Stay Ahead in Fast-Growing Economies.

Browse Reports NowMold Remediation Service Market Share, Trends & Market Forecast (2024-2032)

Mold remediation service market entails selling of services that focus on assessment, removal or prevention of mold in indoor premises.

IMR Group

Description

Mold Remediation Service Market Synopsis:

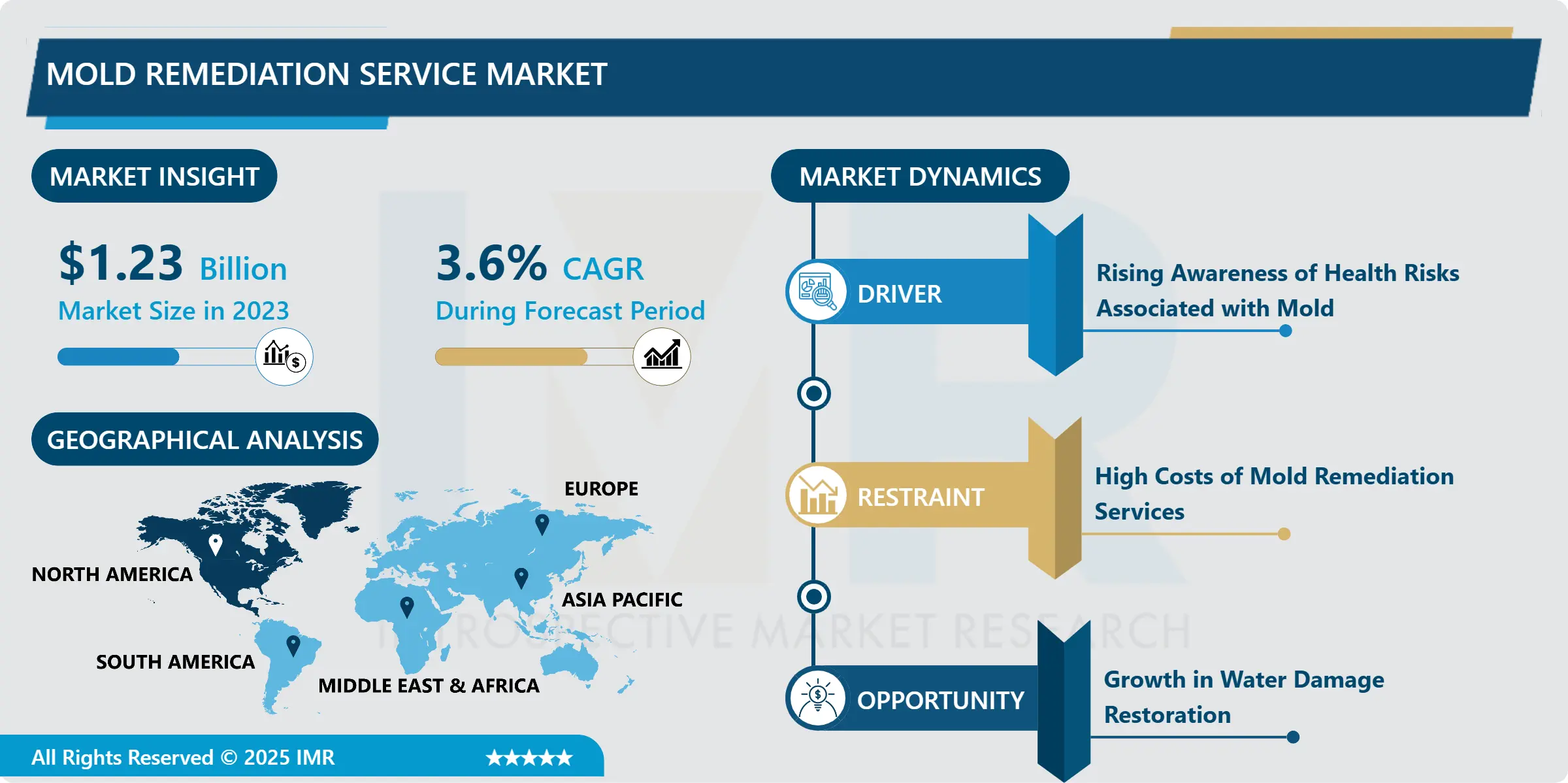

Mold Remediation Service Market Size Was Valued at USD 1.23 Billion in 2023, and is Projected to Reach USD 1.69 Billion by 2032, Growing at a CAGR of 3.6% From 2024-2032.

