Stay Ahead in Fast-Growing Economies.

Browse Reports NowLast Mile Delivery Market Comprehensive Study Report with Recent Trends

The final step of delivery, which involves getting packages from warehouses, factories, or shops to customers, covers various destinations like doorsteps, workplaces, other stores, or local carrier centers.

IMR Group

Description

Last Mile Delivery Market Synopsis

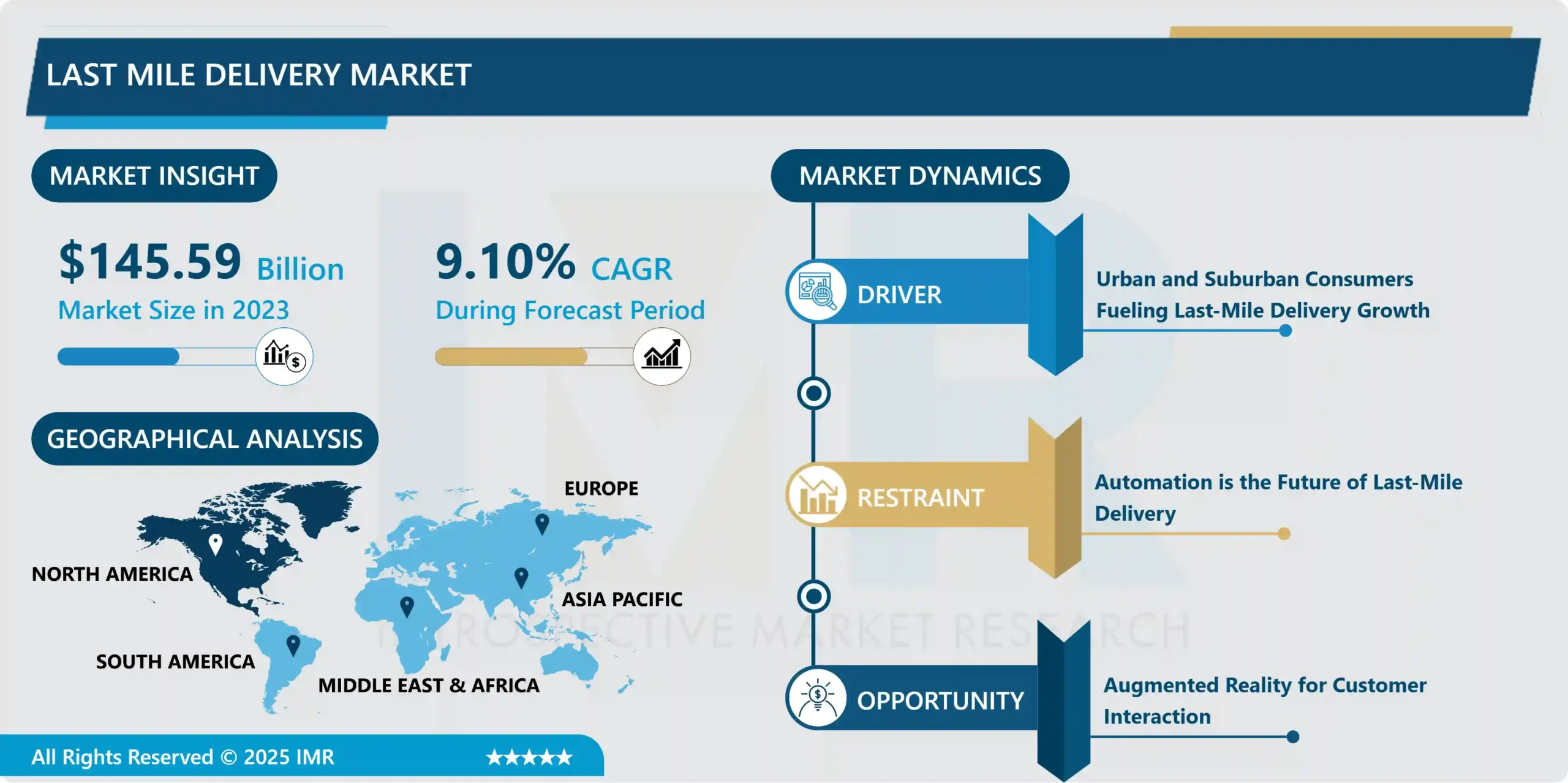

Last Mile Delivery Market Size Was Valued at USD 145.59 Billion in 2023, and is Projected to Reach USD 318.83 Billion by 2032, Growing at a CAGR of 9.1% From 2024-2032.

