Stay Ahead in Fast-Growing Economies.

Browse Reports NowOat Milk Market Trends, Opportunities, and Growth Forecast (2024-2032)

The global oat milk market has emerged as a prominent segment within the plant-based dairy alternatives industry, witnessing strong growth due to increasing consumer preference for sustainable, nutritious, and lactose-free products. Oat milk, derived from whole oat grains and water, is gaining popularity not only among vegans but also among health-conscious and environmentally aware consumers.

IMR Group

Description

Oat Milk Market Synopsis:

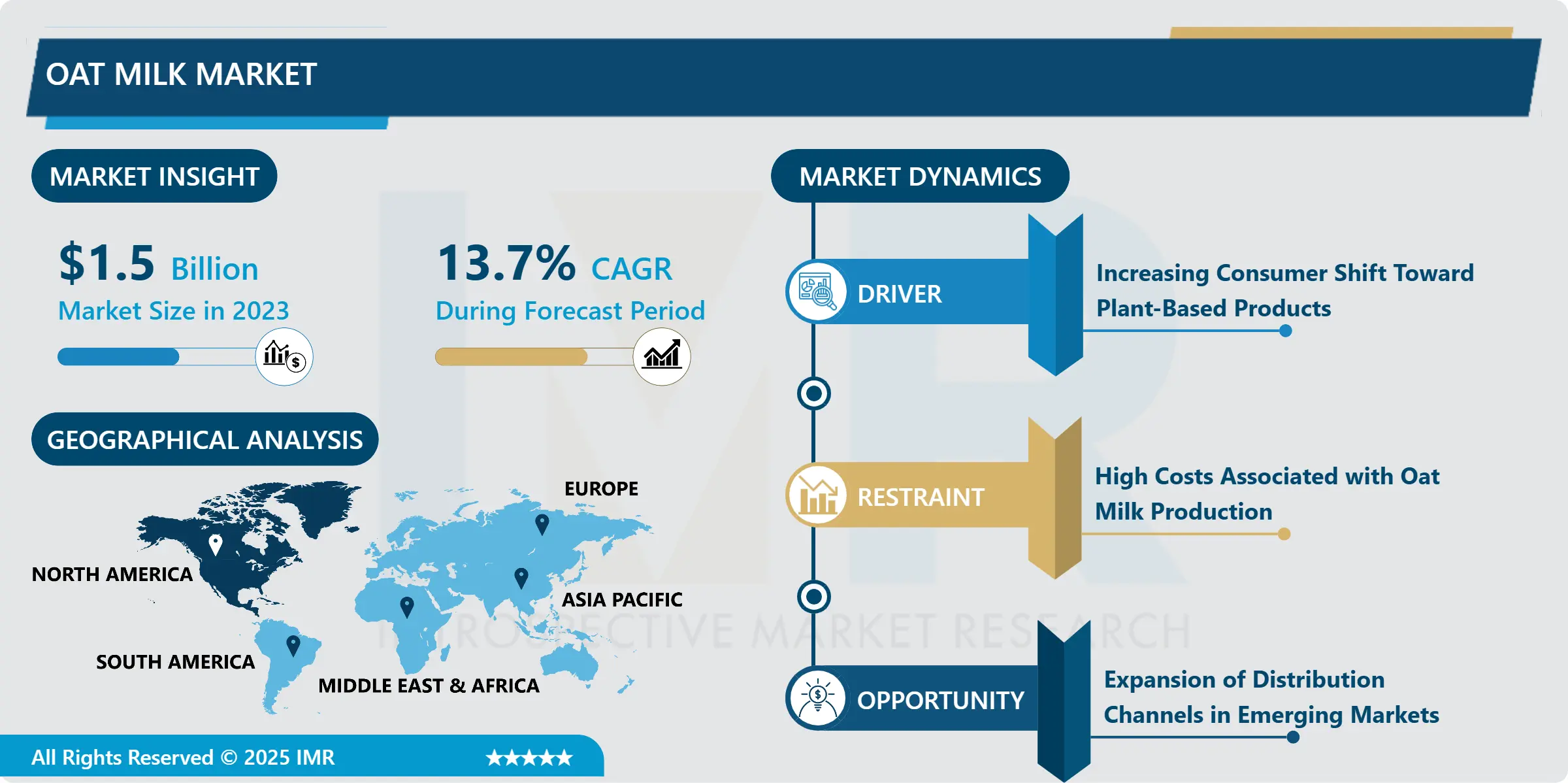

Oat Milk Market Size Was Valued at USD 1.5 Billion in 2023, and is Projected to Reach USD 4.8 Billion by 2032, Growing at a CAGR of 13.7% From 2024-2032.

