Stay Ahead in Fast-Growing Economies.

Browse Reports NowMedical Device Outsourcing Market – Share Analysis (2024–2032)

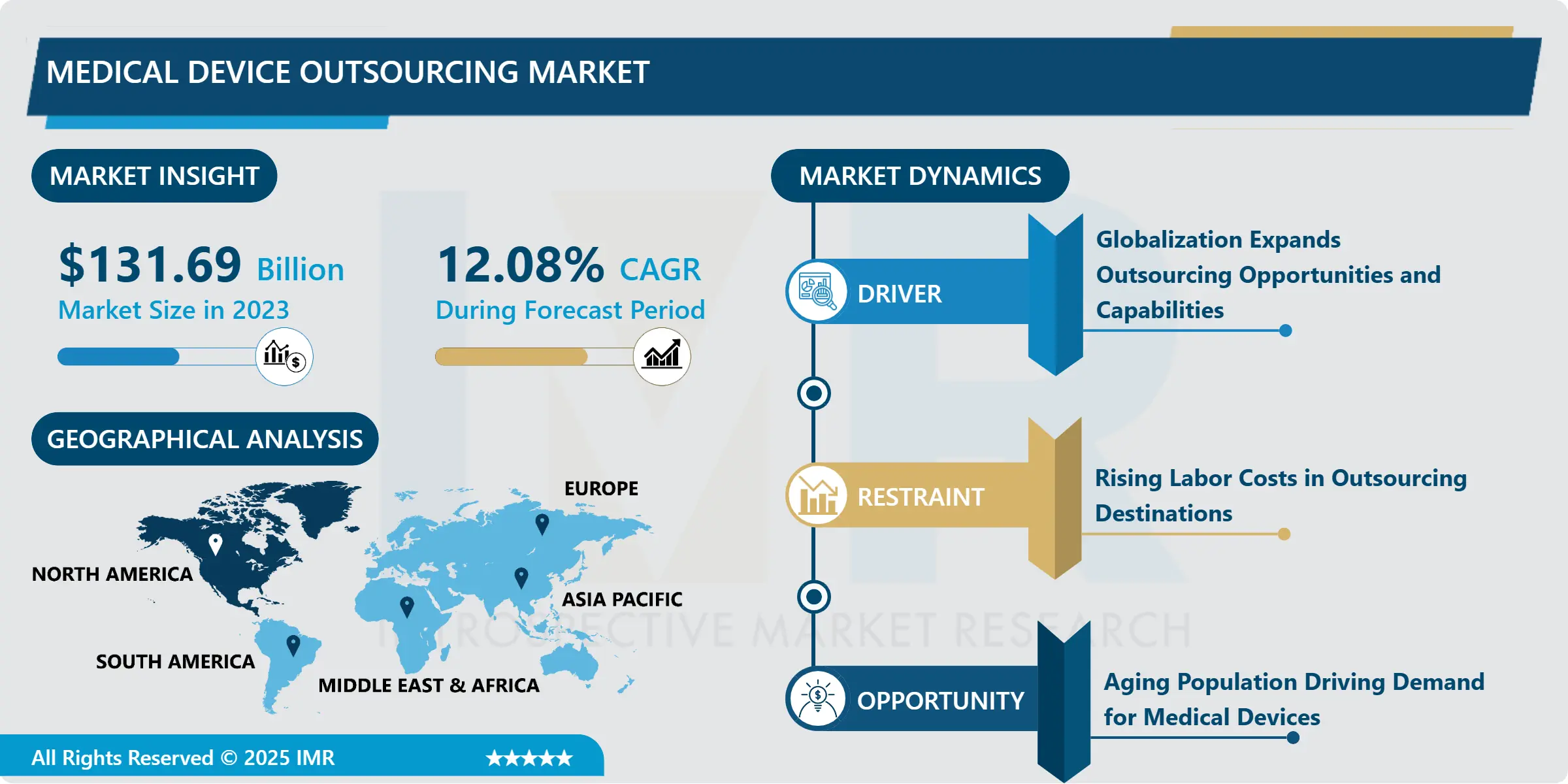

Medical Device Outsourcing Market Size Was Valued at USD 131.69 Billion in 2023, and is Projected to Reach USD 367.55 Billion by 2032, Growing at a CAGR of 12.08% From 2024-2032.

