Stay Ahead in Fast-Growing Economies.

Browse Reports NowPet Hotel Market – Overview and Outlook by Potential Growth By 2024-2032

A pet hotel, sometimes referred to as a pet boarding facility, is a type of special lodging where animals, usually dogs and cats, are left in the care of their owners while they are away. To guarantee the pets’ comfort, safety, and well-being while they are visiting, these institutions offer a variety of services.

IMR Group

Description

Pet Hotel Market Synopsis

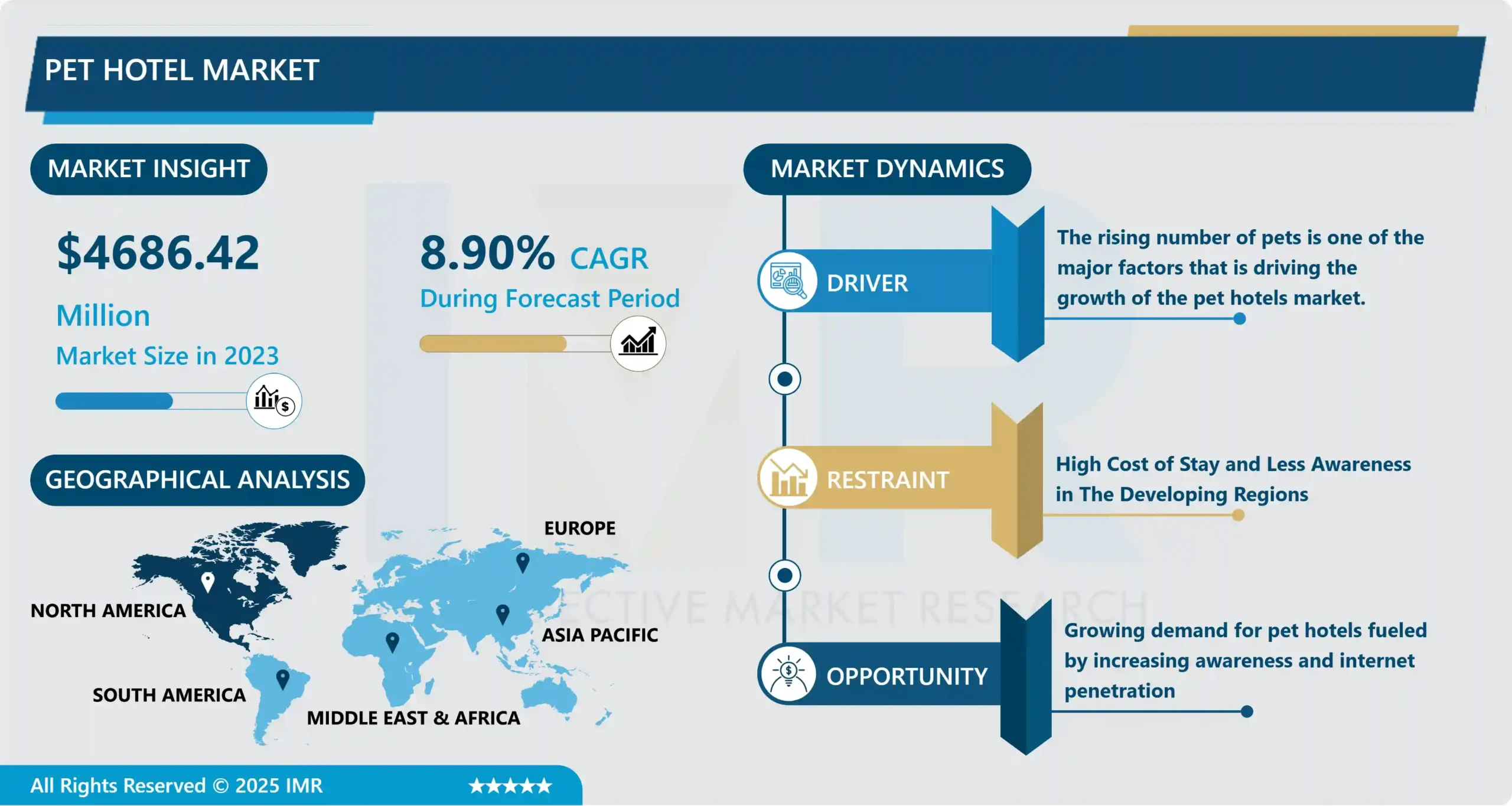

Pet Hotel Market Size Was Valued at USD 4686.42 Million in 2023 and is Projected to Reach USD 10094.67 Million by 2032, Growing at a CAGR of 8.9% From 2024-2032.

