Stay Ahead in Fast-Growing Economies.

Browse Reports NowLow VOC Adhesive Market-Global Expansion & Trend Analysis

The Low VOC Adhesive Market refers to the global market for adhesives formulated with minimal or no volatile organic compounds (VOCs). Low volatile organic compound (VOC) adhesives are adhesives with minimal amounts of volatile organic compounds (VOCs). VOCs are substances that, at room temperature, can evaporate into the atmosphere, possibly hurting one’s health as well as creating pollution and environmental damage. Conventional adhesives frequently have high volatile organic compounds (VOCs), which can release toxic fumes when applied and cured. This adhesive shows high-strength, solvent-based Low-VOC gluing Adhesive enables the gluing of TPO and EPDM membrane to a variety of porous and non-porous substrates. When low VOC adhesives are used instead of typical adhesives, VOC emissions can be reduced by 70–90%.

IMR Group

Description

Low VOC Adhesive Market Synopsis

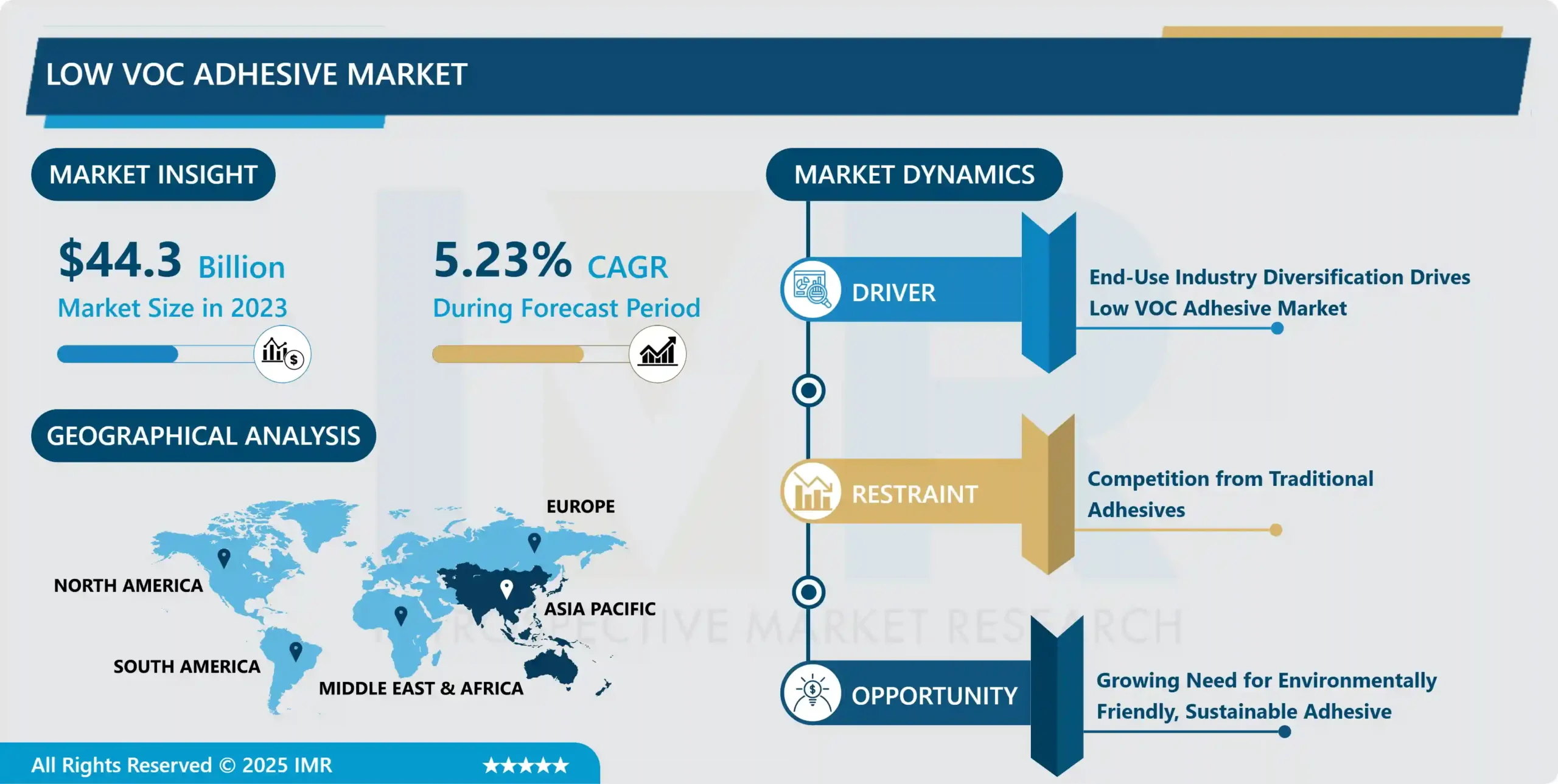

Low VOC Adhesive Market Size Was Valued at USD 44.3 Billion in 2023, and is Projected to Reach USD 70.09 Billion by 2032, Growing at a CAGR of 5.23 % From 2024-2032.

The Low VOC Adhesive Market refers to the global market for adhesives formulated with minimal or no volatile organic compounds (VOCs). Low volatile organic compound (VOC) adhesives are adhesives with minimal amounts of volatile organic compounds (VOCs). VOCs are substances that, at room temperature, can evaporate into the atmosphere, possibly hurting one’s health as well as creating pollution and environmental damage. Conventional adhesives frequently have high volatile organic compounds (VOCs), which can release toxic fumes when applied and cured. This adhesive shows high-strength, solvent-based Low-VOC gluing Adhesive enables the gluing of TPO and EPDM membrane to a variety of porous and non-porous substrates. When low VOC adhesives are used instead of typical adhesives, VOC emissions can be reduced by 70–90%.

Low VOC adhesives are safer for the environment and human health because they are designed to minimize or completely remove harmful emissions. They accomplish this by utilizing technologies that absorb or neutralize volatile organic compounds (VOCs) or by utilizing substitute materials and production techniques that result in fewer VOCs.

These adhesives are widely utilized in a variety of industries, including construction, automotive manufacture, furniture production, packaging, and healthcare, where indoor air quality and environmental considerations are of utmost importance. Water-based adhesives, which use water as a carrier solvent rather than organic solvents, and hot melt adhesives, which solidify without emitting toxic fumes, are two examples of low VOC adhesive types.