IMR Group

Description

Medical Device Outsourcing Market Synopsis:

Medical Device Outsourcing Market Size Was Valued at USD 131.69 Billion in 2023, and is Projected to Reach USD 367.55 Billion by 2032, Growing at a CAGR of 12.08% From 2024-2032.

Medical device outsourcing is a freighting of certain activities associated with medical devices design, manufacturing, construction, or testing by a firm to other firms or individuals over which it exercises control. Third parties are organizations that offer specialized knowledge, infrastructure and other assets that would allow a medical device company to perform certain functions or improve on a particular section of its business.

Outsourcing continues to grow as one of the most essential niches in the healthcare sector due to the growing need for better and unique medical devices and the challenges posed by a stringent global economy within the manufacturing process. Outsourcing has become a desirable option as more and more medical device companies aim at improving quality and reducing costs. This trend is especially observable at a time that firms are under tremendous pressure to effect core competencies outsourcing in their endeavor to outsource specialty of contract manufacturers. In addition, growth in regulatory issues and customers’ requests related to compliance with international quality standards have even more encouraged companies to cooperate with outsourcing firms that can offer adequate certifications and experience.

The scope of services covering development, production, packaging, and distribution of products make the market eclectic. Contract manufacturers are involved in all stages of a product life cycle from design and development to production and delivery. Sophisticated advents of-tm personalized medicine along with advances in minimally invasive devices have driven the requirements for versatile and modular manufacturing solutions. Also, technological factors have supported outsourcing in different ways in terms of product quality and development, 3D printing, and automation, that have created better value for outsourcing.

Regionally, North America targets a large portion of the medical device outsourcing industry owing to the strong manufacturers and effective healthcare systems laid down there. However, the Asia-Pacific is a growing region due to factors such as relatively low costs of production, availability of skilled workforce and the emerging trend of moving production facilities to low cost locations. This transition is pressed further by the availability of political support for foreign investors and health technological development in the country.

The market is expected to show more or less of the same trend in the future also due to advancements in technology, increasing life expectancy, and increasing incidence of diseases. While coming up with their medical devices or when seeking to penetrate a new market, most of them will avoid getting stuck by having to produce certain products on their own since this will be essential in their operations. This evolution really underlines importance of outsourcing for the companies to sustain competitive advantage in the constantly shifting healthcare market.

Medical Device Outsourcing Market Trend Analysis:

Increasing Complexity of Medical Devices and the Role of Outsourcing

The escalation of demands in the sophistication of medical devices is among the main driving forces determining the medical device outsourcing market. These are complex systems that become more sophisticated technologically and functionally to require professional specialization in development, fabrication, and conformity to legal specifications. Current OEMs are gradually realizing that nothing is feasible for them to retain all the required skills as they expand into minimally invasive and connected devices. While these are complex designs, they need not only complex engineering, but also complex software modules for the proper performance and safety. Consequently, OEMs are seeking outsourcing partners who have the technological capability and compliance understanding to help concentrate on value creation and, therefore, out of the norm propositions.

This trend is further compounded by changing regulatory environment that surrounds the medical devices sector. In the same way, compliance with these specific regulations can be quite challenging especially where new technologies that have not been used earlier are incorporated in the BPM by the OEMs, and such technologies need to undergo sophisticated tests to validate their viability within the BPM. Thus, if an OEM decides to outsource to a more experienced outsourcing firms, the latter can provide valuable information concerning compliance with certain regulations, development and implementation of quality management systems, as well as manufacturers’ best practices. Not only does this approach improve the standard of manufacture and safety of the end products, but it also shortens time to market which is especially important in a competitive world. In addition, due to the focus shift of the regulatory bodies towards post-market surveillance as well as never-ending improvement, robust compliance partners become the valuable assets for the OEMs who aim at keeping the leading positions in the fiercely competitive environment and achieve long-term sustainable success.

Meeting Challenges and Driving Innovation

As healthcare systems in both developed and developing countries continue to face the twin pressures of improving the quality of care and reducing costs, the manufacturers of medical devices are finding outsourcing a logical option. This trend allows firms to access independent contract manufacturers and service providers that can greatly reduce the time to develop new products. As these nominal partners perform tasks that are not directly related to medical device companies, such as manufacturing, regulatory affairs, and clinical trials, these companies can invest their efforts in research and development. This transition not only enforces efficiency but also encourages overhauling of products to meet the demands of users and practitioners, modern healthcare technology equipment.

