Stay Ahead in Fast-Growing Economies.

Browse Reports NowMetering Pump Market: Global Outlook & Market Dynamics

The metering pump encompasses the industry involved in the design, manufacturing, and sale of metering pumps. These pumps are specialized devices used to deliver precise amounts of fluids (liquids or slurries) at controlled rates. They are crucial in applications that require accurate and repeatable dosing or injection of chemicals, water, and other fluids.

IMR Group

Description

Metering Pump Market Synopsis

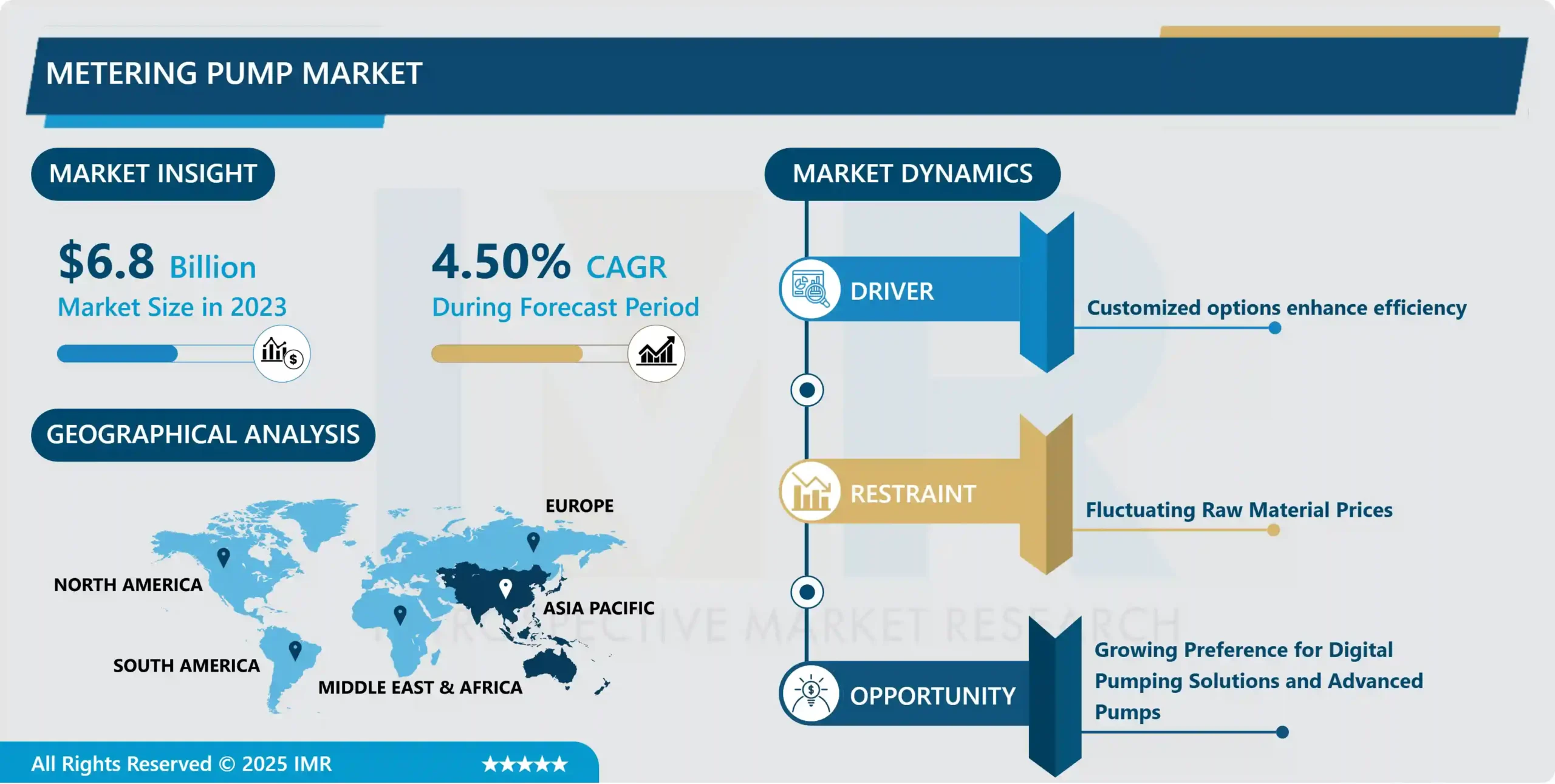

Metering Pump Market Size Was Valued at USD 6.8 Billion in 2023, and is Projected to Reach USD 10.11 Billion by 2032, Growing at a CAGR of 4.5% From 2024-2032.

The metering pump encompasses the industry involved in the design, manufacturing, and sale of metering pumps. These pumps are specialized devices used to deliver precise amounts of fluids (liquids or slurries) at controlled rates. They are crucial in applications that require accurate and repeatable dosing or injection of chemicals, water, and other fluids.

Metering pumps are essential in applications that require precise fluid control, such as chemical dosing, water treatment, and pharmaceutical production. These pumps ensure accurate delivery of liquids, often in small, measured quantities, making them indispensable in industries where precision is critical. Their design allows for the adjustment of flow rates, making them versatile for both low and high-pressure systems.

The advantages of metering pumps include their high accuracy, reliability, and ability to handle a wide range of fluid viscosities. They can operate in challenging conditions, such as extreme temperatures or corrosive environments, without compromising performance. Additionally, their adjustable flow rates and consistent output reduce waste and enhance overall process efficiency. As industries increasingly prioritize automation and precision, the future demand for metering pumps is expected to grow. Rising environmental regulations and the push for sustainable practices will also fuel demand, particularly in sectors like water treatment and chemical processing. Advancements in pump technology, including improved materials and energy-efficient designs, will further expand their adoption, ensuring steady market growth in the coming years.

Metering Pump Market Trend Analysis

Customized Options Enhance Efficiency

