Stay Ahead in Fast-Growing Economies.

Browse Reports NowNon-Dairy Ice Cream Market Industry Overview, Key Insights & Forecast to 2032

The non-dairy ice cream market refers to the segment of the frozen dessert industry dedicated to products that are free from traditional dairy ingredients like milk, cream, and butter. Instead, these ice creams are typically made using alternatives such as coconut milk, almond milk, soy milk, or other plant-based ingredients.

IMR Group

Description

Non-Dairy Ice Cream Market Synopsis

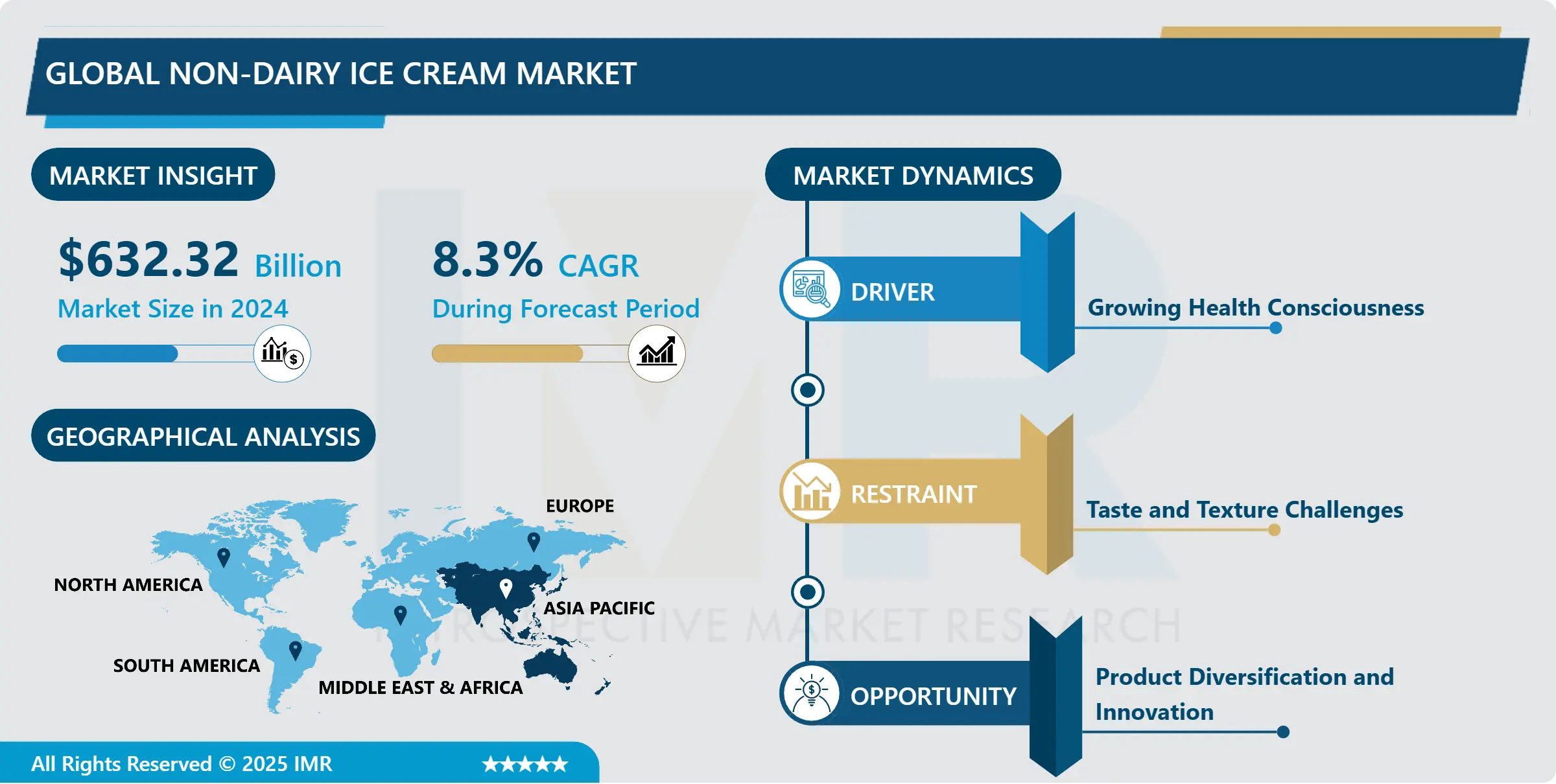

Non-Dairy Ice Cream Market Size Was Valued at USD 632.32 Million in 2024 and is Projected to Reach USD 1196.64 Million by 2032, Growing at a CAGR of 8.3% From 2025-2032.

