Stay Ahead in Fast-Growing Economies.

Browse Reports NowNewborn Screening Market Size, Share, Growth & Forecast (2024-2032)

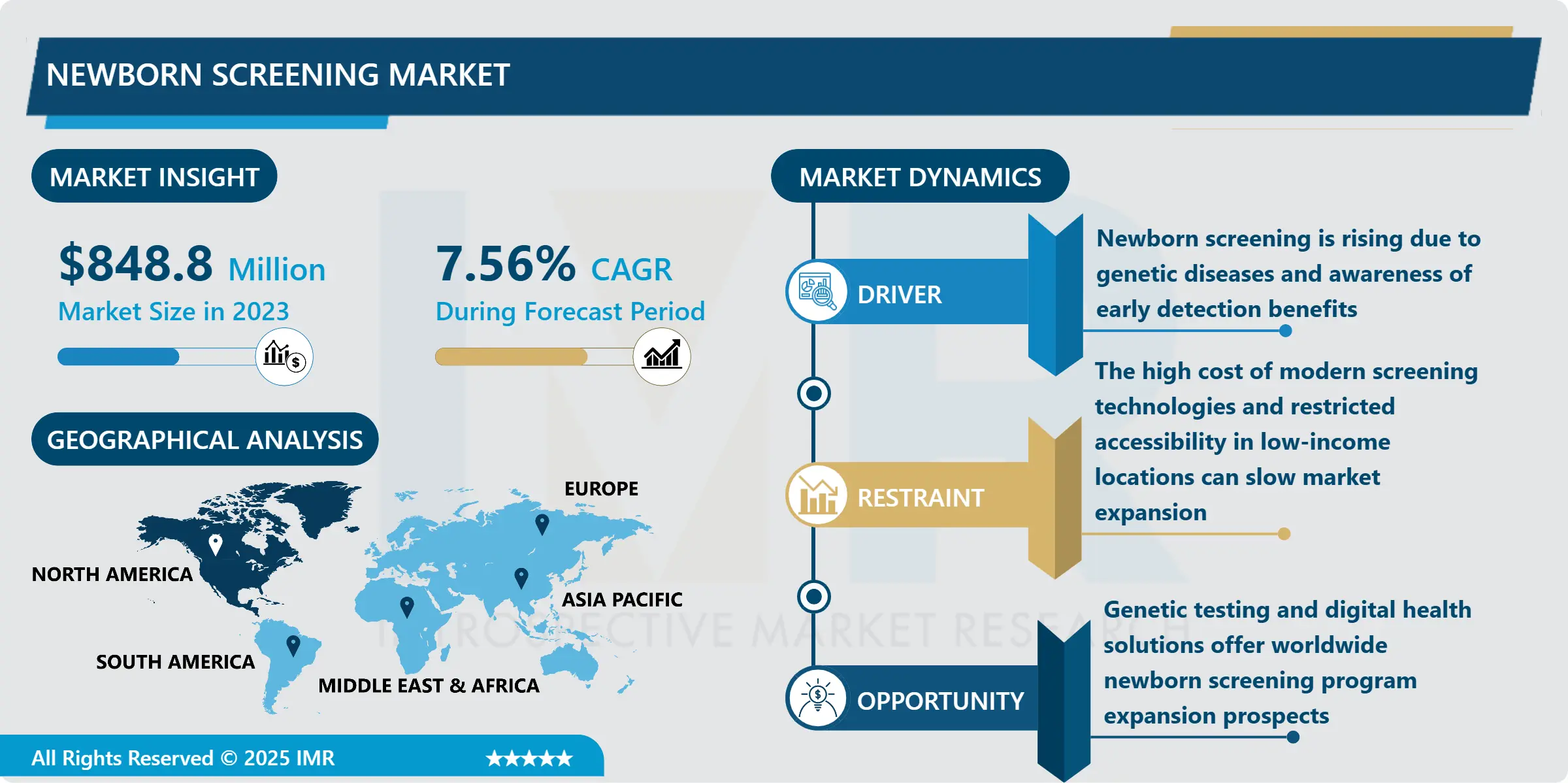

Newborn Screening Market Size Was Valued at USD 848.8 Million in 2023 and is Projected to Reach USD 1635.6 Million by 2032, Growing at a CAGR of 7.56% From 2024-2032.

