Stay Ahead in Fast-Growing Economies.

Browse Reports NowPersulfates Market Demand Outlook, Regional Trends & Forecast (2024–2032)

The drivers of the persulfates market are the increased demand for persulfates that are strong oxidizing agents that can be used in number of sectors, including industrial and commercial among others. These chemical compounds are available in various forms, one of which in this include ammonium persulfate, sodium persulfate and potassium persulfate.

IMR Group

Description

Persulfates Market Synopsis:

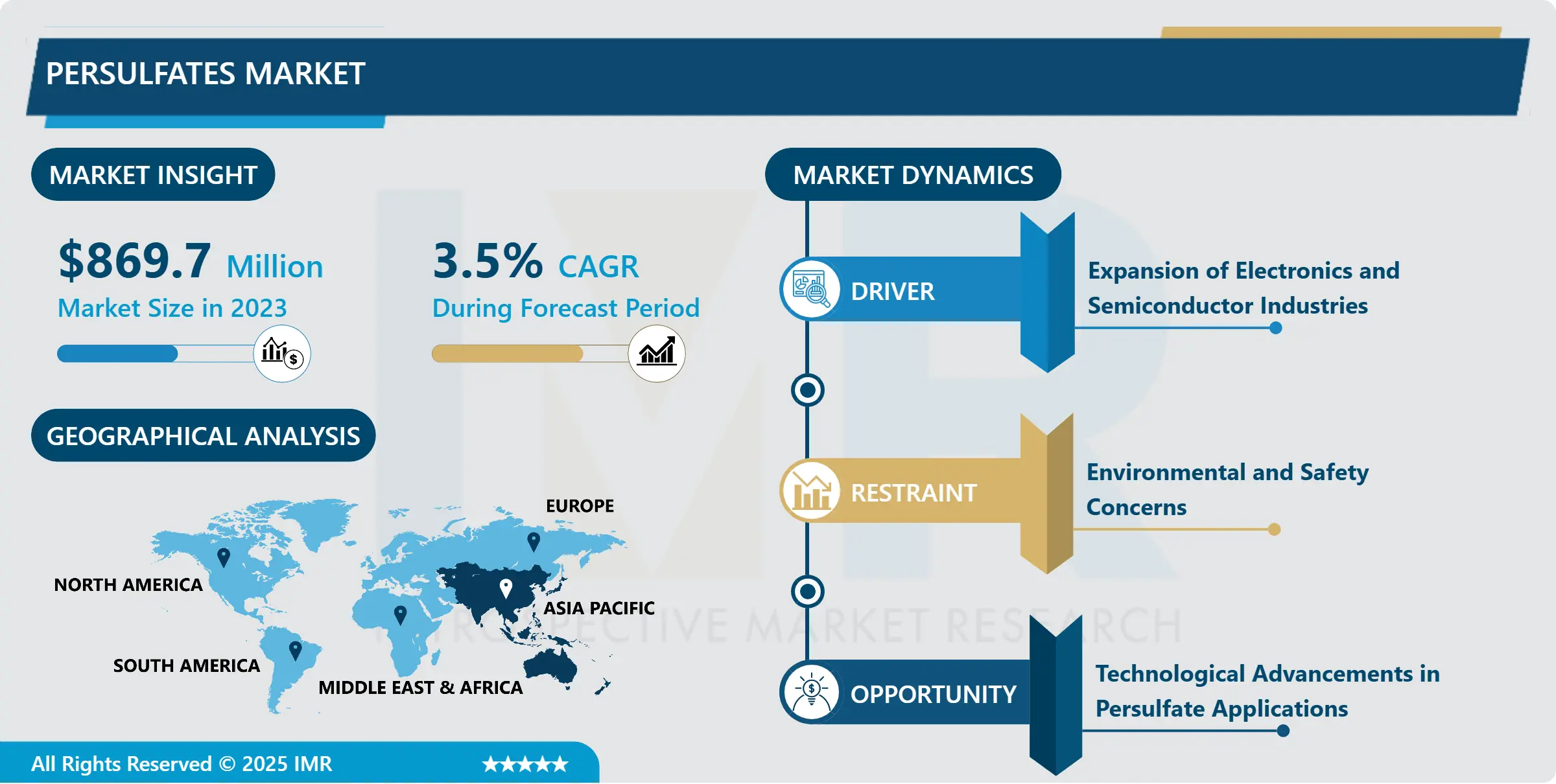

Persulfates Market Size Was Valued at USD 869.70 Million in 2023, and is Projected to Reach USD 1185.30 Million by 2032, Growing at a CAGR of 3.50 % From 2024-2032.