The non-dairy ice cream market refers to the segment of the frozen dessert industry dedicated to products that are free from traditional dairy ingredients like milk, cream, and butter. Instead, these ice creams are typically made using alternatives such as coconut milk, almond milk, soy milk, or other plant-based ingredients. The rising consumer demand for dairy-free options, driven by factors such as lactose intolerance, ethical concerns, and dietary preferences like veganism, has fueled the growth of this market. Non-dairy ice creams offer a range of flavors and textures comparable to traditional ice creams, appealing to a diverse consumer base seeking healthier, more sustainable, and inclusive dessert options. As the market continues to expand, manufacturers are innovating with new ingredients, flavors, and production methods to meet the evolving preferences and expectations of consumers.

Key Market Highlights

Market Size in 2024: USD 632.32 Million

Projected Market Size by 2032: USD 1196.64 Million

CAGR (2025–2032): 8.3%

Fastest-Growing Market: Asia Pacific

By Source: The Almonds Segment is anticipated to lead the market by holding 28.46% of market share throughout the forecast period.

By Product: The Take-home segment is expected to grab 36.81% market share to maintain dominance over the forecast period.

By Region: Asia Pacific is projected to hold 31.05% market share during the forecast period.

Active Players: Eden Creamery LLC, Over The Moo, Dream, Swedish Glace, NadaMoo, and Other Active Players.

Non-Dairy Ice Cream Market Trend Analysis

Driving Forces Behind the Growth of the Non-Dairy Ice Cream Market

An increased incidence rate of lactose intolerance coupled with the increasing cases of dairy allergies in the general population contributes to the growth of the non-dairy ice cream market. Booting out, lactose intolerance which is the inability to take milk or any dairy products mainly affects a one third of the whole world population, globally it is estimated that up to 65 percent of the population have some form of lactose intolerance. Which is why, with increased knowledge about this ailment, people are not only looking for substitutes to dairy in general but to ice cream as well. Likewise, with the ordinary intolerance which may be mild or serious, the general public is opting to skip the foods derived from dairy products. Many people have become aware of special diets in the recent past as more and more people develop restricted diets due to lactose intolerance or other health issues in the society; the market for non-dairy ice cream has hence consequently risen, encouraging more manufactures to produce new flavors and varieties.

Added to this, a shift in consumers’ perception towards health-benefit properties of non-dairy products has also boosted the interest in this segment of Non-Dairy Ice Creams. Consumers are also opting for dairy-free foods due to an increasing trend towards healthier dietary choices as a way of maintaining good health. When prepared, non-dairy is recognized as a healthier choice than the conventional ice cream because usually consumed in fewer calories less saturated fat content and lack of cholesterol. Continuing with the alternative concept, more and more people, became more informed with the health benefits of consuming more plant based products mostly due to the adoption of a vegan diet, Non-dairy has always been the go to when it comes to frozen desserts. Overall, the steady change to a more healthy and conscious consumption pattern constitutes substantial growth prospects for the non-dairy ice cream market in the near future.

Environmental Awareness Driving the Rise of Non-Dairy Ice Cream

Rising concerns about the negative effects dairies have on the environment implies that many people are likely to shift towards other products that are not related to dairies such as non dairy ice cream. Such feelings of the current population on water consumption, greenhouse effect, and the welfare of the animals used in traditional practices of dairy farming, have seen the new generation consumers adopt the new innovative and sustainable forms of dairy farming. Hence, since non-dairy ice cream is made without the use of cow’s milk, they are friendly to the environment and the consumers contributor to compounding environmental issues such as global warming. This shift is also seen as a part of a continuous quest for products that are friendly to the environment by different global citizens.

To meet this cultures shift toward environmentally friendly products cues from the non-dairy ice cream market have called for aspiration of new formulations that use plant based ingredients including almond milk, coconut milk, soy milk and cashew milk. It is imperative to note that these alternatives not only suit the lactose intolerance, or dairy allergy but also vegans, or people with concern for animal life. Thus, using plant-based products as raw materials, manufacturers get not only more ecological but also a differentiated product that contains less saturated fats and cholesterol in comparison with the traditional ice cream on its basis. The positive effects of taste without the health drawbacks related to dairy, positive environmental effects, and ethical concerns have propelled non-dairy into the future and increased the range and choice for consumers.

