Stay Ahead in Fast-Growing Economies.

Browse Reports NowPCOS Diagnostic Market Insights, Dynamics, and Growth Forecast (2024-2032)

The growth of diagnostic market for Polycystic Ovary Syndrome (PCOS) is attributed by the increasing occurrence of PCOS among women of reproductive age across the world.

IMR Group

Description

PCOS diagnostic Market Synopsis:

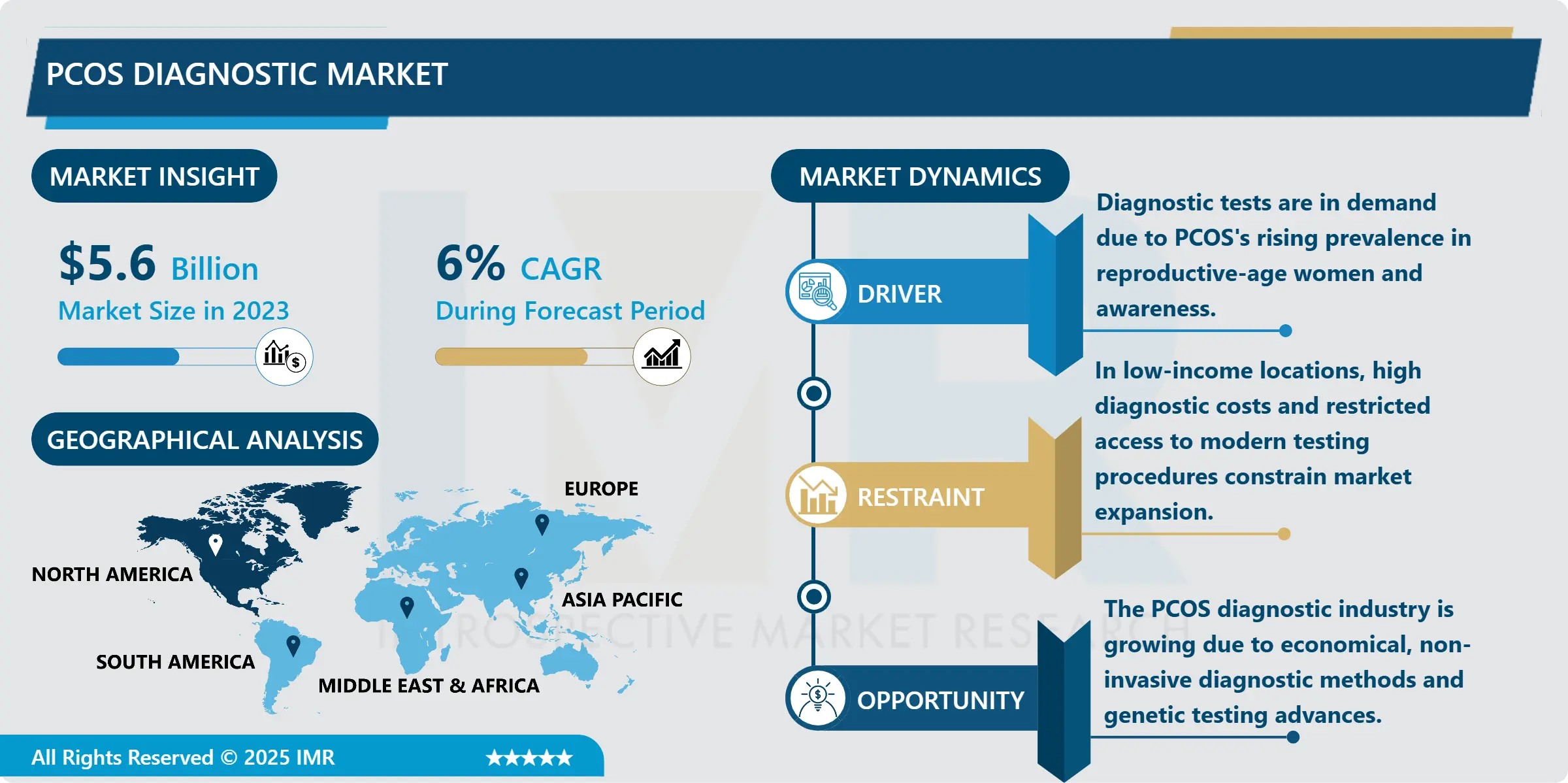

PCOS diagnostic Market Size Was Valued at USD 5.6 Billion in 2023, and is Projected to Reach USD 9.81 Billion by 2032, Growing at a CAGR of 6% From 2024-2032.

