Stay Ahead in Fast-Growing Economies.

Browse Reports NowPeer to Peer Lending Market Size, Share, Growth & Forecast (2024-2032)

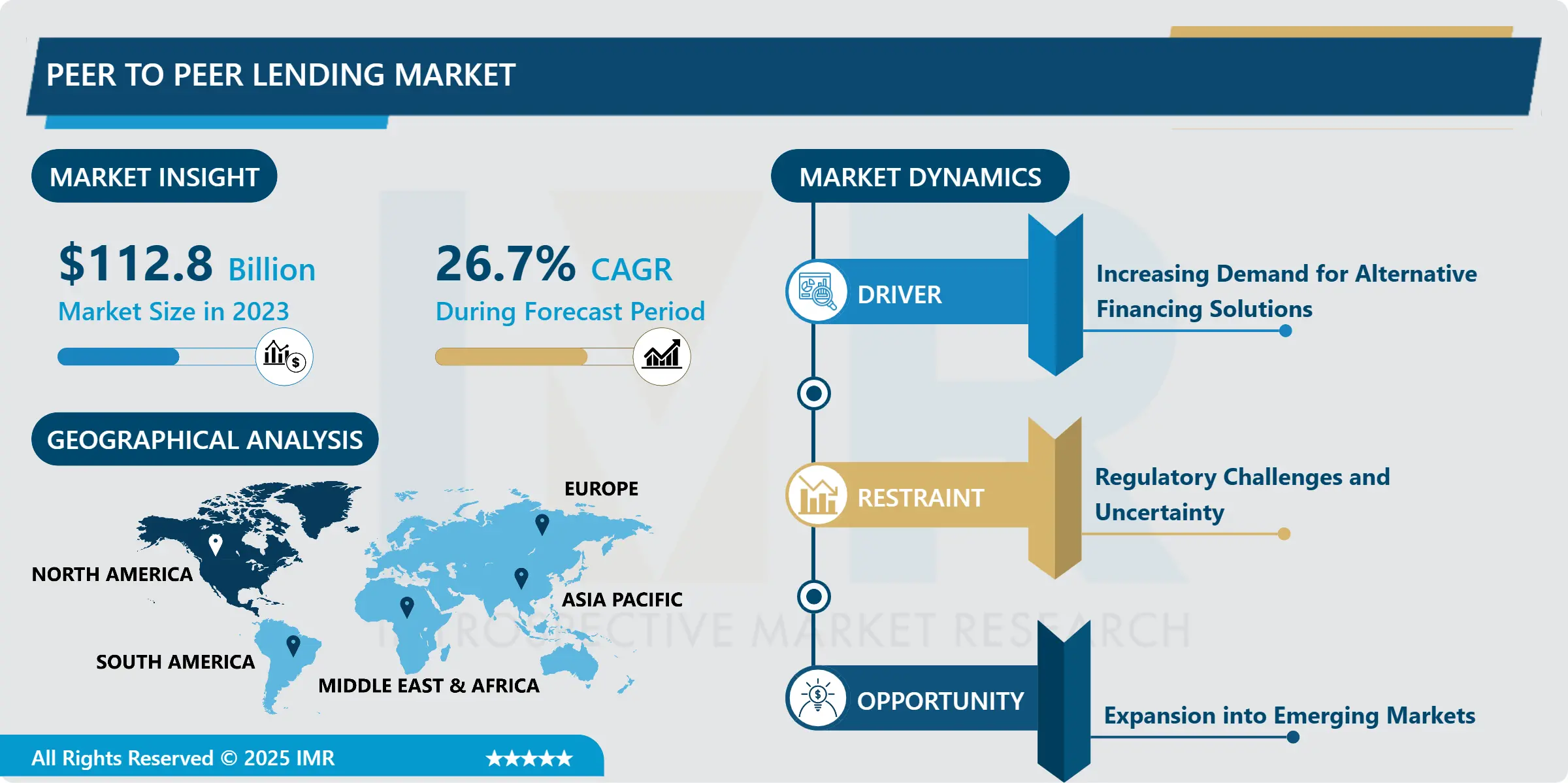

Peer to Peer Lending Market Size Was Valued at USD 112.8 Billion in 2023, and is Projected to Reach USD 949.1 Billion by 2032, Growing at a CAGR of 26.7% From 2024-2032.