IMR Group

Description

Newborn Screening Market Synopsis:

Newborn Screening Market Size Was Valued at USD 848.8 Million in 2023 and is Projected to Reach USD 1635.6 Million by 2032, Growing at a CAGR of 7.56% From 2024-2032.

The newborn screening market is expanding rapidly as early detection of genetic, metabolic, and developmental disorders becomes a global healthcare priority. Newborn screening involves testing infants shortly after birth to identify potentially serious health conditions that can benefit from early intervention. The increasing awareness among parents and healthcare providers about the importance of early diagnosis, coupled with the rising prevalence of congenital disorders, is driving demand for advanced screening solutions. Government initiatives in many regions further support newborn screening programs by mandating testing for a range of treatable conditions, thereby enhancing market growth.

Technological advancements in screening methodologies have transformed the newborn screening market, enabling the detection of a broader spectrum of conditions with higher accuracy and efficiency. Mass spectrometry and DNA-based tests, for instance, are gaining popularity as they allow for rapid and precise identification of disorders. These technologies have helped expand the range of detectable conditions, from metabolic and endocrine disorders to hearing impairments and critical congenital heart defects. In addition, innovations in sample collection methods, such as dried blood spot (DBS) testing, have improved the convenience and accuracy of these screenings.

The newborn screening market is also driven by increasing investments in research and development from both government bodies and private companies. North America and Europe currently dominate the market due to strong healthcare infrastructure and widespread adoption of screening programs. However, emerging markets in Asia-Pacific and Latin America show significant growth potential as awareness and healthcare spending in these regions rise. With the ongoing focus on early diagnosis and preventive healthcare, the newborn screening market is poised for continued growth, as it plays a critical role in improving long-term health outcomes for infants globally.

Newborn Screening Market Trend Analysis:

Expansion of Screening Panels to Include Genetic and Rare Disorders

A major trend in the newborn screening market is the expansion of screening panels to detect a wider array of genetic and rare disorders. Advances in genetic testing technology now allow healthcare providers to screen newborns for complex conditions such as spinal muscular atrophy (SMA) and severe combined immunodeficiency (SCID), among others. This broader scope improves early diagnosis and treatment options for rare conditions, significantly impacting the quality of life for affected infants and supporting market growth.

Rise of Digital Health Solutions and Data Integration

The adoption of digital health solutions and data integration platforms in newborn screening programs is another significant trend. These technologies streamline the management and tracking of screening results, enabling healthcare providers to deliver timely follow-up care. Additionally, data integration allows for better collaboration among healthcare facilities, labs, and public health organizations, improving the efficiency and accuracy of screening programs. This trend is particularly prominent in developed regions but is increasingly spreading to emerging markets as digital infrastructure expands.

Newborn Screening Market Segment Analysis:

Newborn Screening Market is Segmented on the basis of Test Type, Product Type, Technology, Disease Type, End User, and Region.

By Test Type, Dried Blood Spot Test segment is expected to dominate the market during the forecast period

The newborn screening market offers various test types, including the dried blood spot (DBS) test, hearing screen test, and critical congenital heart diseases (CCHD) test, each playing a vital role in early infant health assessment. The dried blood spot test is widely used to screen for metabolic, genetic, and endocrine disorders by analyzing a small blood sample from a newborn’s heel. Hearing screening tests are essential for identifying congenital hearing loss, allowing for timely intervention that can aid in language development. Meanwhile, the CCHD test uses pulse oximetry to detect heart defects that might not be apparent at birth, facilitating immediate treatment if necessary. Together, these screening methods ensure a comprehensive assessment of newborn health, supporting early detection and improved health outcomes.