The last-mile delivery market serves diverse industries such as e-commerce, retail, food and beverage, healthcare, and logistics, driven primarily by the burgeoning demands of online shopping and omnichannel retailing. Businesses rely on these services to streamline supply chain logistics and meet customer expectations for swift and seamless order fulfillment. Simultaneously, consumers benefit from the convenience of doorstep delivery across a wide array of products, including groceries, electronics, and pharmaceuticals.

Advancements in technology, including route optimization algorithms, real-time tracking systems, autonomous vehicles, and drones, are revolutionizing last-mile delivery, enhancing efficiency, reducing costs, and minimizing environmental impact. However, the sector grapples with challenges like urban congestion, regulatory complexities, labor shortages, and escalating operational expenses. Nevertheless, these challenges offer opportunities for market players to innovate, enhance customer service, and forge strategic collaborations to drive sustainable growth and meet evolving consumer needs.

Last mile delivery is important because it makes customers happy. When companies make sure stuff gets to people’s homes or offices quickly and smoothly, it makes them look good and keeps customers coming back. Plus, it lets companies offer cool options like same-day or next-day delivery, which everyone wants these days because they’re all about fast shipping.

Another big deal with last mile delivery is saving money. Companies can figure out the best routes to deliver stuff, use fancy tech like GPS and route planning tools, and just be efficient about getting things where they need to go. This saves them cash, which is a big deal, especially when they’re trying to compete in tough markets where every penny counts.

Efficient last-mile delivery in e-commerce, exemplified by companies like Amazon and Alibaba, plays a crucial role in reducing environmental impact while ensuring timely package delivery. Utilizing eco-friendly vehicles, sustainable packaging, and smart delivery planning, businesses cut down on pollution and contribute to environmental conservation. This process involves coordinating with local carriers, employing specialized services, and leveraging technology like route optimization and delivery drones in urban areas to navigate congested streets, thereby improving delivery times, reducing costs, and enhancing customer satisfaction.

Last Mile Delivery Market Trend Analysis:

Urban and Suburban Consumers Fueling Last-Mile Delivery Growth

The need for last-mile delivery services is greatly pushed by both urban and suburban customers, each with their own specific needs and hurdles. Urban consumers, known for their fast-paced lifestyles and desire for convenience, are a significant driver of the global last-mile delivery market. They prefer quick and adaptable delivery options like same-day delivery and easy pick-up locations, prompting delivery companies to innovate. The crowded nature of cities makes traditional delivery methods difficult, leading to the adoption of inventive solutions such as e-cargo bikes and drones to navigate through traffic efficiently. Moreover, urban consumers are tech-savvy and open to trying new technologies, creating a demand for automated and contactless delivery services, which further boosts the development of last-mile delivery in urban areas.

Suburban customers are also contributing to the growth of the last-mile delivery market. As e-commerce becomes more popular in suburban areas and traditional retail options dwindle, home delivery services become increasingly important. Suburban regions usually cover larger distances and heavily rely on cars, affecting delivery logistics and costs. To address these challenges, solutions like optimizing routes and consolidation hubs are becoming necessary. With suburban populations embracing online shopping more, the demand for efficient last-mile delivery services is expected to rise, driving the expansion of the global last-mile delivery market even further.

Automation is the Future of Last-Mile Delivery

The combination of drones, self-driving delivery vehicles, and bots represents a significant step forward in improving last-mile delivery services. As technology advances rapidly, these innovations have the potential to completely change how goods are transported, particularly in the logistics sector. Big players like Amazon are heavily investing in companies like Aurora to develop state-of-the-art autonomous systems.

This move towards automation brings the promise of faster and more efficient delivery services. For example, Amazon’s use of drones to deliver pharmacy orders within an hour without extra charges demonstrates the incredible capabilities of these technologies. While still relatively new, the adoption of autonomous vehicles for deliveries is picking up speed, signaling a major shift in how goods are transported. As these technologies mature and become more common, they’re expected to have significant growth in the global last-mile delivery market, offering quicker, more dependable, and cost-effective delivery options for both businesses and consumers.

Last Mile Delivery Market Segment Analysis:

Last Mile Delivery Market is Segmented into Delivery Mode, Service Type, Industry Verticals, Vehicle Type, Mode of Operation, and Destination.

By Service Type, the B2C segment holds a 65% share of the global revenue.