The growth of diagnostic market for Polycystic Ovary Syndrome (PCOS) is attributed by the increasing occurrence of PCOS among women of reproductive age across the world. PCOS is among the most prevalent endocrinal dysfunctions affecting women of the child-bearing age in industrialised countries, and which is marked by menstrual cycle disorders, excess androgen levels and polycystic ovaries. The need for good diagnostic systems is more and more pressed as time is the key for controlling diabetes and affect related symptoms that can lead to impotence, diabetes, and heart diseases. This has resulted in creation of diverse ways used in diagnosing the disease such as ultrasounds, blood tests on hormonal balances, and genetic tests.

Major growth drivers of the PCOS diagnostic market are innovation in diagnostic techniques, rising knowledge about PCOS, and the enhancement of health care amenities. Ultrasound and hormonal assays are still the most commonly applied diagnostic tests, however noninvasive diagnostics, including genetic diagnostics, and biochemical markers, are becoming more frequently used. A growth in the specific expenditure in the healthcare industry particularly in the progressive economy has further helped to increase demand for enhanced diagnostic solutions. That is why an increasing number of female population treats diseases of the reproductive system, irregular periods, infertility, and excessive body hair, which also positively affects the demand.

But the market also have some issues like; people in developing region are not much aware about the product, diagnosis is very much costly, and it is difficult to diagnose PCOS at times because it show signs similar to other diseases. Nevertheless, there is great potential in the market, particularly with the growing use of next generation diagnostic techniques in not only treating women with PCOS but also many other diseases where molecular diagnostic tests could provide tailor-made treatment.

PCOS Diagnostic Market Trend Analysis:

Shift Towards Non-Invasive Diagnostic Methods

Diagnostic of PCOS is moving toward noninvasive diagnostic through the molecular biology and genetic test. Ultrasound scanning and blood hormone level tests are widely used despite the growing desire for friendly, invasive techniques. Molecular diagnostics and biologic markers are less invasive, can offer earlier and more precise diagnosis, and objective targets for medical management. Such a tendency has been promoted by a patient’s desire to avoid complex and invasive interventions, as well as the need for faster and less painful diagnosis. While more work is done in this area, these methods become available, the accuracy of the diagnosis and satisfaction of the patients would improve.

Growing Focus on Personalized Medicine

Another significant trend in the PCOS diagnostic market is the growing focus on personalized medicine. With increasing recognition that PCOS presents differently in each patient, there is a shift toward personalized diagnostic approaches. Genetic and molecular profiling, along with hormone-level analysis, is helping clinicians provide more customized care. By understanding the unique genetic and hormonal makeup of each patient, healthcare providers can develop individualized treatment plans that may include lifestyle changes, medications, and fertility treatments, thus improving patient outcomes. This trend is expected to drive innovation in diagnostic technologies and expand the market for personalized PCOS diagnostics.

PCOS Diagnostic Market Segment Analysis:

PCOS diagnostic Market is segmented on the basis of Type of Diagnostic Test, End User, and Region.

By Type of Diagnostic Test, Pelvic Exam segment is expected to dominate the market during the forecast period

The PCOS diagnostic market is segmented by the type of diagnostic test, including pelvic exams, blood tests, transvaginal ultrasounds, and others. Pelvic exams are often the first step in diagnosing PCOS, where a healthcare provider checks for physical signs of the disorder, such as cysts or enlarged ovaries. Blood tests measure hormone levels, including androgens, insulin, and LH (luteinizing hormone), which help in confirming a diagnosis of PCOS. Transvaginal ultrasound is widely used to examine the ovaries for cysts and abnormalities, offering a clearer view of the ovaries and helping to identify the hallmark features of PCOS. Other diagnostic methods include genetic testing, hormonal assays, and molecular diagnostics, which are becoming more advanced and precise, enabling earlier detection and personalized treatment options for those affected by PCOS.

