Stay Ahead in Fast-Growing Economies.

Browse Reports NowLaw Enforcement Software Market – Global Demand & Analysis

The law enforcement software market encompasses a range of software solutions designed specifically for use by law enforcement agencies and related entities. These software applications are developed to enhance operational efficiency, streamline workflows, and improve overall effectiveness in policing and public safety efforts.

IMR Group

Description

Law Enforcement Software Market Synopsis

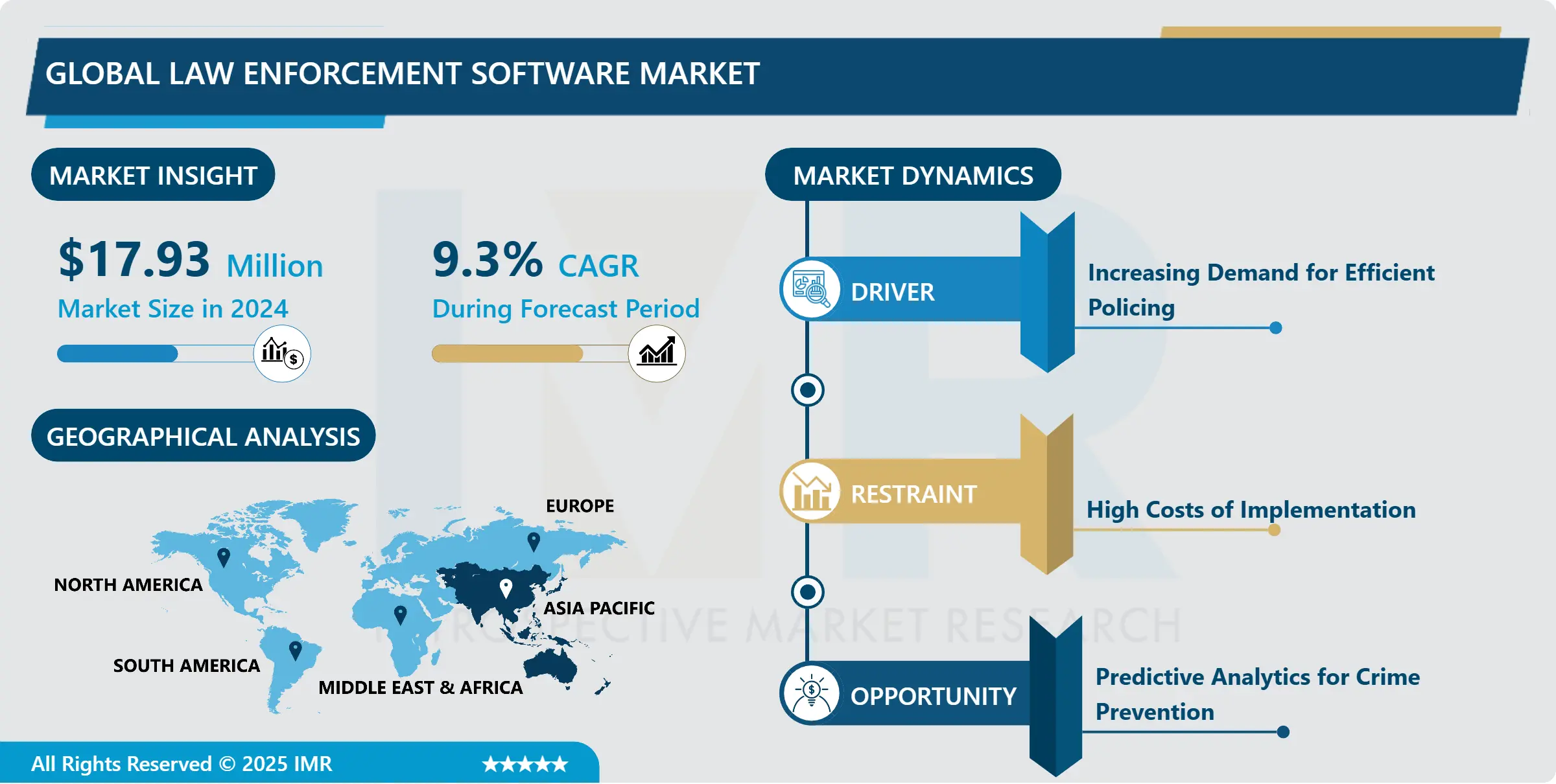

The Law Enforcement Software Market Size Was Valued at USD 16.40 Billion in 2024, and is Projected to Reach USD 36.52 Billion by 2032, Growing at a CAGR of 9.3 % From 2025 to 2032.

