Stay Ahead in Fast-Growing Economies.

Browse Reports NowOperating Room Equipment and Supplies Market Size, Share, Growth & Forecast (2024-2032)

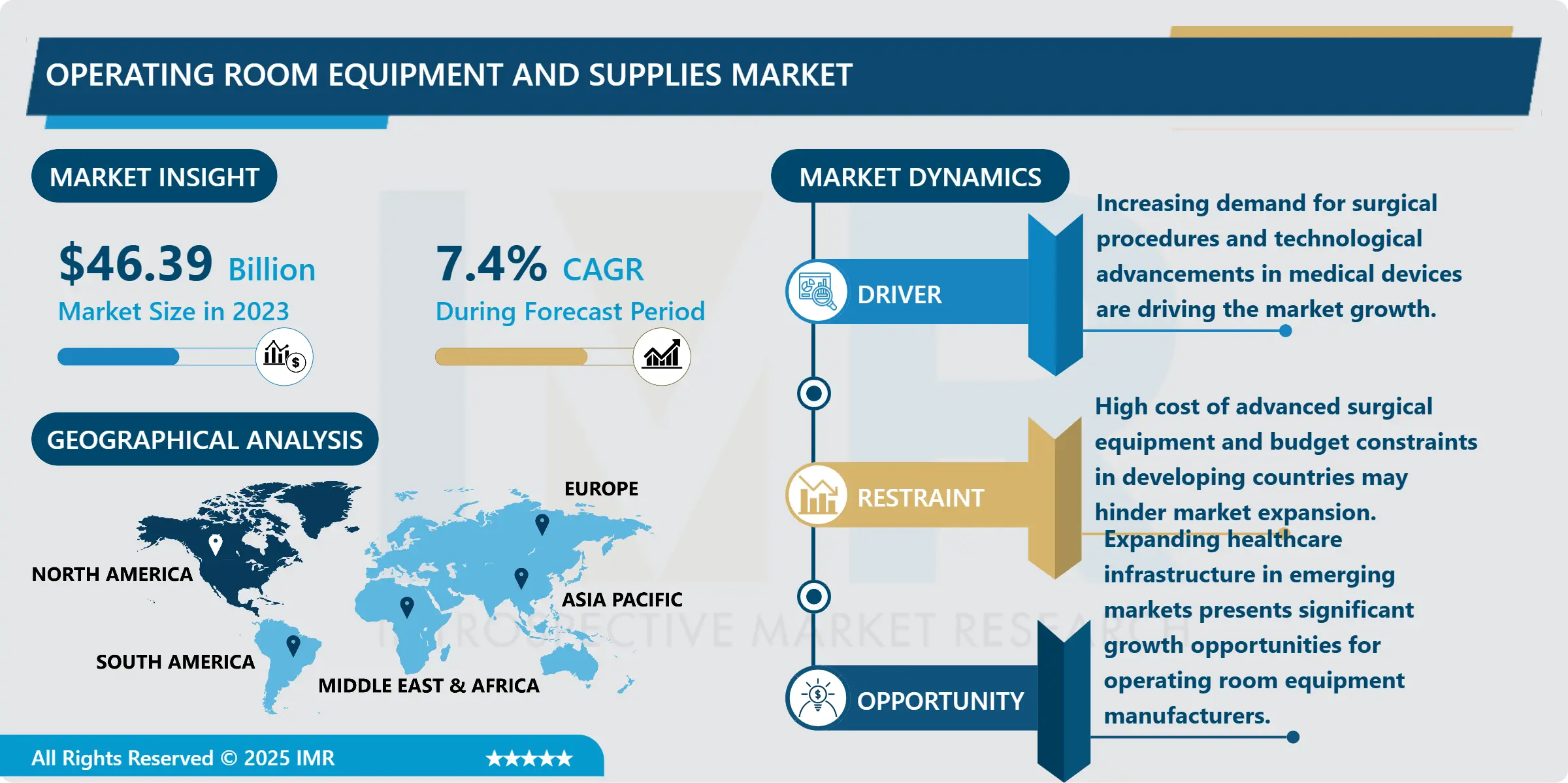

Operating Room Equipment and Supplies Market Size Was Valued at USD 46.39 Billion in 2023, and is Projected to Reach USD 88.21 Billion by 2032, Growing at a CAGR of 7.40% From 2024-2032.

IMR Group

Description

Operating Room Equipment and Supplies Market Synopsis:

Operating Room Equipment and Supplies Market Size Was Valued at USD 46.39 Billion in 2023, and is Projected to Reach USD 88.21 Billion by 2032, Growing at a CAGR of 7.40% From 2024-2032.

