Stay Ahead in Fast-Growing Economies.

Browse Reports NowMobile Virtual Network Operators Market Growth Analysis & Forecast (2024-2032)

The Mobile Virtual Network Operators Market refers to the industry that offers mobile services directly to the consumer whilst it does not own the physical network.

IMR Group

Description

Mobile Virtual Network Operators Market Synopsis:

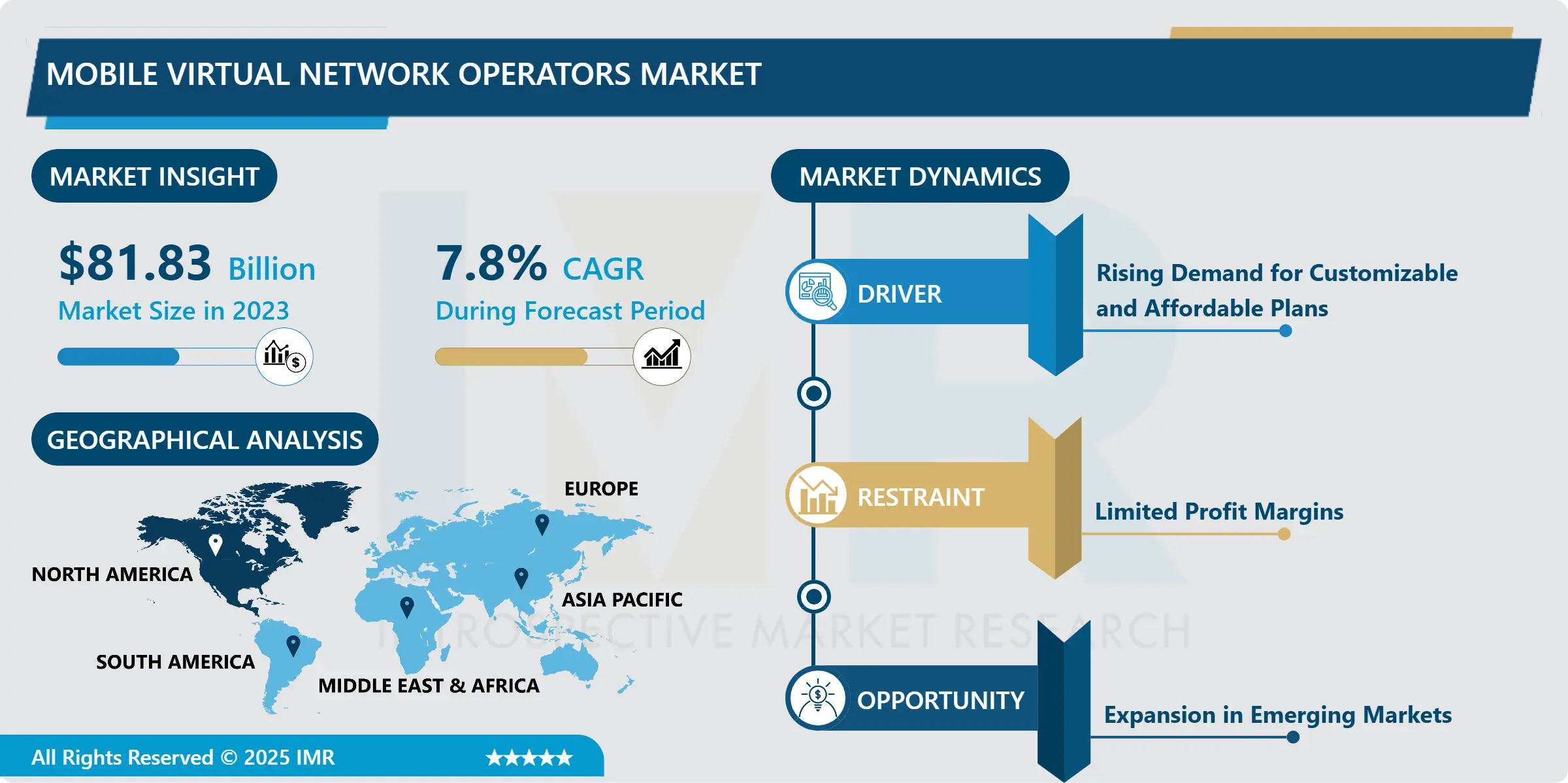

Mobile Virtual Network Operators Market Size Was Valued at USD 81.83 Billion in 2023, and is Projected to Reach USD 160.87 Billion by 2032, Growing at a CAGR of 7.8% From 2024-2032.

The Mobile Virtual Network Operators Market refers to the industry that offers mobile services directly to the consumer whilst it does not own the physical network. MVNOs buy network capacity from the owners of the networks – the MNOs – and make provision of inexpensive, relevant services to targeted segments, through which they can differentiate themselves through matters of price, service delivery or specialization.