The police software market involves a variety of software built for use by law enforcement agencies and related entities. These software programs are developed to increase the operational efficiency as well as the effectiveness of policing and public safety by using better workflow and processes. The main functionalities of law enforcement software usually include crime mapping and analysis tools, incident reporting systems, case management platforms, evidence and property management solutions, and also specialized software for dispatching, scheduling, and resource allocation. The purpose of these technologies would be to renovate old-fashioned policing techniques through using data-driven insights, facilitating the exchange of information between agencies, as well as the process of informed decision making. The law enforcement software market is, in constant growth through technology advancements, including predictive analytics, real-time intelligence, and mobile accessibility, to respond to the emerging challenges of law enforcement agencies all around the world. The development of law enforcement software is fast paced due to the growing need for cutting-edge solutions to improve the operational efficiency and safety of the public. The market includes software products designed for law enforcement agencies and include computer-aided dispatch (CAD), records management system (RMS), jail management system (JMS) and crime analysis software. The main reasons for the market boom are the increase in crime cases, need for the efficient use of resources, and digital policing.

Among the major drivers of the law enforcement software market is an implementation of the cloud-based solutions as well as mobile applications. In recent times, the security sector has started moving towards cloud computing in order to take advantage of features such as scalability, flexibility, and cost benefits. Mobile apps provide mobile officers with instant access to data, which not only increases the speed of decision making but also enhances teamwork between various units. Furthermore, AI technology and predictive analytics have caused a profound transformation of the operations of law enforcement. Artificial intelligence-powered solutions facilitate agencies to automate standard tasks as data analysis, the personnel concentrates on strategic objectives. Predictive analytics algorithms are used to predict patterns and trends which, in turn, help detect possible crimes and apply preemptive strategies in order to do law enforcement in a more proactive way. Moreover, market landscape is shaped by regulatory mandates and initiatives intended for modernizing law enforcement infrastructure. Governments internationally are investing in phasing out old systems and replacing them with new and modern software to ensure better integrability and accountability. Furthermore, the expanding body-worn cameras as well as IoT devices will generate huge data, consequently requiring strong data management and analysis software solutions. The law enforcement software market is projected to grow further, fueled by technological breakthroughs, increasing demand for security, and the necessity to increase efficiency levels. With the rise of data-driven insights and the latest technologies being used by law enforcement agencies, the demand for any sophisticated software solutions will continue to be high, bringing an atmosphere of innovation and collaboration within the global law enforcement community.

Law Enforcement Software Market Trend Analysis

Advancements in Law Enforcement Software Solutions

Adoption of cloud-based solutions in law enforcement agencies within a government perspective represents a large shift towards modernization as well as efficiency. Cloud computing provides police departments with the scaling and flexibility they need that can quickly respond to their changing requirements. Through relocating essential data and applications to the cloud, agencies can aggregate their assets and enhance the efficiency of their operations, thus, eliminating the tedium of managing on-premises hardware and software. This scalability, on the other hand, enables agencies to handle large data volumes more efficiently thus enabling the predictive policing and real-time analytics.

Moreover, cloud-based solutions permit more efficient collaboration and information sharing across law enforcement institutions. By using the cloud where the data is stored, personnel with the appropriate security clearance can access critical information from anywhere with an internet connection, assisting faster decision-making and response times. This accessibility triggers interagency cooperation and collaboration, thus tearing down silos and paving the way for a more coordinated way of doing law enforcement.

In addition, the cloud technology usually has inbuilt security mechanisms and compliance standards that ensure robust data protection and compliance with the regulations. In the light of the fact that law enforcement agencies are more and more moving to the digital field, cloud-based solutions will be of greater importance in the area of operational efficiency and effectiveness.

The Impact of AI and Machine Learning in Law Enforcement

The application of AI and ML in law enforcement software solutions epitomizes an emerging trend which is transforming the manner in which agencies deal with crime prevention and investigation. AI powered tools give law enforcement agencies powerful analytical features that allows them to process and interpret data more effectively and efficiently than ever before. One of the AI applications like predictive policing helps agencies to forecast potential crime hotspots based on the historical data thereby optimizing the resource allocation and making proactive interventions. The technologies of facial recognition are useful in tracing the suspects or missing persons from surveillance cameras, thereby helping the law enforcement to solve cases and protect the public.

