Stay Ahead in Fast-Growing Economies.

Browse Reports NowNon-Alcoholic Wine and Beer Market – Global Demand & Analysis

Low and reduced alcohol beverages become gaining popularity in many regions with key factors such as rising health awareness, promotional strategies, perception towards non-alcoholic beverages and others. According to research, low alcohol beverages such as light beer and reduced alcohol wine have become more welcomed in the marketplace and expected to stimulate the growth in non-alcoholic wine and beer market during forecast period.

IMR Group

Description

Global Non-Alcoholic Wine and Beer Market Overview

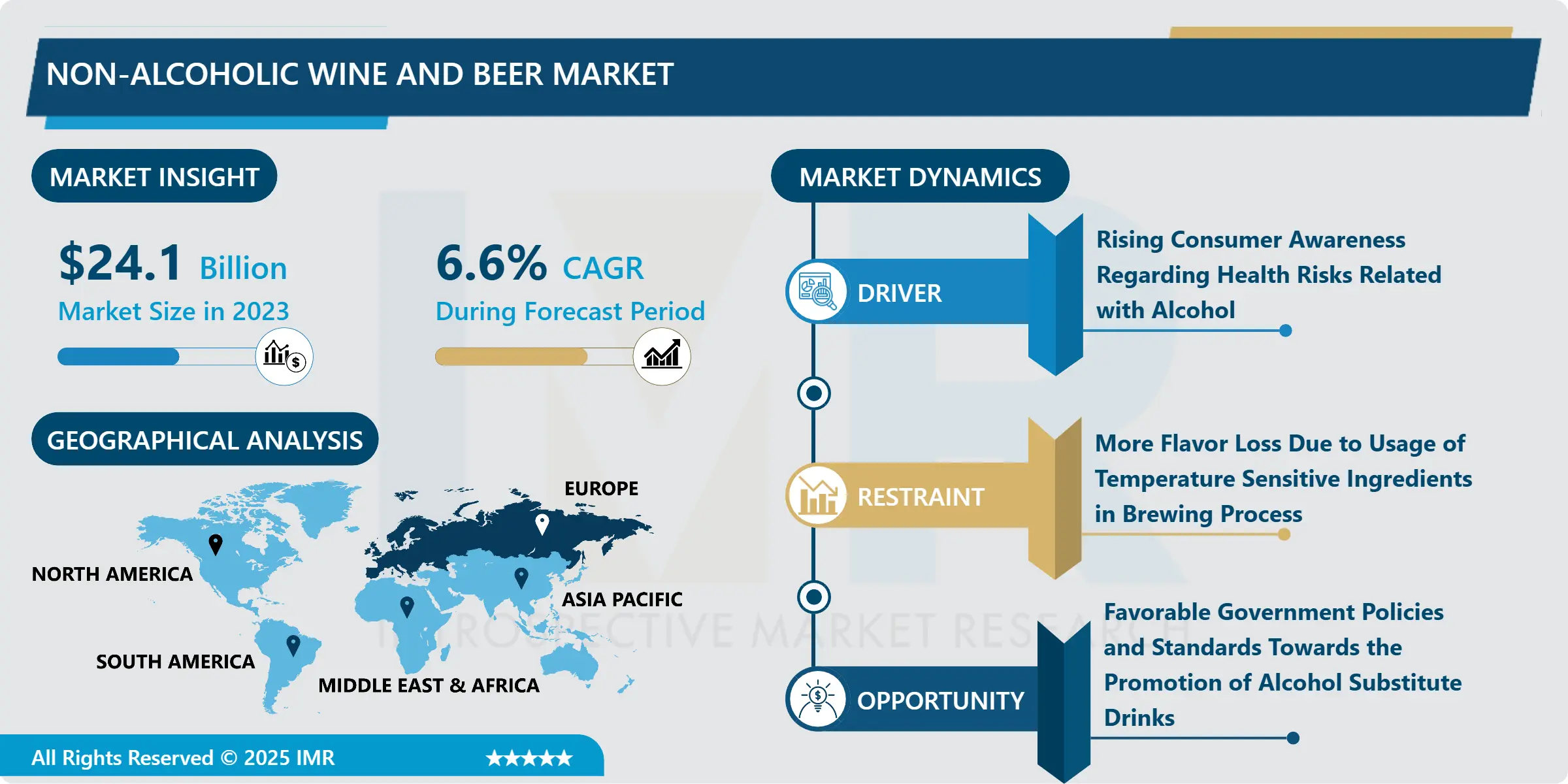

The Non-Alcoholic Wine and Beer market estimated at USD 25.69 Billion in the year 2024, is projected to reach a revised size of USD 42.84 Billion by 2032, growing at a CAGR of 6.6% over the analysis period 2025-2032