Furthermore, sourcing offers potential for service improvements and cost savings, which are paramount in proceedings are intensely competitive as it is in present day environment within the health care industry. Outsourcing with professional outsourcing firms helps medical device manufacturers because they do not need to develop technologies and have optimization at their own costs or within organizational constraints. When initiated, this kind of partnership can lead to better compliance with the industry standards, better quality and improved time to market. While the need for new sophisticated health care products and services is constant and growing, so is the importance of entry and growth strategies which outsourcing can further support. Consequently, the management of outsourcing in the medical device field illustrates the way for coping with the variabilities and developing in a quickly dynamic setting for fulfilling MFBR requirements.

Medical Device Outsourcing Market Segment Analysis:

Medical Device Outsourcing Market Segmented on the basis of By Services, Product, Device Type, Application, End User, and Region

By Services, Quality Assurance segment is expected to dominate the market during the forecast period

QA can be broadly defined as a programmed part of medical device manufacturing that deals with all activities that are related to the product quality standards. This is done through various activities within production planning, production cycle implementation and even post production testing and all this happens successively throughout the entire process of production and manufacture of the raw material used in production of the final product. Due to the principles of reliability and compliance supported by QA, it contributes to risk reductions that not only guarantee the adherence of devices to applicable standard and requirement but also to satisfy the expectations of various stakeholders in the healthcare facilities. Suffice to say that good QA practices make products safer and more effective, that is, they improve health status of users.

There are Regulatory Affairs Services that are central to the medical device industry because it helps manufacturers come to terms with the complex system of rules provided by different government and international organizations. These services are critical as they help organisations to provide products that conform to the legal and market entry requirements. This career involves providing support in regulatory issues so that the appropriate paperwork for approval and certification is produced. They also supervise shifting of regulations and pass on information to the manufacturers on how they can change their behavior and conform to alterative standards in the shortest time possible. Such an approach also assists in gaining early market access while at the same time reassuring stakeholders on issues to do with safety of the devices as well as their effectiveness.

By End User, Small Medical Device Company segment expected to held the largest share

Small MDTs generally serve specialized segments or work on ideas for new and unique medical devices that can respond to patients needs. Because of the fact that they have limited resources than their giant competitors they are more inclined to promote special characteristics which differentiate them in the market or new technologies that are being offered. It can therefore effectively respond and adapt to market requirements as well as implement many changes within relatively short time, which in turn brings innovative and advanced solutions directly to patients and healthcare providers. However, these companies presuppose that successful operation fully depends on the key organizational factors that mean the proper management of operational issues, including the scale of production, the promotion of products, and the growth of partnership within the healthcare system.

Regulatory issues are major problems for small firms in the medical devices industry as regulatory barriers can be elaborate procedures. Other services including the regulatory consulting and the quality management systems are usually important for such firms to meet the requirements of the laws and other acknowledged standards. It also assists in modernizing the development process, making easy for the small firms to prepare documents needed to submit to the regulatory agencies and to communicate with them. With proper advice from specialists in regulating procedures the small medical device company can increase its likelihood of a successful entry to the markets without being slowed down by the complex procedures of a highly specialized field and with limited resources at their immediate disposal.

Medical Device Outsourcing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

In North America specifically the medical device outsourcing market in the United States it enjoys a very strong and developed health care infrastructure which helps it a lot. The medical device industry is popular in the region because the population wants high-quality healthcare solutions. Owing to the increasing need to cut costs and meet higher regulatory standards and enhanced competitiveness, the degree of outsourcing of production, R & D, and logistics function is increasingly evident. This business decision does more than increase productivity and reduce expenses; it also optimises specialised processes and information for manufacturers, freeing up more time to address crucial areas of strength and outsourcing key areas for expertise.

