Stay Ahead in Fast-Growing Economies.

Browse Reports NowNeurodiagnostics Market Opportunities, Challenges & Strategic Forecast (2024-2032)

Neurodiagnostics comprises a variety of applied technologies for diagnosing neurological conditions, which consist mainly of cerebral, neural, and spinal disorders. Diagnoses are enabled by methods such as EEG, EMG, and NCS, which have become indispensable tools for disease diagnosis in the early stages of their development-epilepsy, Alzheimer’s, Parkinson’s, and multiple sclerosis.

IMR Group

Description

Neurodiagnostics Market Synopsis:

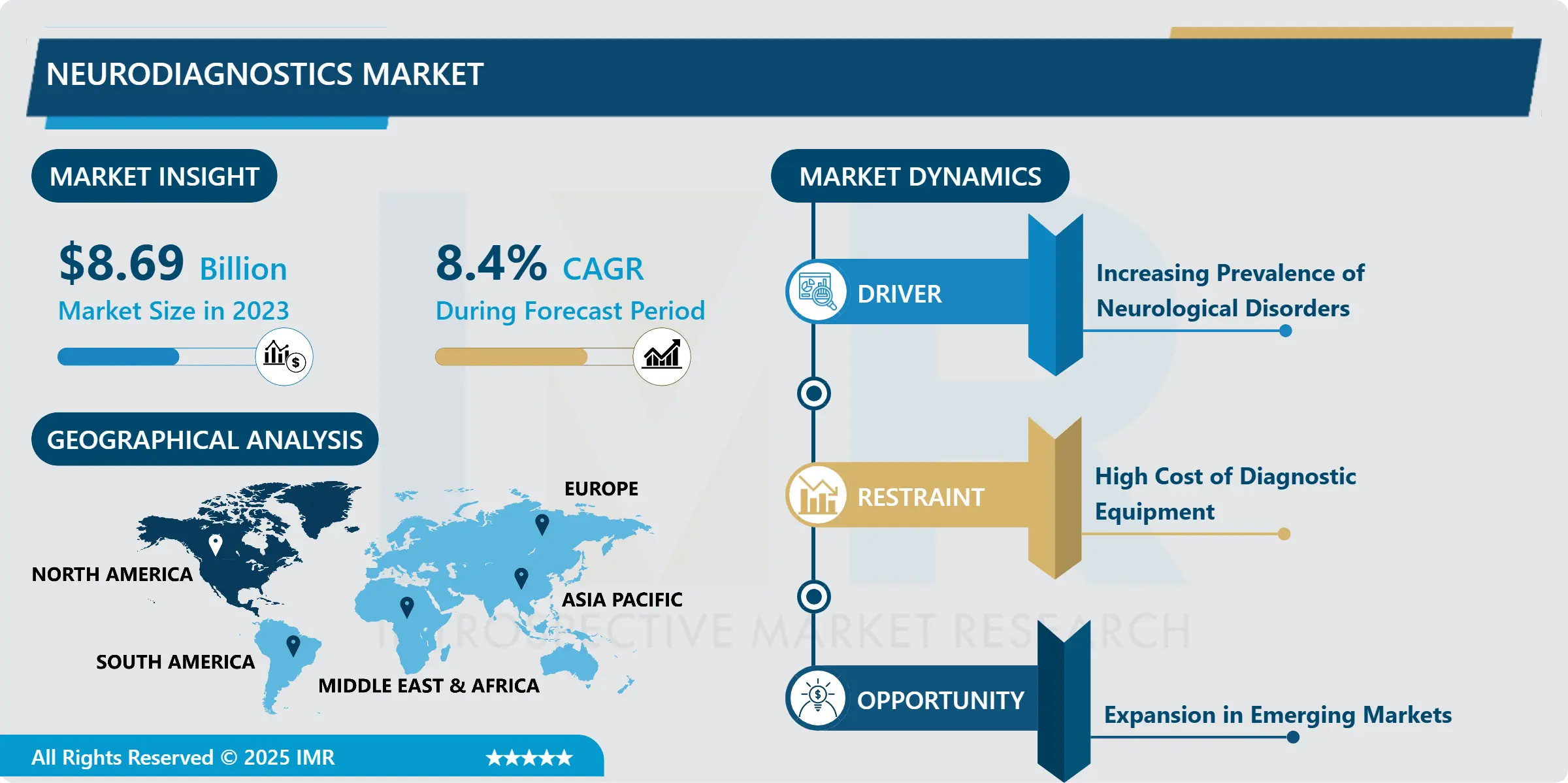

Neurodiagnostics Market Size Was Valued at USD 8.69 Billion in 2023, and is Projected to Reach USD 17.96 Billion by 2032, Growing at a CAGR of 8.4% From 2024-2032.