A pet hotel, sometimes referred to as a pet boarding facility, is a type of special lodging where animals, usually dogs and cats, are left in the care of their owners while they are away. To guarantee the pets’ comfort, safety, and well-being while they are visiting, these institutions offer a variety of services. The pet lodging industry has been greatly impacted by the growing tendency of humanizing pets. Today’s pet owners view their animals as members of the family and look for lodgings that offer a comparable standard of comfort and care. Due to this factor, upscale, individualized pet accommodation services that satisfy each pet’s particular requirements and preferences have become more popular.

As pet-friendly travel and tourism have grown, pet owners are searching for lodging that enables them to take their animals on adventures to new places. Due to this factor, pet-friendly hotels are now able to open in well-known tourist locations, providing easy and comfortable lodging for both pets and their owners. Pet lodging services are in more demand due to the rise of dual-income households. Pet owners need dependable and trustworthy accommodations because they have hectic work schedules and travel plans, and they also need to make sure their pets are safe while they are away. This factor has contributed to the expansion of specialized pet accommodation establishments that offer animals a secure and caring environment.

Pets with unique needs and the elderly pet population want particular attention and facilities. Specialized pet lodging establishments that address the particular needs of these animals, such as mobility support, medical supervision, and individualized care, have emerged as a result of this driving. The pet lodging sector is changing as a result of the incorporation of technology. The convenience and experience for pet owners and facility operators have been improved by technological improvements, which range from online booking platforms to mobile apps for real-time updates and communication. Americans are fond of having furry (or scaly or feathery) pets in their homes. According to the 2023-2024 APPA National Pet Owners Survey, 66% of U.S. households own a pet. This is about 86.9 million households. Dogs were by far the most common pets, with 65.1 million homes owning a dog, followed closely by cats with 46.5 million homes. Other common pets in U.S. households include freshwater fish, birds, small animals, reptiles, horses, and saltwater fish.

Pet Hotel Market Trend Analysis

Integration of specialized pet services within luxury pet hotels

Pet owners are looking for individualized care, opulent lodgings, and extras like spa services and customized diets, which has led to a boom in demand for high-end pet hotel services. This trend is fueled by pet owners’ increased willingness to spend money on the comfort and welfare of their animals.

Concurrently, the growth of the travel and tourism sector has increased pet-friendly travel options, encouraging pet owners to look for lodging options that accommodate their furry friends. Pet hotels have become a popular option, providing stays of one night or more. Pet owners place a high value on safety and well-being, favoring establishments with trained personnel, secure locations, and strict hygienic guidelines. Features that offer peace of mind include 24/7 vet access and webcam surveillance.

To meet this demand, businesses are broadening their offerings and providing specialized care within pet hotels, including daycare, training, rehabilitation, and medical services. This all-inclusive strategy creates a competitive edge in the market by catering to the different demands of dogs and their owners. The transformation of pet hotels into sophisticated businesses designed to satisfy the discriminating needs of contemporary pet owners has been spurred by the convergence of the humanization of pets, the expansion of pet-friendly travel options, and the emphasis on safety and specialized services

Opportunity

Growing demand for pet hotels fueled by increasing awareness and internet penetration

Pet hotels are not a completely new idea, but they are becoming more and more well-known in the industry. The pet hotel business is still very much in its infancy and has a lot of unrealized potential. Players in the sector stand to gain new opportunities as knowledge of this concept grows. This potential expansion is facilitated by the trend toward humanizing pets as well as the rising number of pet owners who are looking for high-end services for their furry friends.