Different trends and opportunities are causing changes in the metering pump market. New developments consist of the emergence of intelligent metering pumps with digital controls and IoT connection, the creation of enhanced materials for long-lasting performance, and an emphasis on environmentally friendly and energy-saving options to adhere to stricter environmental laws.

Businesses provide personalized metering pump options with adjustable flow rates, materials, and designs. Efficiency is enhanced through integration with automation systems. Monitoring from a distance and analyzing data to predict maintenance needs and improve efficiency.

Fast industrial growth and urban development in developing regions such as Asia-Pacific and Latin America are driving up the need for metering pumps in water treatment and chemical processing sectors, generating fresh prospects for usage.

Growing Preference for Digital Pumping Solutions and Advanced Pumps

The growing preference for digital pumping solutions and advanced pumps presents a significant opportunity for the metering pump market. Digital pumps offer precise control over flow rates, pressure, and dosage, making them ideal for applications in industries like water treatment, chemicals, and pharmaceuticals, where accuracy is critical.

Advanced metering pumps, equipped with real-time monitoring and automation capabilities, improve efficiency and reduce operational costs. These smart solutions enable predictive maintenance, minimizing downtime and enhancing reliability, which is highly sought after in process-driven industries.

The rising demand for environmentally friendly solutions is driving innovation in digital pumps that optimize energy consumption and minimize waste. As industries shift towards sustainable practices, digital and advanced pumping solutions are poised to meet the evolving needs of the market, leading to increased adoption and growth for the metering pump industry.

Metering Pump Market Segment Analysis:

Metering Pump Market Segmented on the basis of Type, Pump Drive, Application, End-User, and Region

By Type, Diaphragm Segment Is Expected to Dominate the Market During the Forecast Period

Diaphragm pumps dominate the metering pump market because of their ability to handle a wide range of fluids, such as corrosive and viscous liquids, making them ideal for multiple industries. They resist chemical corrosion and provide precise dosing for important tasks in pharmaceuticals and chemical processing. The ability to control the flow rate enables accurate regulation in dosing procedures.