The drivers of the persulfates market are the increased demand for persulfates that are strong oxidizing agents that can be used in number of sectors, including industrial and commercial among others. These chemical compounds are available in various forms, one of which in this include ammonium persulfate, sodium persulfate and potassium persulfate. There main applications are as starters up in polymerization reactions, in electronics and semiconductor uses, and in other chemical installations as catalysts. They are also applied in water treatment, ornamental and cosmetics, and personal care, and other sectors hence offering multi division applicability.

It has been found that the growth of end use industries like chemicals and personal care, cosmetics as well as electronics has a major impact on the persulfates market. The use of Persulfates as polymerization initiators is influenced by the increasing polymer demand especially from the automobile and textile industries. Increased technological development has led to the increased demand of polymers that produce high performance electronics and devices semiconductors the use of persulfates in the production process make the market even stronger.

Population growth and the expansion of urban areas across the world for water treatment are adding pressures to exquisite solutions, therefore boosting demand for persulfates. In addition, increasing spectrum of automotive industry and its necessity to improve polymer and coating materials consumption also influences the stable and steady equable persulfates market growth. Since the application of persulfates has extended in the recent past, industries including the chemical and pharmaceutical industries, are inventing more uses for persulfates in the market.

Persulfates Market Trend Analysis:

The use and integration of environmentally friendly practice

The use and integration of environmentally friendly practices in the industrial use of persulfates are one of the emerging trends in the market. This trend is due to principally centered aware environmental conservation concerns that have boosted industrial concern regarding cleaner, greener, safer, and sustainable chemicals that prompt the new focus on green persulfates. This trend is most visible in Water Treatment and Cosmetic sector where people are becoming more conscious about the impact of a product on their health.

Another observable trend is in the improvement of more complex forms of persulfates for application in different industries. Companies are concentrating on the enhancement of functionality of persulfates in causes of polymerization and other chemical reaction processes. This includes stabilizing them, and decreasing their environmental footprint as a part of the general trend of green chemistry and green manufacturing.

Overall improved infrastructure

The global persulfates market has considerable opportunities in growing markets; especially Asia Pacific which is experiencing continuous industrial growth. In future, due to manufacturing advancements of countries like China & India, consumption of persulfates in polymerization & chemical synthesis would increase. Also, with overall improved infrastructure as well as improved staple and capital industries, opportunities are also emerging in new markets.

The water treatment industry remains an untapped market especially to organisations in areas whereby the scarcity of water and constant water pollu-ts are on the rise. The usage of persulfates in water purification processes will experience growth as governments and organisations spend more on better water treatment systems. This is an opportunity that could be exploited due to the increasing utilization of persulfates for environmental and sustainable initiatives.

Persulfates Market Segment Analysis:

Persulfates Market is Segmented on the basis of Type, Application, End-User Industry, and Region.

Type, Ammonium Persulfate segment is expected to dominate the market during the forecast period

The persulfates market can be divided into ammonium persulfate, sodium persulfate, and potassium persulfate, each serving unique purposes across different industries. Ammonium persulfate, with its powerful oxidizing characteristics, is used extensively in polymerization processes and the electronics sector, particularly as a depollutant due to its strong oxidizing capabilities. Sodium persulfate, Stands out for its superior stability and is preferred for chemical synthesis and water treatment. Its high solubility allows for a quicker dissolution in processes requiring rapid oxidization, making it highly effective in procedures that demand precise control.

On the other hand, potassium persulfate, like sodium persulfate, is also utilized in various oxidation reactions but is less soluble and often chosen for more specific applications, particularly when working with solid substrates or those requiring slower dissolution rates. Each type serves specialized needs depending on the chemical reactions or environmental factors in the industry.