Low and reduced alcohol beverages become gaining popularity in many regions with key factors such as rising health awareness, promotional strategies, perception towards non-alcoholic beverages and others. According to research, low alcohol beverages such as light beer and reduced alcohol wine have become more welcomed in the marketplace and expected to stimulate the growth in non-alcoholic wine and beer market during forecast period. For instance, according to MDPI, increased the global consumption for light beer from 2006-2011 by 47.2 % in volume. Furthermore, the production of beers with light alcohol content is a booming segment in the global beer market. Over the last few decades, various beer and wine-based products have been developed globally, using different brewing process, technologies, and raw ingredients.

For instance, in Germany, a country with a huge tradition in beer production, according to the Reinheitsgebot, the single ingredients used for obtaining beer and wine are water, malted barley, grapes, hops and yeast. In addition, wheat, rice, rye, oats, maize, unmalted barley, and to a lower range sorghum, millet, and cassava are used in brewing process. According to MDPI, nonalcoholic and low alcoholic beers market growth in 2020 were 20% and it is expected to grow at 24% by 2021.

Report Coverage:

The global market report of Non-alcoholic Wine and Beer Market by the Introspective Market Research includes qualitative and quantitative insights. The company also offers a detailed analysis of the market size and growth rate of the possible segments. Different key insights presented in the report are an overview of that related of the market, also competitive rivalry, recent developments, collaboration and mergers.

Market Dynamics and Factor:

Drivers:

Low and non-alcoholic beverages are gaining more popularity with compared to traditional alcoholic beverages due to rising consumer awareness regarding health risks related with alcohol. For instance, in 2007, according to World Cancer Research Fund reported that a reduce in alcohol content from 14.2% to 10% would reduce the risk of breast and bowel cancer by 7%.

Rising the purchasing power along with switching spending pattern of millennials worldwide is expected to create significant demand for non-alcoholic beer over the forecast period.

Furthermore, significant investments in innovative technology such as cutting edge to produce low ABV beers are supplemental benefiting the strong growth of the alcohol-free beer market which is expected to grow in projected period.

Restraints:

More flavor loss due to usage of temperature sensitive ingredients in brewing process in order to application of high temperature process might be hindering market growth during forecast period.

Opportunities:

Supportive government policies and standards, regarding the promotional activities of alcohol substitutes drinks will stimulate the masses opportunities for existing key players. For instance, in European region, branding of the product as 0% alcohol free will boost the market growth as non-alcoholic beer is not disposed to excise duty.

Furthermore, home delivery of non-alcoholic beer and wine by food delivery services is creates new opportunity in non-alcoholic beer and wine market.

Market Segmentation

Type Insights

Based on product type beer is dominating the market during forecast period. For instance, according to the Distilled Spirits Council of the United States, beer is the dominant segment in the alcoholic beverage sector with a 47.8% market share of the total supplier revenue figures. Based on material type, according to lumen learning, yeasts are the main fermenter and applied in production of wine, beer and other alcoholic drinks. Based on type, alcohol free wine and beer dominating the market in projected period. Based on technology, according to Science Direct Journal, dealcoholization dominating the market in nonalcoholic wine and beer market during forecast period. Based on distribution channel, restaurants and bars dominating the market owing to 70% margin on wine and beer, according to BinWise Inventory Management.

Regional Analysis

Europe dominates the natural food additive market due to several key factors. The region’s strong focus on health and wellness has driven consumer demand for clean-label and organic food products, boosting the need for natural additives. Well-established food safety regulations and high-quality standards also support market growth. Additionally, Europe has a robust food processing industry with advanced technology and a large number of global and regional manufacturers actively innovating in natural additives. The presence of effective distribution channels and a wide variety of product offerings further strengthen Europe’s position. Countries like Germany and France lead in both production and consumption, making Europe a global hub for natural food additives during the forecast period.

Players Covered in Non-Alcoholic Wine and Beer Market are :

Big Drop Brewing

Carlsberg

Bernard Brewery

Erdinger Weibbrau

Suntory Beer

Anheuser-Bush InBev

Moscow Brewing Company

Heineken N.V.

Behnoush Iran

Pierre Chavin and other active players.

Key Industry Development Of Non-Alcoholic Wine and Beer Market

In July 2023, AB InBev announced a €31 million investment in its Belgium breweries, enhancing technology to expand non-alcoholic beer production and upgrade bottling capabilities. This strategic move underscores the company’s commitment to innovation and addressing evolving consumer preferences. The upgrades aim to improve efficiency and meet the growing demand for high-quality, non-alcoholic beverages, reinforcing AB InBev’s position as a global industry leader.