Diaphragm pumps are designed to be leak-proof, ensuring safe handling of hazardous fluids by preventing spills and contamination. They hold volatile substances efficiently, needing little upkeep thanks to their robust, uncomplicated design with minimal moving components, cutting down on operational expenses and downtime.

Diaphragm pumps are well-suited for rough conditions and difficult surroundings, which is why they are perfect for sectors such as oil and gas and mining. Their ability to work with automation enables remote control. This adaptability has resulted in extensive use in industries such as water treatment and pharmaceuticals, establishing them as the primary option in the metering pump industry.

By Application, the Water Treatment Segment Held the Largest Share in 2023

Metering pumps are crucial in water treatment procedures, as they are key in chemical dosing and disinfection. They guarantee precise chemical dosing, such as chlorine, to maintain water safety. Metering pumps are essential in water treatment facilities due to strict regulations, helping meet standards and reduce pollutants in wastewater to protect the environment.

The increasing need for clean water worldwide is a result of fast urbanization and population growth, prompting investments in water treatment facilities and metering pumps. The increasing worry about water scarcity emphasizes the need for effective treatment systems backed by metering pumps. Improving infrastructure involves enlarging and enhancing water treatment plants equipped with dependable pumps.

Metering pumps are crucial in industrial water treatment processes in sectors such as power generation, petrochemicals, and manufacturing. These pumps are essential for industries to accurately dose chemicals to maintain water quality standards. The use of metering pumps is essential for the treatment and recycling of wastewater, which is also on the rise. The market is being propelled by technological advancements such as smart metering pumps that have IoT capabilities and energy efficiency. In places such as the Asia-Pacific region, government funding for water treatment initiatives is increasing, leading to a rise in the market share of the segment.

Metering Pump Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

The prevalence of metering pump market is being fueled by fast industrialization and urbanization in the Asia-Pacific region. The rising industrial sector and urban growth have led to a higher need for metering pumps in industries such as chemical processing, water treatment, oil and gas, and pharmaceuticals. Furthermore, the growing demand for metering pumps in the region has been fueled by the rising need for water and wastewater treatment caused by water scarcity and quality concerns, as well as government actions.

Production of metering pumps is on the rise globally due to the leading role of the chemical industry in Asia-Pacific. Investments in exploration and refining are boosting growth in the oil and gas industry, leading to a demand for metering pumps for chemical injection. The demand for accurate dosing equipment is also spurred by the pharmaceutical and food sectors.

The metering pump market is dominated by the Asia-Pacific region due to its affordable production, innovations in research and development, supportive government regulations for industrial expansion, and the existence of key market participants. Asia-Pacific provides metering pumps worldwide with competitive pricing, local production advantages, and growing technology investments. The region experiences strong economic growth and infrastructure development, fueling demand for metering pumps in industries such as water treatment, chemicals, and pharmaceuticals, resulting in a dynamic and expanding market.

Metering Pump Market Active Players

Grundfos (Denmark)

Milton Roy (United States)

Iwaki Co., Ltd. (Japan)

ProMinent GmbH (Germany)

SPX Flow, Inc. (United States)

LEWA GmbH (Germany)

IDEX Corporation (United States)

Verder Group (Netherlands)

SEKO S.p.A. (Italy)

Nikkiso Co., Ltd. (Japan)

Lutz-Jesco GmbH (Germany)

Tefen Flow and Dosing Technologies Ltd. (Israel)

Blue-White Industries (United States)

Ailipu Technology Co., Ltd. (China)

Doseuro S.r.l. (Italy)

Wuhan Guide Infrared Co., Ltd. (China)

Pulsafeeder, Inc. (United States)

Seko Do Brasil (Brazil)

Eldex Laboratories, Inc. (United States)

Liquid Metronics Incorporated (LMI) (United States)

Watson-Marlow Fluid Technology Group (WMFTG) (United Kingdom)