The exponential growth of e-commerce platforms has reshaped consumer behavior, leading to a surge in online purchases across various product categories. This increased demand for home delivery services, driving the dominance of B2C deliveries.

B2C delivery companies have been at the forefront of embracing technological advancements to streamline their operations and enhance customer experience. Mobile apps, route optimization software, real-time tracking, and other innovations have made B2C deliveries more efficient and convenient, further solidifying their dominance.

B2C delivery services offer a wide range of delivery options to cater to diverse customer needs and preferences. Whether it’s same-day delivery for urgent purchases, express delivery for time-sensitive items, or scheduled deliveries for convenience, B2C delivery companies provide flexible solutions that align with consumer demands.

By Mode of Operation, the non-autonomous segment dominates the global last-mile delivery market, accounting for a significant share of the market revenue.

Non-autonomous solutions are currently more cost-effective than autonomous technologies. The initial investment and maintenance costs for autonomous vehicles and associated infrastructure are higher, making them less attractive from a financial standpoint.

The existing infrastructure and workforce for non-autonomous operations allow for easier and faster scaling compared to autonomous alternatives. Non-autonomous solutions can leverage established transportation networks, warehouses, and delivery personnel, facilitating broader deployment.

Autonomous delivery technologies face significant regulatory challenges and safety concerns. Governments and regulatory bodies are cautious about permitting widespread adoption due to uncertainties surrounding liability, safety standards, and potential impacts on employment.

By Industry Verticals, E-commerce currently dominates the global last-mile delivery market, holding a significant share of 55%.

E-commerce offers unparalleled convenience to consumers, allowing them to shop from the comfort of their homes or on the go using mobile devices. This convenience factor has significantly contributed to the rapid growth of online shopping.

E-commerce breaks down geographical barriers, enabling businesses to reach customers worldwide. This global reach opens up new markets and opportunities for businesses, fostering growth and expansion.

E-commerce platforms leverage data analytics and algorithms to personalize the shopping experience for each customer. By analyzing past purchases, browsing history, and preferences, online retailers can recommend relevant products, promotions, and content tailored to individual interests, enhancing customer satisfaction and loyalty.

Last Mile Delivery Market Regional Insights:

North America Currently holds the largest market share.

North America boasts one of the highest e-commerce penetration rates globally. The widespread adoption of online shopping among consumers has reshaped retail dynamics, with a significant portion of retail sales now occurring online. Factors contributing to this high adoption include widespread internet access, a tech-savvy population, and a culture of convenience-seeking consumers.

The surge in e-commerce has propelled the demand for last-mile delivery services. Consumers increasingly expect fast and reliable delivery options, driving companies to optimize their last-mile logistics to meet these expectations. From same-day delivery to flexible delivery windows, businesses are constantly innovating to provide convenient options to consumers.

North America benefits from a well-developed logistics infrastructure, comprising extensive transportation networks and state-of-the-art warehousing facilities. Major cities are interconnected by highways, railways, and air cargo hubs, facilitating the efficient movement of goods across vast distances. This infrastructure forms the backbone of the region’s e-commerce ecosystem, enabling timely and cost-effective deliveries.

Last Mile Delivery Market Top Key Players:

Amazon.com (United States)

USA Couriers (United States)

A1 Express Services Inc. (United States)

Marble Robot (United States)

United Parcel Service, Inc. (United States)

Power Link Expedite (United States)

Jet Delivery, Inc. (United States)

XPO Logistics, Inc. (United States)

Savioke (United States)

Flirtey (United States)

Matternet (United States)

Dropoff, Inc. (United States)

FedEx (United States)

Drone Delivery (Canada)

Deutsche Post AG (Germany)

DB Schenker (Germany)

DPD (Germany)

Geodis (France)

DSV (Denmark)

SF Express (China)

BEST Inc (China)

YTO Express Group Co. (China)

Kerry Logistics Network Limited (Hong Kong)

Flytrex (Israel)

Aramex (UAE), and Other Major Players.

Key Industry Developments in the Last Mile Delivery Market:

In March 2024, DroneUp, a prominent autonomous drone delivery firm in the U.S., has announced the launch of its pioneering technology aimed at transforming last-mile logistics. The company introduced its innovative autonomous Ecosystem, which integrates advanced ground, air, and software components into a unified platform. This move signifies a significant step toward achieving scalable and economically viable drone delivery solutions for various industries, including retail, quick-service restaurants, and healthcare. The DroneUp Ecosystem combines automated ground infrastructure, a suite of software operating systems, and an autonomous drone platform in a novel approach, heralding a new era in delivery logistics.