The rising use of the internet, which makes it easier to book pet hotels online, is a major factor contributing to this increase. The demand for pet hotel services is anticipated to increase in tandem with the number of pet owners who are using internet platforms to explore and reserve lodging for their animals. The transition to digital booking systems benefits pet owners by increasing ease and broadening the pet hotel brand’s customer base. The need to provide high-quality lodging for furry visitors and the awareness of pet care are becoming more widespread in growing areas as well as in established markets.

Pet hotel services are in high demand as pet ownership increases in these areas and pet owners become pickier about the comfort and upkeep of their animals. This makes it ideal for companies that operate pet hotels to grow and enter new areas. The market for pet services is growing, internet penetration is rising, and increased awareness is positioning the pet hotel business for potential expansion. Pet hotel industry participants can tap into the full potential of this growing market by using these trends and new opportunities.

Pet Hotel Market Segment Analysis:

Pet Hotel Market is Segmented based on Pet Type, Hotel Ratings, Booking Mode, Organization Size, Hotel Type, Service Period, and region.

By Animal Type, Dogs Hotel Segment Is Expected To Dominate The Market During The Forecast Period

The dog segment within the pet hotel industry has experienced significant growth and is poised for continued expansion. Being one of the most popular and cherished pets, dogs have a special place in the hearts of pet owners everywhere. Known for their fidelity, love, and company, they are frequently called “man’s best friend.” This widespread devotion results in a strong desire for grooming, training, and socialization—services that support their overall well-being.

Because regular grooming is crucial to a dog’s health and cleanliness, pet hotels are seeing an increase in demand for their expert grooming services. In a similar vein, training sessions improve obedience and aid with behavioral difficulties, which makes them invaluable for pet owners. Dogs require exercise and social connection, which is further satisfied by group play activities, which increases demand for pet boarding facilities. The need for top-notch care and lodging for dogs is anticipated to rise as the relationship between people and their furry friends gets stronger. Pet hotel entrepreneurs now have a profitable chance to take advantage of the expanding market and meet the changing needs of dog owners throughout the globe.

By Service Period, Short term Segment Held The Largest Share In 2023

Because they are convenient and offer professional care during the day, short-term pet boarding services have become a widely sought-after choice for pet owners. Pet owners who need temporary housing for their animals while they are away for work or other daytime obligations can find these services helpful. The need for short-term pet boarding facilities has increased as a result of the COVID-19 return to work regulations. Pet parents are looking for trustworthy solutions to make sure their animals are secure and well-cared for during the day while they return to their outside-the-home job schedules. There is a considerable demand in the market for short-term boarding services as a result of this change in lifestyle habits.

The demand for short-term boarding services is significantly influenced by the demographics of pet parents. A sizable fraction of pet owners are millennials and Gen Z, and because of their hectic schedules and preference for urban living, they want flexible pet care options. The well-being of their pets is a top priority for these younger generations, and they are prepared to spend money on expert services to make sure their animals are taken care of while they are away. Short-term pet boarding services have been increasingly popular due to a mix of factors such as changing lifestyles, a growing pet ownership demographic, and increased workforce mobility. Therefore, pet boarding establishments that give dependable and adaptable short-term options are in a good position to take advantage of this growing need and offer beneficial solutions to pet owners who require daytime care for their cherished companions.

Pet Hotel Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period in 2023

With a 32.85% revenue share in 2022, North America led the global market for Pet Hotels due to the region’s growing elderly population, fast adoption of new technologies, and increased prevalence of chronic illnesses. For example, the CDC reports that each year more than 795,000 Americans get a stroke, of which 87% are classed as ischemic strokes. Furthermore, healthcare spending in the United States increased by 2.7% in 2021 to reach USD 4.3 trillion, while in Canada, healthcare spending was USD 308 billion, or 12.7% of GDP, in the same year. The market for Pet Hotels in the area is expanding as a result of this significant healthcare spending.

The market is growing because of North America’s extensive investment in healthcare technologies and strong healthcare infrastructure. To enhance patient care and clinical results, hospitals and clinics in the area give priority to sophisticated medical technologies. These aims are supported by Pet Hotels, which provide improved diagnostic capabilities and easy connection with electronic health record (EHR) systems. A substantial amount of the region’s healthcare budget is earmarked for the purchase of medical technology and equipment. With the increased emphasis on telemedicine applications, healthcare providers are investing in cutting-edge solutions like Pet Hotels to improve patient outcomes and operational efficiency.