By End User, Fertility Clinics segment expected to held the largest share

The PCOS diagnostic market is segmented by end user into hospitals & clinics, fertility clinics, and others. Hospitals and clinics dominate the market due to their broad reach and availability of advanced diagnostic tools, such as ultrasound imaging and blood tests for hormone levels. These facilities are the primary points of care for women seeking diagnosis and treatment for PCOS. Fertility clinics also play a significant role, as many women with PCOS experience infertility issues, leading them to seek specialized treatment and diagnostic services. Other end users, such as diagnostic laboratories and research centers, contribute to the market by offering specialized diagnostic services and supporting research on the disorder, helping to advance early detection and treatment options. Each of these segments contributes to the overall growth of the market by addressing different aspects of PCOS diagnosis and care.

PCOS diagnostic Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to dominate the PCOS diagnostic market over the forecast period due to the high prevalence of polycystic ovary syndrome (PCOS) among women in the region, along with advancements in diagnostic technologies and increased healthcare awareness. The presence of key market players, along with a well-established healthcare infrastructure, supports the widespread availability of advanced diagnostic tools like ultrasound, hormonal assays, and genetic testing. Additionally, rising healthcare expenditure, coupled with growing public and private initiatives to raise awareness about PCOS and its long-term health risks, is expected to drive the demand for early and accurate diagnosis in North America. The region’s focus on improving women’s health and fertility treatment options further contributes to its dominance in the market.

Active Key Players in the PCOS diagnostic Market:

Abbott (United States)

Thermo Fisher Scientific, Inc. (United States)

Bio-Rad Laboratories (United States)

Vitrolife (Sweden), Ansh Labs (United States)

Beckman Coulter, Inc. (United States)

GE Healthcare (United States)

Laboratory Corporation of America Holdings (United States)

F. Hoffmann-La Roche Ltd (Switzerland)

Quest Diagnostics (United States)

Siemens Healthineers (Germany)

Hologic, Inc. (United States)

Myriad Genetics, Inc. (United States)

Diagnostica Stago Inc. (France). And Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: PCOS diagnostic Market by Type of Diagnostic Test

4.1 PCOS diagnostic Market Snapshot and Growth Engine

4.2 PCOS diagnostic Market Overview

4.3 Pelvic Exam

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Pelvic Exam: Geographic Segmentation Analysis

4.4 Blood Test

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Blood Test: Geographic Segmentation Analysis

4.5 Transvaginal Ultrasound

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Transvaginal Ultrasound: Geographic Segmentation Analysis

4.6 and Others

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 and Others: Geographic Segmentation Analysis

Chapter 5: PCOS diagnostic Market by End User

5.1 PCOS diagnostic Market Snapshot and Growth Engine

5.2 PCOS diagnostic Market Overview

5.3 Hospitals & Clinics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hospitals & Clinics: Geographic Segmentation Analysis

5.4 Fertility Clinics

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Fertility Clinics: Geographic Segmentation Analysis

5.5 and Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 and Others: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 PCOS diagnostic Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABBOTT (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 THERMO FISHER SCIENTIFIC INC. (UNITED STATES)

6.4 BIO-RAD LABORATORIES (UNITED STATES)

6.5 VITROLIFE (SWEDEN)

6.6 ANSH LABS (UNITED STATES)

6.7 BECKMAN COULTER INC. (UNITED STATES)

6.8 GE HEALTHCARE (UNITED STATES)

6.9 LABORATORY CORPORATION OF AMERICA HOLDINGS (UNITED STATES)

6.10 F. HOFFMANN-LA ROCHE LTD (SWITZERLAND)

6.11 QUEST DIAGNOSTICS (UNITED STATES)

6.12 SIEMENS HEALTHINEERS (GERMANY)

6.13 HOLOGIC INC. (UNITED STATES)

6.14 MYRIAD GENETICS INC. (UNITED STATES)

6.15 DIAGNOSTICA STAGO INC. (FRANCE)

6.16 OTHER ACTIVE PLAYERS

Chapter 7: Global PCOS diagnostic Market By Region

7.1 Overview

7.2. North America PCOS diagnostic Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Type of Diagnostic Test

7.2.4.1 Pelvic Exam

7.2.4.2 Blood Test

7.2.4.3 Transvaginal Ultrasound

7.2.4.4 and Others

7.2.5 Historic and Forecasted Market Size By End User

7.2.5.1 Hospitals & Clinics

7.2.5.2 Fertility Clinics

7.2.5.3 and Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe PCOS diagnostic Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Type of Diagnostic Test