In May 2023, Heineken NV announced it had invested 1.5 billion reais ($300.8 million) in Brazil, focusing on the expansion of its premium and single malt beer portfolios. The investment aimed to strengthen the company’s presence in one of its largest markets by enhancing production capacity and catering to growing consumer demand for high-quality beer options. This move reaffirmed Heineken’s commitment to the Brazilian market.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Non-Alcoholic Wine and Beer Market by Type (2018-2032)

4.1 Non-Alcoholic Wine and Beer Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Alcohol Free

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Lower Alcohol

Chapter 5: Non-Alcoholic Wine and Beer Market by Source (2018-2032)

5.1 Non-Alcoholic Wine and Beer Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Grapes

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Apples

5.5 Malted Grains

5.6 Hops

5.7 Yeast

5.8 Enzymes

5.9 Others

Chapter 6: Non-Alcoholic Wine and Beer Market by Technology (2018-2032)

6.1 Non-Alcoholic Wine and Beer Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Restricted Fermentation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Dealcoholization

Chapter 7: Non-Alcoholic Wine and Beer Market by Sales Stores (2018-2032)

7.1 Non-Alcoholic Wine and Beer Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Liquor Stores

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Convenience Stores

7.5 Supermarkets

7.6 Online Stores

7.7 Restaurants & Bar

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Non-Alcoholic Wine and Beer Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ALARA WHOLEFOODS LTD. (LONDON

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 U.K.)

8.4 BARILLA G.E.R FRATELLI S.P.A (PARMA

8.5 ITALY)

8.6 CONAGRA BRANDS INC. (ILLINOIS

8.7 U.S.)

8.8 ENJOY LIFE FOODS (MONDELEZ INTERNATIONAL) (ILLINOIS

8.9 U.S.)

8.10 GENERAL MILLS INC. (MINNESOTA

8.11 U.S.)

8.12 KELLOGG’S COMPANY (MICHIGAN

8.13 U.S.)

8.14 NOUMI LIMITED (AUSTRALIA)

8.15 PRIMA FOODS LTD. (SOUTH WALES

8.16 U.K.)

8.17 THE HAIN CELESTIAL GROUP INC. (NEW YORK

8.18 U.S.)

8.19 THE KRAFT HEINZ COMPANY (ILLINOIS

8.20 U.S.)

8.21 OTHER KEY PLAYERS

Chapter 9: Global Non-Alcoholic Wine and Beer Market By Region

9.1 Overview

9.2. North America Non-Alcoholic Wine and Beer Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Alcohol Free

9.2.4.2 Lower Alcohol

9.2.5 Historic and Forecasted Market Size by Source

9.2.5.1 Grapes

9.2.5.2 Apples

9.2.5.3 Malted Grains

9.2.5.4 Hops

9.2.5.5 Yeast

9.2.5.6 Enzymes

9.2.5.7 Others

9.2.6 Historic and Forecasted Market Size by Technology

9.2.6.1 Restricted Fermentation

9.2.6.2 Dealcoholization

9.2.7 Historic and Forecasted Market Size by Sales Stores

9.2.7.1 Liquor Stores

9.2.7.2 Convenience Stores

9.2.7.3 Supermarkets

9.2.7.4 Online Stores

9.2.7.5 Restaurants & Bar

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Non-Alcoholic Wine and Beer Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Alcohol Free

9.3.4.2 Lower Alcohol

9.3.5 Historic and Forecasted Market Size by Source

9.3.5.1 Grapes

9.3.5.2 Apples

9.3.5.3 Malted Grains

9.3.5.4 Hops

9.3.5.5 Yeast

9.3.5.6 Enzymes

9.3.5.7 Others

9.3.6 Historic and Forecasted Market Size by Technology

9.3.6.1 Restricted Fermentation

9.3.6.2 Dealcoholization

9.3.7 Historic and Forecasted Market Size by Sales Stores

9.3.7.1 Liquor Stores

9.3.7.2 Convenience Stores

9.3.7.3 Supermarkets

9.3.7.4 Online Stores

9.3.7.5 Restaurants & Bar

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Non-Alcoholic Wine and Beer Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Alcohol Free