IMR Group

Description

Peer to Peer Lending Market Synopsis:

Peer to Peer Lending Market Size Was Valued at USD 112.8 Billion in 2023, and is Projected to Reach USD 949.1 Billion by 2032, Growing at a CAGR of 26.7% From 2024-2032.

P2P or marketplace lending is an emerging financial innovation that allows borrowing and lending of funds personnel with the help of an Internet platform, excluding a bank. As such, these internet platforms which facilitate the borrowing of funds to investors in need of higher returns are characterized by low and competitive interest rates and simpler procedures.

Now let’s’ explore the emerging disruptive innovation in the financial industry known as the Peer to Peer Lending Market. Globally spurred by digitization and emergence of financial innovation solutions such as Fintech, P2P lending platform relies on efficiency through the use of technology in offering lending services. On the positive side borrowers enjoy ‘relaxed’ loan procedures, whereas on the other hand, lenders stand to enjoy better yields than with typical savings or other investment offers.

In the last ten years the market has developed rapidly due to a shift towards Internet and the need for faster and quicker financial services. As a subcategory of internet-based lending, P2P lending started from the niche of providing personal loans and has grown to involve such lending as business loans, student loans, and real estate financing. In their turn, requirements differ from one geographical location to another, with governments being interested in promoting innovative technological advancement while safeguarding the consumers.

Apart from serving under banked population, P2P lending has created opportunities for new and small medium enterprise (SMEs) that find it difficult to access loans from conventional banks. The use of advanced technologies such as artificial intelligence, machine learning and blockchain systems has added immense value to the activities of the P2P platforms with regards to credit risk assessment, fraud prevention and safety of transactions. However, there is still some weakness that could not be avoided such as default risks and regulatory concern of the market, as well as competitive pressure in the market.

Peer to Peer Lending Market Trend Analysis:

Growing Adoption of Blockchain Technology in P2P Lending

Due to these factors the Peer-to-Peer Lending Market is being accelerated by the blockchain technology in terms of security, transparency and effectiveness. The distributed ledger of block chain means that each transaction is therefore documented to eliminate the propensity of embezzlement and build credibility among individuals involved in the chain. Such an application of P2P platforms on the blockchain will enable the use of smart contracts to correct some of the challenges facing the P2P lending business, including automation of loan origination and repayment.

The use of blockchain, in cross-border lending eliminates the middlemen and is cheaper than most of the traditional methods. It also offers an environment for the storage of borrowers’ credit records to supplement the lending institutions ability to evaluate risks better. Rising blockchain penetration makes the P2P platforms to attract more investors, thereby making a broader market, making it one major trend that will define the market.

Expansion into Emerging Markets

Peer-to-Peer Lending Market has growth potential in emerging markets. Sectors across the globe that become more innovative are Asia-Pacific, Latin America, and Africa, where people have little or no access to established brands of banking facilities. This is an area where P2P platforms can effectively meet the demands of the local borrowers and lenders for flexible technology-based solutions.

The awareness level of these gadgets such as smartphone as well as the internet in these areas also plays a major role of popularizing the Fintech applications. They are also pressuring governments and international organizations to support more development of fintech to foster access to money. By operation in these markets, P2P platforms can create great opportunities and help in improving people’s financial freedom all around the world.

Peer to Peer Lending Market Segment Analysis:

Peer to Peer Lending Market is Segmented on the basis of Business Model, Loan Type, Deployment Mode, and Region.