The global Operating Room (OR) Equipment and Supplies market is a critical segment of the healthcare industry, driven by the continuous rise in surgical procedures worldwide. As healthcare infrastructure expands, particularly in emerging economies, the demand for technologically advanced OR equipment such as surgical lights, operating tables, anesthesia machines, and patient monitoring devices continues to grow. Hospitals, ambulatory surgical centers, and specialty clinics are investing significantly in upgrading OR setups to enhance efficiency and improve patient outcomes.

Advancements in minimally invasive surgical techniques, robotic surgeries, and integrated OR systems are reshaping the landscape of the operating room. These innovations are pushing healthcare providers toward adopting smart and modular ORs that support better ergonomics, workflow optimization, and real-time data access. Additionally, the aging global population and growing prevalence of chronic diseases are fueling surgical interventions, further boosting the demand for high-performance OR equipment and disposable supplies.

Market dynamics play a significant role in shaping this industry. On the demand side, increasing healthcare expenditure, government initiatives to modernize hospital infrastructure, and the growing focus on patient safety and infection control are key drivers. Additionally, the shift toward day surgeries and outpatient procedures is prompting facilities to invest in cost-effective, mobile, and space-efficient OR setups.

Conversely, the market faces challenges such as high capital investment requirements, complex regulatory frameworks, and the shortage of skilled professionals in emerging markets. Moreover, fluctuating raw material prices and disruptions in the supply chain, especially due to global events like the COVID-19 pandemic, have impacted the availability and pricing of OR supplies. Despite these hurdles, innovation, public-private partnerships, and rising healthcare digitization present growth opportunities for stakeholders across the value chain.

Operating Room Equipment and Supplies Market Trend Analysis:

Rising Volume of Surgical Procedures Worldwide

The primary drivers of the Operating Room Equipment and Supplies market is the increasing volume of surgical procedures performed globally. The growing prevalence of chronic diseases such as cardiovascular disorders, cancer, orthopedic conditions, and obesity-related complications is leading to a surge in both elective and emergency surgeries. As populations age and diagnostic capabilities improve, more patients are being recommended for surgical interventions, which in turn demands advanced operating room infrastructure and associated supplies.

This rise in surgical volume places pressure on hospitals and surgical centers to maintain high-quality, efficient, and fully-equipped operating environments. Facilities are investing in modern OR tables, surgical lights, and energy-based devices to support diverse surgical specialties. Moreover, infection control protocols necessitate continuous usage of disposable supplies, thereby contributing to recurring demand. The need for faster patient turnover, reduced surgical downtime, and precision tools further supports market growth.

Integration of Smart and Digital Operating Rooms

A significant opportunity lies in the integration of smart technologies and digital systems into the operating room environment. Smart ORs leverage technologies like real-time data monitoring, surgical imaging integration, voice-activated controls, and AI-powered navigation to enhance surgical precision and workflow efficiency. These advancements not only improve clinical outcomes but also reduce procedure time and overall healthcare costs.

Healthcare providers, particularly in developed economies, are increasingly adopting modular and hybrid OR systems that can adapt to various surgical disciplines. With the rise of telemedicine, remote-assisted surgeries, and healthcare IoT, there is a growing market potential for companies offering interoperable and scalable OR solutions. As hospitals aim to future-proof their surgical capabilities, vendors that provide integrated software-hardware solutions, cybersecurity, and maintenance services will find robust growth avenues.

Operating Room Equipment and Supplies Market Segment Analysis:

Operating Room Equipment and Supplies Market is Segmented on the basis of type, application, end user, and region.

By Product Type, Surgical instruments segment is expected to dominate the market during the forecast period

The surgical instruments segment is anticipated to lead the Operating Room Equipment and Supplies market during the forecast period. This dominance is largely attributed to the essential role that surgical instruments play in a wide range of medical procedures, from routine to complex surgeries. Instruments such as scalpels, forceps, scissors, and retractors are integral to every surgery, and their constant demand is further driven by the rise in surgical interventions globally. Additionally, advancements in surgical instruments, including those used in minimally invasive procedures, are encouraging hospitals and surgical centers to upgrade their existing inventory to meet patient safety standards and improve surgical outcomes.