In September 2024, Oracle and Uber collaborated to introduce “Collect and Receive,” a new feature on the Oracle Retail platform aimed at revolutionizing last-mile delivery in retail. Leveraging Oracle Retail Data Store and cloud platform technologies, retailers gained access to Uber Direct, Uber’s white-label delivery solution, through pre-integrated APIs. This joint initiative empowered retailers to optimize inventory management while offering customers an array of delivery choices, including same-day and scheduled options, as well as order pickup and returns at nearby retail or postal locations. The service was made available immediately to Oracle Retail customers in the United States and Canada.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Last Mile Delivery Market by Delivery Mode (2018-2032)

4.1 Last Mile Delivery Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Same-day delivery

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Next-day delivery

4.5 Standard delivery

4.6 Economy delivery

Chapter 5: Last Mile Delivery Market by Service Type (2018-2032)

5.1 Last Mile Delivery Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Business-to-consumer (B2C)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Business-to-business (B2B)

5.5 Consumer-to-consumer (C2C)

Chapter 6: Last Mile Delivery Market by Industry Verticals (2018-2032)

6.1 Last Mile Delivery Market Snapshot and Growth Engine

6.2 Market Overview

6.3 E-Commerce

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Food and grocery

6.5 Healthcare

6.6 Parcel and courier services

6.7 Furniture and appliances

6.8 Fashion and apparel

Chapter 7: Last Mile Delivery Market by Vehicle Type (2018-2032)

7.1 Last Mile Delivery Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Motorcycle

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 LCV

7.5 HCV

7.6 Drones

Chapter 8: Last Mile Delivery Market by Mode of Operation (2018-2032)

8.1 Last Mile Delivery Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Non-Autonomous

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Autonomous

Chapter 9: Last Mile Delivery Market by Destination (2018-2032)

9.1 Last Mile Delivery Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Domestic

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 International

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Last Mile Delivery Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 AMERICOLD LOGISTICS LLC(US)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 C.H. ROBINSON WORLDWIDE INC. (US)

10.4 SCHNEIDER NATIONAL (US)

10.5 CASESTACK (US)

10.6 A.N. DERINGER INC (US)

10.7 ECHO GLOBAL LOGISTICS INC (US)

10.8 EVANS DISTRIBUTION SYSTEMS INC (US)

10.9 MATSON LOGISTICS (US)

10.10 XPO LOGISTICS INC (US)

10.11 LANDSTAR SYSTEM INC

10.12 ODYSSEY LOGISTICS & TECHNOLOGY CORPORATION (US)

10.13 J.B. HUNT TRANSPORT SERVICES INC (US)

10.14 NFI INDUSTRIES INC. (US)

10.15 SWIFT TRANSPORTATION COMPANY (US)

10.16 WERNER ENTERPRISES INC (US)

10.17 PENSKE TRUCK LEASING COL.P(US)

10.18 UNITED PARCEL SERVICE INC (US)

10.19 FEDEX CORPORATION (US)

10.20 DEUTSCHE BAHN (DB) SCHENKER AG(GERMANY)

10.21 HELLMANN WORLDWIDE LOGISTICS SE & CO. KG (GERMANY)

10.22 DHL SUPPLY CHAIN (GERMANY)

10.23 MAERSK (DENMARK)

10.24 DB SCHENKER (GERMANY)

10.25 NAGEL INTERNATIONAL AG (SWITZERLAND)

10.26 CEVA LOGISTICS (NETHERLANDS)

10.27

Chapter 11: Global Last Mile Delivery Market By Region

11.1 Overview

11.2. North America Last Mile Delivery Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Delivery Mode

11.2.4.1 Same-day delivery

11.2.4.2 Next-day delivery

11.2.4.3 Standard delivery

11.2.4.4 Economy delivery

11.2.5 Historic and Forecasted Market Size by Service Type

11.2.5.1 Business-to-consumer (B2C)

11.2.5.2 Business-to-business (B2B)

11.2.5.3 Consumer-to-consumer (C2C)

11.2.6 Historic and Forecasted Market Size by Industry Verticals

11.2.6.1 E-Commerce

11.2.6.2 Food and grocery

11.2.6.3 Healthcare

11.2.6.4 Parcel and courier services

11.2.6.5 Furniture and appliances

11.2.6.6 Fashion and apparel

11.2.7 Historic and Forecasted Market Size by Vehicle Type

11.2.7.1 Motorcycle

11.2.7.2 LCV

11.2.7.3 HCV

11.2.7.4 Drones

11.2.8 Historic and Forecasted Market Size by Mode of Operation

11.2.8.1 Non-Autonomous

11.2.8.2 Autonomous

11.2.9 Historic and Forecasted Market Size by Destination

11.2.9.1 Domestic

11.2.9.2 International

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Last Mile Delivery Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Delivery Mode