In the global electronic stethoscope market in 2022, North America held a 43% market revenue share. The area’s well-established pharmaceutical and healthcare industries guarantee access to the newest technologies. The market is driven in part by an aging population, changing lifestyles, and rising rates of lung and cardiovascular illnesses. Innovation is fueled by major North American market players, who also guarantee a consistent supply of medical products to satisfy expanding demand. Government spending promotes the accessibility and cost of healthcare by lowering illness loads and enhancing diagnostic infrastructure.

Pet Hotel Market Top Key Players:

PetSmart (USA)

Petco (USA)

Rover.com (USA)

Best Friends Pet Care (USA)

Camp Bow Wow (USA)

Wag Hotels (USA)

VCA Animal Hospitals (USA)

Paradise Pet Resorts (USA)

Bark Avenue Pet Resort (USA)

D Pet Hotels (USA)

PetsHotel (USA)

Paradise 4 Paws (USA)

Dogtopia (USA)

WAG Hotel (USA)

Pet Paradise (USA)

Central Bark Doggy Day Care (USA)

PetSuites (USA)

Pet Palace (USA)

Paws Up Pet Resort & Spa (USA)

BARK! Hotel for Dogs (USA)

The Kennel Club LAX (USA)

DogCity Daycare (Canada)

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pet Hotel Market by Pet Type (2018-2032)

4.1 Pet Hotel Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Dogs

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cats

4.5 Others (Horse

4.6 Fish

4.7 Turtle)

Chapter 5: Pet Hotel Market by Hotel Ratings (2018-2032)

5.1 Pet Hotel Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Below 3star

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 3star and Above

Chapter 6: Pet Hotel Market by Booking Mode (2018-2032)

6.1 Pet Hotel Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Offline

6.5 Phone

Chapter 7: Pet Hotel Market by Organisation Size (2018-2032)

7.1 Pet Hotel Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Small & Medium Hotels

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Large Hotel

Chapter 8: Pet Hotel Market by Hotel Type (2018-2032)

8.1 Pet Hotel Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Economic Hotels

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Mid-range Hotels

8.5 Luxury Hotels

Chapter 9: Pet Hotel Market by Service Period (2018-2032)

9.1 Pet Hotel Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Long Term

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Short Term

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Pet Hotel Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 PETSMART (USA)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 PETCO (USA)

10.4 ROVER.COM (USA)

10.5 BEST FRIENDS PET CARE (USA)

10.6 CAMP BOW WOW (USA)

10.7 WAG HOTELS (USA)

10.8 VCA ANIMAL HOSPITALS (USA)

10.9 PARADISE PET RESORTS (USA)

10.10 BARK AVENUE PET RESORT (USA)

10.11 D PET HOTELS (USA)

10.12 PETSHOTEL (USA)

10.13 PARADISE 4 PAWS (USA)

10.14 DOGTOPIA (USA)

10.15 WAG HOTEL (USA)

10.16 PET PARADISE (USA)

10.17 CENTRAL BARK DOGGY DAY CARE (USA)

10.18 PETSUITES (USA)

10.19 PET PALACE (USA)

10.20 PAWS UP PET RESORT & SPA (USA)

10.21 BARK! HOTEL FOR DOGS (USA)

10.22 THE KENNEL CLUB LAX (USA)

10.23 DOGCITY DAYCARE (CANADA)

10.24 POOCH HOTEL (USA)

10.25 PARADISE RANCH PET RESORT (USA)

10.26 HAPPY TAILS PET RESORT (USA)

10.27 PAWS PLAYGROUNDS (CANADA)

10.28 FUR-GET ME NOT (USA)

10.29 4 PAWS PET RESORT (USA)