Mold remediation service market entails selling of services that focus on assessment, removal or prevention of mold in indoor premises. These services are vital in enhancing air quality, health safer and preventing loss due to damage by mold on structures. Mold remediation service can consist of inspection, removal of mold, cleanup, elimination of moisture, and restoration.

Mold removal is vital when it comes to occupying clean space if living and working spaces, or in areas that experience high humidity or water damage. A heightened concern with the health danger of mold, including respiratory tract troubles, allergies, and other chronic ailments, is also influencing the further development of professional removal services. As the incidence of water problems due to floods, breaks, and natural disasters is rising, specialized mold removal services are getting more urgent. Also, the government regulations and health issues have set a higher level to eliminate and control mold that also rule the market.

Services available in mold remediation service markets also may come from different establishments, from independent local businesses to large scale franchises catering the nation. Firms usually provide mold inspections and consultation, mold contamination estimation and remediation, which involves the dismantling and disposal of the affected material, washing, disinfecting and re-coating the affected areas. In addition, Mold detection has been made easier, effective and efficient over the years by the technological improvements in the equipments used during mold detection and expensive mold detection solutions that conform to the environmental conservation by avoiding toxic raw materials used in mold remediation. There has been a higher level of demand of green and sustainable consumer products that fostered the change of traditional mold remediation into more sustainable solution.

Climate change exists and continues to cause an increase in the incidence of severe climate factors such as heavy rainfall, hurricanes and this implies increased incidence of water damage, which, in turn, leads to mold formation. This makes the mold remediation services market to expand year on year globally; particularly a region that is affected by storms or flooding frequently. Also, more housing units, business establishments, and factories are seeking for mold prevention services, which entail regular maintenance services, thereby, creating continuous stream of clientele in the industry. Market players are also implementing the IT tools for improvement in the inspection and monitoring, thereby resulting in increased efficiency and cost competence of the services rendered.

Mold Remediation Service Market Trend Analysis:

Increasing Demand for Eco-Friendly Mold Remediation Solutions

More and more people turn to the organic and non-hazardous mold removal techniques. Both customers and all companies focus on environmental responsibility in all processes concerning property care, including mold eradication. Most conventional mold remediation techniques typically employ the application of toxic chemicals that are disadvantageous to people, and the planet. Therefore, there is an increasing trend on choosing more natural or organic mold removal products and techniques such as plant based cleaner and ozone treatment, which are both friendly to the environment and its people.

Such change is happening due to the higher awareness of eco-friendly products by the customers & also due to higher standards of environmental preparedness and health protection. The mold remediation industry is constantly advancing towards the safety of workers and homeowner as governments and other industrial bodies craft better policies. Therefore companies that are providing green services have a competitive advantage because they are able to provide service to the conscious customers as well as regulatory mandates which will help to support the longer term growth in the mold remediation service market.

Growth in Water Damage Restoration

In the mold remediation service market, there is a major trend that can be taken advantage of which include the increased usage of water damage restoration services. Mold develops most especially due to water infiltration and with the rising incidence of flooding, burst pipes, among others, water damage restoration business together with mold remediation services related to the rise in incidence of mold development is on the rise. The incidences of water damage are expected to increase with changes in climate which bring about frequent occurrences of extreme weathers which are likely to worsen the incident of water damage and hence continuously driving the frequency of mold removal and water damage repair services.