The ongoing trend towards specialized surgeries, including orthopedics, neurosurgery, and cardiovascular procedures, is expanding the variety and complexity of surgical instruments required. Innovations in instrument designs, such as ergonomic handles and materials that enhance precision, are also pushing the market forward. As healthcare systems in both developed and emerging economies continue to grow, the need for high-quality and durable surgical instruments will remain a key focus, solidifying the segment’s leadership in the market. The surgical instruments segment is thus well-positioned to maintain its dominance throughout the forecast period.

By Application, Neurological surgery segment expected to held the largest share

The neurological surgery segment is projected to hold the largest share of the Operating Room Equipment and Supplies market due to the increasing incidence of neurological disorders and advancements in surgical technologies. Conditions such as brain tumors, spinal cord injuries, neurovascular diseases, and epilepsy are on the rise, particularly among aging populations. As these conditions become more prevalent, the demand for specialized equipment and instruments for neurological surgeries, including neurosurgical microscopes, surgical drills, and patient monitoring systems, is growing rapidly.

In addition, technological innovations such as robotic-assisted surgeries and minimally invasive techniques are transforming the field of neurosurgery, making procedures safer and more precise. These advancements reduce recovery times, minimize complications, and improve patient outcomes, further driving the demand for state-of-the-art OR equipment. With a growing number of skilled neurosurgeons and healthcare facilities equipped to perform complex neurological procedures, this segment is expected to dominate the market, capturing a significant share during the forecast period.

Operating Room Equipment and Supplies Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to dominate the Operating Room Equipment and Supplies market during the forecast period due to the advanced healthcare infrastructure and high demand for innovative surgical technologies. The region is home to some of the world’s leading healthcare institutions, offering state-of-the-art surgical facilities and sophisticated medical equipment. The prevalence of chronic diseases, the growing aging population, and the increasing number of surgical procedures performed annually in countries like the United States and Canada contribute significantly to the market’s growth. Moreover, the region’s healthcare systems are actively investing in digital and minimally invasive technologies, propelling demand for advanced operating room equipment.

The North American market benefits from strong government support for healthcare, research, and development, along with the presence of major players in the medical equipment industry. Regulatory frameworks in the region, such as FDA approvals for medical devices, ensure high-quality standards for operating room equipment and supplies, further fueling market growth. The rapid adoption of robotic surgery, integrated OR systems, and patient monitoring technologies are expected to drive the market in North America, maintaining its leadership position throughout the forecast period.

Active Key Players in the Operating Room Equipment and Supplies Market:

Aesculap (Germany)

B. Braun Melsungen AG (Germany)

Conmed Corporation (USA)

GE Healthcare (USA)

Getinge AB (Sweden)

Hill-Rom Holdings, Inc. (USA)

Hologic Inc. (USA)

Intuitive Surgical, Inc. (USA)

Johnson & Johnson (USA)

Karl Storz (Germany)

Medline Industries, Inc. (USA)

Medtronic (Ireland)

Mizuho Medical Co., Ltd. (Japan)

NuVasive, Inc. (USA)

Olympus Corporation (Japan)

Siemens Healthineers (Germany)

Smith & Nephew (UK)

Stryker Corporation (USA)

Terumo Corporation (Japan)

Zimmer Biomet (USA)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Operating Room Equipment and Supplies Market by Product Type

4.1 Operating Room Equipment and Supplies Market Snapshot and Growth Engine

4.2 Operating Room Equipment and Supplies Market Overview

4.3 Surgical Instruments

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Surgical Instruments: Geographic Segmentation Analysis

4.4 Anaesthesia Equipment

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Anaesthesia Equipment: Geographic Segmentation Analysis

4.5 Operating Tables

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Operating Tables: Geographic Segmentation Analysis

4.6 Operating Room Lights

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Operating Room Lights: Geographic Segmentation Analysis

4.7 Sterilization Equipment

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Sterilization Equipment: Geographic Segmentation Analysis

4.8 Patient Monitoring Systems

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Patient Monitoring Systems: Geographic Segmentation Analysis

4.9 Electrosurgical Devices

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Electrosurgical Devices: Geographic Segmentation Analysis

4.10 Endoscopy Equipment

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Endoscopy Equipment: Geographic Segmentation Analysis

4.11 Other Equipment

4.11.1 Introduction and Market Overview

4.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.11.3 Key Market Trends, Growth Factors and Opportunities

4.11.4 Other Equipment: Geographic Segmentation Analysis

Chapter 5: Operating Room Equipment and Supplies Market by Application

5.1 Operating Room Equipment and Supplies Market Snapshot and Growth Engine

5.2 Operating Room Equipment and Supplies Market Overview

5.3 General Surgery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 General Surgery: Geographic Segmentation Analysis