11.3.4.1 Same-day delivery

11.3.4.2 Next-day delivery

11.3.4.3 Standard delivery

11.3.4.4 Economy delivery

11.3.5 Historic and Forecasted Market Size by Service Type

11.3.5.1 Business-to-consumer (B2C)

11.3.5.2 Business-to-business (B2B)

11.3.5.3 Consumer-to-consumer (C2C)

11.3.6 Historic and Forecasted Market Size by Industry Verticals

11.3.6.1 E-Commerce

11.3.6.2 Food and grocery

11.3.6.3 Healthcare

11.3.6.4 Parcel and courier services

11.3.6.5 Furniture and appliances

11.3.6.6 Fashion and apparel

11.3.7 Historic and Forecasted Market Size by Vehicle Type

11.3.7.1 Motorcycle

11.3.7.2 LCV

11.3.7.3 HCV

11.3.7.4 Drones

11.3.8 Historic and Forecasted Market Size by Mode of Operation

11.3.8.1 Non-Autonomous

11.3.8.2 Autonomous

11.3.9 Historic and Forecasted Market Size by Destination

11.3.9.1 Domestic

11.3.9.2 International

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Last Mile Delivery Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Delivery Mode

11.4.4.1 Same-day delivery

11.4.4.2 Next-day delivery

11.4.4.3 Standard delivery

11.4.4.4 Economy delivery

11.4.5 Historic and Forecasted Market Size by Service Type

11.4.5.1 Business-to-consumer (B2C)

11.4.5.2 Business-to-business (B2B)

11.4.5.3 Consumer-to-consumer (C2C)

11.4.6 Historic and Forecasted Market Size by Industry Verticals

11.4.6.1 E-Commerce

11.4.6.2 Food and grocery

11.4.6.3 Healthcare

11.4.6.4 Parcel and courier services

11.4.6.5 Furniture and appliances

11.4.6.6 Fashion and apparel

11.4.7 Historic and Forecasted Market Size by Vehicle Type

11.4.7.1 Motorcycle

11.4.7.2 LCV

11.4.7.3 HCV

11.4.7.4 Drones

11.4.8 Historic and Forecasted Market Size by Mode of Operation

11.4.8.1 Non-Autonomous

11.4.8.2 Autonomous

11.4.9 Historic and Forecasted Market Size by Destination

11.4.9.1 Domestic

11.4.9.2 International

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Last Mile Delivery Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Delivery Mode

11.5.4.1 Same-day delivery

11.5.4.2 Next-day delivery

11.5.4.3 Standard delivery

11.5.4.4 Economy delivery

11.5.5 Historic and Forecasted Market Size by Service Type

11.5.5.1 Business-to-consumer (B2C)

11.5.5.2 Business-to-business (B2B)

11.5.5.3 Consumer-to-consumer (C2C)

11.5.6 Historic and Forecasted Market Size by Industry Verticals

11.5.6.1 E-Commerce

11.5.6.2 Food and grocery

11.5.6.3 Healthcare

11.5.6.4 Parcel and courier services

11.5.6.5 Furniture and appliances

11.5.6.6 Fashion and apparel

11.5.7 Historic and Forecasted Market Size by Vehicle Type

11.5.7.1 Motorcycle

11.5.7.2 LCV

11.5.7.3 HCV

11.5.7.4 Drones

11.5.8 Historic and Forecasted Market Size by Mode of Operation

11.5.8.1 Non-Autonomous

11.5.8.2 Autonomous

11.5.9 Historic and Forecasted Market Size by Destination

11.5.9.1 Domestic

11.5.9.2 International

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Last Mile Delivery Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Delivery Mode