Low volatile organic compound (VOC) adhesives are essential for improving indoor air quality since they release less toxic chemicals into the environment. In addition to creating a healthier indoor atmosphere, this emission reduction lowers the chance of health problems like headaches, dizziness, and respiratory irritation. Using low-VOC adhesives also helps green buildings achieve LEED (Leadership in Energy and Environmental Design) certification, which is in line with sustainability objectives. Businesses and homes can promote environmental stewardship and occupant well-being simultaneously by selecting low VOC adhesive solutions, creating healthier and more sustainable living and working environments.

Low VOC Adhesive Market Trend Analysis

End-Use Industry Diversification drives Low VOC Adhesive Market

Previously specialized goods used in food packaging and healthcare, low volatile organic compound (VOC) adhesives are increasingly expanding into other industries. Because of their strong bonding and little concern about indoor air pollution, they are becoming more and more popular in the building and carpentry industries for flooring, furniture, and building materials. In the packaging sector, flexible packaging and carton sealing are becoming more popular at the same time as e-commerce drives a need for environmentally friendly solutions. This expanding use demonstrates how ecologically friendly adhesive solutions are becoming more and more popular in a variety of industries.

Due to its adaptability and safety benefits, low volatile organic compound (VOC) adhesives are finding their way into a growing number of industries, such as electronics, footwear, and medical devices. The demand for low-VOC adhesive solutions is rising as industry knowledge of VOC emissions rises, creating room for innovation and market expansion.

Growing Need for Environmentally Friendly, Sustainable Adhesive

Diverse industries are experiencing an increase in demand for environmentally friendly adhesives as they prioritize sustainability activities and comply with strict standards. For adhesive industry suppliers and manufacturers, this trend offers a huge chance to profit from innovation and market growth. Businesses can satisfy regulatory requirements, satisfy customer preferences, and contribute to a more sustainable future by funding research and development to generate sustainable adhesive formulations.

Substances (VOCs) found in these goods. The EPA (U.S. Environmental Protection Agency) has tightened emission limitations because volatile organic compounds (VOCs) are harmful to human health and cause air pollution. As a result, businesses are discouraged from making high-VOC products, which promotes innovation in more environmentally friendly options. These substitutes frequently make use of water- or bio-based components, satisfying consumer desire for safer and greener products. This push for sustainability in regulations comes at the same time as consumer awareness of environmental impact and a shift in consumer behaviour toward eco-consciousness

Low VOC Adhesive Market Segment Analysis:

Low VOC Adhesive Market Segmented on the basis of type, chemistry, and end-users industry.

