Stay Ahead in Fast-Growing Economies.

Browse Reports NowOphthalmic Devices Market Size, Share, Growth & Forecast (2024-2032)

The global ophthalmic devices market is a rapidly growing segment within the healthcare industry, driven by an increasing prevalence of eye disorders and advancements in medical technology. Ophthalmic devices include a wide range of instruments and equipment used for the diagnosis, treatment, and surgical intervention of various eye conditions, such as cataracts, glaucoma, diabetic retinopathy, and refractive errors. As the global population ages and the incidence of eye-related diseases rises, the demand for innovative ophthalmic devices is projected to continue expanding.

IMR Group

Description

Ophthalmic Devices Market Synopsis:

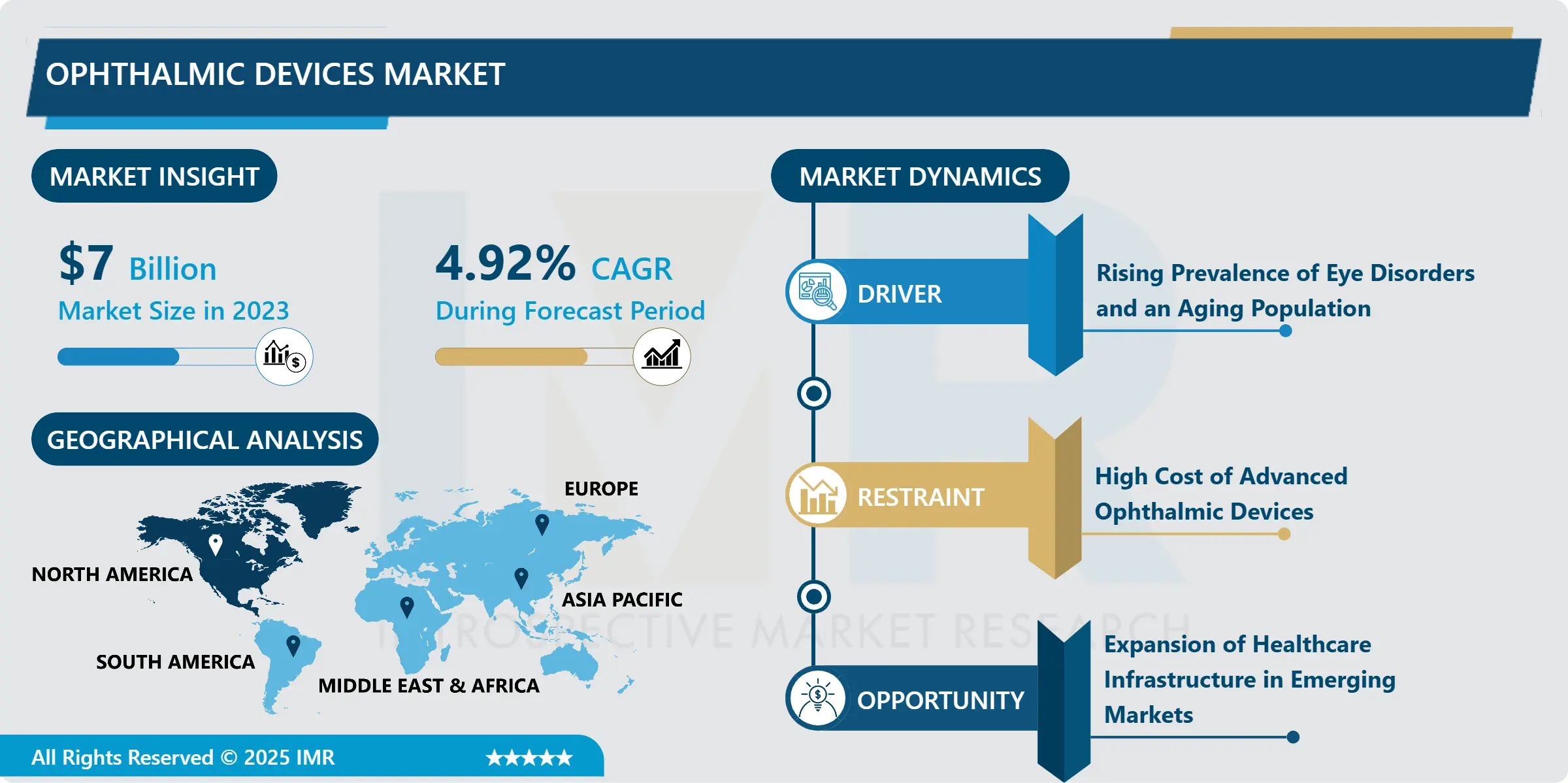

Ophthalmic Devices Market Size Was Valued at USD 7.0 Billion in 2023, and is Projected to Reach USD 10.78 Billion by 2032, Growing at a CAGR of 4.92% From 2024-2032.

The global ophthalmic devices market is a rapidly growing segment within the healthcare industry, driven by an increasing prevalence of eye disorders and advancements in medical technology. Ophthalmic devices include a wide range of instruments and equipment used for the diagnosis, treatment, and surgical intervention of various eye conditions, such as cataracts, glaucoma, diabetic retinopathy, and refractive errors. As the global population ages and the incidence of eye-related diseases rises, the demand for innovative ophthalmic devices is projected to continue expanding.

Advancements in diagnostic technologies, such as optical coherence tomography (OCT) and fundus cameras, are revolutionizing the way eye diseases are diagnosed and monitored. These devices provide highly detailed images of the eye’s internal structures, aiding in the early detection of conditions such as macular degeneration and diabetic retinopathy. Furthermore, surgical devices, including those for cataract and refractive surgery, have significantly improved, allowing for minimally invasive procedures and faster recovery times.