9.4.4.2 Lower Alcohol

9.4.5 Historic and Forecasted Market Size by Source

9.4.5.1 Grapes

9.4.5.2 Apples

9.4.5.3 Malted Grains

9.4.5.4 Hops

9.4.5.5 Yeast

9.4.5.6 Enzymes

9.4.5.7 Others

9.4.6 Historic and Forecasted Market Size by Technology

9.4.6.1 Restricted Fermentation

9.4.6.2 Dealcoholization

9.4.7 Historic and Forecasted Market Size by Sales Stores

9.4.7.1 Liquor Stores

9.4.7.2 Convenience Stores

9.4.7.3 Supermarkets

9.4.7.4 Online Stores

9.4.7.5 Restaurants & Bar

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Non-Alcoholic Wine and Beer Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Alcohol Free

9.5.4.2 Lower Alcohol

9.5.5 Historic and Forecasted Market Size by Source

9.5.5.1 Grapes

9.5.5.2 Apples

9.5.5.3 Malted Grains

9.5.5.4 Hops

9.5.5.5 Yeast

9.5.5.6 Enzymes

9.5.5.7 Others

9.5.6 Historic and Forecasted Market Size by Technology

9.5.6.1 Restricted Fermentation

9.5.6.2 Dealcoholization

9.5.7 Historic and Forecasted Market Size by Sales Stores

9.5.7.1 Liquor Stores

9.5.7.2 Convenience Stores

9.5.7.3 Supermarkets

9.5.7.4 Online Stores

9.5.7.5 Restaurants & Bar

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Non-Alcoholic Wine and Beer Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Alcohol Free

9.6.4.2 Lower Alcohol

9.6.5 Historic and Forecasted Market Size by Source

9.6.5.1 Grapes

9.6.5.2 Apples

9.6.5.3 Malted Grains

9.6.5.4 Hops

9.6.5.5 Yeast

9.6.5.6 Enzymes

9.6.5.7 Others

9.6.6 Historic and Forecasted Market Size by Technology

9.6.6.1 Restricted Fermentation

9.6.6.2 Dealcoholization

9.6.7 Historic and Forecasted Market Size by Sales Stores

9.6.7.1 Liquor Stores

9.6.7.2 Convenience Stores

9.6.7.3 Supermarkets

9.6.7.4 Online Stores

9.6.7.5 Restaurants & Bar

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Non-Alcoholic Wine and Beer Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Alcohol Free

9.7.4.2 Lower Alcohol

9.7.5 Historic and Forecasted Market Size by Source

9.7.5.1 Grapes

9.7.5.2 Apples

9.7.5.3 Malted Grains

9.7.5.4 Hops

9.7.5.5 Yeast

9.7.5.6 Enzymes

9.7.5.7 Others

9.7.6 Historic and Forecasted Market Size by Technology

9.7.6.1 Restricted Fermentation

9.7.6.2 Dealcoholization

9.7.7 Historic and Forecasted Market Size by Sales Stores

9.7.7.1 Liquor Stores

9.7.7.2 Convenience Stores

9.7.7.3 Supermarkets

9.7.7.4 Online Stores

9.7.7.5 Restaurants & Bar

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Non-Alcoholic Wine and Beer Market research report?

A1: The forecast period in the Non-Alcoholic Wine and Beer Market research report is 2025-2032.

Q2: Who are the key players in Non-Alcoholic Wine and Beer Market?

A2: Big Drop Brewing, Carlsberg, Bernard Brewery, Erdinger Weibbrau, Suntory Beer, Anheuser, Bush InBev, Moscow Brewing Company, Heineken N.V., Behnoush Iran, Pierre Chavin and other active players.

Q3: What are the segments of the Non-Alcoholic Wine and Beer Market?

A3: The Non-Alcoholic Wine and Beer Market is segmented into Type, Source, Technology, Sales Stores and region. By Type, the market is categorized into Alcohol Free, Lower Alcohol. By Source the market is categorized into Grapes, Apples, Malted Grains, Hops, Yeast, Enzymes, Others. By Technology the market is categorized into Restricted Fermentation, Dealcoholization. By Sales Stores the market is categorized into Liquor Stores, Convenience Stores, Supermarkets, Online Stores, Restaurants & Bar. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Non-Alcoholic Wine and Beer Market?

A4: The non-alcoholic beer market consists of sales of non-alcoholic beer by entities (organizations, sole traders, and partnerships) that manufacture non-alcoholic beer. Non-alcoholic beer contains 0% to 1.2% of alcohol and it is generally manufactured by removing alcohol from the finished product or by boiling beer to evaporate the alcohol.

Q5: How big is the Non-Alcoholic Wine and Beer Market?

A5: The Non-Alcoholic Wine and Beer market estimated at USD 25.69 Billion in the year 2024, is projected to reach a revised size of USD 42.84 Billion by 2032, growing at a CAGR of 6.6% over the analysis period 2025-2032

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!