By End User, Hospital segment expected to held the largest share

In the newborn screening market, key end users include hospitals, pediatric clinics, and specialized clinics, each playing a vital role in ensuring early detection and intervention for various congenital and metabolic disorders. Hospitals are often the primary setting for newborn screening, given their access to advanced equipment and specialized staff needed for initial testing shortly after birth. Pediatric clinics follow up on screening results, providing ongoing monitoring and care to manage any detected conditions, while smaller clinics may serve as additional screening sites in certain regions, expanding accessibility to screening services. Together, these end users form a comprehensive network that supports early diagnosis, timely intervention, and effective management of newborn health conditions, enhancing overall care quality.

Newborn Screening Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to dominate the newborn screening market over the forecast period, driven by strong healthcare infrastructure, high awareness of early diagnosis benefits, and supportive government policies. The United States, in particular, has well-established newborn screening programs that mandate testing for various congenital disorders, supported by federal and state-level funding. Additionally, advancements in screening technologies, such as genetic testing and mass spectrometry, are widely adopted in this region, contributing to the market’s growth. Increased investments in research and development, along with a high rate of adoption among hospitals and healthcare facilities, further strengthen North America’s leading position in the newborn screening market.

Active Key Players in the Newborn Screening Market:

PerkinElmer Inc., (U.S)

Demant A/S (Denmark)

Natus Medical Incorporated (U.S)

Bio-Rad Laboratories (U.S)

Luminex Corporation (US)

F. Hoffmann-La Roche Ltd., (Switzerland)

Thermo Fisher Scientific Inc., (U.S)

Bruker (US), Danaher (US)

Medtronic (Ireland)

Chromsystems Instruments & Chemicals GmbH (Germany)

Trivitron Healthcare (India)

Baebies Inc., (U.S)

RECIPE Chemicals + Instruments GmbH (Germany)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Newborn Screening Market by Test Type

4.1 Newborn Screening Market Snapshot and Growth Engine

4.2 Newborn Screening Market Overview

4.3 Dried Blood Spot Test

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Dried Blood Spot Test: Geographic Segmentation Analysis

4.4 Hearing Screen Test

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Hearing Screen Test: Geographic Segmentation Analysis

4.5 Critical Congenital Heart Diseases (CCHD) Test

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Critical Congenital Heart Diseases (CCHD) Test: Geographic Segmentation Analysis

Chapter 5: Newborn Screening Market by Product Type

5.1 Newborn Screening Market Snapshot and Growth Engine

5.2 Newborn Screening Market Overview

5.3 Instruments

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Instruments: Geographic Segmentation Analysis

5.4 Reagents

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Reagents: Geographic Segmentation Analysis

5.5 Assay Kits

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Assay Kits: Geographic Segmentation Analysis

Chapter 6: Newborn Screening Market by Technology

6.1 Newborn Screening Market Snapshot and Growth Engine

6.2 Newborn Screening Market Overview

6.3 Tandem Mass Spectrometry

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Tandem Mass Spectrometry: Geographic Segmentation Analysis

6.4 Hearing Screen Technology

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Hearing Screen Technology: Geographic Segmentation Analysis

6.5 Pulse Oximetry Screening Technology

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Pulse Oximetry Screening Technology: Geographic Segmentation Analysis

6.6 Immunoassays and Enzymatic Assays

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Immunoassays and Enzymatic Assays: Geographic Segmentation Analysis

6.7 Electrophoresis

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Electrophoresis: Geographic Segmentation Analysis

6.8 DNA-Based Assays

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 DNA-Based Assays: Geographic Segmentation Analysis

Chapter 7: Newborn Screening Market by Disease Type

7.1 Newborn Screening Market Snapshot and Growth Engine

7.2 Newborn Screening Market Overview

7.3 Critical Congenital Heart Diseases

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Critical Congenital Heart Diseases: Geographic Segmentation Analysis

7.4 Newborn Hearing Loss

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Newborn Hearing Loss: Geographic Segmentation Analysis

7.5 Sickle Cell Disease

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Sickle Cell Disease: Geographic Segmentation Analysis

7.6 Phenylketonuria (PKU)

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Phenylketonuria (PKU): Geographic Segmentation Analysis

7.7 Cystic Fibrosis (CF)

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Cystic Fibrosis (CF): Geographic Segmentation Analysis