By Type, Water-based Adhesives segment is expected to dominate the market during the forecast period

Water-based adhesives are ideally suited for a broad range of demanding applications across diverse end-use markets because of their adaptability and excellent bonding capabilities. These adhesives are perfect for use on porous or non-porous substrates because they are made using a blend of water, polymers, and additives. Adhesives based on water are usually sold in solution form, which activates when the water evaporates or is absorbed by the substrate.

They cover a variety of chemistries, such as liquid polyurethane formulations used in structural engineering and food packaging/flexible laminates (LIOFOL), acrylic-based emulsions, natural- or bio-based adhesives, natural rubber adhesives, and VAM-based emulsions (such as VAE or PVA emulsions). Due to its broad application and superior performance across a range of environments, the water-based adhesive market sector is expected to dominate with such a vast range of features and formulas.

By Chemistry, Polyvinyl Acetate (PVA) segment dominates the market.

The most popular all-purpose adhesive on the market is Polyvinyl Acetate (PVA), also referred to as white glue because of its low cost, simplicity of application, and adaptability. PVA was first discovered in 1912 and has since gained popularity as one of the most accessible and readily available water-dispersed adhesives.

Because of its user-friendly design, which enables simple washing with water and intuitive application formats, it may be used for a variety of activities without the need for complicated procedures. PVA provides enough initial binding strength for materials like cardboard, wood, and paper, which makes it perfect for a variety of common applications, such as children’s art projects, simple repairs, and crafts. These qualities together cement PVA’s leadership in the market for general-purpose adhesives.

Low VOC Adhesive Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

In the Asia Pacific area, low volatile organic compound (VOC) adhesives are gaining popularity. A combination of economic and environmental variables are responsible for this rise. With traditional adhesives containing volatile organic compounds (VOCs), consumers are becoming more conscious of the health dangers and demanding eco-friendly alternatives. Additionally, governments are enforcing more stringent VOC emission rules, which is generating a demand for compliant low VOC products. APAC’s low VOC adhesive market is expected to grow at the quickest rate in the world, offering producers a sizable window of opportunity.

Technology is enabling low volatile organic compound (VOC) adhesives that function on par with conventional choices, doing away with the need to choose between efficacy and sustainability. These adhesives are being used in a number of industries, including packaging, transportation, and construction. Examples include low volatile organic compound (VOC) hot melt adhesives for high-volume production lines, water-based adhesives for paper and packaging, and even bio-based adhesives derived from renewable resources. The Asia Pacific area may lead the way in sustainable manufacturing and advance environmental health by adopting low volatile organic compound (VOC) technologies.

Low VOC Adhesive Market Top Key Players:

3M (US)

Henkel (Germany)

H.B. Fuller (US)

Dow (US)

Sika AG (Switzerland)

AkzoNobel (Netherlands)

PPG Industries (US)

Lord Corporation (US)

Wacker Chemie (Germany)

Ashland Global Holdings Inc. (US)

Mapei (Italy)

Arkema (France)

Avery Dennison Corporation (US)

Huntsman Corporation (US)

The Lubrizol Corporation (US)

National Starch and Chemical Manufacturing Company (US)

Scott Bader Company Ltd (UK)

Delo Industrial Adhesives (Germany)

Dymax Corporation (US)

Pidilite Industries Ltd. (India)

Kanto Chemical Group Inc. (Japan)

Wego Group Company Ltd. (China)

Lechler SpA (Italy)

Franklin International (US)

Sekisui Chemical Co. Ltd. (Japan), and other major players.

Key Industry Developments in the Low VOC Adhesive Market:

In September 2023, the largest pureplay adhesives company in the world, H.B. Fuller Company acquired the operations of UK-based Sanglier Limited, one of the biggest independently owned producers and fillers of sprayable industrial adhesives (aerosol and canister). The acquisition complements technologies acquired through the acquisitions of Apollo and Fourny and sprays capabilities developed in the United States.