Non-Dairy Ice Cream Market Segment Analysis:

Non-Dairy Ice Cream Market is Segmented based on Source, Form, Product, Distribution Channels and Flavor

By Source, Almonds segment is expected to dominate the market during the forecast period

Derived from the food-wholesome almonds, popular for their peculiarity for nutritive values and subtle, nutty taste, almonds have remained the most preferred in the production of the plant-based milk substitutes. The focus on consuming better and more eco-friendly dairy alternatives that can easily substitute traditional cow’s milk stimulated the increase in interest in almonds milk. It has a very fine grain and it has very little flavor, so can be added to products like cereals, morning shakes, breads, etc. Hence, almonds are produced and marketed around the world, and their availability combined with the fairly cheap price of almond milk helps maintain the plant-based milk market under the rule of almond milk.

While soy and almond milk have always had their claim in the dairy substitutes market, coconut milk has recently soared high and has found its own market. Coconut milk, unlike almond milk, is originated from mature coconuts whereby the fleshy part is ground to produce a smooth paste which is then incubated before extracting the milk; this gives it a unique taste and creamy texture. Most plant-based milk have a specific flavor, which will not be the case with coconut milk, as it is both versatile for use in sweet and savory dishes. Be it curries, and soups, and sweets and even beverages, people could not get enough of coconut milk; this thick, delicious and creamy dairy-free solution has not only captured the hearts of lovers of healthy dairy alternatives that do not lack flavors or richness. Furthermore, people have now started realizing its healthy values like MCTs content and religion, such as lauric acid putting coconut milk on the same pedestal of plant based milk rivals.

By Product, Take-home segment held the largest share in 2024

Tetra pak products, especially in terms of plant based milk, are popular with consumers because of the several advantages that include the fact that people can buy large quantities of a particular kind of milk to indulge in as often as they want. These bulk sizes are mostly bought while conducting their usual shopping activities in large stores, specifically supermarkets or through online platforms and this enables consumers to afford to stock plant based milk in large quantity for daily use. The nonstandard nature of take-home packages complements the drift toward acquiring more wholesome and sustainable production of dairy and plant-based milk products, which ensures a constant buying frequency of plant-based milk as a major household necessity. Hence, tempting various tastes and variants, which are available in take-home packages, can suit the different choice of the consumers with different diets and needs, which again secures their leading position in the specified market sector as the dominant product category.

According to the statistics, take-home packs have the most significant market share, whereas impulsive purchases are also significantly important for the Plant-Based Milk consumption, especially in convenience stores and supermarkets. These serve-sized packagings are placed close to the counters where customers might purchase a carton set while paying at the cash register or other frequently accessed zones. Some of the reasons that can lead to impulse buying include necessity, where a person only intends to buy one product but ends up buying another product for one reason or the other; need for convenience, for instance, a person only intends to get a snack but ends up being compelled to buy a certain flavor or brand of the snack. It is vital to note that the new Plant-Based milk in an single-serve packaging is not only meeting the need of 1-time consumers, but over all, they form a pathway to new consumers in the perusal of plant-based milk products. Therefore, sales of impulse products also fall directly into the growth of the plant-based milk market in addition to customers’ constant demand for take-home packs which gives a broader market reach to the product.

Non-Dairy Ice Cream Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Among the markets of Asia Pacific region, the non-dairy ice cream has establish a dominating position as they are supported by number of factors that have complements with the altering consumer’s trend. As a result of evolving consumer preferences and expectations towards consumption of nutrition and health-enhancing products, the use of plant-based products such as soy-based and other plant-based dairy products have gained prominence in Southeast Asian countries including China, Japan, and India. This change is not only driven by concerns about the effects of consuming milk and other dairy products on health but also due to the ever-growing sensitivity of consumers towards the environmental consequences of dairy production processes. Therefore, this type of product has become the topic of high interest and a huge market for both domestic and foreign manufacturers.