The rising awareness of eye health, coupled with government initiatives promoting regular eye exams, is contributing to the growth of the ophthalmic devices market. In developing regions, improving access to eye care services and the expansion of healthcare infrastructure are key drivers of market growth. Additionally, technological advancements in intraocular lenses (IOLs), contact lenses, and laser surgery equipment are expected to fuel demand. The primary drivers of the ophthalmic devices market include the increasing prevalence of eye diseases due to an aging population, lifestyle changes such as prolonged screen time, and the rise of chronic conditions like diabetes, which is associated with diabetic retinopathy. As the global population ages, there is a greater need for cataract surgeries and other corrective eye procedures, driving demand for both diagnostic and surgical ophthalmic devices. Emerging markets, particularly in Asia Pacific and Latin America, present significant growth opportunities due to increased healthcare investments and rising awareness about eye health. Innovations in laser eye surgery and the development of more affordable diagnostic tools are expected to create new opportunities for market players.

Ophthalmic Devices Market Trend Analysis:

Increasing Prevalence of Age-Related Eye Disorders

As the global population ages, the incidence of age-related eye conditions such as cataracts, macular degeneration, and glaucoma has significantly increased. These conditions are leading causes of vision impairment and blindness worldwide, particularly in older adults. Cataract surgeries, in particular, are one of the most common procedures, driving a substantial demand for ophthalmic devices like intraocular lenses (IOLs) and surgical instruments. The aging demographic, especially in regions like North America, Europe, and parts of Asia, has heightened the need for advanced diagnostic tools and surgical devices, which is fueling growth in the ophthalmic devices market.

With longer life expectancies, there is a greater demand for devices that can address these eye diseases more effectively. Improved awareness and access to healthcare, particularly in aging populations, are resulting in more regular eye checkups and interventions. This shift toward preventive care and timely surgeries is a significant driver in the ophthalmic market, prompting manufacturers to develop better, more efficient devices for both diagnosis and treatment of age-related vision issues.

