Stay Ahead in Fast-Growing Economies.

Browse Reports NowOncology Radiopharmaceuticals Market Share, Trends & Market Forecast (2024-2032)

The Oncology Radiopharmaceuticals Market refers to the segment of the healthcare industry focused on the development, production, and distribution of radiopharmaceutical agents specifically used in the diagnosis and treatment of cancer.

IMR Group

Description

Oncology Radiopharmaceuticals Market Synopsis:

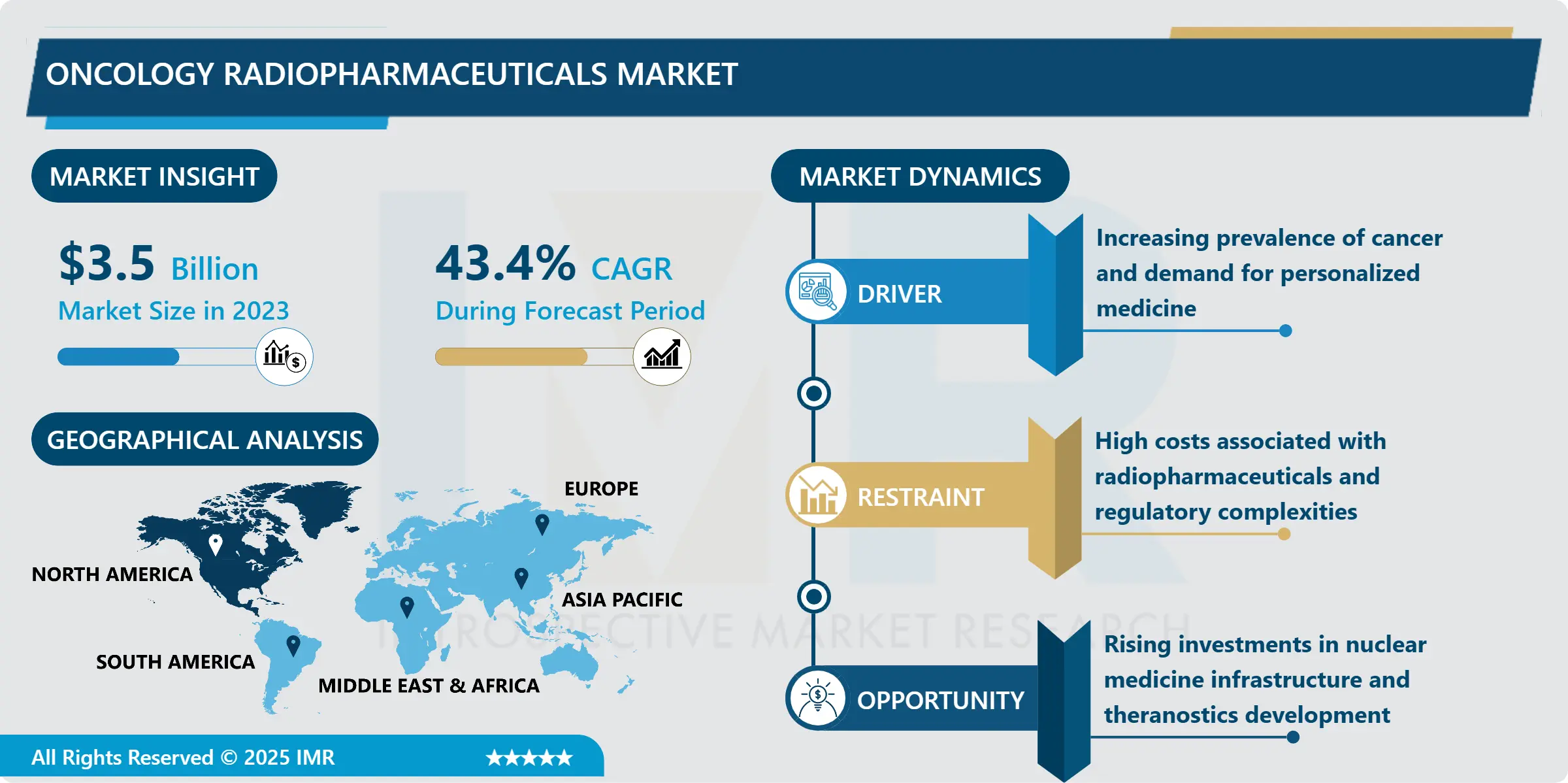

Oncology Radiopharmaceuticals Market Size Was Valued at USD 3.5 Billion in 2023, and is Projected to Reach USD 89.7 Billion by 2032, Growing at a CAGR of 43.4% From 2024-2032.