A great opportunity for mold remediation service provider who can add services to insurance companies, disaster restoration firms, and construction contractor companies. Providers can act as special-knowing sampled professionals in areas such as water damage, or mold remediation, which opens up the market to other sectors, including commercial and residential. As worldwide water damage cases continue to increase companies operating in water damage restoration business are poised to gain from this market for mold remediation.

Mold Remediation Service Market Segment Analysis:

Mold Remediation Service Market is Segmented on the basis of Type, Service Type, Application, End User, and Region.

By Type, Residential segment is expected to dominate the market during the forecast period

The residential segment is projected to dominate the Mold Remediation Service Market during the forecast period. This growth is driven by an increasing awareness of the health risks associated with mold and the need for residential property owners to maintain safe and healthy living environments. Factors such as the rising prevalence of respiratory issues, allergies, and other health concerns linked to mold exposure have fueled the demand for mold remediation services.

The growing trend of home renovation and maintenance activities has contributed to the increasing need for mold remediation in residential properties. The segment’s dominance is further supported by an expanding population, changing weather patterns, and the growing number of homes susceptible to mold growth due to damp conditions. As a result, residential mold remediation services are expected to remain a key focus area for market players throughout the forecast period.

By Application, Water Damage Restoration segment expected to held the largest share

The Water Damage Restoration segment is anticipated to hold the largest share in the Mold Remediation Service Market due to the strong connection between water damage and mold growth. When water infiltrates buildings, especially through flooding, leaks, or high humidity, it creates a favorable environment for mold to develop. Mold remediation services are often needed to address the hazards posed by mold in water-damaged areas.

As water damage can lead to structural damage and health concerns, prompt remediation is essential to prevent further deterioration. The increasing frequency of water-related incidents, such as storms, floods, and plumbing failures, contributes to the rising demand for mold remediation services in water-damaged areas. Furthermore, water damage restoration is critical for maintaining indoor air quality and ensuring the safety of the occupants, driving the growth of this segment within the broader mold remediation market.

Mold Remediation Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The global mold remediation service market is led by North America because people are, more conscious about health risks related to molds, incidences of water damage, and regulatory requirements are well developed in this region. Mold remediation services are popular due to growing mold health concerns in homes, workplaces, and factories. Finally, North America is preferred most due to better infrastructure and an availability of modern mold detection and remediation technologies. Authorities such as the United States and Canadian governments and regulatory authorities have high expectations for quality air and environmental conservation, which enhances the market for professional mold remediation services.

The emergence of hurricanes, floods, and other calamities made necessary the mold remediation service in North American regions. Such events result in water damage in a large scale making conducive environment for growth of mold. Further, environmental change and resulting harsh weather increases the need for its cleaning services hence projected to grow in the future pulling North America ahead of all other regions.

Active Key Players in the Mold Remediation Service Market:

ServiceMaster Clean (USA)

Servpro Industries, LLC (USA)

Moldex Remediation (USA)

Paul Davis Restoration, Inc. (USA)

Roto-Rooter Services Company (USA)

Belfor Property Restoration (USA)

Restoration 1 (USA)

PuroClean (USA)

Disaster Recovery Inc. (USA)

The Duct Guys, LLC (USA)

First Restoration Services (USA)

Indoor Environmental Services, Inc. (USA), and Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Mold Remediation Service Market by Type

4.1 Mold Remediation Service Market Snapshot and Growth Engine

4.2 Mold Remediation Service Market Overview

4.3 Residential

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Residential: Geographic Segmentation Analysis

4.4 Commercial

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Commercial: Geographic Segmentation Analysis

4.5 Industrial

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Industrial: Geographic Segmentation Analysis

Chapter 5: Mold Remediation Service Market by Service Type

5.1 Mold Remediation Service Market Snapshot and Growth Engine

5.2 Mold Remediation Service Market Overview

5.3 Mold Inspection

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Mold Inspection: Geographic Segmentation Analysis

5.4 Mold Removal

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Mold Removal: Geographic Segmentation Analysis

5.5 Mold Prevention

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Mold Prevention: Geographic Segmentation Analysis

5.6 Mold Testing

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Mold Testing: Geographic Segmentation Analysis