Also, continuous incorporation of additional technologies like artificial intelligence (AI) and the internet of things (IoT) in medical devices is also contributing to the enhancement of interaction between manufacturers and outsourcing parties. Indeed, for today, when the technical characteristics of medical devices are becoming increasingly diverse and subtle, the need for highly qualified knowledge of these sophisticated technologies is critical. Thus, by forming long-lasting relationships with outsourcing providers capable of providing applicable technology solutions, MAGE manufacturers can advance in product development, extend the company’s product’s value, and assure adherence to the legal requirements. This trend seems to highlight the overall trend of employing external capabilities for managing issues and improving advanced next medical device development for North American industry.

Active Key Players in the Medical Device Outsourcing Market:

SGS Société Générale de Surveillance SA (Switzerland)

Pace (U.S.)

Intertek Group plc (U.K.)

WuXi AppTec (China)

North American Science Associates, Inc. (U.S.)

Sterigenics U.S., LLC – A Sotera Health company (U.S.)

Charles River Laboratories (U.S.)

Celestica Inc. (Canada)

FLEX LTD. (Singapore)

Heraeus Group (Germany)

Integer Holdings Corporation (U.S.)

Nortech Systems, Inc. (U.S.)

Plexus Corp. (U.S.)

Sanmina Corporation (U.S.)

Eurofins Scientific (France)

TE Connectivity (Switzerland)

ICON plc (Ireland)

Parexel International Corporation (U.S.)

Labcorp Drug Development (U.S.)

Tecomet, Inc. (U.S.)

IQVIA (U.S.)

Jabil Inc. (U.S.)

Syneos Health (U.S.)

PROVIDIEN LLC. (U.S.)

East/West Industries, Inc. (U.S.)

TÜV SÜD (Germany)

Other Active Players

Key Industry Developments in the Medical Device Outsourcing Market:

In 2023, Labcorp announced that its clinical development business spin-off entity will be named Fortrea. This development in the healthcare sector impacts the medical device outsourcing market as Fortrea’s establishment could lead to potential collaborations, partnerships, or outsourcing opportunities in clinical trial management and medical device research

In 2023, Emergo partnered with the Shanghai Center for Medical Testing and Inspection (CMTC) to conduct ongoing usability testing of medical devices in China. This collaboration aligns with China’s NMPA guidelines for Human Factors Engineering, potentially fostering growth in the medical device outsourcing market by addressing regulatory compliance and enhancing product usability

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Device Outsourcing Market by Services

4.1 Medical Device Outsourcing Market Snapshot and Growth Engine

4.2 Medical Device Outsourcing Market Overview

4.3 Quality Assurance

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Quality Assurance: Geographic Segmentation Analysis

4.4 Regulatory Affairs Services

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Regulatory Affairs Services: Geographic Segmentation Analysis

4.5 Product Design and Development Services

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Product Design and Development Services: Geographic Segmentation Analysis

4.6 Product Testing and Sterilization Services

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Product Testing and Sterilization Services: Geographic Segmentation Analysis

4.7 Product Implementation Services

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Product Implementation Services: Geographic Segmentation Analysis

4.8 Product Upgrade Services

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Product Upgrade Services: Geographic Segmentation Analysis

4.9 Product Maintenance Services

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Product Maintenance Services: Geographic Segmentation Analysis

4.10 Raw Material Services

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Raw Material Services: Geographic Segmentation Analysis

4.11 Medical Electrical Equipment Services

4.11.1 Introduction and Market Overview

4.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.11.3 Key Market Trends, Growth Factors and Opportunities

4.11.4 Medical Electrical Equipment Services: Geographic Segmentation Analysis

4.12 Contract Manufacturing and Materials

4.12.1 Introduction and Market Overview

4.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.12.3 Key Market Trends, Growth Factors and Opportunities

4.12.4 Contract Manufacturing and Materials: Geographic Segmentation Analysis

4.13 and Chemical Characterization

4.13.1 Introduction and Market Overview

4.13.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.13.3 Key Market Trends, Growth Factors and Opportunities

4.13.4 and Chemical Characterization: Geographic Segmentation Analysis

Chapter 5: Medical Device Outsourcing Market by Product

5.1 Medical Device Outsourcing Market Snapshot and Growth Engine

5.2 Medical Device Outsourcing Market Overview

5.3 Finished Goods

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Finished Goods: Geographic Segmentation Analysis

5.4 Electronics

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Electronics: Geographic Segmentation Analysis

5.5 and Raw Materials

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 and Raw Materials: Geographic Segmentation Analysis