10.30 PARADISE RANCH (USA)

10.31 K9 RESORTS LUXURY PET HOTEL (USA) OTHERS ARE MAJOR PLAYERS

Chapter 11: Global Pet Hotel Market By Region

11.1 Overview

11.2. North America Pet Hotel Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Pet Type

11.2.4.1 Dogs

11.2.4.2 Cats

11.2.4.3 Others (Horse

11.2.4.4 Fish

11.2.4.5 Turtle)

11.2.5 Historic and Forecasted Market Size by Hotel Ratings

11.2.5.1 Below 3star

11.2.5.2 3star and Above

11.2.6 Historic and Forecasted Market Size by Booking Mode

11.2.6.1 Online

11.2.6.2 Offline

11.2.6.3 Phone

11.2.7 Historic and Forecasted Market Size by Organisation Size

11.2.7.1 Small & Medium Hotels

11.2.7.2 Large Hotel

11.2.8 Historic and Forecasted Market Size by Hotel Type

11.2.8.1 Economic Hotels

11.2.8.2 Mid-range Hotels

11.2.8.3 Luxury Hotels

11.2.9 Historic and Forecasted Market Size by Service Period

11.2.9.1 Long Term

11.2.9.2 Short Term

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Pet Hotel Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Pet Type

11.3.4.1 Dogs

11.3.4.2 Cats

11.3.4.3 Others (Horse

11.3.4.4 Fish

11.3.4.5 Turtle)

11.3.5 Historic and Forecasted Market Size by Hotel Ratings

11.3.5.1 Below 3star

11.3.5.2 3star and Above

11.3.6 Historic and Forecasted Market Size by Booking Mode

11.3.6.1 Online

11.3.6.2 Offline

11.3.6.3 Phone

11.3.7 Historic and Forecasted Market Size by Organisation Size

11.3.7.1 Small & Medium Hotels

11.3.7.2 Large Hotel

11.3.8 Historic and Forecasted Market Size by Hotel Type

11.3.8.1 Economic Hotels

11.3.8.2 Mid-range Hotels

11.3.8.3 Luxury Hotels

11.3.9 Historic and Forecasted Market Size by Service Period

11.3.9.1 Long Term

11.3.9.2 Short Term

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Pet Hotel Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Pet Type

11.4.4.1 Dogs

11.4.4.2 Cats

11.4.4.3 Others (Horse

11.4.4.4 Fish

11.4.4.5 Turtle)

11.4.5 Historic and Forecasted Market Size by Hotel Ratings

11.4.5.1 Below 3star

11.4.5.2 3star and Above

11.4.6 Historic and Forecasted Market Size by Booking Mode

11.4.6.1 Online

11.4.6.2 Offline

11.4.6.3 Phone

11.4.7 Historic and Forecasted Market Size by Organisation Size

11.4.7.1 Small & Medium Hotels

11.4.7.2 Large Hotel

11.4.8 Historic and Forecasted Market Size by Hotel Type

11.4.8.1 Economic Hotels

11.4.8.2 Mid-range Hotels

11.4.8.3 Luxury Hotels

11.4.9 Historic and Forecasted Market Size by Service Period

11.4.9.1 Long Term

11.4.9.2 Short Term

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Pet Hotel Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Pet Type

11.5.4.1 Dogs

11.5.4.2 Cats

11.5.4.3 Others (Horse

11.5.4.4 Fish

11.5.4.5 Turtle)

11.5.5 Historic and Forecasted Market Size by Hotel Ratings

11.5.5.1 Below 3star

11.5.5.2 3star and Above

11.5.6 Historic and Forecasted Market Size by Booking Mode

11.5.6.1 Online

11.5.6.2 Offline

11.5.6.3 Phone

11.5.7 Historic and Forecasted Market Size by Organisation Size

11.5.7.1 Small & Medium Hotels

11.5.7.2 Large Hotel

11.5.8 Historic and Forecasted Market Size by Hotel Type

11.5.8.1 Economic Hotels

11.5.8.2 Mid-range Hotels

11.5.8.3 Luxury Hotels

11.5.9 Historic and Forecasted Market Size by Service Period

11.5.9.1 Long Term

11.5.9.2 Short Term

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Pet Hotel Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Pet Type