Furthermore, the increasing rate of urbanization further the middle income group in the region and the consumer preferences for non-dairy ice creams has also boosted the market. As one observes that consumers have higher disposable income, they prefer more luxurious or premium products such as non-dairy frozen desserts. This has been due to the realization of the large market potential in this segment by major players in the food industry that are consequently dedicating a lot of capital in both product customization from what they consider the standard palate palate and appropriate marketing strategies in the particular regions. Adopting to these characteristics and consumers preferences these companies have well established their ground and created huge market share to their own selves in non dairy ice cream market in Asia Pacific. Altogether, this approach, along with the continually increasing interest in plant-based products among consumers providing the local market with a strong impulse for constant development, it has become one of the fastest-growing segments within the ice cream industry of the region.

Active Key Players in the Non-Dairy Ice Cream Market

Eden Creamery LLC

Over The Moo

Dream

Swedish Glace

NadaMoo

Trader Joe’s

Van Leeuwen Artisan Ice Cream

Unilever

Danone, General Mills

The Booja-Booja Co. Central Europe Ltd.

Happy Cow Limited

Tofutti Brands, Inc.

Bliss Unlimited, LLC

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Non-Dairy Ice Cream Market by Source (2018-2032)

4.1 Non-Dairy Ice Cream Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Coconut milk

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Almond milk

4.5 Cashew milk

4.6 Soy milk

4.7 Other sources

Chapter 5: Non-Dairy Ice Cream Market by Form (2018-2032)

5.1 Non-Dairy Ice Cream Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Singles

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Blends

Chapter 6: Non-Dairy Ice Cream Market by Product (2018-2032)

6.1 Non-Dairy Ice Cream Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Impulse

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Artisanal

6.5 Take home

Chapter 7: Non-Dairy Ice Cream Market by Distribution Channels (2018-2032)

7.1 Non-Dairy Ice Cream Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Supermarkets

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Convenience Stores

7.5 Food & Drink Specialists

7.6 Restaurants

7.7 Online Stores

7.8 Others

Chapter 8: Non-Dairy Ice Cream Market by Flavor (2018-2032)

8.1 Non-Dairy Ice Cream Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Vanilla

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Chocolate

8.5 Butter pecan

8.6 Strawberry

8.7 Neapolitan

8.8 Cookies & Cream

8.9 Mint Choco chip

8.10 Caramel

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Non-Dairy Ice Cream Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 A&B INGREDIENTS (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 AGT FOOD AND INGREDIENTS INC. (CANADA)

9.4 AXIOM FOODS INC. (UNITED STATES)

9.5 BIOWAY (XIAN) ORGANIC INGREDIENTS COLTD. (CHINA)

9.6 BURCON NUTRASCIENCE CORPORATION (CANADA)

9.7 COSUCRA GROUPE WARCOING SA (BELGIUM)

9.8 EMSLAND GROUP (GERMANY)

9.9 FARBEST BRANDS (UNITED STATES)

9.10 FENCHEM BIOTEK LTD. (CHINA)

9.11 GLANBIA PLC (IRELAND)

9.12 INGREDION INCORPORATED (UNITED STATES)

9.13 KERRY GROUP PLC (IRELAND)

9.14 NORBEN COMPANY INC. (UNITED STATES)

9.15 NUTRI-PEA LIMITED (CANADA)

9.16 ROQBERRY (UNITED KINGDOM)

9.17 ROQUETTE FRÈRES (FRANCE)

9.18 SHANDONG JIANYUAN GROUP (CHINA)

9.19 THE SCOULAR COMPANY (UNITED STATES)

9.20 VESTKORN MILLING AS (NORWAY)

9.21 YANTAI SHUANGTA FOOD COLTD. (CHINA)

9.22 OTHER KEY PLAYERS

Chapter 10: Global Non-Dairy Ice Cream Market By Region

10.1 Overview

10.2. North America Non-Dairy Ice Cream Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Source

10.2.4.1 Coconut milk

10.2.4.2 Almond milk

10.2.4.3 Cashew milk

10.2.4.4 Soy milk

10.2.4.5 Other sources

10.2.5 Historic and Forecasted Market Size by Form

10.2.5.1 Singles

10.2.5.2 Blends

10.2.6 Historic and Forecasted Market Size by Product

10.2.6.1 Impulse

10.2.6.2 Artisanal

10.2.6.3 Take home

10.2.7 Historic and Forecasted Market Size by Distribution Channels

10.2.7.1 Supermarkets

10.2.7.2 Convenience Stores

10.2.7.3 Food & Drink Specialists

10.2.7.4 Restaurants

10.2.7.5 Online Stores

10.2.7.6 Others

10.2.8 Historic and Forecasted Market Size by Flavor

10.2.8.1 Vanilla

10.2.8.2 Chocolate

10.2.8.3 Butter pecan

10.2.8.4 Strawberry

10.2.8.5 Neapolitan

10.2.8.6 Cookies & Cream

10.2.8.7 Mint Choco chip

10.2.8.8 Caramel

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Non-Dairy Ice Cream Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Source

