Stay Ahead in Fast-Growing Economies.

Browse Reports NowMedical Textile Market – Comprehensive Study Report with Recent Trends

Medical textiles are specialized textile materials and products that are specifically designed and manufactured for use in healthcare and medical applications which play a crucial role in various medical settings, including hospitals, clinics, surgical centres, and home healthcare.

IMR Group

Description

Medical Textile Market Synopsis

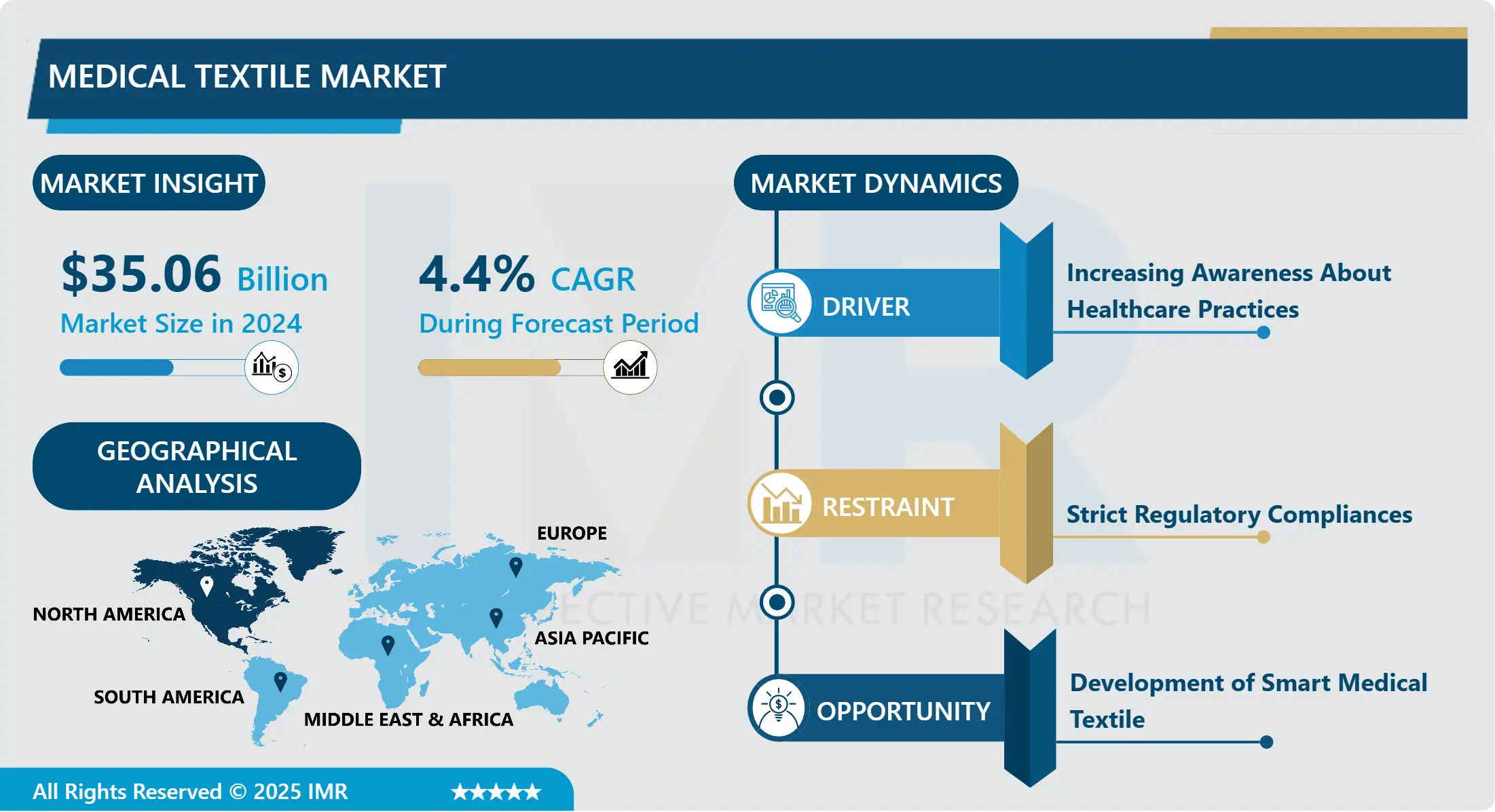

Medical Textile Market Size Was Valued at USD 35.06 Billion in 2024 and is Projected to Reach USD 49.48 Billion by 2032, Growing at a CAGR of 4.4% From 2025-2032.