5.4 Orthopedic Surgery

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Orthopedic Surgery: Geographic Segmentation Analysis

5.5 Cardiovascular Surgery

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Cardiovascular Surgery: Geographic Segmentation Analysis

5.6 Neurological Surgery

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Neurological Surgery: Geographic Segmentation Analysis

5.7 Urological Surgery

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Urological Surgery: Geographic Segmentation Analysis

5.8 Gynecological Surgery

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Gynecological Surgery: Geographic Segmentation Analysis

5.9 Other Specialties3End User

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Other Specialties3End User : Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Operating Room Equipment and Supplies Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AESCULAP (GERMANY)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ALCON INC. (SWITZERLAND)

6.4 B. BRAUN MELSUNGEN AG (GERMANY)

6.5 BARD (USA)

6.6 CONMED CORPORATION (USA)

6.7 GETINGE AB (SWEDEN)

6.8 HILL-ROM HOLDINGS INC. (USA)

6.9 JOHNSON & JOHNSON (USA)

6.10 MEDTRONIC (IRELAND)

6.11 MERCK & CO. INC. (USA)

6.12 MÖLNLYCKE HEALTH CARE (SWEDEN)

6.13 OLYMPUS CORPORATION (JAPAN)

6.14 STRYKER CORPORATION (USA)

6.15 TELEFLEX INC. (USA)

6.16 ZIMMER BIOMET (USA)

6.17

6.18 OTHER ACTIVE PLAYERS

Chapter 7: Global Operating Room Equipment and Supplies Market By Region

7.1 Overview

7.2. North America Operating Room Equipment and Supplies Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Product Type

7.2.4.1 Surgical Instruments

7.2.4.2 Anaesthesia Equipment

7.2.4.3 Operating Tables

7.2.4.4 Operating Room Lights

7.2.4.5 Sterilization Equipment

7.2.4.6 Patient Monitoring Systems

7.2.4.7 Electrosurgical Devices

7.2.4.8 Endoscopy Equipment

7.2.4.9 Other Equipment

7.2.5 Historic and Forecasted Market Size By Application

7.2.5.1 General Surgery

7.2.5.2 Orthopedic Surgery

7.2.5.3 Cardiovascular Surgery

7.2.5.4 Neurological Surgery

7.2.5.5 Urological Surgery

7.2.5.6 Gynecological Surgery

7.2.5.7 Other Specialties3End User

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Operating Room Equipment and Supplies Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Product Type

7.3.4.1 Surgical Instruments

7.3.4.2 Anaesthesia Equipment

7.3.4.3 Operating Tables

7.3.4.4 Operating Room Lights

7.3.4.5 Sterilization Equipment

7.3.4.6 Patient Monitoring Systems

7.3.4.7 Electrosurgical Devices

7.3.4.8 Endoscopy Equipment

7.3.4.9 Other Equipment

7.3.5 Historic and Forecasted Market Size By Application

7.3.5.1 General Surgery

7.3.5.2 Orthopedic Surgery

7.3.5.3 Cardiovascular Surgery

7.3.5.4 Neurological Surgery

7.3.5.5 Urological Surgery

7.3.5.6 Gynecological Surgery

7.3.5.7 Other Specialties3End User

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Operating Room Equipment and Supplies Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Product Type

7.4.4.1 Surgical Instruments

7.4.4.2 Anaesthesia Equipment

7.4.4.3 Operating Tables

7.4.4.4 Operating Room Lights

7.4.4.5 Sterilization Equipment

7.4.4.6 Patient Monitoring Systems

7.4.4.7 Electrosurgical Devices

7.4.4.8 Endoscopy Equipment

7.4.4.9 Other Equipment

7.4.5 Historic and Forecasted Market Size By Application

7.4.5.1 General Surgery

7.4.5.2 Orthopedic Surgery

7.4.5.3 Cardiovascular Surgery

7.4.5.4 Neurological Surgery

7.4.5.5 Urological Surgery

7.4.5.6 Gynecological Surgery

7.4.5.7 Other Specialties3End User

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Operating Room Equipment and Supplies Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Product Type