11.6.4.1 Dogs

11.6.4.2 Cats

11.6.4.3 Others (Horse

11.6.4.4 Fish

11.6.4.5 Turtle)

11.6.5 Historic and Forecasted Market Size by Hotel Ratings

11.6.5.1 Below 3star

11.6.5.2 3star and Above

11.6.6 Historic and Forecasted Market Size by Booking Mode

11.6.6.1 Online

11.6.6.2 Offline

11.6.6.3 Phone

11.6.7 Historic and Forecasted Market Size by Organisation Size

11.6.7.1 Small & Medium Hotels

11.6.7.2 Large Hotel

11.6.8 Historic and Forecasted Market Size by Hotel Type

11.6.8.1 Economic Hotels

11.6.8.2 Mid-range Hotels

11.6.8.3 Luxury Hotels

11.6.9 Historic and Forecasted Market Size by Service Period

11.6.9.1 Long Term

11.6.9.2 Short Term

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Pet Hotel Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Pet Type

11.7.4.1 Dogs

11.7.4.2 Cats

11.7.4.3 Others (Horse

11.7.4.4 Fish

11.7.4.5 Turtle)

11.7.5 Historic and Forecasted Market Size by Hotel Ratings

11.7.5.1 Below 3star

11.7.5.2 3star and Above

11.7.6 Historic and Forecasted Market Size by Booking Mode

11.7.6.1 Online

11.7.6.2 Offline

11.7.6.3 Phone

11.7.7 Historic and Forecasted Market Size by Organisation Size

11.7.7.1 Small & Medium Hotels

11.7.7.2 Large Hotel

11.7.8 Historic and Forecasted Market Size by Hotel Type

11.7.8.1 Economic Hotels

11.7.8.2 Mid-range Hotels

11.7.8.3 Luxury Hotels

11.7.9 Historic and Forecasted Market Size by Service Period

11.7.9.1 Long Term

11.7.9.2 Short Term

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

Q1: What would be the forecast period in the Pet Hotel Market research report?

A1: The forecast period in the Pet Hotel Market research report is 2024-2032.

Q2: Who are the key players in the Pet Hotel market?

A2: PetSmart (USA), Petco (USA), Rover.com (USA), Best Friends Pet Care (USA), Camp Bow Wow (USA), Wag Hotels (USA), VCA Animal Hospitals (USA), Paradise Pet Resorts (USA), Bark Avenue Pet Resort (USA), D Pet Hotels (USA), PetsHotel (USA), Paradise 4 Paws (USA), Dogtopia (USA), WAG Hotel (USA), Pet Paradise (USA), Central Bark Doggy Day Care (USA), PetSuites (USA), Pet Palace (USA), Paws Up Pet Resort & Spa (USA), BARK! Hotel for Dogs (USA), The Kennel Club LAX (USA), DogCity Daycare (Canada), Pooch Hotel (USA), Paradise Ranch Pet Resort (USA), Happy Tails Pet Resort (USA), Paws Playgrounds (Canada), Fur-Get Me Not (USA),4 Paws Pet Resort (USA), Paradise Ranch (USA), K9 Resorts Luxury Pet Hotel (USA) and Others are Major Players.

Q3: What are the segments of the Pet Hotel Market?

A3: The Pet Hotel Market is segmented into Pet Type, Hotel Ratings, Booking Mode, Organization Size, Hotel Type, Service Period, and region. By Pet Type, the market is categorized into Dogs, Cats, Others(Horse, Fish, Turtle). By Hotel Ratings, the market is categorized Below 3star, 3star and Above. By Booking Mode, the market is categorized into Online, Offline, and Phone. By Organization Size, the market is categorized into Small & Medium Hotels and large hotels. By Hotel type, the market is categorized into Economic Hotels, Mid-range Hotels, and Luxury Hotels. By Service Period, the market is categorized into Long Term, and Short Term. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Pet Hotel Market?

A4: A pet hotel, sometimes referred to as a pet boarding facility, is a type of special lodging where animals, usually dogs and cats, are left in the care of their owners while they are away. To guarantee the pets' comfort, safety, and well-being while they are visiting, these institutions offer a variety of services.

Q5: How big is the Pet Hotel Market?

A5: Pet Hotel Market Size Was Valued at USD 4686.42 Million in 2023 and is Projected to Reach USD 10094.67 Million by 2032, Growing at a CAGR of 8.9% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!