For example, it combines AI-driven video analytics and natural language processing which allows law enforcement agencies to automate even tedious tasks like transcribing interviews, analyzing evidence and extracting insights from multimedia sources. These technologies actually not only save time and resources, but also they contribute to the rise of the precision and speed of investigations. In addition to these benefits, AI use in law enforcement brings up important ethical and privacy issues.

It is increasingly essential for the development of strong regulations and supervision in order to ensure that AI tools are applied in a responsible and transparent manner. The complications of biased AI algorithms, misapplication of facial recognition data, and the consequences of automated decision-making demonstrate the need to find a balance between development and keeping individual freedoms and rights. With AI advances in law enforcement, policymakers, military, and technology developers should collaborate to develop standards and ethical frameworks that make accountable and trustworthy use of AI in the public safety and security sector.

Law Enforcement Software Market Segment Analysis:

Law Enforcement Software Market is segmented based on Component, Solutions, Services and and Deployment Type.

By Solutions, Computer-Aided Dispatch (CAD) systems segment is expected to dominate the market during the forecast period

Computer-Aided Dispatch (CAD) systems have established themselves as a key factor in the law enforcement technology market. These systems contribute greatly to the evolution of the emergency response operations by giving sophisticated means to respond to and manage critical events in an efficient manner. CAD systems optimize dispatch procedures, assigning resources on the basis of incident type, location, and available units, which speeds up and improves the accuracy of work. This automation greatly reduces the response time, allowing law enforcement agencies to promptly tackle emergencies and allocate resources properly.

As well, CAD systems increase the effectiveness of resource utilization by connecting actual data flow and mapping tools. Dispatchers can locate incidents, monitor unit availability, and prioritize responses according to the need and nearest units. This level of coordination guarantees that the appropriate personnel and equipment are deployed timely to manage the incidents properly. Moreover, CAD improves communication between dispatchers and field officers by means of integrated messaging and time-to-time updates, so that there is a clear flow of information and situational awareness. In such fast-paced and dynamic emergencies the real-time communications becomes crucial for law enforcement teams to communicate effectively and make informed ground-level decisions. Generally, the full potential of CAD has made it an imposed tool in modern law enforcement agencies, boosting the response time, the incident management and the public safety.

By Services, Implementation segment held the largest share in 2024

The Services category is the main market driver because of several main reasons. The first factor is that businesses and organizations increasingly use service-based solutions to optimize performance, increase efficiency, and decrease expenses. This trend has created huge opportunities for other services in different areas such as technology, healthcare and finance. In the Services segment, the Implementation services seem to be the most fundamental. This implementation phase covers the vital stage of matching the solutions and technologies with the company’s current infrastructures. Strategic planning, customization, integration and testing are the cornerstone of the seamless adoption and functionality of new technologies. This implementation segment reflects the increasing demand for integrated services that go beyond the product acquisition stage to offer continued support for success and a favourable ROI.

Also, the Implementation segment’s supremacy goes in line with the evolving market trends, including enhanced complexity and specialization. While technology landscapes change rapidly, businesses need professional advice and practical assistance so as not to be lost when adapting the technology easily. Implementation services involve project management, training of users, and post-implementation support which is an integral part of the process of solution decomposition. For competitive markets where the factor of time to market and operational efficiency are of high importance, businesses focus on reliable partners who are in a position to provide end-to-end implementation services. This implementation-major focus shows its strategic nature that allies market expansion with adaptability of the latest solutions in different industries, making the service providers main enablers of digital transformation and business efficiency.

Law Enforcement Software Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The market of law enforcement software in the Asia Pacific region now appears to be stronger than ever because of many reasons. In most of the countries of this region, urbanization is very speedy which makes public security and safety management very challenging. With the expansion of urban areas and the increase in population density governments are required to implement more complicated law enforcement technologies to meet the increasing level of security. This phenomenon is especially evident in China, India and Japan where a big population and rapid urbanisation needs to be solved through advanced law enforcement systems.

Moreover, the governments in the region are heavily involved in the implementation of programs directed at improving public security. These programs are the ones that typically get equipped with the modern law enforcement applications that allow for the real-time surveillance, data analysis, and predictive policing. The focus on public safety is fueling the application of new technologies including facial recognition, predictive analytics and video surveillance systems in many law enforcement agencies throughout the region.