By Business Model, Traditional P2P Lending segment is expected to dominate the market during the forecast period

Basic P2P lending focuses on matching borrowers and lenders directly through a platform based on personal relations or real-life contacts and no complicated business models between borrowers and lenders. On the positive side the model allows for establishing trust and community-oriented financing, but on the negative side it may may not be as efficient as the more advanced models.

The more developed marketplace lending model enables borrowers and lenders to be assigned by efficient algorithms. It offers diversified lending opportunities and fit for institutional investors; thus, this makes the approach efficient and strong. It has been in use in areas where the financial frameworks are well developed making its adoption even more inevitable.

By End User, Individual Borrowers segment expected to held the largest share

A large portion of the P2P lending segment consists of individual borrowers. It is that these users enjoy taking easily got personal loan for events such as education, improving their homes, or medical bills. Given low documentation and higher speeds of operations, P2P lending platforms are gaining popularity with this group.

SME receive lots of difficulties in accessing traditional loan due to credit constrains. P2P platforms comes as a savior which offers customer suitable loans at reasonable interest rates. This segment remains active due to the concerns of working capital requirement, capital expenditures, and general expansion and technology upgrade investments.

Peer to Peer Lending Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America holds the highest Peer-to-Peer Lending Market share due to elaborate financial structures and effective usage of online financial platforms. The U.S., for instance, has a relatively developed market for P2P credit together with the most developed P2P lending platforms which serve a wide variety of purposes. The regulation standards in North American region are severe but they are coherent and predictable, and investors seem to appreciate stability.

P2P platform has continued to advance due to the level of technological know-how among the population in the region and the availability of venture capital to grow the venture. This domination is foreseen to persist into the future assisted by advancements in technology in offering the growing customer digital based financial services.

Active Key Players in the Peer to Peer Lending Market:

LendingClub (United States)

Prosper Marketplace (United States)

Funding Circle (United Kingdom)

Zopa (United Kingdom)

Upstart (United States)

RateSetter (United Kingdom)

Mintos (Latvia)

LendInvest (United Kingdom)

Kiva (United States)

Peerform (United States)

Bondora (Estonia)

Auxmoney (Germany), and Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Peer to Peer Lending Market by Dosage Form

4.1 Peer to Peer Lending Market Snapshot and Growth Engine

4.2 Peer to Peer Lending Market Overview

4.3 Injectable

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Injectable: Geographic Segmentation Analysis

4.4 Tablet

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Tablet: Geographic Segmentation Analysis

Chapter 5: Peer to Peer Lending Market by Distribution Channel

5.1 Peer to Peer Lending Market Snapshot and Growth Engine

5.2 Peer to Peer Lending Market Overview

5.3 Hospital Pharmacies

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hospital Pharmacies: Geographic Segmentation Analysis

5.4 Retail Pharmacies

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Retail Pharmacies: Geographic Segmentation Analysis

5.5 Online Pharmacies

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Online Pharmacies: Geographic Segmentation Analysis

Chapter 6: Peer to Peer Lending Market by End User

6.1 Peer to Peer Lending Market Snapshot and Growth Engine

6.2 Peer to Peer Lending Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Specialty Clinics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Specialty Clinics: Geographic Segmentation Analysis

6.5 Ambulatory Surgical Centers

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Ambulatory Surgical Centers: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Peer to Peer Lending Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 LENDINGCLUB (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PROSPER PLACE (UNITED STATES)

7.4 FUNDING CIRCLE (UNITED KINGDOM)

7.5 ZOPA (UNITED KINGDOM)

7.6 UPSTART (UNITED STATES)

7.7 RATESETTER (UNITED KINGDOM)

7.8 MINTOS (LATVIA)

7.9 LENDINVEST (UNITED KINGDOM)

7.10 KIVA (UNITED STATES)

7.11 PEERFORM (UNITED STATES)

7.12 BONDORA (ESTONIA)

7.13 AUXMONEY (GERMANY)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Peer to Peer Lending Market By Region

8.1 Overview

8.2. North America Peer to Peer Lending Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Dosage Form

8.2.4.1 Injectable

8.2.4.2 Tablet

8.2.5 Historic and Forecasted Market Size By Distribution Channel

8.2.5.1 Hospital Pharmacies

8.2.5.2 Retail Pharmacies

8.2.5.3 Online Pharmacies

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Specialty Clinics

8.2.6.3 Ambulatory Surgical Centers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Peer to Peer Lending Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Dosage Form