Expanding Healthcare Infrastructure in Emerging Markets

Emerging markets, particularly in Asia-Pacific, Latin America, and parts of Africa, present a significant opportunity for growth in the ophthalmic devices market. As these regions continue to urbanize and improve their healthcare systems, the demand for advanced ophthalmic technologies is increasing. Governments and healthcare organizations in these regions are making significant investments in medical infrastructure, making eye care services more accessible to a larger portion of the population. This growing focus on healthcare infrastructure is opening new avenues for the expansion of ophthalmic devices, from basic diagnostic tools to more sophisticated surgical equipment.

The rising awareness of eye health in emerging markets, fueled by government health campaigns and private-sector investments, has further boosted demand. As more people seek treatment for vision-related issues and undergo regular eye exams, the need for advanced ophthalmic technologies will continue to rise. This growing demand provides an opportunity for market players to innovate and deliver cost-effective, high-quality products tailored to the needs of these regions, contributing to substantial market growth in the coming years.

Ophthalmic Devices Market Segment Analysis:

Ophthalmic Devices Market is Segmented on the basis of type, application, end user, and region.

By Type, Vision Care Products segment is expected to dominate the market during the forecast period

The Vision Care Products segment is expected to dominate the ophthalmic devices market during the forecast period due to the increasing global prevalence of refractive errors, such as nearsightedness, farsightedness, and astigmatism. With millions of people worldwide requiring corrective measures for their vision, products like eyeglasses, contact lenses, and optical lenses are in high demand. Additionally, the convenience and accessibility of vision care products, including over-the-counter solutions like non-prescription eyeglasses and contact lenses, contribute to their widespread adoption. As a result, this segment is poised for continued growth, driven by both consumer demand and advancements in product design, such as the development of more comfortable and durable lenses.

Furthermore, the growing awareness about eye health and the increasing acceptance of corrective eyewear are boosting the vision care products market. The rise of digital screen usage, particularly with the growing dependence on smartphones, computers, and other electronic devices, has led to a surge in demand for products that can address issues like digital eye strain and improve vision. Innovations in contact lenses, such as those offering advanced features like UV protection and moisture retention, are also supporting the expansion of this segment. As people prioritize eye care and explore various vision correction options, the Vision Care Products segment is set to dominate the market in the coming years.

By Application, Cataract segment expected to held the largest share

The Cataract segment is expected to hold the largest share of the ophthalmic devices market during the forecast period, driven by the high prevalence of cataracts, particularly in aging populations. Cataracts are one of the leading causes of vision impairment and blindness globally, and the increasing number of people requiring cataract surgery is fueling demand for surgical devices like phacoemulsification machines, intraocular lenses (IOLs), and other related equipment. As the global population continues to age, the need for cataract-related treatments and surgeries will only grow, making this segment a dominant force in the ophthalmic devices market.

In addition to the aging demographic, advancements in cataract surgery technology have also contributed to the growth of this segment. The development of minimally invasive procedures, faster recovery times, and more precise surgical tools has made cataract surgery more accessible and effective. Moreover, the increasing availability of healthcare services in emerging markets is driving more people to seek cataract treatment, thus further expanding the market. As these trends continue, the Cataract segment is expected to remain the largest contributor to the ophthalmic devices market in the coming years.

Ophthalmic Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to dominate the ophthalmic devices market during the forecast period due to the region’s advanced healthcare infrastructure, high adoption of innovative medical technologies, and growing awareness about eye health. The United States, in particular, is home to a large aging population, which is a significant driver for the demand for ophthalmic devices such as diagnostic tools and surgical equipment for conditions like cataracts, glaucoma, and age-related macular degeneration. Additionally, the strong presence of key market players and significant investments in research and development contribute to the growth of the market in this region, as new, more effective ophthalmic devices are continuously being introduced.

Moreover, North America’s well-established healthcare system and high healthcare spending further enhance the adoption of advanced ophthalmic devices. Insurance coverage and reimbursement policies for eye surgeries and treatments, such as cataract surgeries and LASIK, make these procedures more accessible to the population, further boosting demand for related ophthalmic devices. The region’s focus on early detection and preventive eye care, alongside the growing awareness of conditions like diabetic retinopathy and myopia, positions North America to maintain a dominant share in the ophthalmic devices market throughout the forecast period.