The global oat milk market has emerged as a prominent segment within the plant-based dairy alternatives industry, witnessing strong growth due to increasing consumer preference for sustainable, nutritious, and lactose-free products. Oat milk, derived from whole oat grains and water, is gaining popularity not only among vegans but also among health-conscious and environmentally aware consumers. Its creamy texture, high fiber content, and naturally sweet taste make it a preferred substitute for traditional dairy milk and other plant-based options.

North America and Europe currently dominate the oat milk market, driven by widespread product availability, strong retail distribution networks, and increasing awareness of vegan diets and food allergies. However, the Asia-Pacific region is expected to witness the fastest growth over the forecast period due to rising disposable incomes, increasing urbanization, and expanding lactose-intolerant populations. The growing number of cafés, coffee chains, and specialty food outlets that use oat milk as a base for lattes and smoothies is further fueling market expansion globally.

Market dynamics in the oat milk sector are shaped by shifting dietary habits and rising concerns about animal welfare and environmental sustainability. Oat milk requires significantly less water and emits fewer greenhouse gases compared to dairy and almond milk, making it an appealing choice for eco-conscious consumers. Additionally, manufacturers are responding to this demand by expanding their portfolios with flavored oat milk, organic options, and barista blends.

However, the market faces challenges related to price sensitivity and limited consumer awareness in developing regions. Supply chain disruptions, especially in sourcing high-quality oats and ensuring clean-label certifications, may impact cost structures. Nevertheless, ongoing innovation, partnerships with foodservice providers, and investment in regional production are expected to create growth opportunities, solidifying oat milk’s place in the global beverage market.

Oat Milk Market Trend Analysis:

Growing Demand for Organic Oat Milk

The demand for organic oat milk is rising steadily as consumers become increasingly conscious of what goes into their food and beverages. Organic oat milk, made from oats grown without synthetic pesticides, herbicides, or genetically modified organisms (GMOs), aligns with the clean-label movement and appeals to health-focused consumers seeking natural and minimally processed alternatives. This segment has particularly gained traction among millennials and Gen Z consumers, who prioritize sustainability, transparency, and ethical sourcing in their purchasing decisions. Organic oat milk is also perceived to be safer and more nutrient-richer, contributing to its rising preference in households and premium foodservice outlets.

Retailers and brands are capitalizing on this trend by expanding their organic oat milk offerings across supermarkets, specialty stores, and e-commerce platforms. Product differentiation through certifications such as USDA Organic, EU Organic, and Non-GMO Project Verified is becoming a key marketing strategy. Furthermore, the integration of functional ingredients like calcium, vitamin D, and probiotics into organic oat milk is enhancing its appeal as a health-enhancing beverage. As consumers continue to shift away from synthetic additives and processed foods, the organic oat milk segment is expected to play a crucial role in the future growth of the plant-based beverage market.

Barista-Grade Oat Milk Driving Foodservice Adoption

A major trend shaping the oat milk market is the rising popularity of barista-grade oat milk specifically formulated for coffee and espresso-based drinks. Unlike standard oat milk, barista versions are crafted to steam and froth like dairy milk, offering a rich, creamy texture that blends seamlessly with coffee. This has made it the preferred non-dairy option for coffee shops, cafés, and specialty beverage outlets. Leading coffee chains such as Starbucks, Costa Coffee, and Blue Bottle have introduced barista oat milk in their menus, contributing significantly to consumer exposure and market growth.

The demand for barista oat milk is also being fueled by the growing global café culture and the increasing number of consumers opting for plant-based milk in their daily coffee rituals. This segment is not only reshaping customer preferences in foodservice but also influencing at-home consumption trends, with many brands launching retail barista editions for coffee enthusiasts. As consumers seek out café-quality experiences at home, the barista oat milk category is expected to grow rapidly, supported by innovations in formulation, taste enhancement, and packaging design aimed at replicating professional coffeehouse standards.

Oat Milk Market Segment Analysis:

Oat Milk Market is Segmented on the basis of type, Flavor, Format, and Region.