Chapter 6: Medical Device Outsourcing Market by Device Type

6.1 Medical Device Outsourcing Market Snapshot and Growth Engine

6.2 Medical Device Outsourcing Market Overview

6.3 Class I

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Class I: Geographic Segmentation Analysis

6.4 Class II

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Class II: Geographic Segmentation Analysis

6.5 and Class III

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and Class III: Geographic Segmentation Analysis

Chapter 7: Medical Device Outsourcing Market by Application

7.1 Medical Device Outsourcing Market Snapshot and Growth Engine

7.2 Medical Device Outsourcing Market Overview

7.3 Cardiology

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Cardiology: Geographic Segmentation Analysis

7.4 Diagnostic Imaging

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Diagnostic Imaging: Geographic Segmentation Analysis

7.5 Orthopaedic

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Orthopaedic: Geographic Segmentation Analysis

7.6 IVD

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 IVD: Geographic Segmentation Analysis

7.7 Ophthalmic

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Ophthalmic: Geographic Segmentation Analysis

7.8 General

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 General: Geographic Segmentation Analysis

7.9 Plastic Surgery

7.9.1 Introduction and Market Overview

7.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.9.3 Key Market Trends, Growth Factors and Opportunities

7.9.4 Plastic Surgery: Geographic Segmentation Analysis

7.10 Drug Delivery

7.10.1 Introduction and Market Overview

7.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.10.3 Key Market Trends, Growth Factors and Opportunities

7.10.4 Drug Delivery: Geographic Segmentation Analysis

7.11 Dental

7.11.1 Introduction and Market Overview

7.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.11.3 Key Market Trends, Growth Factors and Opportunities

7.11.4 Dental: Geographic Segmentation Analysis

7.12 Endoscopy

7.12.1 Introduction and Market Overview

7.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.12.3 Key Market Trends, Growth Factors and Opportunities

7.12.4 Endoscopy: Geographic Segmentation Analysis

7.13 Diabetes Care

7.13.1 Introduction and Market Overview

7.13.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.13.3 Key Market Trends, Growth Factors and Opportunities

7.13.4 Diabetes Care: Geographic Segmentation Analysis

7.14 and Others

7.14.1 Introduction and Market Overview

7.14.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.14.3 Key Market Trends, Growth Factors and Opportunities

7.14.4 and Others: Geographic Segmentation Analysis

Chapter 8: Medical Device Outsourcing Market by End User

8.1 Medical Device Outsourcing Market Snapshot and Growth Engine

8.2 Medical Device Outsourcing Market Overview

8.3 Small Medical Device Company

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Small Medical Device Company: Geographic Segmentation Analysis

8.4 Medium Medical Device Company

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Medium Medical Device Company: Geographic Segmentation Analysis

8.5 Large Medical Device Company

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Large Medical Device Company: Geographic Segmentation Analysis

8.6 and Others

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 and Others: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Medical Device Outsourcing Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA (SWITZERLAND)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 PACE (U.S.)