In April 2023, Dow and Avery Dennison collaborated to create a novel and environmentally friendly hotmelt label adhesive solution that allows polypropylene (PP) or polyethylene (PE) packaging and polyolefin filmic labels to be mechanically recycled in the same stream. Recycle has authorized the adhesive, which is the first of its sort on the label market, for recycling in the HDPE-colored stream.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Low VOC Adhesive Market by Type (2018-2032)

4.1 Low VOC Adhesive Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Water-based Adhesives

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Holt-melt Adhesives

4.5 Reactive

Chapter 5: Low VOC Adhesive Market by Chemistry (2018-2032)

5.1 Low VOC Adhesive Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Polyvinyl Acetate (PVA)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Polyacrylic Acetate (PAE)

5.5 Vinyl Acetate/Ethylene (VAE)

5.6 EVA

5.7 Epoxy

5.8 Others

Chapter 6: Low VOC Adhesive Market by End-User Industry (2018-2032)

6.1 Low VOC Adhesive Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Paper and Packaging

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Building and Construction

6.5 Transportation

6.6 Woodworking

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Low VOC Adhesive Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 3M (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 HENKEL (GERMANY)

7.4 H.B. FULLER (US)

7.5 DOW (US)

7.6 SIKA AG (SWITZERLAND)

7.7 AKZONOBEL (NETHERLANDS)

7.8 PPG INDUSTRIES (US)

7.9 LORD CORPORATION (US)

7.10 WACKER CHEMIE (GERMANY)

7.11 ASHLAND GLOBAL HOLDINGS INC. (US)

7.12 MAPEI (ITALY)

7.13 ARKEMA (FRANCE)

7.14 AVERY DENNISON CORPORATION (US)

7.15 HUNTSMAN CORPORATION (US)

7.16 THE LUBRIZOL CORPORATION (US)

7.17 NATIONAL STARCH AND CHEMICAL MANUFACTURING COMPANY (US)

7.18 SCOTT BADER COMPANY LTD (UK)

7.19 DELO INDUSTRIAL ADHESIVES (GERMANY)

7.20 DYMAX CORPORATION (US)

7.21 PIDILITE INDUSTRIES LTD. (INDIA)

7.22 KANTO CHEMICAL GROUP INC. (JAPAN)

7.23 WEGO GROUP COMPANY LTD. (CHINA)

7.24 LECHLER SPA (ITALY)

7.25 FRANKLIN INTERNATIONAL (US)

7.26 SEKISUI CHEMICAL CO. LTD. (JAPAN)

7.27

Chapter 8: Global Low VOC Adhesive Market By Region

8.1 Overview

8.2. North America Low VOC Adhesive Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Water-based Adhesives

8.2.4.2 Holt-melt Adhesives

8.2.4.3 Reactive

8.2.5 Historic and Forecasted Market Size by Chemistry

8.2.5.1 Polyvinyl Acetate (PVA)

8.2.5.2 Polyacrylic Acetate (PAE)

8.2.5.3 Vinyl Acetate/Ethylene (VAE)

8.2.5.4 EVA

8.2.5.5 Epoxy

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size by End-User Industry

8.2.6.1 Paper and Packaging

8.2.6.2 Building and Construction

8.2.6.3 Transportation

8.2.6.4 Woodworking

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Low VOC Adhesive Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Water-based Adhesives

8.3.4.2 Holt-melt Adhesives

8.3.4.3 Reactive

8.3.5 Historic and Forecasted Market Size by Chemistry

8.3.5.1 Polyvinyl Acetate (PVA)

8.3.5.2 Polyacrylic Acetate (PAE)

8.3.5.3 Vinyl Acetate/Ethylene (VAE)

8.3.5.4 EVA

8.3.5.5 Epoxy

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size by End-User Industry

8.3.6.1 Paper and Packaging

8.3.6.2 Building and Construction

8.3.6.3 Transportation

8.3.6.4 Woodworking

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Low VOC Adhesive Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Water-based Adhesives

8.4.4.2 Holt-melt Adhesives

8.4.4.3 Reactive

8.4.5 Historic and Forecasted Market Size by Chemistry

8.4.5.1 Polyvinyl Acetate (PVA)

8.4.5.2 Polyacrylic Acetate (PAE)

8.4.5.3 Vinyl Acetate/Ethylene (VAE)

8.4.5.4 EVA

8.4.5.5 Epoxy

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size by End-User Industry

8.4.6.1 Paper and Packaging

8.4.6.2 Building and Construction

8.4.6.3 Transportation

8.4.6.4 Woodworking

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Low VOC Adhesive Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Water-based Adhesives