Medical textiles are specialized textile materials and products that are specifically designed and manufactured for use in healthcare and medical applications which play a crucial role in various medical settings, including hospitals, clinics, surgical centres, and home healthcare.

Medical textiles offer unique properties such as moisture management, breathability, barrier protection, antimicrobial properties, and comfort, making them suitable for a wide range of applications as compared to normal textiles. These have revolutionized the healthcare industry by providing functional and innovative solutions for various medical challenges.

Medical textiles are widely used in wound care products such as dressings, bandages, and sutures which help in wound healing by providing a barrier to external contaminants, promoting moisture management, and facilitating the growth of new tissues. They are designed to be comfortable, breathable, soft, and non-irritating to the skin. It is ideal for patients who may be bedridden or have sensitive skin.

Medical textiles are used to manufacture orthopaedic products such as braces, supports, and wraps, which may help to relieve pain and provide support to injured or weakened muscles and joints. The compression garments such as stockings and socks help to improve blood circulation and reduce swelling.

Medical Textile Market Trend Analysis

Medical Textile Market ?Growth Driver- Increasing Awareness About Healthcare Practices

Medical textiles are used in hospitals and healthcare settings to maintain a hygienic environment and prevent the spread of infections. Healthcare providers are increasingly recognizing the importance of patient comfort and safety leading to drive the demand for medical textiles. Medical textiles, such as wound dressings, compression garments, and soft bedding materials are antimicrobial and disposable fabrics that improve patient care and overall safety.

Advancements in textile technologies have led to the development of innovative solutions such as smart textiles with sensors for monitoring vital signs, moisture-wicking fabrics for enhanced comfort, and barrier fabrics for protection against external factors. The awareness of the environmental impact of healthcare practices and the benefits of sustainable textiles drive the demand for textiles that are eco-friendly, biodegradable, and made from recycled materials.

Medical Textile Market Opportunity- Development of Smart Medical Textile

Smart textiles are fabrics integrated with electronic components, sensors, and connectivity features. Some textiles are enabled remote monitoring of patients’ allowing healthcare providers to monitor patients remotely. Some are designed to incorporate drug delivery systems, allowing for localized and controlled medication administration. These textiles can release medicines gradually, eliminating the need for frequent injections or oral dosing with improving patient compliance, enhancing therapeutic efficacy, and simplifying treatment procedures. It has e antimicrobial properties or self-cleaning surfaces, enhancing infection control measures.

Smart medical textiles can monitor and facilitate the healing process of wounds and can sense moisture levels, temperature, and pH balance in the wound area, providing valuable data for healthcare professionals to assess healing progress. These textiles embedded with pressure sensors can continuously monitor pressure points, alerting caregivers when pressure exceeds recommended thresholds and helping to prevent pressure ulcers by promoting timely repositioning or adjustments. The motion sensors can detect sudden changes in body position and acceleration, enabling the detection of falls. It can trigger alarms or alerts healthcare providers or caregivers, allowing for timely intervention.

Medical Textile Market Segment Analysis:

Medical Textile Market Segmented on the basis of type, form, end-user, and distribution channels.

By Type, Non-implantable Segment Is Expected to Dominate the Market During the Forecast Period

Non-implantable medical textiles have a broad range of applications in various medical procedures such as in surgery, wound care, and patient rehabilitation. The increasing number of surgeries worldwide and the growing emphasis on maintaining a sterile surgical environment drive the demand for non-implantable products. The reason behind this is surgical procedures require a significant amount of non-implantable medical textiles, such as surgical gowns, drapes, and bandages. These play a vital role in wound care, including the treatment of acute and chronic wounds. These are designed to protect the wound, promote healing, and prevent infection.

Non-implantable textiles like compression garments and braces assist in managing various orthopaedic conditions, muscle injuries, and post-surgical rehabilitation. These textiles are easily accessible and widely available in the market. These textiles are generally less expensive to manufacture and maintain.

By Form, The Non-woven Segment Held the Largest Share In 2024

Non-woven fabrics can be easily designed and manufactured into various forms such as tapes, drapes, bandages, and wraps offering versatility and making them a popular choice for numerous medical procedures. fabrics have high absorbency, making them ideal for use in wound care products. Non-woven fabrics are cost-effective compared to other medical textile forms. Also, they are easier to manufacture and cost-effective for manufacturers. The demand for medical textile products such as diapers, adult underwear, bed sheets, and pillows, specially made with non-woven materials due to their absorbency and comfort.