9.4 INTERTEK GROUP PLC (U.K.)

9.5 WUXI APPTEC (CHINA)

9.6 NORTH AMERICAN SCIENCE ASSOCIATES INC. (U.S.)

9.7 STERIGENICS U.S. LLC – A SOTERA HEALTH COMPANY (U.S.)

9.8 CHARLES RIVER LABORATORIES (U.S.)

9.9 CELESTICA INC. (CANADA)

9.10 FLEX LTD. (SINGAPORE)

9.11 HERAEUS GROUP (GERMANY)

9.12 INTEGER HOLDINGS CORPORATION (U.S.)

9.13 NORTECH SYSTEMS INC. (U.S.)

9.14 PLEXUS CORP. (U.S.)

9.15 SANMINA CORPORATION (U.S.)

9.16 EUROFINS SCIENTIFIC (FRANCE)

9.17 TE CONNECTIVITY (SWITZERLAND)

9.18 ICON PLC (IRELAND)

9.19 PAREXEL INTERNATIONAL CORPORATION (U.S.)

9.20 LABCORP DRUG DEVELOPMENT (U.S.)

9.21 TECOMET INC. (U.S.)

9.22 IQVIA (U.S.)

9.23 JABIL INC. (U.S.)

9.24 SYNEOS HEALTH (U.S.)

9.25 PROVIDIEN LLC. (U.S.)

9.26 EAST/WEST INDUSTRIES INC. (U.S.)

9.27 TÜV SÜD (GERMANY)

9.28 OTHER ACTIVE PLAYERS

Chapter 10: Global Medical Device Outsourcing Market By Region

10.1 Overview

10.2. North America Medical Device Outsourcing Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Services

10.2.4.1 Quality Assurance

10.2.4.2 Regulatory Affairs Services

10.2.4.3 Product Design and Development Services

10.2.4.4 Product Testing and Sterilization Services

10.2.4.5 Product Implementation Services

10.2.4.6 Product Upgrade Services

10.2.4.7 Product Maintenance Services

10.2.4.8 Raw Material Services

10.2.4.9 Medical Electrical Equipment Services

10.2.4.10 Contract Manufacturing and Materials

10.2.4.11 and Chemical Characterization

10.2.5 Historic and Forecasted Market Size By Product

10.2.5.1 Finished Goods

10.2.5.2 Electronics

10.2.5.3 and Raw Materials

10.2.6 Historic and Forecasted Market Size By Device Type

10.2.6.1 Class I

10.2.6.2 Class II

10.2.6.3 and Class III

10.2.7 Historic and Forecasted Market Size By Application

10.2.7.1 Cardiology

10.2.7.2 Diagnostic Imaging

10.2.7.3 Orthopaedic

10.2.7.4 IVD

10.2.7.5 Ophthalmic

10.2.7.6 General

10.2.7.7 Plastic Surgery

10.2.7.8 Drug Delivery

10.2.7.9 Dental

10.2.7.10 Endoscopy

10.2.7.11 Diabetes Care

10.2.7.12 and Others

10.2.8 Historic and Forecasted Market Size By End User

10.2.8.1 Small Medical Device Company

10.2.8.2 Medium Medical Device Company

10.2.8.3 Large Medical Device Company

10.2.8.4 and Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Medical Device Outsourcing Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Services

10.3.4.1 Quality Assurance

10.3.4.2 Regulatory Affairs Services

10.3.4.3 Product Design and Development Services

10.3.4.4 Product Testing and Sterilization Services

10.3.4.5 Product Implementation Services

10.3.4.6 Product Upgrade Services

10.3.4.7 Product Maintenance Services

10.3.4.8 Raw Material Services

10.3.4.9 Medical Electrical Equipment Services

10.3.4.10 Contract Manufacturing and Materials

10.3.4.11 and Chemical Characterization

10.3.5 Historic and Forecasted Market Size By Product

10.3.5.1 Finished Goods

10.3.5.2 Electronics

10.3.5.3 and Raw Materials

10.3.6 Historic and Forecasted Market Size By Device Type

10.3.6.1 Class I

10.3.6.2 Class II

10.3.6.3 and Class III

10.3.7 Historic and Forecasted Market Size By Application

10.3.7.1 Cardiology

10.3.7.2 Diagnostic Imaging

10.3.7.3 Orthopaedic

10.3.7.4 IVD

10.3.7.5 Ophthalmic

10.3.7.6 General

10.3.7.7 Plastic Surgery

10.3.7.8 Drug Delivery

10.3.7.9 Dental

10.3.7.10 Endoscopy

10.3.7.11 Diabetes Care

10.3.7.12 and Others

10.3.8 Historic and Forecasted Market Size By End User

10.3.8.1 Small Medical Device Company

10.3.8.2 Medium Medical Device Company

10.3.8.3 Large Medical Device Company

10.3.8.4 and Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Medical Device Outsourcing Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Services