Depamu (Hangzhou) Pump Technology Co., Ltd. (China)

Wanner Engineering, Inc. (United States)

Valmet Oyj (Finland)

Heidolph Instruments GmbH & Co. KG (Germany)

Tuthill Corporation (United States)

Grundfos Pumps India Pvt. Ltd. (India)

Cat Pumps (United States)

Accudyne Industries (United States)

SPP Pumps Ltd. (United Kingdom) and Other Active Players

Key Industry Developments in the Metering Pump Market:

In February 2024, Watson-Marlow Fluid Technology Solutions introduced the Qdos H-FLO chemical metering pump with a capacity of up to 158 gallons per hour (600 litres per hour) and 102 pounds per square inch. It offers precision, reliability, and flexibility for various industrial applications.

Advancements in metering pumps facilitate the movement of different fluids rapidly, with a focus on eco-friendly wastewater disposal. Modern infrastructure and high accuracy drive the global market, utilized in various sectors like wastewater treatment, food, petrochemicals, and oil.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Metering Pump Market by Type (2018-2032)

4.1 Metering Pump Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Diaphragm Pumps

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Piston/Plunger Pumps

4.5 Peristaltic Pumps

Chapter 5: Metering Pump Market by Pump Drive (2018-2032)

5.1 Metering Pump Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Solenoid

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Motor

5.5 Pneumatic

Chapter 6: Metering Pump Market by Application (2018-2032)

6.1 Metering Pump Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Water Treatment

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Chemical Injection

6.5 Dosing

6.6 Lubrication

6.7 Disinfection

Chapter 7: Metering Pump Market by End-User (2018-2032)

7.1 Metering Pump Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Water & Wastewater Treatment

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Oil & Gas

7.5 Chemical Processing

7.6 Food & Beverage

7.7 Pharmaceuticals

7.8 Agriculture

7.9 Paper & Pulp

7.10 Textiles

7.11 Mining

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Metering Pump Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 GRUNDFOS (DENMARK)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MILTON ROY (UNITED STATES)