Chapter 6: Mold Remediation Service Market by Application

6.1 Mold Remediation Service Market Snapshot and Growth Engine

6.2 Mold Remediation Service Market Overview

6.3 Water Damage Restoration

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Water Damage Restoration: Geographic Segmentation Analysis

6.4 HVAC Systems

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 HVAC Systems: Geographic Segmentation Analysis

6.5 Walls

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Walls: Geographic Segmentation Analysis

6.6 Ceilings

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Ceilings: Geographic Segmentation Analysis

6.7 and Floors

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 and Floors: Geographic Segmentation Analysis

Chapter 7: Mold Remediation Service Market by End-User

7.1 Mold Remediation Service Market Snapshot and Growth Engine

7.2 Mold Remediation Service Market Overview

7.3 Homeowners

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Homeowners: Geographic Segmentation Analysis

7.4 Commercial Buildings

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Commercial Buildings: Geographic Segmentation Analysis

7.5 Government and Public Sector

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Government and Public Sector: Geographic Segmentation Analysis

7.6 Healthcare Facilities

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Healthcare Facilities: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Mold Remediation Service Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SERVICEMASTER CLEAN (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SERVPRO INDUSTRIES LLC (USA)

8.4 MOLDEX REMEDIATION (USA)

8.5 PAUL DAVIS RESTORATION INC. (USA)

8.6 ROTO-ROOTER SERVICES COMPANY (USA)

8.7 BELFOR PROPERTY RESTORATION (USA)

8.8 RESTORATION 1 (USA)

8.9 PUROCLEAN (USA)

8.10 DISASTER RECOVERY INC. (USA)

8.11 THE DUCT GUYS LLC (USA)

8.12 FIRST RESTORATION SERVICES (USA)

8.13 INDOOR ENVIRONMENTAL SERVICES INC. (USA)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Mold Remediation Service Market By Region

9.1 Overview

9.2. North America Mold Remediation Service Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Residential

9.2.4.2 Commercial

9.2.4.3 Industrial

9.2.5 Historic and Forecasted Market Size By Service Type

9.2.5.1 Mold Inspection

9.2.5.2 Mold Removal

9.2.5.3 Mold Prevention

9.2.5.4 Mold Testing

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Water Damage Restoration

9.2.6.2 HVAC Systems

9.2.6.3 Walls

9.2.6.4 Ceilings

9.2.6.5 and Floors

9.2.7 Historic and Forecasted Market Size By End-User

9.2.7.1 Homeowners

9.2.7.2 Commercial Buildings

9.2.7.3 Government and Public Sector

9.2.7.4 Healthcare Facilities

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Mold Remediation Service Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Residential

9.3.4.2 Commercial

9.3.4.3 Industrial

9.3.5 Historic and Forecasted Market Size By Service Type

9.3.5.1 Mold Inspection

9.3.5.2 Mold Removal

9.3.5.3 Mold Prevention

9.3.5.4 Mold Testing

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Water Damage Restoration

9.3.6.2 HVAC Systems

9.3.6.3 Walls

9.3.6.4 Ceilings

9.3.6.5 and Floors

9.3.7 Historic and Forecasted Market Size By End-User

9.3.7.1 Homeowners

9.3.7.2 Commercial Buildings

9.3.7.3 Government and Public Sector

9.3.7.4 Healthcare Facilities

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Mold Remediation Service Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Residential

9.4.4.2 Commercial

9.4.4.3 Industrial

9.4.5 Historic and Forecasted Market Size By Service Type

9.4.5.1 Mold Inspection

9.4.5.2 Mold Removal

9.4.5.3 Mold Prevention

9.4.5.4 Mold Testing

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Water Damage Restoration

9.4.6.2 HVAC Systems

9.4.6.3 Walls

9.4.6.4 Ceilings

9.4.6.5 and Floors

9.4.7 Historic and Forecasted Market Size By End-User

9.4.7.1 Homeowners

9.4.7.2 Commercial Buildings

9.4.7.3 Government and Public Sector

9.4.7.4 Healthcare Facilities

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Mold Remediation Service Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Residential