Non-woven fabrics are lightweight and provide a comfortable feel. These are often made from eco-friendly materials and are biodegradable. non-woven segment dominates the medical textile market due to its versatility, comfortable characteristics, eco-friendliness, ongoing technological advancements, and increased investment in healthcare. With the growing trend towards disposable products, the demand for non-woven fabrics has increased in the overall market.

Medical Textile Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

North America is known for its advanced research and development capabilities which contribute to the development of cutting-edge medical products, including medical textiles. The well-established and comprehensive healthcare infrastructure, including hospitals, clinics, research institutions, and pharmaceutical companies supports the demand and adoption of medical textiles. North America has stringent regulations and quality standards for medical products which ensures specific safety, performance, and quality requirements.

The region has a growing aging population, resulting in a higher demand for healthcare services and products. It has a robust manufacturing sector, producing a wide range of medical textiles. North American governments often implement favorable initiatives to promote the development and adoption of medical technologies and textiles. These initiatives can include funding for research, industry collaborations, and incentives. There is a growing emphasis on infection control measures in which medical textiles play a vital role in infection prevention and control.

Medical Textile Market Active Players

Medline Industries, Inc. (United States)

Mölnlycke Health Care (Sweden)

Cardinal Health, Inc. (United States)

Paul Hartmann AG (Germany)

Winner Medical Co., Ltd. (China)

KOB Medical Textile (Turkey)

Johnson & Johnson Services, Inc. (United States)

Dupont de Nemours, Inc. (United States)

BSN medical GmbH (Germany)

The Medicom Group (Canada)

Precision Fabrics Group, Inc. (United States)

Fiberweb PLC (United Kingdom)

Fabrico (India)

Hogy Medical Co., Ltd. (Japan)

ATEX Technologies Inc. (United States)

Bally Ribbon Mills (United States)

Vestagen Technical Textiles Inc. (United States)

Bluestar Silicones (France)

Biomedical Structures (United States)

Medical Grade Innovations (United States)

Strategic Partners (United States)

Life Threads LLC (United States)

Indorama Corporation (Thailand)

Herculite (United States)

PurThread Technologies, Inc. (United States)

Fitesa (Brazil)

Kimberly-Clark Corporation (United States)

Other Active Players

Key Industry Developments in the Medical Textile Market:

In January 2024, Medline announced the latest addition to its advanced wound care portfolio, the OptiView® Transparent Dressing with HydroCore™ Technology. This first-of-its-kind wound dressing features an innovative clear design that allows caregivers to quickly and easily inspect, monitor, and blanch skin with the dressing in place.

In November 2023, Cardinal Health announced the launch of its SmartGown™ EDGE Breathable Surgical Gown with ASSIST™ Instrument Pockets, created to provide surgical teams safe and convenient instrument access in the operating room. The gown is designed to hold one recommended instrument per pocket during surgical procedures, helping to provide handling efficiency and enabling clinical teams to focus on delivering safe patient care.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Textile Market by Type (2018-2032)

4.1 Medical Textile Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Non-implantable

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Implantable

4.5 Healthcare

4.6 Hygiene Products

Chapter 5: Medical Textile Market by Form (2018-2032)

5.1 Medical Textile Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Non-woven Fabric

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Knitted Fabric

5.5 Woven Fabric

Chapter 6: Medical Textile Market by End-user (2018-2032)

6.1 Medical Textile Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals and Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Home Healthcare Settings

6.5 Nursing Homes and Assisted Living Facilities

6.6 Others (Military Healthcare

6.7 Veterinary

6.8 Sports Medicine)

Chapter 7: Medical Textile Market by Distribution Channel (2018-2032)

7.1 Medical Textile Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Pharmaceutical Stores

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Hospitals

7.5 Wholesale Distributors

7.6 Online Stores

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Medical Textile Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 MEDLINE INDUSTRIES INC. (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MÖLNLYCKE HEALTH CARE (SWEDEN)