Neurodiagnostics comprises a variety of applied technologies for diagnosing neurological conditions, which consist mainly of cerebral, neural, and spinal disorders. Diagnoses are enabled by methods such as EEG, EMG, and NCS, which have become indispensable tools for disease diagnosis in the early stages of their development-epilepsy, Alzheimer’s, Parkinson’s, and multiple sclerosis.

This has surged the market of neurodiagnostics, especially with increased neurological diseases, more and more attention paid towards health of brain, and advancement of diagnostic technologies. Diagnostic tools include EEG or electroencephalography, EMG or electromyography, EP, or evoked potentials, LTM, or long-term monitoring and NCS, or nerve conduction studies that help in diagnosing various disorders, which affect the brain. As health care systems worldwide improve in their diagnostics accuracy, the neurodiagnostics market is shifting where more advanced pieces of equipment give precise identification of conditions ranging from epilepsy to Alzheimer’s and Parkinson’s disease.

The main drivers for the global market include an aging population, patients with increased neurological conditions, and advances in technological diagnostic equipment. There is also a greater adoption of minimally invasive neurodiagnostic techniques involving wearable devices and portable monitoring systems. Increasing investments in research and development, and in the collaborations of technology providers with healthcare institutions, are driving innovations in neurodiagnostics and making them more efficient and accessible.

However, high prices of some of the advanced diagnostic tools and only skilled professionals are needed to use these devices are some of the limitations in this market. Increasingly, health services providers are turning towards neurodiagnostic devices in order to better patient outcomes-especially in countries with aging populations. On-going demand for higher accuracy in diagnostics and detection of diseases at an earlier stage is likely to provide a thrust for growth going forward.

Neurodiagnostics Market Trend Analysis:

Adoption of AI in Neurodiagnostics

Another trend surfacing in the neurodiagnostics market is the integration of Artificial Intelligence with diagnostic technologies. Most of the artificial intelligence-based solutions today are being developed that enable interpretable neurodiagnostic tests and neuroimaging technologies to improve the precision and speed of diagnoses. The AI algorithms can sort large datasets of EEG, EMG, and other neurodiagnostic machines, which may not otherwise be detected by a human clinician.

AI in Neurodiagnostics the use of AI in neurodiagnostics enhanced the accuracy of diagnosis whereby conditions like epilepsy and Alzheimer’s diseases required early detection. AI facilitates on-time monitoring and alert systems, enhancing the avenue of intervention and patient care, and, therefore intervention. Therefore, its application in neurodiagnostics is likely to increase with the advancement of technology, and this will further revolutionize the market.

Expansion in Emerging Markets

A major trend in the neurodiagnostics market is the coupling of AI with diagnostic technologies. The use of AI-based tools in interpreting data on complex neuroimaging techniques and neurodiagnostic tests provides higher speed and accuracy in diagnosis. Massive datasets from EEG, EMG, among many other devices can be analyzed by AI algorithms at a level that very minute patterns that may not be present clinically to human clinicians are detected.

The use of AI in neurodiagnostics enhances the accuracy of diagnosis, especially for conditions such as epilepsy and Alzheimer’s diseases, which require early detection for effective treatment. It also makes it possible to monitor patients in real time and issue automatic alerts, which will lead to faster interventions and consequently better patient management. With advancements in AI technology, its future in neurodiagnostics is nothing but expansive because the market is going to witness another revolution in the medical field.

Neurodiagnostics Market Segment Analysis:

Neurodiagnostics Market is Segmented on the basis of Product Type, Technology, Application, End User, and Region.

By Product Type, EEG (Electroencephalography) segment is expected to dominate the market during the forecast period

One of the most frequently used neurodiagnostic methods is EEG, primarily when a condition calls for diagnosis, for instance, epilepsy and sleep disorders. EEG devices measure electric activity in the brain, providing real-time information useful in diagnosing seizures and brain injuries and other psychiatric disorders. Today, advances in technology have led to many portable and wireless versions of EEG devices, which allow monitoring in remote patients. The convenience and accessibility are driving the growth of the EEG segment.

EMG (Electromyography): Another significant segment within the neurodiagnostics market is EMG, or Electromyography. EMG devices measure and record the electrical activity of muscles, and this enables diagnosis for muscular dystrophy, nerve damage, and peripheral neuropathies. This growing prevalence of neuromuscular diseases also throws up a greater demand for EMG devices. The portable EMG device and other innovations are also on their way to fuel this segment’s growth and will make the diagnostics more available to a wider range of healthcare providers.