9.5.4.2 Commercial

9.5.4.3 Industrial

9.5.5 Historic and Forecasted Market Size By Service Type

9.5.5.1 Mold Inspection

9.5.5.2 Mold Removal

9.5.5.3 Mold Prevention

9.5.5.4 Mold Testing

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Water Damage Restoration

9.5.6.2 HVAC Systems

9.5.6.3 Walls

9.5.6.4 Ceilings

9.5.6.5 and Floors

9.5.7 Historic and Forecasted Market Size By End-User

9.5.7.1 Homeowners

9.5.7.2 Commercial Buildings

9.5.7.3 Government and Public Sector

9.5.7.4 Healthcare Facilities

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Mold Remediation Service Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Residential

9.6.4.2 Commercial

9.6.4.3 Industrial

9.6.5 Historic and Forecasted Market Size By Service Type

9.6.5.1 Mold Inspection

9.6.5.2 Mold Removal

9.6.5.3 Mold Prevention

9.6.5.4 Mold Testing

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Water Damage Restoration

9.6.6.2 HVAC Systems

9.6.6.3 Walls

9.6.6.4 Ceilings

9.6.6.5 and Floors

9.6.7 Historic and Forecasted Market Size By End-User

9.6.7.1 Homeowners

9.6.7.2 Commercial Buildings

9.6.7.3 Government and Public Sector

9.6.7.4 Healthcare Facilities

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Mold Remediation Service Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Residential

9.7.4.2 Commercial

9.7.4.3 Industrial

9.7.5 Historic and Forecasted Market Size By Service Type

9.7.5.1 Mold Inspection

9.7.5.2 Mold Removal

9.7.5.3 Mold Prevention

9.7.5.4 Mold Testing

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Water Damage Restoration

9.7.6.2 HVAC Systems

9.7.6.3 Walls

9.7.6.4 Ceilings

9.7.6.5 and Floors

9.7.7 Historic and Forecasted Market Size By End-User

9.7.7.1 Homeowners

9.7.7.2 Commercial Buildings

9.7.7.3 Government and Public Sector

9.7.7.4 Healthcare Facilities

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Mold Remediation Service Market research report?

A1: The forecast period in the Mold Remediation Service Market research report is 2024-2032.

Q2: Who are the key players in the Mold Remediation Service Market?

A2: ServiceMaster Clean (USA), Servpro Industries, LLC (USA), Moldex Remediation (USA), Paul Davis Restoration, Inc. (USA), Roto-Rooter Services Company (USA), Belfor Property Restoration (USA), Restoration 1 (USA), PuroClean (USA), Disaster Recovery Inc. (USA), The Duct Guys, LLC (USA), First Restoration Services (USA), Indoor Environmental Services, Inc. (USA), and Other Active Players.

Q3: What are the segments of the Mold Remediation Service Market?

A3: The Mold Remediation Service Market is segmented into Type, Service Type, Application, End User and Region. By Type, the market is categorized into Residential, Commercial, Industrial. By Service Type, the market is categorized into Mold Inspection, Mold Removal, Mold Prevention, Mold Testing. By Application, the market is categorized into Water Damage Restoration, HVAC Systems, Walls, Ceilings, and Floors. By End-User, the market is categorized into Homeowners, Commercial Buildings, Government and Public Sector, Healthcare Facilities. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Mold Remediation Service Market?

A4: Mold remediation service market entails selling of services that focus on assessment, removal or prevention of mold in indoor premises. These services are vital in enhancing air quality, health safer and preventing loss due to damage by mold on structures. Mold remediation service can consist of inspection, removal of mold, cleanup, elimination of moisture, and restoration.

Q5: How big is the Mold Remediation Service Market?

A5: Mold Remediation Service Market Size Was Valued at USD 1.23 Billion in 2023, and is Projected to Reach USD 1.69 Billion by 2032, Growing at a CAGR of 3.6% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!