8.4 CARDINAL HEALTH INC. (UNITED STATES)

8.5 PAUL HARTMANN AG (GERMANY)

8.6 WINNER MEDICAL COLTD. (CHINA)

8.7 KOB MEDICAL TEXTILE (TURKEY)

8.8 JOHNSON & JOHNSON SERVICES INC. (UNITED STATES)

8.9 DUPONT DE NEMOURS INC. (UNITED STATES)

8.10 BSN MEDICAL GMBH (GERMANY)

8.11 THE MEDICOM GROUP (CANADA)

8.12 PRECISION FABRICS GROUP INC. (UNITED STATES)

8.13 FIBERWEB PLC (UNITED KINGDOM)

8.14 FABRICO (INDIA)

8.15 HOGY MEDICAL COLTD. (JAPAN)

8.16 ATEX TECHNOLOGIES INC. (UNITED STATES)

8.17 BALLY RIBBON MILLS (UNITED STATES)

8.18 VESTAGEN TECHNICAL TEXTILES INC. (UNITED STATES)

8.19 BLUESTAR SILICONES (FRANCE)

8.20 BIOMEDICAL STRUCTURES (UNITED STATES)

8.21 MEDICAL GRADE INNOVATIONS (UNITED STATES)

8.22 STRATEGIC PARTNERS (UNITED STATES)

8.23 LIFE THREADS LLC (UNITED STATES)

8.24 INDORAMA CORPORATION (THAILAND)

8.25 HERCULITE (UNITED STATES)

8.26 PURTHREAD TECHNOLOGIES INC. (UNITED STATES)

8.27 FITESA (BRAZIL)

8.28 KIMBERLY-CLARK CORPORATION (UNITED STATES) OTHER MARKET ACTIVE PLAYERS

Chapter 9: Global Medical Textile Market By Region

9.1 Overview

9.2. North America Medical Textile Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Non-implantable

9.2.4.2 Implantable

9.2.4.3 Healthcare

9.2.4.4 Hygiene Products

9.2.5 Historic and Forecasted Market Size by Form

9.2.5.1 Non-woven Fabric

9.2.5.2 Knitted Fabric

9.2.5.3 Woven Fabric

9.2.6 Historic and Forecasted Market Size by End-user

9.2.6.1 Hospitals and Clinics

9.2.6.2 Home Healthcare Settings

9.2.6.3 Nursing Homes and Assisted Living Facilities

9.2.6.4 Others (Military Healthcare

9.2.6.5 Veterinary

9.2.6.6 Sports Medicine)

9.2.7 Historic and Forecasted Market Size by Distribution Channel

9.2.7.1 Pharmaceutical Stores

9.2.7.2 Hospitals

9.2.7.3 Wholesale Distributors

9.2.7.4 Online Stores

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Medical Textile Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Non-implantable

9.3.4.2 Implantable

9.3.4.3 Healthcare

9.3.4.4 Hygiene Products

9.3.5 Historic and Forecasted Market Size by Form

9.3.5.1 Non-woven Fabric

9.3.5.2 Knitted Fabric

9.3.5.3 Woven Fabric

9.3.6 Historic and Forecasted Market Size by End-user

9.3.6.1 Hospitals and Clinics

9.3.6.2 Home Healthcare Settings

9.3.6.3 Nursing Homes and Assisted Living Facilities

9.3.6.4 Others (Military Healthcare

9.3.6.5 Veterinary

9.3.6.6 Sports Medicine)

9.3.7 Historic and Forecasted Market Size by Distribution Channel

9.3.7.1 Pharmaceutical Stores

9.3.7.2 Hospitals

9.3.7.3 Wholesale Distributors

9.3.7.4 Online Stores

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Medical Textile Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Non-implantable

9.4.4.2 Implantable

9.4.4.3 Healthcare

9.4.4.4 Hygiene Products

9.4.5 Historic and Forecasted Market Size by Form

9.4.5.1 Non-woven Fabric

9.4.5.2 Knitted Fabric

9.4.5.3 Woven Fabric

9.4.6 Historic and Forecasted Market Size by End-user

9.4.6.1 Hospitals and Clinics

9.4.6.2 Home Healthcare Settings

9.4.6.3 Nursing Homes and Assisted Living Facilities

9.4.6.4 Others (Military Healthcare

9.4.6.5 Veterinary

9.4.6.6 Sports Medicine)

9.4.7 Historic and Forecasted Market Size by Distribution Channel

9.4.7.1 Pharmaceutical Stores

9.4.7.2 Hospitals

9.4.7.3 Wholesale Distributors

9.4.7.4 Online Stores

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Medical Textile Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Non-implantable