MVNO has become a significant business vertical of the telecommunications industry due to rising customer preference for cheap and specific services. MVNOs work based on gaining right to access infrastructure of the original MNOs that make it easy for them to offer cheaper prices and adopt value added services. More of these operators fit specific consumers’ requirements, for example, individuals who are concerned with costs, particular ethnic groups or young retirees, the millennials generation, and so on.

Competition benefits from MVNOs insofar as a large degree of flexibility is granted to consumers on the telecom market. They occupy the gray area between the low-cost charges and the most expensive services, with often a bias towards the value added services such as data, entertainment and roaming services. It is also experiencing a higher uptake of digital services, where examples of new age mobile virtual network operators cropped up. The increase in the demand for this market segment is further complemented by progressive technologies such as 5G, which act to improve the quality of the services provided, in addition to creating appealing possibilities for MVNOs’ innovations.

MVNOs are penetrating more markets to target different regions with oriented high mobile penetration but undiscovered opportunities to serve a particular customer base. That is why, rules also matter greatly; most of the countries try to promote the MVNOs’ involvement in order to increase the competition level and, as a result, decrease consumers’ tariffs. The on-going evolution in the utilization of the eSIM technology and the general digital transformation trends are opening up new opportunities of the Business Model that in turn defines the possibilities of a high-quality customer acquisition by the brand of the MVNOs.

Mobile Virtual Network Operators Market Trend Analysis:

Growing Adoption of Digital-First MVNOs

One can talk about the emerging nature of the market shift to digital-first MVNOs. Such operators use state-of-the-art digital technologies to manage their work, reduce expenses and improve customers’ experience. Most digital MVNOs are app-based, with many consumers handling everything from self-service to billing and support without visiting a store or relying on a large number of customer service representatives.

The fact of using the digital strategy enables MVNOs to target customers who use their devices actively, including those who prefer to access the internet for managing their mobile contracts. This trend also fits scalability, as MVNOs can add new clients without similar growth in operating costs. As a result, the implementation of AI and machine learning technologies in digital environments helps the MVNOs examine the customers’ behavior and include the relevant products, proposed plans, and efficient delivery of services into the market growth factors.

Expansion in Emerging Markets

MVNOs can tap into the emerging markets as they show indications of a higher mobile penetration, a large number of populace in rural areas that remain unserved or underserved and a continuously increasing call for cheaper or comp??st cost mobile services. Currently, there is a growing mobile users trend especially in developing countries in Asia-Pacific, Africa, and Latin America that could support MVNOs ‘growth.

Markets can be targeted by MVNOs that have low-cost strategies to appeal to the low income earners besides responding to local needs such as; language or facilities such as mobile banking. The governments of these regions are also encouraging MVNO participation in order to improve competition and lower tariffs as well as to guarantee low levels of mobile connectivity. The availability of inexpensive Smartphones and today’s 4G/5G networks add more credibility behind MVNO successes in such emerging economies.

Mobile Virtual Network Operators Market Segment Analysis:

Mobile Virtual Network Operators Market is Segmented on the basis of Type, Business Model, Subscriber, and Region.

By Type, Reseller MVNO segment is expected to dominate the market during the forecast period

Reseller MVNOs on the other hand acquire direct service access from an MNO and offer it to consumers. This type enables firms entering the market more quickly without having large investments in infrastructure, and therefore appeals to new entrants. Though, some problems arise for Reseller MVNOs to gain differentiation strategies since they solely depend on the good-networking host MNO.

Full MVNEs outsources nearly all aspects of it operation including billings, customer care, and branding but has to lease its network infrastructure. Larger levels of operational control over the service offered to consumers and the overall customer experience profile lead to improved competitiveness of Full MVNEs. The cost that has to be committed at the start of the Full MVNEs is larger but the overall revenues are larger, and the Full MVNE NIC is less dependent on complexities in the network and equipment that causes distinction.

By Business Model, Discount segment expected to held the largest share

Value added MVNOs main strategy is based on differentiation and the provision of low prices to attract more buyers on price sensitive segment. For this reason, these operators usually offer stripped down services in order to remain cheap, and are thus frequently used in areas with high levels of competition and prices sensitive consumers.

These MVNOs ally telecom services with media content including streaming services or gaming platforms. This model targets a younger generation as well as different users who require telecommunication and media with harmony between telecom and media business.

Mobile Virtual Network Operators Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The leading market for MVNO is North America due to technological enhancement of communication technology and enhanced mobile communication. The influence of competition in the region promotes the establishment of MVNOs that fulfills the various demands of the consumers. Furthermore, more stringencies of the laws in the United States and Canada foster MVNO involvement to protect customer rationality and equity.