The Oncology Radiopharmaceuticals Market refers to the segment of the healthcare industry focused on the development, production, and distribution of radiopharmaceutical agents specifically used in the diagnosis and treatment of cancer. Radiopharmaceuticals are radioactive compounds that are either injected, swallowed, or inhaled to target specific cancerous tissues or organs. They serve dual purposes: as diagnostic tools in imaging techniques like PET and SPECT scans, and as therapeutic agents in treatments like radiotherapy. With their ability to provide precise and effective cancer targeting while minimizing damage to surrounding healthy tissues, radiopharmaceuticals have emerged as a cornerstone in personalized cancer care. This market is rapidly advancing due to technological innovations, growing cancer prevalence, and the increasing adoption of nuclear medicine as an integral component of oncology.

The global oncology radiopharmaceuticals market is witnessing significant growth, driven by the increasing burden of cancer worldwide. The World Health Organization (WHO) reports cancer as one of the leading causes of death, which fuels the demand for advanced diagnostic and therapeutic solutions. Radiopharmaceuticals stand out for their precision in detecting cancerous lesions and their effectiveness in treating metastatic and primary tumors. Governments and healthcare organizations are increasingly focusing on nuclear medicine infrastructure, further propelling market growth. Additionally, advancements in molecular imaging technologies have paved the way for more accurate diagnostics, thereby enhancing treatment outcomes and improving the quality of life for cancer patients.

Another factor contributing to market growth is the expansion of research and development activities in radiopharmaceuticals. Collaborations between pharmaceutical companies, nuclear medicine specialists, and research institutions are accelerating innovation. For example, newer alpha- and beta-emitting isotopes have shown improved efficacy in treating aggressive cancers such as prostate and thyroid cancers. The increasing prevalence of targeted radionuclide therapy, combined with a growing pipeline of radiopharmaceutical drugs in clinical trials, ensures a promising future for the market. However, challenges such as high costs, limited access to radioisotopes, and regulatory barriers need to be addressed to unlock the full potential of this field.

Oncology Radiopharmaceuticals Market Trend Analysis:

The Rise of Theranostics in Radiopharmaceuticals

One of the most transformative trends in the oncology radiopharmaceuticals market is the rise of theranostics, a novel approach combining therapeutic and diagnostic capabilities in a single platform. Theranostics allows clinicians to use the same radiopharmaceutical compound for both imaging and treatment. For instance, Lutetium-177 PSMA is widely recognized for its dual role in diagnosing and treating prostate cancer. This integrated approach enhances treatment precision, reduces side effects, and accelerates patient recovery. The adoption of theranostics is growing exponentially, supported by advancements in isotope production and nuclear imaging technology. As healthcare systems increasingly emphasize precision medicine, theranostics is expected to play a pivotal role in revolutionizing oncology treatments.

Increasing Investments in Nuclear Medicine Infrastructure

The oncology radiopharmaceuticals market offers immense growth opportunities, particularly through increased investments in nuclear medicine infrastructure. Governments and private entities across the globe are investing heavily in setting up cyclotrons, gamma cameras, and PET/SPECT scanners to enhance the availability of radiopharmaceutical diagnostics and therapies. Developing countries in regions like Asia-Pacific are experiencing a surge in nuclear medicine facilities due to supportive government initiatives and rising healthcare expenditures. Furthermore, partnerships between pharmaceutical giants and nuclear medicine specialists are enabling faster development and commercialization of innovative radiopharmaceuticals. With growing awareness and expanding access to nuclear medicine, the market is poised to experience robust growth in underserved regions.

Oncology Radiopharmaceuticals Market Segment Analysis:

Oncology Radiopharmaceuticals Market is Segmented on the basis of Test Type, Application, End User, and Region.

By Test Type, Radium-223 dichloride segment is expected to dominate the market during the forecast period

The Radium-223 dichloride segment is projected to dominate the oncology radiopharmaceuticals market during the forecast period. Known for its efficacy in treating bone metastases associated with prostate cancer, Radium-223 dichloride provides targeted alpha therapy (TAT) that minimizes systemic side effects. This radiopharmaceutical specifically targets cancerous cells in the bone while sparing healthy tissues, improving patient survival rates and quality of life.

Its growing adoption is also driven by the increasing incidence of prostate cancer and the robust clinical evidence supporting its effectiveness. Clinical studies have shown that Radium-223 dichloride significantly reduces skeletal-related events, a major concern in metastatic cancer patients. Additionally, ongoing research on expanding its application to other cancers, such as breast cancer with bone metastases, is likely to strengthen its market dominance.