9.5.4.2 Implantable

9.5.4.3 Healthcare

9.5.4.4 Hygiene Products

9.5.5 Historic and Forecasted Market Size by Form

9.5.5.1 Non-woven Fabric

9.5.5.2 Knitted Fabric

9.5.5.3 Woven Fabric

9.5.6 Historic and Forecasted Market Size by End-user

9.5.6.1 Hospitals and Clinics

9.5.6.2 Home Healthcare Settings

9.5.6.3 Nursing Homes and Assisted Living Facilities

9.5.6.4 Others (Military Healthcare

9.5.6.5 Veterinary

9.5.6.6 Sports Medicine)

9.5.7 Historic and Forecasted Market Size by Distribution Channel

9.5.7.1 Pharmaceutical Stores

9.5.7.2 Hospitals

9.5.7.3 Wholesale Distributors

9.5.7.4 Online Stores

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Medical Textile Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Non-implantable

9.6.4.2 Implantable

9.6.4.3 Healthcare

9.6.4.4 Hygiene Products

9.6.5 Historic and Forecasted Market Size by Form

9.6.5.1 Non-woven Fabric

9.6.5.2 Knitted Fabric

9.6.5.3 Woven Fabric

9.6.6 Historic and Forecasted Market Size by End-user

9.6.6.1 Hospitals and Clinics

9.6.6.2 Home Healthcare Settings

9.6.6.3 Nursing Homes and Assisted Living Facilities

9.6.6.4 Others (Military Healthcare

9.6.6.5 Veterinary

9.6.6.6 Sports Medicine)

9.6.7 Historic and Forecasted Market Size by Distribution Channel

9.6.7.1 Pharmaceutical Stores

9.6.7.2 Hospitals

9.6.7.3 Wholesale Distributors

9.6.7.4 Online Stores

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Medical Textile Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Non-implantable

9.7.4.2 Implantable

9.7.4.3 Healthcare

9.7.4.4 Hygiene Products

9.7.5 Historic and Forecasted Market Size by Form

9.7.5.1 Non-woven Fabric

9.7.5.2 Knitted Fabric

9.7.5.3 Woven Fabric

9.7.6 Historic and Forecasted Market Size by End-user

9.7.6.1 Hospitals and Clinics

9.7.6.2 Home Healthcare Settings

9.7.6.3 Nursing Homes and Assisted Living Facilities

9.7.6.4 Others (Military Healthcare

9.7.6.5 Veterinary

9.7.6.6 Sports Medicine)

9.7.7 Historic and Forecasted Market Size by Distribution Channel

9.7.7.1 Pharmaceutical Stores

9.7.7.2 Hospitals

9.7.7.3 Wholesale Distributors

9.7.7.4 Online Stores

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Medical Textile Market research report?

A1: The forecast period in the Medical Textile Market research report is 2025-2032.

Q2: Who are the key players in the Medical Textile Market?

A2: Medline Industries, Inc. (United States), Mölnlycke Health Care (Sweden), Cardinal Health, Inc. (United States), Paul Hartmann AG (Germany), Winner Medical Co., Ltd. (China), and Other Active Players.

Q3: What are the segments of the Medical Textile Market?

A3: The Medical Textile Market is segmented into Type, Form, End-user, Distribution Channel, and region. By Type, the market is categorized into Non-implantable, Implantable, Healthcare, and Hygiene Products. By Form, the market is categorized into Non-woven, Knitted, and Woven. By End-user, the market is categorized into Hospitals and Clinics, Home Healthcare Settings, Nursing Homes and Assisted Living Facilities, and Others such as Military Healthcare, Veterinary, and Sports Medicine. By Distribution Channel, the market is categorized into Pharmaceutical Stores, Hospitals, Wholesale Distributors, and Online Stores. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; South Korea; Malaysia; Thailand; Vietnam; The Philippines; Australia; New Zealand; Rest of APAC), Middle East & Africa (Türkiye; Bahrain; Kuwait; Saudi Arabia; Qatar; UAE; Israel; South Africa), South America (Brazil; Argentina; Rest of SA).

Q4: What is the Medical Textile Market?

A4: Medical textiles are specialized textile materials and products that are specifically designed and manufactured for use in healthcare and medical applications which play a crucial role in various medical settings, including hospitals, clinics, surgical centers, and home healthcare.

Q5: How big is the Medical Textile Market?

A5: Medical Textile Market Size Was Valued at USD 35.06 Billion in 2024 and is Projected to Reach USD 49.48 Billion by 2032, Growing at a CAGR of 4.4% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!