7.8 Maple Syrup Urine Disease

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Maple Syrup Urine Disease: Geographic Segmentation Analysis

7.9 Others

7.9.1 Introduction and Market Overview

7.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.9.3 Key Market Trends, Growth Factors and Opportunities

7.9.4 Others: Geographic Segmentation Analysis

Chapter 8: Newborn Screening Market by End User

8.1 Newborn Screening Market Snapshot and Growth Engine

8.2 Newborn Screening Market Overview

8.3 Hospital

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Hospital: Geographic Segmentation Analysis

8.4 Paediatric Clinics

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Paediatric Clinics: Geographic Segmentation Analysis

8.5 Clinics

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Clinics: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Newborn Screening Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 PERKINELMER INC.

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 (U.S)

9.4 DEMANT A/S (DENMARK)

9.5 NATUS MEDICAL INCORPORATED (U.S)

9.6 BIO-RAD LABORATORIES (U.S)

9.7 LUMINEX CORPORATION (US)

9.8 F. HOFFMANN-LA ROCHE LTD.

9.9 (SWITZERLAND)

9.10 THERMO FISHER SCIENTIFIC INC.

9.11 (U.S)

9.12 BRUKER (US)

9.13 DANAHER (US)

9.14 MEDTRONIC (IRELAND)

9.15 CHROMSYSTEMS INSTRUMENTS & CHEMICALS GMBH (GERMANY)

9.16 TRIVITRON HEALTHCARE (INDIA)

9.17 BAEBIES INC.

9.18 (U.S)

9.19 RECIPE CHEMICALS + INSTRUMENTS GMBH (GERMANY)

9.20 OTHER ACTIVE PLAYERS

9.21 OTHER ACTIVE PLAYERS

Chapter 10: Global Newborn Screening Market By Region

10.1 Overview

10.2. North America Newborn Screening Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Test Type

10.2.4.1 Dried Blood Spot Test

10.2.4.2 Hearing Screen Test

10.2.4.3 Critical Congenital Heart Diseases (CCHD) Test

10.2.5 Historic and Forecasted Market Size By Product Type

10.2.5.1 Instruments

10.2.5.2 Reagents

10.2.5.3 Assay Kits

10.2.6 Historic and Forecasted Market Size By Technology

10.2.6.1 Tandem Mass Spectrometry

10.2.6.2 Hearing Screen Technology

10.2.6.3 Pulse Oximetry Screening Technology

10.2.6.4 Immunoassays and Enzymatic Assays

10.2.6.5 Electrophoresis

10.2.6.6 DNA-Based Assays

10.2.7 Historic and Forecasted Market Size By Disease Type

10.2.7.1 Critical Congenital Heart Diseases

10.2.7.2 Newborn Hearing Loss

10.2.7.3 Sickle Cell Disease

10.2.7.4 Phenylketonuria (PKU)

10.2.7.5 Cystic Fibrosis (CF)

10.2.7.6 Maple Syrup Urine Disease

10.2.7.7 Others

10.2.8 Historic and Forecasted Market Size By End User

10.2.8.1 Hospital

10.2.8.2 Paediatric Clinics

10.2.8.3 Clinics

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Newborn Screening Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Test Type

10.3.4.1 Dried Blood Spot Test

10.3.4.2 Hearing Screen Test

10.3.4.3 Critical Congenital Heart Diseases (CCHD) Test

10.3.5 Historic and Forecasted Market Size By Product Type

10.3.5.1 Instruments

10.3.5.2 Reagents

10.3.5.3 Assay Kits

10.3.6 Historic and Forecasted Market Size By Technology

10.3.6.1 Tandem Mass Spectrometry

10.3.6.2 Hearing Screen Technology

10.3.6.3 Pulse Oximetry Screening Technology

10.3.6.4 Immunoassays and Enzymatic Assays

10.3.6.5 Electrophoresis

10.3.6.6 DNA-Based Assays

10.3.7 Historic and Forecasted Market Size By Disease Type

10.3.7.1 Critical Congenital Heart Diseases

10.3.7.2 Newborn Hearing Loss

10.3.7.3 Sickle Cell Disease

10.3.7.4 Phenylketonuria (PKU)

10.3.7.5 Cystic Fibrosis (CF)

10.3.7.6 Maple Syrup Urine Disease

10.3.7.7 Others

10.3.8 Historic and Forecasted Market Size By End User

10.3.8.1 Hospital

10.3.8.2 Paediatric Clinics

10.3.8.3 Clinics

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Newborn Screening Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Test Type