By Application, Epilepsy segment expected to held the largest share

It is one of the leading applications of neurodiagnostics, considering the use of EEG and other neurodiagnostic tests as essentials for detecting and monitoring seizures. The epilepsy epidemiology is now on the rise as it progresses in increasing younger age groups across the globe, thus heightening the demand for precise and time-saving diagnostic tools. Neurodiagnostics designed for application in epilepsy is increasingly in demand due to the curiosity of healthcare providers to get hold of advanced methods to detect seizure disorders and further ameliorate the outcomes for patients through optimal treatment planning.

There is also an increase in Alzheimer’s disease among people, hence the growing neurodiagnostics market. With the increasing proportion of elderly populations across the world, cases of Alzheimer’s are projected to rise. Advanced imaging techniques and neurodiagnostic tests will be very important in early detection and therefore timely intervention and management of symptoms. Demand for Neurodiagnostic devices related to Alzheimer’s will continue to rise because people are raising awareness about the disease along with the misery it causes to the families as well as its victims.

Neurodiagnostics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America leads the market due to the region’s sophisticated healthcare infrastructure and its high adoption of new and innovative medical technologies. The advanced healthcare infrastructure and significant investments in research and development had given a platform to be at the forefront of neurodiagnostic progress in the region. Also, strong government support for healthcare innovation alongside the rising incidence of neurological disorders in North America has supplemented growth in the neurodiagnostics market in the region.

Further, the region is occupied by a large percentage of neurodiagnostics leading firms around the world, which explains why North America is at the top. Such firms are continually advancing their diagnostic tools, contributing to their leadership in the global market. With the need for accurate and timely diagnosis increasing by the day, the leadership of neurodiagnostics by North America will continue forever more.

Active Key Players in the Neurodiagnostics Market:

Philips (Netherlands)

Siemens Healthineers (Germany)

GE Healthcare (USA)

Medtronic (Ireland)

Nihon Kohden Corporation (Japan)

BrainScope Company, Inc. (USA)

Natus Medical Incorporated (USA)

Compumedics Limited (Australia)

Abbott Laboratories (USA)

EMOTIV (USA)

Cadwell Laboratories, Inc. (USA)

Schiller AG (Switzerland)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Neurodiagnostics Market by Product Type

4.1 Neurodiagnostics Market Snapshot and Growth Engine

4.2 Neurodiagnostics Market Overview

4.3 EEG (Electroencephalography)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 EEG (Electroencephalography): Geographic Segmentation Analysis

4.4 EMG (Electromyography)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 EMG (Electromyography): Geographic Segmentation Analysis

4.5 EP (Evoked Potentials)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 EP (Evoked Potentials): Geographic Segmentation Analysis

4.6 LTM (Long-term Monitoring)

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 LTM (Long-term Monitoring): Geographic Segmentation Analysis

4.7 NCS (Nerve Conduction Studies)

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 NCS (Nerve Conduction Studies): Geographic Segmentation Analysis

4.8 Others

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Others: Geographic Segmentation Analysis

Chapter 5: Neurodiagnostics Market by End User

5.1 Neurodiagnostics Market Snapshot and Growth Engine

5.2 Neurodiagnostics Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hospitals: Geographic Segmentation Analysis

5.4 Diagnostic Centers

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Diagnostic Centers: Geographic Segmentation Analysis

5.5 Research & Academic Institutes

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Research & Academic Institutes: Geographic Segmentation Analysis

5.6 Homecare Settings

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Homecare Settings: Geographic Segmentation Analysis

Chapter 6: Neurodiagnostics Market by Application

6.1 Neurodiagnostics Market Snapshot and Growth Engine

6.2 Neurodiagnostics Market Overview

6.3 Epilepsy

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Epilepsy: Geographic Segmentation Analysis

6.4 Alzheimer’s Disease

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Alzheimer’s Disease: Geographic Segmentation Analysis

6.5 Parkinson’s Disease

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Parkinson’s Disease: Geographic Segmentation Analysis

6.6 Multiple Sclerosis

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Multiple Sclerosis: Geographic Segmentation Analysis

6.7 Sleep Disorders

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Sleep Disorders: Geographic Segmentation Analysis

6.8 Others

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Others: Geographic Segmentation Analysis

Chapter 7: Neurodiagnostics Market by Technology

7.1 Neurodiagnostics Market Snapshot and Growth Engine

7.2 Neurodiagnostics Market Overview

7.3 Conventional Neurodiagnostics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Conventional Neurodiagnostics: Geographic Segmentation Analysis

7.4 Portable Neurodiagnostic Devices

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Portable Neurodiagnostic Devices: Geographic Segmentation Analysis