Using technological innovations like 5G, the North American MVNOs can frequently deliver services at par with the MNOs. This advantage, combined with an educated and digitally connected population and massive investments in digitalization, further strengthens North America we talked about in the previous section as the most prominent market for MVNOs.

Active Key Players in the Mobile Virtual Network Operators Market:

Virgin Mobile (United Kingdom)

TracFone Wireless (United States)

Lycamobile (United Kingdom)

Giffgaff (United Kingdom)

Freenet AG (Germany)

Lebara (United Kingdom)

TalkTalk (United Kingdom)

Republic Wireless (United States)

Kajeet (United States)

Boost Mobile (United States)

PosteMobile (Italy)

Tuenti (Spain), and Other Active Players

Key Industry Developments in the Mobile Virtual Network Operators Market:

In December 2023, Tello revealed a new array of cell phone plans, which include more options for high-speed data and lower prices. Each of the high-speed data options can be paired with 0, 100, 300, 500, or unlimited minutes. The new plan options include 10GB or 15 GB of high-speed data per month. Moreover, the company has also reduced the price of the older option. For instance, 25 GB of high-speed data per month, which was previously available for USD 29, is now reduced to 35 GB of data for USD 25.

In November 2023, Tesco Mobile Ireland announced a new referral program, which rewards referrers and new customers for their advocacy. The company launched in Ireland in 2013 and has more than 1 million customers with a network coverage of over 99%. With the new referral program, the company aims to capture more customers and gain better traction in the Irish mobile virtual network operator market.

In October 2023, Fliggs Mobile announced its partnership with T-Mobile for launching its Web3 MVNO. In the mobile app of Fliggs Mobile, the company has integrated a non-custodial wallet, which offers customers a secure and convenient gateway to Web3. Fliggs mobile also enables universal access to Web3 and FinTech services, which enables customers to have better control over their data and improve privacy in digital transactions. Moreover, the wallet also facilitates cryptocurrency payments, charitable donations, and cashback loyalty programs.

In March 2023, T-Mobile U.S. announced its entering into a definitive agreement for acquiring Ka’ena Corporation and its subsidiaries and brands, which include Ultra Mobile, Mint Mobile, and wholesaler Plum. T-Mobile is acquiring the brand’s sales, digital, marketing, and service options; The company also intends to use its supplier relationships and distribution to assist the brand growth and offer competitive prices to U.S. customers who are looking for value offerings. Both the Mint and Ultra brands are complementary to T-Mobile’s current prepaid service offering.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Mobile Virtual Network Operators Market by Type

4.1 Mobile Virtual Network Operators Market Snapshot and Growth Engine

4.2 Mobile Virtual Network Operators Market Overview

4.3 Reseller MVNO

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Reseller MVNO: Geographic Segmentation Analysis

4.4 Full MVNO

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Full MVNO: Geographic Segmentation Analysis

4.5 Service Provider MVNO

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Service Provider MVNO: Geographic Segmentation Analysis

Chapter 5: Mobile Virtual Network Operators Market by Business Model

5.1 Mobile Virtual Network Operators Market Snapshot and Growth Engine

5.2 Mobile Virtual Network Operators Market Overview

5.3 Discount

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Discount: Geographic Segmentation Analysis

5.4 Telecom

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Telecom: Geographic Segmentation Analysis

5.5 Media/Entertainment

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Media/Entertainment: Geographic Segmentation Analysis

5.6 Retail

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Retail: Geographic Segmentation Analysis

5.7 Migrant

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Migrant: Geographic Segmentation Analysis

5.8 Business

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Business: Geographic Segmentation Analysis

Chapter 6: Mobile Virtual Network Operators Market by Subscriber

6.1 Mobile Virtual Network Operators Market Snapshot and Growth Engine

6.2 Mobile Virtual Network Operators Market Overview

6.3 Individual Consumers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Individual Consumers: Geographic Segmentation Analysis

6.4 Enterprise

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Enterprise: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Mobile Virtual Network Operators Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 VIRGIN MOBILE (UNITED KINGDOM)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 TRACFONE WIRELESS (UNITED STATES)

7.4 LYCAMOBILE (UNITED KINGDOM)

7.5 GIFFGAFF (UNITED KINGDOM)

7.6 FREENET AG (GERMANY)

7.7 LEBARA (UNITED KINGDOM)

7.8 TALKTALK (UNITED KINGDOM)

7.9 REPUBLIC WIRELESS (UNITED STATES)

7.10 KAJEET (UNITED STATES)

7.11 BOOST MOBILE (UNITED STATES)

7.12 POSTEMOBILE (ITALY)

7.13 TUENTI (SPAIN)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Mobile Virtual Network Operators Market By Region