8.5.4.2 Holt-melt Adhesives

8.5.4.3 Reactive

8.5.5 Historic and Forecasted Market Size by Chemistry

8.5.5.1 Polyvinyl Acetate (PVA)

8.5.5.2 Polyacrylic Acetate (PAE)

8.5.5.3 Vinyl Acetate/Ethylene (VAE)

8.5.5.4 EVA

8.5.5.5 Epoxy

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size by End-User Industry

8.5.6.1 Paper and Packaging

8.5.6.2 Building and Construction

8.5.6.3 Transportation

8.5.6.4 Woodworking

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Low VOC Adhesive Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Water-based Adhesives

8.6.4.2 Holt-melt Adhesives

8.6.4.3 Reactive

8.6.5 Historic and Forecasted Market Size by Chemistry

8.6.5.1 Polyvinyl Acetate (PVA)

8.6.5.2 Polyacrylic Acetate (PAE)

8.6.5.3 Vinyl Acetate/Ethylene (VAE)

8.6.5.4 EVA

8.6.5.5 Epoxy

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size by End-User Industry

8.6.6.1 Paper and Packaging

8.6.6.2 Building and Construction

8.6.6.3 Transportation

8.6.6.4 Woodworking

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Low VOC Adhesive Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Water-based Adhesives

8.7.4.2 Holt-melt Adhesives

8.7.4.3 Reactive

8.7.5 Historic and Forecasted Market Size by Chemistry

8.7.5.1 Polyvinyl Acetate (PVA)

8.7.5.2 Polyacrylic Acetate (PAE)

8.7.5.3 Vinyl Acetate/Ethylene (VAE)

8.7.5.4 EVA

8.7.5.5 Epoxy

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size by End-User Industry

8.7.6.1 Paper and Packaging

8.7.6.2 Building and Construction

8.7.6.3 Transportation

8.7.6.4 Woodworking

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Low VOC Adhesive Market research report?

A1: The forecast period in the Low VOC Adhesive Market research report is 2024-2032.

Q2: Who are the key players in the Low VOC Adhesive Market?

A2: 3M (US), Henkel (Germany), H.B. Fuller (US), Dow (US), Sika AG (Switzerland), AkzoNobel (Netherlands), PPG Industries (US), Lord Corporation (US), Wacker Chemie (Germany), Ashland Global Holdings Inc. (US), Mapei (Italy), Arkema (France), Avery Dennison Corporation (US), Huntsman Corporation (US), The Lubrizol Corporation (US), National Starch and Chemical Manufacturing Company (US), Scott Bader Company Ltd (UK), Delo Industrial Adhesives (Germany), Dymax Corporation (US), Pidilite Industries Ltd. (India), Kanto Chemical Group Inc. (Japan), Wego Group Company Ltd. (China), Lechler SpA (Italy), Franklin International (US), Sekisui Chemical Co. Ltd. (Japan) and Other Major Players.

Q3: What are the segments of the Low VOC Adhesive Market?

A3: The Low VOC Adhesive Market is segmented into Type, Chemistry, End-User Industry and region. By Type, the market is categorized into Water-based Adhesives, Holt-melt Adhesives, and Reactive. By Chemitry, the market is categorized into Polyvinyl Acetate (PVA), Polyacrylic Acetate (PAE), Vinyl Acetate/Ethylene (VAE), EVA, Epoxy and Others. By End-User Industry, the market is categorized into Paper and Packaging, Building and Construction, Transportation, Woodworking, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Low VOC Adhesive Market?

A4: The Low VOC Adhesive Market refers to the global market for adhesives formulated with minimal or no volatile organic compounds (VOCs). Low volatile organic compound (VOC) adhesives are adhesives with minimal amounts of volatile organic compounds (VOCs). VOCs are substances that, at room temperature, can evaporate into the atmosphere, possibly hurting one's health as well as creating pollution and environmental damage. Conventional adhesives frequently have high volatile organic compounds (VOCs), which can release toxic fumes when applied and cured.

Q5: How big is the Low VOC Adhesive Market?

A5: Low VOC Adhesive Market Size Was Valued at USD 44.3 Billion in 2023, and is Projected to Reach USD 70.09 Billion by 2032, Growing at a CAGR of 5.23 % From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!