7.5 Wireless Neurodiagnostic Devices

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Wireless Neurodiagnostic Devices: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Neurodiagnostics Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 PHILIPS (NETHERLANDS)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SIEMENS HEALTHINEERS (GERMANY)

8.4 GE HEALTHCARE (USA)

8.5 MEDTRONIC (IRELAND)

8.6 NIHON KOHDEN CORPORATION (JAPAN)

8.7 BRAINSCOPE COMPANY INC. (USA)

8.8 NATUS MEDICAL INCORPORATED (USA)

8.9 COMPUMEDICS LIMITED (AUSTRALIA)

8.10 ABBOTT LABORATORIES (USA)

8.11 EMOTIV (USA)

8.12 CADWELL LABORATORIES INC. (USA)

8.13 SCHILLER AG (SWITZERLAND)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Neurodiagnostics Market By Region

9.1 Overview

9.2. North America Neurodiagnostics Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Product Type

9.2.4.1 EEG (Electroencephalography)

9.2.4.2 EMG (Electromyography)

9.2.4.3 EP (Evoked Potentials)

9.2.4.4 LTM (Long-term Monitoring)

9.2.4.5 NCS (Nerve Conduction Studies)

9.2.4.6 Others

9.2.5 Historic and Forecasted Market Size By End User

9.2.5.1 Hospitals

9.2.5.2 Diagnostic Centers

9.2.5.3 Research & Academic Institutes

9.2.5.4 Homecare Settings

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Epilepsy

9.2.6.2 Alzheimer’s Disease

9.2.6.3 Parkinson’s Disease

9.2.6.4 Multiple Sclerosis

9.2.6.5 Sleep Disorders

9.2.6.6 Others

9.2.7 Historic and Forecasted Market Size By Technology

9.2.7.1 Conventional Neurodiagnostics

9.2.7.2 Portable Neurodiagnostic Devices

9.2.7.3 Wireless Neurodiagnostic Devices

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Neurodiagnostics Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Product Type

9.3.4.1 EEG (Electroencephalography)

9.3.4.2 EMG (Electromyography)

9.3.4.3 EP (Evoked Potentials)

9.3.4.4 LTM (Long-term Monitoring)

9.3.4.5 NCS (Nerve Conduction Studies)

9.3.4.6 Others

9.3.5 Historic and Forecasted Market Size By End User

9.3.5.1 Hospitals

9.3.5.2 Diagnostic Centers

9.3.5.3 Research & Academic Institutes

9.3.5.4 Homecare Settings

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Epilepsy

9.3.6.2 Alzheimer’s Disease

9.3.6.3 Parkinson’s Disease

9.3.6.4 Multiple Sclerosis

9.3.6.5 Sleep Disorders

9.3.6.6 Others

9.3.7 Historic and Forecasted Market Size By Technology

9.3.7.1 Conventional Neurodiagnostics

9.3.7.2 Portable Neurodiagnostic Devices

9.3.7.3 Wireless Neurodiagnostic Devices

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Neurodiagnostics Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Product Type

9.4.4.1 EEG (Electroencephalography)

9.4.4.2 EMG (Electromyography)

9.4.4.3 EP (Evoked Potentials)

9.4.4.4 LTM (Long-term Monitoring)

9.4.4.5 NCS (Nerve Conduction Studies)

9.4.4.6 Others

9.4.5 Historic and Forecasted Market Size By End User

9.4.5.1 Hospitals

9.4.5.2 Diagnostic Centers

9.4.5.3 Research & Academic Institutes

9.4.5.4 Homecare Settings

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Epilepsy

9.4.6.2 Alzheimer’s Disease

9.4.6.3 Parkinson’s Disease

9.4.6.4 Multiple Sclerosis

9.4.6.5 Sleep Disorders

9.4.6.6 Others

9.4.7 Historic and Forecasted Market Size By Technology

9.4.7.1 Conventional Neurodiagnostics

9.4.7.2 Portable Neurodiagnostic Devices

9.4.7.3 Wireless Neurodiagnostic Devices

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Neurodiagnostics Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Product Type