8.1 Overview

8.2. North America Mobile Virtual Network Operators Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Reseller MVNO

8.2.4.2 Full MVNO

8.2.4.3 Service Provider MVNO

8.2.5 Historic and Forecasted Market Size By Business Model

8.2.5.1 Discount

8.2.5.2 Telecom

8.2.5.3 Media/Entertainment

8.2.5.4 Retail

8.2.5.5 Migrant

8.2.5.6 Business

8.2.6 Historic and Forecasted Market Size By Subscriber

8.2.6.1 Individual Consumers

8.2.6.2 Enterprise

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Mobile Virtual Network Operators Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Reseller MVNO

8.3.4.2 Full MVNO

8.3.4.3 Service Provider MVNO

8.3.5 Historic and Forecasted Market Size By Business Model

8.3.5.1 Discount

8.3.5.2 Telecom

8.3.5.3 Media/Entertainment

8.3.5.4 Retail

8.3.5.5 Migrant

8.3.5.6 Business

8.3.6 Historic and Forecasted Market Size By Subscriber

8.3.6.1 Individual Consumers

8.3.6.2 Enterprise

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Mobile Virtual Network Operators Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Reseller MVNO

8.4.4.2 Full MVNO

8.4.4.3 Service Provider MVNO

8.4.5 Historic and Forecasted Market Size By Business Model

8.4.5.1 Discount

8.4.5.2 Telecom

8.4.5.3 Media/Entertainment

8.4.5.4 Retail

8.4.5.5 Migrant

8.4.5.6 Business

8.4.6 Historic and Forecasted Market Size By Subscriber

8.4.6.1 Individual Consumers

8.4.6.2 Enterprise

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Mobile Virtual Network Operators Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Reseller MVNO

8.5.4.2 Full MVNO

8.5.4.3 Service Provider MVNO

8.5.5 Historic and Forecasted Market Size By Business Model

8.5.5.1 Discount

8.5.5.2 Telecom

8.5.5.3 Media/Entertainment

8.5.5.4 Retail

8.5.5.5 Migrant

8.5.5.6 Business

8.5.6 Historic and Forecasted Market Size By Subscriber

8.5.6.1 Individual Consumers

8.5.6.2 Enterprise

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Mobile Virtual Network Operators Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Reseller MVNO

8.6.4.2 Full MVNO

8.6.4.3 Service Provider MVNO

8.6.5 Historic and Forecasted Market Size By Business Model

8.6.5.1 Discount

8.6.5.2 Telecom

8.6.5.3 Media/Entertainment

8.6.5.4 Retail

8.6.5.5 Migrant

8.6.5.6 Business

8.6.6 Historic and Forecasted Market Size By Subscriber

8.6.6.1 Individual Consumers

8.6.6.2 Enterprise

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Mobile Virtual Network Operators Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Reseller MVNO

8.7.4.2 Full MVNO

8.7.4.3 Service Provider MVNO

8.7.5 Historic and Forecasted Market Size By Business Model

8.7.5.1 Discount

8.7.5.2 Telecom

8.7.5.3 Media/Entertainment

8.7.5.4 Retail

8.7.5.5 Migrant

8.7.5.6 Business

8.7.6 Historic and Forecasted Market Size By Subscriber

8.7.6.1 Individual Consumers

8.7.6.2 Enterprise

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Mobile Virtual Network Operators Market research report?

A1: The forecast period in the Mobile Virtual Network Operators Market research report is 2024-2032.

Q2: Who are the key players in the Mobile Virtual Network Operators Market?

A2: Virgin Mobile (United Kingdom), TracFone Wireless (United States), Lycamobile (United Kingdom), Giffgaff (United Kingdom), Freenet AG (Germany), Lebara (United Kingdom), TalkTalk (United Kingdom), Republic Wireless (United States), Kajeet (United States), Boost Mobile (United States), PosteMobile (Italy), Tuenti (Spain), and Other Active Players.

Q3: What are the segments of the Mobile Virtual Network Operators Market?

A3: The Mobile Virtual Network Operators Market is segmented into Type, Business Model, Subscriber and region. By Type, the market is categorized into Reseller MVNO, Full MVNO, Service Provider MVNO. By Business Model, the market is categorized into Discount, Telecom, Media/Entertainment, Retail, Migrant, Business. By Subscriber, the market is categorized into Individual Consumers, Enterprise. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Mobile Virtual Network Operators Market?

A4: The Mobile Virtual Network Operators Market refers to the industry that offers mobile services directly to the consumer whilst it does not own the physical network. MVNOs buy network capacity from the owners of the networks – the MNOs – and make provision of inexpensive, relevant services to targeted segments, through which they can differentiate themselves through matters of price, service delivery or specialization.

Q5: How big is the Mobile Virtual Network Operators Market?

A5: Mobile Virtual Network Operators Market Size Was Valued at USD 81.83 Billion in 2023, and is Projected to Reach USD 160.87 Billion by 2032, Growing at a CAGR of 7.8% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!