8.3.4.1 Injectable

8.3.4.2 Tablet

8.3.5 Historic and Forecasted Market Size By Distribution Channel

8.3.5.1 Hospital Pharmacies

8.3.5.2 Retail Pharmacies

8.3.5.3 Online Pharmacies

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Specialty Clinics

8.3.6.3 Ambulatory Surgical Centers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Peer to Peer Lending Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Dosage Form

8.4.4.1 Injectable

8.4.4.2 Tablet

8.4.5 Historic and Forecasted Market Size By Distribution Channel

8.4.5.1 Hospital Pharmacies

8.4.5.2 Retail Pharmacies

8.4.5.3 Online Pharmacies

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Specialty Clinics

8.4.6.3 Ambulatory Surgical Centers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Peer to Peer Lending Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Dosage Form

8.5.4.1 Injectable

8.5.4.2 Tablet

8.5.5 Historic and Forecasted Market Size By Distribution Channel

8.5.5.1 Hospital Pharmacies

8.5.5.2 Retail Pharmacies

8.5.5.3 Online Pharmacies

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Specialty Clinics

8.5.6.3 Ambulatory Surgical Centers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Peer to Peer Lending Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Dosage Form

8.6.4.1 Injectable

8.6.4.2 Tablet

8.6.5 Historic and Forecasted Market Size By Distribution Channel

8.6.5.1 Hospital Pharmacies

8.6.5.2 Retail Pharmacies

8.6.5.3 Online Pharmacies

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Specialty Clinics

8.6.6.3 Ambulatory Surgical Centers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Peer to Peer Lending Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Dosage Form

8.7.4.1 Injectable

8.7.4.2 Tablet

8.7.5 Historic and Forecasted Market Size By Distribution Channel

8.7.5.1 Hospital Pharmacies

8.7.5.2 Retail Pharmacies

8.7.5.3 Online Pharmacies

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Specialty Clinics

8.7.6.3 Ambulatory Surgical Centers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Peer to Peer Lending Market research report?

A1: The forecast period in the Peer to Peer Lending Market research report is 2024-2032.

Q2: Who are the key players in the Peer to Peer Lending Market?

A2: LendingClub (United States), Prosper Marketplace (United States), Funding Circle (United Kingdom), Zopa (United Kingdom), Upstart (United States), RateSetter (United Kingdom), Mintos (Latvia), LendInvest (United Kingdom), Kiva (United States), Peerform (United States), Bondora (Estonia), Auxmoney (Germany), and Other Active Players.

Q3: What are the segments of the Peer to Peer Lending Market?

A3: The Peer to Peer Lending Market is segmented into Business Model, Loan Type, Deployment Mode and Region. By Business Model, the market is categorized into Traditional P2P Lending, Marketplace Lending. By Loan Type, the market is categorized into Consumer Lending, Small Business Lending, Real Estate Lending, Student Lending. By End User, the market is categorized into Individual Borrowers, Small and Medium Enterprises (SMEs). By Deployment Mode, the market is categorized into Online, Offline. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Peer to Peer Lending Market?

A4: P2P or marketplace lending is an emerging financial innovation that allows borrowing and lending of funds personnel with the help of an Internet platform, excluding a bank. As such, these internet platforms which facilitate the borrowing of funds to investors in need of higher returns are characterized by low and competitive interest rates and simpler procedures.

Q5: How big is the Peer to Peer Lending Market?

A5: Peer to Peer Lending Market Size Was Valued at USD 112.8 Billion in 2023, and is Projected to Reach USD 949.1 Billion by 2032, Growing at a CAGR of 26.7% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!