7.3.4.1 Pelvic Exam

7.3.4.2 Blood Test

7.3.4.3 Transvaginal Ultrasound

7.3.4.4 and Others

7.3.5 Historic and Forecasted Market Size By End User

7.3.5.1 Hospitals & Clinics

7.3.5.2 Fertility Clinics

7.3.5.3 and Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe PCOS diagnostic Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Type of Diagnostic Test

7.4.4.1 Pelvic Exam

7.4.4.2 Blood Test

7.4.4.3 Transvaginal Ultrasound

7.4.4.4 and Others

7.4.5 Historic and Forecasted Market Size By End User

7.4.5.1 Hospitals & Clinics

7.4.5.2 Fertility Clinics

7.4.5.3 and Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific PCOS diagnostic Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Type of Diagnostic Test

7.5.4.1 Pelvic Exam

7.5.4.2 Blood Test

7.5.4.3 Transvaginal Ultrasound

7.5.4.4 and Others

7.5.5 Historic and Forecasted Market Size By End User

7.5.5.1 Hospitals & Clinics

7.5.5.2 Fertility Clinics

7.5.5.3 and Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa PCOS diagnostic Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Type of Diagnostic Test

7.6.4.1 Pelvic Exam

7.6.4.2 Blood Test

7.6.4.3 Transvaginal Ultrasound

7.6.4.4 and Others

7.6.5 Historic and Forecasted Market Size By End User

7.6.5.1 Hospitals & Clinics

7.6.5.2 Fertility Clinics

7.6.5.3 and Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America PCOS diagnostic Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Type of Diagnostic Test

7.7.4.1 Pelvic Exam

7.7.4.2 Blood Test

7.7.4.3 Transvaginal Ultrasound

7.7.4.4 and Others

7.7.5 Historic and Forecasted Market Size By End User

7.7.5.1 Hospitals & Clinics

7.7.5.2 Fertility Clinics

7.7.5.3 and Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the PCOS diagnostic Market research report?

A1: The forecast period in the PCOS diagnostic Market research report is 2024-2032.

Q2: Who are the key players in the PCOS diagnostic Market?

A2: Abbott (United States), Thermo Fisher Scientific, Inc. (United States), Bio-Rad Laboratories (United States), Vitrolife (Sweden), Ansh Labs (United States), Beckman Coulter, Inc. (United States), GE Healthcare (United States), Laboratory Corporation of America Holdings (United States), F. Hoffmann-La Roche Ltd (Switzerland), Quest Diagnostics (United States), Siemens Healthineers (Germany), Hologic, Inc. (United States), Myriad Genetics, Inc. (United States), Diagnostica Stago Inc. (France), and other Active Player.

Q3: What are the segments of the PCOS diagnostic Market?

A3: The PCOS diagnostic Market is segmented into By Type of Diagnostic Test, End User and region. By Type of Diagnostic Test (Pelvic Exam, Blood Test, Transvaginal Ultrasound, and Others), By End User (Hospitals & Clinics, Fertility Clinics, and Others). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA)

Q4: What is the PCOS diagnostic Market?

A4: PCOS (Polycystic Ovary Syndrome) diagnostic refers to the medical assessment process used to identify the presence of PCOS, a common hormonal disorder affecting women of reproductive age. This diagnosis is based on a combination of clinical symptoms, including irregular menstrual cycles, excess androgen levels, and the appearance of polycystic ovaries on ultrasound. Diagnostic methods include blood tests to measure hormone levels, such as testosterone and insulin, ultrasound imaging to observe ovarian morphology, and the evaluation of symptoms like acne, hirsutism, and weight gain. Early and accurate diagnosis of PCOS is crucial for effective management and prevention of associated health risks, such as infertility, diabetes, and cardiovascular diseases.

Q5: How big is the PCOS diagnostic Market?

A5: PCOS diagnostic Market Size Was Valued at USD 5.6 Billion in 2023, and is Projected to Reach USD 9.81 Billion by 2032, Growing at a CAGR of 6% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!