7.5.4.1 Surgical Instruments

7.5.4.2 Anaesthesia Equipment

7.5.4.3 Operating Tables

7.5.4.4 Operating Room Lights

7.5.4.5 Sterilization Equipment

7.5.4.6 Patient Monitoring Systems

7.5.4.7 Electrosurgical Devices

7.5.4.8 Endoscopy Equipment

7.5.4.9 Other Equipment

7.5.5 Historic and Forecasted Market Size By Application

7.5.5.1 General Surgery

7.5.5.2 Orthopedic Surgery

7.5.5.3 Cardiovascular Surgery

7.5.5.4 Neurological Surgery

7.5.5.5 Urological Surgery

7.5.5.6 Gynecological Surgery

7.5.5.7 Other Specialties3End User

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Operating Room Equipment and Supplies Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Product Type

7.6.4.1 Surgical Instruments

7.6.4.2 Anaesthesia Equipment

7.6.4.3 Operating Tables

7.6.4.4 Operating Room Lights

7.6.4.5 Sterilization Equipment

7.6.4.6 Patient Monitoring Systems

7.6.4.7 Electrosurgical Devices

7.6.4.8 Endoscopy Equipment

7.6.4.9 Other Equipment

7.6.5 Historic and Forecasted Market Size By Application

7.6.5.1 General Surgery

7.6.5.2 Orthopedic Surgery

7.6.5.3 Cardiovascular Surgery

7.6.5.4 Neurological Surgery

7.6.5.5 Urological Surgery

7.6.5.6 Gynecological Surgery

7.6.5.7 Other Specialties3End User

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Operating Room Equipment and Supplies Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Product Type

7.7.4.1 Surgical Instruments

7.7.4.2 Anaesthesia Equipment

7.7.4.3 Operating Tables

7.7.4.4 Operating Room Lights

7.7.4.5 Sterilization Equipment

7.7.4.6 Patient Monitoring Systems

7.7.4.7 Electrosurgical Devices

7.7.4.8 Endoscopy Equipment

7.7.4.9 Other Equipment

7.7.5 Historic and Forecasted Market Size By Application

7.7.5.1 General Surgery

7.7.5.2 Orthopedic Surgery

7.7.5.3 Cardiovascular Surgery

7.7.5.4 Neurological Surgery

7.7.5.5 Urological Surgery

7.7.5.6 Gynecological Surgery

7.7.5.7 Other Specialties3End User

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the Operating Room Equipment and Supplies Market research report?

A1: The forecast period in the Operating Room Equipment and Supplies Market research report is 2024-2032.

Q2: Who are the key players in the Operating Room Equipment and Supplies Market?

A2: Aesculap (Germany), B. Braun Melsungen AG (Germany), Conmed Corporation (USA), GE Healthcare (USA), Getinge AB (Sweden), Hill-Rom Holdings, Inc. (USA), Hologic Inc. (USA), Intuitive Surgical, Inc. (USA), Johnson & Johnson (USA), Karl Storz (Germany), Medline Industries, Inc. (USA), Medtronic (Ireland), Mizuho Medical Co., Ltd. (Japan), NuVasive, Inc. (USA), Olympus Corporation (Japan), Siemens Healthineers (Germany), Smith & Nephew (UK), Stryker Corporation (USA), Terumo Corporation (Japan), Zimmer Biomet (USA), and Other Active Players.

Q3: What are the segments of the Operating Room Equipment and Supplies Market?

A3: The Operating Room Equipment and Supplies Market is segmented into Type, Application, End User and region. By Product Type, the market is categorized into Surgical Instruments, Anesthesia Equipment, Operating Tables, Operating Room Lights, Sterilization Equipment, Patient Monitoring Systems, Electrosurgical Devices, Endoscopy Equipment, Other Equipment. By Application, the market is categorized into General Surgery, Orthopedic Surgery, Cardiovascular Surgery, Neurological Surgery, Urological Surgery, Gynecological Surgery, Other Specialties. By End User, the market is categorized into Hospitals, Ambulatory Surgical Centers, Specialty Clinics. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Operating Room Equipment and Supplies Market?

A4: The Operating Room Equipment and Supplies Market refers to the sector that encompasses a wide range of medical devices, instruments, and consumables used in surgical procedures within operating rooms. This includes equipment such as surgical tables, lights, anesthesia machines, patient monitoring systems, and a variety of surgical instruments, along with sterile supplies like gloves, drapes, and sutures. The market is driven by advancements in surgical technology, rising demand for healthcare services, and the increasing number of surgeries globally. It supports healthcare facilities in improving surgical outcomes, enhancing efficiency, and ensuring patient safety.

Q5: How big is the Operating Room Equipment and Supplies Market?

A5: Operating Room Equipment and Supplies Market Size Was Valued at USD 46.39 Billion in 2023, and is Projected to Reach USD 88.21 Billion by 2032, Growing at a CAGR of 7.40% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!