9.5.4.1 EEG (Electroencephalography)

9.5.4.2 EMG (Electromyography)

9.5.4.3 EP (Evoked Potentials)

9.5.4.4 LTM (Long-term Monitoring)

9.5.4.5 NCS (Nerve Conduction Studies)

9.5.4.6 Others

9.5.5 Historic and Forecasted Market Size By End User

9.5.5.1 Hospitals

9.5.5.2 Diagnostic Centers

9.5.5.3 Research & Academic Institutes

9.5.5.4 Homecare Settings

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Epilepsy

9.5.6.2 Alzheimer’s Disease

9.5.6.3 Parkinson’s Disease

9.5.6.4 Multiple Sclerosis

9.5.6.5 Sleep Disorders

9.5.6.6 Others

9.5.7 Historic and Forecasted Market Size By Technology

9.5.7.1 Conventional Neurodiagnostics

9.5.7.2 Portable Neurodiagnostic Devices

9.5.7.3 Wireless Neurodiagnostic Devices

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Neurodiagnostics Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Product Type

9.6.4.1 EEG (Electroencephalography)

9.6.4.2 EMG (Electromyography)

9.6.4.3 EP (Evoked Potentials)

9.6.4.4 LTM (Long-term Monitoring)

9.6.4.5 NCS (Nerve Conduction Studies)

9.6.4.6 Others

9.6.5 Historic and Forecasted Market Size By End User

9.6.5.1 Hospitals

9.6.5.2 Diagnostic Centers

9.6.5.3 Research & Academic Institutes

9.6.5.4 Homecare Settings

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Epilepsy

9.6.6.2 Alzheimer’s Disease

9.6.6.3 Parkinson’s Disease

9.6.6.4 Multiple Sclerosis

9.6.6.5 Sleep Disorders

9.6.6.6 Others

9.6.7 Historic and Forecasted Market Size By Technology

9.6.7.1 Conventional Neurodiagnostics

9.6.7.2 Portable Neurodiagnostic Devices

9.6.7.3 Wireless Neurodiagnostic Devices

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Neurodiagnostics Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Product Type

9.7.4.1 EEG (Electroencephalography)

9.7.4.2 EMG (Electromyography)

9.7.4.3 EP (Evoked Potentials)

9.7.4.4 LTM (Long-term Monitoring)

9.7.4.5 NCS (Nerve Conduction Studies)

9.7.4.6 Others

9.7.5 Historic and Forecasted Market Size By End User

9.7.5.1 Hospitals

9.7.5.2 Diagnostic Centers

9.7.5.3 Research & Academic Institutes

9.7.5.4 Homecare Settings

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Epilepsy

9.7.6.2 Alzheimer’s Disease

9.7.6.3 Parkinson’s Disease

9.7.6.4 Multiple Sclerosis

9.7.6.5 Sleep Disorders

9.7.6.6 Others

9.7.7 Historic and Forecasted Market Size By Technology

9.7.7.1 Conventional Neurodiagnostics

9.7.7.2 Portable Neurodiagnostic Devices

9.7.7.3 Wireless Neurodiagnostic Devices

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Neurodiagnostics Market research report?

A1: The forecast period in the Neurodiagnostics Market research report is 2024-2032.

Q2: Who are the key players in the Neurodiagnostics Market?

A2: Philips (Netherlands), Siemens Healthineers (Germany), GE Healthcare (USA), Medtronic (Ireland), Nihon Kohden Corporation (Japan), BrainScope Company, Inc. (USA), Natus Medical Incorporated (USA), Compumedics Limited (Australia), Abbott Laboratories (USA), EMOTIV (USA), Cadwell Laboratories, Inc. (USA), Schiller AG (Switzerland), and Other Active Players.

Q3: What are the segments of the Neurodiagnostics Market?

A3: The Neurodiagnostics Market is segmented into Product Type, Technology, Application, End User and region. By Product Type, the market is categorized into EEG (Electroencephalography), EMG (Electromyography), EP (Evoked Potentials), LTM (Long-term Monitoring), NCS (Nerve Conduction Studies), Others. By End User, the market is categorized into Hospitals, Diagnostic Centers, Research & Academic Institutes, Homecare Settings. By Application, the market is categorized into Epilepsy, Alzheimer’s Disease, Parkinson’s Disease, Multiple Sclerosis, Sleep Disorders, Others. By Technology, the market is categorized into Conventional Neurodiagnostics, Portable Neurodiagnostic Devices, Wireless Neurodiagnostic Devices. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Neurodiagnostics Market?

A4: Neurodiagnostics comprises a variety of applied technologies for diagnosing neurological conditions, which consist mainly of cerebral, neural, and spinal disorders. Diagnoses are enabled by methods such as EEG, EMG, and NCS, which have become indispensable tools for disease diagnosis in the early stages of their development-epilepsy, Alzheimer's, Parkinson's, and multiple sclerosis.

Q5: How big is the Neurodiagnostics Market?

A5: Neurodiagnostics Market Size Was Valued at USD 8.69 Billion in 2023, and is Projected to Reach USD 17.96 Billion by 2032, Growing at a CAGR of 8.4% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!