Application, Polymerization segment expected to held the largest share

In the persulfates market, the polymerization segment is expected to hold the largest share due to the significant role persulfates play in polymerization reactions. These chemicals, which are powerful oxidizing agents, are commonly used as initiators in the polymerization of various monomers, including styrene, acrylates, and butadiene. The polymerization process is essential in producing a wide range of products, from plastics to adhesives and coatings, thus driving demand for persulfates in these applications.

Efficiency in initiating polymer reactions under various conditions makes them indispensable for the manufacturing of high-quality synthetic materials. As industries such as automotive, construction, and packaging continue to expand, the need for polymerization will likely increase, thereby boosting the consumption of persulfates. Consequently, the polymerization segment is poised to dominate the market.

Persulfates Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia Pacific holds the largest market share of persulfates because of the increasing role of chemicals and the pace of industrialization in countries such as China, India, and Japan. The demand for persulfates as initiators in the polymerization of products within the region such as electronics, textiles and automobile industry due to the regions robust manufacturing industry. Further, and more importantly, there is a rising trend of water treatment and environmental factor concerns in the region and since persulfates are heavily used in water treatment process, they are therefore expected to be a growth area for the key players in the market.

With Asia Pacific as the leading region that is rapidly experiencing the industrial growth, the same region is projected to dominate the market for persulfates in the near future. These markets include infrastructure, automotive, construction and consumer electronics, and equipment and covered consumption of persulfates across these industries, guaranteeing continued demand for the regional chemical. However, the region has been encountering rising environmental legislations that may propel the need for more green persulfate products in the future years.

Active Key Players in the Persulfates Market:

AkzoNobel (Netherlands)

Evonik Industries (Germany)

LANXESS (Germany)

Merck Group (Germany)

Mitsubishi Gas Chemical Company (Japan)

Nouryon (Netherlands)

PeroxyChem (USA)

Sinochem International Corporation (China)

Solvay (Belgium)

United Initiators (Germany),

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Persulfates Market by Type

4.1 Persulfates Market Snapshot and Growth Engine

4.2 Persulfates Market Overview

4.3 Herbicides

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Herbicides: Geographic Segmentation Analysis

4.4 Fungicides

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Fungicides: Geographic Segmentation Analysis

4.5 Rodenticides

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Rodenticides: Geographic Segmentation Analysis

4.6 Others

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Others: Geographic Segmentation Analysis

Chapter 5: Persulfates Market by Formulation

5.1 Persulfates Market Snapshot and Growth Engine

5.2 Persulfates Market Overview

5.3 Liquid

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Liquid: Geographic Segmentation Analysis

5.4 Solid

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Solid: Geographic Segmentation Analysis

5.5 Gas

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Gas: Geographic Segmentation Analysis

Chapter 6: Persulfates Market by Mode Of Application

6.1 Persulfates Market Snapshot and Growth Engine

6.2 Persulfates Market Overview

6.3 Foliar Spray

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Foliar Spray: Geographic Segmentation Analysis

6.4 Soil Treatment

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Soil Treatment: Geographic Segmentation Analysis

6.5 Seed Treatment

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Seed Treatment: Geographic Segmentation Analysis

6.6 Post-Harvest

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Post-Harvest: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Persulfates Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AKZONOBEL (NETHERLANDS)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MERCK GROUP (GERMANY)

7.4 PEROXYCHEM (USA)

7.5 UNITED INITIATORS (GERMANY)

7.6 EVONIK INDUSTRIES (GERMANY)

7.7 NOURYON (NETHERLANDS)

7.8 MITSUBISHI GAS CHEMICAL COMPANY (JAPAN)

7.9 LANXESS (GERMANY)

7.10 SOLVAY (BELGIUM)

7.11 SINOCHEM INTERNATIONAL CORPORATION (CHINA)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Persulfates Market By Region

8.1 Overview

8.2. North America Persulfates Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Herbicides

8.2.4.2 Fungicides

8.2.4.3 Rodenticides

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size By Formulation

8.2.5.1 Liquid

8.2.5.2 Solid

8.2.5.3 Gas

8.2.6 Historic and Forecasted Market Size By Mode Of Application

8.2.6.1 Foliar Spray

8.2.6.2 Soil Treatment

8.2.6.3 Seed Treatment

8.2.6.4 Post-Harvest

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Persulfates Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Herbicides