10.4.4.1 Quality Assurance

10.4.4.2 Regulatory Affairs Services

10.4.4.3 Product Design and Development Services

10.4.4.4 Product Testing and Sterilization Services

10.4.4.5 Product Implementation Services

10.4.4.6 Product Upgrade Services

10.4.4.7 Product Maintenance Services

10.4.4.8 Raw Material Services

10.4.4.9 Medical Electrical Equipment Services

10.4.4.10 Contract Manufacturing and Materials

10.4.4.11 and Chemical Characterization

10.4.5 Historic and Forecasted Market Size By Product

10.4.5.1 Finished Goods

10.4.5.2 Electronics

10.4.5.3 and Raw Materials

10.4.6 Historic and Forecasted Market Size By Device Type

10.4.6.1 Class I

10.4.6.2 Class II

10.4.6.3 and Class III

10.4.7 Historic and Forecasted Market Size By Application

10.4.7.1 Cardiology

10.4.7.2 Diagnostic Imaging

10.4.7.3 Orthopaedic

10.4.7.4 IVD

10.4.7.5 Ophthalmic

10.4.7.6 General

10.4.7.7 Plastic Surgery

10.4.7.8 Drug Delivery

10.4.7.9 Dental

10.4.7.10 Endoscopy

10.4.7.11 Diabetes Care

10.4.7.12 and Others

10.4.8 Historic and Forecasted Market Size By End User

10.4.8.1 Small Medical Device Company

10.4.8.2 Medium Medical Device Company

10.4.8.3 Large Medical Device Company

10.4.8.4 and Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Medical Device Outsourcing Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Services

10.5.4.1 Quality Assurance

10.5.4.2 Regulatory Affairs Services

10.5.4.3 Product Design and Development Services

10.5.4.4 Product Testing and Sterilization Services

10.5.4.5 Product Implementation Services

10.5.4.6 Product Upgrade Services

10.5.4.7 Product Maintenance Services

10.5.4.8 Raw Material Services

10.5.4.9 Medical Electrical Equipment Services

10.5.4.10 Contract Manufacturing and Materials

10.5.4.11 and Chemical Characterization

10.5.5 Historic and Forecasted Market Size By Product

10.5.5.1 Finished Goods

10.5.5.2 Electronics

10.5.5.3 and Raw Materials

10.5.6 Historic and Forecasted Market Size By Device Type

10.5.6.1 Class I

10.5.6.2 Class II

10.5.6.3 and Class III

10.5.7 Historic and Forecasted Market Size By Application

10.5.7.1 Cardiology

10.5.7.2 Diagnostic Imaging

10.5.7.3 Orthopaedic

10.5.7.4 IVD

10.5.7.5 Ophthalmic

10.5.7.6 General

10.5.7.7 Plastic Surgery

10.5.7.8 Drug Delivery

10.5.7.9 Dental

10.5.7.10 Endoscopy

10.5.7.11 Diabetes Care

10.5.7.12 and Others

10.5.8 Historic and Forecasted Market Size By End User

10.5.8.1 Small Medical Device Company

10.5.8.2 Medium Medical Device Company

10.5.8.3 Large Medical Device Company

10.5.8.4 and Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Medical Device Outsourcing Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Services

10.6.4.1 Quality Assurance

10.6.4.2 Regulatory Affairs Services

10.6.4.3 Product Design and Development Services

10.6.4.4 Product Testing and Sterilization Services

10.6.4.5 Product Implementation Services

10.6.4.6 Product Upgrade Services

10.6.4.7 Product Maintenance Services

10.6.4.8 Raw Material Services

10.6.4.9 Medical Electrical Equipment Services

10.6.4.10 Contract Manufacturing and Materials

10.6.4.11 and Chemical Characterization

10.6.5 Historic and Forecasted Market Size By Product

10.6.5.1 Finished Goods

10.6.5.2 Electronics

10.6.5.3 and Raw Materials

10.6.6 Historic and Forecasted Market Size By Device Type

10.6.6.1 Class I

10.6.6.2 Class II

10.6.6.3 and Class III

10.6.7 Historic and Forecasted Market Size By Application

10.6.7.1 Cardiology

10.6.7.2 Diagnostic Imaging

10.6.7.3 Orthopaedic

10.6.7.4 IVD

10.6.7.5 Ophthalmic

10.6.7.6 General

10.6.7.7 Plastic Surgery

10.6.7.8 Drug Delivery

10.6.7.9 Dental

10.6.7.10 Endoscopy

10.6.7.11 Diabetes Care

10.6.7.12 and Others

10.6.8 Historic and Forecasted Market Size By End User

10.6.8.1 Small Medical Device Company

10.6.8.2 Medium Medical Device Company

10.6.8.3 Large Medical Device Company

10.6.8.4 and Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Medical Device Outsourcing Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Services