10.3.4.1 Coconut milk

10.3.4.2 Almond milk

10.3.4.3 Cashew milk

10.3.4.4 Soy milk

10.3.4.5 Other sources

10.3.5 Historic and Forecasted Market Size by Form

10.3.5.1 Singles

10.3.5.2 Blends

10.3.6 Historic and Forecasted Market Size by Product

10.3.6.1 Impulse

10.3.6.2 Artisanal

10.3.6.3 Take home

10.3.7 Historic and Forecasted Market Size by Distribution Channels

10.3.7.1 Supermarkets

10.3.7.2 Convenience Stores

10.3.7.3 Food & Drink Specialists

10.3.7.4 Restaurants

10.3.7.5 Online Stores

10.3.7.6 Others

10.3.8 Historic and Forecasted Market Size by Flavor

10.3.8.1 Vanilla

10.3.8.2 Chocolate

10.3.8.3 Butter pecan

10.3.8.4 Strawberry

10.3.8.5 Neapolitan

10.3.8.6 Cookies & Cream

10.3.8.7 Mint Choco chip

10.3.8.8 Caramel

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Non-Dairy Ice Cream Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Source

10.4.4.1 Coconut milk

10.4.4.2 Almond milk

10.4.4.3 Cashew milk

10.4.4.4 Soy milk

10.4.4.5 Other sources

10.4.5 Historic and Forecasted Market Size by Form

10.4.5.1 Singles

10.4.5.2 Blends

10.4.6 Historic and Forecasted Market Size by Product

10.4.6.1 Impulse

10.4.6.2 Artisanal

10.4.6.3 Take home

10.4.7 Historic and Forecasted Market Size by Distribution Channels

10.4.7.1 Supermarkets

10.4.7.2 Convenience Stores

10.4.7.3 Food & Drink Specialists

10.4.7.4 Restaurants

10.4.7.5 Online Stores

10.4.7.6 Others

10.4.8 Historic and Forecasted Market Size by Flavor

10.4.8.1 Vanilla

10.4.8.2 Chocolate

10.4.8.3 Butter pecan

10.4.8.4 Strawberry

10.4.8.5 Neapolitan

10.4.8.6 Cookies & Cream

10.4.8.7 Mint Choco chip

10.4.8.8 Caramel

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Non-Dairy Ice Cream Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Source

10.5.4.1 Coconut milk

10.5.4.2 Almond milk

10.5.4.3 Cashew milk

10.5.4.4 Soy milk

10.5.4.5 Other sources

10.5.5 Historic and Forecasted Market Size by Form

10.5.5.1 Singles

10.5.5.2 Blends

10.5.6 Historic and Forecasted Market Size by Product

10.5.6.1 Impulse

10.5.6.2 Artisanal

10.5.6.3 Take home

10.5.7 Historic and Forecasted Market Size by Distribution Channels

10.5.7.1 Supermarkets

10.5.7.2 Convenience Stores

10.5.7.3 Food & Drink Specialists

10.5.7.4 Restaurants

10.5.7.5 Online Stores

10.5.7.6 Others

10.5.8 Historic and Forecasted Market Size by Flavor

10.5.8.1 Vanilla

10.5.8.2 Chocolate

10.5.8.3 Butter pecan

10.5.8.4 Strawberry

10.5.8.5 Neapolitan

10.5.8.6 Cookies & Cream

10.5.8.7 Mint Choco chip

10.5.8.8 Caramel

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Non-Dairy Ice Cream Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Source