10.4.4.1 Dried Blood Spot Test

10.4.4.2 Hearing Screen Test

10.4.4.3 Critical Congenital Heart Diseases (CCHD) Test

10.4.5 Historic and Forecasted Market Size By Product Type

10.4.5.1 Instruments

10.4.5.2 Reagents

10.4.5.3 Assay Kits

10.4.6 Historic and Forecasted Market Size By Technology

10.4.6.1 Tandem Mass Spectrometry

10.4.6.2 Hearing Screen Technology

10.4.6.3 Pulse Oximetry Screening Technology

10.4.6.4 Immunoassays and Enzymatic Assays

10.4.6.5 Electrophoresis

10.4.6.6 DNA-Based Assays

10.4.7 Historic and Forecasted Market Size By Disease Type

10.4.7.1 Critical Congenital Heart Diseases

10.4.7.2 Newborn Hearing Loss

10.4.7.3 Sickle Cell Disease

10.4.7.4 Phenylketonuria (PKU)

10.4.7.5 Cystic Fibrosis (CF)

10.4.7.6 Maple Syrup Urine Disease

10.4.7.7 Others

10.4.8 Historic and Forecasted Market Size By End User

10.4.8.1 Hospital

10.4.8.2 Paediatric Clinics

10.4.8.3 Clinics

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Newborn Screening Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Test Type

10.5.4.1 Dried Blood Spot Test

10.5.4.2 Hearing Screen Test

10.5.4.3 Critical Congenital Heart Diseases (CCHD) Test

10.5.5 Historic and Forecasted Market Size By Product Type

10.5.5.1 Instruments

10.5.5.2 Reagents

10.5.5.3 Assay Kits

10.5.6 Historic and Forecasted Market Size By Technology

10.5.6.1 Tandem Mass Spectrometry

10.5.6.2 Hearing Screen Technology

10.5.6.3 Pulse Oximetry Screening Technology

10.5.6.4 Immunoassays and Enzymatic Assays

10.5.6.5 Electrophoresis

10.5.6.6 DNA-Based Assays

10.5.7 Historic and Forecasted Market Size By Disease Type

10.5.7.1 Critical Congenital Heart Diseases

10.5.7.2 Newborn Hearing Loss

10.5.7.3 Sickle Cell Disease

10.5.7.4 Phenylketonuria (PKU)

10.5.7.5 Cystic Fibrosis (CF)

10.5.7.6 Maple Syrup Urine Disease

10.5.7.7 Others

10.5.8 Historic and Forecasted Market Size By End User

10.5.8.1 Hospital

10.5.8.2 Paediatric Clinics

10.5.8.3 Clinics

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Newborn Screening Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Test Type

10.6.4.1 Dried Blood Spot Test

10.6.4.2 Hearing Screen Test

10.6.4.3 Critical Congenital Heart Diseases (CCHD) Test

10.6.5 Historic and Forecasted Market Size By Product Type

10.6.5.1 Instruments

10.6.5.2 Reagents

10.6.5.3 Assay Kits

10.6.6 Historic and Forecasted Market Size By Technology

10.6.6.1 Tandem Mass Spectrometry

10.6.6.2 Hearing Screen Technology

10.6.6.3 Pulse Oximetry Screening Technology

10.6.6.4 Immunoassays and Enzymatic Assays

10.6.6.5 Electrophoresis

10.6.6.6 DNA-Based Assays

10.6.7 Historic and Forecasted Market Size By Disease Type

10.6.7.1 Critical Congenital Heart Diseases

10.6.7.2 Newborn Hearing Loss

10.6.7.3 Sickle Cell Disease

10.6.7.4 Phenylketonuria (PKU)

10.6.7.5 Cystic Fibrosis (CF)

10.6.7.6 Maple Syrup Urine Disease

10.6.7.7 Others

10.6.8 Historic and Forecasted Market Size By End User

10.6.8.1 Hospital

10.6.8.2 Paediatric Clinics

10.6.8.3 Clinics

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Newborn Screening Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Test Type