By Application, Diagnosis segment expected to held the largest share

The Diagnosis segment is anticipated to hold the largest market share, driven by the rising adoption of imaging techniques such as PET and SPECT scans. These imaging modalities utilize radiopharmaceuticals to detect tumors at an early stage, enabling timely intervention and better patient outcomes. PET imaging, in particular, is gaining prominence due to its high sensitivity and specificity in identifying cancerous tissues.

Additionally, advancements in hybrid imaging technologies, such as PET/CT and SPECT/CT, are further boosting the demand for radiopharmaceuticals in diagnostics. With the increasing emphasis on early detection and personalized treatment plans, the diagnostic segment is expected to maintain its leadership in the oncology radiopharmaceuticals market. Supportive government policies and growing healthcare infrastructure in emerging economies are further fueling growth.

Oncology Radiopharmaceuticals Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America dominated the oncology radiopharmaceuticals market in 2023. The region’s leadership is attributed to advanced healthcare infrastructure, a strong presence of key market players, and a high prevalence of cancer. The United States, in particular, has been at the forefront, driven by significant investments in nuclear medicine and continuous R&D activities. Moreover, increasing government funding for cancer research and the availability of advanced imaging systems have further propelled the market’s growth in North America.

Active Key Players in the Oncology Radiopharmaceuticals Market

Advanced Accelerator Applications (France)

Bayer AG (Germany)

Blue Earth Diagnostics (UK)

Bracco Imaging S.p.A. (Italy)

Cardinal Health, Inc. (USA)

Curium (France)

GE Healthcare (USA)

IBA Radiopharma Solutions (Belgium)

Isotopia Molecular Imaging Ltd. (Israel)

Jubilant Radiopharma (Canada)

Lantheus Medical Imaging (USA)

Nordion (Canada)

Novartis AG (Switzerland)

Siemens Healthineers (Germany)

Telix Pharmaceuticals (Australia)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Oncology Radiopharmaceuticals Market by Type

4.1 Oncology Radiopharmaceuticals Market Snapshot and Growth Engine

4.2 Oncology Radiopharmaceuticals Market Overview

4.3 Cloud-Based

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Cloud-Based: Geographic Segmentation Analysis

4.4 On-Premise

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 On-Premise: Geographic Segmentation Analysis

Chapter 5: Oncology Radiopharmaceuticals Market by Deployment Model

5.1 Oncology Radiopharmaceuticals Market Snapshot and Growth Engine

5.2 Oncology Radiopharmaceuticals Market Overview

5.3 Public Cloud

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Public Cloud: Geographic Segmentation Analysis

5.4 Private Cloud

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Private Cloud: Geographic Segmentation Analysis

5.5 Hybrid Cloud

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Hybrid Cloud: Geographic Segmentation Analysis

Chapter 6: Oncology Radiopharmaceuticals Market by Pricing Model

6.1 Oncology Radiopharmaceuticals Market Snapshot and Growth Engine

6.2 Oncology Radiopharmaceuticals Market Overview

6.3 Subscription-Based

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Subscription-Based: Geographic Segmentation Analysis

6.4 Pay-As-You-Go

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Pay-As-You-Go: Geographic Segmentation Analysis

6.5 One-Time Payment

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 One-Time Payment: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Oncology Radiopharmaceuticals Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ADVANCED ACCELERATOR APPLICATIONS (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BAYER AG (GERMANY)

7.4 BLUE EARTH DIAGNOSTICS (UK)

7.5 BRACCO IMAGING S.P.A. (ITALY)

7.6 CARDINAL HEALTH INC. (USA)

7.7 CURIUM (FRANCE)

7.8 GE HEALTHCARE (USA)

7.9 IBA RADIOPHARMA SOLUTIONS (BELGIUM)

7.10 ISOTOPIA MOLECULAR IMAGING LTD. (ISRAEL)

7.11 JUBILANT RADIOPHARMA (CANADA)

7.12 LANTHEUS MEDICAL IMAGING (USA)

7.13 NOVARTIS AG (SWITZERLAND)

7.14 NORDION (CANADA)

7.15 SIEMENS HEALTHINEERS (GERMANY)

7.16 TELIX PHARMACEUTICALS (AUSTRALIA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Oncology Radiopharmaceuticals Market By Region

8.1 Overview

8.2. North America Oncology Radiopharmaceuticals Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Cloud-Based

8.2.4.2 On-Premise

8.2.5 Historic and Forecasted Market Size By Deployment Model

8.2.5.1 Public Cloud

8.2.5.2 Private Cloud

8.2.5.3 Hybrid Cloud

8.2.6 Historic and Forecasted Market Size By Pricing Model

8.2.6.1 Subscription-Based

8.2.6.2 Pay-As-You-Go

8.2.6.3 One-Time Payment

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Oncology Radiopharmaceuticals Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Cloud-Based