11.6.4.1 Same-day delivery

11.6.4.2 Next-day delivery

11.6.4.3 Standard delivery

11.6.4.4 Economy delivery

11.6.5 Historic and Forecasted Market Size by Service Type

11.6.5.1 Business-to-consumer (B2C)

11.6.5.2 Business-to-business (B2B)

11.6.5.3 Consumer-to-consumer (C2C)

11.6.6 Historic and Forecasted Market Size by Industry Verticals

11.6.6.1 E-Commerce

11.6.6.2 Food and grocery

11.6.6.3 Healthcare

11.6.6.4 Parcel and courier services

11.6.6.5 Furniture and appliances

11.6.6.6 Fashion and apparel

11.6.7 Historic and Forecasted Market Size by Vehicle Type

11.6.7.1 Motorcycle

11.6.7.2 LCV

11.6.7.3 HCV

11.6.7.4 Drones

11.6.8 Historic and Forecasted Market Size by Mode of Operation

11.6.8.1 Non-Autonomous

11.6.8.2 Autonomous

11.6.9 Historic and Forecasted Market Size by Destination

11.6.9.1 Domestic

11.6.9.2 International

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Last Mile Delivery Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Delivery Mode

11.7.4.1 Same-day delivery

11.7.4.2 Next-day delivery

11.7.4.3 Standard delivery

11.7.4.4 Economy delivery

11.7.5 Historic and Forecasted Market Size by Service Type

11.7.5.1 Business-to-consumer (B2C)

11.7.5.2 Business-to-business (B2B)

11.7.5.3 Consumer-to-consumer (C2C)

11.7.6 Historic and Forecasted Market Size by Industry Verticals

11.7.6.1 E-Commerce

11.7.6.2 Food and grocery

11.7.6.3 Healthcare

11.7.6.4 Parcel and courier services

11.7.6.5 Furniture and appliances

11.7.6.6 Fashion and apparel

11.7.7 Historic and Forecasted Market Size by Vehicle Type

11.7.7.1 Motorcycle

11.7.7.2 LCV

11.7.7.3 HCV

11.7.7.4 Drones

11.7.8 Historic and Forecasted Market Size by Mode of Operation

11.7.8.1 Non-Autonomous

11.7.8.2 Autonomous

11.7.9 Historic and Forecasted Market Size by Destination

11.7.9.1 Domestic

11.7.9.2 International

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

Q1: What would be the forecast period in the Last Mile Delivery Market research report?

A1: The forecast period in the Last Mile Delivery Market research report is 2024-2032.

Q2: Who are the key players in the Last Mile Delivery Market?

A2: Amazon.com (United States), USA Couriers (United States), A1 Express Services Inc. (United States), Marble Robot (United States), United Parcel Service, Inc. (United States), Power Link Expedite (United States), Jet Delivery, Inc. (United States), XPO Logistics, Inc. (United States), Savioke (United States), Flirtey (United States), Matternet (United States), Dropoff, Inc. (United States), FedEx (United States), Drone Delivery (Canada), Deutsche Post AG (Germany), DB Schenker (Germany), DPD (Germany), Geodis (France), DSV (Denmark), SF Express (China), BEST Inc (China), YTO Express Group Co. (China), Kerry Logistics Network Limited (Hong Kong), Flytrex (Israel), Aramex (UAE), and Other Major Players.

Q3: What are the segments of the Last Mile Delivery Market?

A3: The Last Mile Delivery Market is segmented into Delivery Mode, Service Type, Industry Verticals, Vehicle Type, Mode of Operation, Destination, and Region. By Delivery Mode the market is categorized into (Same-day delivery, Next-day delivery, Standard delivery, Economy delivery), By Service Type the market is categorized into (Business-to-consumer (B2C), Business-to-business (B2B), Consumer-to-consumer (C2C)), By Industry Verticals the market is categorized into (E-Commerce, Food and grocery, Healthcare, Parcel and courier services, Furniture and appliances, Fashion and apparel), By Vehicle Type the market is categorized into (Motorcycle, LCV, HCV, Drones), By Mode of Operation the market is categorized into (Non-Autonomous, Autonomous), By Destination the market is categorized into (Domestic, International). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Last Mile Delivery Market?

A4: The final step of delivery, which involves getting packages from warehouses, factories, or shops to customers, covers various destinations like doorsteps, workplaces, other stores, or local carrier centers.

Q5: How big is the Last Mile Delivery Market?

A5: Last Mile Delivery Market Size Was Valued at USD 145.59 Billion in 2023, and is Projected to Reach USD 318.83 Billion by 2032, Growing at a CAGR of 9.1% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!