Stay Ahead in Fast-Growing Economies.

Browse Reports NowLogistics Business Outsourcing Market – Comprehensive Industry Analysis

The logistics business outsourcing market refers to the delegation of logistics operations to specialized third-party providers known as 3PLs or 4PLs. These service providers handle a wide range of functions such as warehousing, inventory control, order fulfillment, packaging, and both inbound and outbound transportation. Outsourcing logistics enables companies to focus on core business activities while ensuring cost efficiency, timely deliveries, and operational flexibility.

IMR Group

Description

Logistics Business Outsourcing Market Synopsis:

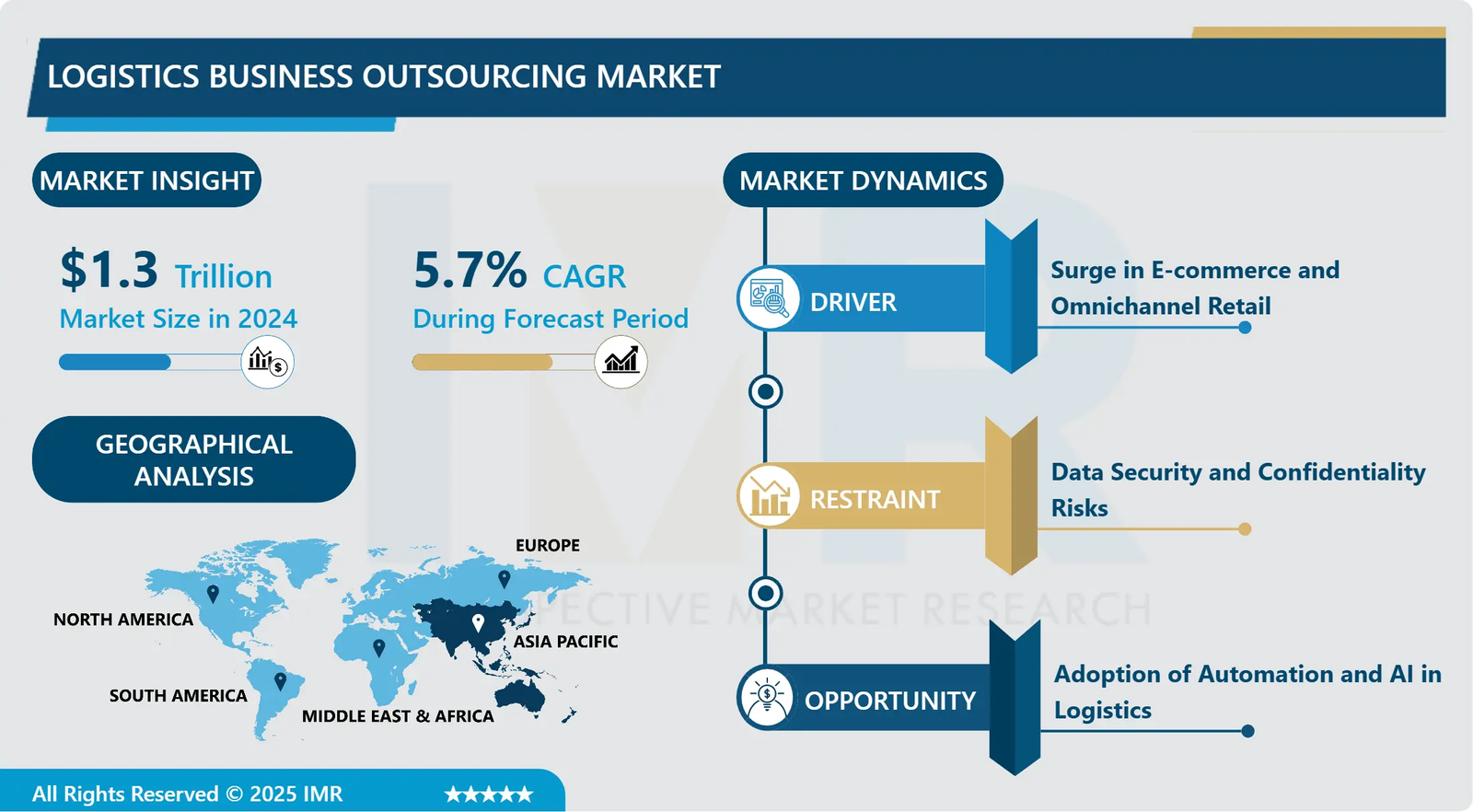

Logistics Business Outsourcing Market Size Was Valued at USD 1.30 Trillion in 2024, and is Projected to Reach USD 2.03 Trillion by 2032, Growing at a CAGR of 5.7% from 2025-2032.