10.7.4.1 Dried Blood Spot Test

10.7.4.2 Hearing Screen Test

10.7.4.3 Critical Congenital Heart Diseases (CCHD) Test

10.7.5 Historic and Forecasted Market Size By Product Type

10.7.5.1 Instruments

10.7.5.2 Reagents

10.7.5.3 Assay Kits

10.7.6 Historic and Forecasted Market Size By Technology

10.7.6.1 Tandem Mass Spectrometry

10.7.6.2 Hearing Screen Technology

10.7.6.3 Pulse Oximetry Screening Technology

10.7.6.4 Immunoassays and Enzymatic Assays

10.7.6.5 Electrophoresis

10.7.6.6 DNA-Based Assays

10.7.7 Historic and Forecasted Market Size By Disease Type

10.7.7.1 Critical Congenital Heart Diseases

10.7.7.2 Newborn Hearing Loss

10.7.7.3 Sickle Cell Disease

10.7.7.4 Phenylketonuria (PKU)

10.7.7.5 Cystic Fibrosis (CF)

10.7.7.6 Maple Syrup Urine Disease

10.7.7.7 Others

10.7.8 Historic and Forecasted Market Size By End User

10.7.8.1 Hospital

10.7.8.2 Paediatric Clinics

10.7.8.3 Clinics

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Newborn Screening Market research report?

A1: The forecast period in the Newborn Screening Market research report is 2024-2032.

Q2: Who are the key players in the Newborn Screening Market?

A2: PerkinElmer Inc., (U.S), Demant A/S (Denmark), Natus Medical Incorporated (U.S), Bio-Rad Laboratories (U.S), Luminex Corporation (US), F. Hoffmann-La Roche Ltd., (Switzerland), Thermo Fisher Scientific Inc., (U.S), Bruker (US), Danaher (US), Medtronic (Ireland), Chromsystems Instruments & Chemicals GmbH (Germany), Trivitron Healthcare (India), Baebies Inc., (U.S), and RECIPE Chemicals + Instruments GmbH (Germany), and Other Active Players.

Q3: What are the segments of the Newborn Screening Market?

A3: The Newborn Screening Market is segmented into By Test Type, Product Type, Technology Disease Type, End User and region. By Test Type (Dried Blood Spot Test, Hearing Screen Test, Critical Congenital Heart Diseases (CCHD) Test), Product Type (Instruments, Reagents, Assay Kits), Technology (Tandem Mass Spectrometry, Hearing Screen Technology, Pulse Oximetry Screening Technology, Immunoassays and Enzymatic Assays, Electrophoresis, DNA-Based Assays), Disease Type (Critical Congenital Heart Diseases, Newborn Hearing Loss, Sickle Cell Disease, Phenylketonuria (PKU), Cystic Fibrosis (CF), Maple Syrup Urine Disease, Others), End User (Hospital, Paediatric Clinics, Clinics) . By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Newborn Screening Market?

A4: Newborn screening is a public health program aimed at the early identification of specific genetic, metabolic, hormonal, and functional disorders in newborns shortly after birth. Through a series of simple tests, usually involving a blood sample taken from a heel prick, along with hearing and heart defect screenings, newborn screening can detect conditions that might not be apparent at birth but could lead to severe health issues if left untreated. By identifying these conditions early, newborn screening enables timely intervention, treatment, and management, significantly improving the long-term health outcomes for affected infants and preventing potential disabilities, developmental delays, or life-threatening complications.

Q5: How big is the Newborn Screening Market?

A5: Newborn Screening Market Size Was Valued at USD 848.8 Million in 2023 and is Projected to Reach USD 1635.6 Million by 2032, Growing at a CAGR of 7.56% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!