Active Key Players in the Ophthalmic Devices Market:

AbbVie Inc. (USA)

Alcon (Switzerland)

Bausch + Lomb (USA

Carl Zeiss Meditec AG (Germany)

CooperVision (USA)

EssilorLuxottica (France/Italy)

Hoya Corporation (Japan)

Johnson & Johnson Vision (USA)

Kowa Company, Ltd. (Japan)

Medtronic (Ireland)

Merck & Co., Inc. (USA)

Nidek Co., Ltd. (Japan)

Novartis (Switzerland)

Rayner (UK)

Santen Pharmaceutical Co., Ltd. (Japan)

TearLab Corporation (USA)

Thermo Fisher Scientific (USA)

Topcon Corporation (Japan)

Toshiba Medical Systems Corporation (Japan)

Visionary Optics (USA), and Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ophthalmic Devices Market by Type

4.1 Ophthalmic Devices Market Snapshot and Growth Engine

4.2 Ophthalmic Devices Market Overview

4.3 Vision Care Products (e.g.

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Vision Care Products (e.g.: Geographic Segmentation Analysis

4.4 eyeglasses

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 eyeglasses: Geographic Segmentation Analysis

4.5 contact lenses)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 contact lenses): Geographic Segmentation Analysis

4.6 Surgical Devices (e.g.

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Surgical Devices (e.g.: Geographic Segmentation Analysis

4.7 cataract surgery devices

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 cataract surgery devices: Geographic Segmentation Analysis

4.8 laser systems)

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 laser systems): Geographic Segmentation Analysis

4.9 Diagnostic & Monitoring Devices (e.g.

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Diagnostic & Monitoring Devices (e.g.: Geographic Segmentation Analysis

4.10 tonometer’s

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 tonometer’s: Geographic Segmentation Analysis

4.11 fundus cameras)

4.11.1 Introduction and Market Overview

4.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.11.3 Key Market Trends, Growth Factors and Opportunities

4.11.4 fundus cameras): Geographic Segmentation Analysis

Chapter 5: Ophthalmic Devices Market by Application

5.1 Ophthalmic Devices Market Snapshot and Growth Engine

5.2 Ophthalmic Devices Market Overview

5.3 Cataract

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Cataract: Geographic Segmentation Analysis

5.4 Glaucoma

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Glaucoma: Geographic Segmentation Analysis

5.5 Refractor Disorders

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Refractor Disorders: Geographic Segmentation Analysis

5.6 Vitreo Retinal Disorders

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Vitreo Retinal Disorders: Geographic Segmentation Analysis

5.7 Others (e.g. diabetic retinopathy

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others (e.g. diabetic retinopathy: Geographic Segmentation Analysis

5.8 macular degeneration)

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 macular degeneration): Geographic Segmentation Analysis

Chapter 6: Ophthalmic Devices Market by End User

6.1 Ophthalmic Devices Market Snapshot and Growth Engine

6.2 Ophthalmic Devices Market Overview

6.3 Hospitals and Eye Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals and Eye Clinics: Geographic Segmentation Analysis

6.4 Academic and Research Laboratories

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Academic and Research Laboratories: Geographic Segmentation Analysis

6.5 Others (e.g.

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others (e.g.: Geographic Segmentation Analysis

6.6 diagnostic centers)

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 diagnostic centers): Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Ophthalmic Devices Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ALCON (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BAUSCH + LOMB (UNITED STATES)