The logistics business outsourcing market refers to the delegation of logistics operations to specialized third-party providers known as 3PLs or 4PLs. These service providers handle a wide range of functions such as warehousing, inventory control, order fulfillment, packaging, and both inbound and outbound transportation. Outsourcing logistics enables companies to focus on core business activities while ensuring cost efficiency, timely deliveries, and operational flexibility.

The market includes several key segments such as Third-Party Logistics (3PL), Fourth-Party Logistics (4PL), reverse logistics, green logistics, and military logistics, among others. These segments cater to various industries by optimizing the movement, storage, and flow of goods throughout the supply chain. Growing globalization, e-commerce expansion, and technological advancements have significantly driven the adoption of logistics outsourcing.

Logistics service providers offer tailored solutions depending on client needs, including value-added services like real-time tracking, demand forecasting, and route optimization. These capabilities not only improve supply chain visibility and responsiveness but also help reduce overhead costs and delivery times.

Logistics Business Outsourcing Market Growth and Trend Analysis:

Logistics Business Outsourcing Market Growth Driver- Surge in E-commerce and Omnichannel Retail

The explosive growth of e-commerce and omnichannel retail has become a primary driver for logistics outsourcing. Consumers now demand faster, more flexible delivery options, which pushes businesses to optimize their supply chains. Instead of building costly in-house logistics networks, companies partner with 3PL providers to access warehousing, fulfillment, and last-mile delivery services across regions.

Omnichannel models where customers shop across physical stores, websites, and mobile apps require integrated logistics support for real-time inventory management and seamless order processing. Logistics outsourcing enables retailers to scale quickly, adapt to fluctuating demand, and meet service expectations efficiently. The surge in online orders, especially in post-pandemic economies, has reinforced the value of outsourcing logistics as a cost-effective, scalable, and technology-enabled solution that keeps operations lean and responsive to customer needs. ?

Logistics Business Outsourcing Market Limiting Factor- Data Security and Confidentiality Risks

One of the major restraints in logistics outsourcing is the risk of data breaches and confidentiality lapses. When businesses entrust logistics providers with customer information, inventory data, and transactional records, it creates vulnerabilities in cybersecurity. If the third-party lacks robust data protection systems, sensitive information may be exposed to cyber-attacks or unauthorized access. Cases have been reported where insufficient encryption or internal controls led to leaks of customer databases and supply chain blueprints.

Compliance with data protection regulations like GDPR becomes complex when logistics operations span across borders. This creates legal and operational risks. For industries such as pharmaceuticals, defense, or electronics, any data compromise can lead to severe financial loss and reputational damage. Hence, data governance and cybersecurity readiness remain a pressing concern restraining wider adoption.

Logistics Business Outsourcing Market Expansion Opportunity- Adoption of Automation and AI in Logistics

The increasing adoption of automation and artificial intelligence (AI) presents a significant opportunity in the logistics outsourcing market. Logistics service providers are investing in cutting-edge technologies like autonomous guided vehicles (AGVs), robotic sorters, AI-powered demand forecasting, and route optimization tools. These technologies streamline operations, reduce delivery times, and lower labor dependency, leading to significant cost savings.

Businesses that outsource logistics gain access to such advanced infrastructure without the need for heavy capital investment. Additionally, AI enables predictive analytics and real-time decision-making, improving supply chain visibility and responsiveness. Automation also supports sustainability by optimizing fuel usage and reducing carbon emissions. This technological evolution not only enhances efficiency but also creates differentiation for 3PL providers. Companies leveraging tech-enabled outsourcing gain a competitive edge in speed, accuracy, and customer satisfaction.

Logistics Business Outsourcing Market Challenge Barrier- Lack of Customization in Standardized Services

A notable challenge in logistics outsourcing is the limited customization offered by many third-party logistics (3PL) providers. To maximize efficiency and scale, providers often use standardized service models that may not suit the specific operational needs of niche industries. For example, pharmaceutical companies require cold chain logistics and strict regulatory compliance, while luxury brands demand high-security storage and white-glove delivery. Standard services may lack flexibility in such cases, leading to inefficiencies or service gaps.