By Type, Reduced fat segment is expected to dominate the market during the forecast period

The reduced fat oat milk segment is projected to dominate the global oat milk market during the forecast period. This growth is driven by increasing consumer demand for lower-calorie, heart-healthy beverage options that still offer the creamy texture and nutritional benefits of full-fat oat milk. With growing awareness around obesity, cholesterol, and lifestyle-related diseases, health-conscious individuals are shifting toward beverages that align with weight management and wellness goals. Reduced fat oat milk provides a balance between taste and nutrition, making it a popular choice among both individual consumers and institutional buyers such as schools and hospitals.

In addition, the rise of fitness culture and the emphasis on plant-based, low-fat diets are contributing to the segment’s strong momentum. Manufacturers are innovating within this space by introducing reduced fat variants fortified with essential nutrients like calcium, vitamin D, and B12, to enhance their functional appeal. These products are also being marketed with clean-label claims and sustainable packaging, appealing to environmentally and health-conscious segments of the population. As a result, the reduced fat oat milk category is expected to see substantial growth in both developed and emerging markets over the coming years.

By Flavoured, Natural segment expected to held the largest share

Within the flavored oat milk category, the natural segment is anticipated to hold the largest market share during the forecast period. This trend is largely driven by the growing consumer demand for clean-label products that are free from artificial additives, preservatives, and sweeteners. Natural flavored oat milk typically includes subtle enhancements such as vanilla, cinnamon, or cocoa derived from organic or plant-based sources, offering a mild and authentic taste profile that resonates with health-conscious buyers. As awareness of food ingredients continues to rise, consumers are increasingly choosing beverages with simple, recognizable components that support both wellness and transparency.

Furthermore, the natural flavor segment benefits from its broad appeal across different age groups and consumption occasions. It is widely preferred for use in cereals, smoothies, baking, and coffee due to its light and versatile taste, which doesn’t overpower other ingredients. Brands are tapping into this preference by highlighting “natural” or “no added flavor” claims on packaging and promoting the purity of their sourcing and manufacturing processes. As the push toward natural and minimally processed food products continues, the natural flavored oat milk segment is well-positioned to maintain its dominance in the global market.

Oat Milk Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to dominate the global oat milk market over the forecast period, driven by the region’s increasing adoption of plant-based and dairy-free alternatives. In countries like the United States and Canada, consumer awareness of health and environmental issues has led to a significant shift toward plant-based diets. The growing prevalence of lactose intolerance, along with an increasing number of consumers embracing vegan and flexitarian lifestyles, has spurred demand for oat milk as a sustainable, nutrient-rich alternative to dairy. The convenience of oat milk in various food and beverage applications, such as coffee, smoothies, and baking, is further bolstering its market presence in North America.

In addition, North America benefits from a well-established retail infrastructure and a rapidly expanding foodservice sector that is increasingly incorporating oat milk into their offerings. Major coffee chains like Starbucks and Dunkin’ Donuts have adopted oat milk in their menu items, contributing to widespread consumer exposure. Moreover, the strong presence of leading oat milk brands such as Oatly, Califia Farms, and Silk in the region continues to fuel competition, innovation, and product diversification, which enhances consumer choice. With a combination of health-consciousness, environmental awareness, and expanding retail options, North America is poised to maintain its leadership in the oat milk market during the forecast period.

Active Key Players in the Oat Milk Market:

Alpro (Belgium)

Califia Farms (USA)

Chobani LLC (USA)

Danone S.A. (France)

Elmhurst 1925 (USA)

Happy Planet (Canada)

Minor Figures (UK)

Nestlé S.A. (Switzerland)

Oatly (Sweden)

Oatsome (USA)

Pacific Foods (USA)

Planet Oat (USA)

Rude Health (UK)

The Hain Celestial Group (USA)

Thrive Market (USA), Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Oat Milk Market by Type

4.1 Oat Milk Market Snapshot and Growth Engine

4.2 Oat Milk Market Overview

4.3 Regular / Full fat

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Regular / Full fat: Geographic Segmentation Analysis

4.4 Reduced fat

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Reduced fat: Geographic Segmentation Analysis

Chapter 5: Oat Milk Market by Flavor

5.1 Oat Milk Market Snapshot and Growth Engine

5.2 Oat Milk Market Overview

5.3 Natural

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Natural: Geographic Segmentation Analysis

5.4 Flavored

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Flavored: Geographic Segmentation Analysis

Chapter 6: Oat Milk Market by Format

6.1 Oat Milk Market Snapshot and Growth Engine

6.2 Oat Milk Market Overview

6.3 Shelf-stable

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Shelf-stable: Geographic Segmentation Analysis

6.4 Refrigerated

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Refrigerated: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Oat Milk Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ALPRO (BELGIUM)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CALIFIA FARMS (USA)