8.4 IWAKI COLTD. (JAPAN)

8.5 PROMINENT GMBH (GERMANY)

8.6 SPX FLOW INC. (UNITED STATES)

8.7 LEWA GMBH (GERMANY)

8.8 IDEX CORPORATION (UNITED STATES)

8.9 VERDER GROUP (NETHERLANDS)

8.10 SEKO S.P.A. (ITALY)

8.11 NIKKISO COLTD. (JAPAN)

8.12 LUTZ-JESCO GMBH (GERMANY)

8.13 TEFEN FLOW AND DOSING TECHNOLOGIES LTD. (ISRAEL)

8.14 BLUE-WHITE INDUSTRIES (UNITED STATES)

8.15 AILIPU TECHNOLOGY COLTD. (CHINA)

8.16 DOSEURO S.R.L. (ITALY)

8.17 WUHAN GUIDE INFRARED COLTD. (CHINA)

8.18 PULSAFEEDER INC. (UNITED STATES)

8.19 SEKO DO BRASIL (BRAZIL)

8.20 ELDEX LABORATORIES INC. (UNITED STATES)

8.21 LIQUID METRONICS INCORPORATED (LMI) (UNITED STATES)

8.22 WATSON-MARLOW FLUID TECHNOLOGY GROUP (WMFTG) (UNITED KINGDOM)

8.23 DEPAMU (HANGZHOU) PUMP TECHNOLOGY COLTD. (CHINA)

8.24 WANNER ENGINEERING INC. (UNITED STATES)

8.25 VALMET OYJ (FINLAND)

8.26 HEIDOLPH INSTRUMENTS GMBH & CO. KG (GERMANY)

8.27 TUTHILL CORPORATION (UNITED STATES)

8.28 GRUNDFOS PUMPS INDIA PVT. LTD. (INDIA)

8.29 CAT PUMPS (UNITED STATES)

8.30 ACCUDYNE INDUSTRIES (UNITED STATES)

8.31 SPP PUMPS LTD. (UNITED KINGDOM)

Chapter 9: Global Metering Pump Market By Region

9.1 Overview

9.2. North America Metering Pump Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Diaphragm Pumps

9.2.4.2 Piston/Plunger Pumps

9.2.4.3 Peristaltic Pumps

9.2.5 Historic and Forecasted Market Size by Pump Drive

9.2.5.1 Solenoid

9.2.5.2 Motor

9.2.5.3 Pneumatic

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Water Treatment

9.2.6.2 Chemical Injection

9.2.6.3 Dosing

9.2.6.4 Lubrication

9.2.6.5 Disinfection

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Water & Wastewater Treatment

9.2.7.2 Oil & Gas

9.2.7.3 Chemical Processing

9.2.7.4 Food & Beverage

9.2.7.5 Pharmaceuticals

9.2.7.6 Agriculture

9.2.7.7 Paper & Pulp

9.2.7.8 Textiles

9.2.7.9 Mining

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Metering Pump Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Diaphragm Pumps

9.3.4.2 Piston/Plunger Pumps

9.3.4.3 Peristaltic Pumps

9.3.5 Historic and Forecasted Market Size by Pump Drive

9.3.5.1 Solenoid

9.3.5.2 Motor

9.3.5.3 Pneumatic

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Water Treatment

9.3.6.2 Chemical Injection

9.3.6.3 Dosing

9.3.6.4 Lubrication

9.3.6.5 Disinfection

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Water & Wastewater Treatment

9.3.7.2 Oil & Gas

9.3.7.3 Chemical Processing

9.3.7.4 Food & Beverage

9.3.7.5 Pharmaceuticals

9.3.7.6 Agriculture

9.3.7.7 Paper & Pulp

9.3.7.8 Textiles

9.3.7.9 Mining

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Metering Pump Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Diaphragm Pumps

9.4.4.2 Piston/Plunger Pumps

9.4.4.3 Peristaltic Pumps

9.4.5 Historic and Forecasted Market Size by Pump Drive

9.4.5.1 Solenoid

9.4.5.2 Motor

9.4.5.3 Pneumatic

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Water Treatment

9.4.6.2 Chemical Injection

9.4.6.3 Dosing

9.4.6.4 Lubrication

9.4.6.5 Disinfection

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Water & Wastewater Treatment

9.4.7.2 Oil & Gas

9.4.7.3 Chemical Processing

9.4.7.4 Food & Beverage

9.4.7.5 Pharmaceuticals

9.4.7.6 Agriculture

9.4.7.7 Paper & Pulp

9.4.7.8 Textiles

9.4.7.9 Mining

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Metering Pump Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Diaphragm Pumps

9.5.4.2 Piston/Plunger Pumps

9.5.4.3 Peristaltic Pumps

9.5.5 Historic and Forecasted Market Size by Pump Drive

9.5.5.1 Solenoid

9.5.5.2 Motor

9.5.5.3 Pneumatic

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Water Treatment

9.5.6.2 Chemical Injection

9.5.6.3 Dosing

9.5.6.4 Lubrication

9.5.6.5 Disinfection

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Water & Wastewater Treatment

9.5.7.2 Oil & Gas

9.5.7.3 Chemical Processing

9.5.7.4 Food & Beverage

9.5.7.5 Pharmaceuticals

9.5.7.6 Agriculture

9.5.7.7 Paper & Pulp

9.5.7.8 Textiles

9.5.7.9 Mining

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Metering Pump Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Diaphragm Pumps

9.6.4.2 Piston/Plunger Pumps

9.6.4.3 Peristaltic Pumps

9.6.5 Historic and Forecasted Market Size by Pump Drive

9.6.5.1 Solenoid

9.6.5.2 Motor

9.6.5.3 Pneumatic

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Water Treatment

9.6.6.2 Chemical Injection

9.6.6.3 Dosing

9.6.6.4 Lubrication

9.6.6.5 Disinfection

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Water & Wastewater Treatment