10.7.4.1 Quality Assurance

10.7.4.2 Regulatory Affairs Services

10.7.4.3 Product Design and Development Services

10.7.4.4 Product Testing and Sterilization Services

10.7.4.5 Product Implementation Services

10.7.4.6 Product Upgrade Services

10.7.4.7 Product Maintenance Services

10.7.4.8 Raw Material Services

10.7.4.9 Medical Electrical Equipment Services

10.7.4.10 Contract Manufacturing and Materials

10.7.4.11 and Chemical Characterization

10.7.5 Historic and Forecasted Market Size By Product

10.7.5.1 Finished Goods

10.7.5.2 Electronics

10.7.5.3 and Raw Materials

10.7.6 Historic and Forecasted Market Size By Device Type

10.7.6.1 Class I

10.7.6.2 Class II

10.7.6.3 and Class III

10.7.7 Historic and Forecasted Market Size By Application

10.7.7.1 Cardiology

10.7.7.2 Diagnostic Imaging

10.7.7.3 Orthopaedic

10.7.7.4 IVD

10.7.7.5 Ophthalmic

10.7.7.6 General

10.7.7.7 Plastic Surgery

10.7.7.8 Drug Delivery

10.7.7.9 Dental

10.7.7.10 Endoscopy

10.7.7.11 Diabetes Care

10.7.7.12 and Others

10.7.8 Historic and Forecasted Market Size By End User

10.7.8.1 Small Medical Device Company

10.7.8.2 Medium Medical Device Company

10.7.8.3 Large Medical Device Company

10.7.8.4 and Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Medical Device Outsourcing Market research report?

A1: The forecast period in the Medical Device Outsourcing Market research report is 2024-2032.

Q2: Who are the key players in the Medical Device Outsourcing Market?

A2: SGS Société Générale de Surveillance SA (Switzerland), Pace (U.S.), Intertek Group plc (U.K.), WuXi AppTec (China), North American Science Associates, Inc. (U.S.), Sterigenics U.S., LLC – A Sotera Health company (U.S.), Charles River Laboratories (U.S.), Celestica Inc. (Canada), FLEX LTD. (Singapore), Heraeus Group (Germany), Integer Holdings Corporation (U.S.), Nortech Systems, Inc. (U.S.), Plexus Corp. (U.S.), Sanmina Corporation (U.S.), Eurofins Scientific (France), TE Connectivity (Switzerland), ICON plc (Ireland), Parexel International Corporation (U.S.), Labcorp Drug Development (U.S.), Tecomet, Inc. (U.S.), IQVIA (U.S.), Jabil Inc. (U.S.), Syneos Health (U.S.), PROVIDIEN LLC. (U.S.), East/West Industries, Inc. (U.S.), TÜV SÜD (Germany), and Other Active Players.

Q3: What are the segments of the Medical Device Outsourcing Market?

A3: The Medical Device Outsourcing Market is segmented into By Services, By Product, By Device Type, By Application, By End User and region. By Services, the market is categorized into Quality Assurance, Regulatory Affairs Services, Product Design and Development Services, Product Testing and Sterilization Services, Product Implementation Services, Product Upgrade Services, Product Maintenance Services, Raw Material Services, Medical Electrical Equipment Services, Contract Manufacturing and Materials, and Chemical Characterization. By Product the market is categorized into Finished Goods, Electronics, and Raw Materials. By Device Type, the market is categorized into Class I, Class II, and Class III. By Application, the market is categorized into Cardiology, Diagnostic Imaging, Orthopaedic, IVD, Ophthalmic, General, Plastic Surgery, Drug Delivery, Dental, Endoscopy, Diabetes Care, and Others. By End User, the market is categorized into Small Medical Device Company, Medium Medical Device Company, Large Medical Device Company, and Others.By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Medical Device Outsourcing Market?

A4: Medical device outsourcing involves delegating specific tasks or processes related to the design, development, manufacturing, assembly, or testing of medical devices to external vendors or partners. These third-party organizations provide specialized expertise, facilities, and resources to support medical device companies in various aspects of their operations, enabling them to optimize efficiency and productivity.

Q5: How big is the Medical Device Outsourcing Market?

A5: Medical Device Outsourcing Market Size Was Valued at USD 131.69 Billion in 2023, and is Projected to Reach USD 367.55 Billion by 2032, Growing at a CAGR of 12.08% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!