8.3.4.2 Fungicides

8.3.4.3 Rodenticides

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size By Formulation

8.3.5.1 Liquid

8.3.5.2 Solid

8.3.5.3 Gas

8.3.6 Historic and Forecasted Market Size By Mode Of Application

8.3.6.1 Foliar Spray

8.3.6.2 Soil Treatment

8.3.6.3 Seed Treatment

8.3.6.4 Post-Harvest

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Persulfates Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Herbicides

8.4.4.2 Fungicides

8.4.4.3 Rodenticides

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size By Formulation

8.4.5.1 Liquid

8.4.5.2 Solid

8.4.5.3 Gas

8.4.6 Historic and Forecasted Market Size By Mode Of Application

8.4.6.1 Foliar Spray

8.4.6.2 Soil Treatment

8.4.6.3 Seed Treatment

8.4.6.4 Post-Harvest

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Persulfates Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Herbicides

8.5.4.2 Fungicides

8.5.4.3 Rodenticides

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size By Formulation

8.5.5.1 Liquid

8.5.5.2 Solid

8.5.5.3 Gas

8.5.6 Historic and Forecasted Market Size By Mode Of Application

8.5.6.1 Foliar Spray

8.5.6.2 Soil Treatment

8.5.6.3 Seed Treatment

8.5.6.4 Post-Harvest

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Persulfates Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Herbicides

8.6.4.2 Fungicides

8.6.4.3 Rodenticides

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size By Formulation

8.6.5.1 Liquid

8.6.5.2 Solid

8.6.5.3 Gas

8.6.6 Historic and Forecasted Market Size By Mode Of Application

8.6.6.1 Foliar Spray

8.6.6.2 Soil Treatment

8.6.6.3 Seed Treatment

8.6.6.4 Post-Harvest

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Persulfates Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Herbicides

8.7.4.2 Fungicides

8.7.4.3 Rodenticides

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size By Formulation

8.7.5.1 Liquid

8.7.5.2 Solid

8.7.5.3 Gas

8.7.6 Historic and Forecasted Market Size By Mode Of Application

8.7.6.1 Foliar Spray

8.7.6.2 Soil Treatment

8.7.6.3 Seed Treatment

8.7.6.4 Post-Harvest

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Persulfates Market research report?

A1: The forecast period in the Persulfates Market research report is 2024-2032.

Q2: Who are the key players in the Persulfates Market?

A2: AkzoNobel (Netherlands), Evonik Industries (Germany), LANXESS (Germany), Merck Group (Germany), Mitsubishi Gas Chemical Company (Japan), Nouryon (Netherlands), PeroxyChem (USA), Sinochem International Corporation (China), Solvay (Belgium), United Initiators (Germany), and Other Active Players.

Q3: What are the segments of the Persulfates Market?

A3: The Persulfates Market is segmented into Type, Application, By End-User Industry and Region. By Type, the market is categorized into Ammonium Persulfate, Sodium Persulfate, Potassium Persulfate. By Application, the market is categorized into Polymerization, Electronics & Semiconductor Industry, Chemical Synthesis, Cosmetics & Personal Care, Water Treatment, Oil & Gas, Others. By End-User Industry, the market is categorized into Automotive, Textile, Construction, Healthcare, Food & Beverage, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Persulfates Market?

A4: The drivers of the persulfates market are the increased demand for persulfates that are strong oxidizing agents that can be used in number of sectors, including industrial and commercial among others. These chemical compounds are available in various forms, one of which in this include ammonium persulfate, sodium persulfate and potassium persulfate. There main applications are as starters up in polymerization reactions, in electronics and semiconductor uses, and in other chemical installations as catalysts. They are also applied in water treatment, ornamental and cosmetics, and personal care, and other sectors hence offering multi division applicability.

Q5: How big is the Persulfates Market?

A5: Persulfates Market Size Was Valued at USD 869.70 Million in 2023, and is Projected to Reach USD 1185.30 Million by 2032, Growing at a CAGR of 3.50 % From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!