9.6.7.2 Oil & Gas

9.6.7.3 Chemical Processing

9.6.7.4 Food & Beverage

9.6.7.5 Pharmaceuticals

9.6.7.6 Agriculture

9.6.7.7 Paper & Pulp

9.6.7.8 Textiles

9.6.7.9 Mining

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Metering Pump Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Diaphragm Pumps

9.7.4.2 Piston/Plunger Pumps

9.7.4.3 Peristaltic Pumps

9.7.5 Historic and Forecasted Market Size by Pump Drive

9.7.5.1 Solenoid

9.7.5.2 Motor

9.7.5.3 Pneumatic

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Water Treatment

9.7.6.2 Chemical Injection

9.7.6.3 Dosing

9.7.6.4 Lubrication

9.7.6.5 Disinfection

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Water & Wastewater Treatment

9.7.7.2 Oil & Gas

9.7.7.3 Chemical Processing

9.7.7.4 Food & Beverage

9.7.7.5 Pharmaceuticals

9.7.7.6 Agriculture

9.7.7.7 Paper & Pulp

9.7.7.8 Textiles

9.7.7.9 Mining

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Metering Pump Market research report?

A1: The forecast period in the Metering Pump Market research report is 2024-2032.

Q2: Who are the key players in the Metering Pump Market?

A2: Grundfos (Denmark), Milton Roy (United States), Iwaki Co., Ltd. (Japan), ProMinent GmbH (Germany), SPX Flow, Inc. (United States), LEWA GmbH (Germany), IDEX Corporation (United States), Verder Group (Netherlands), SEKO S.p.A. (Italy), Nikkiso Co., Ltd. (Japan), Lutz-Jesco GmbH (Germany), Tefen Flow and Dosing Technologies Ltd. (Israel), Blue-White Industries (United States), Ailipu Technology Co., Ltd. (China), Doseuro S.r.l. (Italy), Wuhan Guide Infrared Co., Ltd. (China), Pulsafeeder, Inc. (United States), Seko Do Brasil (Brazil), Eldex Laboratories, Inc. (United States), Liquid Metronics Incorporated (LMI) (United States), Watson-Marlow Fluid Technology Group (WMFTG) (United Kingdom), Depamu (Hangzhou) Pump Technology Co., Ltd. (China), Wanner Engineering, Inc. (United States), Valmet Oyj (Finland), Heidolph Instruments GmbH & Co. KG (Germany), Tuthill Corporation (United States), Grundfos Pumps India Pvt. Ltd. (India), Cat Pumps (United States), Accudyne Industries (United States), SPP Pumps Ltd. (United Kingdom) and Other Active Players.

Q3: What are the segments of the Metering Pump Market?

A3: The Metering Pump Market is segmented into Type, Pump Drive, Application, End-User, and region. By Type, the market is categorized into Diaphragm Pumps, Piston/Plunger Pumps, and Peristaltic Pumps. By Pump Drive, the market is categorized into Solenoid, Motor, and Pneumatic. By Application, the market is categorized into Water Treatment, Chemical Injection, Dosing, Lubrication, and Disinfection. By End-User, the market is categorized into Water & Wastewater Treatment, Oil & Gas, Chemical Processing, Food & Beverage, Pharmaceuticals, Agriculture, Paper & Pulp, Textiles, and Mining. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Metering Pump Market?

A4: The metering pump market encompasses the industry involved in the design, manufacturing, and sale of metering pumps. These pumps are specialized devices used to deliver precise amounts of fluids (liquids or slurries) at controlled rates. They are crucial in applications that require accurate and repeatable dosing or injection of chemicals, water, and other fluids.

Q5: How big is the Metering Pump Market?

A5: Metering Pump Market Size Was Valued at USD 6.8 Billion in 2023, and is Projected to Reach USD 10.11 Billion by 2032, Growing at a CAGR of 4.5% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!