7.4 CHOBANI LLC (USA)

7.5 DANONE S.A. (FRANCE)

7.6 ELMHURST 1925 (USA)

7.7 HAPPY PLANET (CANADA)

7.8 MINOR FIGURES (UK)

7.9 NESTLÉ S.A. (SWITZERLAND)

7.10 OATLY (SWEDEN)

7.11 OATSOME (USA)

7.12 PACIFIC FOODS (USA)

7.13 PLANET OAT (USA)

7.14 RUDE HEALTH (UK)

7.15 THE HAIN CELESTIAL GROUP (USA)

7.16 THRIVE MARKET (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Oat Milk Market By Region

8.1 Overview

8.2. North America Oat Milk Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Regular / Full fat

8.2.4.2 Reduced fat

8.2.5 Historic and Forecasted Market Size By Flavor

8.2.5.1 Natural

8.2.5.2 Flavored

8.2.6 Historic and Forecasted Market Size By Format

8.2.6.1 Shelf-stable

8.2.6.2 Refrigerated

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Oat Milk Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Regular / Full fat

8.3.4.2 Reduced fat

8.3.5 Historic and Forecasted Market Size By Flavor

8.3.5.1 Natural

8.3.5.2 Flavored

8.3.6 Historic and Forecasted Market Size By Format

8.3.6.1 Shelf-stable

8.3.6.2 Refrigerated

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Oat Milk Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Regular / Full fat

8.4.4.2 Reduced fat

8.4.5 Historic and Forecasted Market Size By Flavor

8.4.5.1 Natural

8.4.5.2 Flavored

8.4.6 Historic and Forecasted Market Size By Format

8.4.6.1 Shelf-stable

8.4.6.2 Refrigerated

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Oat Milk Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Regular / Full fat

8.5.4.2 Reduced fat

8.5.5 Historic and Forecasted Market Size By Flavor

8.5.5.1 Natural

8.5.5.2 Flavored

8.5.6 Historic and Forecasted Market Size By Format

8.5.6.1 Shelf-stable

8.5.6.2 Refrigerated

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Oat Milk Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Regular / Full fat

8.6.4.2 Reduced fat

8.6.5 Historic and Forecasted Market Size By Flavor

8.6.5.1 Natural

8.6.5.2 Flavored

8.6.6 Historic and Forecasted Market Size By Format

8.6.6.1 Shelf-stable

8.6.6.2 Refrigerated

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Oat Milk Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Regular / Full fat

8.7.4.2 Reduced fat

8.7.5 Historic and Forecasted Market Size By Flavor

8.7.5.1 Natural

8.7.5.2 Flavored

8.7.6 Historic and Forecasted Market Size By Format

8.7.6.1 Shelf-stable

8.7.6.2 Refrigerated

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Oat Milk Market research report?

A1: The forecast period in the Oat Milk Market research report is 2024-2032.

Q2: Who are the key players in the Oat Milk Market?

A2: Alpro (Belgium), Califia Farms (USA), Chobani LLC (USA), Danone S.A. (France), Elmhurst 1925 (USA), Happy Planet (Canada), Minor Figures (UK), Nestlé S.A. (Switzerland), Oatly (Sweden), Oatsome (USA), Pacific Foods (USA), Planet Oat (USA), Rude Health (UK), The Hain Celestial Group (USA), Thrive Market (USA), Other Active Players.

Q3: What are the segments of the Oat Milk Market?

A3: The Oat Milk Market is segmented into Type, Flavor, Format and region. By Type, the market is categorized into Regular / Full fat, Reduced fat. By Flavor, the market is categorized into Natural, Flavored. By Format, the market is categorized into Shelf-stable, Refrigerated. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Oat Milk Market?

A4: The oat milk market refers to the growing global industry focused on the production, distribution, and consumption of oat-based milk, a plant-based alternative to dairy milk. Made from oats and water, oat milk is favored for its creamy texture, naturally sweet flavor, and nutritional benefits such as fiber and vitamins. It has gained significant traction among health-conscious, lactose-intolerant, vegan, and environmentally aware consumers due to its sustainable production process, which requires less water and land compared to dairy and other plant-based milk alternatives. The market continues to expand, driven by increasing demand across retail, foodservice, and beverage sectors.

Q5: How big is the Oat Milk Market?

A5: Oat Milk Market Size Was Valued at USD 1.5 Billion in 2023, and is Projected to Reach USD 4.8 Billion by 2032, Growing at a CAGR of 13.7% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!