

8.4.4.1 Accident & Illness

8.4.4.2 Accident Only

8.4.4.3 Embedded Wellness

8.4.5 Historic and Forecasted Market Size by Animal Type

8.4.5.1 Dogs

8.4.5.2 Cats

8.4.5.3 Horses

8.4.5.4 Exotic Pets

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by Sales Channel

8.4.6.1 Agency

8.4.6.2 Broker

8.4.6.3 Direct

8.4.6.4 Bancassurance

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Pet Insurance Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Coverage Type

8.5.4.1 Accident & Illness

8.5.4.2 Accident Only

8.5.4.3 Embedded Wellness

8.5.5 Historic and Forecasted Market Size by Animal Type

8.5.5.1 Dogs

8.5.5.2 Cats

8.5.5.3 Horses

8.5.5.4 Exotic Pets

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by Sales Channel

8.5.6.1 Agency

8.5.6.2 Broker

8.5.6.3 Direct

8.5.6.4 Bancassurance

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pet Insurance Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Coverage Type

8.6.4.1 Accident & Illness

8.6.4.2 Accident Only

8.6.4.3 Embedded Wellness

8.6.5 Historic and Forecasted Market Size by Animal Type

8.6.5.1 Dogs

8.6.5.2 Cats

8.6.5.3 Horses

8.6.5.4 Exotic Pets

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by Sales Channel

8.6.6.1 Agency

8.6.6.2 Broker

8.6.6.3 Direct

8.6.6.4 Bancassurance

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pet Insurance Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Coverage Type

8.7.4.1 Accident & Illness

8.7.4.2 Accident Only

8.7.4.3 Embedded Wellness

8.7.5 Historic and Forecasted Market Size by Animal Type

8.7.5.1 Dogs

8.7.5.2 Cats

8.7.5.3 Horses

8.7.5.4 Exotic Pets

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by Sales Channel

8.7.6.1 Agency

8.7.6.2 Broker

8.7.6.3 Direct

8.7.6.4 Bancassurance

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Pet Insurance Market research report?

A1: The forecast period in the Pet Insurance Market research report is 2024-2032.

Q2: Who are the key players in the Pet Insurance Market?

A2: Trupanion (US), Nationwide (US), Petplan (United Kingdom), Healthy Paws (US), Embrace Pet Insurance (US), ASPCA Pet Health Insurance (US), Figo Pet Insurance (US), PetFirst Pet Insurance (US), Hartville Pet Insurance (US), Agria Pet Insurance (Sweden), Direct Line Group (UK), VPI Pet Insurance (US), Petsecure (Canada), Pets Best (US), MetLife Pet Insurance (US), 24PetWatch (Canada), PetSure (Australia), Anicom Holdings (Japan), Oneplan Pet Insurance (South Africa), Healthy Paws Pet Insurance & Foundation (US)and Other Major Players.

Q3: What are the segments of the Pet Insurance Market?

A3: The Pet Insurance Market is segmented into Coverage Type, Animal Type, Sales Channel and region. By Coverage Type, the market is categorized into Accident & Illness, Accident Only, Embedded Wellness. By Animal Type, the market is categorized into Dogs, Cats, Horses, Exotic Pets, Others. By Sales Channel, the market is categorized into Agency, Broker, Direct, Bancassurance. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Pet Insurance Market?

A4: Pet insurance is an insurance policy bought by the pet owner to pay partly or in total for the veterinary treatment of the insured pet’s illness or injury. Some policy also covers the pet death, or in case the lost or stolen. Moreover, the growing medical expenses in veterinary medicine and employing of expensive medical techniques and drugs is boosting the demand of pet insurance market.

Q5: How big is the Pet Insurance Market?

A5: Global Pet Insurance Market size was valued at USD 11.01 Billion in 2023 and is projected to reach USD 45.37 Billion by 2030, growing at a CAGR of 17.04% from 2024 to 2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!