AI and machine learning-led advancements in surveillance systems are indeed revolutionizing the law enforcement software market trend of Asia Pacific. AI-based software technology is assisting law enforcement agencies to process data efficiently, including detecting trends, and identifying possible risks in real-time. This capacity is transforming the way the law enforcement agencies function by making them more proactive in crime prevention and more efficient in their response.

In addition to this, the increasing demand for cloud-based solutions and mobile apps for law enforcement is accelerating market growth in the Asia Pacific region as well. These technologies provide scalability, flexibility, and accessibility, giving law enforcement personnel the opportunity to obtain urgently needed information and tools at their fingertips, no matter where they are..

Active Key Players in the Law Enforcement Software Market

IBM Corporation

Accenture Plc

Motorola Solutions Inc

Axon Enterprise Inc

NICE Ltd

Esri

Nuance Communication

Palantir Technologies Inc

Hexagon Safety and Infrastructure

Genetec

Other Active Players

Key Industry Developments in the Law Enforcement Software Market :

In March 2023-:Motorola Solutions has launched the new Avigilon Security Suite which gives worldwide enterprises of all scales secure, scalable and adaptable video security and access management. The Avigilon security suite consists of the on-premises Avigilon Unity and cloud-native Avigilon Alta systems.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Law Enforcement Software Market by Component (2018-2032)

4.1 Law Enforcement Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solutions

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Law Enforcement Software Market by Solutions (2018-2032)

5.1 Law Enforcement Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Computer-Aided Dispatch

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Record Management

5.5 Case Management

5.6 Jail Management

5.7 Incident Response

5.8 Digital Policing

5.9 Others

Chapter 6: Law Enforcement Software Market by Services (2018-2032)

6.1 Law Enforcement Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Implementation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Training and Support

6.5 Consulting

6.6 Others

Chapter 7: Law Enforcement Software Market by Deployment Type (2018-2032)

7.1 Law Enforcement Software Market Snapshot and Growth Engine

7.2 Market Overview

7.3 On-premises

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Cloud

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Law Enforcement Software Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ARDAGH(EUROPE)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SHANGHAI YANLONGJI(CHINA)

8.4 THE GLASS RECYCLING COMPANY(SOUTH AFRICA)

8.5 SPRING POOL(US)

8.6 PACE GLASS(US)

8.7 VITRO MINERALS(GEORGIA)

8.8 MARCO ABRASIVES(US)

8.9 RUMPKE(US)

8.10 BINDER+CO(AUSTRIA)

8.11 OWENS CORNING(US)

8.12 VETROPACK HOLDING(EUROPE)

8.13 OTHER KEY PLAYERS

Chapter 9: Global Law Enforcement Software Market By Region

9.1 Overview

9.2. North America Law Enforcement Software Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Component

9.2.4.1 Solutions

9.2.4.2 Services

9.2.5 Historic and Forecasted Market Size by Solutions

9.2.5.1 Computer-Aided Dispatch

9.2.5.2 Record Management

9.2.5.3 Case Management

9.2.5.4 Jail Management

9.2.5.5 Incident Response

9.2.5.6 Digital Policing

9.2.5.7 Others

9.2.6 Historic and Forecasted Market Size by Services

9.2.6.1 Implementation

9.2.6.2 Training and Support

9.2.6.3 Consulting

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size by Deployment Type

9.2.7.1 On-premises

9.2.7.2 Cloud

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Law Enforcement Software Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Component

9.3.4.1 Solutions

9.3.4.2 Services

9.3.5 Historic and Forecasted Market Size by Solutions

9.3.5.1 Computer-Aided Dispatch

9.3.5.2 Record Management

9.3.5.3 Case Management

9.3.5.4 Jail Management

9.3.5.5 Incident Response

9.3.5.6 Digital Policing

9.3.5.7 Others

9.3.6 Historic and Forecasted Market Size by Services

9.3.6.1 Implementation

9.3.6.2 Training and Support

9.3.6.3 Consulting

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size by Deployment Type

9.3.7.1 On-premises

9.3.7.2 Cloud

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Law Enforcement Software Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Component