10.6.4.1 Coconut milk

10.6.4.2 Almond milk

10.6.4.3 Cashew milk

10.6.4.4 Soy milk

10.6.4.5 Other sources

10.6.5 Historic and Forecasted Market Size by Form

10.6.5.1 Singles

10.6.5.2 Blends

10.6.6 Historic and Forecasted Market Size by Product

10.6.6.1 Impulse

10.6.6.2 Artisanal

10.6.6.3 Take home

10.6.7 Historic and Forecasted Market Size by Distribution Channels

10.6.7.1 Supermarkets

10.6.7.2 Convenience Stores

10.6.7.3 Food & Drink Specialists

10.6.7.4 Restaurants

10.6.7.5 Online Stores

10.6.7.6 Others

10.6.8 Historic and Forecasted Market Size by Flavor

10.6.8.1 Vanilla

10.6.8.2 Chocolate

10.6.8.3 Butter pecan

10.6.8.4 Strawberry

10.6.8.5 Neapolitan

10.6.8.6 Cookies & Cream

10.6.8.7 Mint Choco chip

10.6.8.8 Caramel

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Non-Dairy Ice Cream Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Source

10.7.4.1 Coconut milk

10.7.4.2 Almond milk

10.7.4.3 Cashew milk

10.7.4.4 Soy milk

10.7.4.5 Other sources

10.7.5 Historic and Forecasted Market Size by Form

10.7.5.1 Singles

10.7.5.2 Blends

10.7.6 Historic and Forecasted Market Size by Product

10.7.6.1 Impulse

10.7.6.2 Artisanal

10.7.6.3 Take home

10.7.7 Historic and Forecasted Market Size by Distribution Channels

10.7.7.1 Supermarkets

10.7.7.2 Convenience Stores

10.7.7.3 Food & Drink Specialists

10.7.7.4 Restaurants

10.7.7.5 Online Stores

10.7.7.6 Others

10.7.8 Historic and Forecasted Market Size by Flavor

10.7.8.1 Vanilla

10.7.8.2 Chocolate

10.7.8.3 Butter pecan

10.7.8.4 Strawberry

10.7.8.5 Neapolitan

10.7.8.6 Cookies & Cream

10.7.8.7 Mint Choco chip

10.7.8.8 Caramel

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Non-Dairy Ice Cream Market research report?

A1: The forecast period in the Non-Dairy Ice Cream Market research report is 2025-2032.

Q2: Who are the key players in the Non-Dairy Ice Cream Market?

A2: Eden Creamery LLC, Over The Moo, Dream, Swedish Glace, NadaMoo, Trader Joe’s, Van Leeuwen Artisan Ice Cream, Unilever, Danone, General Mills, The Booja-Booja Co. Central Europe Ltd., Happy Cow Limited, Tofutti Brands, Inc., Bliss Unlimited, LLC and Other Active Players.

Q3: What are the segments of the Non-Dairy Ice Cream Market?

A3: The Non-Dairy Ice Cream Market is segmented into By Source, By Form, By Product, By Distribution Channels, By Flavor and region. By Source, the market is categorized into Coconut milk, Almond milk, Cashew milk, Soy milk and Other sources. By Form, the market is categorized into Singles and Blends. By Product, the market is categorized into Impulse, Artisanal and Take home. By Distribution Channels, the market is categorized into Supermarkets, Convenience Stores, Food & Drink Specialists, Restaurants, Online Stores and Others. By Flavor, the market is categorized into Vanilla, Chocolate, Butter pecan, Strawberry, Neapolitan, Cookies & Cream, Mint Choco chip and Caramel. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Non-Dairy Ice Cream Market?

A4: The non-dairy ice cream market refers to the segment of the frozen dessert industry dedicated to products that are free from traditional dairy ingredients like milk, cream, and butter. Instead, these ice creams are typically made using alternatives such as coconut milk, almond milk, soy milk, or other plant-based ingredients. The rising consumer demand for dairy-free options, driven by factors such as lactose intolerance, ethical concerns, and dietary preferences like veganism, has fueled the growth of this market. Non-dairy ice creams offer a range of flavors and textures comparable to traditional ice creams, appealing to a diverse consumer base seeking healthier, more sustainable, and inclusive dessert options. As the market continues to expand, manufacturers are innovating with new ingredients, flavors, and production methods to meet the evolving preferences and expectations of consumers.

Q5: How big is the Non-Dairy Ice Cream Market?

A5: Non-Dairy Ice Cream Market Size Was Valued at USD 632.32 Million in 2024 and is Projected to Reach USD 1196.64 Million by 2032, Growing at a CAGR of 8.3% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!