7.4 CANON INC. (JAPAN)

7.5 CARL ZEISS AG (GERMANY)

7.6 ESSILOR INTERNATIONAL (FRANCE)

7.7 GLAUCUS CORPORATION (UNITED STATES)

7.8 HAAG-STREIT GROUP (SWITZERLAND)

7.9 HEIDELBERG ENGINEERING (GERMANY)

7.10 HOYA CORPORATION (JAPAN)

7.11 JOHNSON & JOHNSON VISION (UNITED STATES)

7.12 NIDEK CO. LTD. (JAPAN)

7.13 TOPCON CORPORATION (JAPAN)

7.14

7.15 OTHER ACTIVE PLAYERS

Chapter 8: Global Ophthalmic Devices Market By Region

8.1 Overview

8.2. North America Ophthalmic Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Vision Care Products (e.g.

8.2.4.2 eyeglasses

8.2.4.3 contact lenses)

8.2.4.4 Surgical Devices (e.g.

8.2.4.5 cataract surgery devices

8.2.4.6 laser systems)

8.2.4.7 Diagnostic & Monitoring Devices (e.g.

8.2.4.8 tonometer’s

8.2.4.9 fundus cameras)

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Cataract

8.2.5.2 Glaucoma

8.2.5.3 Refractor Disorders

8.2.5.4 Vitreo Retinal Disorders

8.2.5.5 Others (e.g. diabetic retinopathy

8.2.5.6 macular degeneration)

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals and Eye Clinics

8.2.6.2 Academic and Research Laboratories

8.2.6.3 Others (e.g.

8.2.6.4 diagnostic centers)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Ophthalmic Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Vision Care Products (e.g.

8.3.4.2 eyeglasses

8.3.4.3 contact lenses)

8.3.4.4 Surgical Devices (e.g.

8.3.4.5 cataract surgery devices

8.3.4.6 laser systems)

8.3.4.7 Diagnostic & Monitoring Devices (e.g.

8.3.4.8 tonometer’s

8.3.4.9 fundus cameras)

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Cataract

8.3.5.2 Glaucoma

8.3.5.3 Refractor Disorders

8.3.5.4 Vitreo Retinal Disorders

8.3.5.5 Others (e.g. diabetic retinopathy

8.3.5.6 macular degeneration)

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals and Eye Clinics

8.3.6.2 Academic and Research Laboratories

8.3.6.3 Others (e.g.

8.3.6.4 diagnostic centers)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Ophthalmic Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Vision Care Products (e.g.

8.4.4.2 eyeglasses

8.4.4.3 contact lenses)

8.4.4.4 Surgical Devices (e.g.

8.4.4.5 cataract surgery devices

8.4.4.6 laser systems)

8.4.4.7 Diagnostic & Monitoring Devices (e.g.

8.4.4.8 tonometer’s

8.4.4.9 fundus cameras)

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Cataract

8.4.5.2 Glaucoma

8.4.5.3 Refractor Disorders

8.4.5.4 Vitreo Retinal Disorders

8.4.5.5 Others (e.g. diabetic retinopathy

8.4.5.6 macular degeneration)

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals and Eye Clinics

8.4.6.2 Academic and Research Laboratories

8.4.6.3 Others (e.g.

8.4.6.4 diagnostic centers)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Ophthalmic Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Vision Care Products (e.g.

8.5.4.2 eyeglasses

8.5.4.3 contact lenses)

8.5.4.4 Surgical Devices (e.g.

8.5.4.5 cataract surgery devices

8.5.4.6 laser systems)

8.5.4.7 Diagnostic & Monitoring Devices (e.g.

8.5.4.8 tonometer’s

8.5.4.9 fundus cameras)

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Cataract

8.5.5.2 Glaucoma

8.5.5.3 Refractor Disorders

8.5.5.4 Vitreo Retinal Disorders

8.5.5.5 Others (e.g. diabetic retinopathy

8.5.5.6 macular degeneration)

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals and Eye Clinics

8.5.6.2 Academic and Research Laboratories

8.5.6.3 Others (e.g.

8.5.6.4 diagnostic centers)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Ophthalmic Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Vision Care Products (e.g.