9.4.4.1 Solutions

9.4.4.2 Services

9.4.5 Historic and Forecasted Market Size by Solutions

9.4.5.1 Computer-Aided Dispatch

9.4.5.2 Record Management

9.4.5.3 Case Management

9.4.5.4 Jail Management

9.4.5.5 Incident Response

9.4.5.6 Digital Policing

9.4.5.7 Others

9.4.6 Historic and Forecasted Market Size by Services

9.4.6.1 Implementation

9.4.6.2 Training and Support

9.4.6.3 Consulting

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size by Deployment Type

9.4.7.1 On-premises

9.4.7.2 Cloud

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Law Enforcement Software Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Component

9.5.4.1 Solutions

9.5.4.2 Services

9.5.5 Historic and Forecasted Market Size by Solutions

9.5.5.1 Computer-Aided Dispatch

9.5.5.2 Record Management

9.5.5.3 Case Management

9.5.5.4 Jail Management

9.5.5.5 Incident Response

9.5.5.6 Digital Policing

9.5.5.7 Others

9.5.6 Historic and Forecasted Market Size by Services

9.5.6.1 Implementation

9.5.6.2 Training and Support

9.5.6.3 Consulting

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size by Deployment Type

9.5.7.1 On-premises

9.5.7.2 Cloud

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Law Enforcement Software Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Component

9.6.4.1 Solutions

9.6.4.2 Services

9.6.5 Historic and Forecasted Market Size by Solutions

9.6.5.1 Computer-Aided Dispatch

9.6.5.2 Record Management

9.6.5.3 Case Management

9.6.5.4 Jail Management

9.6.5.5 Incident Response

9.6.5.6 Digital Policing

9.6.5.7 Others

9.6.6 Historic and Forecasted Market Size by Services

9.6.6.1 Implementation

9.6.6.2 Training and Support

9.6.6.3 Consulting

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size by Deployment Type

9.6.7.1 On-premises

9.6.7.2 Cloud

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Law Enforcement Software Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Component

9.7.4.1 Solutions

9.7.4.2 Services

9.7.5 Historic and Forecasted Market Size by Solutions

9.7.5.1 Computer-Aided Dispatch

9.7.5.2 Record Management

9.7.5.3 Case Management

9.7.5.4 Jail Management

9.7.5.5 Incident Response

9.7.5.6 Digital Policing

9.7.5.7 Others

9.7.6 Historic and Forecasted Market Size by Services

9.7.6.1 Implementation

9.7.6.2 Training and Support

9.7.6.3 Consulting

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size by Deployment Type

9.7.7.1 On-premises

9.7.7.2 Cloud

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Law Enforcement Software Market research report?

A1: The forecast period in the Law Enforcement Software research report is 2025-2032.

Q2: Who are the key players in the Law Enforcement Software Market?

A2: IBM Corporation, Accenture Plc, Motorola Solutions Inc, Axon Enterprise Inc, NICE Ltd, Esri, Nuance Communication, Palantir Technologies Inc, Hexagon Safety and Infrastructure, Genetec, and Other Major Players. and Other Active Players.

Q3: What are the segments of the Law Enforcement Software Market?

A3: The Law Enforcement Software Market is segmented into By Component, By Solutions By Services, By Deployment Type and region. By Component, the market is categorized into Solutions and Services.By Solutions, the market is categorized into Computer-Aided Dispatch, Record Management, Case Management, Jail Management, Incident Response and Digital Policing. By Services, the market is categorized into Implementation, Training and Support, Consulting and Others. By Deployment Type the market is categorized into On-premises and Cloud. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Law Enforcement Software Market?

A4: The law enforcement software market encompasses a range of software solutions designed specifically for use by law enforcement agencies and related entities. These software applications are developed to enhance operational efficiency, streamline workflows, and improve overall effectiveness in policing and public safety efforts. Key functionalities of law enforcement software often include crime mapping and analysis tools, incident reporting systems, case management platforms, evidence and property management solutions, as well as specialized software for dispatching, scheduling, and resource allocation. These technologies aim to modernize traditional policing methods by leveraging data-driven insights, facilitating information sharing among agencies, and enabling more informed decision-making processes. The law enforcement software market continues to evolve with advancements in technology, incorporating features like predictive analytics, real-time intelligence, and mobile accessibility to support the evolving needs of law enforcement agencies worldwide.

Q5: How big is the Law Enforcement Software Market Law Enforcement Software Market?

A5: The Law Enforcement Software Market Size Was Valued at USD 16.40 Billion in 2024, and is Projected to Reach USD 36.52 Billion by 2032, Growing at a CAGR of 9.3 % From 2025 to 2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!