Articles in logistics publications highlight client dissatisfaction when providers fail to adapt systems or protocols to align with unique workflows. Customization often requires deeper integration, real-time communication, and investment in specialized infrastructure all of which increase costs. This limits smaller players from fully benefiting from outsourcing and poses a significant challenge in high-complexity sectors.

Logistics Business Outsourcing Market Segment Analysis:

Logistics Business Outsourcing Market is segmented based on Service Type, Outsourcing Type, Mode of Transport, and Region

By Service Type, Transportation Management Segment is Expected to Dominate the Market During the Forecast Period

Rapid expansion of e-commerce, global trade, and the increasing need for efficient, cost-effective delivery solutions. Transportation management services help businesses streamline inbound and outbound logistics, optimize delivery routes, and manage carrier relationships more effectively. With rising fuel costs and growing consumer demand for faster deliveries, companies are increasingly outsourcing transportation to third-party providers to enhance operational efficiency.

Advancements in technology such as real-time tracking, AI-driven route planning, and telematics have significantly improved the performance and reliability of outsourced transportation services. These factors, combined with the complexity of managing international shipping and last-mile delivery, make transportation management the most critical and in-demand segment in the logistics outsourcing landscape.

By Outsourcing Type, Third-Party Logistics (3PL) Segment Held the Largest Share in 2024

Growing need for cost-effective and scalable logistics solutions across sectors like retail, manufacturing, and healthcare. 3PL providers offer essential services such as transportation, warehousing, inventory management, and order fulfillment, helping companies reduce operational complexities and capital investments. The surge in e-commerce and increasing customer expectations for fast, reliable deliveries further boosted the reliance on 3PLs.

These providers also bring technological advancements like real-time tracking and route optimization, enhancing supply chain efficiency. Additionally, their global networks and experience in handling cross-border logistics make them a preferred choice for businesses expanding internationally. Overall, 3PLs provided the flexibility, speed, and efficiency that helped them capture the largest market share in 2024.

Logistics Business Outsourcing Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

Rapid industrial growth, booming e-commerce, and expanding manufacturing bases make the Asia-Pacific region the dominant force in the logistics business outsourcing market for the 2025–2032 period. Countries like China, India, and Vietnam are witnessing a surge in demand for efficient logistics services due to rising cross-border trade and growing consumer expectations.

Businesses are increasingly outsourcing transportation, warehousing, and fulfillment operations to manage complex and large-scale supply chains. Government investments in infrastructure such as smart ports, dedicated freight corridors, and logistics parks are further improving efficiency. Additionally, cost-effective labor and widespread adoption of automation and AI in logistics operations make the region attractive for global companies. With its strategic trade positioning and strong technological progress, Asia-Pacific is expected to sustain and strengthen its lead in the logistics outsourcing market throughout the forecast period.

Logistics Business Outsourcing Market Active Players:

A.P. Møller – Mærsk A/S (Denmark)

Blue Dart (India)

Deutsche Bahn AG (Germany)

DHL International GmbH (Germany)

DHL Supply Chain (UK)

Ekart Logistics (India)

FedEx (India)

FedEx Corporation (USA)

GXO Logistics (UK)

Inexia (France)

Kuehne + Nagel International AG (Switzerland)

Nippon Express Co. Ltd. (Japan)

STS Logistics (Russia)

United Parcel Service of America Inc. (USA)

Wincanton (UK)

XPO Logistics Inc. (USA)

Other Active Players

Key Industry Developments in the Logistics Business Outsourcing Market:

In May 2025, GXO Logistics had extended its long-term partnership with bioMérieux, a global leader in in vitro diagnostics. The renewed contract included the Instrumentation range and built upon two decades of collaboration marked by supply chain innovation. Together, they had redesigned warehouse operations with automation, temperature control, and a unified warehouse management system to enhance global distribution efficiency and compliance.