8.6.4.2 eyeglasses

8.6.4.3 contact lenses)

8.6.4.4 Surgical Devices (e.g.

8.6.4.5 cataract surgery devices

8.6.4.6 laser systems)

8.6.4.7 Diagnostic & Monitoring Devices (e.g.

8.6.4.8 tonometer’s

8.6.4.9 fundus cameras)

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Cataract

8.6.5.2 Glaucoma

8.6.5.3 Refractor Disorders

8.6.5.4 Vitreo Retinal Disorders

8.6.5.5 Others (e.g. diabetic retinopathy

8.6.5.6 macular degeneration)

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals and Eye Clinics

8.6.6.2 Academic and Research Laboratories

8.6.6.3 Others (e.g.

8.6.6.4 diagnostic centers)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Ophthalmic Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Vision Care Products (e.g.

8.7.4.2 eyeglasses

8.7.4.3 contact lenses)

8.7.4.4 Surgical Devices (e.g.

8.7.4.5 cataract surgery devices

8.7.4.6 laser systems)

8.7.4.7 Diagnostic & Monitoring Devices (e.g.

8.7.4.8 tonometer’s

8.7.4.9 fundus cameras)

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Cataract

8.7.5.2 Glaucoma

8.7.5.3 Refractor Disorders

8.7.5.4 Vitreo Retinal Disorders

8.7.5.5 Others (e.g. diabetic retinopathy

8.7.5.6 macular degeneration)

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals and Eye Clinics

8.7.6.2 Academic and Research Laboratories

8.7.6.3 Others (e.g.

8.7.6.4 diagnostic centers)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Ophthalmic Devices Market research report?

A1: The forecast period in the Ophthalmic Devices Market research report is 2024-2032.

Q2: Who are the key players in the Ophthalmic Devices Market?

A2: AbbVie Inc. (USA), Alcon (Switzerland), Bausch + Lomb (USA, Carl Zeiss Meditec AG (Germany), CooperVision (USA), EssilorLuxottica (France/Italy), Hoya Corporation (Japan), Johnson & Johnson Vision (USA), Kowa Company, Ltd. (Japan), Medtronic (Ireland), Merck & Co., Inc. (USA), Nidek Co., Ltd. (Japan), Novartis (Switzerland), Rayner (UK), Santen Pharmaceutical Co., Ltd. (Japan), TearLab Corporation (USA), Thermo Fisher Scientific (USA), Topcon Corporation (Japan), Toshiba Medical Systems Corporation (Japan), Visionary Optics (USA), and Other Active Players.

Q3: What are the segments of the Ophthalmic Devices Market?

A3: The Ophthalmic Devices Market is segmented into Type, Application, End User and region. By Type, the market is categorized into Vision Care Products (e.g., eyeglasses, contact lenses), Surgical Devices (e.g., cataract surgery devices, laser systems), Diagnostic & Monitoring Devices (e.g., tonometer’s, fundus cameras). By Application, the market is categorized into Cataract, Glaucoma, Refractor Disorders, Vitreo Retinal Disorders, Others (e.g. diabetic retinopathy, macular degeneration). By End User, the market is categorized into Hospitals and Eye Clinics, Academic and Research Laboratories, Others (e.g., diagnostic centers). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Ophthalmic Devices Market?

A4: The ophthalmic devices market refers to the industry that encompasses a wide range of medical devices used for the diagnosis, treatment, and surgery of eye conditions and disorders. These devices include diagnostic instruments like optical coherence tomography (OCT) and fundus cameras, surgical tools for cataract, glaucoma, and refractive surgeries, as well as vision care products such as eyeglasses, contact lenses, and intraocular lenses (IOLs). The market is driven by the increasing prevalence of eye-related diseases, advancements in technology, and growing demand for vision correction and eye care treatments globally.

Q5: How big is the Ophthalmic Devices Market?

A5: Ophthalmic Devices Market Size Was Valued at USD 7.0 Billion in 2023, and is Projected to Reach USD 10.78 Billion by 2032, Growing at a CAGR of 4.92% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!