8.3.4.2 On-Premise

8.3.5 Historic and Forecasted Market Size By Deployment Model

8.3.5.1 Public Cloud

8.3.5.2 Private Cloud

8.3.5.3 Hybrid Cloud

8.3.6 Historic and Forecasted Market Size By Pricing Model

8.3.6.1 Subscription-Based

8.3.6.2 Pay-As-You-Go

8.3.6.3 One-Time Payment

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Oncology Radiopharmaceuticals Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Cloud-Based

8.4.4.2 On-Premise

8.4.5 Historic and Forecasted Market Size By Deployment Model

8.4.5.1 Public Cloud

8.4.5.2 Private Cloud

8.4.5.3 Hybrid Cloud

8.4.6 Historic and Forecasted Market Size By Pricing Model

8.4.6.1 Subscription-Based

8.4.6.2 Pay-As-You-Go

8.4.6.3 One-Time Payment

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Oncology Radiopharmaceuticals Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Cloud-Based

8.5.4.2 On-Premise

8.5.5 Historic and Forecasted Market Size By Deployment Model

8.5.5.1 Public Cloud

8.5.5.2 Private Cloud

8.5.5.3 Hybrid Cloud

8.5.6 Historic and Forecasted Market Size By Pricing Model

8.5.6.1 Subscription-Based

8.5.6.2 Pay-As-You-Go

8.5.6.3 One-Time Payment

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Oncology Radiopharmaceuticals Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Cloud-Based

8.6.4.2 On-Premise

8.6.5 Historic and Forecasted Market Size By Deployment Model

8.6.5.1 Public Cloud

8.6.5.2 Private Cloud

8.6.5.3 Hybrid Cloud

8.6.6 Historic and Forecasted Market Size By Pricing Model

8.6.6.1 Subscription-Based

8.6.6.2 Pay-As-You-Go

8.6.6.3 One-Time Payment

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Oncology Radiopharmaceuticals Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Cloud-Based

8.7.4.2 On-Premise

8.7.5 Historic and Forecasted Market Size By Deployment Model

8.7.5.1 Public Cloud

8.7.5.2 Private Cloud

8.7.5.3 Hybrid Cloud

8.7.6 Historic and Forecasted Market Size By Pricing Model

8.7.6.1 Subscription-Based

8.7.6.2 Pay-As-You-Go

8.7.6.3 One-Time Payment

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Oncology Radiopharmaceuticals Market research report?

A1: The forecast period in the Oncology Radiopharmaceuticals Market research report is 2024-2032.

Q2: Who are the key players in the Oncology Radiopharmaceuticals Market?

A2: Advanced Accelerator Applications (France), Bayer AG (Germany), Blue Earth Diagnostics (UK), Bracco Imaging S.p.A. (Italy), Cardinal Health, Inc. (USA) and Other Active Players.

Q3: What are the segments of the Oncology Radiopharmaceuticals Market?

A3: The Oncology Radiopharmaceuticals Market is segmented into Test Type, Application, End User and region. By Test Type, the market is categorized into Radium-223 dichloride, Sodium iodide I131, Lobenguane iodine-131, Lutetium-177, Yttrium-90, Fludeoxyglucose F 18, Gallium Citrate Ga 67, Technetium-99m, Others. By Application, the market is categorized into Diagnosis, Treatment. By End User, the market is categorized into Diagnostic Centers, Hospitals and Clinics, Research Institutes. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Oncology Radiopharmaceuticals Market?

A4: The Oncology Radiopharmaceuticals Market refers to the segment of the healthcare industry focused on the development, production, and distribution of radiopharmaceutical agents specifically used in the diagnosis and treatment of cancer. Radiopharmaceuticals are radioactive compounds that are either injected, swallowed, or inhaled to target specific cancerous tissues or organs. They serve dual purposes: as diagnostic tools in imaging techniques like PET and SPECT scans, and as therapeutic agents in treatments like radiotherapy. With their ability to provide precise and effective cancer targeting while minimizing damage to surrounding healthy tissues, radiopharmaceuticals have emerged as a cornerstone in personalized cancer care. This market is rapidly advancing due to technological innovations, growing cancer prevalence, and the increasing adoption of nuclear medicine as an integral component of oncology.

Q5: How big is the Oncology Radiopharmaceuticals Market?

A5: Oncology Radiopharmaceuticals Market Size Was Valued at USD 3.5 Billion in 2023, and is Projected to Reach USD 89.7 Billion by 2032, Growing at a CAGR of 43.4% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!