In March 2025, Blue Dart Express Ltd. had partnered with DMRC to launch South Asia Pacific’s first metro-enabled urban logistics service. The initiative aimed to utilize Delhi Metro trains and stations for faster, eco-friendly cargo transport across Delhi-NCR. This move had marked a major shift toward sustainable urban logistics by reducing road congestion and emissions.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter’s Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Logistics Business Outsourcing Market by Service Type (2018-2032)

4.1 Logistics Business Outsourcing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Transportation Management

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Warehousing and Distribution

4.5 Value-Added Services

4.6 Supply Chain Management

Chapter 5: Logistics Business Outsourcing Market by Outsourcing Type (2018-2032)

5.1 Logistics Business Outsourcing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Third-Party Logistics (3PL)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Fourth-Party Logistics (4PL)

5.5 Managed Transportation Services (MTS)

Chapter 6: Logistics Business Outsourcing Market by Mode of Transport (2018-2032)

6.1 Logistics Business Outsourcing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Road

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Air

6.5 Sea

6.6 Rail

6.7 Multimodal

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Logistics Business Outsourcing Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 A.P. MØLLER – MÆRSK A/S (DENMARK)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 BLUE DART (INDIA)

7.4 DEUTSCHE BAHN AG (GERMANY)

7.5 DHL INTERNATIONAL GMBH (GERMANY)

7.6 DHL SUPPLY CHAIN (UK)

7.7 EKART LOGISTICS (INDIA)

7.8 FEDEX (INDIA)

7.9 FEDEX CORPORATION (USA)

7.10 GXO LOGISTICS (UK)

7.11 INEXIA (FRANCE)

7.12 KUEHNE + NAGEL INTERNATIONAL AG (SWITZERLAND)

7.13 NIPPON EXPRESS CO. LTD. (JAPAN)

7.14 STS LOGISTICS (RUSSIA)

7.15 UNITED PARCEL SERVICE OF AMERICA INC. (USA)

7.16 WINCANTON (UK)

7.17 XPO LOGISTICS INC. (USA)

7.18 OTHER ACTIVE PLAYERS

Chapter 8: Global Logistics Business Outsourcing Market By Region

8.1 Overview

8.2. North America Logistics Business Outsourcing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Logistics Business Outsourcing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Logistics Business Outsourcing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Logistics Business Outsourcing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Logistics Business Outsourcing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Logistics Business Outsourcing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

Q1: What is the Forecast Period Covered in the Logistics Business Outsourcing Market Research Report?

A1: The projected forecast period for the Logistics Business Outsourcing Market Research Report is 2025-2032.

Q2: Who are the Key Players in the Logistics Business Outsourcing Market?

A2: A.P. Møller – Mærsk A/S (Denmark), Blue Dart (India), Deutsche Bahn AG (Germany), DHL International GmbH (Germany), DHL Supply Chain (UK), Ekart Logistics (India), FedEx (India), FedEx Corporation (USA), GXO Logistics (UK), Inexia (France), Kuehne + Nagel International AG (Switzerland), Nippon Express Co. Ltd. (Japan), STS Logistics (Russia), United Parcel Service of America Inc. (USA), Wincanton (UK), XPO Logistics Inc. (USA), and Other Active Players.

Q3: How is the Logistics Business Outsourcing Market segmented?

A3: The Logistics Business Outsourcing Market is segmented into Service Type, Outsourcing Type, Mode of Transport, and Region. By Service Type, the market is categorized into Transportation Management, Warehousing and Distribution, Value-Added Services, Supply Chain Management. By Outsourcing Type, the market is categorized into Third-Party Logistics (3PL), Fourth-Party Logistics (4PL), Managed Transportation Services (MTS). By Mode of Transport, the market is categorized into Road, Air, Sea, Rail, Multimodal. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; ; Spain; Rest of Western Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil; Argentina, Rest of SA.).

Q4: What defines the Logistics Business Outsourcing Market?

A4: The logistics business outsourcing market refers to the delegation of logistics operations to specialized third-party providers known as 3PLs or 4PLs. These service providers handle a wide range of functions such as warehousing, inventory control, order fulfillment, packaging, and both inbound and outbound transportation. Outsourcing logistics enables companies to focus on core business activities while ensuring cost efficiency, timely deliveries, and operational flexibility.

Q5: What is the market size of the Logistics Business Outsourcing Market?

A5: Logistics Business Outsourcing Market Size Was Valued at USD 1.30 Trillion in 2024, and is Projected to Reach USD 2.03 Trillion by 2032, Growing at a CAGR of 5.7% from 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!